Archive for April, 2019

-

Morning News: April 24, 2019

Eddy Elfenbein, April 24th, 2019 at 7:02 amEurope Not Feeling Much Pain From Trump Tariffs, Central Bank Says

SoftBank Bets $1 Billion on Battered Payments Firm Wirecard

Blockbuster Battle Between Steven Spielberg and Netflix Fizzles

Behind Airbnb’s Bet on Show Business to Hook Travelers

Adding to Ghosn Woes, Nissan Slashes Profit Outlook to Near-Decade Low

Samsung Plans $116 Billion Investment in Non-Memory Chips to Challenge TSMC, Qualcomm

Want to Make Millions and Pay No Taxes? Try Real Estate

John McAfee Vows to Unmask Bitcoin’s Satoshi Nakamoto

Made in China, Exported to the World: The Surveillance State

Verizon Beats on Earnings as Wireless Sales Hit $22.7 Billion

Mario Batali’s Former Empire Is Thriving—as Long as He Stays Away

Walgreens Raises Tobacco-Buying Age to 21, Strengthening a Consensus

Nick Maggiulli: The Problem With Most Financial Advice

Lawrence Hamtil: The Low Volatility – Momentum Barbell: S&P vs MSCI Indices

Cullen Roche: Was the GFC a Once-in-a-Lifetime Event?

Be sure to follow me on Twitter.

-

Earnings from Sherwin-Williams and Stryker

Eddy Elfenbein, April 23rd, 2019 at 6:13 pmWe had two earnings reports today. Before the opening bell, Sherwin-Williams (SHW) reported Q1 earnings of $3.60 per share. That was below estimates of $3.69 per share. Sales rose 1.9% to $4.04 billion. Importantly, the company didn’t alter its full-year outlook of $20.40 to $21.40, which excludes acquisition costs. That compares with $18.53 per share a year ago. For Q2, Sherwin expects sales to rise by 2% to 5%. For the full year, they expect sales to rise by 4% to 7%.

Commenting on the first quarter, John G. Morikis, Chairman and Chief Executive Officer, said, “We made good progress on our pricing initiatives across all segments during the quarter and effectively managed SG&A spending, but volumes fell short of expectations due to a slower start to the architectural painting season in North America and continued challenging conditions in many end markets outside North America. Despite the volume shortfall and higher year-over-year raw material costs, consolidated Company adjusted gross margin, which excludes acquisition-related costs, improved sequentially and was flat year-over-year. We expect the positive trend in gross margin and operating expense control to continue as the year progresses, and volume growth should also improve over the balance of the year, particularly in the back half.

“Looking at our performance by segment, in The Americas Group, despite a strong backlog and project pipeline reported by many of our professional customers, volume growth in the quarter was slower than expected. We continued to invest by opening 15 net new store locations in The Americas Group during the quarter. In our Consumer Brands Group, most of the softness in demand in the quarter was in markets outside North America. Consumer Brands Group adjusted segment operating margin in the first quarter expanded sequentially and year-over-year, and we are very well positioned across all North American retail channels heading into the important spring selling season. Performance Coatings Group achieved modest sales growth and increased adjusted segment operating margin in the quarter against year-over-year raw material pressure.

Shares of SHW looked like they were going to drop on Tuesday, but the shares closed higher by 1.9% on the day.

Stryker (SYK) reported Q1 earnings of $1.88 per share, which beat the Street by four cents per share. That’s an increase of 11.9% over last year. Net sales rose 8.5% to $3.5 billion, and organic net sales increased by 7.3%. For the quarter, Stryker’s adjusted operating margin was 25.1%.

Based on our first quarter performance we now expect 2019 organic net sales growth to be in the range of 6.8% to 7.5% and expect adjusted net earnings per diluted share to be in the range of $8.05 to $8.20.

For the second quarter we expect adjusted net earnings per diluted share to be in the range of $1.90 to $1.95.

If foreign currency exchange rates hold near current levels, we expect net sales in the second quarter will be negatively impacted by approximately 1.5% and full year will be negatively impacted by approximately 1.0%, and net earnings per diluted share will be negatively impacted by $0.01 to $0.03 in the second quarter and negatively impacted by $0.05 to $0.10 in the full year.

