Archive for January, 2019

-

The Members Exchange

Eddy Elfenbein, January 7th, 2019 at 11:20 amThe Wall Street Journal reports that a new exchange is being launched, the Members Exchange.

A group of financial heavyweights including Morgan Stanley , Fidelity Investments and Citadel Securities LLC plans to launch a new low-cost stock exchange to challenge the New York Stock Exchange and Nasdaq Inc., the companies said.

The creation of the new venue, called Members Exchange or MEMX, comes after years of frustration among Wall Street brokers and traders with the fees charged by U.S. stock exchanges.

MEMX will be controlled by the nine banks, brokerages and high-frequency trading firms funding it, according to a news release viewed by The Wall Street Journal. Such an arrangement harks back to the era when exchanges were owned by their members, typically stockbrokers.

MEMX investors also include investment banks Bank of America Merrill Lynch and UBS AG, high-speed trader Virtu Financial Inc. and retail brokers Charles Schwab Corp., E*Trade Financial Corp. and TD Ameritrade Holding Corp., according to the news release.

I’m conflicted because on one hand this is a challenge to NYSE and ICE. On the other hand, I like ICE because I recognize its monopoly-like hold.

It will still take some time before any challenger can get established.

New York-based MEMX is set to make its plans public on Monday. Representatives of the investor group said they would seek to apply for exchange status with the Securities and Exchange Commission early this year. SEC approval for a new exchange is a drawn-out process that can take 12 months or longer, meaning it may be 2020 or later before MEMX is up and running.

A launch would inject new competition into the heavily concentrated stock-exchange business. Today, all but one of the 13 active U.S. stock exchanges is owned by three corporations: NYSE parent Intercontinental Exchange Inc., known as ICE for short, Nasdaq and Cboe Global Markets Inc. Between them they handle more than three-fifths of U.S. equities trading volume.

It’s not easy to challenge the king.

Despite its prominent backers, there is no guarantee that MEMX will succeed. New exchanges often struggle to attract trading activity away from established markets. IEX Group Inc., a startup that was founded in 2012 and now runs the only independent exchange not owned by the big three, handles 2.5% of U.S. equities trading volume.

But brokers looking to save costs could be drawn to MEMX’s low fees. ICE, Nasdaq and Cboe have faced criticism for raising fees for services such as the data feeds that brokers use to monitor moves in stock prices. The three big exchange groups say their prices are fair.

-

Morning News: January 7, 2019

Eddy Elfenbein, January 7th, 2019 at 7:08 amXi’s Top Trade Official Unexpectedly Attended China-U.S. Talks

Trump Has Promised to Bring Jobs Back. His Tariffs Threaten to Send Them Away.

Chinese Tech Investors Flee Silicon Valley as Trump Tightens Scrutiny

Housing Bear Who Called 2018 Slowdown Says Worst Yet to Come

Apple: 3 Things Tim Cook Didn’t Tell You

Apple’s Biggest Problem? My Mom

Lilly to Buy Loxo Oncology For About $8 Billion in Cancer Bet

Kroger, Microsoft Create Futuristic Grocery Store. Amazon, Take Note

Tesla CEO Musk Breaks Ground at Shanghai Gigafactory to Launch China Push

Sony’s Chief Plans to Make Entertainment Assets a Priority

Richer Americans Are Skipping SUVs for Station Wagons

Activist Investor Starboard Seeks Changes at Dollar Tree

Lawrence Hamtil: The Recession Portfolio

Ben Carlson: 10 Things Investors Can Expect in 2019

Jeff Carter: To Make Huge Gains, You Have To Be a Warrior

Be sure to follow me on Twitter.

-

RPM International Earned 52 Cents per Share

Eddy Elfenbein, January 4th, 2019 at 9:33 amThis morning, RPM International (RPM) reported fiscal Q2 earnings of 52 cents per share. Sales rose 3.6% to $1.36 billion. This was not a good report. Wall Street had been expecting 68 cents per share.

