Archive for October, 2019

-

Morning News: October 24, 2019

Eddy Elfenbein, October 24th, 2019 at 7:35 amMario Draghi is Leaving the ECB: Here Are the Key Moments of His 8-year Reign

Germany’s Factory Recession Sends Industry Employment Plunging

C.E.O. Confidence Is Collapsing. That Could Hurt Stocks.

The Permian Basin Is Facing Its Biggest Threat Yet

Twitter Stock Plunges as Quarterly Sales and Forecast Disappoint Wall Street

One Family Built Forever 21, and Fueled Its Collapse

Tesla Shares Soar 21% as Surprise Profit Answers Skeptics

Nokia Shares Slide as 5G Troubles Prompt a Profit Warning

A Lafite From China? This $300 Wine Is the Real Thing

Hyundai Targets EV Sales of Over Half a Million by 2025, Posts Disappointing Third-Quarter

Facebook’s Zuckerberg, Accused of Lying, Withstands a Washington ‘Beating’

Animal Spirits: The Least Happy Age & Why the IPO Market is Different This TIme

Michael Batnick: Where’s the Buyback Beef?

Jeff Carter: 3 Legs of The Stool

Joshua Brown: Private Markets Look Like the Dumb Money Now

Be sure to follow me on Twitter.

-

Globe Life Beats Earnings

Eddy Elfenbein, October 23rd, 2019 at 5:23 pmAfter the bell, Globe Life (GL) reported Q3 net operating income of $1.73 per share, compared with $1.59 per share for the year-ago quarter. Wall Street had been expecting $1.69 per share. Here are some highlights:

• Net income as an ROE was 12.0%. Net operating income as an ROE excluding net unrealized gains on fixed maturities was 14.7%.

• Life underwriting margin at Liberty National Exclusive Agency and American Income Exclusive Agency increased over the year-ago quarter by 12% and 9%, respectively.

• Health underwriting margin at Family Heritage Exclusive Agency increased over the year-ago quarter by 12%.

• Life premiums increased over the year-ago quarter by 7% at American Income Exclusive Agency and health premiums increased over the year-ago quarter by 7% at both Family Heritage Exclusive Agency and American Income Exclusive Agency.

• Life net sales at Liberty National Exclusive Agency and American Income Exclusive Agency increased over the year-ago quarter by 12% and 9%, respectively.

• 932,946 shares of common stock were repurchased during the quarter.

-

Morning News: October 23, 2019

Eddy Elfenbein, October 23rd, 2019 at 7:06 amTrouble Brews for American Companies That Gorged on Cheap Credit

The Stock Market Has a Lot of Money Riding on the 2020 Election

Google Claims a Quantum Breakthrough That Could Change Computing

Huawei Launches Foldable Phone in China at Prices Starting from $2,400

Verizon To Offer Customers A Year of Disney+ For Free, Upstaging Quibi’s T-Mobile News

How Biogen Salvaged Alzheimer’s Drug After a Costly Failure

Zuckerberg to Admit that Facebook Has Trust Issues

China Factory Production Key as Tesla Reports Third-Quarter Results

WeWork Staff, Facing Job Cuts, Express Outrage at Founder Payout

Boeing Ousts Top Executive as 737 Max Crisis Swells

Datsun Brand Set to Go as Nissan Rolls Back Ghosn’s Expansionist Strategy

Johnson & Johnson CEO Testified Baby Powder Was Safe 13 Days Before FDA Bombshell

Nick Maggiulli: Escape the Fee Prison Now

Michael Batnick: Uncomfortable Reading

Cullen Roche: No One Knows What Individual Stocks are Actually Worth

Be sure to follow me on Twitter.

