Archive for March, 2019

-

The US Economy Added 20K Jobs Last Month

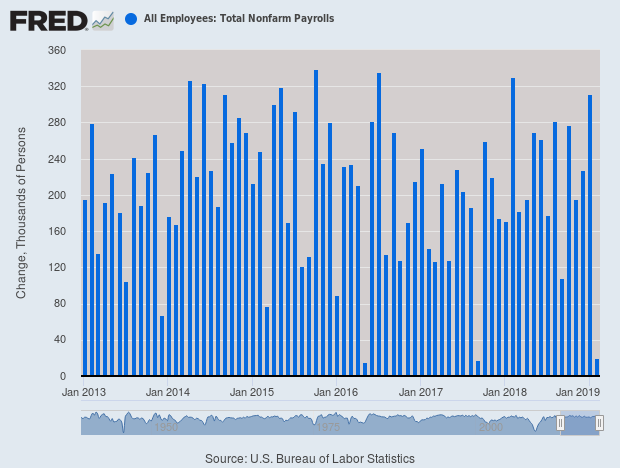

Eddy Elfenbein, March 8th, 2019 at 8:52 amThe February jobs report is out, and it’s a shocker. The US economy added just 20,000 jobs last month. Wall Street had been expecting an increase of 180,000. February was one of the slowest months for jobs in years.

The previous months were revised higher. The unemployment rate fell to 3.8%.

Economists did not immediately panic as hiring has been strong in recent months and they do not see one weak number as a signal of an imminent recession. But the disappointing February figure comes as growth is slowing. The tax cuts and stimulus of additional government spending seem to be wearing off, economic growth abroad has weakened, and the partial government shutdown and ongoing trade tensions appear to be weighing on consumer and business spending.

Hiring was slow in every industry except health care and white-collar businesses. Construction lost 31,000 jobs and leisure and hospitality, which is normally a driver of growth, was unchanged.

Economists have been predicting hiring would slow down for awhile now. Job openings exceed the number of unemployed, meaning there aren’t many Americans left to hire and many companies complain they can’t find the talent they want.

Wages grew 3.4 percent in the past year, the best annual gain since April 2009, when the United States was in the Great Recession. Wages are now growing well above the cost of living. Inflation has been just 1.6 percent in the past year, according to the Commerce Department.

The current labor market is widely viewed as the best since the start of the 2000s, most economists and business leaders say. There is so much demand for highly-skilled workers with specialized data and computer skills that employers are sometimes hiring and poaching workers when they don’t have an actually job opening for them.

-

CWS Market Review – March 8, 2019

Eddy Elfenbein, March 8th, 2019 at 7:08 am“If you don’t have a competitive advantage, don’t compete.” – Jack Welch

