CWS Market Review – July 13, 2018

“Intelligent investment is more a matter of mental approach than it is of technique.”

– Ben Graham

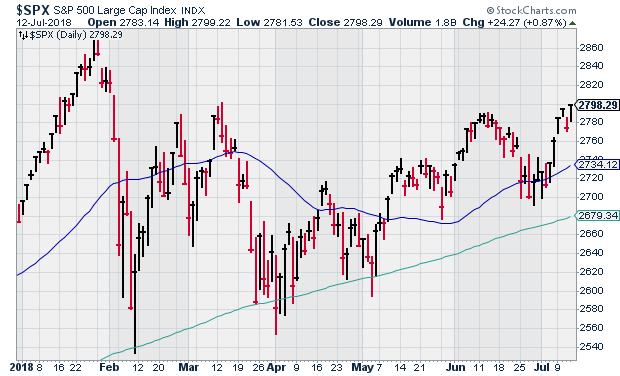

On Thursday, the S&P 500 closed at its highest level since February 1. The Nasdaq Composite did even better, closing at an all-time high. Our Buy List is no slouch, either. Since May 31, the Buy List is up 5.8% which is well ahead of the broader market. Buy List stocks like Moody’s (MCO), Fiserv (FISV) and Church & Dwight (CHD) are at new highs.

What’s the reason for Wall Street’s happy mood? This really isn’t a case of good things happening. Instead, it’s the ebbing of the fear that bad things were coming (more specifically, the U.S. engaging in a protracted trade war with the world, especially China).

In this week’s issue, we’ll take a closer look at the trade news impacting Wall Street. I’ll also preview our Buy List earnings reports coming next week. Second-quarter earnings season is starting now. Get ready because we’re soon going to have a lot of earnings news.

The Jobs Machine Churns On

Here’s an interesting stat on our Buy List: In 15 of the last 16 trading sessions, the daily swing in our Buy List has been less pronounced than that of the overall market. In other words, on up days, we’re less up. On down days, we’re less down. In fact, we’ve been much less down.

In technical terms, this means that our portfolio has a low “beta.” Typically, our beta is low, but it’s been unusually low recently. The reason is that Wall Street is swinging back and forth between two possible outlooks for trade. On some days, it looks good for trade. Then on other days, it doesn’t look so good.

The key is that our portfolio isn’t so wedded to these competing outlooks. We aim for high-quality stocks that prosper no matter what the environment. As a result, we’ve been sidestepping the trade-related swings of late. Think of the market as a boat that’s rocking in the waves. Our Buy List is nestled near the center of the boat, but lots of investors are perched at either side, getting soundly tossed about each day.

The S&P 500 has rallied eight times in the last ten days. Last Friday, China and the U.S. imposed tariffs on each other. I think some investors thought that the world would implode. Well, it didn’t happen. It’s as if there’s a sudden realization that life will go on.

The trade news is bad, but it’s not that bad. The economy will motor on. Later today, some of the big banks will report Q2 earnings. I think we’ll see good results. In fact, the banking sector was especially strong on Thursday. For Q2, corporate profits probably rose more than 20%.

Last Friday, the government released the jobs report for June, and the numbers were pretty good. The U.S. economy created 213,000 net new jobs last month. The unemployment rate ticked up from 3.8% to 4.0%. I dug into the decimals and the increase was closer to 0.3%. That’s the largest monthly increase in the unemployment rate since November 2010.

A big uptick in unemployment is a pretty good indicator of a recession, but I doubt it in this case. The reason is more workers joining the labor pool. That creates the oxymoron of more jobs leading to a higher unemployment rate. After nine years of economic expansion, the jobs-to-population ratio isn’t that high. In fact, the ratio is currently lower than it was at any point from 1987 to 2008.

But with good jobs news, we got some concerns about inflation. On Thursday, the government released the latest inflation figures for June. Consumer prices rose by just 0.1%. What’s notable is that in the past year, inflation is up by 2.87%. That’s the fastest rate since January 2012.

