Archive for September, 2017

-

Third-Quarter Performance Update

Eddy Elfenbein, September 30th, 2017 at 4:08 pmWe have three quarters of 2017 under our belt. So far, our Buy List is up 11.53% on the year. That compares with a gain of 12.53% for the S&P 500.

Add in dividends are we’re up 12.36% compared with 14.24% for the S&P 500.

Here’s how each stock has done:

Company Symbol YTD % Total Return Cerner CERN 50.56% 50.56% Moody’s MCO 47.67% 49.13% HEICO HEI 45.51% 45.68% CR Bard BCR 42.66% 43.05% Sherwin-Williams SHW 33.23% 34.27% Cognizant Tech Solutions CTSH 29.47% 30.05% Intercontinental Exchange ICE 21.77% 22.92% Fiserv FISV 21.34% 21.34% Microsoft MSFT 19.87% 21.93% Stryker SYK 18.54% 19.65% AFLAC AFL 16.94% 18.99% Continental Building Products CBPX 12.55% 12.55% Danaher DHR 10.20% 10.74% Axalta Coating Systems AXTA 6.32% 6.32% Ross Stores ROST -1.57% -0.81% Alliance Data Systems ADS -3.04% -2.41% Ingredion INGR -3.46% -2.65% RPM International RPM -4.63% -2.99% Cinemark CNK -5.60% -3.41% Hormel Foods HRL -7.67% -6.27% Express Scripts ESRX -7.95% -7.95% Wabtec WAB -8.76% -8.39% Snap-on SNA -13.00% -11.86% Signature Bank SBNY -14.75% -14.75% JM Smucker SJM -18.06% -16.59% Total 11.53% 12.36% CWS Market Review – September 29, 2017

Eddy Elfenbein, September 29th, 2017 at 7:08 am“Forecasts may tell you a great deal about the forecaster; they tell you nothing about the future.” – Warren Buffett

On Thursday, the S&P 500 closed at 2,510.06, yet another all-time high. We still have one day left, but this could be the eighth-straight quarterly gain for the S&P 500. If we include dividends, it will be the 11th-straight monthly gain. Not only that, but it looks like this September could be the least volatile September on record.

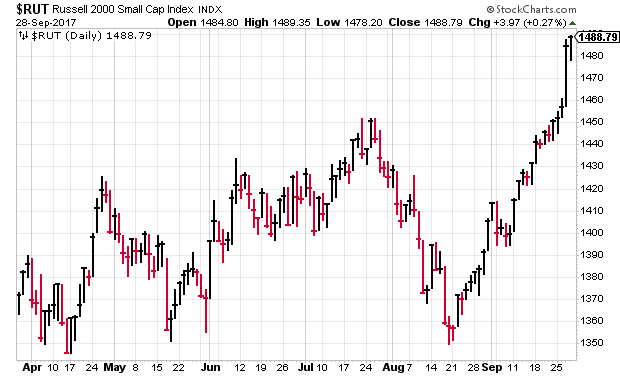

Even with as well as the big-cap indexes have been doing, the small-caps have been particularly popular lately. On Wednesday, the Russell 2000 skyrocketed 1.5% for its best day since June. (And yes, in 2017, a 1.5% counts as “skyrocketing.”) The index is up nearly 10% since mid-August.

We should be thankful for the market’s good mood, but we should always be prepared for whatever the market throws our way. In this week’s CWS Market Review, I want to focus on some recent economic news. I’ll also discuss the Buy List’s performance so far this year. Later on, I’ll have some updates on our Buy List stocks.

Expect a Good Earnings Season Next Month

On Thursday, the government updated its report for Q2 GDP growth. They now say that the economy grew, in real terms, by 3.1% during the second quarter. That makes it one of the better quarters in this cycle, but will the good news last?

I’m not so sure. We may slip back into our 2% trend line that’s been very hard to shake for several years now. The Atlanta Fed’s GDP Now forecasts Q3 growth at 2.1% (Take note of Mr. Buffett’s comments on forecasters in this week’s epigraph.)

