Archive for May, 2018

-

Cerner and the VA

Eddy Elfenbein, May 14th, 2018 at 10:37 amThere have been a lot of headaches with Cerner’s new digital health program for the VA. A recent report blasted the program.

While the report is new, the story isn’t. Cerner said they’re addressing the problems. The story is getting extra attention because the project has been supported by Jared Kushner.

The project’s price tag and political sensitivity — it was designed to address nagging problems with military and veteran health care at a cost of about $20 billion over the next decade — means it is “just another ‘too big to fail’ program,” the tester said. “The end result everyone is familiar with — years and years of delays and many billions spent trying to fix the mess.”

The unclassified findings could further delay a related VA contract with Cerner Corp., the digital health records company that began installing the military’s system in February 2017. The VA last year chose Cerner as its vendor, with the belief that sharing the same system would facilitate the exchange of health records when troops left the service. The military program, called MHS Genesis, was approved in 2015 under President Barack Obama.

In a briefing with reporters late Friday, Pentagon officials said they had made many improvements to the pilot at four bases in the Pacific Northwest since the study team ended its review in November.

To be fair, the problems don’t appear to originate with Cerner but rather with an antiquated government system. Fixing this turns out to be a bigger issue than people expected. Shares of Cerner are down about 2% today.

-

Morning News: May 14, 2018

Eddy Elfenbein, May 14th, 2018 at 7:42 amNAFTA Math May Not Add Up to More U.S. Auto Jobs

Fed’s Mester Says Improved Economic Outlook Supports More Rate Rises

A Major Social Security Change Is Coming in 2022

‘Too Many Jobs in China Lost:’ Why On Earth Is ‘America First’ Trump Vowing to Save China’s ZTE?

Icahn Chalks Up Win as Xerox Scraps $6.1 Billion Fujifilm Deal

Tesla Executives Step Away, Adding to Auto Maker’s Challenges

Facebook Suspends 200 Apps Over Data Misuse Investigation

Nissan Profit Hit by Strong Yen, Higher Materials, R&D Costs

HSBC Says Trade Deal Shows Blockchain Viable for Trade Finance

Why Traditional TV Is In Trouble

The 130-Year-Old Bankruptcy That Created a $5 Billion Oil Giant

JPMorgan Applies to Set Up Majority-Owned Securities Business in China

Ben Carlson: Just Half a Percent

Jeff Miller: Which Stocks Benefit Most from Trump Policy Changes?

Michael Batnick: These Are the Goods

Be sure to follow me on Twitter.

-

CWS Market Review – May 11, 2018

Eddy Elfenbein, May 11th, 2018 at 7:08 am“Necessity never made a good bargain.” – Charlie Munger

The first-quarter earnings season is almost over, and it’s been a good one for Wall Street. Stocks, however, weren’t as happy as the results would suggest. Still, there’s been some positive news for stock investors.

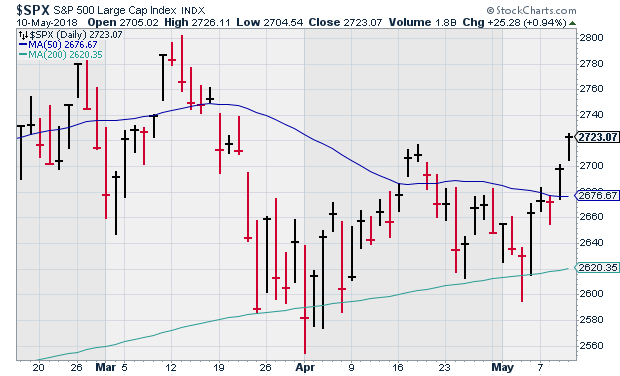

The Dow has added 800 points in the last week. The S&P 500 has rallied four times in the last five sessions, and on Wednesday, the index closed above its 50-day moving average for the first time in three weeks. Still, the 200-DMA lurks. We’re less than 4% above it, and I suspect the bears are planning another strike.