“We achieved solid top-line improvement with sales growth of 3.6%, despite the unfavorable foreign currency translation effect of 2.0%,” stated Frank C. Sullivan, RPM chairman and chief executive officer. “Like many manufacturers, our bottom line was impacted by a continued rise in costs for raw materials, freight, labor and energy, as well as adverse foreign exchange translation. SG&A improved by 30 basis points, and adjusted SG&A, excluding restructuring expenses, improved by 100 basis points versus last year’s second quarter. Restructuring activities related to our MAP to Growth operating improvement plan, the details of which we shared at an investor day on November 28, are well under way. Our plan is focused on driving greater efficiency and long-term profitability of the business to enhance shareholder value.

For Q3, RPM expects earnings between 10 and 12 cents per share.

-

December NFP +312,000

Eddy Elfenbein, January 4th, 2019 at 8:54 amToday’s jobs report was a blow-out. The US economy added 312,000 net new jobs last month. The unemployment rate ticked up to 3.9% thanks to more people entering the labor force. Interestingly, today’s jobs report had the highest jobs-to-population ratio in exactly 10 years.

The jobless rate, which was last higher in June, rose for the right reason as 419,000 new workers entered the workforce and the labor force participation rate increased to 63.1 percent. The participation level was up 0.2 percentage points from November and 0.4 percentage points compared with a year earlier.

A broader measure of unemployment that includes discouraged workers and those holding part-time jobs for economic reasons held steady at 7.6 percent.

In addition to the big job gains, wages jumped 3.2 percent from a year ago and 0.4 percent over the previous month. The year-over-year increase is tied with October for the best since April 2009. The average work week rose 0.1 hour to 34.5 hours.

Economists surveyed by Dow Jones had been expecting job growth of just 176,000, though they projected the unemployment rate to fall to 3.6 percent. The wage number also was well above expectations of 3 percent on the year and 0.3 percent from November.

The report for November was revised higher by 21,000, and the one for October was revised upward by 37,000.

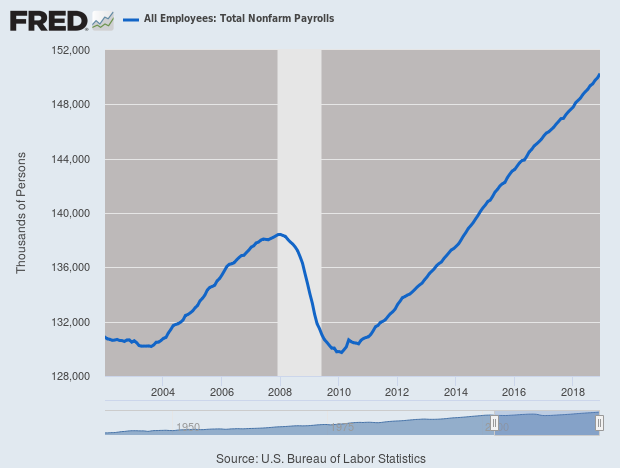

Here’s a look at the growth in non-farm payrolls:

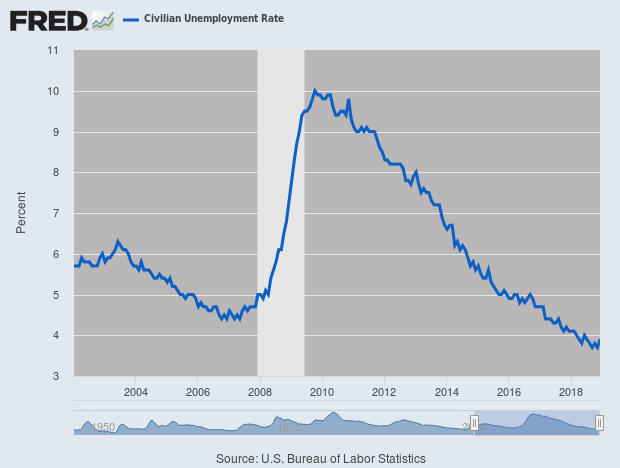

Here’s the unemployment rate:

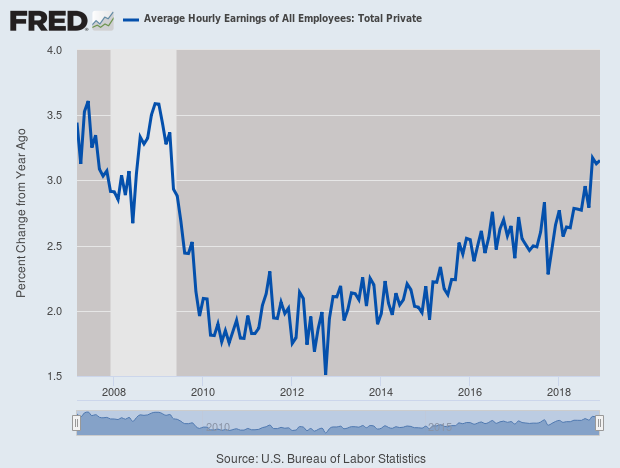

In the last year, average hourly earnings are up 3.2%.