Earnings season will soon start and then we’ll get a much better look at how the corporate world fared during Q3. Remember, of course, that profits and the broader economy don’t always need to move at the same speed, or even in the same direction.

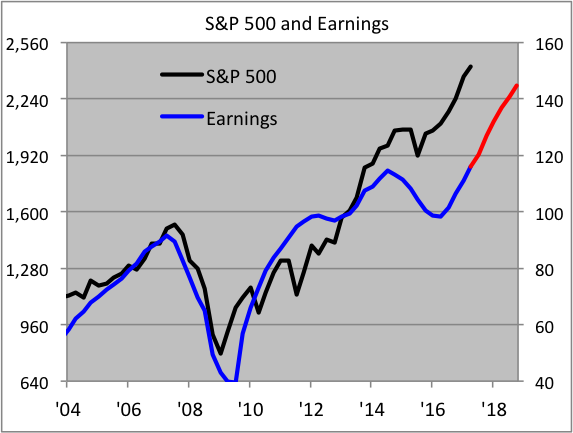

Wall Street currently expects the S&P 500 to report Q3 earnings of $32.90 per share. That’s the index-adjusted number. As is often the case, that figure has been pared back as earnings season approaches, but the estimate cuts have been less than we saw during Q2.

If the forecast of $32.90 is correct (if!), that would translate to quarterly profit growth of 14.7%. It would also be the sixth quarter in a row of profit growth for the S&P 500. Some of the previous growth has relied heavily on share buybacks. We’re seeing less of that recently. Share buybacks are down 25% since the start of 2016.

The S&P 500 is currently expected to earn $127.05 this year and $144.71 next year. That means the stock market is currently going for 17.3 times next year’s earnings. That’s elevated, but I wouldn’t say it’s an obvious bubble. Let’s also remember how low bond yields are. To give you an example, the yield for five-year TIPs (the inflation-protected securities) is just 0.16%.

The chart below shows the S&P 500 (black line, left scale) along with its trailing earnings (blue line, right scale). The two lines are scaled at a ratio of 16-to-1 so whenever the lines cross, the market’s P/E Ratio is exactly 16. The red part of the line is Wall Street’s estimate.

This should also be the 30th quarter in a row of growing dividends. As I’ve pointed out a few times, this rally has been about dividends almost as much as it’s been about share prices. For all the talk we’ve heard of a bubble, stock prices have largely kept pace with dividends.

On our own Buy List, we had recent dividend increases from Microsoft (MSFT) and Ingredion (INGR). We may get another soon from RPM International (RPM).

Some Buy List stocks that look particularly good right now include Signature Bank (SBNY), Danaher (DHR), Alliance Data Systems (ADS) and Stryker (SYK). Remember to pay attention to our Buy Below prices.

The Buy List’s Performance So Far

We still have one day left in the third quarter, but I wanted to give you an update on how the Buy List is doing so far this year. Through Thursday, our Buy List is up 11.09%. That trails the S&P 500, which is up 12.11%.

Neither figure includes dividends. I didn’t have enough time to calculate the dividend-adjusted returns, but our Buy List yields a little bit less than the market as a whole. I hope to post all those numbers soon.

While we’re trailing the market at the moment, I think we have a very good shot at once again beating it for the year. Our difficult period came in late July and early August, during Q2 earnings season, when a few bad earnings reports caused our Buy List to lose its lead. That was a tough time for us, but we’ve gotten back on track. Lately, in fact, our Buy List has been beating the overall market.

Also, we shouldn’t lose sight of the fact that the Buy List is making money for us this year. What works against us is that the market’s rally has been skewed to a small number of stocks that have performed very well.

Through Thursday, four of our Buy List stocks are up more than 40%. The big winners are CR Bard (BCR), HEICO (HEI), Moody’s (MCO) and Cerner (CERN). Remember that sometime in Q4, CR Bard will become Becton, Dickinson.

Our biggest loser this year is Smucker (SJM), which is down nearly 19% YTD. The next biggest loser is Signature Bank, which I think looks especially tempting below $130 per share. It’s interesting how often one year’s biggest losers becomes the next year’s biggest winners.

