CWS Market Review – August 9, 2019

“When trade stops, war comes.” – Jack Ma

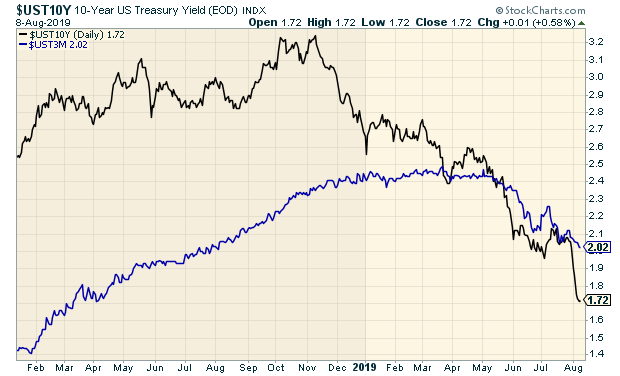

The trade war heated up again this week, and that shook the stock and bond markets. Gold is at a six-year high, while the yield on the 10-year Treasury fell to a three-year low.

The stock market recently dropped for six days in a row. The S&P 500 touched its lowest point in two months. There’s now talk that interest rates in the U.S. could go negative very soon. That’s already happened in much of Europe. I’ll tell you what it all means.

Also this week, we got our final two Buy List earnings reports for this earnings season. Becton, Dickinson had good news, while Disney did not. I’ll have all the details in a bit. But first, let’s look at the latest ructions in the trade war.

Interest Rates Are Plunging Around the World

Last week, the Federal Reserve cut interest rates by 0.25%. That was the spark in a series of mini-explosions that shook the market for a few days. President Trump tweeted that he was going to add more tariffs on $300 billion worth of goods from China. That move probably increased the odds that the Fed will cut rates again next month. In fact, some people suggested that the Fed could cut them by 0.5%. There’s also the chance that the Fed could do a surprise cut before the next meeting.

The People’s Bank of China, which is China’s Federal Reserve, struck back and allowed the yuan to sink below seven to the dollar (meaning a number that’s higher than seven to the dollar). This hasn’t happened in 11 years. Until now, the PBOC has defended the yuan at seven to the dollar. The yuan trades at the official rate inside China and at the unofficial rate outside China. (When in doubt, believe the price not controlled by the government.) Both markets had the yuan sinking below seven.

China also said it will no longer buy U.S. agricultural products. China used to be a major buyer of U.S. soybeans. China has a massive population to feed. The soybeans aren’t for people but for pigs. Half of the world’s pigs are in China. I don’t see the point of this move. American farmers will find new buyers. The only ones hurt will be poor people in China who will have to pay higher prices. China will turn to countries like Brazil and Russia to fill the void.

The problem with a trade war is that each action spurs a reaction, and that causes a counter-reaction. Small disputes can quickly escalate into something much bigger.

That’s why China’s currency decision caused a global freakout. It showed that China is fighting back against President Trump’s tariffs. After that, I tweeted to watch out for the next move, which would be the U.S. Treasury Department’s labeling China as a “currency manipulator.” A few hours later, that’s exactly what happened.

The stock market dropped nearly 3% on Monday. That’s really not that much for a one-day loss, but it was the biggest drop in several months, so it probably will have a larger psychological effect. Conversely, the bond market soared. The yield on the 10-year Treasury fell below 1.6% this week. That’s less than half the yield from November. The 10-year yield is now 30 basis points below that of the three-month yield.

This has brought up talk of a worldwide deflationary trend. All over the place, commodity prices are falling, with the exception of gold and silver, which are soaring (as is Bitcoin). Prices for copper, iron, oil and other commodities are down. The impact is being felt everywhere. In Japan and in several countries in Europe, one-year government bonds carry negative yields. Right now, about $15 trillion worth of bonds carry negative yields. That’s about one-fourth of the world’s total. In Germany, the entire yield curve is negative.

All of the recent events are reinforcing the current trend. The dollar is strong and may get much stronger. Last quarter, China had its slowest quarter of economic growth rate in 27 years. Lower commodity prices have an unexpected impact. For example, transportation companies can be negatively impacted. Also, trade routes are reestablished. Vietnam has done well thanks to President Trump’s trade policies. We’re witnessing a historic shift in interest rates.

