Archive for June, 2018

-

Strong Relative Performance for our Buy List

Eddy Elfenbein, June 25th, 2018 at 10:53 pmToday was a remarkable day for the stock market. A large group of stocks fell sharply while the rest were barely scratched. Fortunately, our Buy List was tilted toward the latter.

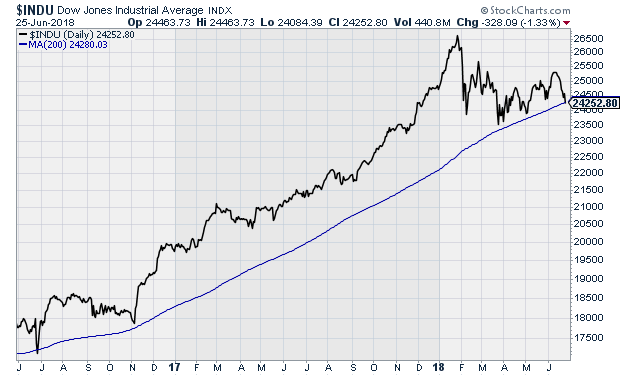

The S&P 500 fell 1.37%. The Dow lost 328 points. In fact, the Dow closed below its 200-day moving average for the first time in 501 trading days.

The S&P 500 briefly dipped below 2,700 but rallied some late in the day. The big divergence can be seen by looking at the value and growth indexes. The S&P 500 Value Index fell -0.89% while the growth part fell -1.78%. That’s exactly double.

The effect is even more pronounced by looking at the High Beta and Low Vol indexes. The S&P 500 High Beta index fell 2.28% today. Low Vol actually gained 0.16%. Nineteen of our 25 stocks outpaced the S&P 500 today.

Our Buy List lost -0.63% today. That was much better than the overall market.

Here’s the sector breakdown, worst to first.

Tech -2.28%

Energy -2.20%

Discrete -2.18%

Materials -1.46%

Industrials -1.24%

Financials-1.03%

Health Care -0.90%

REITs -0.18%

Telecom -0.08%

Staples +0.44%

Utes +1.65% -

Harley Will Move Some Production Overseas

Eddy Elfenbein, June 25th, 2018 at 12:29 pmThis is what to worry about with a trade war. Harley-Davidson (HOG) said they’ll move some production out of the U.S. due to trade tariffs.

In response to the Trump administration’s tariffs, the EU responded by jacking up the tariffs on U.S. bikes. That dings Harley $2,200 per each bike.

Harley-Davidson’s move is some of the most direct evidence yet that tit-for-tat trade fights between the United States and other countries have consequences for American companies. Harley-Davidson said it stood to lose as much as $100 million a year.

“Increasing international production to alleviate the EU tariff burden is not the company’s preference, but represents the only sustainable option,” Harley-Davidson said in a regulatory filing on Monday.

The EU began imposing tariffs Friday on $3.2 billion worth of American goods, including motorcycles, orange juice, bourbon, peanut butter, motorboats, cigarettes and denim. They are a response to the Trump administration’s tariffs on steel and aluminum imports from Europe.

For motorcycles, the EU raised its 6% tariff to 31%. That will make each bike about $2,200 more expensive to export, Harley said.

Last year, Harley sold 140,000 bikes in the U.S. and about 40,000 in Europe.

-

Major “Defensive” Day

Eddy Elfenbein, June 25th, 2018 at 11:16 amThe stock market is taking a hit so far this morning. Today is very good example of the market becoming much more defensive. In simpler terms, risky stocks are getting slammed, but conservative ones aren’t down so much. That’s good news for our Buy List in that while we’re down, we’re not down by nearly as much as the market.

In fact, some of our most defensive names are in the green today. Church & Dwight (CHD), Hormel (HRL) and Smucker (SJM) are all currently positive today.

The best place to look to see this effect is by comparing the S&P 500 High Beta index to the S&P 500 Low Vol index. So far, High Beta is down 2.22% today while the Low Vol is up 0.22%.

This means that the market is becoming more defensive and less willing to take on risk.

-

Morning News: June 25, 2018

Eddy Elfenbein, June 25th, 2018 at 7:08 amWhat Happens When Social Security’s Trust Funds Run Out?

What’s the Yield Curve? `A Powerful Signal of Recessions’ Has Wall Street’s Attention

Did The Supreme Court Potentially Bankrupt Tens Of Thousands Of Small Online Businesses?

