Archive for June, 2019

-

Another Tame Inflation Report

Eddy Elfenbein, June 12th, 2019 at 12:55 pmThe CPI report came out this morning and it was another tame report. For May, consumer prices rose just 0.1%. That matched Wall Street’s expectations. That’s after a 0.3% rise in April. In the last year, consumer prices are up 1.9%.

The core rate, which excludes food and energy, was also up 0.1%. In the last year, the core rate is up 2.0%.

Gasoline prices fell 0.5% in May after rising 5.7% in April. Food prices rebounded 0.3% in May after dipping 0.1% in the prior month. Food consumed at home increased 0.3% last month.

Owners’ equivalent rent of primary residence, which is what a homeowner would pay to rent or receive from renting a home, increased 0.3% in May after rising 0.3% in April.

Healthcare costs increased 0.3%, matching April’s rise. The solid increase in healthcare costs at both the consumer and production levels last month suggests a pickup in the core PCE price index in May.

The cost of hospital services increased 0.5% in May and the cost of doctor visits ticked up 0.1%. But the prices for prescription medication fell 0.2%.

Apparel prices were unchanged in May after tumbling 0.8% in the prior month. They had declined for two months in a row after the government introduced a new method and data to calculate apparel prices.

Prices for used motor vehicles and trucks tumbled 1.4%. That was the largest drop since last September and marked the fourth straight monthly decrease. The cost of motor vehicle insurance fell 0.4%, the most since May 2007. There were also decreases in the cost of recreation.

But prices for airline tickets, household furnishings and new vehicles rose last month. Household furnishings are likely to trend higher in the coming months because of U.S. President Donald Trump’s decision in early May to slap additional tariffs of up to 25% on $200 billion of Chinese goods.

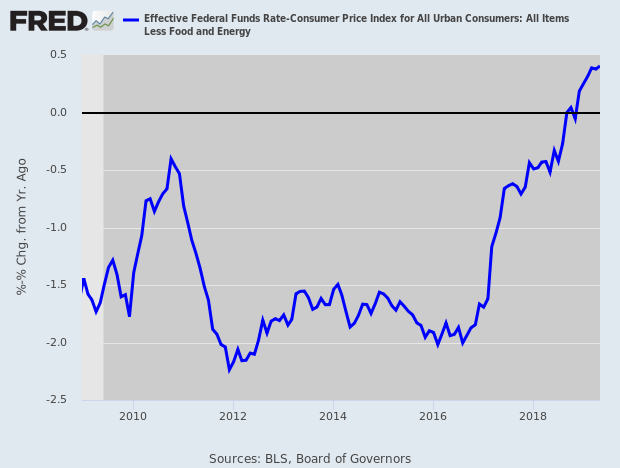

Here’s the real Fed funds rate based on core inflation.

-

Morning News: June 12, 2019

Eddy Elfenbein, June 12th, 2019 at 7:13 amHong Kong Markets Roiled by Interbank Rate Squeeze Amid Protests

Iran Scrambles to Lift Petrochemical Sales as Sanctions Hammer Oil

Ten U.S. States Sue to Stop Sprint-T-Mobile Deal, Saying Consumers Will Be Hurt

House Opens Tech Antitrust Inquiry With Look at Threat to News Media

Dassault to Buy Medidata in $5.7 Billion Health Data Push

Highlights from Tesla’s Annual Meeting

Your iPhone Is Already Made in America

Facebook’s New Study App Pays Adults for Data After Teen Scandal

Grubhub Stock Gets a Boost on Amazon’s Exit From Food Delivery

GE’s Larry Culp Faces Ultimate CEO Test in Trying to Save a Once-Great Company

A Krispy Kreme in Times Square Will Have Stadium-Style Seats and a Glaze Waterfall

Kraft Introduces ‘Salad Frosting’ to Help Trick Your Kids Into Eating More Vegetables

Nick Maggiulli: Being Wrong When You Get It Right

Cullen Roche: Three Charts I Think I’m Thinking About

Jeff Carter: If You Immigrate, You Can’t Bank

Be sure to follow me on Twitter.