-

Morning News: January 4, 2019

Eddy Elfenbein, January 4th, 2019 at 7:37 amOil Rises to $57 on China-U.S. Trade Talks, OPEC Cuts

Chinese Consumers’ Confidence Sags, Casting a Pall Over the Global Economy

China Cuts Banks’ Reserve Ratio to Ratchet Up Support for 2019

Jerome Powell Pledged Allegiance to Data and Some of It Looks Grim

Leveraged Loan Investors Worry Good Times Will Soon Haunt Them

Last Month, Investors Seemed Too Pessimistic. Now, They Seem Prescient.

Forget Fed Hikes, Traders Are Now Fully Pricing a Cut by April 2020

Bristol-Myers: Analysis On Celgene Deal

Audits Reveal Deutsche Bank’s Links to Tax Trade Scandal

Pioneering Southwest Airlines Co-Founder Herb Kelleher Dies At 87

Mountain for Rent: $4,500 a Day

Joshua Brown: On A Dime & What Are Your Thoughts: Is Apple Going to Zero?

Ben Carlson: 2017 vs. 2018 in the Stock Market

Blue Harbinger: How Much Cash Are You Keeping On The Sidelines?

Be sure to follow me on Twitter.

-

Morning News: January 3, 2019

Eddy Elfenbein, January 3rd, 2019 at 7:16 amE.C.B. Takes Reins of Italian Bank to Prevent Wider Crisis

Chinese Companies Flocked to U.S. Markets in 2018. The Trade War May Have Had a Role.

Powell and Trump Are Locked in a Battle for Wall Street’s Trust

‘Flash-Crash’ Moves Hit Currency Markets

Bristol-Myers and Celgene to Merge in $74 Billion Equity Value Deal

Apple Cuts Outlook as Chinese Slowdown Hits iPhone Demand

Apple’s Warning a Bad Omen for Wall Street Bulls

Tesla Cuts U.S. Prices on All Vehicles, Shares Drop

New Netflix CFO to Tackle Cash Flow Conundrum

Cullen Roche: Is This The Worst Thing The WSJ Has Ever Published?

Nick Maggiulli: The Rise After the Fall

Ben Carlson: Animal Spirits: The Market Swoon

Jeff Carter: The Margin of Safety

Roger Nusbaum: The Benefits Of Nonconformity

Joshua Brown: The Fed Could be Completely Out Of The Game in 2019

Be sure to follow me on Twitter.

-

Dividend Champs on the Buy List

Eddy Elfenbein, January 2nd, 2019 at 7:52 amI don’t purposely seek out Dividend Aristocrats for the Buy List (meaning stocks that have raised their dividends for more than 25 years in a row), but we tend to have a few. Rather, I think it’s because we focus on the qualities that many long-term dividend-raisers have.

We currently have ten Buy List stocks that have raised their dividend for at least 20 years in a row:

Hormel Foods (HRL) 53 years

Becton Dickinson (BDX) 47 years

RPM International (RPM) 45 years

Sherwin-Williams (SHW) 40 years

AFLAC (AFL) 36 years

Stryker (SYK) 25 years

Ross Stores (ROST) 24 years

Church & Dwight (CHD) 22 years

JM Smucker (SJM) 21 years

Factset Research System (FDS) 20 yearsOf our new stocks, Raytheon (RTN) is at 14 years and Broadridge Financial Solutions (BR) is at 12. Both Disney (DIS) and Hershey (HSY) are at nine. Eagle Bancorp (EGBN) doesn’t currently pay a dividend.

-

Morning News: January 2, 2019

Eddy Elfenbein, January 2nd, 2019 at 7:00 amU.S.-China Trade War Takes Toll on Global Manufacturing

$1 Billion Is the Loneliest Number for Hedge Funds in 2019

Key Fed Yield Gauge Points to Rate Cuts for First Time Since 2008

Investors Are Still Cautiously Optimistic About 2019. But Here’s What Could Go Wrong.

