Archive for October, 2018

-

Morning News: October 8, 2018

Eddy Elfenbein, October 8th, 2018 at 7:08 amNordhaus, Romer Win 2018 Nobel Prize in Economic Sciences

Saudi Crown Prince’s 2021 Aramco IPO Deadline Is a Daunting Test

China to Pump $175 Billion Into Its Economy as Slowdown and Trade War Loom

Norway Is Plowing Cash Back Into Its Wealth Fund

Tech Workers Want to Know: What Are We Building This For?

Silicon Valley Investors Shunned Juul but Backed Other Nicotine Startups

UK Seeks Additional Reassurances from Comcast on Independence of Sky News

Toy Makers May Struggle This Holiday Season Amid the Absence of Toys ‘R’ Us and More Trade War Fears

Walmart Partners With MGM to Boost Video-on-Demand Service Vudu

Tesla’s Autonomous Driving Narrative Has Hit A Brick Wall

Comcast’s Revenge: Never Sell Hulu

UBS Goes on Trial in France Over Alleged Tax Fraud

Ben Carlson: Checking In on Bond Market Losses

Jeff Carter: The Fed And Valuation

Roger Nusbaum: FIRE Wars Escalate

Be sure to follow me on Twitter.

-

September NFP +134K, Unemployment 3.7%

Eddy Elfenbein, October 5th, 2018 at 8:37 amThe jobs report is out. The US economy created 134,000 new new jobs last month. The unemployment rate fell to 3.7%. That’s the lowest since December 1969. Revisions added another 87,000 to nonfarm payrolls. Labor force participation rate was 62.7%.

A separate measure of unemployment that includes discouraged workers and those holding jobs part-time for economic reasons — sometimes called the “real unemployment rate” — edged higher to 7.5 percent.

Unemployment among black Americans declined three-tenths of a point to 6 percent, slightly above its record low of 5.9 percent achieved in May.

The closely watched average hourly earnings component showed a 2.8 percent year-over-year increase, in line with Wall Street estimates. The average work week was unchanged at 34.5 hours.

After the report, the 10-year Treasury yield climbed to the highest in seven years.

-

CWS Market Review – October 5, 2018

Eddy Elfenbein, October 5th, 2018 at 7:08 am“The economy looks very good.” – Fed Chairman Jerome Powell

The fourth quarter is underway, and for the first time in several weeks, the stock market looks a bit nervous. Of course, that’s in a relative sense. The stock market’s been so calm lately that even a mild breeze gets your attention.

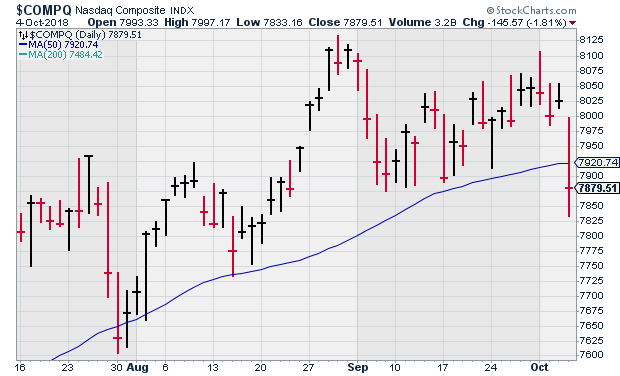

On Thursday, the S&P 500 fell by 0.82% which made it the worst day for stocks in 99 calendar days. Actually, the S&P 500 got off light. The Nasdaq fell more than twice as much (see below). But honestly, a 0.82% drop ain’t that bad. Thursday ranks as only the 20th worst day this year, and most of the 19 others came near the start of the year. Volatility has chilled out so much that we’ve almost forgotten what it feels like.

It’s way too early to say if this is the start of something big, but we know that the bears attacked and got away with it. (So far.) Make no mistake—they’ll be back. Remember the adage that “the market goes up via the staircase but goes down out the window.” That certainly was the case in February when the S&P 500 lost 8.5% in a week.

