Archive for June, 2018

-

CWS Market Review – June 29, 2018

Eddy Elfenbein, June 29th, 2018 at 7:08 am“There is a danger of expecting the results of the future to be predicted from the past.” – John Maynard Keynes

In recent issues of CWS Market Review, I’ve discussed how the stock market has become more defensive of late. By that I mean the riskier stocks are lagging while high-quality names are holding up well. This is a very important change, and it’s been reflected in the performance of our Buy List. Since June 1, the S&P 500 has fallen by 0.67%, but our Buy List has gained 2.18%. In fact, we’re now leading the market for the year (not including dividends).

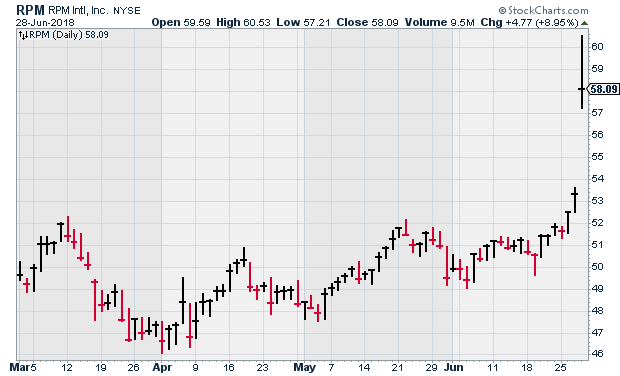

This week, we had more good news from our Buy List. On Wednesday, shares of Ross Stores touched a new all-time high. Remember how the stock got clocked after its last earnings report? Quality always shines through; it just takes time. Then on Thursday, RPM International jumped 9%. I’ll give you the full story on that in a bit. We also had good earnings from FactSet, plus higher guidance, but the stock fell anyway. I’ll tell you what it means. But first, let’s talk a little more about the market’s pivot towards defense.

High Beta Finally Starts to Falter

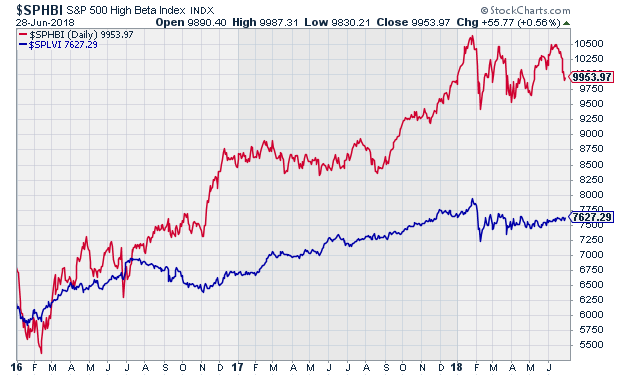

I realize I may sound like a broken record talking about the big shift in the market, but it became a lot more pronounced this week. A good way of looking at the stock market is to compare the relative performance of High Beta stocks versus Low Volatility stocks.

If you’re not familiar with these phrases, I’ll skip the mumbo-jumbo and make it easy for you. High Beta stocks are risky stocks that tend to bounce around a lot while Low Vol stocks are conservative stocks that tend to be a lot more stable. When the market goes up, High Betas are supposed to go up a lot. When the market falls, High Betas get extra punished. At least, that’s the theory.

Investing tends to move in cycles and we can clearly see that in the High-Beta-versus-Low-Vol fight. It’s not that one is always superior to another (though Low Vol is the clear winner historically). Instead, it’s that each side has its moment in the sun. As investors, we need to be aware of which way the sun is shining.

In 2015, Low Vol owned High Beta. That all changed in February 2016. Since then, it’s been High Beta’s world (Exhibit A: the FAANG stocks). This group started doing really well after the election. Only recently has Low Vol started to fight back.

Why now? Part of it could be nervousness about the market. Also, there could be fears about an escalating trade war that could do real damage to the economy. This week, Harley-Davidson (a former Buy List stock) said it’s moving some production outside the U.S. in response to higher tariffs. The EU said they’re jacking up tariffs on U.S. bikes from 6% to 31%. Harley said that would raise the sticker price on each bike by $2,200. That’s a tough pill to swallow.

With our Buy List, I don’t try to pick out Low-Vol names. Instead, I go for high-quality stocks at a discount, and that strategy tends to overlap with Low Vol. In the biz, they would say that’s a Low Vol “tilt.” More importantly, the shift away from high-profile tech stocks and towards more defensive names benefits us. That’s why June has been so good for us.