Stryker raised the low end of 2019 guidance by five cents per share. Wall Street had been expecting $1.96 per share for Q2, and $8.13 per share for the entire year.

-

Morning News: April 23, 2019

Eddy Elfenbein, April 23rd, 2019 at 7:05 amA Vicious, Untreatable Killer Leaves China Guessing

Oil Climbs Toward $75 in London After Trump Tightens Screws on Iran

Fed Seems Resigned to Bubble Risk in Effort to Extend Expansion

After the Bust, Are Bitcoins More Like Tulip Mania or the Internet?

China’s Starbucks Challenger Files for U.S. IPO

Elon Musk Predicts Tesla Driverless Taxi Fleet Next Year

Lyft Underwriters Hail Promising Future as Uber Looms

This Estonian Start-Up Has Become a Thorn in Uber’s Side

China’s Bytedance Says India TikTok Ban Causing $500,000 Daily Loss, Risks Jobs

Beyond Meat Details Plans for Initial Public Offering

Cell Tower REITs: 5G’s True Killer App

Samsung Retrieving All Galaxy Fold Samples After Defect Reports

Ben Carlson: A Bad Year in the Bond Market is a Bad Day in the Stock Market

Howard Lindzon: India and The Internet…

Be sure to follow me on Twitter.

-

Morning News: April 22, 2019

Eddy Elfenbein, April 22nd, 2019 at 7:04 amU.S. Ending Iran Waivers Could Affect Oil Markets and Beyond

Free Speech Puts U.S. on ‘a Collision Course’ With Global Limits on Big Tech

Financial Market ‘Pause Party’ Makes Fed Rate Cut Less Likely

Trump’s Washing Machine Tariffs Stung Consumers While Lifting Corporate Profits

The Fed Is in Worse Shape Than the Economy as Post-Crisis Expansion Reaches a Decade

Uber, Lyft IPOs May Lead to Higher Fares

Huawei First-Quarter Revenue Grows 39% to $27 Billion Amid Heightened U.S. Pressure

Qualcomm: Why The Success Story Just Begins

Clorox and Unilever Want the Booming Bacteria Business to Thrive

Tesla Investigates Video of Parked Model S Exploding in Shanghai

America’s Elderly Are Twice as Likely to Work Now Than in 1985

Japanese Prosecutors Bring New Charges Against Carlos Ghosn

Joshua Brown: Investing in the Real World – Not a Backtest!

Roger Nusbaum: A New Tool For Considering Life Expectancy In Retirement Planning? & Healthspan & Financialspan

Michael Batnick: How to Stay Out of Debt & Why Didn’t You…

Be sure to follow me on Twitter.

-

CWS Market Review – April 19, 2019

Eddy Elfenbein, April 19th, 2019 at 7:08 am“Selling your winners and holding your losers is like cutting the flowers and watering the weeds.” – Peter Lynch

First-quarter earnings season is here, and we’re getting a good idea of what the first three months of the year were like. As with any earnings season, some stocks are soaring (like Qualcomm) and others falling on hard times (Bank of New York).

We’ve already had the first of our stock reports. Some companies have done well. Others, not so well. In this week’s issue of CWS Market Review, I’ll run down all of our Buy List earnings reports.

Next week will be even busier as seven of our Buy List stocks are due to report. On top of that, we’ll also get our first look at the Q1 GDP report. Before I get to this week’s earnings news, let’s look at the big jump we got from Disney.

Disney Soars to an All-Time High

I have to apologize for only briefly discussing Disney (DIS) last week. I don’t believe I gave their investor presentation the coverage it was due. Please forgive me. I hope the 11.5% price surge helped ease some of the pain.

Disney had a great rollout of its streaming service. I think the news on Disney has been so negative for so long that anything positive can help propel the shares. This week, the stock touched a new all-time high.

