Archive for September, 2019

-

The Peak of the Decade Cycle

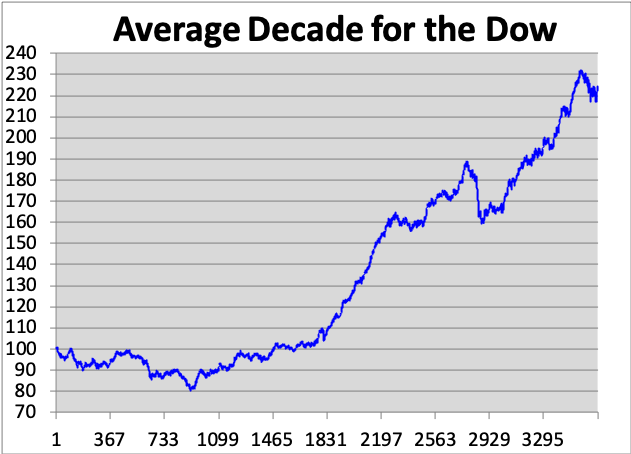

Eddy Elfenbein, September 10th, 2019 at 1:58 pmToday is the peak day in the decade cycle for stocks.

Let me be clear that I don’t put much faith in these things. I would never make an investment decision based on this. I just think it’s interesting for historic reasons.

Having said that, historically, the Dow has peaked on September 10 of the last year of a decade (years that end in 9).

After that, the Dow has fallen 22.3% to a low on June 27 of the third year of decade (ending in 2).

Stocks have continued to be negative until October 27 of the fifth year of the decade (years that end in 4). That’s slightly more than half the time. The stock market’s entire capital gain comes in the other half.

From June 27 of the third year until September 10 of the last year, the Dow has gained 188.9%. That’s a little over seven years.

The big weakness of this analysis is that it’s a small sample size. Sure, the Dow dates back to 1896, but that’s not that many decades to work with.

The average decade gain for the Dow is 124.4% (through the end of last year).

This is what the average decade has looked like for the Dow (set to 100 on January 1 of the first year).

-

Morning News: September 10, 2019

Eddy Elfenbein, September 10th, 2019 at 7:30 amChina Scraps Foreign Investment Limit in Stock, Bond Markets

China’s Pork Prices Soar, Adding to Beijing’s Troubles

Singapore Economy Shows Some Signs of Hope as Trade War Drags On

U.S. States Launch Antitrust Probe of Google, Advertising in Focus

Juul Illegally Marketed E-Cigarettes, F.D.A. Says

Subduing the Housing Godzillas

WeWork Reportedly Pressured by SoftBank to Shelve IPO

Elliott Appears to Revert to Old Form in Taking On AT&T

Jack Ma Ends 20-Year Reign Over Alibaba Wealth Creation Empire

Alibaba’s New Chairman Says He Has to Reinvent Retail Before Someone Else Does

‘Target Circle’ Loyalty Program Going Nationwide in October

PG&E Plan Offers Nearly $18 Billion to Wildfire Victims and Public Entities

The Best and Worst Case Scenarios for Bonds from Here

Joshua Brown: The Ancient Relationship Between Financial Advice and FinTech & CX

Roger Nusbaum: 25% In One Alternative? No & Don’t Underestimate The Sleep Factor

Be sure to follow me on Twitter.

-

Morning News: September 9, 2019

Eddy Elfenbein, September 9th, 2019 at 7:48 amRussia’s Massive Gold Stash Is Now Worth More Than $100 Billion

China Has Added Nearly 100 Tons of Gold to Its Reserves

Apple, Foxconn Broke a Chinese Labor Law to Build Latest iPhones

U.S. States Kick Off Antitrust Probe Expected to Focus on Google

How Each Big Tech Company May Be Targeted by Regulators

A Manufacturing Recession Could Cost Trump a Second Term

The World Wastes Tons of Food. A Grocery ‘Happy Hour’ Is One Answer.

Amazon’s Effort to Recruit 30,000 Workers Collides With Saturated Job Market

Volkswagen Hopes Fresh Logo Signals an Emission-Free Future

There Will Be Blood: How a Manhattan Scion Built a Rural Empire

Nearly All British Airways Flights Canceled as Pilots Go on Strike

JPMorgan Creates ‘Volfefe’ Index to Track Trump Tweet Impact

Jeff Miller: Is it Time to Worry about Crowded Trades?