Preview of RPM International’s Earnings Report

We haven’t had many Buy List earnings reports lately, but we’ll get another one next week. RPM International (RPM) is due to report before the market opens on Wednesday, October 4. This will be for RPM’s fiscal first quarter, which ended on August 31. The consensus on Wall Street is for earnings of 84 cents per share. That’s an increase of one penny over last year’s result.

This will be an interesting report because RPM has missed Wall Street’s consensus for the last three quarters. The shares dropped 7% after the last earnings report came out in July. I want to see signs of improvement here. RPM makes building materials and adhesives.

In July, RPM said they see Q1 earnings ranging between 83 and 85 cents per share and between $2.85 and $2.95 per share for the fiscal year. That disappointed investors. Wall Street had been expecting 89 cents per share for Q1 and $3 per share for the fiscal year.

The company blamed a rainy spring for poor results at their Kirker nail-enamel business. I’m usually suspicious when the weather is used as an excuse. A higher tax rate last quarter ate up 12 cents per share.

I also expect to see a modest dividend increase from RPM. They currently pay out 30 cents per share. The company has raised its dividend every year since 1973. I don’t think they’ll go very high, but they’ll do enough to keep the streak alive.

Buy List Updates

This has been a rough year for Ross Stores (ROST), but the shares have improved recently, plus they got a nice upgrade this week. I think the deep discounter got tossed in with many other retailers that were being done in by Amazon, but investors should understand that Ross competes for a different market segment.

Late last year, ROST got close to $70 per share, but by July, it was trading below $52. This week, an analyst at JP Morgan upgraded Ross to “outperform” from “market perform.” That was the latest catalyst in a nice rally over the past month. The stock closed Thursday at $64.80 per share. Notice how often good stocks take their lumps but then come charging back.

Hormel Foods (HRL) announced the resignation of their chairman, Jeffrey Ettinger. He was the CEO until last year. Lately, HRL has been struggling along with many other food stocks. The shares seem to have found a floor around $31 per share.

Axalta Coating Systems (AXTA) said it was shutting down operations in Venezuela. I’m surprised it’s taken this long. It’s sad what’s happening in Venezuela. I hope the country can emerge from this crisis successfully.

Sherwin-Williams (SHW) updated its Q3 guidance to reflect the disruptions caused by the recent hurricanes. The company now expects core sales to rise for Q3 in the low single digits. Previously, Sherwin gave Q3 earnings guidance of $3.70 to $4.10 per share. The company has now lowered that range to $3.40 to $3.70 per share. Actually, that’s not as bad as some were expecting. The shares rallied 2% on Thursday on the news. The CEO said, “”While we are still assessing the longer-term impact of these tragic events on our business, the sales momentum we are seeing across most geographies—particularly in our company-operated stores in the unaffected regions of the U.S. and Canada—should enable us to recover some of the third-quarter earnings shortfall over the balance of the year.”

The Financial Times notes that investors are expecting the Bank of England to raise interest rates soon. That’s caused trading volume for Intercontinental Exchange (ICE) to surge to its highest level in four years.

That’s all for now. Q4 begins next week. On Monday, we’ll get the September ISM report. On Wednesday, Janet Yellen will be speaking. Also, the ADP payroll report will come out. On Friday morning, the September jobs report comes out. The unemployment rate for August was 4.4%, which is close to a 16-year low. There’s a good chance we’ll make a new low. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Morning News: September 29, 2017

Eddy Elfenbein, September 29th, 2017 at 7:02 amChina’s Harsh Words Mask a Trade Boom With South Korea

South Korea Follows China By Banning ICOs

Cryptocurrency Exchanges Get Nod to Operate in First for Japan

Carney Says U.K. Economy Still Looks on Track for Rate Hike

Economists Dispute Mnuchin’s Claim of Tax Plan’s Deficit Cut

After Winning Trump’s Ear, Boeing Notches Victory in Trade Spat

VW’s Diesel Woes Reach $30 Billion After Surprise U.S. Hit

Ikea Has Acquired TaskRabbit — And It Could Fix the Most Annoying Thing About the Furniture Giant

Wall Street Journal to End Print Editions in Europe and Asia

Whole Foods is Investigating a Credit Card Security Breach

For Uber in London, a New Route: Diplomacy

Roku Connects With Investors in Debut, Shares Soar Over 67%

Joshua Brown: Why Won’t You People Panic Already?