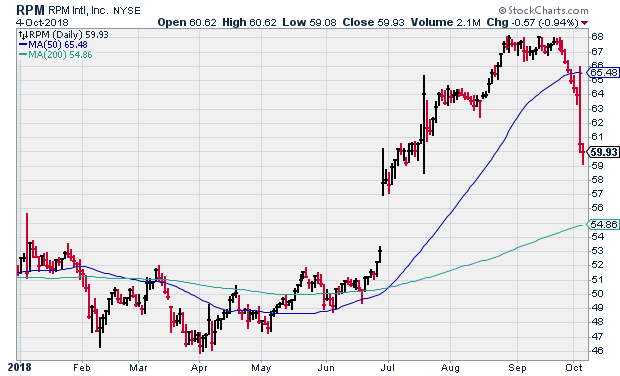

If you’ve been with us for a while, you won’t be surprised to hear that I’m not terribly worried. Even if we’re headed for a rocky few days, our stocks are in good shape. Plus, we have Q3 earnings coming up soon. In this week’s CWS Market Review, I want to discuss the current market climate in greater detail. I’ll also talk about this week’s earnings miss from RPM International. Despite the miss, the company just raised its dividend for the 45th year in a row. But first, let’s look at the ruckus in the bond market and what it means for investors.

The Bond Market Sneezes—Now What?

Even though the Federal Reserve raised interest rates last week, the effect has finally been felt this week. But the impact hasn’t been apparent in the stock market as much as it has in the bond market. Traditionally, the bond market leads the stock market by around six to nine months, give or take.

On Wednesday, the 10-year yield rose by 10 basis points to 3.15%. Then on Thursday, it rose another four points to 3.19%. The 10-year now has its highest yield in more than seven years. When the yield moves up like that, we also want to look at what’s happening with the inflation-protected bonds. Sure enough, they’ve been moving up too. On Thursday, the 10-year TIPs yield closed above 1%. That’s up from 0.25% thirteen months ago.

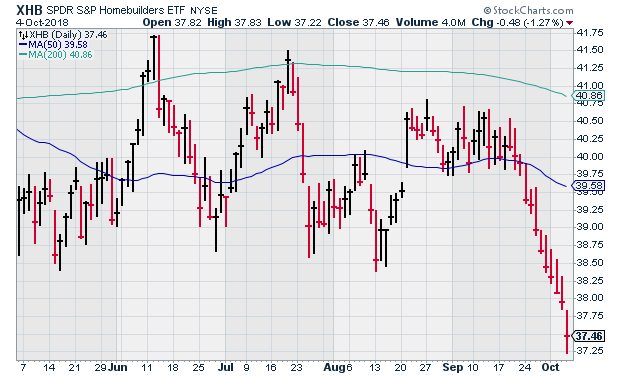

In other words, this isn’t an inflation story. It’s a demand-for-money story. Lenders are demanding more money, in real terms, from borrowers, and they’re getting it. Investors need to understand that this has a big impact on the economy. For example, one effect of higher bond yields is on the mortgage market, and, by extension, the housing market. The Homebuilder ETF (XHB) has now fallen for 12 straight days. I’m not saying housing is headed for a bust, but investors are clearly more cautious. There are cracks showing up in housing, but the overall market seems mostly healthy.

The market can turn very quickly. At recently as Wednesday, the S&P 500 traded above its all-time high close during the day, but it couldn’t hold on by the closing bell. Now the S&P 500 is less than 1% away from its 50-day moving average. The index hasn’t closed below its 50-DMA in more three months.

The market has also experienced poor market breadth. That’s a fancy way of saying that even though the overall stock market raced higher, fewer and fewer stocks were doing the heavy lifting. Michael Batnick noted that even though the S&P 500 was on the doorstep of a new high, just 27 stocks in the index were within 1% of their high. Meanwhile, 38 stocks were more than 30% off their high. Quietly, a large group of stocks has sat out this last rally.

This same effect has been reflected in the poor relative performance of small-cap stocks. During the first half of the year, small-caps did quite well in comparison to the rest of the market. But at the beginning of the summer, the little guys started to lag, and the gap really started to widen in the last few weeks. September was the worst relative performance month for small-caps in four years. This could be the result of the Trade War rhetoric from Washington. Larger companies tend to be skewed toward large multinationals, while small-caps are skewed towards domestic manufacturing.