In this week’s issue, I’ll go over our final earnings report for Q1, which was from Cognizant Technology Solutions. The IT outsourcer had a solid quarter. Unfortunately, the stock dipped on lower guidance. Still, I like CTSH a lot. I’ll have more to say later on.

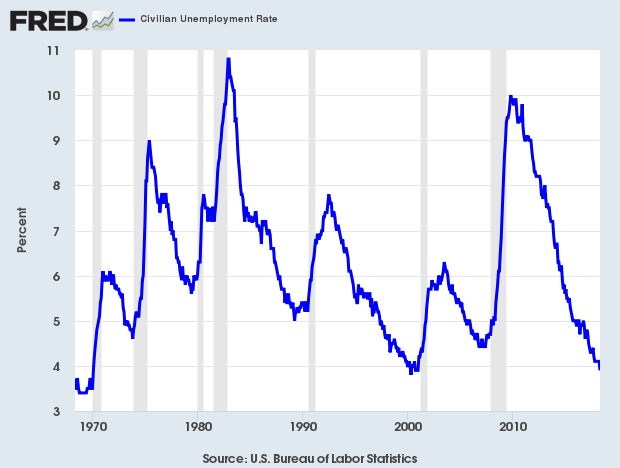

I’ll also discuss the improving economy. Last week’s jobs report showed the lowest jobless rate since 2000. Of course, that was a terrible time for stocks, which is a good reminder that the economy and the stock market are hardly the same thing. Let’s take a closer look at the economy and see if we’re in the best climate in a half a century.

The Best Economy in 50 Years?

Last Friday, the government reported that the unemployment rate for April fell to 3.9%. That’s the lowest rate in more than 17 years. Actually, if we dig a little deeper, we can see that we’re very close to the lowest jobless rate since the 1960s.

Splitting out the decimals, April’s unemployment rate was the third-lowest since January 1970. The other two low months, both in 2000, were only a tiny bit lower than April. If the economy had created only a few thousand more jobs, then we could have said it was the lowest jobless rate since the 1960s.

To be fair, long-term comparisons like that are a bit sketchy. It’s not so much a question of one reading being better than another. Rather, the economy is very different today, and in many ways. Plus, a number of years ago, the government overhauled how it measures unemployment.

Still, I don’t want those points to obscure the overall picture. The U.S. economy is doing quite well. Real GDP for Q1 grew by 2.3%. That number will be revised twice more in the coming weeks. What about Q2? That’s hard to say, but I’ll note that the housing market continues to be healthy, and that’s probably the most important driver of the cycle. The Atlanta Fed currently pegs Q2 GDP growth at 4%, but we won’t get the official numbers until the summer.

Overall, this is good news for us as investors. What’s important to stress is how the stock market has changed. During an expansion, defensive stocks tend to lag. We’ve certainly seen that with stocks like Church & Dwight (CHD), Hormel Foods (HRL) and JM Smucker (SJM). As long-term investors, we can afford to take the proper perspective. It’s not that these companies are bad or that they’ve done something wrong. Rather, they’re in the wrong part of the cycle, and these cycles don’t last forever.

So what’s been doing well? One sector that’s been red-hot is Energy. This week, oil crossed above $70 per barrel for the first time since 2014. Remember that it was a little over two years ago when oil was trading around $26 per barrel. How times have changed! What’s interesting is that many Energy stocks initially didn’t rally with the uptick in oil prices. Oil stocks typically follow actual oil, but this time, it was almost like the stocks didn’t trust the rally.

However, that all changed two months ago, when Energy stocks start to rally. In fact, when you compare the rally to the broader market, it’s been a gem of a rally. Since mid-March, the S&P 500 Energy sector is up close to 15% while the S&P 500 is down less than 1%.