-

Morning News: June 11, 2019

Eddy Elfenbein, June 11th, 2019 at 7:18 amU.S. Job Openings Outnumber Unemployed by Widest Gap Ever

Trump Says Mexico Tariffs Worked, Emboldening Trade Fight With China

China Says Will Respond if U.S. Escalates Trade Tension

Chinese Tech Giant Huawei Hints That U.S. Pressure Is Hurting Sales

Top Japanese Chip Gear Firm to Honor U.S. Blacklist of Chinese Firms

Apple’s U.S. iPhones Can All Be Made Outside of China If Needed

Expedia Is Undervalued In A Recession Resistant Industry

Salesforce Dreams of Being Microsoft or Oracle

Amazon: Impact Of Increasing Rivalry With FedEx

Nissan and Renault Lock Horns as Relationship Sours Further

Deutsche Bank Tax Probe Targets About 80 Current, Former Staff

Howard Lindzon: Momentum Monday – We Don’t Need No Stinking Tariffs

Ben Carlson: Managing Money vs. Managing Wealth & Talk Your Book: The Net Lease REIT ETF

Joshua Brown: Get Used To It & Trump on the Fed: They’re Disruptive

Be sure to follow me on Twitter.

-

CNBC’s Interview with Raytheon’s and UT’s CEOs

Eddy Elfenbein, June 10th, 2019 at 12:06 pmWatch CNBC’s full interview with the CEOs of United Technologies and Raytheon from CNBC.

-

Trump Is Concerned about the Raytheon Deal

Eddy Elfenbein, June 10th, 2019 at 12:02 pmPresident Donald Trump on Monday said he has concerns that a merger between United Technologies and Raytheon would harm competition and make it more difficult for the U.S. government to negotiate defense contracts.

“I’m a little concerned about United Technologies and Raytheon,” Trump said in an exclusive interview with CNBC. Aerospace companies have “all merged in so it’s hard to negotiate” with them, he added, suggesting the defense industry could be heading in the same direction.

Asked whether he would have problems with the merger, Trump replied, “Only if they have the same products. That would be the thing that bothers me most.”

(…)

“We are complementary, not competitive,” Raytheon CEO Tom Kennedy told CNBC in an interview. “I don’t know the last time we competed against United Technologies.”

Greg Hayes, United Technologies’ CEO and chairman who is slated to be CEO of the new company, once the merger closes, said he looked forward “to talking to the president later today,” about potential job growth under the deal.

Still, the president repeatedly expressed concerns about dwindling competition in aerospace.

“When I hear United and I hear Raytheon, when I hear they’re merging, does that make it less competitive? It’s already not competitive,” Trump said.

“I just want to see competition. They’re two great companies, I love them both. But I want to see that we don’t hurt our competition.”

-

Morning News: June 10, 2019

Eddy Elfenbein, June 10th, 2019 at 7:07 amU.K. Economy Shrinks as Factory Output Falls Most Since 2002

Argentina’s Economic Misery Could Bring Populism Back to the Country

China Summons Tech Giants to Warn Against Cooperating With Trump Ban

Mnuchin Dashes Investor Dreams of Quick Fannie-Freddie Windfall

Wall Street Asks When, Not if, the Fed Will Cut Interest Rates

United Technologies, Raytheon to Combine as Defense Giant

Some Big Tech Firms Cut Employees’ Access to Huawei, Muddying 5G Rollout

A Billboard No. 1 Is at Stake, So Here’s an Album With Your Taylor Swift Hoodie

Renault Rift with Nissan Widens Over Governance, Casts Shadow on Alliance

Employees Sour on Tesla Amid Cost-Cutting, Layoffs

3 Reasons to Retire as Early as You Can

‘Trade of Our Lives’: After Mueller, UBS Banker Faces Questions

Michael Batnick: Talk Your Book: The Net Lease REIT & Ackshually…

Jeff Carter: Network Effects and Venture Capital & SEC and Kik

Jeff Miller: Weighing the Week Ahead: Should Investors Bank on the Fed?

Be sure to follow me on Twitter.

-

It’s Official: Raytheon and United Technologies to Merge

Eddy Elfenbein, June 10th, 2019 at 6:09 amThe deal is expected to close in the first half of next year. The combined company will be called Raytheon Technologies. The deal is all cash. RTN shareholders will get 2.3348 shares of the new company for every one they own now.