The company is serious about taking Netflix on, and they have an impressive service in Disney+. It’s also very competitive price-wise: $7 per month or $70 per year. Not only did Disney’s stock surge, but it held on to its gains and even pushed a little higher.

I supposed investor sentiment has been negative on Disney for years since it’s hard for some people to look positively on Disney. Even Disney critics have been impressed with Iger’s strategy. Content really is king, and it will be hard to compete against the Mouse House. This week, I’m raising my Buy Below on Disney to $135 per share. The next earnings report is due on May 8.

This Week’s Buy List Earnings Reports

Here’s a look at our Q1 Earnings Calendar so far.

Company Ticker Date Estimate Result Eagle Bancorp EGBN 17-Apr $1.12 $1.11 Signature Bank SBNY 17-Apr $2.77 $2.65 Torchmark TMK 17-Apr $1.59 $1.64 Check Point Software CHKP 18-Apr $1.31 $1.32 Danaher DHR 18-Apr $1.01 $1.07 Sherwin-Williams SHW 23-Apr $3.69 Stryker SYK 23-Apr $1.84 Moody’s MCO 24-Apr $1.93 AFLAC AFL 25-Apr $1.06 Cerner CERN 25-Apr $0.61 Hershey HSY 25-Apr $1.46 Raytheon RTN 25-Apr $2.47 Fiserv FISV 30-Apr $0.82 Church & Dwight CHD 2-May $0.66 Cognizant Technology Solutions CTSH 2-May $1.04 Continental Building Products CBPX 2-May $0.35 Intercontinental Exchange ICE 2-May $0.90 Disney DIS 8-May $1.55 Becton, Dickinson BDX 9-May $2.58 Broadridge Financial BR TBA $1.50 Now let’s dive in. Signature Bank (SBNY) kicked off earnings season for us on Wednesday morning when the New York-based bank reported Q1 earnings of $2.65 per share. That was 12 cents below Wall Street’s consensus. Traders were not pleased. The shares fell 5.9% during Wednesday’s trading.

For the quarter, net interest margin was 2.75%. That’s down 11 basis points from a year ago. Total assets now stand at $48.55 billion. That’s an increase of 9.3% over last year’s Q1. Last quarter, the bank was hurt by a $9.4 million decline in pre-payment penalty income. Overall, this was a weak quarter for SBNY.

During the quarter, Signature bought back 173,193 shares for $22.9 million. While I’m not happy with Signature’s results last quarter, I’m still willing to stick by them. The stock slid about 5% on Wednesday, but we’re still doing well with SBNY this year (+22.9%). Signature Bank remains a buy up to $140 per share.

After the close on Wednesday, Eagle Bancorp (EGBN) reported adjusted earnings of $1.11 per share. That was one penny below estimates. That’s up from $1.04 per share one year ago.

Eagle is currently going through a transition after the former CEO, Ron Paul, announced his retirement. Susan G. Riel is the interim President and CEO. About the Q1 results, she noted, “The Company’s assets ended the quarter at $8.39 billion, representing 9% growth over the first quarter of 2018. First-quarter 2019 earnings resulted in a return on average assets of 1.62% (1.85% excluding nonrecurring costs as defined above) and a return-on-average tangible common equity of 13.38% (15.26% excluding nonrecurring costs as defined above).”

The shares pulled back some in Thursday’s trading, but nothing too severe. Eagle is a buy up to $55 per share.

I never would have guessed that Torchmark (TMK) would be an earnings standout, but here we are. Also after the bell on Wednesday, the life-insurance company reported Q1 earnings of $1.65 per share.

The key figure is net operating income which came in at $1.64 per diluted common share. That beat estimates by five cents per share compared with $1.47 per diluted common share from a year ago. The details look pretty good. Net income as an ROE was 12.9%. Net operating income as an ROE, excluding net unrealized gains on fixed maturities, was 14.7%.

Last quarter, Torchmark bought back 1.1 million shares. This quiet stock is now a 19% winner for us this year. Buy up to $91 per share.

