Archive for July, 2018

-

Morning News: July 19, 2018

Eddy Elfenbein, July 19th, 2018 at 7:30 amAuto Industry Pushes White House to Back Off Tariffs

Fed Chairman Powell Says Cryptocurrencies Present Big Risks to Investors

Justice Department Wants to Speed Up Appeal of AT&T-Time Warner Deal

Trump’s Trade War Lands at Air Show as Airbus Masks China Buyers

Boeing Boosts Its Wide-Body Backlog With Freighter Sales

How IBM Cloud Is Superior To Amazon AWS & IBM: Not Enough Credit

AmEx Declines as Forecast Fails to Match Rosiest Predictions

Sinclair Tries to Appease F.C.C. But Its Tribune Bid Is Challenged

Bowing to Trump, Novartis Joins Pfizer in Freezing Drug Prices

Marriott Follows Starbucks In Dropping Plastic Straws

That Anti-Straw Movement? It’s All Based On One 9-year-old’s Suspect Statistic

MGM Resorts Suffers Backlash After Suing Shooting Victims

Jeff Carter: Turning Down A Seed Deal

Joshua Brown: Young Investors: Here Are Your First Steps

Be sure to follow me on Twitter.

-

Five Earnings Reports Tomorrow

Eddy Elfenbein, July 18th, 2018 at 4:40 pmTomorrow will be a busy day for the Buy List. Five stocks will be reporting earnings. All of them will report before the opening bell.

Alliance Data Systems will have their conference call at 8:30 am ET.

Danaher’s call starts at 8:00 am ET.

Snap-on, Signature Bank and RPM International will have their calls at 10:00 am ET.

-

Buybacks for Berkshire?

Eddy Elfenbein, July 18th, 2018 at 1:24 pmShares of Berkshire Hathaway (BRKA) have been up as much as $15,500 today. Even for a $300K stock, that’s a big move. This could be Berkshire’s best day in years.

So what’s the news? It looks like Buffett may finally go through with a share buyback. From Myles Udland at Yahoo Finance:

Warren Buffett’s Berkshire Hathaway (BRK-A, BRK-B) has just set the table for a new stock buyback.

In a press release late Tuesday, the company said that it has amended its policy regarding share repurchases, now allowing for repurchases of Berkshire stock to be made at the discretion of Buffett and vice chairman Charlie Munger so long as both men “believe that the repurchase price is below Berkshire’s intrinsic value, conservatively determined.”

Following this news, shares of Berkshire were up as much as 4%, indicating investors sees the company’s decision to rework its share buyback plan as a sign that repurchases are likely to occur in the months ahead.

Previously the company had said it would not repurchase shares unless they traded at less than or equal to a 20% premium to the stock’s book value. As of Tuesday’s close the stock was trading at a roughly 40% premium to its book value.

Additionally, the company will not repurchase stock in excess of an amount that would reduce its cash and equivalent holdings to less than $20 billion. In its release Tuesday, Berkshire said no repurchases will be made under this new program until after its second quarter earnings are released after the market close on August 3

-

Morning News: July 18, 2018

Eddy Elfenbein, July 18th, 2018 at 6:00 amChina Says U.S.-Led Trade War Has Become Biggest ‘Confidence Killer’ for World Economy

Fed’s Powell Says A Long Trade War Could Hurt U.S. Economy

Bernanke, Geithner, Paulson Voice Some Concern About Next Crisis

Crude-Oil Caution: Volatility Ahead

How Does Netflix’s Sub Miss Impact Roku?

Alibaba Faces A Much Bigger Threat Than Trade War

Bank of America: Responsible Growth

Johnson & Johnson’s Pharma Business Fuels Sales Growth

The Next Company on Jeff Bezos’ Hit List May Shock You

Google to Be Fined Record $5 Billion by EU Over Android

Texas Instruments Chief Resigns; Conduct Violations Cited

Papa John’s Founder Will Not ‘Go Quietly’ as Company Tries to Push Him Away

Nick Maggiulli: The Most Important Asset

Roger Nusbaum: Common Sense In Investing & Life; It Can Be That Simple

Ben Carlson: Are SUVs Ruining Retirement Savings?