-

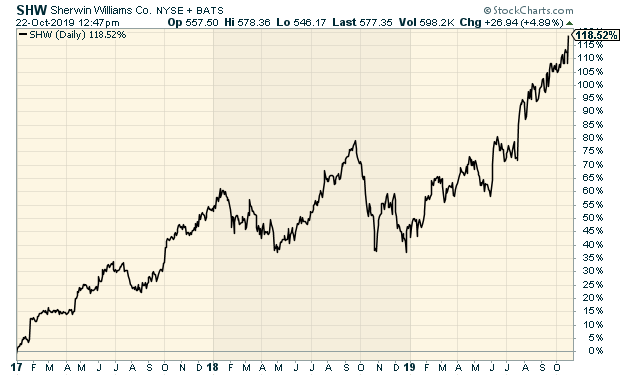

Sherwin-Williams Beats and Raises Guidance

Eddy Elfenbein, October 22nd, 2019 at 12:42 pmThis morning, Sherwin-Williams (SHW) posted Q3 adjusted earnings of $6.65 per share. That beat Wall Street’s estimates of $6.48 per share. The shares are up about 5% today.

This was a very good quarter for Sherwin. The CEO said:

“Sherwin-Williams delivered strong results in the quarter as adjusted earnings per share increased 17.1% year-over-year to $6.65. Our performance in the quarter was driven by continued strength in North American architectural paint markets, which offset choppiness in some industrial end markets. U.S. and Canada same store sales growth was 8.1% as our pro painting customers continued to report strong demand. As a result of this strong volume and operating efficiencies, consolidated gross margin expanded over 300 basis points to 45.7%. Adjusted EBITDA margin in the quarter improved 150 basis points to 18.9% compared to the prior year.

“For the second consecutive quarter, all three operating segments increased segment profit and margin compared to the same period last year. In The Americas Group, our North American paint stores generated strong growth in all regions and all customer end markets, led by double digit growth in residential repaint. With the strong volume, the team delivered incremental operating margin of approximately 37%, and we have opened 31 net new stores year to date.

Segment profit in The Americas Group increased $85.9 million to $663.7 million in the quarter and increased $122.1 million to $1.61 billion in nine months due primarily to higher paint sales volume and selling price increases.

Sherwin is increasing its full-year guidance range to $20.90 – $21.30 per share. The previous range was $20.40 to $21.40 per share. Since Sherwin has already made $16.83 per share for the first nine months of this year, the new range implies Q4 earnings of $4.07 to $4.47 per share.

SHW is up 118% for us since we first added it to the Buy List in 2017.

-

Morning News: October 22, 2019

Eddy Elfenbein, October 22nd, 2019 at 7:34 amHalf the World’s Banks Are Too Weak to Survive a Downturn, McKinsey Says

Chinese Vice Foreign Minister Says Progress Made in Trade Talks With U.S.

Biogen Surges as Momentum for Alzheimer’s Treatment Revives Hope

Boeing’s Crisis Grows: Tense Meetings, Falling Stock, Angry Lawmakers

Macy’s, Home to $8,000 Mink Jackets, Will Stop Selling Fur Products By 2021

Facebook Lays On the Charm for Its Libra Cryptocurrency Plan

WeWork Considers Rescue Plans From SoftBank and JPMorgan

How A Major U.S. Farm Lender Left a Trail of Defaults, Lawsuits

Diaper Rush: Conquering a $9 Billion Market No One Wants to Talk About

UPS Strikes Agreements to Use Drones to Deliver Medical Supplies

Infosys Dives Most in Two Years As Whistle-Blowers Target CEO

Ben Carlson: 9 Questions I’m Pondering at the Moment & What Does the Future Hold For CFA Charterholders?

Roger Nusbaum: Habits Make The Investor & Financial Stress Will Kill Us

Howard Lindzon: Momentum Monday – Housing Stocks and Verizon…Barf

Be sure to follow me on Twitter.

-

Danaher Is Selling Some Business Ahead of Biopharma Deal

Eddy Elfenbein, October 21st, 2019 at 1:13 pmThe following is a press release from Danaher (DHR) announcing that it’s selling some businesses ahead of its acquisition of GE’s Biopharma business. They expect the deal to close in Q1 of 2020.

