CWS Market Review – December 8, 2017

“People calculate too much and think too little.” – Charlie Munger

Before I get to today’s newsletter, I wanted to let you know that I’ll be announcing the 2018 Buy List in the December 22nd newsletter. That’s in two weeks.

The new Buy List will have 25 stocks. I’ll be adding five new stocks and deleting five old ones. We like to keep our turnover low. The new list won’t take effect until the start of trading in the new year. I like to let investors know what the changes are a few days before they go into effect. I’m very excited for our new Buy List (our 13th!).

Now let’s turn to this week’s newsletter. On Thursday, the S&P 500 finally halted its four-day losing streak. The damage was very minor, and the major indexes are still very close to all-time highs. I have to say that the recent market environment has been nearly picture-perfect; interest rates and inflation are low, corporate profits are growing and consumer confidence is soaring. The S&P 500 has traded above its 200-DMA continuously for 18 months. I’ll warn you—this won’t last!

Lately, some big-name tech stocks have been getting knocked about. At the same time, Wall Street has been favoring cyclical stocks. The Dow Transports, for example, recently broke 10,000 for the first time ever. This could be the start of a major rotation. I’ll tell you what it all means.

We also have a big Fed meeting coming our way next week. Expect another rate hike. I think it’s a mistake, but alas, they didn’t ask me. Later on, I have some Buy List updates for you. Stryker, one of our stalwarts, just raised its dividend as it has every year since 1993. But first, let’s see what this rotation is all about.

Wall Street Turns from Tech to Cyclicals

While the stock market has remained strong, quietly there’s been a changing of the guard. Recently, big tech stocks have been lagging the market. Bear in mind what a good year it’s been for them. The tech sector has made up nearly half the S&P 500’s gains this year. If you lump Amazon in with the techs, then it’s more than half.

Tech first started to lag the market last Tuesday, November 28. It then got much worse for tech on Wednesday, November 29. After that, tech stocks appeared to stabilize, but they lagged again this past Monday. On our Buy List, Microsoft (MSFT) has been a victim of this shift. We can’t say yet if the trend is over.

Overall, the impact hasn’t been earth-shaking, but it’s interesting because it’s been so new. For so long, large-cap tech was such an easy trade. (There was a brief hiccup in June, but that didn’t last long.)

Here’s what’s important: The flip side of lagging tech is a buoyant environment for cyclical stocks. By Cyclicals, I mean stocks whose businesses are heavily tied to the economic cycle. You may own a wonderfully-run homebuilder or chemical maker, but their prospects are always at the mercy of where we are in the cycle. Investors need to understand that.

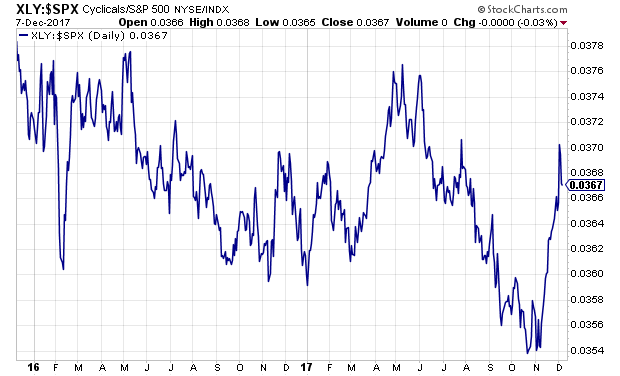

We can see a good example of this by looking at the Consumer Discretionaries ETF (XLY). This sector was a giant winner at the start of this bull market. Their outperformance lasted for years, but starting about two years ago, the Consumer Discretionaries started to lag. Not badly, but they did fall behind. Lately, however, they’ve been rock stars.

Similarly, the Dow Transports (^DJT) have been popping. This is an old-time index of 20 stocks involved in the business of moving people and things about. For the first time ever, the Transports broke 10,000. I wonder how many investors are aware that CSX Corporation (CSX), a boring old railroad, is up 56% this year. That’s more than all the FAANG stocks.

If we drill down a little, one of the best-performing sectors of the Cyclicals has been the homebuilders. NVR (NVR), for example, is a $3,400 stock that’s more than doubled this year. After a long brutal stretch, things are finally looking up for the housing market. Home prices are rising at their fastest pace in three years. Last week, we learned that new-home sales jumped to a 10-year high. It’s all about the cycle.

We’re also seeing new-found strength in financial stocks. On our Buy List, you can see that in stocks like AFLAC (AFL) and Signature Bank (SBNY). The theme seems to be stocks that do the financing, and stuff that’s bought via financing.

What Does This Rotation Mean for Us?

What does this shift to Cyclicals mean? I suspect that this is the market’s confirmation of some recent good news for the economy. As we’ve noted before, consumer confidence is at a 17-year high. Inflation is still low. Housing is coming back. GDP growth for Q2 and Q3 were pretty good, and it looks like Q4 may even top those two. Simply put, the economy is doing well, and the market’s rotation is reflecting that.