I also want to make an important point about our Buy List. We’re not going to beat the market every single year. We realize that our style of investing tends to follow a very general cycle. When junkier names lead, we lag. That’s just how the game is. Ideally, we don’t lag by very much. That’s pretty much what happened during the early part of this year. When the cycle turns and conservative names do better, we often do much better. Tie it all together and it’s a good long-term strategy for us.

On a side note, social media being what it is, I’ll periodically hear from critics ragging me for lagging the market in a particular month. What they fail to mention is what kind of market it was. If we lag by a little in a High-Beta climate, I consider that to be good news. The lesson is to understand what climate you’re in.

I suspect the shift towards defense will continue for a few more months. Simply put: too many good names have been left behind. This is an excellent market for us and for our strategy. Now let’s take a look at this week’s earnings report.

FactSet Beats, Raises Guidance…and Falls

On Tuesday morning, FactSet (FDS) reported fiscal Q3 earnings of $2.18 per share. That beat Wall Street’s estimate by five cents per share. Quarterly revenues rose 8.9% to $339.9 million.

Thanks to the good earnings, FactSet bumped up its full-year earnings forecast. The old range was $8.35 to $8.55 per share; the new range is $8.37 to $8.62 per share.

Despite the good news, the stock fell 5.2% on Wednesday, and that’s on top of sliding into the earnings report. In four days of trading, FDS lost more than 8.6%.

Why was the market so grumpy? I really can’t say. The numbers look solid. Phil Snow, FactSet’s CEO, said, “We are making progress integrating and cross-selling our acquisitions, resulting in important wins this quarter, particularly within Analytics. We continue to innovate with the launch of the Open:FactSet marketplace and enhancing our risk offering. We believe we have a solid pipeline for the fourth quarter and expect to finish fiscal 2018 in our guidance range.”

A key metric I like to watch on FactSet is their Annual Subscription Value, or ASV. For Q3, ASV rose 5.3% to $1.36 billion. That’s pretty good. At the end of the quarter, FactSet had 4,975 clients. That’s an increase of 80 clients. User count rose by 860 to 89,506. Business is looking good.

One negative is that FactSet’s operating margin fell to 31.0% last quarter, compared with 31.9% a year ago. The company blamed the drop on restructuring actions and certain one-time administrative expenses. I’d hardly blame an 8% drop on that.

The CFO said, “We made good progress on our annual and medium-term goals this quarter. The restructuring actions we initiated this quarter help us to optimize costs and benefit margins in the future. With our balanced capital-allocation framework including our robust share-buyback program and an increase in dividends, we continued to return value to shareholders.”

For the first nine months of the year, FDS has made $6.34 per share. The new outlook implies Q4 earnings of $2.03 to $2.28 per share. Wall Street had been expecting $2.19 per share.

FactSet seems to be the latest in a recent trend for our Buy List stocks. They report good earnings, yet the share prices fall. I’m not concerned at all about FactSet. I’m dropping our Buy Below down to $211 per share to reflect the recent pullback. This is a good stock.

RPM International Jumps on Elliott Deal

Shares of RPM International (RPM) were in the news on Thursday. Bear in mind that RPM is never in the news, so the mere fact that they’re in the news is itself newsworthy.

Here’s what happened. The company announced that it has reached an agreement with Elliott Management. Elliott is an activist investor. That’s the new name for corporate raiders. These are guys who take big positions in undervalued companies and then demand that they make changes to boost the share price. These tactics are often criticized because they’re thought to be at the expense of the company’s long-term interest. Still, academic research has shown that activists can boost the share price.

Elliott is run by Paul Singer, and they’re one of the better activist groups. Since we look for good, overlooked companies as well, we have crossed paths with Elliott before. If you recall, they pushed for changes at Cognizant last year, and it worked out well for us.

I’ll summarize the agreement between RPM and Elliott. RPM will add two new board members. The board will also form an Operating Improvement Committee. (Shouldn’t every committee be that?) The OIC will “focus on operational and financial initiatives to create and enhance shareholder value. Certain of these initiatives will center around setting and achieving new company margin targets based on top-performing industry standards and optimization of RPM’s balance sheet, including streamlining working capital and implementing new capital allocation guidelines and capital return plans.”

The idea is that RPM will be more transparent regarding its financial goals. They’ll provide an update for shareholders by November 30. RPM’s CEO said:

“Over the past year, RPM’s Board and management have begun working on initiatives to drive greater efficiency across our operations while maintaining our growth momentum,” said Mr. Sullivan. “We have made some progress in reducing SG&A and identified key opportunities to improve manufacturing efficiencies, lower operating costs, and improve working capital. The initiatives announced today position us to progress significantly on these plans.