Danaher Corporation (DHR) today announced that it has signed an agreement to sell its label-free biomolecular characterization, chromatography hardware and resins, and microcarriers and particle validation standards businesses to Sartorius AG for approximately $750 million. The combined revenue of the businesses, which are part of Danaher’s Life Sciences segment, was approximately $140 million in 2018.

Danaher entered into the agreement to sell these businesses as a step towards obtaining regulatory approval for its pending acquisition of the GE Biopharma business, and the closing of the Sartorius AG agreement is conditioned upon Danaher’s closing its acquisition of the GE Biopharma business. Danaher’s acquisition of the GE Biopharma business, the proposed regulatory remedies (the package of businesses being sold), the approval of Sartorius as the buyer in such remedies, and Sartorius’ acquisition described above all remain subject to approvals from various regulatory authorities.

Thomas P. Joyce, Jr., President and Chief Executive Officer, stated, “This represents a significant step in the regulatory process toward closing the GE Biopharma acquisition. While timing around meeting all closing conditions, including regulatory approvals, is still uncertain, we remain very encouraged by the progress to date and expect closing of the transaction in the first quarter of 2020.”

-

Morning News: October 21, 2019

Eddy Elfenbein, October 21st, 2019 at 7:31 amThese 20 Countries Will Dominate Global Growth in 2024

JPMorgan Warns U.S. Money-Market Stress Likely to Get Much Worse

How Exploding Private Sector Balance Sheets Have Changed Recessions As We Know Them

In a Strong Economy, Why Are So Many Workers on Strike?

Estate Taxes Are Easy to Flee, but They Still Help States

Boeing Expresses Regret Over Ex-Pilot’s 737 MAX Messages, Faults Simulator

Facebook Open to Currency-Pegged Stablecoins for Libra Project

G.M. Contract Terms May Be a Tougher Fit for Its Rivals

Online Influencers Tell You What to Buy, Advertisers Wonder Who’s Listening

Halliburton Profit Falls 32% on Weak North America Drilling

Behind Ken Fisher’s Ads, a Hardball Culture Reels in Billions

Goldman’s Unwelcome Streak: A String of Insider Trading Charges

Cullen Roche: Three Things I Think I Think – What if it All Comes Crashing Down?

Jeff Miller: Weighing the Week Ahead: Earnings Season Opportunity?

Joshua Brown: How Narrative Economics Shape Our World – Barry Talks with Robert Shiller

Be sure to follow me on Twitter.

-

CWS Market Review – October 18, 2019

Eddy Elfenbein, October 18th, 2019 at 7:08 am“There is nothing more deceptive than an obvious fact.” – Sherlock Holmes

This week, our two Buy List bank stocks rallied after reporting better-than-expected earnings. Signature Bank gained 1.9%, and Eagle Bank rose 1.4%. At one point, Eagle was up more than 11% on the day.

I’m especially glad to see good news from Eagle after the stock got a super-atomic wedgie three months ago. Shares of EGBN are now up 16% off their low, yet the stock is still trading at less than 10 times this year’s earnings. I’ll have all the details in a bit.

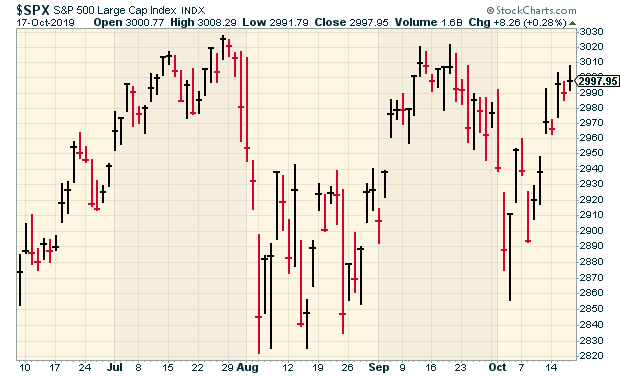

On Thursday, the S&P 500 came close to finishing above 3,000 for the first time in a month, but it fell just shy. Over four scary trading days this summer, the index dropped 5.5%, and we’ve nearly made it all back.