Check Point Software (CHKP) had a decent earnings report, but poor guidance caused traders to knock 7.4% off the share price on Thursday. For Q1, the cyber-security firm earned $1.32 per share. That beat estimates by one penny per share. CEO Gil Shwed said, “We had good results in the first quarter with 13 percent growth in our security subscriptions including advanced solutions for Cloud and Mobile as well as SandBlast Zero day threat prevention.”

For the current quarter, Check Point said it sees revenues coming in between $474 million and $500 million. The consensus on the Street was for $486 million. But for earnings, CHKP sees EPS ranging between $1.32 and $1.40. Wall Street had been expecting $1.38 per share. I know the price drop is painful, but don’t be rattled. This is a good company. Buy up to $130 per share.

On Thursday, Danaher (DHR) reported Q1 earnings of $1.07 per share. That beat the street by six cents per share. Previously, the company had given us a range of $1 to $1.03 per share. This is an important time for Danaher. The company recently announced that it’s buying GE’s biopharma unit for $21.4 billion. The company also plans to spin off its dental business later this year.

For Q2, Danaher expects earnings to range between $1.13 and $1.16 per share. Danaher lowered its full-year guidance from $4.75 – $4.85 per share to $4.72 – $4.80 per share. There’s nothing wrong. This reflects the share dilution to buy GE Biopharma. The deal should close sometime in Q4.

Danaher’s CEO said, “During the first quarter, we achieved 5.5% core-revenue growth and believe we expanded our market-leading positions across a number of our businesses. Combined with high-single-digit adjusted-earnings-per -growth and good cash-flow generation, our performance is a testament to our team’s focused execution and the power of the Danaher Business System.”

The shares rallied 1.5% after the earnings report. Danaher is a buy up to $136 per share.

Next Week’s Earnings Reports

We have several earnings reports coming our way next week. On Tuesday, Sherwin-Williams and Stryker are due to report.

A few months ago, Sherwin-Williams (SHW) warned us that they weren’t going to have a good Q4, and they were right. The good news is that sales improved in December, but not by enough to make up the difference.

For 2019, Sherwin sees net sales rising 4% to 7% and earnings coming in between $20.40 and $21.40 per share. That’s a pretty good forecast, and it tells me the issues they had in Q4 may be over. Wall Street’s consensus for Q1 is for $3.69 per share.

For Q1, Stryker (SYK) sees earnings coming in between $1.80 and $1.85 per share. I think there’s a good chance for an earnings beat. Last earnings season, the orthopedics company beat earnings by three cents per share, and the stock jumped 11%. The company noted that they had the best organic growth in a decade. Stryker’s operating margins rose to 27.5%. That’s quite good. For the full year, they see earnings between $8 and $8.20 per share.

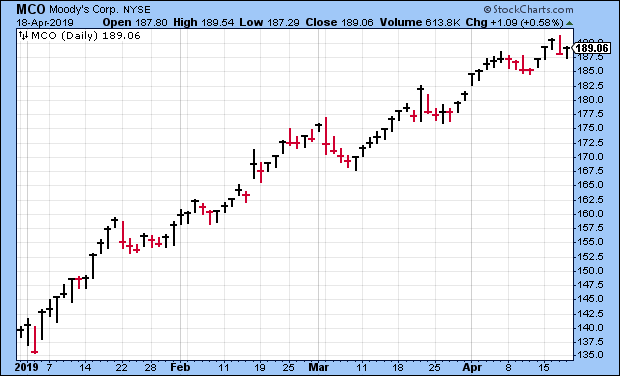

Moody’s (MCO) is our #1 performer this year, with a 35% gain. The credit-ratings agency reports earnings on Wednesday. The Q4 report wasn’t especially good, but it wrapped up a solid 2018 for Moody’s.

For 2019, Moody’s sees earnings of $7.85 to $8.10 per share. Wall Street had been expecting $7.94 per share. In February, the company bumped up its dividend by 14% to 50 cents per share. The company also announced that a $500 million accelerated share-repurchase program is expected to be completed during Q2. The consensus for Q1 is for $1.93 per share.

We have four Buy List stocks due to report next Thursday.

The last AFLAC (AFL) earnings report was quite good. The duck stock beat expectations and raised its dividend. That was its 36th consecutive annual dividend hike.

