Archive for June, 2018

-

OK…Maybe Not

Eddy Elfenbein, June 13th, 2018 at 11:59 amIn a strange development today, Stryker (SYK) said they’re not in deal talks with Boston Scientific (BSX). This comes two days after there were reports that a deal was on the table. I guess we can infer that they weren’t able to reach a deal or price.

On Monday, The Wall Street Journal reported Stryker had made a takeover approach to Boston Scientific, a move that would create a medical-device giant and would be the latest effort to consolidate a corner of the health-care industry that has produced a raft of large deals lately.

Stryker said in a filing with the Securities and Exchange Commission on Wednesday it doesn’t typically comment on these matters, but it chose to respond following market speculation about a possible deal for Boston Scientific.

Stryker’s filing didn’t dispute that it had made a takeover approach.

The Journal had reported it wasn’t clear how receptive Boston Scientific was to a deal. Boston Scientific said in a statement after the Journal reported on the advance Monday that it was aware of the report but declined to comment.

Boston Scientific declined to comment Wednesday after Stryker’s filing.

Stryker, based in Kalamazoo, Mich., is one of the largest makers of knee- and hip-replacement parts, competing with companies including Johnson & Johnson and Zimmer Biomet Holdings Inc.

Boston Scientific, based in Marlborough, Mass., is one of the largest makers of heart devices such as pacemakers and artery-opening stents, competing with Medtronic and Abbott Laboratories . It develops devices used in diagnosing and treating coronary artery disease, heart monitoring and a broad range of gastrointestinal and pulmonary conditions. The company also makes non-heart devices such as endoscopes, a type of surgical camera.

Stryker is rallying today, but it hasn’t made back everything it lost from the drop earlier this week.

-

Morning News: June 13, 2018

Eddy Elfenbein, June 13th, 2018 at 7:11 amProfessor Who Rang VIX Alarm Says Tether Used to Boost Bitcoin

Trump’s Trade War Could Mess Up the Fed’s Plans

What’s in a Name? Consumer Bureau to Find Out

Trump Gambles and Loses on AT&T

AT&T-Time Warner Ruling Shows a Need to Reboot Antitrust Laws

Netflix and Alphabet Will Need to Become ISPs, Fast

ZTE Shares Tank in Asian Markets After it Agrees to Pay $1.4 Billion Settlement to the US

Toyota Pumps $1 Billion in Grab in Auto Industry’s Biggest Ride-Hailing Bet

Nissan Doubles Down on Emerging Markets as U.S. Sales Slow

Musk’s Model 3 Miscalculation Culminates in Major Tesla Job Cuts

Zara Goes High-Tech in Race With Amazon

There Aren’t Enough Drivers to Keep Up With Your Delivery Lifestyle

Nick Maggiulli: It Can Happen to Anyone: On the Life-Altering Effects of Money

Roger Nusbaum: Never Underestimate the Importance of Balance

Ben Carlson: Why Do Stocks Generally Go Up Over Time?

Be sure to follow me on Twitter.

-

Inflation Is Up 2.8% in the Last Year

Eddy Elfenbein, June 12th, 2018 at 10:51 amThe government reported the CPI numbers for May this morning. In the last month, headline inflation is up just 0.21% while the headline core rate rose 0.17%.

Over the last year, headline inflation is up 2.80%. That’s the fastest rate in more than six years.

The core rate is up 2.24% in the last 12 months. That’s close to the fastest rate since late 2008. The current title holder is 2.33% from February 2016. We might be able to break that soon. Year-over-year core inflation has been over 3% since 1995.

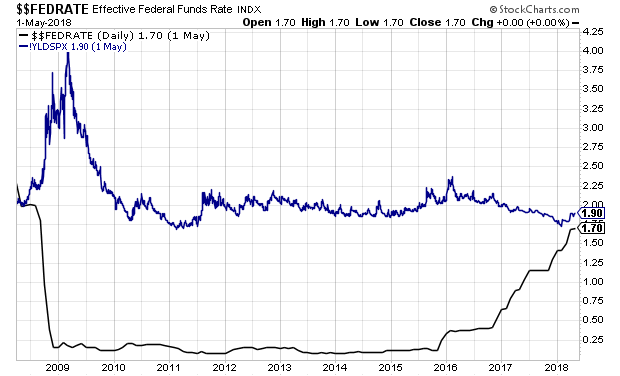

Here’s the real Fed funds rate based on core inflation. The Fed funds will likely rise tomorrow by 0.25%. It looks like it will take two more hikes to bring us to 0%.