In this week’s CWS Market Review, I’ll go over our two Buy List earnings reports for this week. I’ll also preview the reports we have coming next week. It’s going to be a busy week for us. We have seven Buy List stocks due to report, including five on Thursday. I’ll break it all down for you. But first, let’s look at look at our Q3 earnings calendar.

Q3 Earnings Calendar

Here’s a table of the 20 Buy List stocks that are reporting this earnings season (the other five don’t follow the March/June/September/December cycle). I’ve included each stock’s earnings date, Wall Street’s consensus and the actual results. Please note that not all the dates are out, and the earnings consensus may change.

Company Symbol Date Estimate Results Eagle Bancorp EGBN 16-Oct $1.07 $1.08 Signature Bank SBNY 17-Oct $2.70 $2.75 Sherwin-Williams SHW 22-Oct $6.48 Globe Life GL 23-Oct $1.69 AFLAC AFL 24-Oct $1.07 Cerner CERN 24-Oct $0.66 Danaher DHR 24-Oct $1.15 Hershey HSY 24-Oct $1.60 Raytheon RTN 24-Oct $2.86 Check Point Software CHKP 28-Oct $1.40 Stryker SYK 29-Oct $1.90 Cognizant Technology Solutions CTSH 30-Oct $1.05 Moody’s MCO 30-Oct $1.99 Church & Dwight CHD 31-Oct $0.61 Intercontinental Exchange ICE 31-Oct $0.94 Becton, Dickinson BDX 5-Nov $3.31 Fiserv FISV 6-Nov $0.97 Disney DIS 7-Nov $0.95 Broadridge Financial BR TBA $0.72 Continental Building Products CBPX TBA $0.39 Earnings from Eagle and Signature

Three months ago, shares of Eagle Bancorp (EGBN) plunged after the bank reported higher legal costs. Unfortunately, Eagle couldn’t say much because it’s an ongoing investigation. However, Eagle made it clear that it would have no impact on their operations.

On Wednesday, we learned that that appears to be correct. Eagle reported net income of $36.5 million for its third quarter. That’s down 6% from a year ago. That works out to $1.07 per share. Excluding two non-recurring items, Eagle made $1.08 per share. That beat Wall Street’s consensus by a penny.

Those aren’t bad numbers, especially considering the low interest rates and flat yield curve. Remember that a bank is basically the yield curve with incorporation papers. The key stat for any bank is net interest margin. For Q3, Eagle’s net interest margin was 3.72%.

Susan Riel, Eagle’s CEO, said, “We continue to see good lending opportunities and have worked to attract more deposits to fund those loans and to bring down the loan-to-deposit ratio at third quarter-end 2019 compared to second quarter-end 2019. Furthermore, by sustaining favorable operating leverage, we maintain strong profitability while rates remain very low, and we stay well positioned when interest rates begin moving back to more normalized levels, given the degree of variability in our asset pricing.”

Nonperforming loans are just 0.66% of total assets. Another key stat for any bank is the efficiency ratio. That’s the ratio of non-interest expense to total revenue. For Q3, Eagle’s efficiency ratio was 38.34%. That’s pretty good. Earlier this year, Eagle snapped its ten-year streak of quarterly earnings growth.

Now for the important concern, which is legal costs. For Q3, Eagle has legal bills of $3.6 million. That’s up from $2.1 million a year ago. Of course, that’s due to the investigation that the bank mentioned this summer. All Eagle could say is that they expect “elevated” levels of legal costs for the rest of this year.

Overall, Eagle Bancorp is making do in a difficult environment. The stock is going for just under 10 times this year’s earnings estimate. Eagle remains a buy up to $47 per share.

On Thursday, Signature Bank (SBNY) reported Q3 earnings of $2.75 per share. That was five cents better than expectations.

Total deposits now stand at $39.06 billion. That’s an increase of 8.2% over the last year. I like that non-accrual loans are just 0.09% of total loans, and if you exclude taxi-medallion loans, then it’s just 0.06%. Net interest margin on a tax-equivalent basis is just 2.68%.