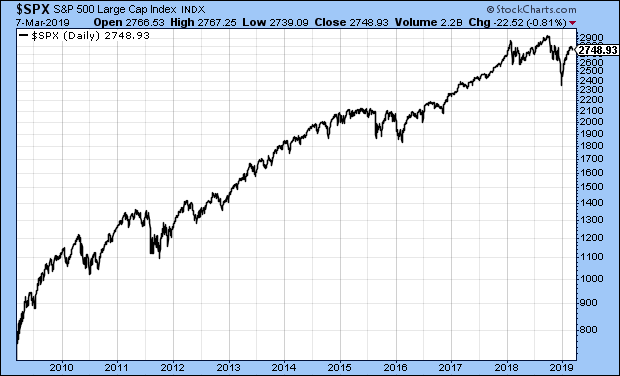

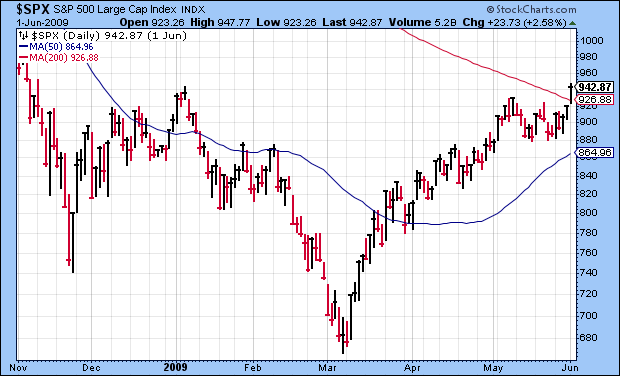

Tomorrow is the Bull Market’s 10th birthday. On March 9, 2009, the S&P 500 closed at 676.53. Since then, the market has more than quadrupled. Once we include dividends, it’s up fivefold. (Yep, those reinvested divies sure do add up!)

This has been one of the longest and strongest bull markets in history. Yet what I find interesting is how hated it’s been. Some folks just can’t stand this rally. All along the way, I’ve heard countless voices telling me that the upsurge was all phony and that we’re about to plunge into the abyss. Just you wait!

Some folks said it was a house of cards built by the Fed. Others said it was all a mirage because of share buybacks. In this week’s issue, I want to look back on the amazing bull run and see what important lessons are there. Later on, we’ll look at the growing gap between the stock and bond markets. On our Buy List, we had a nice earnings beat from Ross Stores. The deep-discounter gave us a 13% dividend boost as well. But first, let’s wish the mighty bull a happy 10th birthday.

Happy 10th Birthday to the Bull!

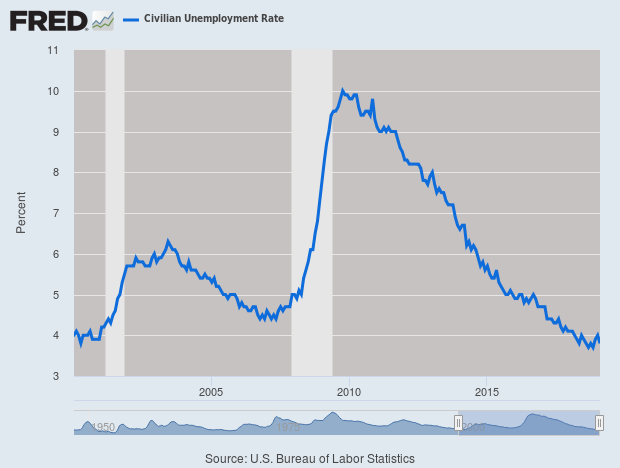

Let’s turn back the clock to March 6, 2009. That was a Friday, and like today, it was the day of the February jobs report. The report was a disaster. The U.S. economy lost a staggering 651,000 jobs in February 2009. The details were even worse. The number for January was revised to a loss of 655,000 jobs, and the loss for December was revised to 681,000. That was the single-worst month for jobs in 60 years.

There was bad news everywhere. The unemployment rate came in at 8.1%, which was a 25-year high. (Note that some of these numbers have since been revised over the last ten years, but these are the numbers that came out ten years ago.)

During the day on March 6, the S&P 500 fell to a devilish low of 666.79. The Dow got down to 6,469.95. Adjusted for inflation, that’s unchanged from the Dow’s peak 43 years before. Think about that. Forty-three years of no change.

I bring up these stats to point out a crucial lesson: this was the best time to invest in a generation. The news was terrible, and stocks were a great buy. Investors had to tune out the fear and focus on the long-term. But make no mistake – that’s not what the experts were saying.

I’ll give you an example. On March 6, the Wall Street Journal ran an editorial titled “Obama’s Radicalism is Killing the Dow.” Talk about lousy timing. The article wasn’t written by some nobody; it was by a former chairman of the President’s Council of Economic Advisors, Nouriel Roubini, who had earned the nickname “Dr. Doom.” Roubini said the market had even further to fall.

Let’s look at some indicators. The Volatility Index was at 50. Yikes! The TED Spread (remember that one) was at 1%. On Friday, the S&P 500 actually closed a tiny bit higher. The market sunk again on Monday, but crucially, it didn’t break below Friday’s low. On Monday, the S&P 500 closed at 676.53. That was a 12-year low. As of now, that stands as the lowest close this century.