That sounds pretty vague. I’m not sure if this means they’re pushing for a buyout or pushing to divest some businesses. RPM owns several well-known niche brands like Rust-Oleum. RPM jumped 9% on Thursday. Perhaps that’s due to Singer’s reputation. This is very good news for us. This is a company that has raised its dividend for the last 44 years in a row, and a lot of investors have never heard of them. RPM’s fiscal Q4 earnings report will come out on July 19. I’m raising our Buy Below on RPM to $62 per share.

That’s all for now. Next week begins the second half of 2018. On Monday, we’ll get the ISM report for June. Tuesday is factory orders. The stock market will be closed on Wednesday in honor of Independence Day. America turns 242 years old! Then on Friday, we’ll get the jobs report for June. The report for May showed the lowest unemployment figures since the 1960s. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Syndication Partners

I’ve teamed up with Investors Alley to feature some of their content. I think they have really good stuff. Check it out!

Buy This Export to China That Is Exempt From Tariffs

Sometimes investment opportunities can be found in the most innocuous of headlines. A perfect example of this occurred in the back-and-forth tariff threats between the U.S. and China.

One of the Chinese government’s threatened retaliation measures would be to impose tariffs on the most successful export industry the United States has had in recent years – energy. China said it would slap a 25% tariff on imports on U.S. oil, coal and certain refined products. But there is one notable exception – liquefied natural gas (LNG).

Of course, China may decide to impose a tariff on LNG too, but that is doubtful. And therein lies the tale of an investment opportunity for you.

Two Stocks to Buy and One to Sell with Oil Prices Climbing Again

President Trump is at it again! On June 13, he again blamed OPEC for the rising price of oil. In a tweet he said, “Oil prices are too high, OPEC is at it again. Not good!”. This follows a similar tweet on April 20 when President Trump said “oil prices are artificially Very High” due to the supply curbs by OPEC and its allies.

Trump’s tweet comes ahead of a meeting next week of oil ministers from OPEC and Russia who are under pressure from the U.S. to raise output by at least one million barrels of oil a day, after more than a year of enacting production cuts.

So is OPEC to blame? Yes and no. There are other factors at play here such as a robust global economy that has driven up demand for oil. For example, if you look at just China and India, they have imported 962,000 barrels per day more in the first five months of 2018 than in the same period last year.

But the real problem is on the supply side, with President’s Trump’s imposition of new sanctions on Iran exacerbating an already bad situation. Let me explain.

-

Morning News: June 29, 2018

Eddy Elfenbein, June 29th, 2018 at 7:05 amChina Has Refused To Recycle The West’s Plastics. What Now?

China’s Penetration of Silicon Valley Creates Risks for Startups

US-China Trade War Will Spill Into Other Asian Economies

China’s ZTE Still in Limbo Over U.S. Commerce Ban

Nike Posts Growth in Home Market

Bird CEO Explains Why His Scooter Startup Needed $300 Million

Crypto Coin Graveyard Fills Up Fast as ICOs Meet Their Demise

Friday Could Be The Busiest Day in U.S. Airline History — Hopefully, A Fragile System Is Ready

Howard Lindzon: Nike Just Did It…Fashology 101

Roger Nusbaum: A Black Swan ETF?

Ben Carlson: Rocket Men Precision

Be sure to follow me on Twitter.

-

RPM Jumps on Agreement with Elliot Management

Eddy Elfenbein, June 28th, 2018 at 9:52 amRPM International (RPM) is in the news today. RPM is never in the news so the idea that they’re in the news is itself newsworthy.

The company has announced an agreement with Elliott Management, an activist investor, to enhance shareholder value.

First off, RPM will get two new members on the board. The board will also form an Operating Improvement Committee. This committee will “focus on operational and financial initiatives to create and enhance shareholder value. Certain of these initiatives will center around setting and achieving new company margin targets based on top-performing industry standards and optimization of RPM’s balance sheet, including streamlining working capital and implementing new capital allocation guidelines and capital return plans.”

RPM will now be more transparent regarding their financial goals. They’ll provide an update by November 30.