Mark Hines: Stock Exchange: Are You Patient or Complacent?

Jeff Carter: Technology Makes the Future Terrifying, Especially Without Education

Be sure to follow me on Twitter.

Morning News: September 28, 2017

Eddy Elfenbein, September 28th, 2017 at 7:03 amTrump Proposes The Most Sweeping Tax Overhaul in Decades

Trump Tax Plan Sends Dollar, Bond Yields Higher

Trump Gets to Replace His Auditor as IRS Head Prepares to Leave

May Says Boeing Undermining Relations With U.K. Over Bombardier

Bitcoin Blow as Fund Drops U.S. Exchange Application

Toshiba Reaches Deal With Bain-Apple Group to Sell Chip Business

Roku’s IPO Price Just Gave the Company a $1.3 Billion Valuation

Uber Can’t Be Warm and Cuddly and Worth $70 Billion

Uber Closes Xchange Leasing After Losing $9,000 Per Car

Sonic’s Stock Plunges After Credit Card Hack That Could Affect Millions

IBM Now Has More Employees in India Than in the U.S.

Mexico Opens Way for NAFTA Talks to Run Into 2018

Here’s Where the Most Millionaires Are Being Minted

Roger Nusbaum: Portfolio For An Apocalypse?

Howard Lindzon: Making the Call and Answering The Phone

Be sure to follow me on Twitter.

Morning News: September 27, 2017

Eddy Elfenbein, September 27th, 2017 at 7:04 amU.S. Slaps Duties on Canadian Jet, Raising Trade Tensions

Uber Is Hunting For a New U.K. Head Amid Regulatory Battles

Uber Says It Will Leave Quebec Rather Than Face New Rules

Alstom, Siemens Forget High-Speed-Rail Feud Amid Asian Onslaught

Equifax’s Interim CEO Brings Charm, Focus on Growing Abroad

Bombardier’s $6 Billion Jet Takes Hit as Boeing Wins U.S. Duties

EasyJet Joins Forces With U.S. Startup to Develop Electric Plane

Lyft Adds Ford to Its List of Self-Driving Car Partners

Despite Naysayers, Why Is Electric-Vehicle Pioneer Tesla Betting Big on India?

British Vacuum Maker Dyson Plans Electric Car Assault

Mercedes Invests $1 Billion in Electric SUV Production in U.S.

Two Chinese Investors Exit Investments in Wanda’s Legendary

SK Hynix Set to Invest in Toshiba Chip Unit, Details Consortium’s Plans

Ben Carlson: The Prudent Endowment Fund

Cullen Roche: Value Investing is Dead, Long Live Value Investing!

Joshua Brown: Incoming – Hot New Additions to EBI November!

Be sure to follow me on Twitter.

Morning News: September 26, 2017

Eddy Elfenbein, September 26th, 2017 at 6:56 amOil Back in Bull Market as Kurdish Vote Amplifies Supply Risk

Gold Rises 115 Points to 30154 as North Korea Worries Continue

Biggest Gem Found in a Century Finally Sells for $53 Million

Euro Hits One-Month Low as Confidence Shaken After German Vote

SEC Chairman Faces Questions From Congress After Data Breach

Alibaba Takes Control of Delivery Business at Center of U.S. Probe

Nestle Leaves the Fireworks at Home

Will The T-Mobile-Sprint Merger Finally Come To Fruition?

Why Elon Musk Is Getting Trolled by Mercedes Benz’s Parent Company

Cadillac Finally Has an Answer to Tesla’s Autopilot

Disney Reimagines Its Stores to be More Like a Vacation

Howard Lindzon: Winning When You Lose

Roger Nusbaum: Balance Sheet Reduction By Paper Cut

Jeff Carter: I Learned Some Things At the G7/I7

Be sure to follow me on Twitter.