This has also been an unusual rough patch for our Buy List. Since September 13, our Buy List is down 3.6%, while the S&P 500 is down only 0.1%. That kind of deviation from the market is typical for many mutual funds and hedge funds, but it’s rare for us. What’s also notable is that it’s come at a time when there hasn’t been a lot of news, good or bad, impacting our stocks. I’d be concerned if we were hearing lower guidance or seeing big earnings misses. That’s not the case. Instead, it appears that the market is shifting away from high-quality stocks.

What to Do Now?

I think there’s a decent chance that we’ll see a slide in stock prices before the end of the year. It really depends on what happens with the bond market. Also, I think if the S&P 500 breaks below its 50-DMA, that would give confidence to the bears. I’d also be on the lookout for a deep dive from a well-known glamour stock.

But I’m not urging investors to head for the exits. Instead, this is a good time for investors to remain calm and cautious. Investors should make sure they have plenty of dividend stocks.

One of our Buy List stocks that looks particularly good right now is Torchmark (TMK), the insurance company. TMK is about as conservative as they come. The shares are going for 13.5 times next year’s earnings. That’s a 17% discount below the rest of the market.

RPM International’s Earnings Miss

On Wednesday, RPM International (RPM) reported earnings for the first quarter of its fiscal year. For Q1, the company earned 76 cents per share which was well below Wall Street’s estimate of 88 cents per share. Net sales rose 8.5% to $1.46 billion.

Wall Street was not pleased. On Wednesday, the stock dropped 5.4%. Frankly, this was not a very good quarter for RPM. What went wrong? This is what the company had to say:

“We saw strong top-line sales growth in the first quarter, with organic sales growth up 7.8%, while profitability continued to be adversely affected by rising raw material costs. In addition, bottom-line results reflected the impact of restructuring charges, higher legal and advertising costs in our consumer segment, and the adverse effect of transactional foreign exchange,” stated Frank C. Sullivan, RPM chairman and chief executive officer.

“Our team is focused on driving increased profitability, long-term growth and enhanced value for our shareholders, and we are making good progress in executing on our operating improvement plan, which is specifically designed to increase margins, reduce working capital, and improve overall operating efficiency. During the quarter, we continued our strategic restructuring initiatives, including the reduction of more than 150 positions and the announced closure of four manufacturing facilities, all in line with our 2020 Margin Acceleration Plan,” stated Sullivan.

Now for the good news. On Thursday, RPM raised its quarterly dividend by 9.4% to 35 cents per share. Going by Thursday’s close, RPM now yields 2.34%. The new dividend will be payable on October 31 to shareholders of record as of October 16. This is the 45th consecutive annual dividend increase. That’s quite a track record. This week, I’m dropping our Buy Below on RPM International down to $64 per share.

Buy List Updates

This week, Intercontinental Exchange (ICE) said they’re buying all of MERS, the Mortgage Electronic Registrations Systems. ICE already owned an undisclosed amount of MERS. This could be a big deal. The mortgage industry has been woefully behind in going from paper to digital. The financial crisis probably put off any real reform for a few years. Perhaps that time has passed. ICE’s business model has been to buy out older incumbents and give them a shot of advanced technology.

This doesn’t really affect us, but General Electric chose Larry Culp, the former CEO of Danaher (DHR), to be their new CEO. Culp is a great choice, and GE’s stock shot up on the news. My only fear is that GE is in bad enough shape that Culp can’t do much. By the way, the change at the top at GE won’t have any impact on the deal with Wabtec (WAB). Danaher reports earnings on October 18.

Stryker (SYK) said this week that it’s buying HyperBranch for $220 million. “HyperBranch is dedicated to developing medical devices based on its proprietary polymers and cross-linked hydrogels. Its Adherus AutoSpray Dural Sealant product is one of only two FDA-approved dural sealants on the market.”

Additionally, last Friday it was announced that Stryker will pay $7.8 million to “settle charges it violated the Foreign Corrupt Practices Act, without admitting or denying the allegations.”

That’s all for now. The first batch of third-quarter earnings reports will start coming next week, though not yet for any of our Buy List stocks. Monday is Columbus Day. While many government offices and businesses will be closed, the stock market will be open. There’s not much in the way of economic reports next week, but I want to see what Thursday’s CPI report has to say. So far, inflation has been well contained, and I hope that trend continues. (So does the Fed.) Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Syndication Partners

I’ve teamed up with Investors Alley to feature some of their content. I think they have really good stuff. Check it out!

