Archive for November, 2018

-

October CPI +0.3

Eddy Elfenbein, November 14th, 2018 at 10:03 amI had been saying that I was expecting inflation to run a bit hot in October. This morning’s CPI report partially vindicates my view.

For October, consumer prices rose by 0.3%. That’s the biggest increase in nine months. The core rate rose by just 0.1%.

In the last 12 months, the regular CPI is up 2.5% while the core rate is up by 2.2%.

The U.S. central bank left interest rates unchanged last Thursday, but is expected to increase borrowing costs in December for a fourth time this year. In its statement after last week’s policy meeting, the Fed noted that annual inflation measures “remain near 2 percent.”

Last month, gasoline prices rebounded 3.0 percent, accounting for more than one-third of the increase in the CPI, after slipping 0.2 percent in September.

Food prices fell 0.1 percent after being unchanged in September. Food consumed at home declined for a second straight month in October. Food prices were held down by cheaper bread, cereals, pork, dairy products, fruits and vegetables.

Owners’ equivalent rent of primary residence, which is what a homeowner would pay to rent or receive from renting a home, rose 0.3 percent in October after advancing 0.2 percent in the prior month. The rent index gained 0.2 percent.

Healthcare costs increased 0.2 percent last month after a similar gain in September. Apparel prices edged up 0.1 percent after jumping 0.9 percent in September.

Oil had fallen for the last 12 days in a row. It looks like that streak will end today.

-

Morning News: November 14, 2018

Eddy Elfenbein, November 14th, 2018 at 7:12 amCrude’s Collapse Is Sending Shockwaves Across Global Markets

Japan, German Contractions Open Cracks in Global Economy

Weaker Retail Sales Loom Over China’s Economy Despite Some Bright Spots

Greenspan Says U.S. May Be Seeing the First Signs of Inflation

Billionaire Cohen Says Bear Market Coming Within Two Years

Dominating Retail? Yes. Reviving a City? No Thanks.

Who Has the Copyright Over My Cheese?

FAA Launches Review of Boeing’s Safety Analyses

Snap Reveals U.S. Subpoenas on IPO Disclosures

Pfizer Loses Blockbuster Drug Patent Fight in UK Supreme Court

Waymo CEO Says Alphabet Unit Plans to Launch Driverless Car Service in Coming Months

Is Apple Trying to Hide Something From Investors?

Nick Maggiulli: The Old Gods and the New

Ben Carlson: What If You Retire At a Stock Market Peak?

Michael Batnick: Animal Spirits: How to Create the Perfect Fund

Be sure to follow me on Twitter.

-

Introducing @CrossingWallSt on Premo

Eddy Elfenbein, November 13th, 2018 at 9:44 amBig news! I’m happy to announce that I’ve partnered with the good folks at Premo Social to start a premium Twitter feed.

For $30 per month, this feed has all the benefits of Twitter but without the trolls, hacks and stock promoters. We’ve taken regular Twitter and made it a lot better. It’s an outlet for investors to discuss the markets in greater detail without having scammers try to hijack the conversation.

I’m really excited about this, and I’d love to have you join us. It’s so cheap, you can’t afford not to sign up! You can sign up here.

What are you waiting for???

This is much more than a regular Twitter feed. @CrossingWallSt has lots more news and analysis on what you need to know to be an informed investor. This is an important time for the market and the economy so don’t be left behind. We’re offering a great product for investors in this difficult period.

Come on and join us today!

-

Morning News: November 13, 2018

Eddy Elfenbein, November 13th, 2018 at 7:07 amOPEC Sees Demand for Its Crude Declining Faster as Rivals Surge

Yellen Says Fed More to Blame for Wider Trade Deficit Than China

China’s Liu and Mnuchin Talk Trade for the First Time in Months

Could Oysters Ease Trade Tensions With U.S.? European Leaders Hope So

Trump’s Tax Cut Was Supposed to Change Corporate Behavior. Here’s What Happened.