Here’s the press release:

Raytheon Company (NYSE: RTN) and United Technologies Corp. (NYSE: UTX) have entered into an agreement to combine in an all-stock merger of equals. The transaction will create a premier systems provider with advanced technologies to address rapidly growing segments within aerospace and defense. The merger of Raytheon, a leading defense company, and United Technologies, a leading aerospace company, comprised of Collins Aerospace and Pratt & Whitney, will offer a complementary portfolio of platform-agnostic aerospace and defense technologies. The combined company, which will be named Raytheon Technologies Corporation, will offer expanded technology and R&D capabilities to deliver innovative and cost-effective solutions aligned with customer priorities and the national defense strategies of the U.S. and its allies and friends. The combination excludes Otis and Carrier, which are expected to be separated from United Technologies in the first half of 2020 as previously announced.

The combined company will have approximately $74 billion in pro forma 2019 sales. With a strong balance sheet and robust cash generation, Raytheon Technologies will enjoy enhanced resources and financial flexibility to support significant R&D and capital investment through business cycles.

Under the terms of the agreement, which was unanimously approved by the Boards of Directors of both companies, Raytheon shareowners will receive 2.3348 shares in the combined company for each Raytheon share. Upon completion of the merger, United Technologies shareowners will own approximately 57 percent and Raytheon shareowners will own approximately 43 percent of the combined company on a fully diluted basis. The merger is expected to close in the first half of 2020, following completion by United Technologies of the previously announced separation of its Otis and Carrier businesses. The timing of the separation of Otis and Carrier is not expected to be affected by the proposed merger and remains on track for completion in the first half of 2020. The merger is intended to qualify as a tax-free reorganization for U.S. federal income tax purposes.

“Today is an exciting and transformational day for our companies, and one that brings with it tremendous opportunity for our future success. Raytheon Technologies will continue a legacy of innovation with an expanded aerospace and defense portfolio supported by the world’s most dedicated workforce,” said Tom Kennedy, Raytheon Chairman and CEO. “With our enhanced capabilities, we will deliver value to our customers by anticipating and addressing their most complex challenges, while delivering significant value to shareowners.”

“The combination of United Technologies and Raytheon will define the future of aerospace and defense,” said Greg Hayes, United Technologies Chairman and CEO. “Our two companies have iconic brands that share a long history of innovation, customer focus and proven execution. By joining forces, we will have unsurpassed technology and expanded R&D capabilities that will allow us to invest through business cycles and address our customers’ highest priorities. Merging our portfolios will also deliver cost and revenue synergies that will create long-term value for our customers and shareowners.”

-

WSJ: “Raytheon, United Technologies in Talks to Merge”

Eddy Elfenbein, June 9th, 2019 at 6:27 amThis is big. From the WSJ:

United Technologies and Raytheon are in talks to combine in an all-stock deal that would create a giant in the aerospace and defense industries, according to a person familiar with the matter.

The companies, which together have a market value of roughly $166 billion, could announce a deal in the coming days assuming talks don’t fall apart at the last minute, the person said.

Exact terms couldn’t be learned but United Technologies shareholders are likely to own a majority of the combined company.

The tie-up, expected to be billed as a merger-of-equals, wouldn’t affect United Technologies’ existing plans to spin off its Otis elevator and Carrier building-systems businesses into separate companies. Raytheon would be combining with United’s remaining aerospace business, and all transactions would take place at the same time. United Technologies has said the spinoffs will take place in the first half of next year.

Adjusting for the spinoffs, the companies’ combined market value would likely still be north of $100 billion. The new entity would be the world’s second-largest aerospace-and-defense company by sales after Boeing, with annual revenue of more than $70 billion last year.

In addition to other benefits from increased scale, the proposed deal could help the enlarged company weather any slowdown in the commercial aerospace and defense markets.

United Technologies Chairman and Chief Executive Greg Hayes is expected to lead the combined company, while Raytheon Chairman and CEO Thomas Kennedy would be chairman, the person said.

United Technologies has a market value of roughly $114 billion, while Raytheon’s is about $52 billion.

The deal would be one of the largest in a year that has included some big mergers but otherwise has been lackluster. Right now the biggest proposed acquisition is Bristol-Myers Squibb Co.’s $74 billion purchase of rival drugmaker Celgene Corp.

A United Technologies-Raytheon combination has long been speculated on by analysts and investors, given that the two companies operate in mainly different segments and could benefit from sharing technology.

It would unite the maker of Pratt & Whitney engines—used on commercial airliners such as the Airbus SE A320neo—and the F-35 combat jet, with Raytheon, the fourth-largest U.S. defense contractor by revenue.