Be sure to follow me on Twitter.

-

Three Key Trends

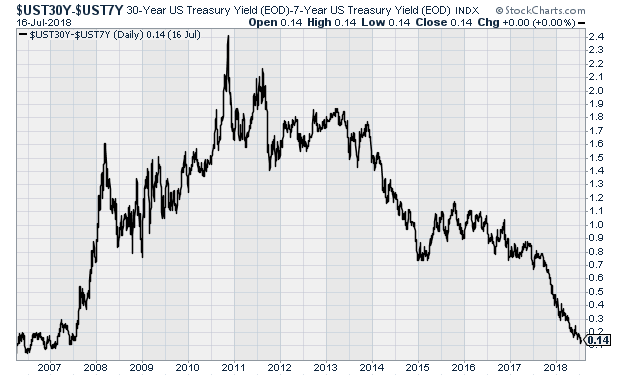

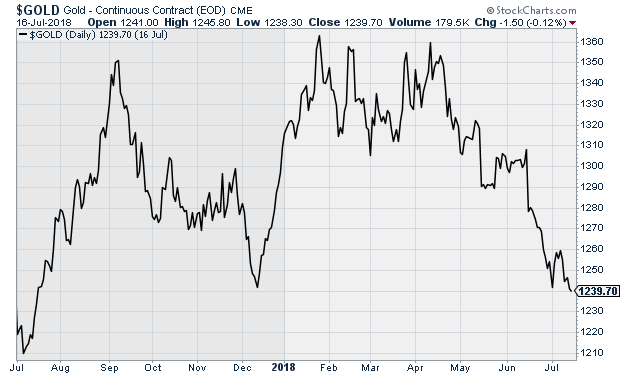

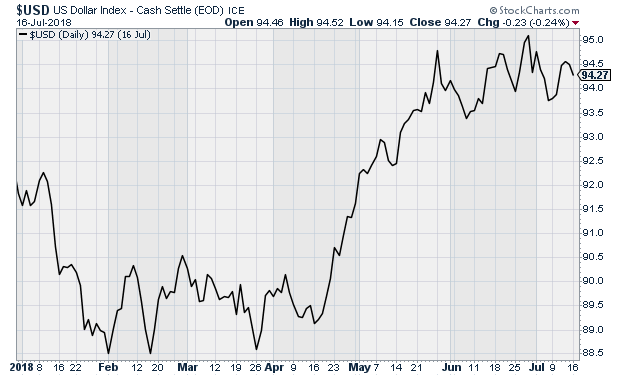

Eddy Elfenbein, July 17th, 2018 at 1:39 pmThere are three key trends impacting the markets right now, and they’re all related.

1. The long-end of the yield curve is flattening.

2. The dollar is rising.

3. Gold is falling.Now for some charts.

Here’s the spread between the seven- and 30-year Treasuries. The spread is now down to 14 basis points.

Gold is near its lowest point in the last year.

The dollar took a beating last year, but it’s been gaining ground this year.

-

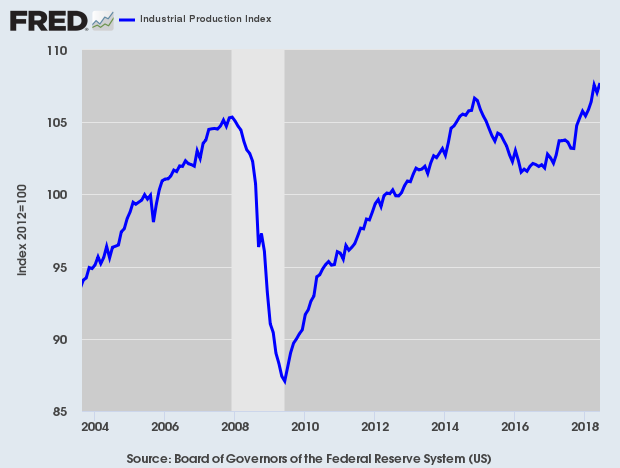

Industrial Production Rebounds in June

Eddy Elfenbein, July 17th, 2018 at 1:26 pmWhile Chairman Powell’s words seem to be soothing the market, we got a pretty good report on industrial production.