-

Morning News: June 12, 2018

Eddy Elfenbein, June 12th, 2018 at 7:17 amOil: Short-Term Pain For Long-Term Gain

Draghi Learns Lesson From Fed as ECB Stays Vague on Rate Outlook

FAA’s Safety Rules for Commercial Drones Are Overly Strict, Report Says

The $1.4 Trillion U.S. ‘Surplus’ That Trump’s Not Talking About

North Korea Open For Business? Some See Hope in Trump Talks

Trump May Doom the Medium He Loves

Senators Set Deadline for Ajit Pai’s FCC to Open Up About Its DDoS Attack Claims

3 Social Security Myths You Can’t Afford to Believe

China Phone Giant Xiaomi May Be Twice as Expensive as Apple

Building-Materials Firm USG Agrees to Knauf’s $7 Billion Buyout

Wendy’s and Other Burger Chains Are Slamming IHOP for Its ‘IHOb’ Rebrand

Jaguar Land Rover Preps for Electric Era Moving SUV From UK

Howard Lindzon: Momentum Monday…Are We Too Extended?

Michael Batnick: What Do Clients Want?

Cullen Roche: Tariffs Won’t Make America Great Again

Be sure to follow me on Twitter.

-

Smucker’s Rebound

Eddy Elfenbein, June 11th, 2018 at 4:06 pmThis is quickly becoming a theme for our Buy List stocks. They drop after earnings and then quickly make back all they’ve lost. Now it’s Smucker’s turn:

In the last four says, SJM has gained four cents.

-

Signature Bank and the Trumps

Eddy Elfenbein, June 11th, 2018 at 3:33 pmUSA Today recently ran a story detailing some real estate deals by Jared Kushner or Michael Cohen. The deals were financed by Signature Bank (SBNY), a member of our Buy List.

I want to make it clear that SBNY merely financed these deals. This doesn’t mean they organized the deals. USA Today describes Signature as a “bank tied to the Trump family.” That’s disingenuous. Ivanka Trump was on their Board from 2011 to 2013. Barney Frank, hardly a Trump fan, is currently on the Board.

-

Stryker Looking at Boston Scientific

Eddy Elfenbein, June 11th, 2018 at 12:18 pmThe Wall Street Journal is reporting that Stryker is looking at buying Boston Scientific. If this deal happened, it would be huge.

Stryker has recently made a takeover approach to rival Boston Scientific, a move that would create a medical-device giant with a combined value of more than $110 billion, according to people familiar with the matter.

It is unclear whether Boston Scientific is receptive to the approach, and it is far from guaranteed there will be a deal. It comes amid a flurry of deal activity in the health-care sector as companies respond to industry and regulatory changes, demands for lower medical costs and the pressure to find new sources of growth.

A deal, should one be inked, would be one of the biggest of the year, given Boston Scientific’s market value of $44 billion Monday morning.

A combination of the two medical-device giants would bring together Stryker’s expertise in orthopedics, neurotechnology and spinal procedures with Boston Scientific’s operations in cardiovascular and so-called rhythm management, which develops implantable devices that monitor the heart and deliver electricity to treat cardiac abnormalities.

Stryker, based in Kalamazoo, Mich., had a market value of about $67 billion Monday morning before The Wall Street Journal reported news of the approach and its stock dipped. It is one of the biggest makers of knee- and hip-replacement parts, competing with companies including Johnson & Johnson and Zimmer Biomet Holdings Inc. The company develops a range of medical devices that are used in orthopedics, neurotechnology and other surgical procedures. Last year, it generated global net sales of $12.4 billion, up almost 10%. Profits slumped 38% to $1.02 billion, hurt by one-time charges stemming from changes in the U.S. tax code. Excluding this impact, earnings rose by 12% to $2.5 billion.

A takeover of Boston Scientific would diversify Stryker’s business into other areas of the medical-technology market and allow both companies to reach new customers.

Boston Scientific, based in Marlborough, Mass., is one of the biggest makers of heart devices such as pacemakers and artery-opening stents, competing with Medtronic PLC and Abbott Laboratories . It develops devices used in functions such as diagnosing and treating coronary artery disease, heart monitoring and a broad range of gastrointestinal and pulmonary conditions. The company also makes non-heart devices such as endoscopes.

Last year, Boston Scientific had net sales of $9.05 billion, up 7.9%. Profit fell to $104 million from $347 million.