During Q3, Signature bought back 630,000 shares of stock for $75 million. There’s still more than $300 million left in its current authorization.

Signature got off to a great start for us this year. It became a 30% winner in just six weeks. Since then, it’s been lagging, but SBNY has picked up some recently. On Thursday, shares of Signature gained 1.9% after the earnings report. Signature Bank remains a buy up to $130 per share.

Preview of Next Week’s Earnings

We have seven Buy List stocks due to report earnings next week. Let me run down what to expect.

Sherwin-Williams (SHW) has been an outstanding stock for us. It’s up 42% this year. Three months ago, Sherwin made $6.57 per share, which beat estimates by 20 cents per share. On Tuesday, Sherwin is due to report its Q3 earnings.

For this year, Sherwin expects earnings between $20.40 and $21.40 per share. That’s very doable. The company has already made $10.17 per share for the first half of the year. For Q3, Wall Street expects $6.48 per share.

On Thursday, the shares made another new high. Sherwin is currently trading above my $550 Buy Below price, so don’t chase it. I may raise our Buy Below next week, but I want to see the earnings numbers first.

On Wednesday, it’s Globe Life’s (GL) turn. This will be the first earnings report under its new name. Previously, the company was known as Torchmark. For Q2, GL earned $1.67 per share, which was two cents ahead of estimates.

For 2019, Globe Life sees net operating income per share between $6.67 and $6.77. The current price is around 14 times that. For Q3, Wall Street expects $1.69 per share.

Thursday will be a busy day. We have five Buy List earnings reports coming out.

Three months ago, AFLAC (AFL) said they made $1.14 per share for Q2. Forex knocked off a penny per share. The CEO said the duck stock aims to buy back $1.3 to $1.7 billion worth of stock this year.

AFLAC didn’t exactly raise guidance, but they said that earnings should come in at the higher end of their current range which is $4.10 to $4.30 per share. That’s based on an average exchange rate of 110.39 yen to the dollar. For Q3, the consensus on Wall Street is for earnings of $1.07 per share.

Cerner (CERN) has been somewhat weak since the summer, but that could change soon. The healthcare-IT firm said it expects Q3 earnings of 65 to 67 cents per share. I think they can beat that. For the full year, Cerner sees earnings between $2.64 and $2.72 per share.

For Q2, Cerner said that bookings came in at $1.432 billion, which was the high end of its range. Revenue rose 5% to $1.431 billion. Earlier this year, Cerner reached an agreement with Starboard Value to start paying a dividend and increase its buyback authorization by $1.5 billion. The current yield is a little bit over 1%.

Danaher (DHR) sees Q3 earnings ranging between $1.12 and $1.15 per share. For the full year, the company projects earnings between $4.75 and $4.80 per share.

Earlier this year, Danaher had been expecting 2019 earnings of $4.75 to $4.85 per share, but they lowered guidance due to share dilution for the GE Biopharma deal. That deal should close sometime in Q4. Last month, Danaher IPO’d Envista (NVST), which was their dental business. Danaher still holds a large stake in the company.

Shares of Hershey (HSY) had a quick downturn last month. The stock dropped seven times in eight sessions for a total loss of 8.3%. Fortunately, HSY has stabilized recently.

Hershey had a very good quarter for Q2, but guidance wasn’t as much as I hoped for. The chocolatier currently expects 2019 earnings of $5.68 to $5.74 per share. For Q2, Hershey beat the Street by 14 cents per share, yet it only raised the low-end of its guidance by five cents. I thought that was odd. For Q3, Wall Street expects earnings of $1.60 per share.

Raytheon (RTN) should be helped by the big defense-spending bill that was recently passed by Congress. For 2019, Raytheon expects sales of $28.6 billion to $29.1 billion and earnings between $11.50 and $11.70 per share. For Wednesday, the consensus is for $2.86 per share.

At some point, shareholders of RTN will get 2.3348 shares of Raytheon Technologies. That’s the name for the combined company with United Technologies (UTX). However, Raytheon Technologies will not include the spinoffs of Otis and Carrier. That’s led to a bit of confusion as to how much those 2.3348 shares are worth. The deal should close in the first half of next year.