Buy These 3 High-Yield Stocks Raising Dividends in October

I always look forward to the start of a new calendar quarter. Within a few weeks stocks with policies of quarterly dividend increases will start to declare the next dividend rates. It is an interesting market effect that the investing public doesn’t take into account that some companies grow dividends every quarter. The market acts surprised every time it happens. Investors can get ahead of the share price gains by getting in before the dividend announcements.

The best places to find stocks with quarterly dividend increases and current great yields are energy infrastructure stocks and the renewable energy providers. These companies have long term contracts often with built in rate escalators, providing steady income streams. They generate growth by developing or acquiring new assets, each with its own long term service contract. These assets range from interstate energy pipelines, to natural gas liquids processing facilities to wind or solar energy projects.

For the best long term investment results, you want companies that have histories of dividend growth and a solid plan to continue that growth. Look for a balance of current yield and the annual dividend growth prospects. Here are three stocks that fit these criteria.

Buy These 5 Stocks to Beat One of the Most Popular High Yield ETFs

A lot of income investors own shares of the iShares Mortgage Real Estate Capped ETF (NYSE: REM) as a stock market investment that pays a high (over 10%) current dividend yield. The problem with REM is that it holds a lot of the highly leveraged, dangerous to your wealth, residential mortgage-backed securities, or as they are regularly referred to (MBS REITs).

Since the middle of 2017, the REM share price has been slowly eroding. That drop indicates that for many companies in the fund’s portfolio, higher interest rates and a flat yield curve are a danger to profits and continued dividend payments. A better option for the high-income focused investor is to build a portfolio from the financially strongest stocks out of the REM holdings list.

According to the tax rules that govern their operation, a REIT can own real estate property or participate in the financing of real estate assets. REITs that focus on owning real estate are referred to as equity REITs, while those that focus on the mortgage side of real estate are called finance REITs. The finance REIT side of the REIT universe typically carries much higher dividend yields, which are very attractive to income-focused investors.

A significant number of finance REITs employ a business model that involves owning government agency guaranteed MBS and leveraging their MBS portfolios to turn the 3% bond yields paid by these safe MBS into the cash flow to pay a double-digit dividend yield. Changing interest rates at either the short or long end of the yield curve will eat into one of these company’s cash flow generation ability. If you look at their histories, most are now paying dividends that are much lower than just a few years ago.

To build a mini-REM portfolio that gives a higher yield and does not destroy principal value, the strategy is to buy those finance REITs that have not been slashing dividend rates because their business models failed to adjust for changing interest rates.

Here are five stocks out of the REM holdings that have not reduced dividends in the last five years.

-

Morning News: October 5, 2018

Eddy Elfenbein, October 5th, 2018 at 7:05 amNafta’s China Clause Is Latest Blow to Trudeau’s Asia Ambitions

China Spy Chips Report Adds Pressure on Pentagon Cloud Security

Macron, With Popularity Slumping, Tries Tax Cuts for France’s Working Class

Era of Bank Secrecy Ends as Swiss Start Sharing Account Data

Will U.S. Economic Growth Dip, or Will the Rest of the World Catch Up?

Lindsey Graham Welcomed Trump’s China Tariffs, Then Helped Companies Avoid Them

The Big Problem at the Heart of Tech’s Latest Spy Scandal

SoftBank Deepening Ties to Ride-Hailing Firm Grab With $500 Million Funding

Unilever Backs Down on Dutch HQ Move After British Investor Revolt

Yale Invests in Crypto Fund That Raised $400 Million

Elon Musk Calls the SEC the `Shortseller Enrichment Commission’ on Twitter

Amazon CEO Jeff Bezos Just Overtook Bill Gates on Forbes’ List of the Richest Americans

Blue Harbinger: Is Breaking News Useless Noise Or Trading Fuel?

Cullen Roche: Debunking Passive Investing Myths on Bloomberg TV

Howard Lindzon: The Elastic IPO

Be sure to follow me on Twitter.