(…)

Waltham, Mass.-based Raytheon, whose sales rose 6.7% last year to $27.1 billion, produces missiles such as the Tomahawk together with radars and other electronic-warfare systems. It has invested heavily in recent years ahead of the recent uptick in Pentagon spending, and has the biggest export business among the five largest U.S. defense contractors.

(…)

The U.S. defense industry has morphed from about 60 big companies at the start of the 1980s to only five prime contractors today. Pentagon leaders have indicated they wouldn’t allow further mergers between the main players— Lockheed Martin Corp. , Boeing, Northrop Grumman, General Dynamics and Raytheon.

-

May Jobs Report; NFP +75,000

Eddy Elfenbein, June 7th, 2019 at 8:34 amThe jobs report for May is out, and it’s not that great.

The unemployment rate stayed the same at 3.6%. Nonfarm payrolls increased by 75,000, but revisions knocked off 75,000 jobs in March and April.

The labor force participation rate is 62.8%. The U-6 rate is 7.1%.

Average hourly earnings rose six cents to $27.83. That’s up 0.2% for the month, and 3.1% in the last year.

To match the jobs-to-population ratio we had 20 years ago, we’d need 10 million more jobs. Or 15 million fewer people.

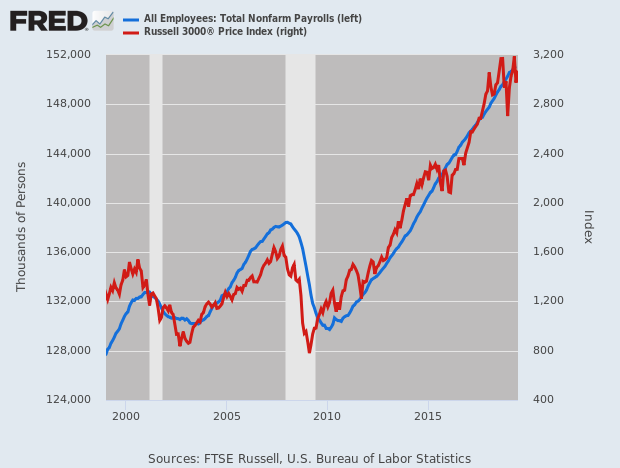

Here’s an update to one of my favorite charts. This has NFP in blue and the Russell 2000 in red.

-

CWS Market Review – June 7, 2019

Eddy Elfenbein, June 7th, 2019 at 7:08 am“Go for a business that any idiot can run—because sooner or later,

any idiot probably is going to run it.” – Peter LynchMy friend and blogger extraordinaire Josh Brown has a clever way of describing the relationship between the economy and the stock market. He says to think of a woman walking a dog through a park. The woman is walking in a clear path, while the dog lurches all around.

The woman is like the economy. She’s following a steady path. Meanwhile, the dog is like the stock market. It’s erratic and jumping back and forth, but ultimately, the dog arrives at the same destination as the woman.

That metaphor has come to mind lately as we’ve experienced a temper tantrum in the financial markets, while the actual economy remains quite stable. The bond market is soaring, and the stock market is dropping. In this week’s CWS Market Review, I’ll explain what it means for us and our investments.

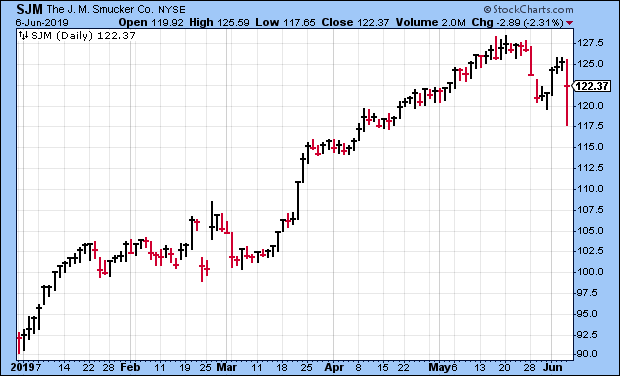

Speaking of which, we just had a very good earnings report from JM Smucker. The jam folks topped Wall Street’s estimates by 13 cents per share. Smucker also had good guidance for the coming year. SJM is now a 30.9% winner for us this year. Before we get to that, let’s take a look at the financial market’s latest freak out.

Will the Fed Come to Wall Street’s Rescue?

Late last year, the stock market threw a hissy fit when the Federal Reserve stuck by its plans to raise interest rates. The central bank was planning to raise rates three times in 2019. Traders didn’t like that at all. Between September and December, the stock market tanked.

