CWS Market Review – August 18, 2017

“Good investment advice is repetitive and boring. There is nothing exciting about it.”

– D. Muthukrishnan

Volatility may slowly be creeping back into Wall Street. Last Thursday, the S&P 500 fell by 1.45%. As I explained in last week’s CWS Market Review, that’s not really that big a move in historical terms. But compared with how calm the market’s been this year, it was a jolt.

Some market watchers dismissed last week’s move as being due to jitters about North Korea. That’s right, but we got another downdraft this week, and again, it happened on Thursday. This time, the S&P 500 lost 1.54%. That’s the index’s biggest daily drop in three months. Not many other days have come close.

I’m not ready to say that this a major change for the market. It could be a false start, and the stock market may quickly return to its sleepy ways. But it’s something to notice. Trends can only last so long.

In this week’s CWS Market Review, I’ll highlight some of the market’s recent trends. Later on, I’ll discuss the very nice earnings report we got from Ross Stores. The deep-discounter is doing just fine against the great Amazon behemoth. Ross raised its full-year earnings guidance for the second time this year. I’ll also preview three more Buy List earnings reports coming our way next week. But first, let’s look at what’s shaking Wall Street.

The Slow-Moving Break-Up of the Baby-Step Rally

Three times in the last six trading sessions, the S&P 500 had a daily move of more than 1%. Normally, that’s no big deal, but in 2017, it’s enough to get your attention. Last year, the S&P 500 had 48 days in which it closed up or down by more than 1%. In 2015, there were 72. So far this year, there have been seven.

Here a remarkable stat: Not once since election day has there been a 3% drawdown for the market. In other words, from top to bottom, the S&P 500 has never been down by more than 3%. That’s the longest such streak on record. For more than nine months, it’s been a baby-step rally the whole way. However, there are a few disparate events that seem to be coming together all at once that could shake things up. Let me take them one at a time.

I was critical of the last Fed rate increase. Now it appears the market is starting to doubt the Fed’s commitment to more rate increases. The futures market had been expecting a third rate increase this year in December. Now the odds are slightly against it. Traders don’t give a 50% chance for another rate increase until March 2018. That’s actually more hawkish than a few days ago when the next hike was pegged for June 2018. Whatever the case, traders think the Fed will be on hold for several more months. By the way, I should add that Janet Yellen’s term ends in February. President Trump may reappoint her.

Speaking of the president, many of the investing themes that took hold of the market after the election have quietly melted away. A good example is small-cap stocks. Last November, the Russell 2000 soared. There was a great deal of optimism that the new administration would be a boon for smaller companies. (Please note: I’m not making a political statement. I’m merely reflecting what traders believed at the time.)

But the sector soon started to lag the baby-step rally. In the last month, the Russell 2000 has been drifting lower in absolute terms. On Thursday, the index dropped below its 200-day moving average, which is often a bad omen. The Russell hasn’t traded below its 200-DMA in more than a year.

Watching the small-cap sector is important because it could be an early warning sign that investors are pulling back on riskier names. In a bull market, you want to see stable blue chips rally alongside the up-and-comers. Whenever the score tilts heavily to one side, you know something’s up.

Along with small-caps, the energy sector is getting beaten up. Just like small-caps, energy stocks jumped last November on hopes of the incoming administration. But the Energy Sector ETF (XLE) has fallen for the last six days in a row, and 11 times in the last 13 days. There’s just no love for energy stocks at the moment.

Here’s what happening: On the surface, we’ve seen a baby-step rally. The S&P 500 is moving mostly upward, with very low volatility. But below the surface, investors have been quietly shunning riskier areas and fleeing to safety. Or rather, perceived safety. But this is unusual because it’s the opposite of what we normally see in the late stages of a bull run. Typically, when investors exit safety and chase madly after risk, that’s a sign of a frothy market.

On top of that, we’ve seen pronounced weakness in the U.S. dollar all year. Mind you, that’s not all bad. In fact, the weak dollar probably bailed out the market this earnings season. But are all these trends separate or are they different expressions of the same event?

One possible explanation is that the economy simply isn’t as strong as people thought. That’s why investors are shifting toward safety. Despite a low unemployment rate, GDP isn’t moving so fast, and that could require more assistance from the Fed. Lower rates, or a slower increase in rates, would also make the U.S. dollar less attractive.

Going forward, I encourage investors to remain focused on high-quality stocks. Two Buy List stocks that look particularly good at the moment are Danaher (DHR) and Alliance Data Systems (ADS). As always, make sure your portfolio is well diversified. Now let’s look at the good news from Ross Stores.

