Archive for June, 2019

-

Morning News: June 20, 2019

Eddy Elfenbein, June 20th, 2019 at 7:09 amChina, U.S. to Resume Trade Talks But China Says Demands Must Be Met

Powell Gave, But the Markets Want Much More

Banks to Fight Over $18 Trillion Held By the Poorest of the Rich

American Airlines Just Ordered 50 New Airbus Planes — A Huge Blow to Boeing

Launching a Global Currency is a Bold, Bad Move for Facebook

Google CEO’s Sunny New Message: We Want to Be Helpful

Oracle’s Revenue Beats Targets in Latest Quarter

T-Mobile Prepares for Boost Auction if Dish Network Talks Stall

Data ‘R’ Us: Alibaba, JD.com Seek to Lock in Merchant Loyalty With New Services

Deutsche Bank Faces Criminal Investigation for Potential Money-Laundering Lapses

What’s Wrong With Modern Buildings? Everything, Starting With How They’re Made

Jeff Miller: Stock Exchange: Brilliant Trading Or Is The Market Just Up?

Howard Lindzon: What Makes A Great Investor & Art Over Science or Science Over Art? Just Have a Plan

Joshua Brown: FAQ: Where Should a New Investor Begin? & Changing the Ratio

Be sure to follow me on Twitter.

-

No Change

Eddy Elfenbein, June 19th, 2019 at 2:03 pmThe Fed didn’t cut rates. Here’s the statement:

Information received since the Federal Open Market Committee met in May indicates that the labor market remains strong and that economic activity is rising at a moderate rate. Job gains have been solid, on average, in recent months, and the unemployment rate has remained low. Although growth of household spending appears to have picked up from earlier in the year, indicators of business fixed investment have been soft. On a 12-month basis, overall inflation and inflation for items other than food and energy are running below 2 percent. Market-based measures of inflation compensation have declined; survey-based measures of longer-term inflation expectations are little changed.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. In support of these goals, the Committee decided to maintain the target range for the federal funds rate at 2-1/4 to 2-1/2 percent. The Committee continues to view sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee’s symmetric 2 percent objective as the most likely outcomes, but uncertainties about this outlook have increased. In light of these uncertainties and muted inflation pressures, the Committee will closely monitor the implications of incoming information for the economic outlook and will act as appropriate to sustain the expansion, with a strong labor market and inflation near its symmetric 2 percent objective.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its maximum employment objective and its symmetric 2 percent inflation objective. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michelle W. Bowman; Lael Brainard; Richard H. Clarida; Charles L. Evans; Esther L. George; Randal K. Quarles; and Eric S. Rosengren. Voting against the action was James Bullard, who preferred at this meeting to lower the target range for the federal funds rate by 25 basis points.

Here are the economic projections.

St. Louis Fed President James Bullard voted this meeting in favor of a quarter-point rate cut. The median forecast shows the Fed not changing rates this year, and only one cut next year.

-

Morning News: June 19, 2019

Eddy Elfenbein, June 19th, 2019 at 7:07 amGlobal Economic Growth Is Already Slowing. The U.S. Trade War Is Making It Worse.

Globalization Is Moving Past the U.S. and Its Vision of World Order

Trump Moves From Trade War Toward Currency War

Why Trump Might End Up Regretting the Rate Cut He Wants So Badly

Wall Street Takes on Long-Term Care Payouts as Insurers Balk at Costs

Energy Storage Will Be Big Business Soon

Airbus Edges Back Into Lead With Paris Orders for Newest Jet

A $300 Billion Rainbow Economy Is Booming in the Middle of China

U.S. Steel to Idle Two Furnaces as Demand Falls

Google Makes Housing Commitment Valued at $1 Billion

How 7.4 Tons of Venezuela’s Gold Landed in Africa—and Vanished

Nick Maggiulli: The Greatest Asset Bubble of All Time

Cullen Roche: Three Things I Think I Think – Libra Edition

Jeff Carter: Facebook’s New Crypto

Roger Nusbaum: Do Small Portfolio Changes Matter?

Be sure to follow me on Twitter.

-

Morning News: June 18, 2019

Eddy Elfenbein, June 18th, 2019 at 7:15 amHow Japan Turned Against Its ‘Bazooka’-Wielding Central Bank Chief

Saudis Push to Renew OPEC’s Oil-Export Curbs, Despite Tanker Attacks

Draghi Shock Hits Euro, Boosts Stocks

What Businesses Claim Will Hurt Them (and You) if New Trump Tariffs Take Effect

Investors Haven’t Been This Bearish Since 2008 Financial Crisis

Ripple to Invest Up to $50 Million in MoneyGram

Sotheby’s to Be Sold, Jolting the Art World

Beyond Meat: An Update On Short Thesis

Sports Illustrated Operating Rights Sold

U.S. Steel Suffers New Fire Knocking Out Pollution Controls in Plant Near Pittsburgh

World’s Top Bicycle Maker Says the Era of ‘Made in China’ Is Over

Michael Batnick: The Best Year For Unicorns?