Some of the rise in oil is due to increased geopolitical tensions, but this is also a result of a stronger economy. Our Buy List doesn’t currently have any Energy stocks. That’s not part of a macro-economic prediction on my part. Instead, I just didn’t see any Energy stocks that I strongly liked. As a result, our Buy List may lag the overall market on days when Energy does well. I hope to find Energy stocks in a future Buy List, but I’ll never add a stock just for the sake of diversity.

With the improving economy, and rise in oil prices, we really haven’t seen a meaningful uptick in inflation. On Thursday, the government published its report on inflation for April. Wall Street had been expecting an increase of 0.3%. Instead, it was up 0.2%. During April, gasoline prices were up 3.0%, but that’s after falling 4.9% in March. In the last year, inflation is running at 2.5%.

If we look at the “core rate,” which excludes food and energy, inflation rose by 0.1% in April, and it’s up 2.1% over the last year. To me, this suggests inflation is well under control. Right now, the key for investors is to focus on high-quality stocks. Three of our Buy List stocks that look particularly good right now are Check Point Software (CHKP), Signature Bank (SBNY) and Carriage Services (CSV).

Now let’s take a look at our final earnings report for the first-quarter earnings season.

Cognizant Technology Drops on Lower Guidance

On Monday, Cognizant Technology (CTSH) reported fiscal Q1 earnings of $1.06 per share. That met estimates, although the company had been expecting earnings of at least $1.04 per share. Cognizant is an impressive company. Q1 was up from 84 cents per share one year ago, and their quarterly revenue rose 18.4% to $3.91 billion. Cognizant’s operating margin was just over 20%, which is nice to see. The company’s long-term target is for 21%.

“We achieved solid financial results in the first quarter and progressed our shift to digital services and solutions,” said Francisco D’Souza, Chief Executive Officer. “Cognizant has built the capabilities and scale to help clients digitize their offerings, create personalized customer experiences, instrument their operations, and modernize their IT infrastructure. This digital-at-scale value proposition is winning with clients and positioning us well to deliver a strong 2018.”

Now for guidance. Cognizant expects Q2 earnings of at least $1.09 per share and revenues between $4 and $4.04 billion. Wall Street had been expecting $1.12 per share. Cognizant also lowered its full-year forecast. Originally, CTSH was expecting earnings of at least $4.53 per share. Now they expect at least $4.47 per share.

“First quarter results demonstrate solid execution of our plan to drive sustainable revenue growth while increasing margins,” said Karen McLoughlin, Chief Financial Officer. “Our full year 2018 non-GAAP diluted EPS guidance reflects a higher than originally anticipated effective income tax rate due to the updated interpretation of the U.S. Tax Cuts and Jobs Act of 2017. Our strong balance sheet and cash flows continue to support both our capital return program and our investments in the business to drive future growth and continue our shift to digital services and solutions.”

The stock dropped 5% on Monday. This is a classic case of having a good quarter on the books but the Street focusing only on guidance. Cognizant’s CFO spoke with Barron’s and she had many good things to say. Karen McLoughlin noted that Cognizant’s higher-margin “digitization” services revenue rose 27% last quarter. This now makes up 29% of the company’s total revenue.

I’m not worried at all about Cognizant’s business. CTSH is a buy up to $81 per share.

Buy List Updates

That’s it for our Buy List earnings reports, but our stocks with April quarters will report soon. Both Ross Stores (ROST) and Hormel Foods (HRL) are due to report on May 24. I’ll preview them in next week’s issue. Now I want to provide updates on some of our Buy List stocks.

On May 2, Cerner (CERN) released a disappointing earnings report. At one point early in trading on May 3, Cerner was down more than 10%. Since then, CERN has rallied for five-straight days. On Thursday, it closed 4% higher than where it was before the earnings report. Sure, it makes no sense, but this is why I stress investing in high-quality stocks. The good stuff always shines through.

Moody’s (MCO) broke out to a new high on Thursday. It’s now our best performer on the year with a gain of 17.7%. Here’s their investor presentation for Q1.