Uber Claims to Have Changed. A London Judge Will Decide.

U.S. Shale Companies Motor Ahead Despite OPEC

Losing China Has Taken Wind Out of Xiaomi’s IPO Sails

Intel’s Chip Stumble Is Letting Rivals Pull Ahead

Amazon, Microsoft and Google Face Backlash over ICE, Military Deals

JPMorgan to Sell Stake in Saudi Arabian Bank for $203 Million

Jeff Bezos’ Blue Origin Will Start Selling Tickets to Space Next Year

Toshiba Says SEC Completes Accounting Probe, No Penalty

Lawrence Hamtil: The Skew and Equal-Weighting

Cullen Roche: 5 Questions and Answers on “Passive” Investing & Part Deux

Howard Lindzon: Carpe Volatility…Bitcoin and Amazon

Be sure to follow me on Twitter.

-

CWS Market Review – June 22, 2018

Eddy Elfenbein, June 22nd, 2018 at 7:08 am“Opportunity is missed by most people because it is dressed in overalls and looks like work.” – Thomas Edison

On Thursday, the Dow Jones Industrial Average closed lower for the eighth day in a row. That’s a rare event. If the index closes down on Friday, it will tie the Dow’s longest losing streak of the last 40 years.

Should we be worried? Nah, not really. The stat, scary as it sounds, is somewhat misleading. Over those eight days, the broader S&P 500 rose three times. Also, the first drop of the Dow losing streak was for a grand total of 1.58 points. Sure, it counts as a drop, but it’s less than puny.

This week’s issue has a theme, which is change. The business climate is constantly in flux. This is an important lesson for investors. I’ll give you my thoughts on what it means. I’ll also give you a sneak preview of some Buy List candidates I’m considering for next year. Later on, I’ll preview next week’s earnings report from FactSet. Plus, I’ll fill you in on the latest from Alliance Data Systems. Last month, I said it “could be a big turnaround for us.” It looks like that’s happening.

GE Gets Booted from the Dow

Truthfully, the Dow Jones is not a very good index to follow. It gets lots of attention because it’s so old. Around here, we prefer to follow the S&P 500. One major criticism of the Dow is that it’s a price-weighted index. That means it’s calculated by adding up the share prices of all 30 stocks and then dividing by some divisor. It doesn’t matter how big or small the companies are. Roughly speaking, each dollar in share price of a Dow stock is worth about seven points in the Dow.

The S&P 500 is value-weighted. That means it’s adjusted for its market value. Each point in the S&P 500 is worth about $8.5 billion. Following the Dow just makes little sense. In fact, the Dow had to make a big change this week. The index-keepers decided to kick out General Electric (GE). This is a huge deal.

General Electric wasn’t just a blue-chip stock. It was bluest of the blue. GE was a part of the Dow continuously since 1907. The company it replaced was the Tennessee Coal, Iron and Railroad Company. (I love that name.) The GE brand was recognized all around the world for quality. Ronald Reagan was their corporate spokesman during the 1950s. Traveling around the country extolling the virtues of free enterprise was his training for big-time politics.

In 1985, if you had gone to any stockbroker worth his or her salt and asked for a portfolio of dependable blue-chip stocks, you can be sure GE would have made the cut. There’s an important point here for investors, and it’s that companies are dynamic entities. Things change. A good reputation in the past doesn’t guarantee success in the future.

