CWS Market Review – February 22, 2019

“If a stock advances ten points, it is very likely to have a relapse of four points or more.” – Charles Dow

On Christmas Eve, I ran a poll on Twitter asking folks how much further the market had to fall.

How much further does the S&P 500 have to fall before hitting bottom?

— Eddy Elfenbein (@EddyElfenbein) December 24, 2018

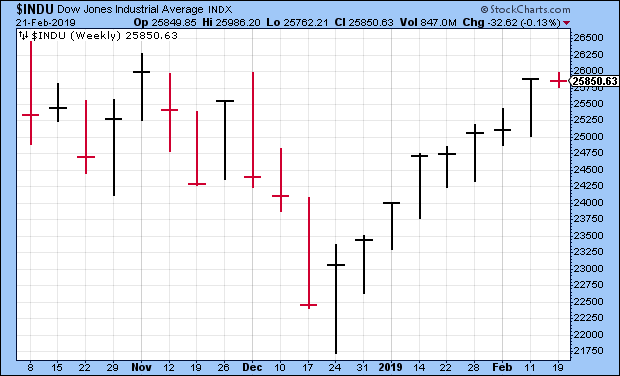

Most respondents thought it had further to go. Some thought it had a lot further. The median answer was about 10%. As it turned out, I posted the poll precisely 64 minutes before the lowest close.

In other words, we were right at the low just as people were worried that the low was still a good way off. Now here we are two months later, and the S&P 500 is up 18% since Christmas Eve. That’s a huge gain for such a short amount of time. The Dow is very close to finishing nine straight weeks of gains.

This is another good lesson on why it’s important to tune out the noise. Instead, focus on superior companies. Our Buy List is already up 11.2% this year, and we have a modest lead over the S&P 500. We’ve seen several new highs recently. On Thursday, Check Point, Danaher, Hershey and Stryker all reached new 52-week highs.

In this week’s issue, I want to cover our recent earnings reports. Moody’s got a nice boost after it raised its dividend by 14%. We have a 21% gain in MCO this year. Smucker said its profits for next year will be above Wall Street’s forecast. But first, I want to discuss some important economic news.

The Fed Will Be Patient With Interest Rates this Year

In late January, the Federal Reserve decided to hold off raising interest rates. The central bank also said that it will be patient with future rate hikes. That was a key message to the market, and it signaled a favorite climate for investors.

This week, the Fed released the minutes from that meeting, and it underscored the Fed’s change of heart. I had been critical of the Fed’s previous outlook of two or three rate increases this year. I don’t think that’s necessary, and the Fed seems to have taken my side. I think there’s a good chance that we won’t see any hikes this year.

Of all the factors that correlate with a strong stock market, low real short-term interest rates are one of the best. It looks like that’s what we’re going to get.

Last week, I mentioned that I was skeptical of the government’s recent report on retail sales. It was far more pessimistic than economists had been expecting. This week, Walmart reported very good results for the fourth quarter. On this matter, I’ll stand with Walmart over the government. On our Buy List, Ross Stores (ROST) is due to report on March 5. I think we’ll see very good results.

There are a few signs that have me concerned. The growth in risky loans to the corporate sector is alarming. There’s now an estimated $2 trillion in “leverage loans.” It’s as if the subprime debacle has been reborn, just in the corporate sector.

This has actually been a great year for banks. The two top performers on the Buy List so far are our two banks, Signature (SBNY) and Eagle (EGBN).

Fortunately, Moody’s said that banks are better able to handle the debt situation than during the financial crisis. However, if the economy deteriorates, things could get messy. Speaking of Moody’s, let’s look at their recent earnings report.

Moody’s Boosts Dividend by 14%

Last Friday, shortly after I sent you last week’s newsletter, Moody‘s (MCO) reported Q4 earnings of $1.63 per share. That was four cents below expectations. Revenue fell 9% to $1.1 billion. Despite the weak end to the year, Moody’s had a very good 2018. For all of 2018, Moody’s made $7.39 per share. That’s an increase of 22% over 2017.

For 2019, Moody’s sees earnings of $7.85 to $8.10 per share. Wall Street had been expecting $7.94 per share. The best news is that Moody’s raised its quarterly dividend by 14% to 50 cents per share.

Moody’s also announced that “a $500 million accelerated share-repurchase program is expected to be complete during the second quarter of 2019.” Traders responded by lifting the shares to a four-month high. We have a 21.8% YTD gain. This week, I’m raising my Buy Below price on Moody’s to $180 per share.

Earnings from Hormel Foods and Continental Building Products

On Thursday morning, Hormel Foods (HRL) reported fiscal-Q1 earnings of 44 cents per share. That matched Wall Street’s expectations. Sales rose 1% to $2.4 billion which was just below estimates. Overall, these numbers were basically what I was expecting. Operating margin came in at 13%.

“We had a solid quarter with sales growth from Refrigerated Foods, Grocery Products and International,” said Jim Snee, chairman of the board, president and chief executive officer. “Three of our four segments generated earnings growth which keeps us on track to deliver our full-year guidance.”