I also wanted to say a few words about Alliance Data Systems (ADS). This is turning into our problem stock for 2018, and I wanted to make sure you understand what’s going on.

The loyalty-rewards stock has been in a world of pain lately. Last Friday, ADS dropped as low as $192 per share. Four months ago, it was as high as $278.

Everyone, it seems, expected them to lower guidance in their Q1 earnings report. Instead, the company beat earnings by a good margin and reiterated their full-year earnings forecast of $22.50 to $23 per share. If that number is accurate, that means the stock was recently trading for about eight times earnings. Still, that news didn’t placate the critics, and ADS fell after the earnings report.

There are a few concerns with Alliance’s business. One is that short-term rates are rising. Clearly, that’s going to impact their business, but that’s a regular feature of being in the credit-card biz. Another issue is that their delinquencies have been rising. The company blames the issue on hurricanes, which may be a good reason, but it’s not an excuse. It’s still a business problem. Alliance is also more aggressively leveraged than its peers. That’s not a problem during good times, but it can be a major headache when the dial turns.

Ultimately, I think ADS suffers from “once bitten, twice shy” effect. So many on Wall Street were so blindsided by the financial crisis that they’re now oversensitive to anything that hints of the old bubble. This needs a reality check. The problems in play during the housing bubble were wholly different from what we’re seeing with ADS. Their balance sheet is in far better condition than those of Lehman Brothers and others back in the day.

I’m not looking past the real problems ADS has, but we need proper perspective. Fortunately, the shares have rebounded in the past week. I’m sticking with ADS. This could be a big turnaround for us.

FactSet (FDS) increased its quarterly dividend by 14%. The payout will rise from 56 to 64 cents per share. This is the 13th year in a row that FDS has raised its dividend. The dividend will be paid on June 19 to holders of record at the close of business on May 31. FDS is a buy up to $207 per share.

Wabtec (WAB) has been improving lately. Here’s a PDF from their recent investor conference. This is a good intro if you’re not familiar with them. Wabtec is a buy up to $93 per share.

That’s all for now. Next week will be fairly quiet for economic news. The retail-sales report comes out on Tuesday. That’s often a good indicator for consumer spending. On Wednesday, we’ll get a look at industrial production and housing starts. The March IP report finally reached an all-time high. Industrial production is still recovering from the big tumble it had in 2015. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Morning News: May 11, 2018

Eddy Elfenbein, May 11th, 2018 at 7:03 amUS Sanctions Cause Kremlin-Linked Russian Tycoon To Have To Give Up His Private Jets

What to Watch For in President Trump’s Long-Awaited Drug Price Speech

FCC Hits Robocaller With $120 Million Fine But the Calls Probably Won’t Stop Anytime Soon

The Real Winner in Apple’s New Credit Card Deal Might Surprise You

Nvidia Reveals Crypto Sales for First Time and Predicts Big Drop

Dropbox Revenue Increases as It Lands More Paying Users

Wall Street Is So Sure MoviePass Will Fail, It’s Become Incredibly Expensive to Short

Apple Leaves Overseas Cash Out of Its Latest Quarterly Report

Skechers Says In New Lawsuit It Was Harmed By Adidas Paying Players Under The Table

Elon Musk Offers Free Rides in His New Boring Tunnel

Barclays CEO Jes Staley Fined $870,000 For Trying to Unmask An Anonymous Whistleblower

Michael Batnick: The Blame Game

Blue Harbinger: Do You have a Strategy?

Be sure to follow me on Twitter.

-

Book Review: When the Wolves Bite

Eddy Elfenbein, May 10th, 2018 at 10:31 am“I wouldn’t do business with you if you were the last man on Earth.” So said billionaire Carl Icahn on live television to fellow billionaire Bill Ackman.

On January 25, 2013, for 27 riveting minutes of uninterrupted television, world financial markets came to a halt as two of the wealthiest men on the planet tore into each other. It was great TV.