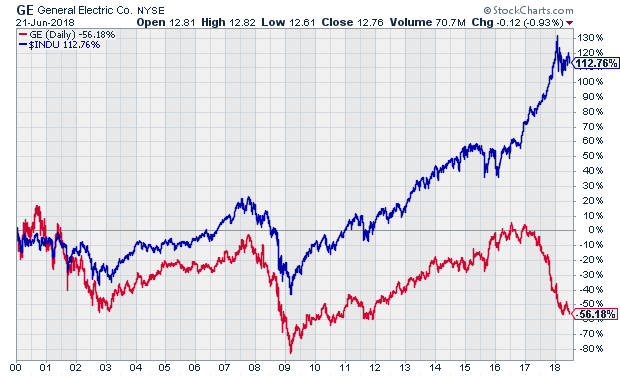

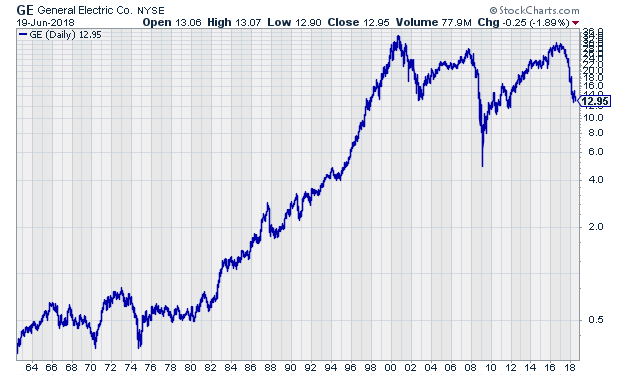

GE’s stock fell by half in the past year. The stock made up about 0.5% of the weight of the Dow. That was less than half of the second-smallest stock. With the recent Wabtec (WAB) deal, we’re actually beneficiaries of GE’s headaches. Here’s a look at GE versus the Dow since the start of the millennium.

People love to believe companies are all-powerful. The famous science-fiction film 2001: A Space Odyssey shows the astronauts flying on a Pan-Am Space Clipper. Pan-Am!! Please. That may have been the least-believable part of the whole movie. Poor Pan-Am went kablooey long before the calendar got to the real 2001. Pan-Am also made an appearance in the original Blade Runner, as did other long-gone names like Atari and Bell Telephone.

This is an important lesson for investors. Things change. Companies don’t last forever. Stalwarts become complacent, and upstarts are always challenging incumbents. Jeff Bezos is now worth $145 billion. Amazon went public in 1997.

For many years, we used to have Bed, Bath & Beyond on our Buy List. This was a can’t-miss stock for many years. Then it stopped. In retrospect, I held on to BBBY for too long. Ultimately, we made the right choice to let it go. The world changed, and it didn’t. One of the hardest aspects of long-term investing is realizing when it’s time to let a good stock go. With that thought in mind, let’s look at some possible changes for 2019.

Potential Buy List Ideas for 2019

Our strategy at Crossing Wall Street is that we hold 25 stocks for the entire year and then make five changes at the end of each year. The first half of the trading year comes to a close next week. I wanted to take this opportunity to share some preliminary thoughts about what stocks I may add next year and which stocks I may delete. Please bear in mind that these are my early thoughts and are subject to change between now and the end of the year.

Before I get to that, let me update you on the Buy List’s performance so far. Through Thursday, our Buy List is up 1.60% this year compared with 2.85% for the S&P 500. Please note that that doesn’t include dividends although the dividend-adjusted figures are what I use for the official year-end stats (I just didn’t have enough time to do the math). Although we’re trailing the index, we’ve narrowed the gap in the past few weeks. Also, our Buy List has been far more stable than the S&P 500. Our “beta” typically runs around 0.95, give or take. This year, our beta is 0.84.

Here are some names that I’m thinking about ditching for next year.

First up is Wabtec (WAB). It’s not that I don’t like WAB. I like them a lot. The issue is that the merger with GE’s transportation business changes who they are. After the merger, it won’t be the same company we originally bought. This is not an automatic “no” vote for next year, but it’s something we have to look at carefully.

Becton, Dickinson (BDX) is in a similar situation. We didn’t buy BDX. We got it through buying BCR. Fortunately, I like BDX, and it’s doing well for us. But it’s not the stock we bought. I want to make sure this is one for us.

I hate to put Stryker (SYK) in this group, but we need to. The Boston Scientific idea fell through. That’s probably for the best, but I think it’s safe to assume that Stryker is still looking to make a deal. I like Stryker a lot, but I can’t say the same about a merger candidate.

I’ve been patient with Signature Bank (SBNY), but the results have been mediocre. I want to see improvement. Finally, I really didn’t like the last earnings report from Cerner (CERN). I hope it was a near-term problem. We’ll see.

Again, none of these names is a sell, but I want you to know my thoughts. Now here are some names on my radar for next year.

Hershey (HSY)

Colgate-Palmolive (CL)

3M (MMM)

Emerson Electric (EMR)

Compass Minerals (CMP)

TransDigm (TDG)

Disney (DIS)

Johnson & Johnson (JNJ)

PayPal (PYPL)

This is just a preliminary list of stocks that I’m looking at. I reserve the right to change my mind. In upcoming issues, I’ll have more updates on my plans for the new Buy List. Now let’s look at our Buy List earnings report for next week.