Boston Scientific has had some victories and stumbles in launching newer heart products in recent years. Last year, it recalled its new heart-valve replacement product, Lotus, over manufacturing defects. Analysts say it is uncertain whether the product, once viewed as having big sales potential, will come back to the market. But the company has notched increased sales of its Watchman device, designed to prevent strokes in people with an irregular heartbeat.

There have been a number of big medical-device transactions in recent years as industry shifts prompt some of its biggest players to seek greater scale and diversity. Last year, Becton Dickinson & Co. acquired C.R. Bard Inc. for $24 billion. In 2015, Medtronic did a $49.9 billion deal to buy Covidien PLC.

-

Morning News: June 11, 2018

Eddy Elfenbein, June 11th, 2018 at 7:12 amOil Slips on Signs Russia Boosted Crude Output Before OPEC Meets

Swiss Voters Reject Radical Sovereign Money Plan in Landslide

Now the Fed Must Reckon With Long-Term Strategy

The Repeal of Net Neutrality Is Official. Here’s How That Could Affect You.

Bitcoin Tumbles as Hackers Hit South Korean Exchange Coinrail

KKR Nears Deal to Buy Envision Healthcare

Amazon Is Being Blasted by a Watchdog Group Over China Echo Factory Conditions

AT&T Judge Could Clear Time Warner Deal With ‘No Blackout’ Fix

Xiaomi Unveils Big Loss as It Prepares to Hawk IPO to Investors

GDPR: The Biggest Data Breaches And The Shocking Fines (That Would Have Been)

Bidding for Fox Will Get Serious After Court Ruling

Stitch Fix: Risen From The Ashes

Ben Carlson: Is the U.S. Due For A Recession?

Jeff Miller: Do Individual Investors Face a Pivotal Decision?

Joshua Brown: You Have to Live Through the Statistics

Be sure to follow me on Twitter.

-

CWS Market Review – June 8, 2018

Eddy Elfenbein, June 8th, 2018 at 7:08 am“If you would know the value of money, go and try to borrow some.”

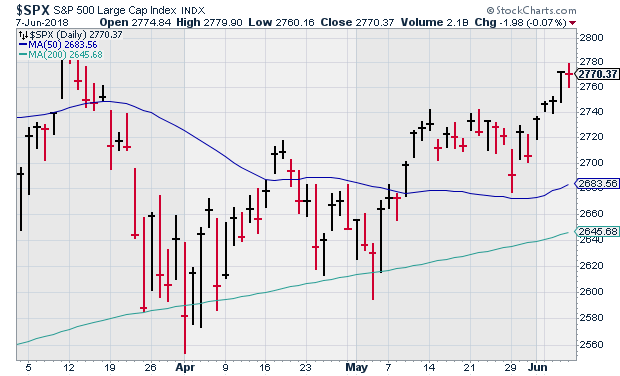

– Benjamin FranklinThe stock market suddenly got a lot more interesting this week. The Nasdaq Composite broke out to a new all-time high. So did the small-cap Russell 2000. The Dow is back over 25,000, and the S&P 500 rallied for four days in a row. The index recently touched its highest point in more than two months.

The market isn’t so much celebrating good news as it is feeling relieved that the prospect for bad news has dissipated. Global tensions seem to be relaxing. There may even be some sort of détente with North Korea. In the last few weeks, the price of oil has dropped more than 10%.

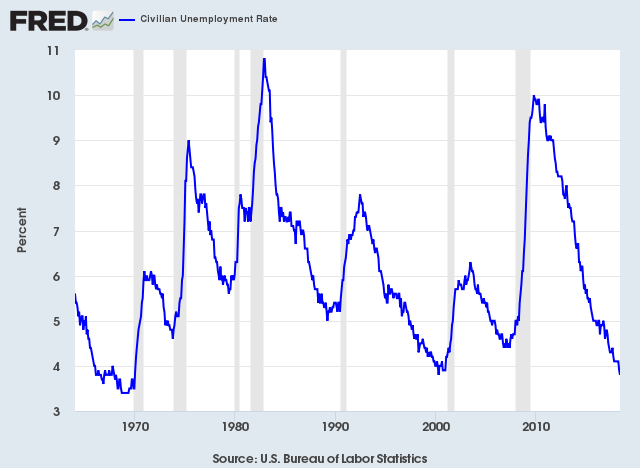

One piece of good news came last Friday when the government said that the unemployment rate fell to its lowest since the 1960s. In this week’s issue, we’ll take a closer look at the market and the economy. I’ll also discuss the disappointing earnings report from Smucker. I also have several Buy List updates for you this week (nice rebound for Ross Stores!). But first, is this really the best economy in half a century?