Markets Are Signaling Higher Odds of a 2019 Recession

Big Tech May Look Troubled, but It’s Just Getting Started

Big Claims Strain Senior Living Market for U.S. Insurers

Google Wins U.S. Approval for Radar-Based Hand Motion Sensor

In the Race for Content, Hollywood Is Buying Up Hit Podcasts

South Koreans Seek Nippon Steel Asset Seizure in ‘Forced Labor’ Case

Ben Carlson: Mindless Resolutions

Michael Batnick: Animal Spirits: Market Swoon

Jeff Carter: New Year’s Resolutions and Predictions

Cullen Roche: The Best Lessons of 2018 – Patience & Discipline

Howard Lindzon: Happy 2019 and More Predictions – Everyone Wants To Be A Planet

Be sure to follow me on Twitter.

-

CWS Market Review – January 1, 2019

Eddy Elfenbein, January 1st, 2019 at 9:55 pmHappy New Year! The 2018 trading year has come to a close. First, let’s take a look at the Buy List for 2019. Here are the 25 stocks for the 2019 Buy List. It’s locked and sealed, and I can’t make any changes for 12 months.

The 2019 Buy List

For tracking purposes, I assume the Buy List is a $1 million portfolio that’s equally divided among 25 stocks. Below are all 25 positions with the number of shares for each and the closing price for 2018. Whenever I discuss how the Buy List is doing, the list below is what I’m referring to.

Company Ticker Price Shares Balance AFLAC AFL $45.56 877.96313 $40,000.00 Becton, Dickinson BDX $225.32 177.52530 $40,000.00 Broadridge Financial Solutions BR $96.25 415.58442 $40,000.00 Cerner CERN $52.44 762.77651 $40,000.00 Check Point Software CHKP $102.65 389.67365 $40,000.00 Church & Dwight CHD $65.76 608.27251 $40,000.00 Cognizant Technology Solutions CTSH $63.48 630.11972 $40,000.00 Continental Building Products CBPX $25.45 1571.70923 $40,000.00 Danaher DHR $103.12 387.89760 $40,000.00 Disney DIS $109.65 364.79708 $40,000.00 Eagle Bancorp EGBN $48.71 821.18661 $40,000.00 FactSet Research Systems FDS $200.13 199.87008 $40,000.00 Fiserv FISV $73.49 544.29174 $40,000.00 Hershey HSY $107.18 373.20396 $40,000.00 Hormel Foods HRL $42.68 937.20712 $40,000.00 Intercontinental Exchange ICE $75.33 530.99695 $40,000.00 JM Smucker SJM $93.49 427.85325 $40,000.00 Moody’s MCO $140.04 285.63268 $40,000.00 Raytheon RTN $153.35 260.84121 $40,000.00 Ross Stores ROST $83.20 480.76923 $40,000.00 RPM International RPM $58.78 680.50357 $40,000.00 Sherwin-Williams SHW $393.46 101.66218 $40,000.00 Singnature Bank SBNY $102.81 389.06721 $40,000.00 Stryker SYK $156.75 255.18341 $40,000.00 Torchmark TMK $74.53 536.69663 $40,000.00 Total $1,000,000.00 The five new stocks are Broadridge Financial Solutions, Disney, Eagle Bancorp, Hershey and Raytheon. We’ll also gain a 26th stock when Danaher spins off its dental business.

The five sells are Alliance Data Systems, Carriage Services, Ingredion, Snap-on and Wabtec.

Disney is now our largest stock, with a market cap of $163 billion. The Buy List is mostly large- and mid-cap stocks. Only two are smaller than $5 billion. Eagle Bancorp is $1.7 billion, and Continental Building Products is about $937 million.

Only AFLAC and Fiserv have been on the Buy List all 14 years. This is Stryker’s 12th year.