The brawl was vicious, personal and highly entertaining. The supposed subject of their discussion was an unlikely one: Herbalife, a nutritional-supplements company. On its prospects, they viscerally disagreed; Icahn was long and Ackman was short.

Typically, portfolio managers speak in measured tones. Not this time. These two men loathed each other, and they weren’t shy about expressing it. Naturally, Wall Street loved it. During the segment, trading volume dropped 20%.

Coolly presiding over the mayhem was CNBC anchor Scott Wapner, who details the full story in his fun and engaging new book, “When the Wolves Bite: Two Billionaires, One Company and an Epic Wall Street Battle.”

Here’s the TV segment. If anything, Wapner downplays the zaniness. As the insults started to fly, you can hear traders hooting in the background. At one point, Wapner has to remind Icahn, a billionaire 20 times over, that “bullshit” is inappropriate for cable TV.

Wapner explains how the Ackman/Icahn kerfuffle long predated their on-air brawl. Years earlier, Ackman felt Icahn had screwed him out of millions in a stock deal, and the courts agreed. Icahn, the cantor’s son from Queens, didn’t take the loss well. “I couldn’t figure out if he was the most sanctimonious guy I ever met in my life or the most arrogant.”

Despite their feud, or perhaps driving it, the two men aren’t terribly dissimilar. They’re both rich, very smart and incredibly driven. Both are also “activist investors,” which is the new, more respectable name for “corporate raiders.”

Ackman made his name by shorting MBIA, the mortgage insurer. He chose right and made a fortune. Icahn, whose voice still carries the pugnacity of his native Queens, is a legendary investor. Five years ago, the cover of Time magazine labeled Icahn the “Master of the Universe.”

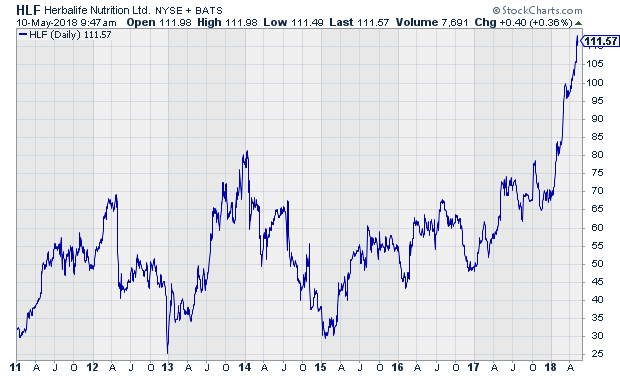

The story picks up speed in 2012, when Ackman and his Pershing Square hedge fund decide to take a $1 billion short position in Herbalife, the multilevel marketing company. Under the leadership of their ebullient CEO Michael O. Johnson, Herbalife sold diet shakes and teas, mostly to Hispanic customers. Like many MLM firms, the strategy was to get to new people to sign on as distributors who then had to buy more products. The new distributors were then encouraged to sign on still more distributors.

This left the question, “Were Herbalife’s sales real, or were they just selling to their own distributers?” In May 2012, before Ackman initiated his short, the stock got pummeled after David Einhorn queried management on precisely this topic. They fumbled their answer, and Wall Street’s judgment was brutal. The next day, shares of Herbalife plunged 40%.

On balance, history suggests that Herbalife is indeed a legitimate enterprise, if perhaps an unseemly one. But Ackman’s thesis was that the whole thing was a sham and a Ponzi Scheme. He used the media and an investor conference to relentlessly criticize Herbalife. That’s what irritated Icahn. He objected to Ackman’s bear-raid tactic of taking an outsized short position and then scaring the bejesus out of everyone. In response, Ackman accused Icahn of using the same tactics.

Wapner is a skilled storyteller, and the book has its tragicomic moments. By 2014, the battle started to turn against Ackman. At one investor conference, Ackman slammed Harbalife for more than two hours, and the shares soared 25% that day. Herbalife was so creeped out by Ackman’s obsession that they commissioned a psychological evaluation of him, looking at his desires and motivations, the same way the FBI profiles serial murderers.