The Best Economy in 50 Years?

Last Friday, the government released the jobs report for May, and it said that the U.S. economy created 223,000 net new jobs last month. That figure beat expectations of 190,000 jobs. The unemployment rate ticked down to 3.8% which tied the cycle low from April 2000. However, if you work out the decimals, the jobless rate is actually the lowest since the 1960s. (Well, since December 1969.) For women, it’s the lowest jobless rate since 1953.

Despite the good news, there are some noticeable holes in the current expansion. For one, it’s always a bit dicey to compare unemployment rates over such a long period of time. The economy is quite different from what it was in 1960, and so is the labor market. While the economic numbers are improving, we’re still not seeing much in the way of wage growth. In the last year, average hourly earnings were up 2.7%. That’s okay, and it’s above inflation, but it needs to be better. The equation is simple: higher wages means more shoppers.

The Federal Reserve meets again next week, and it’s a near-certainty that the central bank will raise interest rates. This will be their seventh increase of this cycle. To recap, the Fed raised rates once in 2015, another time in 2016, then three times last year and already once more this year. This will bring the target range for Fed funds up to 1.75% to 2%.

Not too long ago, it looked like there might be four hikes this year, but that’s probably off the table. For now. With this meeting, we’ll get a post-meeting press conference with Chairman Jay Powell. The Fed members will also update their economic forecasts. These forecasts are notoriously poor, but I have to give the Fed some credit: they’ve largely stuck to their recent rate-hike plans.

I’ve tried to stress to investors that rising interest rates are Kryptonite to a stock rally. However, and this is crucial, it usually takes a few hikes to do any real damage. We’re now getting close to the point where the Fed funds rate is equal to the dividend yield of the S&P 500. In 2009, that would have seemed like it was light-years away.

I like to keep track of the “real” Fed funds rate. That’s the rate adjusted for inflation (I prefer using the core rate). After next week’s hike, the real Fed funds rate will be very close to something it hasn’t been in a long time—a positive number! In real terms, the Fed has been handing out free money for over a decade. I think we’ll need one more hike to finally push real Fed funds into positive territory. As a very general rule, it’s hard to be against stocks when the Fed is handing out free checks. The Fed’s low-rate policy has certainly been a key driver of this long rally.

But what about next year? According to the Fed’s last projections, they see three more hikes next year. But there was wide dispersion, meaning the individual estimates are far apart. That’s why next week’s meeting is so important. We’ll probably get a better idea of the Fed’s thinking. Three more hikes could do some damage to the economy and the market.

There are a few things to consider. One is that long-term rates have come down some. That’s kinda like the ceiling for short-term rates. Trouble usually happens when short rates exceed long rates. My favorite indicator is the 2/10 Spread which is now at 45 basis points. That’s down about 90 basis points in the last 18 months. We’re not in the danger zone yet, but it’s no longer unthinkable.

Smucker Drops after Poor Earnings

On Thursday, JM Smucker (SJM) got dinged for a 5.4% loss after the jelly company reported disappointing earnings. Smucker reported fiscal Q4 earnings (after a few adjustments) of $1.93 per share, which was well below the company’s own guidance of $2.17 to $2.27 per share. Wall Street had been expecting $2.18 per share. The CEO blamed the miss on “industrywide headwinds and certain discrete items.” More on that in a bit.

Smucker also had disappointing guidance for the coming year. Smucker sees this year’s earnings (ending in April) coming in between $8.40 and $8.65 per share. Wall Street had been expecting $9.18 per share.

There are a few reasons for Smucker’s slide. For one, Canada announced retaliatory tariffs on American jam which is a core SJM product. The company is also facing higher costs which places it in the tough position of passing said costs on to consumers. This is a tough environment in which to raise prices. Bear in mind that Smucker is a lot more than jelly. They also make Jif peanut butter and Folger’s coffee, and they have a pet-food division, which is the company’s largest.

Last quarter, sales of Smucker’s consumer foods fell by 1.8%. Pet food was flat, while coffee was up 0.5%. For the quarter, net sales fell by 0.1%. The issue really comes down to pricing and how much latitude Smucker truly has. Everyone in the industry is facing the same issue. These results suggest that Smucker may have to give in and deal with lower margins. To be fair, Smucker has already started to adjust its business model to better compete in a challenging market. For example, they’re looking to sell off their baking business.