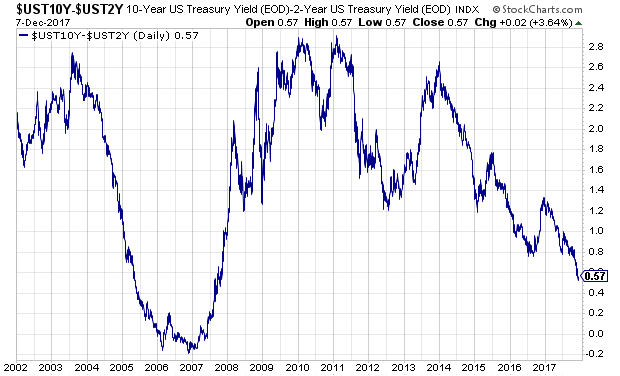

Another reflection of the improving economy is the flattening of the yield curve. The spread between the 2- and 10-year Treasury yields recently fell to just 57 basis points. That’s down from 130 basis points less than a year ago and 260 basis points four years ago.

The yield curve is going to get flatter soon. The Federal Reserve is getting together next week, and it seems certain that they’ll raise interest rates again. The central bank has said it sees three more rate hikes next year, plus another three in 2019. I think three hikes in 2018 has a good chance of happening, but I’m not so sure about 2019. At the upcoming Fed meeting, the Fed will update its projections. I won’t be surprised if they walk back their 2019 forecast.

The reason is the key part of the flattening yield curve—long-term rates aren’t moving that much. In fact, long-term yields are lower than where they were at the start of the year. Frankly, I’m not sure why that is.

Fortunately, we’re not economists and we don’t have to overly concern ourselves with why something is happening. As investors, it’s good enough to know that it’s happening. Shortly after the election, we saw a similar rotation away from tech and towards Cyclicals. However, that move was matched by a sharp drop-off in long-term bonds. We’re not seeing that this time.

This means that bonds are still pretty weak competition against stocks. While stock valuations are elevated (but not extreme), you can still find good deals. On our Buy List, there are several stocks poised to benefit from a continued rotation into Cyclicals. For example, I like Sherwin-Williams (SHW), the paint people. Also, Signature Bank (SBNY) continues to look good. Another Cyclical that looks good now is Wabtec (WAB). Now let’s look at a nice dividend boost from Stryker.

Buy List Updates

We got some good news this week from Stryker (SYK). The orthopedics company said it’s raising its quarterly dividend by 11%. The payout will rise from 42.5 to 47 cents per share.

With all those artificial hips and limbs, Baby Boomers are gradually turning bionic. This is great news for Stryker. The company has raised its dividend every year since 1993.

“Our financial strength is reflected in the 11% increase in our dividend for 2018 as we continue to execute on our capital-allocation strategy,” said Kevin A. Lobo, Chairman and Chief Executive Officer. “With strong organic sales growth and leveraged adjusted-earnings gains, we believe we are well positioned to continue to deliver dividend increases in line with our adjusted earnings growth.”

The new dividend will be payable on January 31 to shareholders of record on December 29. Based on Thursday’s closing price, SYK yields 1.24%.

Shares of Express Scripts (ESRX) have been acting much better recently. Since mid-October, the stock is up nearly 19%. The company is benefiting from an improved environment. Someone could make an offer for ESRX. Thanks to the CVS-and-Aetna deal, there’s a belief that Amazon may jump in, or possibly, Walgreens Boots Alliance. Bernstein recently upgraded the stock and raised its target price from $51 to $65 per share. It also said that Express could greatly benefit from tax reform.

Shares of Cinemark (CNK) got some welcome news this week. First, Cineworld said it’s buying Regal Entertainment for $3.6 billion. Whenever there’s one buyout in an industry, it usually bodes well for other companies. Perhaps someone will make an offer for CNK. The theater chain also announced it’s jumping into the subscription business.

For $8.99 per month, you’ll be able to see one film per month, plus get a 20% discount on concessions, and bring a friend along for $8.99 for a movie. I think this is a good idea. It’s probably not a game-changer, but it fights back against services like Movie Pass.

That’s all for now. The big news next week will be the Federal Reserve meeting. It will be a two-day meeting, on Tuesday and Wednesday. After the meeting, Janet Yellen will be holding a press conference. The Fed will also update its economic projections for the next few years. Then on Thursday, we’ll get the retail-sales report, and on Friday, the industrial-production report comes out. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Here’s an interview I did this past week on Bloomberg TV. I thought it went well.

Posted by Eddy Elfenbein on December 8th, 2017 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

- Tweets by @EddyElfenbein

-

-

Archives

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His