“This guy Ackman,” to quote Icahn, seemed possessed. The more he lost, the more defiant he became. He even compared Herbalife’s evasions to the Nazis’ “big lie.” As Herbalife rallied, Icahn increased his already massive fortune, but causing Ackman pain seemed the greater reward.

One of the more disquieting details in the book is the way big investors manipulate the media. In fact, Ackman was able to marshal much of the political system against Herbalife. Apparently, if you have enough cash to spend, it doesn’t seem terribly difficult to weaponize social justice in the cause of your portfolio. I have to wonder where else this dynamic exists.

The judgment of Wall Street is clear: shares of Herbalife are up more than 64% so far this year. As entertaining as the Herbalife story is, it’s also just baffling. What drove these men? Why was Ackman so darn relentless? Why did he short Herbalife after Einhorn gave it such a haircut? It’s odd that a battle over a nutritional-supplements company is tinged with Greek drama. When egos are in play, all the money in the world isn’t enough.

-

Barry Ritholtz on Fund Fees

Eddy Elfenbein, May 10th, 2018 at 9:25 amYesterday, Barry Ritholtz had an incisive column on the evolving nature of fees in the investment world.

Today, he added:

I (of course!) ran long, and the editors cut my blathering down to a more manageable 800 or so words. But some background of how this came about, along with a few things that did not make the final cut are worth sharing.

First, Peter Boockvar introduced me to Andrew Wellington a while ago (Andrew is Lyrical’s CIO and co-founder). I have been mulling over his thoughts for a while. Lyrical charges a 0.75% management fee, and 25 percent of the outperformance versus the benchmark (there is also a bigger cap weighted 0.45% + 25% of alpha version).

I like the 0.75% + 25% of alpha versus 2.00% plus 20% of beta + alpha

And, the combination of outperformance and $9 billion in assets impressed me, making me think these fees could be a bigger force in both active management and alternative investments.

Exchange traded funds are not immune from this fee pressure either: I also spoke with Eddy Elfenbein, who manages the first ETF that charges a variable fee. The active concentrated CWS (Crossing Wall Street!) fees flex as they either beat its index or not. He is aligned with his shareholders in that he makes less when his model does not out-perform. “I wanted to show our investors that I have skin in the game, and my interests are aligned with theirs. If we beat the index, I get a bonus. If we fall short, they get a savings. It’s that simple.”

-

Morning News: May 10, 2018

Eddy Elfenbein, May 10th, 2018 at 7:10 amIran’s Door to the West Is Slamming Shut, and That Leaves China

Oil Traders Prepare to Cut Iranian Crude on Trump Sanctions

‘Humbling’ U.S. Settlement Clears Crisis-Era Hangover for RBS

One of the World’s Biggest Phone Firms Is Stopping Operations Because of a Ban on Buying

Mulvaney Downgrades Student Loan Unit in Consumer Bureau Reshuffle

California Takes Big Step to Require Solar on New Homes

Apple Scraps $1 Billion Irish Data Center Over Planning Delays

Struggling Tesla Faces an Investor Insurrection

Nvidia’s $18 Billion Rally Burns Bears Just in Time for Earnings

Alexa and Siri Can Hear This Hidden Command. You Can’t.

Expectations Capped, Wells Fargo Investors Await Details on Costs

Anbang Insurance Founder’s Stunning Fall Ends With 18-Year Prison Term

Lawrence Hamtil: Revisiting the Case For An Equal-Weighted EM Strategy

Joshua Brown: The Drawdown Blues

Animal Spirits: Tesla Hathaway

Be sure to follow me on Twitter.

-

Morning News: May 9, 2018

Eddy Elfenbein, May 9th, 2018 at 7:04 amEuropean Companies Rushed to Invest in Iran. What Now?