For 2019, AFLAC is looking for earnings of $4.10 to $4.30 per share. That assumes the yen trades at ¥110.39 to the dollar. AFLAC didn’t provide Q1 guidance, but Wall Street expects $1.06 per share.

I’m still enjoying the nice 10% pop we got from Cerner (CERN) last week. The company announced that it had reached an agreement with Starboard Value. As part of the agreement, Cerner will start paying a dividend. The company also increased its buyback authorization by $1.5 billion.

For Q1, Cerner expects earnings between 60 and 62 cents per share on revenue of $1.365 billion to $1.415 billion. For all of 2019, the company is looking for earnings between $2.57 and $2.67 per share on revenue of $5.65 billion to $5.85 billion.

Hershey’s (HSY) last earnings report wasn’t so sweet. Comparable-sales growth was flat. In North America, comparable sales fell 0.3%. Earnings came in at $1.26 per share, which was a penny below estimates. For the moment, the problem is pricing pressure. Quarterly sales rose 2.5% to $1.99 billion.

For 2019, Hershey sees earnings ranging between $5.63 and $5.74 per share. The consensus for Q1 is $1.46 per share.

Also on Thursday will be Raytheon (RTN). The CEO noted that Raytheon ended last year with record bookings and backlog which positions them “well for 2019 and beyond.”

For 2019, Raytheon expects EPS of $11.40 to $11.60 on sales of $28.6 to $29.1 billion. That’s a little light; I had been expecting $11.50 to $12 per share. Still, business is going well. For Q1, the consensus on Wall Street is for earnings of $2.47 per share.

That’s all for now. The news next week will again be dominated by earnings. Also, there will be some economic news. On Monday, the existing-home sales report comes out. That’s followed on Tuesday by the new-home sales report. Thursday is jobless claims and durable goods. Then on Friday, we get the first look at Q1 GDP. I’m expecting a number close to 2%. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Morning News: April 19, 2019

Eddy Elfenbein, April 19th, 2019 at 7:05 amSome Better-Than-Expected China Data Can’t Save the World Economy

Socialist! Capitalist! Economic Systems as Weapons in a War of Words

D.E. Shaw Is to Buck Industry Trend With 3-and-30 Fees

Amazon Gives Up on Chinese Domestic Shopping Business

Amazon Launches Free Music Streaming to Juice Alexa-Device Sales

Merger Talks of Deutsche Bank and Commerzbank Roil Emotions

I.P.O. Day for Pinterest and Zoom Ends With Shares Sharply Higher

National Enquirer to Be Sold to James Cohen, Heir to Hudson News Founder

U.S. Refiners Planning Major Plant Overhauls in Second Quarter

What This Week’s Apple-Qualcomm-Intel Dance Means for the Future of 5G

Nissan Slams Output Cut Report as ‘Completely Incorrect’

Ben Carlson: Recessions vs. Bear Markets & Money Made By Chance

Jeff Carter: Some Tips on Angel Investing

Jeff Miller: What Is Your Trading Timeframe Now?

Be sure to follow me on Twitter.

Morning News: April 18, 2019

Eddy Elfenbein, April 18th, 2019 at 6:27 amStocks Erase Week’s Gains After Weak Manufacturing Surveys

Business Quietly Returns to Saudi Arabia After Khashoggi’s Murder

Treasury Issues Rules on Tax Breaks for Opportunity Zones

U.S. Antitrust Scrutiny Tests T-Mobile’s $26 Billion Bet on Sprint

Pinterest Prices I.P.O. at $19 a Share, for a $12.7 Billion Valuation

Lyft Investors Sue Over Slump, Claiming IPO Was Overhyped

Amazon, Facing Entrenched Rivals, Says to Shut China Online Store

First Japan-Built Airliner in 50 Years Takes on Boeing and Airbus

The Cult Japanese Retailer Making Billions Breaking All the Rules

Powerful New iPhone Expected After Apple’s Embarrassing Surrender

JPMorgan Shuffles Roles at Top

The Last Place for Traders to Earn Real Money

Cullen Roche: Hard Truths for the Inflation Truthers

Jeff Miller: What Is Your Trading Timeframe Now?