“Over the past year, RPM’s Board and management have begun working on initiatives to drive greater efficiency across our operations while maintaining our growth momentum,” said Mr. Sullivan. “We have made some progress in reducing SG&A and identified key opportunities to improve manufacturing efficiencies, lower operating costs, and improve working capital. The initiatives announced today position us to progress significantly on these plans. Both Kirk and John add new perspectives and proven operational track records to our Board, and we look forward to benefitting from their expertise and experience as we take action to drive operational efficiencies, long-term performance, and value creation.”

Jeff Rosenbaum, Portfolio Manager at Elliott Management, said, “We are pleased to have worked constructively with RPM’s Board and management team on the initiatives announced today. RPM has an outstanding collection of leading brands, and we believe the company has significant potential for further operating, financial, and balance sheet improvements. Kirk Andrews brings strong portfolio and operational review and execution experience with his leadership in NRG’s recent $855 million cost and margin enhancement program. And John Ballbach brings strong industry know-how and leadership skills from his work as a Valspar senior executive. They will both add immediate value to RPM’s Board and newly formed Operating Improvement Committee. We are confident that this ‘no stone unturned’ review will lead to several hundred basis points of margin improvement, capital returned to shareholders, and superior overall results for the Company.”

-

Q1 GDP Growth Revised to 2.0%

Eddy Elfenbein, June 28th, 2018 at 8:53 amThis morning, the government revised the economic growth numbers for the first quarter of this year. According to the new data, the US economy grew, in real terms, at a 2% annualized rate for Q1.

That’s been about the average for the recovery. What’s interesting is that the recovery has been less than the average of the last several decades.

There’s been talk of the economy ramping up to a faster growth rate. So far, the numbers say that hasn’t happened. Of course, this is for Q1 which began six months ago and ended three months ago, so Q2 could be a different story. The Atlanta Fed thinks Q2 came in at 4.5%.

I hope so. That’s a very good number, and it could signal that things are ramping up. We’ll get our first look at the Q2 numbers in late July.

Here’s a look at the year-over-year growth rate in real GDP.

-

Morning News: June 28, 2018

Eddy Elfenbein, June 28th, 2018 at 7:10 amSurging Oil Prices Are Doing Nothing for Stocks in 2018

Gold Marks Third Straight Decline and Another 6-Month Low

BOE Warns of Growing Risks in Global Debt Markets

Ford Fiestas Aren’t Tools of War, Automakers Say in Trump Retort

Vanguard Group Goes Greener With Two ESG ETFs

Elon Musk Races to Exit Tesla’s ‘Production Hell’

T-Mobile, Sprint Bosses Defend Wireless Merger

The New GE Could Use Some Berkshire Spirit

Why Canopy Growth Corp’s Shares Plunged 12% Today

Google Exec Says Microsoft Beat Search Giant to Buy GitHub

MoviePass Owner Dips Below 25 Cents as AMC Debuts Rival Service

Amazon Plans Start-Up Delivery Services for Its Own Packages

Nick Maggiulli: You See What You Want To See

Cullen Roche: How Blogging Changed Wall Street

Michael Batnick: Animal Spirits: Individual Alpha

Be sure to follow me on Twitter.

-

Ross Stores Hits New High

Eddy Elfenbein, June 27th, 2018 at 11:55 amOn May 25, shares of Ross Stores (ROST) fell 7% after the deep-discount retailer reported earnings. I thought the earnings were just fine, but traders apparently disagreed.

This is from the CWS Market Review of June 1:

Ross Stores (ROST) reported fiscal Q1 adjusted earnings of $1.11 per share. Earlier, the company had projected earnings of $1.03 to $1.07 per share. They made 82 cents per share for last year’s Q1.

There were a few accounting items to adjust for. Ross said they were helped in Q1 by 17 cents per share due to tax reform plus two cents per share thanks to “the favorable timing of packaway-related expenses that we expect to reverse in subsequent quarters.”

Q1 sales rose 9% to $3.6 billion, and comparable-stores sales were up 3%. Ross had been expecting 1% to 2%. I knew that forecast was too low. The company said it was hurt by poor weather during the quarter. I’m usually pretty skeptical of weather as an excuse. Ross’s operating margin fell to 15.1%. That’s still pretty good.

For fiscal Q2, Ross expects earnings of 95 to 99 cents per share. They see same-store sales growth of 1% to 2%. That’s pretty low. The good news is that Ross raised its full-year guidance. The old range was $3.86 to $4.03 per share, and the new range is $3.92 to $4.05 per share.

Pretty good, but still, shares of Ross dropped in one day from $82.96 to $77.34. Here we are one month later and ROST touched $87.22 this morning.