Beneath the noise, there was a small news item that didn’t get too much attention at that time. Congress was considering backing off on the mark-to-market rules. I can’t say for certain, but that’s my strongest contender for what led the market to turn around. The lesson here is that many experts were flat wrong. For disciplined investors with a long-term focus, this was a great time.

Within a month, the S&P 500 soared 25%. The index gained 70% in less than a year. By the bull’s first birthday, Nobel Prize-winning economist Dr. Robert Shiller said the market was due for a pullback. Long-time readers will remember that 2009 was one of the best years for our Buy List. We beat the market by nearly 20%.

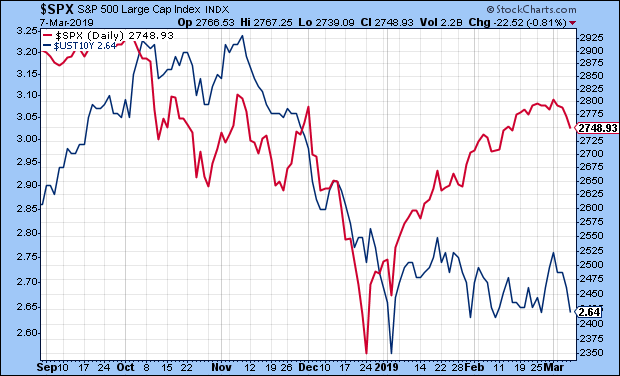

The Divergence Between Stocks and Bonds

There’s been an interesting divergence lately between the stock and bond markets. Let me explain what I think is driving it. Late last year, the stock market tanked. The S&P 500 lost about 20% in three months.

While stock prices plunged, bond prices soared and bond yields fell. That’s perfectly natural as investors seek out safety. The yield on the 10-year bond fell from 3.24% on November 8 to a low of 2.56% on January 3. That’s a huge drop for less than two months.

Since then, the stock market has recovered a lot of lost ground (the red line below), but bond yields haven’t moved much at all (the blue line). On Thursday, the 10-year yield stood at 2.69%. That’s just five basis points higher than where it was at the end of 2018, yet the stock market is up more than 9.6% on the year.

So stocks go down, and bonds go up. Then stocks go up and bonds stay the same. What’s going on?

I think this phenomenon threads together a few important trends. One is obvious. The bond market is reflecting the Federal Reserve’s newly-found “patience.” If the Fed is going to chill out on interest rates, then it makes sense for long-term yields to be stable. The yield on the two-year Treasury, which can serve as a quick proxy for Fed policy, hasn’t moved much in several weeks.

The low long-term yields also suggest that the market is rallying on higher valuations. That’s always a fragile enterprise. I’ll take any rally we can get, but we’re getting one where the P/E Ratio is getting bigger. The “P” is rising while the “E” is pretty flat. There’s nothing wrong with a higher earnings multiple, but we should bear in mind that it can be fleeting.

This year may be a tough one for earnings growth. In fact, there’s a chance that earnings may contract a bit this year. We’ve already seen earnings estimates get slashed for Q1. Earnings valuations are decently (though not perfectly) correlated with long-term interest rates.

This also suggests that the market is more cautious about the economy. I would say that it’s unlikely that a recession will start this year, but it could be a year of more subdued growth. For example, the yield on the 10-year TIPs, the inflation-protected bond, recently got down to 0.72%. That’s an eight-month low.

Within the stock market, growth stocks have been outpacing value stocks. That may not last much longer. As a whole, our Buy List is holding up well this year. We’re ahead of the market, and we have 11 stocks that are more than double-digits. That includes our favorite retailer, which just reported earnings.