FactSet Earnings Review

FactSet (FDS) is due to report fiscal Q3 earnings on Tuesday, June 26. FDS is one of our two Buy List stocks with quarters that end in May. The other is RPM International (RPM). Three months ago, FactSet had a good earnings report for fiscal Q2. They made $2.12 per share, which was an increase of 17% over the year before. The report was six cents ahead of Wall Street’s consensus.

Digging into the Q2 numbers, we see that organic revenues increased 5.7% to $310.4 million. A key metric I watch is their adjusted operating margin. That fell from 33.1% in last year’s Q2 to 31.4% for this year. The company blamed the negative foreign exchange. On the plus side, free cash flow rose more than 20% to $86.1 million.

An important metric for FactSet is what the company calls “Annual Subscription Value” or ASV. At the end of Q2, that stood at $1.35 billion. Their “organic” ASV rose by 5.8%. Frankly, that could be higher. Like many companies, FDS was greatly helped by a lower tax rate. The company also approved adding $300 million to its current share-buyback program.

What to expect next week: unfortunately, FactSet stopped providing quarterly guidance, but they still give guidance for the full year. In March, the company raised its 2018 guidance range for this by 10 cents at both ends. They now see full-year adjusted EPS between $8.35 and $8.55 per share. That’s pretty good.

The current consensus on Wall Street for Q3 is for $2.13 per share. That sounds about right. Shares of FDS have been on a nice run over the last few weeks. Since May 2, FDS is up 15%. The company also recently raised its dividend by 14%. That was its 13th consecutive annual dividend increase. Look for more good earnings news next week.

Alliance Data Systems Is a Buy up to $251 per Share

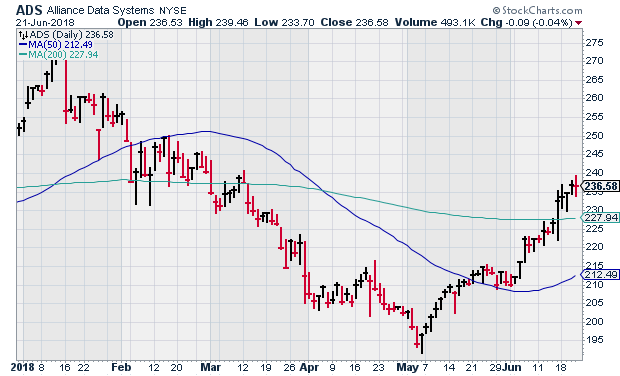

In the May 11 issue of CWS Market Review, I said Alliance Data Systems (ADS) “could be a big turnaround for us.” It’s still early, but it looks like I was onto something.

The rebound is pretty impressive so far. Let’s not kid ourselves: ADS got clobbered earlier this year, but it’s making up for lost ground. On May 4, shares of the loyalty-rewards folks got as low at $192.02, but on Thursday, the stock came close to cracking $240 per share.

ADS reiterated its full-year earnings forecast of $22.50 to $23 per share. It’s funny how that news hasn’t had much impact at all. A few weeks ago, no one wanted to hear any good news. But now, ADS seems to rally every day. Their Q3 earnings report will be out next month. Wall Street expects $4.62 per share. I think they can beat that. This week, I’m lifting my Buy Below on Alliance Data Systems to $251 per share.

That’s all for now. Next week is the final week of trading for the first half of 2018. We’re already halfway done with the year and halfway to a new Buy List. The big economic news will come on Thursday when the government updates the GDP numbers for Q1. Last month, they raised the figure from 2.2% to 2.3%. Let’s see if they do it again. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Morning News: June 22, 2018

Eddy Elfenbein, June 22nd, 2018 at 7:05 amTrade Tensions Are the Biggest Risk for the Euro Zone, the IMF Says

OPEC Meeting to Wrestle With Lingering Permian ‘Pandemonium’

Bank of Mexico Raises Overnight Rate to 7.75%

Big Banks Clear Fed’s Stress Test

Federal Judge Rules that Consumer Protection Bureau is Unconstitutional

How American Flight Attendants, Using Facebook, Changed Airline Policy On Separated Migrant Kids

Google Engineers Refused to Build Security Tool to Win Military Contracts

Red Hat Revenue, Profit Guidance Miss Expectations; Shares Tank

PayPal to Acquire Fraud Prevention Company Simility for $120 Million

One of the World’s Largest Commercial Real Estate Companies is Going Public

Chanel Opens Its Books for the First Time

Blue Harbinger: What Is Your Trading Personality?