U.S. industrial production increased in June, boosted by a sharp rebound in manufacturing and further gains in mining output, the latest sign of robust economic growth in the second quarter.

The Federal Reserve said on Tuesday industrial production rose 0.6 percent last month after a downwardly revised 0.5 percent decline in May. Economists polled by Reuters had forecast industrial production rising 0.6 percent last month after a previously reported 0.1 percent dip in May.

Industrial production increased at a 6.0 percent annualized rate in the second quarter, faster than the 2.4 percent pace logged in the January-March period.

Manufacturing output surged 0.8 percent in June after decreasing 1.0 percent in May. A 7.8 percent jump in motor vehicle production buoyed manufacturing output last month. Motor vehicle production declined 8.6 percent in May after a fire at a parts supplier caused a sharp drop in the assembly of trucks.

-

Powell’s Testimony

Eddy Elfenbein, July 17th, 2018 at 10:06 amFed Chairman’s Jay Powell testified today before Congress. Here are some highlights:

Since I last testified here in February, the job market has continued to strengthen and inflation has moved up. In the most recent data, inflation was a little above 2 percent, the level that the Federal Open Market Committee, or FOMC, thinks will best achieve our price stability and employment objectives over the longer run. The latest figure was boosted by a significant increase in gasoline and other energy prices.

An average of 215,000 net new jobs were created each month in the first half of this year. That number is somewhat higher than the monthly average for 2017. It is also a good deal higher than the average number of people who enter the work force each month on net. The unemployment rate edged down 0.1 percentage point over the first half of the year to 4.0 percent in June, near the lowest level of the past two decades. In addition, the share of the population that either has a job or has looked for one in the past month–the labor force participation rate–has not changed much since late 2013. This development is another sign of labor market strength. Part of what has kept the participation rate stable is that more working-age people have started looking for a job, which has helped make up for the large number of baby boomers who are retiring and leaving the labor force.

Another piece of good news is that the robust conditions in the labor market are being felt by many different groups. For example, the unemployment rates for African Americans and Hispanics have fallen sharply over the past few years and are now near their lowest levels since the Bureau of Labor Statistics began reporting data for these groups in 1972. Groups with higher unemployment rates have tended to benefit the most as the job market has strengthened. But jobless rates for these groups are still higher than those for whites. And while three-fourths of whites responded in a recent Federal Reserve survey that they were doing at least okay financially in 2017, only two-thirds of African Americans and Hispanics responded that way.

Incoming data show that, alongside the strong job market, the U.S. economy has grown at a solid pace so far this year. The value of goods and services produced in the economy–or gross domestic product–rose at a moderate annual rate of 2 percent in the first quarter after adjusting for inflation. However, the latest data suggest that economic growth in the second quarter was considerably stronger than in the first. The solid pace of growth so far this year is based on several factors. Robust job gains, rising after-tax incomes, and optimism among households have lifted consumer spending in recent months. Investment by businesses has continued to grow at a healthy rate. Good economic performance in other countries has supported U.S. exports and manufacturing. And while housing construction has not increased this year, it is up noticeably from where it stood a few years ago.

I will turn now to inflation. After several years in which inflation ran below our 2 percent objective, the recent data are encouraging. The price index for personal consumption expenditures, which is an overall measure of prices paid by consumers, increased 2.3 percent over the 12 months ending in May. That number is up from 1.5 percent a year ago. Overall inflation increased partly because of higher oil prices, which caused a sharp rise in gasoline and other energy prices paid by consumers. Because energy prices move up and down a great deal, we also look at core inflation. Core inflation excludes energy and food prices and generally is a better indicator of future overall inflation. Core inflation was 2.0 percent for the 12 months ending in May, compared with 1.5 percent a year ago. We will continue to keep a close eye on inflation with the goal of keeping it near 2 percent.