(…)

“Again this quarter, our well-developed strategy of shifting our mix toward branded, value-added products in our domestic and international businesses more than offset significant declines in the commodity businesses,” Snee said. “We continue to intentionally transition our portfolio away from commodity products and the associated earnings volatility.”

Hormel said it sold its Muscle Milk business to Pepsi for $465 million. Importantly, Hormel reaffirmed its full-year 2019 outlook of $1.77 to $1.91 per share and sales guidance of $9.7 billion to $10.2 billion. The company said the Muscle Milk deal will add a few pennies to this year’s EPS. The current outlook doesn’t reflect the deal, but later on, Hormel will adjust for it. The shares slid 2.6% on Thursday. I’m dropping my Buy Below on Hormel to $45 per share.

After the bell on Thursday, Continental Building Products (CBPX) reported Q2 earnings of 56 cents per share. That matched Wall Street’s estimate. For Q4, the wallboard company saw sales rise by 7.1%. That was almost all due to higher prices since volume was basically flat. For the year, Continental made $2.02 per share. The CEO said, “We finished the year on a strong note, generating strong earnings growth and achieving record-setting results in 2018 driven by higher sales and our highly efficient low-cost operations.”

The company gives guidance on several metrics except EPS. For 2019, Continental sees SG&A of $40 million to $42 million, and capital expenditures of $28 million to $32 million. Cost of goods sold inflation per unit compared with 2018 is expected to be 4.5% to 6.5%. This was a decent quarter for CBPX. The stock is a good value after a brutal second half of last year. From high to low, CBPX lost nearly 40%. Look for a rebound.

Earnings Preview for JM Smucker

JM Smucker (SJM) will report its fiscal Q3 earnings on Tuesday, February 26 before the opening bell. The last report was a dud, and the jam maker took down its full-year guidance.

But we got a sneak preview of the earnings report this week when the company said that results in the second half of the fiscal year (November 1 to April 30) are in line with expectations. Wall Street expects earnings of $2.02 per share.

Here’s the good news. Smucker said that results for FY 2020, which begins on May 1, will be above Wall Street’s expectations. Wall Street currently sees earnings of $8.22 per share. Smucker forecasts long-term profit growth of 8%.

Buy List Updates

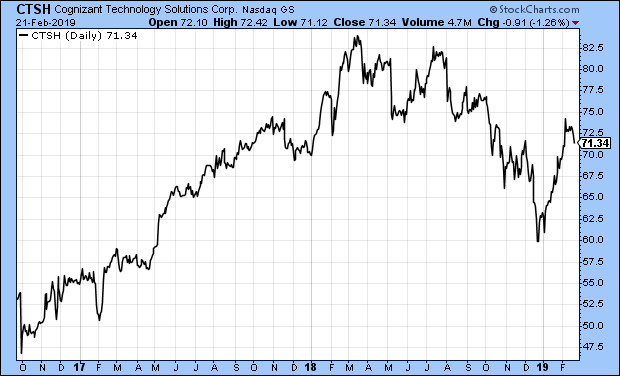

On September 30, 2016, shares of Cognizant Technology Solutions (CTSH) dropped more than 17% after the company said that an internal investigation revealed that the company may have violated the U.S. Foreign Corrupt Practices Act.

Reading between the lines, I assumed that meant bribes to facilities in India. Importantly, Cognizant notified the SEC and DOJ. The same day, the company’s president resigned. At the time, I told investors to hang on, and the stock is up 57% from that day’s low.

This week, we learned the details. The government charged two former Cognizant executives for offering a $2 million bribe to officials in India. (Cognizant has more than 250,000 employees and about half of them work in India.) The company will pay $25 million to the government to settle the charges.

This is obviously very troubling, but I have to commend Cognizant for the way it handled this mess. The company notified the authorities and cooperated fully. The government will not be prosecuting the company. Think how often cover-ups have turned out to be worse than the original crimes. This is another reason why we prefer to invest in high-quality stocks; they tend to be much more responsible corporate citizens. This was an ugly episode, but Cognizant handled it well.

Ross Stores (ROST) said it will report its fiscal Q4 earnings on March 5. This is for the all-important holiday-shopping season (November, December and January). Ross said it expects Q4 numbers between $1.09 and $1.14 per share.

The recent earnings report from Hershey (HSY) wasn’t that great, but this week, the company reaffirmed its full-year forecast. The chocolatier sees full-year 2019 earnings ranging between $5.63 and $5.74 per share. The plan is to raise prices in North America this year. On Thursday, the stock hit a new 52-week high. Buy up to $114 per share.

That’s all for now. Next week, we’ll get the latest housing starts report on Tuesday. Factory orders are on Wednesday. We’ll finally get the long-delayed Q4 GDP report on Thursday. Wall Street expects something close to 2% growth. The jobless-claims report is also due out on Thursday. Friday is ISM and personal income. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

P.S. I’ll be on Bloomberg TV’s market-wrap segment this Wednesday, February 27 at 3:50 pm ET.

Posted by Eddy Elfenbein on February 22nd, 2019 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His