Amazon’s Grand Search For 2nd Headquarters Ends With Split: NYC And D.C. Suburb

Stocks Dive After Apple Supplier Slashes Outlook

Apple Has a Plan B as iPhone Demand Peaks; Many Suppliers Don’t

WeWork’s Rise: How a Sublet Start-Up Is Taking Over

Goldman Sachs Tumbles on 1MDB Scandal and ‘Fear of the Unknown’

Home Depot Tops Sales Estimates, Boosts Annual Forecasts

Clean Energy Is Surging, but Not Fast Enough to Solve Global Warming

Jeff Carter: There Ain’t No Such Thing As a Free Lunch

Roger Nusbaum: In Search Of Kind Of Close

Howard Lindzon: Momentum Monday ….The Trumpy Bear Market of 2019?

Be sure to follow me on Twitter.

-

Three Very Good Days for Our Buy List

Eddy Elfenbein, November 12th, 2018 at 5:21 pmThe stock market has fallen over the last three days while our Buy List has beaten the market each of those days — and by a good amount. The S&P 500 is down 3.12% since last Thursday while our Buy List is down just 1.10%.

It always seems a little odd highlighting your outperformance during a difficult period. I call this the “we suck less” line, but frankly, this is a very important thing to do. What truly helps long-term success is holding up better during difficult times.

Part of our recent success lately has been due to the market’s shift towards defensiveness. I’ll give some examples. Amazon is now 20% below its high. Google is 18% below its high. Facebook is 35% below its high. Now let’s look at some stocks that made new highs today: Coke, McDonalds, Procter & Gamble, Clorox and Hormel Foods. All staples.

Meanwhile, commodities are suffering. The price of silver closed at $14.01 per ounce. That’s its lowest price since early 2016.

West Texas crude has now fallen for 11 sessions in a row. On October 26, oil closed at $67.59 per barrel. Today, it closed at $59.93.

-

Morning News: November 12, 2018

Eddy Elfenbein, November 12th, 2018 at 7:12 amHow an Intelligence Expert Helps Wall Street Mavens Think Smarter

This Is How the Unicorn Bubble Will Burst

This Is the Single Most Meaningless Shopping Event

If OPEC Thought Its Job Was Done, 2019 Will Be a Nasty Shock

Oil Pucks and Pellets; Canada Eyes New Ways to Move Stranded Crude

How Trump’s Trade War Went From 18 Products to 10,000

No Joke: Donald Trump Once Proposed a Tax-the-Rich Strategy to Save Social Security

SoftBank Targets $20 Billion IPO for Japanese Mobile Unit

How One Family Built $8 Billion Startup Far From Silicon Valley

Veritas Capital, Elliott Clinch $5.5 Billion Acquisition of Athenahealth

Diageo Sells Seagram’s and Sambuca Brands

Vista Reaches Deal to Buy Software Firm Apptio for $1.94 Billion

Ben Carlson: Trends & Time Lapses

Jeff Miller: Market Storm Averted?

Be sure to follow me on Twitter.

-

In Flanders Fields

Eddy Elfenbein, November 11th, 2018 at 11:53 amIn Flanders fields the poppies blow

Between the crosses, row on row,

That mark our place; and in the sky

The larks, still bravely singing, fly

Scarce heard amid the guns below.We are the Dead. Short days ago

We lived, felt dawn, saw sunset glow,

Loved and were loved, and now we lie,

In Flanders fields.Take up our quarrel with the foe:

To you from failing hands we throw

The torch; be yours to hold it high.

If ye break faith with us who die

We shall not sleep, though poppies grow

In Flanders fields.By Lieutenant Colonel John McCrae, MD (1872-1918)

Canadian Army -

CWS Market Review – November 9, 2018

Eddy Elfenbein, November 9th, 2018 at 7:08 am“The path is smooth that leadeth on to danger.” – William Shakespeare, Venus and Adonis

On Tuesday, Americans went to the polls and they voted for gridlock. Or more accurately, the Democrats won control of the House of Representatives while the Republicans increased their Senate majority.

What does this mean for us as investors? Eh…not much, really. Sure, I know how partisans like to jump and holler, but the long-term impact on the markets is pretty small. Historically, bull markets have done just fine while there’s been gridlock in Washington. If anything, Wall Street seems pleased that the uncertainty of the election has passed.