Howard Lindzon: Momentum Monday – Sneaky Good

Jeff Carter: Tech in The Classroom

Be sure to follow me on Twitter.

-

August Jobs Report: NFP +130K, 3.7%

Eddy Elfenbein, September 6th, 2019 at 8:34 amThe August jobs report is out. The U.S. economy created 130,000 net new jobs last month. The unemployment rate stayed at 3.7%.

Average hourly earnings rose 11 cents to $28.11 per hour. That’s an increase of 0.4%, and up 3.2% in the last year.

There were some revisions to the NFP data. June was revised lower by 15,000 and July was down 5,000.

Within the job gains, the Census Bureau added 25,000 jobs while manufacturing added 3,000 jobs. The Labor Force Participation Rate rose to 63.2% from 63%.

-

CWS Market Review – September 6, 2019

Eddy Elfenbein, September 6th, 2019 at 7:08 am“An economist is an expert who will know tomorrow why the things he predicted yesterday didn’t happen today.” – Laurence J. Peter

Wall Street seems to be in a better mood recently, though we can’t say how long that will last. This week, we got some positive economic news. It seems that the recession, which was so certain to arrive any moment, has decided to stay away. At least for the time being.

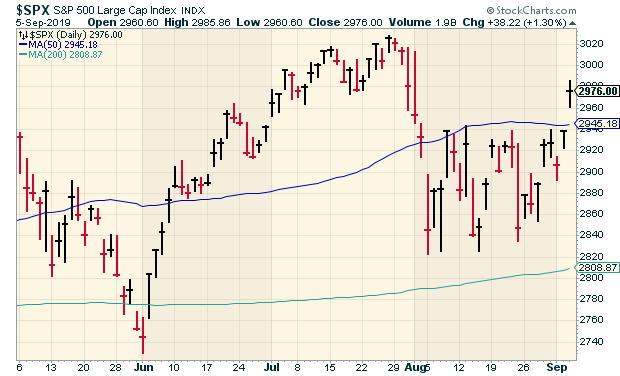

The S&P 500 gapped above its 50-day moving average, which is a key technical sign. On Thursday, the index closed at its highest level since July 31 (the day of the Fed’s rate cut). Just a few weeks ago, everyone was so nervous. Today, we’re less than 2% away from a new all-time high. I’m reminded of the great Jesse Livermore quote: “It never was my thinking that made the big money for me. It always was my sitting.”

In this issue, I want to discuss where we are with the economy and the overall market. It looks like the Fed is about to give us another interest rate cut in a few days. Also in this issue, I’ll look at the recent earnings report from Smucker. The jelly folks disappointed Wall Street—and me. Apparently, their pet-food business hasn’t been so strong. Still, I don’t think the damage was that bad.

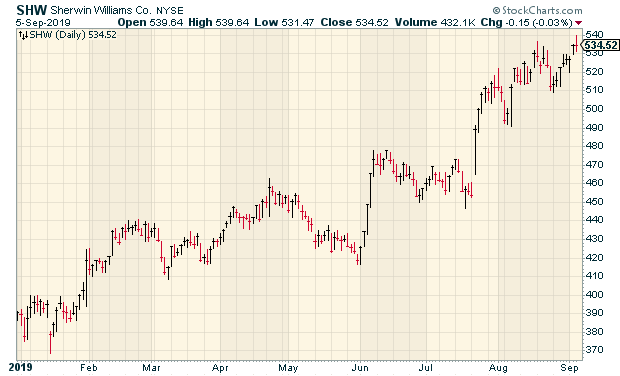

I’ll also fill you in on the latest at Church & Dwight, plus I’m raising our Buy Below for Sherwin-Williams. There’s a lot to get to this week, so let’s jump right in and see how the U.S. economy is faring.

Chill Out, We’re Not in a Recession. At Least Not Yet.

The mindset on Wall Street has changed dramatically this year. Only a few months ago, investors expected the Fed to continue raising interest rates. The Fed even said that’s what it was planning to do. Now we’ve had an interest-rate cut—the first in over a decade—and it looks like more are on the way.