The Senate May Begin Restoring Net Neutrality Today—Or Kill It for Good

Vodafone’s $22 Billion Liberty Deal to Reshape European Telecom

SoftBank CEO Accidentally Announces That Walmart Has Beaten Amazon in the Battle to Buy Flipkart

Jobs Platform Glassdoor to Be Acquired by Japan’s Recruit Holdings for $1.2 Billion

Dish Network Quarterly Revenue Misses Estimates on Pay-TV Losses

Parks, ‘Black Panther’ Propel Disney Earnings Past TV Decline

Disney CEO Is Upbeat About Deal With Fox

MoviePass Owner’s Cash Runs Low With $9.95 Monthly Deal Taking Toll

What Is Blockchain? New Facebook Unit To Explore Tech Behind Bitcoin

Toyota’s Upbeat Profit Forecast, Stock Buyback Lift Shares

Tesla Urged to ‘Raise Its Game’

Nick Maggiulli: Why Winners Keep Winning

Ben Carlson: Lawmakers Don’t Understand How Buybacks Work

Michael Batnick: Should I Time the Market?

Be sure to follow me on Twitter.

-

Oil Breaks $70

Eddy Elfenbein, May 8th, 2018 at 10:43 amFor the first time since 2014, oil is above $70 per barrel. Two years ago, oil got as low as $26. We’re obviously waiting on the president’s decision about the Iran deal.

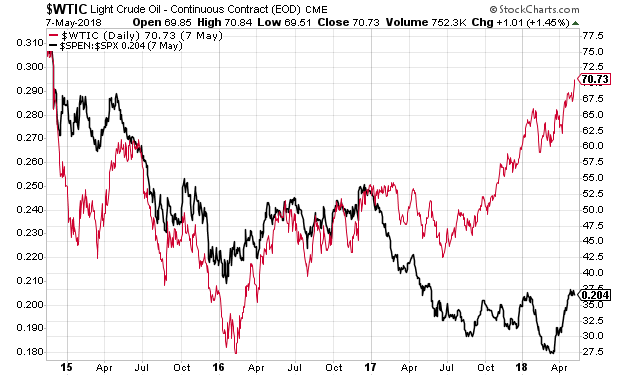

Interestingly, oil prices and the share prices of energy stocks had diverged. Here’s a chart showing oil (in red) and the Energy Sector divided by the S&P 500 (in black). Only recently have energy stocks seen a bounce in relative terms.

It’s almost as if the stock market doubted the oil rally would last. Then they finally threw in the towel.

-

Morning News: May 8, 2018

Eddy Elfenbein, May 8th, 2018 at 7:09 amAustralia Plots Early Return to Surplus By Defying Global Forces

Should the Fed Create `FedCoin’ to to Rival Bitcoin? A Former Top Official Says `Maybe’

Comcast Is Still Trying to Bust Up the Fox-Disney Marriage. Here’s How They Could Do It

Shire (SHPG) Agrees to Be Acquired by Takeda for $62 Billion

The 13 Best Warren Buffett Quotes from the Berkshire Hathaway Meeting

T-Mobile, Sprint Come Up Short in Making Their Case For A Wireless Merger

Alibaba Buys Rocket Internet’s Daraz to Expand its E-commerce Empire into South Asia

Dimon Lays Out 100-Year China Vision With Trade Spat on Horizon

Goldman, Wells Fargo Look to Credit Cards for Bigger Returns

Icahn, Deason Want Bid Of At Least $40 Per Share For Xerox

Amazon’s Prime Video Service Has A Weird Problem — People Are Paying For It But Aren’t Watching It

Elon Musk Wants to Fill Warren Buffett’s `Moat’ With Candy, But It Still Holds Water

Roger Nusbaum: Has The Bear Arrived?

Howard Lindzon: Momentum Monday …The Only Thing Not Working is Complaining

Be sure to follow me on Twitter.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His