If this trade bickering continues, there’s a real risk of a global recession. I don’t think the U.S. is in serious danger, but Europe may be. I don’t want to frighten investors. Our portfolio is in a good spot.

In fact, with the market being so nervous, our Buy List has performed very well lately. Of course, I mean that in relative terms. We outperform when everyone else gets scared. Our Buy List has outperformed the S&P 500 for the last 11 days in a row. For the year, we’re beating the market by 22.33% to 17.20%.

Now let’s look at earnings from Becton, Dickinson and Disney.

Earnings from Becton, Dickinson and Disney

On Tuesday, the last of our Buy List stocks reported results for the Q2 earnings season.

Before the opening, Becton, Dickinson (BDX) said they made $3.08 per share for the third quarter. That was three cents more than Wall Street had been expecting. This was a pretty solid report from Becton. Revenues rose 1.7% to $4.35 billion.

In May, the company lowered its full-year forecast, so there was some nervousness that it might happen again. Fortunately, Becton stood by its current range of $11.65 to $11.75 per share. The company expects constant-currency revenues to grow by 5% to 6%.

“Third quarter performance was strong. Our revenues highlight the breadth and diversity of the growth drivers in our portfolio, and we are seeing strength across all three segments,” said Vincent A. Forlenza, chairman and CEO. “As anticipated, our performance has accelerated, and we expect this momentum to continue. We remain confident in our outlook for fiscal year 2019 and our ability to deliver value to customers and shareholders.”

Becton has three major business segments. For Q2, BD Medical had constant-currency revenue growth of 6%. BD Life Sciences was up 5.4%. BD Interventional was up 5.2%. To give you an idea of the currency impact, BDX saw revenue outside the U.S. fall by 1.6% for the quarter. Adjusted for currency, it was an increase of 6.5%.

I suspect someone was expecting bad news because shares of BDX dropped off on Friday and again on Monday before the earnings announcement. The good results clearly mollified investors. BDX rallied on Tuesday, Wednesday and Thursday for a combined gain of 6.4%. This week, I’m raising my Buy Below on Becton, Dickinson to $260 per share.

After the closing bell, Disney (DIS) reported a big earnings miss. For Q2, the Mouse House earned $1.35 per share. That was 40 cents below estimates. I’ll confess, this was a big shock to me. I was expecting an earnings beat.

The story behind Disney’s Q2 is pretty complicated and not nearly as bad as the surface numbers suggest. Some of the problems are legacy issues that won’t be a factor in the near future. For example, Disney had incurred costs to complete the merger with Fox’s entertainment business. The Fox deal will still be an issue in Q3 and Q4.

Disney’s CEO Bob Iger said he thought the results from Fox, particularly the studio, were “disappointing.” The movie “Dark Phoenix” was a bomb at the box office. Iger said that he’s not worried about the merger. They knew it was a big deal, and it will have setbacks.

Disney has lots of big plans for the future. The company is ramping up investments in its streaming services. These could be big winners soon. In November, Disney will launch its bundled streaming package for $12.99.

Income at Disney’s U.S. parks fell due to investments for their new Star Wars expansion. Despite the earnings miss, there’s nothing to suggest that Disney’s current business strategy isn’t working. The latest Avengers movie is the highest-grossing film in movie history.

Shares of Disney fell nearly 5% on Wednesday but gained close to half of that back on Thursday. To be cautious, I’m lowering my Buy Below on Disney to $148 per share.

On our Buy List, we have three stocks with quarters than ended in July: Ross Stores (ROST), Hormel Foods (HRL) and JM Smucker (SJM). Ross and Hormel will report earnings on August 22. Smucker will report on August 27.

That’s all for now. Next week should be fairly quiet for economic news. I’ll be on the lookout for Tuesday’s CPI report. The market fears deflation, but I’m curious what the facts have to say. On Thursday, we’ll get reports on retail sales and industrial production. The last report on retail sales was pretty good. Let’s see if this trend continues. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Posted by Eddy Elfenbein on August 9th, 2019 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His