The futures market currently thinks there’s a 96% chance the Fed will cut rates at its meeting on September 18. Some folks even thought the Fed would go with a 0.5% cut, but that seems like it’s off the table.

In late July and early August, Wall Street got spooked by more talk of a trade war between the U.S. and China. President Trump had announced more tariffs, and China responded by letting its currency fall. Wall Street got scared. The S&P 500 hadn’t had a drop of more than 2.5% all year. Suddenly we had three such days in less than three weeks. In six trading days, the Volatility Index doubled. Then came the really big news: the yield curve inverted for the first time in 12 years.

In the newsletter, I tried to caution you that the economy isn’t in danger of a recession just yet. Consumer spending is holding up well, and the housing market is slowly expanding. As long as you have those in your corner, the damage can only be so bad.

This week, we got more news that the economy is doing fine. On Thursday, the ISM Non-Manufacturing Index rose to 56.4. That was above expectations of 53.8, and it was an impressive bounce back from a low reading for July. This week’s durable-goods order was also pretty good, and consumer confidence beat expectations.

Those were the positives. One weak spot was the August ISM Manufacturing Index which came in at 49.1. This is just for the factory segment of the U.S. economy. Any number below 50 means the factory sector is contracting. This is the first time we’ve had a sub-50 number in three years. (If you recall, the economy had a minor pause in 2016, but not enough to fall into recession. In the last issue of CWS Market Review, I talked about the growing gap within the economy. Specifically, consumers are healthy, while many businesses aren’t.

We saw evidence during the recent earnings season. Now that we have some distance from it, I want to discuss the second-quarter earnings season in greater detail because it turned out to be better than it could have been. There was a time when Wall Street was expecting to see a slight earnings decline. The latest numbers from S&P show that earnings for Q2 were up nearly 5% from a year ago. That’s not a lot, but it is positive.

The end of Q3 is not far away, and estimates for Q3 have been getting pared back which is common just ahead of earning season. Wall Street now expects a decline of 0.7%. Once the results are in, I wouldn’t be surprised to see another increase.

For all of 2019, Wall Street expects the S&P 500 to have earnings of $162 (that’s the index-adjusted number). For 2020, the Street is looking for earnings of $181. That means that the S&P 500 is currently going for 16.4 times next year’s earnings estimate. Assuming the estimate is anywhere close to accurate, that means the market is probably fairly valued. I just don’t see any evidence that we’re in a stock bubble.

When interest rates go so low, that helps the case for higher stock prices. This is for two main reasons. The first is that it cuts interest expenses for companies which makes their debt load easier to bear. The other reason is that it makes bonds tougher competition for stocks. As a result, stocks need to rally to keep up.

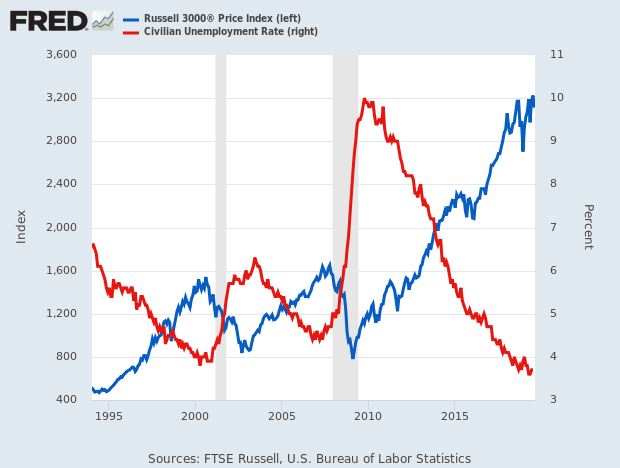

This week I did some research looking at how stocks and bonds match up against each other depending on the yield on the 10-year Treasury Inflation-Protected bond. Basically, 0.50% is the tipping point. Above that, bonds beat stocks. Below that, stocks crush bonds. It makes perfect sense. The yield is currently at 0.01%. In other words, bond yields are so dirt cheap right now that you have no choice but to own stocks.

Within the market, however, is another story. I still think the trend in favor of low volatility and defensive stocks is intact. Investors should pay attention to consumer staples and stocks with rich dividends. A solid stock like AFLAC (AFL) now has a dividend yield that’s 58 basis points higher than the 10-year Treasury. That’s a deal that’s hard to turn down.