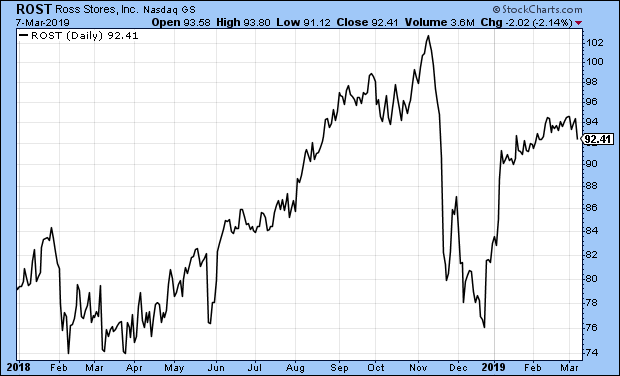

Ross Stores Earned $1.20 per Share

On Tuesday, Ross Stores (ROST) reported its fiscal Q4 earnings. The deep-discounter earned $1.20 per share. That’s for the big holiday shopping season. Previously, the company had given guidance of $1.09 to $1.14 per share. Sales for Q4 were $4.11 billion, which topped estimates of $4.05 billion. Comparable-stores sales were 4% whereas the Street was expecting 2.3%.

As usual, the company gave weak guidance. Ross sees Q1 earnings of $1.05 to $1.11 per share. The Street was expecting $1.18.

Looking ahead, Ms. Rentler said, “While we hope to do better, we continue to take a prudent approach to forecasting our business for 2019. Although we remain favorably positioned as an off-price retailer, we face our own difficult sales and earnings comparisons, a very competitive retail landscape, and an uncertain macro-economic and political environment.”

Well, they always say that. Ross sees full-years of $4.30 to $4.50 per share. Wall Street had been expecting $4.51 per share.

Ross is authorizing a $2.55 billion share buyback. If that’s not enough, Ross is raising its dividend. The quarterly payout will rise 13.3% from 22.5 cents to 25.5 cents per share. The new dividend is payable on March 29 to stockholders of record as of March 18.

The stock reacted in a few different ways following the earnings report. In the after-hours market, the shares were down, but the stock opened higher in the morning. It’s in times like that that I’m glad we’re not traders. In any event, Ross is doing very well. This week, I’m raising our Buy Below on Ross Stores to $95 per share.

Buy List Updates

With the earnings report from Ross Stores behind us, we’re now entering the lull period for Buy List earnings reports. FactSet (FDS) is due to report on March 26. RPM International (RPM) will probably report in early April. Outside those two, we don’t have anything until Q1 earnings season starts in mid-April.

One stock that made the news this week was Cognizant Technology Solutions (CTSH). On Thursday, the IT outsourcer announced a $600 million accelerated buyback. This is part of the already-announced plan to use 50% of their free cash flow to reward investors either by buybacks or dividends. Cognizant remains a good buy up to $74 per share.

That’s all for now. The big jobs report is later today. On Monday, we’ll get another retail-sales report. I expect a revision to the terrible numbers for December. On Tuesday, we’ll get the latest CPI report. I expect more subdued inflation. On Wednesday, we get durable goods and construction spending. New-home sales are on Thursday, and industrial production is on Friday. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Morning News: March 8, 2019

Eddy Elfenbein, March 8th, 2019 at 7:06 amGlobal Economy Slows, Pushing Europe’s Central Bank to Make a Surprise Move

China’s $345 Billion Stock Rout Shows Beijing’s Fear of Bubbles

Beijing Is Getting Trade Jitters

Norway Gives $1 Trillion Wealth Fund Approval to Dump Some Oil Stocks

U.S. Job Growth Seen Slowing in February After Outsized Gains

As Trade Wars Rage, Emerson Plots New U.S. Expansion

Mark Zuckerberg Wants Facebook to Emulate WeChat. Can It?

When Mark Zuckerberg Said Privacy, He Didn’t Mean Privacy From Facebook

The Gazillion-Dollar Standoff Over Two High-Frequency Trading Towers

Airbnb Gobbles Up Last-Minute Booking Service HotelTonight

Endeavor Returns Money to Saudi Arabia, Protesting Khashoggi Murder

A College Chain Crumbles, and Millions in Student Loan Cash Disappears

Cullen Roche: The Monetary Duration Dilemma

Ben Carlson: From Chaos to Concept

Be sure to follow me on Twitter.