I also like to look at the “core rate” which excludes food and energy prices. In June, core inflation rose by 0.2%. The year-over-year increase is 2.26%, but that’s up by 0.54% since November. In other words, inflation has effectively erased two of the Fed’s rate hikes in the last few months.

To sum up, this is a very good time to be an investor. The trouble spots are still a way off. Continue to focus on high-quality stocks like you’ll see on our Buy List. Don’t let a bad reaction to an earnings report faze you. Traders are fickle. So often, our best stocks drop the day after earnings but rally back later on. We also want to pay attention to stocks that reaffirm or increase their guidance. Now let’s look at our first batch of Q2 earnings reports.

Second-Quarter Earnings Calendar

Over the next few weeks, 21 of our 25 Buy List stocks will report their earnings. I don’t have all the earnings dates just yet, but here’s a preliminary list of each stock, the earnings date and Wall Street’s estimate.

| Company | Ticker | Date | Estimate |

| Alliance Data Systems | ADS | 19-Jul | $4.67 |

| Danaher | DHR | 19-Jul | $1.09 |

| RPM International | RPM | 19-Jul | $1.18 |

| Snap-On | SNA | 19-Jul | $2.95 |

| Sherwin-Williams | SHW | 24-Jul | $5.66 |

| Stryker | SYK | 24-Jul | $1.73 |

| Wabtec | WAB | 24-Jul | $0.93 |

| Check Point Software | CHKP | 25-Jul | $1.30 |

| AFLAC | AFL | 26-Jul | $0.99 |

| Moody’s | MCO | 27-Jul | $1.89 |

| Fiserv | FISV | 31-Jul | $0.74 |

| Becton, Dickinson | BDX | 2-Aug | $2.86 |

| Ingredion | INGR | 2-Aug | $1.92 |

| Intercontinental Exchange | ICE | 2-Aug | $0.89 |

| Carriage Services | CSV | TBA | $0.37 |

| Cerner | CERN | TBA | $0.60 |

| Church & Dwight | CHD | TBA | $0.47 |

| Cognizant Technology Solutions | CTSH | TBA | $1.10 |

| Continental Building Products | CBPX | TBA | $0.45 |

| Signature Bank | SBNY | TBA | $2.81 |

| Torchmark | TMK | TBA | $1.49 |

On Thursday, four of our Buy List stocks are due to report: Alliance Data Systems, Danaher, RPM International and Snap-on.

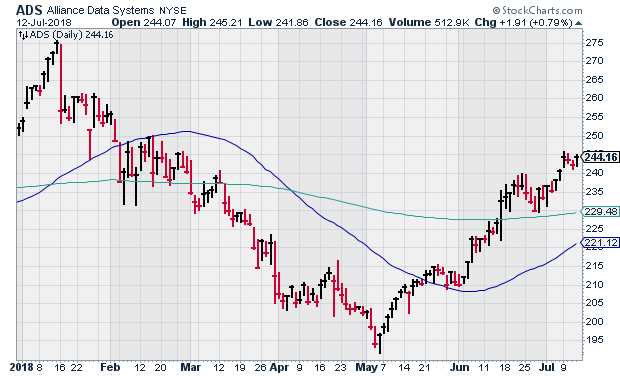

I’m most curious about Alliance Data Systems (ADS). The loyalty-rewards company has staged a furious turnaround for us. Three months ago, Alliance reported Q1 core earnings of $4.44 per share. That easily topped Wall Street’s estimate of $4.23 per share, however, the estimate had been severely pared back going into the earnings report. Not long before, Wall Street had been expecting over $5.10 per share for Q1.

Regarding Q1, Alliance’s CEO said, “This quarter’s pro-forma revenue growth of 4 percent and core EPS growth of 13 percent should reflect our softest quarter of the year. Specifically, higher reserve levels required to cover the transitory impacts of the internal recovery investment was an approximate $0.60 hit to core EPS for the first quarter. Moving forward, recovery rates should move in our favor.”