Overall, our Buy List is having a very good year (+22.89%!!), but not all our stocks are rallying. Let’s take a look at the soggy earnings report from Smucker.

Smucker’s Earnings Fall Flat

On August 27, JM Smucker (SJM) released its fiscal Q1 earnings data, and it wasn’t good news. Comparable net sales fell 4%, and earnings fell 11% to $1.58 per share. That was 16 cents below expectations.

The company was hurt by poor sales of its pet-foods business. Smucker owns Milk Bone and Meow Mix. In recent years, the company has been working to build up this business. That’s why they bought Ainsworth, but the competition has been stronger than they thought. Management has conceded the difficulties in this sector. Smucker’s coffee business was weak last quarter as well.

“Our first quarter performance fell short of our expectations primarily due to the timing of shipments and deflationary pricing in the coffee and peanut butter categories, as well as competitive activity in the premium-dog-food category,” said Mark Smucker, Chief Executive Officer.

“We have continued momentum in many key product categories, and we are already taking decisive actions and prioritizing initiatives that strengthen our business. We remain confident in our strategy, which includes a continued focus on our growth imperatives to lead in the best categories, build brands consumers love, and be everywhere, combined with a relentless focus on operating with financial discipline, all of which will enhance shareholder value for the long term.”

Smucker also lowered guidance. Previously, the company was expecting sales to rise by 1% to 2%. Now they expect sales to be flat to -1%. Smucker had been expecting earnings of $8.45 to $8.65 per share. Now they see earnings of $8.35 to $8.55 per share. That’s a reduction of 10 cents at both ends, which is a little more than 1%. That’s actually not so terrible.

After the earnings came out, the shares took an 8% hit, but SJM appears to have stabilized. Still, I’m not happy with these results. This week, I’m dropping my Buy Below on Smucker to $112 per share.

There’s not much in the way of earnings for the next few weeks, but I want you to know what to expect. FactSet (FDS) is due to report its fiscal Q4 results on September 26. Then, RPM International (RPM) will release its fiscal Q1 report on October 2. Those are the only two Buy List earnings reports we’ll see until Q3 earnings season begins in mid-October. The next five weeks will be very quiet on the earnings front.

On Thursday, shares of Church & Dwight (CHD) dropped about 3.3% after an investment firm came out with a negative piece on the consumer-products company. I won’t address the specifics of their allegations, but I’ll note that these things happen every so often. The stock price often takes a hit in the short term. Frankly, I’m not worried about Church & Dwight. CHD remains a buy up to $82 per share.

Before I go, I also want to raise my Buy Below price for Sherwin-Williams (SHW). When the paint people beat earnings in July, I raised my Buy Below price. Sherwin beat estimates by 20 cents per share. The stock started to rally and has continued climbing. On Thursday, SHW reached an intra-day high of $539.64 per share. We now have a 35.8% gain in this stock in 2019. This week, I’m lifting our Buy Below on Sherwin-Williams to $550 per share. I’m very happy with how this stock has bounced back after taking a big tumble late last year. I hope SJM recovers like that.

That’s all for now. The big August jobs report is due out later today. There are a few economic reports to look out for next week. On Wednesday, the government will release the latest report on consumer prices. Inflation has remained tame so far this year. Let’s hope that continues. Perhaps the most important report will come on Friday with the release of the retail-sales report. The last report was pretty good, and consumer spending has held up well. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Morning News: September 6, 2019

Eddy Elfenbein, September 6th, 2019 at 7:04 amNo Place Like Home: Chinese Firms Stung By Trade War Build Up Domestic Brands

China Ratchets Up Stimulus, Cutting Reserve Ratio to Lowest Level Since 2007

Trump Administration Wants To Privatize Fannie Mae and Freddie Mac

States to Launch Google, Facebook Antitrust Probes

Ray Dalio Sees 25% Chance of Recession This Year and in 2020

Slack Intensifies a War of Words

NYC Sues T-Mobile Over ‘Pervasive’ Illegal Sales Tactics

Why WeWork’s IPO Struggles Could Hurt

Telenav Tries to Reassure Investors After Stock Plummets 45% on GM-Google Deal

Volkswagen’s Road to Riches or Ruin Starts in This Factory

How High Tech Is Changing One of the Oldest Jobs: Farming

More Broken Promises at Sears as Layoffs and Store Closures Top Original Projections

Why Do Countries Borrow in Foreign Currency?