-

“Who Is Cognizant?”

Eddy Elfenbein, March 7th, 2019 at 12:07 pmAs an outsourcer of technology services for a range of big American companies, Cognizant has largely remained below the radar since launching more than two decades ago. But it is suddenly being thrust into the spotlight for its work for moderating some of Facebook’s most graphic and controversial content.

Cognizant and Accenture are two of the many tech services providers Facebook employs to do routine work. Three years ago, that included curating the social media giant’s “trending topics” feed, which has since been scrapped. Today, it involves policing Facebook content to ensure it doesn’t violate the company’s terms service. Cognizant staffers are paid $15 per hour, according to The Verge — or what some fast-food restaurants around the U.S. are offering.

Though it’s not well-known among consumers, Cognizant has been a player in the tech outsourcing and consulting space for 25 years. Their clients are everywhere, using Cognizant for everything from call centers to IT strategy.

“They’re a one-stop shop of IT consulting,” said David Holt, an analyst with CFRA.

New Jersey HQ, but most workers in India

Cognizant is big — it has a market value of $41 billion, and as of last year had roughly 280,000 employees. Most of those are in India, where it has about 195,000 workers. The company’s headquarters are in Teaneck, New Jersey, a few minutes’ drive from New York. It has 32 other locations across the country, where it employs about 50,000 people, along with offices in Europe.

Although it’s global, Cognizant makes most of its money in the U.S. It generated $16 billion in revenue last year, three-quarters of which was in the U.S.

The company started in 1994 as the tech department of Dun & Bradstreet, and went public four years later.

Moderating content is a small part of its business

Facebook has gotten heat for subcontracting out the emotionally challenging work of moderating the content that runs on its site, but others have hired Cognizant for similar things. Cognizant workers in Ireland have done work for Google, according to the Sunday Times, performing tasks like verifying Google Maps listings for the equivalent of $13.50 per hour.

The company declined to break out the number of employees it has in content moderation, but that line of work is a small part of its business overall. Most of its work is providing IT services to large companies, including developing software, maintaining and testing applications, and creating digital infrastructure. Its clients range from 3M and Prudential Insurance to the state of Ohio.

In its earlier days, the company specialized in helping large companies outsource their data operations, but it has recently shifted more of its work to consulting as clients’ tech budgets have flattened.

Cognizant’s top revenue line is financial services, which accounts for just over a third of its business. (The company works with 16 out of the top 20 North American financial institutions, according to a client presentation.) It also develops and supports software for the health care industry, which makes up 28 percent of its revenue, according to securities filings.

Moderation risks

Cognizant recognized the challenges of moderating online content as far back as 2012, publishing a white paper called “How to De-Risk the Creation and Moderation of User-Generated Content.”

“The huge growth and pervasiveness of [user-generated content] within companies’ core online user experience poses potentially complex challenges and heightens unnecessary exposure to risk,” the paper said. It also proposed several methods of moderating content, including automated screening and human moderation, which, although effective, “can be highly inefficient,” it wrote.

Using people to moderate a thousand six-minute videos would cost $277, the paper estimated.

In response to the Verge’s story, Cognizant sent CBS News a statement that said, in part: “Our goal is to ensure that we provide a variety of support options including on-site counselors, a robust wellness program and resources and wellness classes covering a range of disciplines to support the needs of every employee involved in content moderation.”

“We have investigated the specific workplace issues raised in a recent report, previously taken action where necessary and have steps in place to continue to address these concerns and any others raised by our employees,” the statement said.

Top visa sponsor

Cognizant is one of the largest employers of skilled foreign workers in the U.S, according to Citizenship and Immigration Services. In 2016, it received approval for 21,000 H1-B visas—nearly double the number given to the next-highest petitioner, Infosys. The average salary for those jobs was $84,300.

The U.S. government’s recent crackdown on visa applications has hurt Cognizant’s business, it said in its latest annual report.