Joshua Brown: I Did Everything I Was Supposed To Do

Ben Carlson: What If Interest Rates Don’t Rise Again For a Long Time? & Talk Your Book: Trading with MarketSmith

Be sure to follow me on Twitter.

-

This Fed is the Big Story this Week

Eddy Elfenbein, June 17th, 2019 at 9:54 amThis week’s news will be dominated by the big Fed meeting. The meeting starts tomorrow and the policy statement is due out on Wednesday afternoon.

I doubt we’ll see a rate cut now, but the futures market isn’t completely ruling one out. The question is, what comes next? There’s now a consensus on Wall Street that the Fed will soon cut rates, probably next month. I’m still a doubter, but I’m in the minority. We’ll learn a lot this week.

This morning, the New York Fed released its Empire State report which looks at the economy of New York. It appears that things really slowed down in New York.

The other economic news has been a bit soft but nothing awful. The jobs report wasn’t terrific, but unemployment is still low. Retail sales weren’t as bad as some folks feared. Even the stock market has been acting better.

-

Morning News: June 17, 2019

Eddy Elfenbein, June 17th, 2019 at 7:16 amHundreds of Companies Descend on Washington to Fight Trump’s Tariffs

‘Catastrophic,’ ‘Cataclysmic’: Trump’s Tariff Threat Has Retailers Sounding Alarm

Huawei Warns Trump’s Ban Might Wipe Out $30 Billion of Sales Growth

Deutsche Bank’s Impending Auf Wiedersehen Will Hurt Americans

Airbus Wins Major 100-Plane Order Over Boeing

Pfizer to Buy Cancer Drug Developer Array for $10.64 Billion

Sprint and T-Mobile Merger Approval, Said to Be Near, Could Undercut Challenge by States

Banks Face New Challenges in Italian Diamond Scandal

In Finance, ‘J. Crew’ Is a Verb. It Means to Stick It to a Lender

Goldman Sachs Wants to Look More Like Blackstone

UBS Loses Role in Bond Deal for Chinese Firm on Outcry Over Pig Comment

Bribes and Backdoor Deals Help Foreign Firms Sell to China’s Hospitals

Cullen Roche: Three Things I Think I Think – Soccer Edition

Jeff Miller: Weighing the Week Ahead: A De Facto Expansion of the Fed’s Mandate?

Howard Lindzon: Momentum Monday – A Good Market Of Stocks Right Now and How I Prune To Hold Winners

Be sure to follow me on Twitter.

-

Retail Sales Rose Last Month

Eddy Elfenbein, June 14th, 2019 at 11:02 amThis morning’s retail sales report indicated that sales were up last month. Also, the numbers for April were revised higher.

The Commerce Department said on Friday retail sales rose 0.5% last month as households bought more motor vehicles and a variety of other goods. Data for April was revised up to show retail sales gaining 0.3%, instead of dropping 0.2% as previously reported.

Economists polled by Reuters had forecast retail sales climbing 0.6% in May. Compared to May last year, retail sales increased 3.2%.

Excluding automobiles, gasoline, building materials and food services, retail sales advanced 0.5% last month after an upwardly revised 0.4% rise in April. These so-called core retail sales correspond most closely with the consumer spending component of gross domestic product.

More evidence that the Fed doesn’t need to cut.

-

CWS Market Review – June 14, 2019

Eddy Elfenbein, June 14th, 2019 at 7:08 am“People calculate too much and think too little.” – Charlie Munger

The big news this week came on Sunday night when Raytheon and United Technologies announced a merger agreement. This is exciting news, but the details aren’t so encouraging. I’ll discuss what I mean in a bit.

We also have a big Federal Reserve meeting coming next week. Wall Street expects the Fed to ride to the rescue once again. I’m not so sure. I’ll preview what to expect.

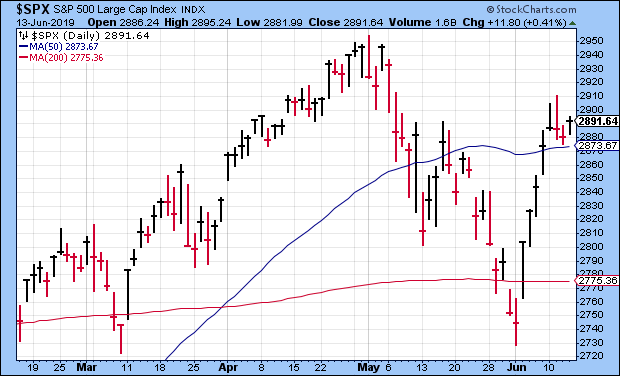

The stock market has already rallied back pretty impressively. The S&P 500 closed Thursday at its highest point in five weeks. Several of our stocks are at or near new 52-week highs.