Ben Carlson: Debunking the Silly “Passive is a Bubble” Myth

Joshua Brown: Investors Beating Workers in Trump’s Economy, Same As It Ever Was

Be sure to follow me on Twitter.

-

Out of Bonds and Into Stocks

Eddy Elfenbein, September 5th, 2019 at 11:10 amInteresting day on Wall Street so far. This morning, we learned that the ISM Non-manufacturing figure for August rose to 56.4.

In other words, you can put those recession plans on hold. For now.

The response is that bonds are falling sharply and stocks are rising. Not all stocks; Defensive stocks aren’t doing much while Cyclicals are up a lot.

The S&P 500 High Beta index is up about 3% while the S&P 500 Low Vol index is flat.

The S&P 500 opened up above its 50-day moving average. It may not be a breakout, but it sure looks like one.

-

Morning News: September 5, 2019

Eddy Elfenbein, September 5th, 2019 at 7:11 amU.S. Imposes Duties on Structural Steel from China, Mexico

China, U.S. to Hold Trade Talks in October as Mistrust Remains

After 32 Rate Cuts in 2019, Traders Say Many More Are Coming

Is the U.S. Ready to Rein in Big Tech?

CVS-Aetna Merger Wins Antitrust Approval From Judge

Nissan Chief Hiroto Saikawa Confirms He Was Improperly Overpaid

In U-turn, Ford Ditches Plan to Unify China Sales System After Partners Push Back

Gold Could Soar to Its Highest Level Since 2013 if the Fed Keeps Cutting Rates

Palo Alto Networks Intends to Acquire Zingbox for $75 Million

Slack Shares Plunge Despite Raising Full-Year Outlook

Millennials are Taking Over Fashion, Too

A Nobel-Winning Economist Goes to Burning Man

Ben Carlson: Re-Framing the Next Downturn

Michael Batnick: Animal Spirits: Who Are the Losers? & The Cost of Doing Parenting Business

Roger Nusbaum: A Look at a Talebian Asset Allocation

Be sure to follow me on Twitter.

-

Remarkable Stat

Eddy Elfenbein, September 4th, 2019 at 4:44 pmI was messing around with some data today and I found out a remarkable stat.

When the 10-year TIPs yield is 0.50% or higher, the Long-Term Bond ETF (TLT) outperforms the S&P 500 ETF (SPY) by 6.97% on an annualized basis.

When the TIPs yield is 0.49% or lower, the SPY beats the TLT by 26.46% annualized.

I used data going back to the beginning of 2003. Right now, the 10-year TIPs yields -0.03%.

-

Morning News: September 4, 2019

Eddy Elfenbein, September 4th, 2019 at 7:16 amLabor Pains: Japanese Jobs for South Korean Graduates Dry Up Amid Trade Row

Walmart’s CEO Steps Into the Gun Debate. Other CEOs Should Follow.

Fed’s Rosengren Sees ‘No Immediate’ Easing Needed

Dudley: What I Meant When I Said ‘Don’t Enable Trump’

10-year Treasury Yield Dives to 3-year Low After Manufacturing Sector Contracts in August

Google Target of New U.S. Antitrust Probe by State Attorneys General

Is One of the World’s Biggest Lawsuits Built on a Sham?

Cathay Pacific’s Chairman Resigns as China Pressures Hong Kong Business

OxyContin Maker Prepares ‘Free-Fall’ Bankruptcy as Settlement Talks Stall

Porsche Unveils Its First-Ever Electric Car

Ben & Jerry’s New Ice Cream Flavor Takes Aim At Racism In The Criminal Justice System

Acclaimed ‘Lehman Trilogy’ to Move to Broadway

Nick Maggiulli: The Best Way to Consume Information

Cullen Roche: EVERYONE Funds Their Spending

Joshua Brown: Chart o’ the Day: Where the Bears Are in Trouble

Be sure to follow me on Twitter.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His