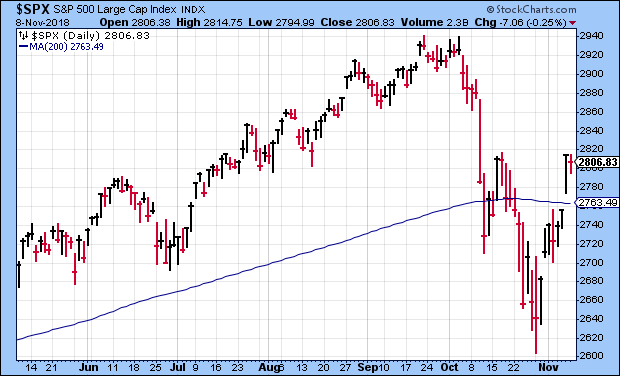

It’s true that things have improved recently for the stock market. Before Thursday’s pullback, the S&P 500 rallied six times in seven days. Since October 29, the index has added 6.3%. That’s a nice change from Red October. Measuring from the closing high to the closing low, the S&P 500 has already gained back most of what it lost.

Then on Wednesday, the S&P 500 crossed the crucial threshold by closing above its 200-day moving average (the blue line in the chart above). The Volatility Index is now back to its lowest levels in a month, but I think this may be a false pause. In this issue, I’ll lay out my reasons. We also had our final two Buy List earnings reports for this cycle. I’ll break it all down for you. Plus, we got a nice 16% dividend hike from Snap-on. But first, let’s look at the other election this week, the 9-0 vote at the Fed to leave interest rates alone.

The Fed Pauses but More Rate Hikes Are Coming

The Federal Reserve met on Tuesday and Wednesday of this week. As expected, the central bank decided to forgo an interest-rate hike, but another one is probably coming next month. The Fed has already raised rates three times this year and eight times this cycle. The current range for Fed funds is 2% to 2.25%. Interestingly, that brings short-term rates to nearly even with inflation.

The Fed’s policy statement was refreshingly optimistic. (I should explain that central bankers are trained to see the downside of every event. They’re not happy unless the world is coming to an end, so even a little optimism is noteworthy.) Specifically, the Fed said “the labor market has continued to strengthen, and that economic activity has been rising at a strong rate.” The Fed also noted that household spending “has continued to grow strongly.” In Fedspeak, that means the economy is on fleek.

The Fed didn’t address the housing market directly, but that could be a concern. The stock market’s freak-out during October was largely centered on housing. I think the market was overdoing it, and we’re starting to see some effects of that. On our Buy List, you’ll note the sharp rebound in stocks like Sherwin-Williams (SHW). SHW has risen the last eight days in a row for a gain of 13.2%. In a bit, I’ll cover the good earnings report from CBPX, our wallboard stock. It plunged 30% last month.

While the housing panic was way overdone, I still believe we should be cautious about the market. In fact, I think it’s very likely the market will soon see volatility heat up and share prices fall. I don’t want to alarm you. I’m not predicting the Apocalypse (sorry, central bankers). Rather, I see a mild autumn swoon.

What has me concerned is next week’s inflation report. Given the slight rise in wages we saw in October, it’s very likely some cost pressures have made their way into consumer prices. It’s not much, but it’s a change from what we’ve seen. If I know Wall Street, the market—particularly the bond market—will overreact. That’s what it’s paid to do. Over the past week, the market has recovered too quickly for my liking.

Right now, the market expects the Fed to raise rates in December, then again in March. After that, the market expects the Fed to take a six-month break. I’m not so sure about that. If next week’s inflation report comes in hot, then the Fed may be pressured to step up its rate increases.

The good news is that the selloff gave us a lot of good stocks at good prices. In fact, a few of our Buy List stocks like Hormel Foods, Church & Dwight, Ross Stores and Intercontinental Exchange have all broken out to new highs.

For now, I encourage you to remain calm. There are plenty of good stocks out there. Some stocks on our Buy List that look especially good are Moody’s (MCO), which is down from an earnings miss, Cognizant Technology Solutions (CTSH), which looks good below $75 per share, and Torchmark (TMK), which is a nice buy if you can snag it below $88 per share. Now let’s look at this week’s earnings reports.