Nice Rebound for Ross Stores

Eddy Elfenbein, September 25th, 2017 at 10:34 amIt took us a while, but we’re finally seeing a rebound in shares of Ross Stores (ROST). The stock got clobbered with other retailers this year. ROST fell from $69.81 in November to a low of $52.85 last month.

Thanks to an upgrade from JP Morgan, Ross is up 4.4% today to $63.56 per share.

Morning News: September 25, 2017

Eddy Elfenbein, September 25th, 2017 at 7:05 amAs China Piles on Debt, Consumers Seek a Piece of the Action

Japan Raises $11.6 Billion Selling Another Stake in Postal Giant

Top BP Executive Warns OPEC Needs to Prolong Oil Output Curbs

Mark Zuckerberg Can’t Stop You From Reading This Because The Algorithms Have Already Won

Facebook Fail Is Blow for Silicon Valley Cult of Founder Control

Uber Boss Dara Khosrowshahi Apologises After London Ban

One Surprise Standout for Uber: Food Delivery

ABB Plans Makeover of GE’s `Unloved Child’ in $2.6 Billion Deal

SAP Wants To Help Companies Get a Better Picture of You

Solar Panels Perfect Case Of Protectionism Costing More Jobs Than It Saves

Walt Disney Threatens to Pull ESPN, ABC From Optimum

Department Stores Cling to Power Over Landlords on Mall Upgrades

Joshua Brown: What Should Keep Facebook Shareholders Up At Night

Jeff Miller: Weighing the Week Ahead: Time For Tax Reform?

Ben Carlson: The End of the Go-Go Years

Be sure to follow me on Twitter.

CWS Market Review – September 22, 2017

Eddy Elfenbein, September 22nd, 2017 at 7:08 am“The expectation of an event creates a much deeper impression on the exchange than the event itself.” – Jose de la Vega, 1688

First, the good news. The stock market continues its winning ways. The Dow just set nine straight daily records, and the S&P 500 is over 2,500. Not only that, but it’s been one of the calmest markets in history. Ryan Detrick notes that the Dow rose by less than 0.3% for seven straight sessions. That’s only the second time that’s happened in the Dow’s 121-year history. Volatility is low, and markets are happy.

Now the bad news. The Federal Reserve made it clear this week that they intend to keep on raising interest rates. Not just once more in December, but a few more times after that in 2018 and 2019. In my opinion, this is a big mistake.

The evidence (to me) is clear that the need for higher rates has faded. After all, inflation has cooled off. We’ve just gone through two big hurricanes. Plus, there’s been some weak economic news lately. I’m not alone in this opinion. Not too long ago, the futures market started to believe that we might not get a rate hike for the next year. But the Fed wants higher rates, and in these matters, they always get their way.

Unfortunately, as investors, we don’t get to choose the environment. We have to deal with reality as it is. In this week’s CWS Market Review, I’ll explain what the Fed said this week and what it means for us. We also got two dividend hikes from our Buy List stocks. Microsoft hiked its payout by 7.6%, and Ingredion boosted its payout by 20%. I love seeing nice dividend increases from our stocks. I’ll have more to say on these in a bit, but first, let’s look why the Fed is on the wrong course.

The Federal Reserve Holds Firm

Lately, I had been telling you that the Federal Reserve won’t be raising interest rates any time soon. Silly me. I was assuming the Fed was going off the evidence. Big mistake.

We had five very soft inflation reports in a row. Only the last one was anything close to the Fed’s target of 2%. Let’s look at some the recent data. Last Friday, the Fed said that industrial production fell by 0.9% last month, and Hurricane Harvey was responsible for 0.75% of that. We also learned that retail sales fell 0.4% in August. Take out gasoline, and retail sales still fell 0.2%. That’s not good.

The Atlanta Fed’s GDP model now sees Q3 coming in at 2.2%. The New York Fed’s model is down to 1.3%. Sure, Harvey bears some of the blame, but not all. The economy is growing, but at a tepid pace.

But the Fed is having none of this. On Wednesday, the central bank released its policy statement, along with its revised economic forecasts. I should warn you that the Fed’s track record isn’t merely bad—it’s bad for economists.