Looking ahead, my colleagues on the FOMC and I expect that, with appropriate monetary policy, the job market will remain strong and inflation will stay near 2 percent over the next several years. This judgment reflects several factors. First, interest rates, and financial conditions more broadly, remain favorable to growth. Second, our financial system is much stronger than before the crisis and is in a good position to meet the credit needs of households and businesses. Third, federal tax and spending policies likely will continue to support the expansion. And, fourth, the outlook for economic growth abroad remains solid despite greater uncertainties in several parts of the world. What I have just described is what we see as the most likely path for the economy. Of course, the economic outcomes we experience often turn out to be a good deal stronger or weaker than our best forecast. For example, it is difficult to predict the ultimate outcome of current discussions over trade policy as well as the size and timing of the economic effects of the recent changes in fiscal policy. Overall, we see the risk of the economy unexpectedly weakening as roughly balanced with the possibility of the economy growing faster than we currently anticipate.

-

Morning News: July 17, 2018

Eddy Elfenbein, July 17th, 2018 at 8:35 amThe Oil Market Is Getting More Dangerous

IBM Is Experimenting With a Cryptocurrency That’s Pegged to the US Dollar

Netflix’s Q2 Earnings in 3-Must See Metrics

Goldman Sachs Makes it Official: David Solomon to Become Next CEO, Replacing Lloyd Blankfein

Didi Seeks $1.5 Billion Car Services Spinoff Ahead of Likely IPO

Jeff Bezos Named Richest Man in History as Amazon Workers Strike Over Pay And Conditions

Amazon Foes Walmart and Microsoft Deepen Tech Partnership

Salesforce Acquires Datorma for a Reported $800 Million

How Tesla Stacks Up Against America’s Most Productive Car Factories

CRISPR Therapeutics Stock History: The Rise of the World’s Biggest Gene-Editing Biotech

Ford Agrees to Pay $299.1 Million to Resolve Air-Bag Lawsuit

Papa John’s Founder Says Resignation Was a Mistake

Lawrence Hamtil: Exploring Why P/E 10 Works Better In Some Markets Than Others

Joshua Brown: It’s Always a Remix

Be sure to follow me on Twitter.

-

Alliance Data Drops Sharply

Eddy Elfenbein, July 16th, 2018 at 10:17 amShares of Alliance Data Systems (ADS) are down sharply this morning. This morning, the company reported its metrics for June.

I don’t think the numbers were that bad. However, we’ll know a lot more when ADS reports their earnings this Thursday.

-

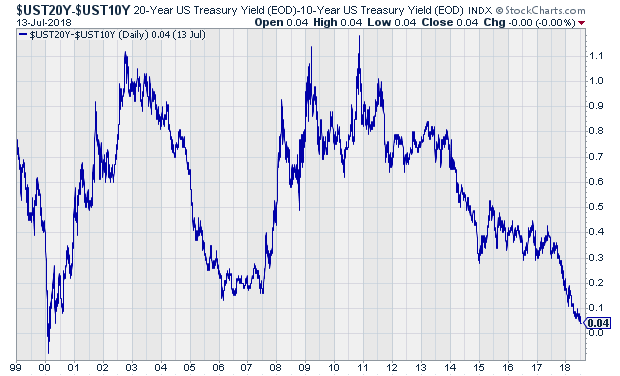

The Long End Is Nearly Flat

Eddy Elfenbein, July 16th, 2018 at 10:04 amThe long end of the yield curve is nearly flat. Just four basis points separates the 10- and 20-year Treasuries. You can see similar effects on other points. This is the tightest the long end has been since the 2000 market peak.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His