Earnings from Becton, Dickinson and Continental Building

We had our final two Buy List earnings report for this earnings season this week. On Tuesday, Becton, Dickinson (BDX) reported fiscal Q4 earnings of $2.93 per share. That matched Wall Street’s estimates, and it was also a nice increase from $2.40 per share one year ago. This was a big year for BDX because it was the first year they’ve operated after absorbing CR Bard. For the year, Becton made $11.01 per share. Adjusting for the acquisition, revenues were up 5.8% for the fiscal year.

“Fiscal 2018 was a historic year for BD with the successful completion of the acquisition of C. R. Bard. We are extremely proud of our strong fourth quarter and fiscal year results, which demonstrate how agile we can be as an organization while executing concurrently on two transformative acquisitions,” said Vincent A. Forlenza, Chairman and CEO. “We enter fiscal 2019 with continued strong momentum and confidence in our ability to execute on our strategy, deliver on our commitments and create value for our shareholders.”

What I really like about Becton is that they raised their earnings outlook during the entire year. Let’s look at some history. In fiscal 2017, they made $9.48 per share. Last November, the company originally pegged EPS for FY 2018 at $10.55 to $10.65. In February, they bumped the range up to $10.85 to $11 per share. In May, they raised the range again to $10.90 to $11.05 per share. Then in August, it went to $10.95 to $11.05 per share. Ultimately, they made $11.01 per share. I love watching those steady increases.

What about 2019? For the current fiscal year, BDX expects earnings between $12.05 and $12.15 per share. They’re looking for adjusted revenue to rise by 5% to 6%.

On Tuesday morning, shares of BDX plunged. I have no idea why. The report looked just fine to me, but traders gonna trade. Sure enough, BDX rallied back and closed higher by 1.4% by the closing bell. Becton, Dickinson remains a buy up to $260 per share.

Then on Thursday, we got the earnings report from Continental Building Products (CBPX). I’ve been anticipating this one. In October, the stock got a super-atomic wedgie. It plunged 30% on no company-specific news. Traders were freaking about housing, and anything remotely related to that got clobbered. As a wallboard company, Continental got caught in the crossfire.

After the bell on Thursday, Continental said they made 51 cents per share for their third quarter. That beat estimates by three cents per share. The details of the report look pretty good. Net sales increased by 12.6% to $131.2 million. Also, gross margin increased to 28.1% compared to 24.5% last year.

“We executed strong operational and financial results in the quarter with a 76% increase in earnings per share and significant operating cash flow driven by higher net sales and our highly efficient low cost operations,” stated Jay Bachmann, President and Chief Executive Officer. “We achieved a 21% increase in EBITDA and a 360 basis point improvement in gross margin, marking the fifth straight quarter that we have expanded gross margin. This overall improvement reflects our relentless focus on our Bison Way continuous improvement effort as our associates work together to streamline our operations and elevate our service to customers. We are especially pleased to deliver these results against a backdrop of continuing inflationary pressures in freight, labor and raw materials.”

Continental doesn’t give EPS guidance, but they do offer ranges for a few operating metrics. Roughly, it probably translates to 60 cents per share for Q4 and $2 for the entire year. That’s pretty much what I had been expecting before the stock’s recent nosedive. I like CBPX and I’m willing to stick with them, but I’m lowering my Buy Below price to $33 per share to reflect the selloff.

That’s the end of the third-quarter earnings season for us, but on our Buy List, we have three stocks with quarters ending in October. That means they’re due to report earnings soon. Ross Stores (ROST) and Hormel Foods (HRL) will report on November 20, and JM Smucker (SJM) will report on November 28. I’m expecting another dividend increase from Hormel. It’s easy to predict these things when the company has raised its dividend every year for the last 52 years. I’ll preview these stocks in next week’s issue.