This is why we focus on high-quality names. They may get knocked around, but quality shines through.

-

Morning News: June 27, 2018

Eddy Elfenbein, June 27th, 2018 at 6:43 amHedge Fund Managers See Echo of Past Crashes in Markets

China’s ‘Big Mama’ Steps In as Yuan Tumbles Further

Trump’s Trade War Revives Fears China Will Devalue Yuan

The Trade War Finally Got Real

Trump Threatens Harley-Davidson With Taxes ‘Like Never Before’ and Predicts Its Eventual Collapse

The Culture Clash Behind GE’s Quick Exit From Baker Hughes Stake

Facebook Loosens Ban on Cryptocurrency Ads for Approved Vendors

Facebook Abandons its Plans to Build Giant Drones and Lays Off 16 Employees

Uber Regains Temporary License to Operate in London After Promising to Stop Being Terrible

We Have Reached Peak Screen. Now Revolution Is In The Air.

Google Retires DoubleClick, AdWords Brand Names

Roger Nusbaum: What You Need Might Cost More Than Three Basis Points

Ben Carlson: My Evolution on Asset Allocation

Joshua Brown: How to Chop Up Your Portfolio

Be sure to follow me on Twitter.

-

High Beta vs. Low Vol

Eddy Elfenbein, June 26th, 2018 at 8:04 amHere’s an intra-day look at High Beta vs. Low Vol ETFs over the past two weeks. Low Vol hasn’t moved much while High Beta has been knocked about.

In financial markets, it’s interesting how often a big move like yesterday’s is quietly hinted at in the prior few days. The gap between the two gradually got bigger, until it completely blew apart yesterday.

-

FactSet Earns $2.18 per Share

Eddy Elfenbein, June 26th, 2018 at 7:10 amThis morning FactSet (FDS) reported fiscal Q3 earnings of $2.18 per share. That beat Wall Street’s estimate by five cents per share. Revenues increased 8.9% to $339.9 million compared.

Thanks to the good earnings, FactSet bumped up its full-year earnings forecast. The old range was $8.35 to $8.55 per share. The new range is $8.37 to $8.62 per share.

The CEO said, “We are making progress integrating and cross selling our acquisitions resulting in important wins this quarter, particularly within Analytics. We continue to innovate with the launch of the Open:FactSet marketplace and enhancing our risk offering. We believe we have a solid pipeline for the fourth quarter and expect to finish fiscal 2018 in our guidance range.”

A key metric for FactSet is Annual Subscription Value or ASV. For Q3, ASV rose 5.3% to $1.36 billion. At the end of the quarter, FactSet had 4,975 clients. That’s an increase of 80 clients. User count rose by 860 to 89,506.

FactSet’s operating margin fell to 31.0% last quarter compared with 31.9% a year ago. The drop reflects restructuring actions and certain one-time administrative expenses.

The CEO said, “We made good progress on our annual and medium term goals this quarter. The restructuring actions we initiated this quarter help us to optimize costs and benefit margins in the future. With our balanced capital allocation framework including our robust share buyback program and an increase in dividends, we continued to return value to shareholders.”

For the first nine months of the year, FDS has earned $6.34 per share. The new outlook implies Q4 earnings of $2.03 to $2.28 per share. Wall Street had been expecting $2.19 per share.

-

Morning News: June 26, 2018

Eddy Elfenbein, June 26th, 2018 at 7:04 amDow Jones Cuts Losses; Is Donald Trump About To Blink In China Trade War?

The Supreme Court Just Issued a Ruling Affecting the Credit Card Industry — and Silicon Valley, Too

Judge Dismisses Climate Suits Targeting Big Oil Companies

GE’s Exit From the Dow Will Change the Index’s Calculation In An Important Way

GE Is To Spin Off Health Care Division In Bid to Streamline

Harley-Davidson To Shift Some Production Overseas Due To Trade War

With Cryptocurrencies in Freefall, One Big Firm Doubles Down

BMW Warns of U.K. Pullback If There’s No Brexit Deal

Apple’s Tim Cook Weighs In On Social Issues

How to Solve the Plastic Crisis

Kinder Morgan, EagleClaw, Apache to Develop Permian Highway Pipeline

McDonald’s Wants to Win Breakfast by Selling the Best Part of the Muffin

Joshua Brown: Three Uncelebrated Edges

Ben Carlson: The Best Free Investing Tools on the Web

Howard Lindzon: Momentum Monday – I Wish It Was Friday

Be sure to follow me on Twitter.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His