Remember last year when Sherwin-Williams dropped 23% in a little over a month? Anything related to housing got smashed up. I’m glad we held on. This week, the stock made a new high. Sherwin is outpacing the market again this year.

Before we get to that, let’s look at the merger news between Raytheon and United Technologies.

Raytheon and United Technologies Are Merging

On Sunday afternoon, the financial media reported that Raytheon (RTN) and United Technologies (UTX) were in advanced merger talks. Shortly afterward, the news became official. The two defense giants are getting married. The deal is all stock.

On the surface, it’s a great fit. United Technologies is a Dow component and an outstanding company. Raytheon, of course, is a proud member of our Buy List. The new company will be called Raytheon Technologies. The companies said the merger will cut costs by $500 million which would save the Pentagon (and taxpayers) a bundle.

There are some important details. UTX is undergoing a major strategic overhaul. The company recently bought Rockwell Collins. They now plan to be strictly a defense company. In November, UTX announced plans to spin off two of its divisions: Otis Elevator and Carrier.

Those deals will be done before the Raytheon deal. As such, RTN shareholders won’t get any shares in those two companies. According to the merger deal, RTN shareholders will get 2.3348 shares of the new company for every one they own now.

OK, that sounds great, but 2.3348 shares of what? There’s no precise way to know what that’s worth until Otis and Carrier are spun off. It’s like saying to a new homebuyer, “Congratulations on your new home! By the way, what you bought isn’t exactly what you see. Your house will be missing a few rooms.”

The deal says that Raytheon shareholders will own 43% of the new company while UTX shareholders will own the other 57%. But that still doesn’t answer the question: how much are we being offered?

At one point, Raytheon was up 8% in Monday’s pre-market trading. The stock gapped up at the open, but it gradually slid back during the trading day. Then on Tuesday, RTN fell nearly $10 per share. That’s not encouraging.

As merger premiums go, this was a flop. To be fair, President Trump made some critical comments about the deal which probably weighed on the shares. The president has a valid point about industry consolidation. In the 1980s, there were 60 major defense contractors. Today, there are five.

Twenty years ago, the Pentagon blocked a merger deal between Lockheed Martin and Northrup Grumman. I’m not sure if that could happen anymore. From an anti-trust standpoint, the current deal doesn’t have much to worry about. The two businesses don’t overlap very much.

The companies said that the deal could bring an extra $20 billion to investors as a result of dividends and share buybacks, but some United Technologies shareholders aren’t pleased. Famed investor Bill Ackman sent a letter expressing his disapproval.

Raytheon and UTX understand they’re in a difficult spot. They have to compete against companies like Boeing which makes tons of money off its commercial business. As a result, they can be a very competitive bidder on military contracts. That puts a squeeze on profit margins which creates a need to cut costs. As a result, there’s incentive to merge. This won’t be the last big deal you’ll see in this sector.

I’m not against a merger deal, but I would have liked to see a better offer. I think Raytheon is undervalued as it is, and it appears that UTX isn’t offering us any sort of premium. I should note that Raytheon has an enviable balance sheet. That’s important because defense/aerospace is a capital-intensive business, meaning you gotta spend a lot to make a lot.

The other issue for RTN shareholders is that their stock is basically stuck until the deal is finalized. I would expect RTN to track UTX closely for the next several months. As per the rules of the Buy List, RTN will remain a member of the Buy List for the rest of this year.

My take: I like the idea of a merger. UTX is a great partner. I think some merger deal was inevitable, but I don’t like the price. In fact, I’m not sure what the price is. But going by the market’s reaction, Raytheon should be getting more. I hope to hear more details soon. Raytheon remains a buy up to $190 per share.

Next Week’s Fed Meeting

The Federal Reserve gets together again next week. This is one of the meetings where the central bank revises its economic forecasts.

Lately, Wall Street has been asking for (demanding) interest-rate cuts in order to help out the stock market. I don’t think the Fed will play ball.

For one, the economic data isn’t that bad. The recent jobs report was a little light, but the unemployment rate is still just 3.6%. That’s close to a 50-year low. This week’s CPI report showed that consumer inflation is basically right in the Fed’s target zone.

The latest data from the futures market show that investors think there’s a 31.7% chance that the Fed will cut next week. I don’t see a cut happening. Central bankers are cautious folks. I agree with the decision a few months ago to hold off on the planned rate hikes, but jumping in and cutting rates right now is something very different.