-

The NYSE’s Proposal to Alter Exchange Fees

Eddy Elfenbein, October 4th, 2018 at 10:15 amBloomberg has an interesting story on Intercontinental Exchange‘s (ICE) proposal to alter how stock exchanges make money. ICE (owner of the NYSE) wants to freeze rates they can charge for market data.

The SEC wants an incentive system. The drawback under that plan is that trades would be routed to the exchange that paid the most, not that best served the client.

ICE’s plan is to “reduce the maximum amount exchanges can charge for trades to 10 cents per 100 shares, from 30 cents.” They claim that would dramatically reduce the amount of rebates. More importantly, ICE wants exchanges to agree not to raise fees for “existing market data products, connectivity services and co-location.” This is a sensitive topic, and many investors already think the data fees are too high.

“We recognize that a large part of the industry’s support for the Transaction Fee Pilot is driven by a desire to reduce their cost to trade,” according to the NYSE letter. “We propose addressing this concern by taking fixed cost growth off the table during the Alternative Pilot and reducing the existing Access Fee Cap.”

Some in the industry would like to see market-data rates comes down, so simply freezing them, and thereby keeping the status quo, might not alleviate their concerns.

-

Morning News: October 4, 2018

Eddy Elfenbein, October 4th, 2018 at 7:06 amThe Big Hack: How China Used a Tiny Chip to Infiltrate U.S. Companies

Congress Backs F.A.A. Measure But With Few New Traveler Protections

What Happened To Treasurys On Wednesday?

Bond Bears Popping Champagne Say U.S. Yields Have Room to Rise

Firing Back at Trump in the Trade War With Tariffs Aimed at His Base

Wealth Managers Count Cost of U.S.-Chinese Trade War on Asian Business

The Republican Attack on California

eBay Claims Amazon Illegally Tried to Poach Top Sellers

Cadillac Edges Tesla in Semi-Automated Driving Test

Honda Putting $2.75 Billion Into G.M.’s Self-Driving Venture

Barnes & Noble Names Board Committee to Review Possible Sale, Shares Soar

E-Cigarette Maker Juul Files Complaints Against ‘Copycat Products’

Roger Nusbaum: Only One Fund? That’s Crazy!

Michael Batnick: The End is Nigh

Joshua Brown: Jerome Powell Making Sense

Be sure to follow me on Twitter.

-

RPM Earns 76 Cents per Share

Eddy Elfenbein, October 3rd, 2018 at 7:56 amFiscal 2019 first-quarter net sales were a record $1.46 billion, up 8.5% over the $1.35 billion reported a year ago. Including the impact of restructuring charges, first-quarter net income was $69.8 million versus $116.4 million in the year-ago period, and diluted earnings per share (EPS) were $0.52 compared to $0.86 in the year-ago quarter. Income before income taxes (IBT) was $91.9 million compared to $155.3 million reported in the fiscal 2018 first quarter. RPM’s consolidated earnings before interest and taxes (EBIT) were $113.9 million compared to $177.6 million reported in the fiscal 2018 first quarter. The fiscal 2019 first quarter included asset write-offs and other restructuring-related expenses of $39.8 million. Excluding these charges, RPM’s adjusted EBIT was $153.7 million and diluted EPS was $0.76.

“We saw strong top-line sales growth in the first quarter, with organic sales growth up 7.8%, while profitability continued to be adversely affected by rising raw material costs. In addition, bottom-line results reflected the impact of restructuring charges, higher legal and advertising costs in our consumer segment, and the adverse effect of transactional foreign exchange,” stated Frank C. Sullivan, RPM chairman and chief executive officer.

“Our team is focused on driving increased profitability, long-term growth and enhanced value for our shareholders, and we are making good progress in executing on our operating improvement plan, which is specifically designed to increase margins, reduce working capital, and improve overall operating efficiency. During the quarter, we continued our strategic restructuring initiatives, including the reduction of more than 150 positions and the announced closure of four manufacturing facilities, all in line with our 2020 Margin Acceleration Plan,” stated Sullivan.