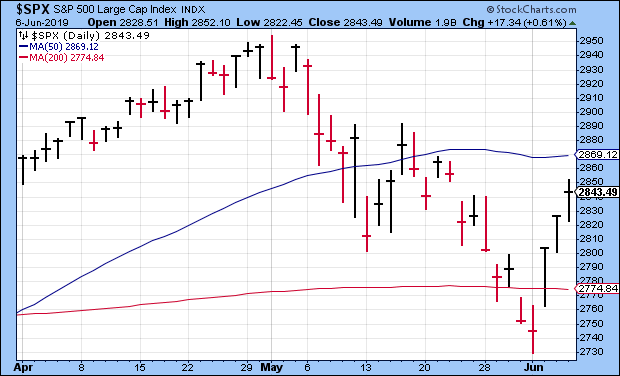

The Fed eventually got the message and backed off. The stock market snapped back quickly. It rallied much faster than I had expected. Now we’re in the spring, and the stock market is unhappy again. The major indexes took a bath during May. The selling really got going after a pair of tweets from President Trump escalated the Trade War with China.

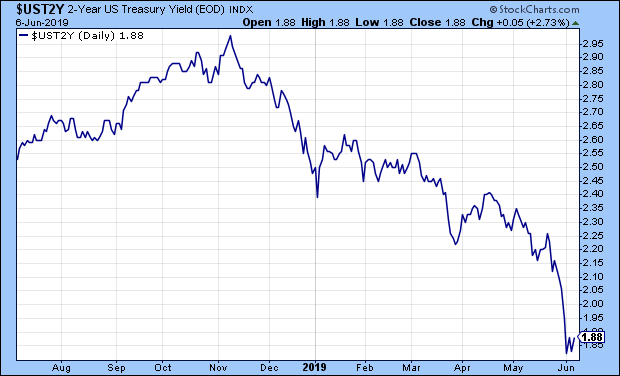

Will the Fed come to the rescue again? That’s what the bond market thinks. In anticipation of rate cuts, the yield on the two-year Treasury has fallen off a cliff. The two-year is often a decent proxy for Fed policy. It fell from 2.26% on March 21 to 1.82% this past Monday. That’s a big move for such a short amount of time.

The futures market agrees. The Fed funds futures now thinks the Fed will cut rates at its July meeting, and again at its September meeting. This is a huge about-face from a few months ago. In fact, the futures are split on the odds of a third rate cut in December. This has led to the yield curve becoming partially inverted. Of course, with rates already so low, the Fed doesn’t have much room to cut rates.

Will the Fed take the bait? I’m a skeptic. Central bankers don’t like big dramatic moves, and Chairman Jay Powell is a cautious guy. Without much data indicating that a rate cut is needed, I don’t see the Fed making a move. Just because the market is getting the shakes doesn’t mean the Fed’s going to change course. In the Fed’s mind, they already placated Wall Street by calling off the rate hikes. But now Wall Street wants rate cuts? I doubt it.

I’m in the minority here, but Wall Street is getting way ahead of itself. I’ll give you an example. Recently, Chairman Powell made some perfectly anodyne remarks about the Fed being ready to “act as appropriate to sustain the expansion.” Big deal. All Fed officials say stuff like that. But Wall Street completely overreacted and interpreted the remark as meaning the Fed is ready to pivot. That was enough to spark a relief rally this week.

That leads me back to our original metaphor. The financial markets (the dog on the leash) are frightened that we’re headed to recession meaning that the actual economy (the lady walking the dog) has shown very few signs of trouble.

Sure, this week’s ISM Manufacturing report came in a little light, but it wasn’t that bad. Some other data have been soft, but consumer confidence remains high. The jobless claims reports have been pretty good. Also, mortgage rates are down, so that will help the housing sector. But listening to the financial markets, you’d think the economy is plunging into the abyss.

Not only that, but it’s the kinds of stocks that have taken a beating that’s interesting. The pain has mostly been felt among more aggressive, cyclical stocks. For example, tech stocks have been down. Also, energy stocks are lagging badly. The small-cap Russell 2000 has fallen way behind.

This rotation has been great news for our Buy List stocks. On Thursday, our Buy List closed at a high for this year. This is especially impressive since the S&P 500 is still 3.5% below its high from a few weeks ago. We’re now up 18.4% so far in 2019. That’s 5% better than the S&P 500 (not including dividends).