Let’s dig into the policy statement. Not surprisingly, the Fed decided against raising interest rates at this meeting. That means the target for Fed funds remains between 1% and 1.25%. In the statement, they acknowledged the damaged caused by the hurricanes, but added that “the storms are unlikely to materially alter the course of the national economy over the medium term.” This is probably true. Plus, a lot or rebuilding news to be done. Note that Continental Building Products (CBPX) had another big gap up this week while shares of Danaher (DHR) touched a new high.

The Fed also said the economy is growing moderately and the jobs market continues to get better. They also said that core inflation is low, and will probably remain so. I agree.

Now let’s turn to the Fed’s economic projections. This is often referred to as the “blue dots,” due to the dot plot in the report. The Fed now sees core inflation rising to 1.9% next year, and 2% in 2019. Mind you, the Fed has consistently overestimated future inflation. Not only that, but if anything, core inflation was been trending downward. It’ll probably something like 1.5% this year. Don’t get me wrong: I’m all for the Fed battling inflation. But I’m not wild about fighting inflation that doesn’t appear to exist.

Of the 16 members on the FOMC (not all of whom vote at policy meetings), 12 see another rate increase in December. Prior to the meeting, the futures market thought there was a 37% chance of a December hike. Now that’s up to 78%.

For 2018, the median forecast calls for three more rate hikes. That would bring the Fed funds target range to 2% to 2.25%. On a side note, if the Fed’s inflation forecast is correct, that would mean the real (or inflation-adjusted) range would finally be positive. It’s been negative for nearly a decade. In other words, you could borrow money from the Fed for free, after adjusting for inflation.

The median Fed forecast calls for one more hike in 2019, plus another one in 2020. The Fed also projects inflation and interest rates for the “long run.” (“But this long run is a misleading guide to current affairs. In the long run we are all dead.” – JM Keynes.)

Here’s an interesting nugget. The Fed members see long-run interest rates at 2.75%. Combined with the long-run inflation forecast of 2%, this implies the Fed believes the “equilibrium rate” is 0.75%. That’s the interest rate at which (theoretically) everything should come into balance (again, theoretically). I’d guess that if you polled economists on the equilibrium rate prior to the financial crisis, they probably would have pegged it around 2%. So as long as the Fed is below 0.75% in real terms, they view themselves as pumping up the economy.

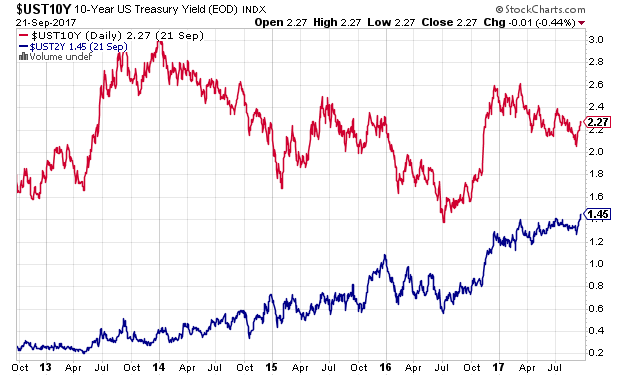

Remember that for much of 2017, long-term interest rates have been falling. Lots of other people were betting that the Fed would take a breather. But in the last two weeks, a lot has changed. The yield on the 10-year bounced from 1.88% on September 7, to 2.11% on Thursday.

That’s not all. The yield on the two-year Treasury is now up to 1.45%. That’s the highest in nearly nine years. The two-year is a good maturity to watch, because it’s usually very sensitive to interest-rate expectations. For some context, six years ago, the two-year was yielding as low as 0.16%.

What does all this mean? A December rate hike from the Fed won’t be a disaster. The problem is that it gives the Fed less room to operate if and when things get bad. There’s also no reason to worry about the stock market. The market can rally along with higher rates. That’s what happened from 2004 to 2006.

In last week’s issue, I talked about the impact of the weak dollar on the stock market. If the dollar gains strength, this means that the nature of what’s rallying could change. For example, bank stocks tend to perform when short-term rates rise. That’s how they make their money. On our Buy List, I still like Signature Bank (SBNY), especially below $125.