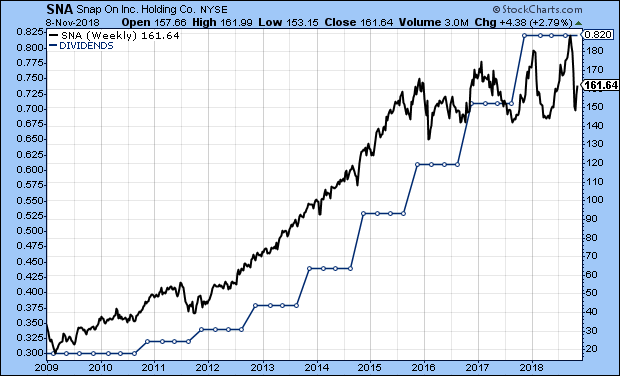

Snap-on Boosts Dividend by 16%

After the close on Thursday, Snap-on (SNA) gave its shareholders a nice raise. The company is raising its quarterly dividend from 82 to 95 cents per share. That’s an increase of nearly 16%. This is Snap-on’s ninth-straight annual increase. Based on the stock’s closing price, the new dividend yields 2.35%. Based on next year’s estimate, the dividend works out to a payout ratio of about 30%.

This dividend hike is especially good to see after the stock got dinged nearly 10% a few weeks ago after the earnings report. The earnings were good, but the top-line number was weak. The new dividend is payable December 10 to shareholders of record on November 20. Snap-on is a buy up to $167 per share.

Before I go, I also wanted to lower our Buy Below on Cerner (CERN) to $63 per share. I still like Cerner, but I wanted to adjust the price to reflect the drop after the last earnings report.

That’s all for now. Monday is when Veterans Day is observed in the United States, but the stock market will be open. (Sunday will be the 100th anniversary of the end of the First World War.) On Wednesday, the CPI for October will be released. So far, inflation has been fairly tame, but I think there’s a chance we’ll see evidence of higher prices. On Thursday, the retail sales report for October comes out. Then on Friday, the industrial production report is due to be released. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Syndication Partners

I’ve teamed up with Investors Alley to feature some of their content. I think they have really good stuff. Check it out!

It Is Time To Get Bullish On Stocks?

Volatility Will Normalize and Here’s How To Profit When It Happens

-

Morning News: November 9, 2018

Eddy Elfenbein, November 9th, 2018 at 7:03 amSpenders or Thrifters: As Singles’ Day Nears, Are China’s Shoppers About to Drop?

Trump’s Tariffs Have Fully Kicked In—Yet China’s Exports Grow

Russia Clashes With Western Oil Buyers Over New Deals as Sanctions

Oil Teeters Near Record Losing Streak After Entering Bear Market

What Bond Carnage? Pimco Boosts Allianz With $11 Billion Inflow

SEC to Review Corporate Democracy Rules Risking Investor Clash

Judge Blocks the Disputed Keystone XL Pipeline In A Setback For Trump’s Energy Agenda

FDA Plans to Sharply Restrict Sales of Flavored E-Cigarettes

Why Ford Motor Company Is Scooting Into Micro-Mobility

VW Plans to Sell Electric Tesla Rival for Less Than $23,000

Google Overhauls Sexual Misconduct Policy After Employee Walkout

Bitcoin Pioneer Who Gave Away Over $100 Million Has No Regrets

Roger Nusbaum: Portfolio Update

Jeff Miller: Boost Your General Mills Dividend Yield

Ben Carlson: Things You See During Every Market Correction

Be sure to follow me on Twitter.

-

Today’s Fed Policy Statement

Eddy Elfenbein, November 8th, 2018 at 2:03 pmInformation received since the Federal Open Market Committee met in September indicates that the labor market has continued to strengthen and that economic activity has been rising at a strong rate. Job gains have been strong, on average, in recent months, and the unemployment rate has declined. Household spending has continued to grow strongly, while growth of business fixed investment has moderated from its rapid pace earlier in the year. On a 12-month basis, both overall inflation and inflation for items other than food and energy remain near 2 percent. Indicators of longer-term inflation expectations are little changed, on balance.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that further gradual increases in the target range for the federal funds rate will be consistent with sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee’s symmetric 2 percent objective over the medium term. Risks to the economic outlook appear roughly balanced.

In view of realized and expected labor market conditions and inflation, the Committee decided to maintain the target range for the federal funds rate at 2 to 2-1/4 percent.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its maximum employment objective and its symmetric 2 percent inflation objective. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments.

Voting for the FOMC monetary policy action were: Jerome H. Powell, Chairman; John C. Williams, Vice Chairman; Thomas I. Barkin; Raphael W. Bostic; Lael Brainard; Richard H. Clarida; Mary C. Daly; Loretta J. Mester; and Randal K. Quarles.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His