On Thursday, seven of our stocks hit new 52-week highs: AFLAC (AFL), Cerner (CERN), Church & Dwight (CHD), Danaher (DHR), FactSet (FDS), Hershey (HSY) and Intercontinental Exchange (ICE).

The past few weeks have been excellent for our investing style. The reason is that Wall Street has gotten nervous that a trade war will sink the economy. For the most part, that doesn’t impact our stocks that much. Over the last five weeks, the high-volatility sector has been toast, and we’ve been fine. Apple and Facebook are both down more than 20%, and Google is down 19%. Now let’s look at a surprising winner for us this year.

Smucker Is a Buy up to $130 per Share

On Thursday, JM Smucker (SJM) reported fiscal Q4 earnings of $2.08 per share. Smucker ends its fiscal year on April 30. That’s why we get the earnings report at an odd time.

Overall, this was a solid quarter for SJM. First, some math. Previously, Smucker had given us full-year guidance of $8.00 to $8.20 per share. For the first nine months of the fiscal year, the company had made $6.20 per share. That implies an estimate for Q4 of $1.80 to $2.00 per share. Wall Street had been expecting $1.95 per share.

Whichever number you take, Smucker did much better than estimates. The company also provided guidance for the current fiscal year which is fiscal 2020. Smucker expects sales growth of 1% to 2%. The company expects earnings to range between $8.45 and $8.65 per share. That’s a bold forecast. Wall Street had been expecting $8.33 per share.

Sales growth was a bit weaker than expected. For the quarter, net sales rose 6.8% to $1.90 billion. Wall Street had been expecting $1.93 billion. Like other consumer companies, Smucker has been cutting prices. For the quarter, gross margins fell 2.4% to 36.4%. On the plus side, the pet-food business is doing well. (Yes, Smucker is a lot more than jelly.)

CEO Mark Smucker said:

“We are pleased with the progress that we made during the year towards executing against our strategic plan, which supported fourth-quarter adjusted-earnings growth of 8 percent and full-year adjusted-earnings growth of 4 percent. We successfully integrated Ainsworth, extending our leadership in pet foods, while our key growth brands delivered double-digit sales growth, demonstrating the power of our brands when supported by ongoing product innovation, including 1850® coffee and Jif Power Ups®. We continued to focus on productivity, allowing us to deliver on our cost reduction targets for the year, providing fuel for investment in future growth.”

“As we transition to fiscal year 2020, our organization is committed to delivering on its growth imperatives to lead in the best categories, build brands consumers love, and be everywhere our consumers want us to be. Disciplined investment in our brands across pet food, coffee, and snacking leaves us well-positioned to drive sustainable financial growth and enhance shareholder value for the long term.”

The stock initially dropped 6.1% after the earnings report, but it eventually closed down 2.3%. We have little reason to complain. SJM has been a big winner for us this year. This week, I’m lifting my Buy Below on Smucker to $130 per share.

Buy List Updates

Cerner (CERN) said it’s paying a dividend of 18 cents per share. This is important because it will be Cerner’s first-ever dividend. Impressively, the dividend is 20% higher than the estimate Cerner gave in February.

The new dividend is being paid after Cerner reached a deal with Starboard Value, an activist investor. The dividend will be paid on July 26 to shareholders of record of June 18. It’s not a lot, but it’s good to see. I’m raising my Buy Below on Cerner to $76 per share.

Last month, Church & Dwight (CHD) released a pretty good earnings report. The consumer-products company beat estimates by four cents per share. I was pleased to see gross margins increase by 20 basis points to 45.1%. Operating margins rose 120 basis points to 23.1%.

The company reiterated its full-year EPS guidance of $2.43 to $2.47. That’s an increase of 7% to 9% over last year. For Q2, CHD expects earnings of 52 cents per share, which matches the Street. After the earnings report, I thought of raising my Buy Below price, but I decided against doing so. The shares have performed well recently and touched a new 52-week high on Thursday. I’m raising my Buy Below on Church & Dwight to $82 per share.

That’s all for now. The May jobs report will be out later this morning. Next week, we’ll be getting some important economic reports. On Monday, we’ll get the job-openings report (JOLTS). The CPI report comes out on Wednesday. I’ll be curious to see if there are any price pressures building in the U.S. economy. Then on Friday, we’ll get the retail-sales report and the report on industrial production. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His