Ross Stores Beats and Raises Guidance (Again)

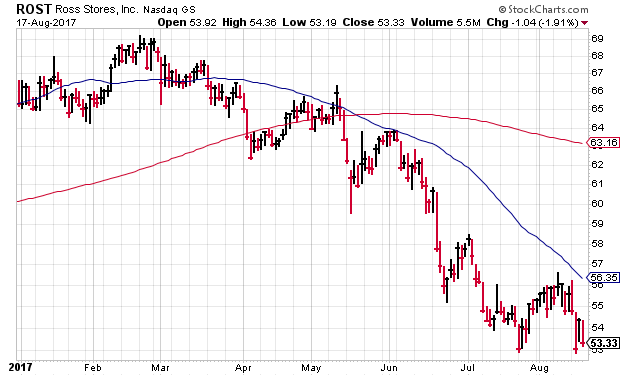

After the closing bell on Thursday, Ross Stores (ROST) reported very good earnings for their fiscal second quarter. This came as a huge relief for traders, as folks who keep an eye on retail had been expecting the worst. Shares of Ross had been drifting lower for much of this year.

I’m glad we’ve stuck by Ross because it’s an excellent firm. Ross is one of the few retailers that’s been able to withstand the great Amazon beast. For Q2, Ross earned 82 cents per share. That was well above the range of 73 to 76 cents per share that Ross had been expecting. Even as a Ross fan, this is more than I had anticipated.

Let’s dig into some of the numbers. Ross’s quarterly sales rose 8% to $3.432 billion. Their comp-store sales rose by 4%. That really impressed me. For Q2, Ross had been expecting an increase of 1% to 2%. A great number is that their quarterly operating margin came in at 14.9%, which is very good for a retailer. This tells us that Ross is holding up well within its sector.

Now for guidance. Ross sees Q3 earnings ranging between 64 and 67 cents per share. In last week’s issue, I said I was looking for something like 65 to 68 cents per share, so that’s pretty close. Ross also gave Q4 guidance of 88 to 92 cents per share. Q4 is November, December and January.

If you add those two ranges together, plus the $1.64 per share Ross has already made in the first half of this year, that translates to a full-year range of $3.16 to $3.23 per share. That’s an increase over the previous full-year range of $3.07 to $3.17 per share. This is actually the second time Ross has increased its full-year guidance. Things are obviously going well for them.

Ross has also been using its cash flow to buy back tons of its own stock. I’m not wild about this practice, but at least Ross actually reduces the share count. Through Thursday, Ross was our worst-performing stock this year. That may soon change. Thanks to the earnings report, shares of Ross were up more than 10% in the after-hours session. A word of caution: the after-hours market doesn’t always line up with what the stock will do once the real trading starts the next morning.

This time, we can congratulate ourselves. In last week’s newsletter, I told you Ross Stores was “a good value here.” We stuck by a good company when others got scared and ran away. This week, I’m raising my Buy Below on Ross Stores to $61 per share.

Three Buy List Earnings Reports Next Week

We have three more Buy List earnings reports next week. But I promise you, after that, we’re going into a long earnings lull period. We won’t see another Buy List earnings report until early October. Let’s look at who’s reporting next week.

HEICO (HEI) plans to release their fiscal Q3 earnings after the closing bell on Wednesday, August 23. The company had a very good earnings report last May, but the stock market was not impressed. That is, it wasn’t impressed until several weeks later, when HEICO started a furious rally. Sure that doesn’t make a whole lot of sense, but welcome to Planet Wall Street.

Wall Street expects earnings of 53 cents per share. The company said it expects sales to rise by 8% to 10% and net income to rise by 12% to 14%. Last year, HEICO made $1.86 per share. If we assume no change in shares outstanding, that implies 2017 EPS of $2.08 to $2.12.

One final note. Shares of HEICO took a 4% dip on Thursday after the stock was downgraded by Deutsche Bank. HEICO is up more than 32% for us this year.

Next Thursday, we’ll get earnings reports from Hormel Foods (HRL) and JM Smucker (SJM). Both companies will report results before the opening bell.

Unfortunately, Hormel has been one of our weaker stocks this year. Frankly, their last earnings report was kinda blah. The company faced a headwind of an oversupply of turkeys. The good news is that Hormel is standing by its full-year forecast of $1.65 to $1.71 per share. However, they now say they expect results to be at the low end of that range.

Hormel has missed the last three earnings reports—each time by one penny per share. This time, the consensus on Wall Street is for 37 cents per share. I think the losing streak will come to an end.

Next week’s report will be for Smucker’s fiscal Q1. For fiscal 2018, Smucker said they expect earnings to range between $7.85 and $8.05 per share. They beat earnings for Q4, but that was due to cost-cutting. I’m all for keeping costs down, but you need to grow the top line as well. Wall Street expects Q1 earnings of $1.63 per share.

That’s all for now. There’s not much on the calendar for next week except for the start of the Jackson Hole conference. This is the big Fed shindig every August out in Wyoming. Several times, the Fed has used the occasion for important policy announcements. I doubt we’ll see much this year. The conference begins on Thursday. On Friday, I’ll be keeping an eye out for the latest report on durable goods. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Posted by Eddy Elfenbein on August 18th, 2017 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His