Three white workers sued Cognizant last year, accusing the company of discriminating in favor of South Asian workers. That lawsuit it pending.

It recently settled bribery charges

In mid-February, the Securities and Exchange Commission charged two Cognizant executives with bribing officials in India. Without admitting wrongdoing, Cognizant paid $25 million to settle those charges. The company itself was not charged.

Cognizant’s then-president, Gordon Cobur, and its chief legal officer, Steven Schwartz, were accused of paying and concealing nearly $4 million in bribes in connection with building the company campus in Chennai, India.

The nearly three-year-long investigation hurt Cognizant’s stock, but analysts say it’s unlikely to affect business going forward.

“Morally or ethically, it’s not really a good look, but for the financial impact–they have around $4 billion in cash, so $25 million is more or less a drop in the pond,” said CFRA’s Holt. He added, “It’s pretty common across a multitude of companies to have those kinds of fines.”

The company also announced a $600 million accelerated share repurchase.

-

Morning News: March 7, 2019

Eddy Elfenbein, March 7th, 2019 at 7:07 amGlobal Stocks Stuck in Worst Run of the Year Ahead of ECB

Trump Wants a China Deal and a Stocks Rally. He May Not Get Both

In Blow to Trump, America’s Trade Deficit in Goods Hits Record $891 Billion

Powell’s Pause Won’t Last If Services Gauge Is Any Guide

Facebook’s Mark Zuckerberg Says He’ll Shift Focus to Users’ Privacy

Apollo Thinks It’s Big Enough, Tough Enough to Be GE Capital

Tesla Swerves on Strategy, Trailed by Growing Doubts

Regulators Move to Ease Post-Crisis Oversight of Wall Street

Huawei Fights Back Against U.S. Blackout with Texas Lawsuit

Amazon Closing All U.S. Pop-Ups

Ghost Workers Sap Tunisia’s Phosphate Wealth

Michael Batnick: I Will Say This

Roger Nusbaum: Attitude Is Everything

Jeff Miller: Who Moved My Cheese?

Joshua Brown: Four Things You Need Before Starting A Company

Be sure to follow me on Twitter.

-

Econ Updates

Eddy Elfenbein, March 6th, 2019 at 12:53 pmThere are a few econ stats I wanted to pass along. The ADP payroll report showed an increase of 183,000 net new jobs last month. The government report is due out on Friday.

The United States imported more goods than ever last year, including a record amount from China, ballooning America’s trade deficit with the rest of the world to $891.3 billion and delivering a setback to President Trump’s goal of narrowing that gap.

The increase was driven by some factors outside Mr. Trump’s control, like a global economic slowdown and the relative strength of the United States dollar, both of which weakened overseas demand for American goods. But the widening gap was also exacerbated by Mr. Trump’s $1.5 trillion tax cut, which has been largely financed by government borrowing, and the trade war he escalated last year.

The trade deficit is the difference between how much a country sells to its trading partners and how much it buys. Mr. Trump has long boasted that his trade policies would reduce that gap, which he views as a measure of whether partners like China and the European Union are taking advantage of the United States, a diagnosis that few economists share.

Instead, in a year when Mr. Trump imposed tariffs on steel, aluminum, washing machines, solar panels and a variety of Chinese goods, the trade deficit grew by 12.5 percent from 2017, or nearly $70 billion dollars, the Commerce Department said Wednesday. The deficit in goods, which Mr. Trump particularly targets, grew to $891.2 billion for the year, its highest level in history.

The February ISM Non-manufacturing index rose to 59.7 from 56.7 in January.

-

The Market Made Its Low 10 Years Ago Today

Eddy Elfenbein, March 6th, 2019 at 11:24 amTen years ago today, on March 6, 2009, the S&P 500 finally bottomed out at its lowest point of this century. During the day, the S&P 500 got to 666. It’s more than quadrupled since then.

It was a Friday and that morning, the jobs report for February came out. The U.S. economy had shed 651,000 net jobs. The VIX was near 50 and the TED Spread was still about 1%. Adjusted for inflation, the Dow was basically where it was 43 years before.