Last year, Smucker made $7.96 per share. The stock closed Thursday at $100.80, which is exactly 12 times the lower bound of their full-year guidance. This week, I’m dropping my Buy Below on Smucker down to $114 per share. I still like Smucker, but the company needs to make some important adjustments in order to meet a difficult environment.

Buy List Updates

Our philosophy of investing is to focus on great companies and hold them as long as we can. This has two important benefits. The first is that it’s less work, which is always nice. But more importantly, it’s a superior system because it removes us from the irrationality of the day-to-day market. I often stress this, but we got a good lesson recently from Ross Stores (ROST).

I’m a big fan of Ross, and it’s been part of our Buy List for several years. The deep-discounter reported earnings on May 24. They beat expectations, but their guidance wasn’t that hot. Well, that’s what Ross always does, so I paid it no mind. I thought the earnings report was just fine, but the market gods were not pleased. Shares of ROST dropped nearly 7% the next day.

In last week’s issue, I wrote, “I’m not at all worried about Ross Stores.” Sure enough, Ross has rallied six times in the last seven days. The stock closed Thursday at $85.09. Not only did Ross make back everything it lost, but the stock is even higher than it was going into earnings.

I will freely admit you that I had no idea Ross would snap back so quickly. Of course, I was puzzled by the drop in the first place. But this is the reality of stock investing. Sometimes, weird things happen. This is precisely why we lock in on great companies and let time do the heavy lifting. This week, I’m raising my Buy Below on Ross Stores to $90 per share.

Another stock that’s rising from the ashes is Alliance Data Systems (ADS). Poor ADS has been one of our worst stocks this year. The stock went from a high of $278 in January down to $192 in early May. The last earnings report was pretty good, but that wasn’t enough to halt the selling. Lately, however, ADS has turned a corner. The shares closed Thursday at $220.57. It’s too early to declare victory, but things are finally going in the right direction. Check out this recent article from Forbes, “Why Alliance Data Is Trading at a Discount.”

Carriage Services (CSV) made some news this week, which is pretty rare. The funeral-home company made some complicated moves to restructure its balance sheet. This was to correct for, in their words, “unforced errors.” Since the company had to issue more shares, they reduced their four-quarter EPS guidance to $1.33 to $1.38. I think the moves are to Carriage’s long-term benefit. Don’t abandon this one.

In early May, Continental Building Products (CBPX) missed earnings by a penny per share. During the next trading day, the stock got as low at $25.70 per share. That was a loss of over 7%. I was impressed that the company didn’t change its full year forecast. Here we are five weeks later, and CBPX is up to $31.45 per share. That’s a 14% gain in the last 23 days. I’m raising our Buy Below on Continental Building to $34 per share.

We’re done with Buy List earnings reports for a while. FactSet (FDS) is due to report on June 26, but that’s it until the Q2 earnings season starts up in mid-July. RPM International’s (RPM) fiscal fourth quarter ended in May, and their earnings will probably be out in late July.

That’s all for now. Get ready for a Fed rate hike next week. The Federal Reserve meets on Tuesday and Wednesday. The policy statement will come out at 2 p.m. on Wednesday. We’ll also get a look at the updated forecasts. There will also be some key economic reports. The retail-sales report will come out on Thursday. Then on Friday, we’ll get to see the latest report on industrial production. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Morning News: June 8, 2018

Eddy Elfenbein, June 8th, 2018 at 7:04 amArgentina Reaches $50 Billion Financing Deal With I.M.F.

Brazil Hosts Major Auction for Oil Fields

Oil Prices Fall on Dip in China Demand, Surging U.S. Output

As Utility Stocks Get Crushed, Possibilities Emerge

Betting on Crisis, Hedge Funds Short Italian Bonds

Banks Don’t Share Wells Fargo’s ‘Systemic’ Account Problems, Regulator Says

How the Gig Economy Is Reshaping Work: Not So Much

Jack Ma’s Ant Financial Valued Around $150 Billion After Funding Round

Google Renounces AI Weapons; Will Still Work With Military

Tesla’s Energy Storage Business Is Surging

KFC is Right — People Are Gobbling Up ’Meat Replacements’

Lawrence Hamtil: Not Even Buffett Can Escape the Reversion to the Mean

Roger Nusbaum: Indexing Will Fail? Really?

Blue Harbinger: Do You Start the Day With a Trading Plan?

Be sure to follow me on Twitter.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His