ADS reiterated its full-year guidance of $22.50 to $23 per share with revenue of $8.35 billion. If those numbers are right, then ADS is going for a decent valuation. For Q2, Wall Street expects earnings of $4.67 per share.

Danaher (DHR) had a very good report for Q1. The company made 99 cents per share. Initially, the company provided Q1 guidance of 90 to 93 cents per share. They followed that up by saying that thanks to strong results from their Life Sciences and Diagnostics platforms, “specifically at Cepheid,” they’ll beat their guidance. They were right.

For Q2, Danaher sees earnings of $1.07 to $1.10 per share. In April, the company raised its full-year guidance. The old range was $4.25 to $4.35 per share. The current range is $4.38 to $4.45. In 2017, DHR made $4.03 per share.

RPM International (RPM) is usually one of our quietEst stocks, but it’s been making a lot of noise lately. Since April 2, shares of RPM are up nearly 30%. The recent spark came when the company said they reached an agreement with Elliott Management.

According to the agreement, RPM will add two new board members. The board will also form an Operating Improvement Committee. The OIC will “focus on operational and financial initiatives to create and enhance shareholder value. Certain of these initiatives will center around setting and achieving new company margin targets based on top-performing industry standards and optimization of RPM’s balance sheet, including streamlining working capital and implementing new capital allocation guidelines and capital return plans.”

The idea is that RPM will be more transparent regarding its financial goals. They’ll provide an update for shareholders by November 30. Traders approved the deal. The stock jumped 9% on the Elliott news.

I should mention that RPM is an off-cycle stock. Their fiscal Q4 ended in May.

For Q4, they expect consolidated revenue growth in the “mid-to-upper” single digits. In April, RPM narrowed its full-year guidance from $3 – $3.10 per share to $3.05 – $3.10 per share. This is a good company going for a good valuation. Let’s also remember that RPM has raised its dividend for the last 44 years in a row. That’s a nice streak.

Snap-on (SNA) was our surprise winner last earnings season. The company reported Q1 earnings of $2.79 per share, seven cents more than estimates. The shares jumped more than 6% that day.

Lately, I’ve been concerned by weakness in Snap-on’s tool group. Fortunately, their other business units are picking up the slack. Wall Street currently expects Q2 earnings of $2.95 per share.

I’m also going to include Signature Bank (SBNY). Officially, the bank hasn’t said yet when they’ll report earnings, but they usually report early. I’m guessing it will report on Thursday. The stock just dipped down to an eight-month low. The New York-based bank took a massive charge during Q1 for its medallion loans. The other headwind SBNY is facing is the narrowing yield curve. Wall Street expects Q2 earnings of $2.81 per share.

Ingredion (INGR) won’t report until August 2, but after the bell on Thursday, the company warned that its Q2 results will be between $1.63 and $1.68 per share. Wall Street had been expecting $1.92 per share. They also lowered their full-year guidance from $7.90 to $8.20 per share, down to $7.50 to $7.80 per share. That’s the second time they’ve lowered guidance this year. Ingredion also announced an aggressive cost-cutting program. That usually makes me suspicious. A good company should always be looking to cut costs. I’m not pleased with Ingredion. I’m dropping my Buy Below price to $100.

That’s all for now. Earnings season will start to heat up next week. We’ll also get some key economic reports. The retail sales report comes out on Monday. Then on Tuesday, we’ll get a look at industrial production. The data series has improved over the last two years. Then on Wednesday, the housing starts report comes out. Also, Fed Chairman Jerome Powell will deliver his semiannual Congressional testimony on Tuesday and Wednesday. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Syndication Partners

I’ve teamed up with Investors Alley to feature some of their content. I think they have really good stuff. Check it out!

Sell These Drug Retailers About to Get Amazoned

Here are Three Companies Profiting from New Uses for Blockchain Technology

Posted by Eddy Elfenbein on July 13th, 2018 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His