Michael Batnick” Money Made By Chance

Be sure to follow me on Twitter.

Morning News: April 17, 2019

Eddy Elfenbein, April 17th, 2019 at 7:09 amGerman Economy Heads for Worst Growth in Six Years

China’s Economy Stabilizes After Beijing Opens the Bank Vaults

China’s First-Quarter Growth Unexpectedly Steadies, But Too Early to Call Clear Recovery

China Is Considering Stimulus Measures to Bolster Consumption

U.S. Restrictions on Qatar Airways Could Lead to Unraveling of Aviation Agreements

Powell Adopts an Inflation Stance Yellen Shunned

Truck Drivers See Orders, Miles Fall in Latest U.S. Slowdown Signal

With AT&T’s Exit, Disney Takes Firmer Control of Hulu

Apple and Qualcomm Settle All Disputes Worldwide

The Most Measured Person in Tech Is Running the Most Chaotic Place on the Internet

IBM’s Mixed Q1 on Slowing Cloud Growth

Martha Stewart Brand Finds A Buyer, But Even At Cheaper Price, There’s No Guarantee Deal Pays Off

Nick Maggiulli: The Will to Survive

Howard Lindzon: Momentum Monday – If The Fed….

Ben Carlson: The Stephen A. Smiths of Personal Finance

Be sure to follow me on Twitter.

Morning News: April 16, 2019

Eddy Elfenbein, April 16th, 2019 at 7:03 amStocks March on as European Volatility Vanishes

U.S. Risks Roiling Oil Markets in Trying to Tighten Sanctions

Chevron Says Dutch Supreme Court Rejects Ecuador’s $9.5 Billion Claim

France and Belgium Refuse Support for New Trade Talks With the U.S.

Hulu Spends $1.43 Billion to Buy Back AT&T Stake, Values Streaming Service at $15 Billion

Netflix Results Face New Pressures With Higher Costs, New Rivals

The World’s Biggest Electric Vehicle Company Looks Nothing Like Tesla

After 60,000% Rally, America’s Top Stock Has Suddenly Gone Cold

Champion Accidentally Hit the Fashion Jackpot

BlackRock’s Larry Fink Says Market Has Risk of ‘Melt Up’ Not Melt Down

Goldman Offers Fresh Details on Overhaul Progress as Revenue Slides

Deutsche Bank Is Subpoenaed for Trump Records by House Democrats

Lawrence Hamtil: Stocks Are Still The Better Long-Term Bet

Michael Batnick: The Acquirer’s Podcast

Be sure to follow me on Twitter.

Morning News: April 15, 2019

Eddy Elfenbein, April 15th, 2019 at 7:10 amU.S. Waters Down Demand China Ax Subsidies in Push for Trade Deal

In Search for Leverage, Trump May Be Undercutting His Own Trade Deals

Worried a Recession is Coming, U.S. Online Lenders Reduce Risk

Trump’s Fed Attacks Cast a Chill at Global Finance Gathering

As Fed Chief, Jerome Powell Navigates an Angry President and Turbulent Markets

Shocked by Your Tax Refund? Next Year Could Be Worse Unless You Act Now

In Quest for Electric Supercars, Engineers Head to Start-Ups

Toyota Sells Electric Vehicle Technology to Chinese Startup Singulato

‘Experiential’ Tesla and iPhone Stores Aren’t Really Helping Struggling Malls

Jack Ma Again Endorses Extreme Overtime as Furor Rages On

Mass Production of iPhones to Start in India

Publicis Surges as $4.4 Billion Epsilon Deal Deepens Data Push

The Smart Gun Doesn’t Exist for the Dumbest Reasons

Jeff Miller: Weighing the Week Ahead: What Will Q1 Earnings Reveal About Economic Strength?

Ben Carlson: Prudent Risk Management or Market Timing in Disguise? & Why We’ll Never All Be Happy Again

Be sure to follow me on Twitter.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His