Roger Nusbaum: The Pre & Early Retirement Anxiety Reducing ETF Portfolio

Ben Carlson: The Original Flash Crash (or Why Liquidity Fears Are Nothing New)

Be sure to follow me on Twitter.

-

Morning News: June 21, 2018

Eddy Elfenbein, June 21st, 2018 at 7:12 amCentral Bank Leaders Warn Trade Conflicts Could Damage Global Economy

Oil Prices Rise on Declining U.S. Supplies, Attacks on Libyan Ports

Argentina to Join Widely Watched Emerging Markets Index By MSCI

Nightmare on China’s Wall Street Part II

China Accuses U.S. of Trade ‘Abuses’ as India Hits Back at Trump

Trump Says Trade Wars Are ‘Easy.’ Here Come the First American Casualties.

21st Century Fox Agrees to Higher Offer From Disney

How A Reduction In Hospital Deaths Helped Amazon And Buffett Pick Atul Gawande

Micron Earnings Prove the Doubters Wrong Again

Xiaomi Starts Taking Orders for the World’s Biggest IPO for Two Years

Is There A Smarter Path to Artificial Intelligence? Some Experts Hope So

A CO2 Shortage is Causing a Beer and Meat Crisis in Britain

Michael Batnick: Animal Spirits: The Mother of All Credit Bubbles

Cullen Roche: The Fall of GE and the Rise of Indexing

Joshua Brown: Preparing Yourself Mentally for What’s to Come

Be sure to follow me on Twitter.

-

Sweet Nostalgia with Warren Buffett and Bill Gates

Eddy Elfenbein, June 20th, 2018 at 11:40 am -

Morning News: June 20, 2018

Eddy Elfenbein, June 20th, 2018 at 7:05 amSaudi Struggles For Gulf Oil Producers’ Support Ahead of OPEC Meeting

China Tells Farmers To Grow More Soybeans Amid Trade Fight With U.S.

Cryptocurrencies Fall as Korean Exchange Says $32 Million of Coins Stolen

U.S. Growth Is ‘Close to a Peak’, But Risks Are Mounting

Microsoft Employees Protest Work With ICE, as Tech Industry Mobilizes Over Immigration

GE Drops Out of the Dow After More Than a Century

Ford and Volkswagen Discuss Developing Vehicles Together

Amazon Urged Not to Sell Facial Recognition Technology to Police

PayPal Agrees to Buy Payments Firm Hyperwallet for $400 Million

AT&T in Talks to Acquire AppNexus for About $1.6 Billion

Can My Pension Lower My Social Security Benefits?

Commerce Secretary Shorted Stock as Negative Coverage Loomed

Nick Maggiulli: The Evil Hours

Ben Carlson: Too Big To Be Simple?

Be sure to follow me on Twitter.

-

GE Kicked Out Of The Dow

Eddy Elfenbein, June 19th, 2018 at 10:47 pmDow Jones announced this afternoon that General Electric (GE) is being removed from the Dow Jones Industrial Average for Walgreens Boots Alliance (WBA).

This isn’t completely unexpected. Here’s me three years ago:

I have to wonder how much longer GE will be in the Dow.

— Eddy Elfenbein (@EddyElfenbein) April 10, 2015

GE simply doesn’t make up much of the Dow. The stock closed today at $12.99. That means it makes up about 100 points in the Dow, which is currently at 24,700. The average Dow stock makes up over 800 points in the index.

GE has been a Dow member for over 110 years. On November 7, 1907, General Electric replaced Tennessee Coal, Iron and Railroad Company in the Dow. GE was an original Dow stock in 1896 but it was dropped in 1898, added back in 1899, then dropped again 1901 and added back in 1907.

I find it interesting that many dystopian movies feature powerful corporations (Pan-Am in 2001 or Atari in Blade Runner). In reality, these organizations come and go faster than you think.

The current Dow divisor is 0.14523396877348. That means every $1 in a Dow stock is about seven Dow points. The divisor will now be adjusted for WBA. Here’s the GE chart going back 56 years:

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His