This is a boring market, and boring markets are usually good markets.

Investors should continue to focus on high-quality names. In addition to Signature, two other Buy List stocks I particularly like are Ross Stores (ROST) and Intercontinental Exchange (ICE). As always, please watch my Buy Below prices. There’s no need to chase after good stocks.Dividend Hikes from Microsoft and Ingredion

We recently got two dividend increases for our Buy List stocks. Last Friday, Ingredion (INGR) announced a 20% dividend increase. INGR’s payout will rise from 50 to 60 cents per share. Business has been good. Last month, Ingredion reported earnings above expectations.

“We are proud of our record of delivering consistent shareholder value. From dividends and share repurchases to capital investments and acquisitions, we are committed to a balanced deployment of cash consistent with our strategic blueprint,” said Ilene Gordon, chairman, president and CEO.

The new dividend is payable on October 25 to stockholders of record at the close of business on October 2. Based on Thursday’s close, INGR yields 2%.

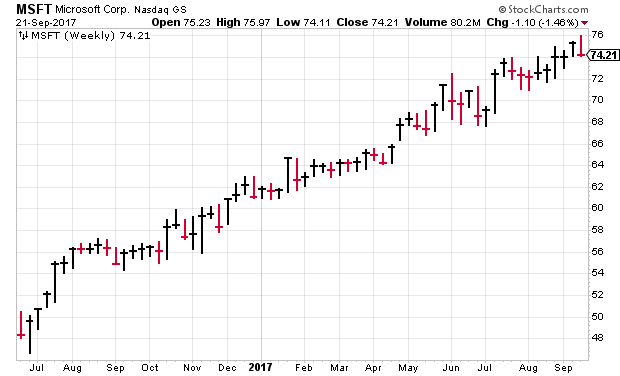

Then on Tuesday, Microsoft (MSFT) announced a 7.6% increase to its dividend. The quarterly payout will rise from 39 to 42 cents per share. In last week’s CWS Market Review, I said, “I’m expecting 42 cents, maybe 43 cents per share.” Close enough.

The dividend is payable December 14 to shareholders of record on November 16. The ex-dividend date will be November 15. By the way, too many investors ignore the importance of dividends. Remember that those dividend increases can add up. Microsoft is now yielding 11.3% based on its 2009 low. Even in today’s terms, MSFT yields 2.26%. That’s only two basis points below a 10-year Treasury. I like Microsoft a lot.

That’s all for now. We’re going to get some key economic reports next week. On Tuesday, we’ll get reports on consumer confidence and new-home sales. Then on Wednesday, the durable-goods report comes out. On Thursday, the government will have its second revision of Q2 GDP growth. Last month, the estimate for Q2 growth was revised to 3.0% from the initial estimate of 2.8%. Friday will be the last trading day of the third quarter. We’re also get the income and spending reports for August. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Morning News: September 22, 2017

Eddy Elfenbein, September 22nd, 2017 at 7:03 amFive Reasons Why China’s Rating Cut Doesn’t Matter for Its Bonds

In Germany, Blue-Collar Jobs Provide Bulwark to Populism

SEC Hack Threatens a Bedrock of U.S. Capitalism: Transparency

Who Will Be Trump’s Pick to Lead the Fed? We Asked Experts to Rate the Odds

Puerto Rico’s Economic Crisis Grows in Maria’s Wake

Facebook Can’t Hide Behind Algorithms

Uber Loses Its License to Operate in London

L’Oreal Advances on Prospects for Sale of Nestle’s Holding

Elon Musk’s Solar Partnership Strategy Doesn’t Look So Crazy Anymore

GE Nears Sale of Its Industrial Unit to ABB

Jamie Dimon Lays Into Bitcoin Again, Says It’s ‘Worth Nothing’

Why You Shouldn’t Imitate Bill Gates If You Want To Be Rich

Why Didn’t Equifax Protect Your Data? Because Corporations Have All The Power

Jeff Miller: Stock Exchange: Climbing the Wall of Worry

Cullen Roche: Let’s Throw Some “Keynesian” Bombs

Be sure to follow me on Twitter.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His