For the July FOMC meeting, the futures market thinks there’s a 90% chance the Fed will cut. That really surprises me. Traders think the Fed will cut again in September and a third time in December.

To give you an idea of how much things have changed, one month ago, traders saw a 9% chance of two rate cuts by September. Now the odds are 76%. The yield on the two-year Treasury, which is a good proxy for Fed policy, just dropped to its lowest yield in 18 months.

I think Wall Street has gotten ahead of itself. Next week’s meeting will include the Fed’s updated forecast for interest rates. I expect to see a cautious approach from the Fed. I also think Chairman Powell may try to talk down expectations in his press conference. Wall Street could be surprised by the Fed’s unwillingness to help them out.

Wall Street’s temper tantrum really got going after a pair of President Trump’s tweets in early May threatened to ratchet up the trade war. However, there’s a big G20 meeting at the end of this month. I think there’s a good chance the president will announce some sort of breakthrough. That could take the pressure off the market. I don’t think the Fed wants to see itself as Wall Street’s servant.

Buy List Updates

Shares of Disney (DIS) got a nice boost this week after an analyst at Morgan Stanley raised his price target from $135 to $160 per share. I’m lifting my Buy Below on Disney to $150 per share.

Two weeks ago, Ross Stores (ROST) released another solid earnings report. As per tradition, the deep discounter offered pessimistic guidance. For Q2, Ross sees earnings of $1.05 to $1.11 per share. The cautious guidance held me from raising my Buy Below price. It shouldn’t have, however, so I’ll do it this week. Ross Stores is a buy up to $106 per share.

This week, I’m also going to drop the Buy Below on Signature Bank (SBNY) to $127 per share. That could be a good sign. It seems like every time I cut my Buy Below on SBNY, it starts to rally.

That’s all for now. The Federal Reserve meets next week on Tuesday and Wednesday. The policy statement is due out on Wednesday at 2 p.m. ET. On Tuesday, we’ll get the latest report on housing starts. The jobless-claims report is due out on Thursday. On Friday, the report on existing-home sales is released. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Morning News: June 14, 2019

Eddy Elfenbein, June 14th, 2019 at 7:04 amAs Trade War Hits, China Factories See Slowest Growth Since 2002

How Tanker Attacks in the Strait of Hormuz Could Affect Oil Prices

Boeing’s Decision on New Jet Is Critical in Rivalry With Airbus

Facebook’s New Cryptocurrency, Libra, Gets Big Backers

PetSmart’s Chewy Gets Wall Street Tails Wagging with $1 Billion IPO

Broadcom Falls After Cutting Its Chip Sales Guidance: 6 Key Takeaways

Who Are You Calling Chicken? Tyson Foods is Getting into the Business of Plant-Based Meat

Does Amazon Really Pay No Taxes? Here’s the Complicated Answer

Manhattan’s Newest Flagship Department Stores Are Ignoring the Retail Apocalypse

Stanford Team Aims at Alexa and Siri With a Privacy-Minded Alternative

Volkswagen to Float 10% of Truck Unit, Seeks to Raise 1.9 Billion Euros

Hey, Raptors Fans, You Want Fries With Those 3-Pointers?

Roger Nusbaum: Putting a Price Tag on Happiness

Jeff Miller: Do You Evaluate Your Trading Mistakes?

Ben Carlson: David Swensen & a Target Date Fund Walk Into a Bar

Be sure to follow me on Twitter.

-

Morning News: June 13, 2019

Eddy Elfenbein, June 13th, 2019 at 7:56 amOil Surges as Tankers in Gulf Suffer Another Suspected Attack

Is Bitcoin Growing Up? Regulated Futures Boom as Investors Seek a Safer Ride

Hong Kong’s Financial Elite Grow Uneasy as China Tensions Rise

The Fed Needs to Be the Adult in the Economy

As Trade War With U.S. Grinds On, Chinese Tourists Stay Away

Social Security Is Staring at Its First Real Shortfall in Decades. Big Cuts Could Follow.

Alibaba Files for a Hong Kong Mega-Listing

Huawei Files to Trademark Mobile OS Around the World After U.S. Ban

Mitsubishi Envisions More Comfortable Regional Flights on its New ‘SpaceJet’

Here’s What FedEx’s Breakup With Amazon Means

Investors Pumped Billions Into Suburbs That Never Got Built

Store’s Bid to Shame Customers Over Plastic Bags Backfires

Petrobras Ignored Warnings About Fuel Broker Implicated in Graft Probe

Joshua Brown: The Big Kickoff & A 2% Tax on America’s 75,000 Wealthiest Families Would Raise $2.75 Trillion

Michael Batnick: More Art Than Science, Dad Cat Bounce & Operational Momentum

Be sure to follow me on Twitter.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His