Here’s a brief description (via Hoovers) of our five new stocks along with my starting Buy Below price:

Broadridge Financial Solutions (BR) does business by proxy. The company provides technology-based investor communications, trade processing, and related services – the back-office infrastructure that facilitates operations – to financial services companies around the world. Clients include banks, broker-dealers, mutual funds, and institutional investors. Through its proprietary ProxyEdge system, Broadridge processes and distributes proxy materials, voting instructions, and other information to investors, processing more than 2 billion investor communications per year. It also offers related services, such as marketing communications and online shareholder meetings. Broadridge operates offices in more than a dozen countries in North America, Europe, Africa, Asia and Australia. Buy below $102 per share.

The monarch of this magic kingdom is no man but a mouse: Mickey Mouse. The Walt Disney Company (DIS) is the world’s largest media conglomerate, with assets encompassing movies, television, publishing, and theme parks. Its Disney/ABC Television Group includes the ABC television network and 10 broadcast stations, as well as a portfolio of cable networks including ABC Family, Disney Channel, and ESPN (80%-owned). Walt Disney Studios produces films through imprints Walt Disney Pictures, Disney Animation, and Pixar. It also owns Marvel Entertainment and Lucasfilm, two extremely successful film producers. In addition, Walt Disney Parks and Resorts runs its popular theme parks including Walt Disney World and Disneyland. Buy below $118.

For those nest eggs that need a little help hatching, holding company Eagle Bancorp (EGBN) would recommend its community-oriented EagleBank subsidiary. The bank serves businesses and individuals through more than 20 branches in Maryland, Virginia, and Washington, DC, and its suburbs. Deposit products include checking, savings, and money market accounts; certificates of deposit; and IRAs. Commercial real estate loans represent more than 70% of its loan portfolio, while construction loans make up another more than 20%. The bank, which has significant expertise as a Small Business Administration lender, also writes business, consumer, and home equity loans. EagleBank offers insurance products through an agreement with The Meltzer Group. Buy below $54.

The Hershey Company (HSY) works to spread Almond Joy and lots of Kisses. With its portfolio of more than 80 global brands, the #1 chocolate producer in North America has built a big business manufacturing such well-known chocolate and candy brands as Hershey’s, Kisses, Reese’s peanut butter cups, Twizzlers, Mounds and Almond Joy candy bars (under a license), York peppermint patties, and Kit Kat wafer bars. Hershey also makes grocery goods, including baking chocolate, chocolate syrup, cocoa mix, cookies, snack nuts, breath mints, and bubble gum. Beyond candy, Hershey’s has expanded into the snacks category. Products from the chocolate king are sold to a variety of wholesale distributors and retailers throughout North America and exported overseas. Buy below $114.

Raytheon (RTN), “light of the gods,” shines in the upper pantheon of US military contractors; the company regularly places among the Pentagon’s top 10 prime contractors. Its air/land/sea/space/cyber defense offerings include reconnaissance, targeting, and navigation systems, as well as missile systems (Patriot, Sidewinder, and Tomahawk), unmanned ground and aerial systems, sensing technologies, and radars. Additionally, Raytheon makes systems for communications (satellite) and intelligence, radios, cybersecurity, and air traffic control. It also offers commercial electronics products and services, as well as food safety processing technologies. The US government accounts for a large portion of sales. Buy below $163.

The 2018 Buy List

Now let’s look at how the 2018 Buy List did. For 2018, the S&P 500 lost 6.24% while our Buy List lost 6.30%. Including dividends, the S&P 500 lost 4.38% while our Buy List lost 5.11%. So we trailed the overall market, but, to be fair, not by much.

Our Buy List fell 3% behind the market by May, but it performed much better since then. Also, we were weighed down by very big losses in Carriage Services and Alliance Data Systems.

For the long-term, we’ve done quite well. Over the last 13 years, our Buy List has gained 211.32% while the S&P 500 has gained 164.00%. That includes some very difficult years.

Our biggest winner this year was Church & Dwight (CHD) which gained more than 31%. CHD was a new addition to this year’s Buy List. I suppose there will always be a market for baking soda and condoms. Eleven of our stocks finished positive this year, and 14 of our 25 stocks beat the S&P 500 in terms of price. Again, our problem was that the big losers really held us back.

For people who care about such things, the “beta” of our Buy List in 2018 was 0.8085. That’s pretty low for us. The correlation of the daily changes of the Buy List to the changes of the S&P 500 was 93.34%.

The chart below details the Buy List’s performance. I’ve listed each stock along with the number of shares and the starting and ending prices.

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His