-

Morning News: October 3, 2018

Eddy Elfenbein, October 3rd, 2018 at 7:09 amItalian Markets Find Relief After Budget-Deficit Concessions

There’s No Escape From This U.S. Car Crash

Fed’s Powell Says Strong Economic Path `Not Too Good to Be True’

The Super-Rich Are Stockpiling Wealth in Black-Box Charities

Offering Inspiration and Advice, Real Vision Is HGTV for Hedge Fund Hopefuls

Berkshire Hathaway Is Trading At A Discount To Its Intrinsic Value

GE Downgrade Will Lift Its Costs in a Debt Market It Once Ruled

Elon Musk’s Ultimatum to Tesla: Fight the S.E.C., or I Quit

Tencent Music Files for U.S. IPO

Toys ‘R’ Us Lenders Plan to Revive Brand

Facebook Hack Puts Thousands of Other Sites at Risk

Nick Maggiulli: Exception To The Rule

Cullen Roche: Three Things I Think I Think – ETF Edition

Ben Carlson: 9 Underrated Investing Books

Michael Batnick: Animal Spirits: Buy the Housing Dip

Be sure to follow me on Twitter.

-

ICE Looks to Buy All of MERS

Eddy Elfenbein, October 2nd, 2018 at 12:53 pmI mentioned this in the previous post but it’s worth discussing in more detail. Intercontinental Exchange (ICE) already owns part of Mortgage Electronic Registration Systems, also known as MERS, but we don’t know how much. ICE is currently planning to buy the whole thing. A deal may come in the next few weeks.

What ICE has done successfully is buy analog markets and make them digital. That looks to be their plan with MERS, the system that tracks millions of mortgages.

The mortgage industry is still mostly on paper. The financial crisis has stalled any serious effort to move the industry to the wonderful paperless word.

One of the problems it that MERS has been under special regulations due to lawsuits surrounding the financial crisis. That’s kept most buyers at bay, but that looks to be ending which, in turn, is drawing ICE’s interest.

The Financial Times article quotes one observer, “If I had to guess, what is probably their long-term play is to create the New York Stock Exchange for mortgages.” MERS registers 5.5 million new loans every year which is about 75% of all new mortgages.

Here’s the FT on ICE:

Most financial exchanges were built in centuries past, when brokers and traders agreed deals with shouts and hand gestures. Intercontinental Exchange was formed in May 2000 as the dotcom bubble was losing air.

Entrepreneur Jeffrey Sprecher set up the company as an all-electronic marketplace for gas and power. ICE received an inadvertent assist from the energy trader Enron, whose rival online platform imploded when the company did. “After the collapse of Enron, our revenues took off,” Mr Sprecher has said.

A lack of attachment to physical trading venues marked its growth. In 2001 it acquired International Petroleum Exchange, the largest energy futures exchange in Europe. After shutting down the IPE’s floor in 2005, volumes in flagship crude oil contract Brent have grown eightfold.

ICE also shut down the trading floor after purchasing the New York Board of Trade, an exchange for cotton, sugar and other soft commodities, in 2007. The Winnipeg Commodity Exchange, a Canadian canola seed venue, was acquired by ICE and incorporated into its US-based electronic futures platform.

In 2013 ICE made its largest-ever acquisition with the purchase of the NYSE Euronext. The prize justifying its $10bn price tag was the all-electronic Liffe futures exchange in London, but the deal also gave ICE ownership of the New York Stock Exchange — whose ornate floor has been kept open.

-

Buy List Updates

Eddy Elfenbein, October 2nd, 2018 at 10:36 amHere are a few stories I wanted to pass along.

GE has selected Larry Culp to be their new CEO. Larry was the former CEO of Danaher (DHR). This is an outstanding choice. While at Danaher, the stock rose 465%, much more than the S&P 500. However, my fear is that GE is in so much trouble that there’s not much a CEO can do.

GE made a lot of news yesterday by rising over 10%. But as I noted, it was really going from 65% off its high to something like 61% off its high.

Stryker (SYK) said it’s buying HyperBranch for $220 million. “HyperBranch is dedicated to developing medical devices based on its proprietary polymers and cross-linked hydrogels. Its Adherus AutoSpray Dural Sealant product is one of only two FDA-approved dural sealants on the market.”

Additionally, on Friday it was announced that Stryker will pay $7.8 million to “settle charges it violated the Foreign Corrupt Practices Act, without admitting or denying the allegations.”

Intercontinental Exchange (ICE) is close to taking full control of Mortgage Electronic Registration Systems. This could be a very big deal.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His