The news was terrible, yet it was a great time to buy. In fact, it was one of the best times to buy in a generation.

-

Morning News: March 6, 2019

Eddy Elfenbein, March 6th, 2019 at 7:06 amOECD Cuts Global Outlook Again and Warns Worse May Be Ahead

As Trump Moves to End Trade War With China, Business Asks: Was It Worth It?

JPMorgan Leads Banks’ Flight from Poor Neighborhoods

Wall Street Regulators Could Take a Fresh Look at Bonuses

Companies Falsely Labeled Products ‘Made in U.S.A.’ Their Financial Penalty? $0.

Low-Income Tax Filers Targeted With False Promise of Big Refunds

Why Napalm Is a Cautionary Tale for Tech Giants Pursuing Military Contracts

Philip Morris Paid for India Manufacturing Despite Ban on Foreign Investment

Ousted Nissan Boss Ghosn Leaves Japan Jail After $9 Million Bail

Czech Cyber Watchdog Says Its Huawei Warning Took U.S. by Surprise

GE’s Lowered Expectations for Quick Turnaround Should Be ‘Wake-Up Call’

Someone Just Paid the Equivalent of 250 Teslas to Buy This One Car

Nick Maggiulli: No Laws, Only Tendencies

Ben Carlson: Averages Are Clean But Actual Results Are Messy

Howard Lindzon: Where Were You On March 9, 2009

Be sure to follow me on Twitter.

-

Ross Stores Earned $1.20 per Share

Eddy Elfenbein, March 5th, 2019 at 4:12 pmRoss Stores‘s (ROST) fiscal Q4 earnings are out. The deep discounter earned $1.20 per share for its fiscal Q4. That’s the big holiday shopping season. The company had given guidance of $1.09 to $1.14 per share. Sales for Q4 were $4.11 billion which topped estimates of $4.05 billion. Comp stores sales were 4% whereas the Street was expecting 2.3%.

As usual, the company gave weak guidance. Ross sees Q1 earnings of $1.05 to $1.11 per share. The Street was at $1.18.

Looking ahead, Ms. Rentler said, “While we hope to do better, we continue to take a prudent approach to forecasting our business for 2019. Although we remain favorably positioned as an off-price retailer, we face our own difficult sales and earnings comparisons, a very competitive retail landscape, and an uncertain macro-economic and political environment.”

They always say that. Ross sees full-years of $4.30 to $4.50 per share. Wall Street had been expecting $4.51 per share.

Ross is authorizing a $2.55 billion share buyback. If that’s not enough, Ross is raising its dividend. The quarterly payout will rise 13.3% from 22.5 cents to 25.5 cents per share. The new dividend is payable on March 29 to stockholders of record as of March 18.

-

Morning News: March 5, 2019

Eddy Elfenbein, March 5th, 2019 at 7:09 amChina Needs to Brace for a ‘Tough Economic Battle Ahead,’ Says Li

Widening Russia Money Laundering Scandal Hits Europe Bank Shares

Has Amazon Given Up on Changing Whole Foods’ Pricey Image?

GE: Notably Undervalued After Blockbuster Biopharma Deal

Google Finds It’s Underpaying Many Men as It Addresses Wage Equity

AT&T Assembles a Media Team, Joining a Battle With Giants

Airfares To Hawaii Plummet As Southwest Launches New Service Starting At $49

F.D.A. Criticizes Walgreens and Other Retailers for Selling Tobacco Products to Minors

Nightstar Stock Is Latest Winner From Gene-Therapy Gold Rush

Nevada’s Gold Is at Center of Barrick vs. Newmont Fight

Lilly’s 50% Price Cut to Insulin Humalog Is Still Unaffordable

Joshua Brown: This Incredible Stat Will Make You Zero Dollars!

Ben Carlson: The Alternative Was Worse

Roger Nusbaum: The Joy of Stoicism & Not Caring

Michael Batnick: Just A Little Bit More

Be sure to follow me on Twitter.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His