That’s all for now. Expect a lot of earnings news next week. There’s also an election in Canada in Monday. On Tuesday, the report on existing-home sales is due out. On Wednesday, there’s a big OPEC meeting. Then on Thursday, the report on durable goods is due out, as is the report on sales of new homes. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Morning News: October 18, 2019

Eddy Elfenbein, October 18th, 2019 at 7:03 amChina’s Economy Slows on Weak Investment, Testing Global Growth

China’s GDP Growth Grinds to Near 30-Year Low as Tariffs Hit Production

Russia’s Thawing Permafrost May Cost Economy $2.3 Billion a Year

After Hemorrhaging $100 Billion, Europe Stages a Comeback

How A Small Aluminum Maker Won U.S. Trade Protection

Defiant Zuckerberg Says Facebook Won’t Police Political Speech

Boeing C.E.O., Already Set for House Hearing, Is Likely to Face Senate, Too

GM Transforms Who Wins, Who Loses in the Future of Work

Credit Suisse to Start Charging Wealthy Clients for Cash Deposits

Juul Halts Online Sales of Some Flavored E-Cigarettes

Johnson & Johnson to Pay $117 Million Over Surgical Device Marketing

Coca-Cola Stock Jumps as Strong Sales of Coke Zero Sugar Continue to Drive Revenue Growth

Ben Carlson: A Eulogy for the 60/40 Portfolio

Michael Batnick: Trading Behavior

Roger Nusbaum: Is The 60/40 Portfolio Really Dead?

Be sure to follow me on Twitter.

Signature Bank Beat Estimates

Eddy Elfenbein, October 17th, 2019 at 11:57 amThis morning, Signature Bank (SBNY) reported Q3 earnings of $2.75 per share. Net interest margin on a tax-equivalent basis was 2.68%. Total deposits rose to $39.06 billion. Wall Street had been expecting $2.70 per share.

Here are some details from the press release:

Net Income for the 2019 Third Quarter Was $148.7 Million, or $2.75 Diluted Earnings Per Share, Versus $155.4 Million, or $2.84 Diluted Earnings Per Share, Reported in the 2018 Third Quarter.

The Bank Declared a Cash Dividend of $0.56 Per Share, Payable on or After November 15, 2019 to Common Stockholders of Record at the Close of Business on November 1, 2019.

During the 2019 Third Quarter, the Bank Repurchased 629,503 Shares of Common Stock For a Total of $75.0 Million. Thus Far, the Bank Has Repurchased $189.7 Million of Common Stock From Its $500 Million Authorization.

Total Deposits in the Third Quarter Grew $1.52 Billion to $39.06 Billion; Total Deposits Have Grown $2.97 Billion, or 8.2 Percent, Since the End of the 2018 Third Quarter. Average Deposits Increased a Record $1.75 Billion in the 2019 Third Quarter.

In Line with the Bank’s Strategy to Increase Floating Rate Assets and Reduce Its Commercial Real Estate Concentration, the Bank Decreased Commercial Real Estate Loans by $873.1 Million. Conversely, Commercial & Industrial Loans Grew by $885.4 Million During the Quarter. Therefore, For the 2019 Third Quarter, Loans Increased $4.9 Million to $37.94 Billion. Since the End of the 2018 Third Quarter, Loans Have Increased 8.0 Percent, or $2.81 Billion.

Non-Accrual Loans Were $32.5 Million, or 0.09 Percent of Total Loans, at September 30, 2019, Versus $41.3 Million, or 0.11 Percent, at the End of the 2019 Second Quarter and $134.2 Million, or 0.38 Percent, at the End of the 2018 Third Quarter. Excluding Taxi Medallion Loans, Non-Accrual Loans Were $22.9 Million, or Six Basis Points of Total Loans.

Net Interest Margin on a Tax-Equivalent Basis was 2.68 Percent, Compared with 2.74 Percent for the 2019 Second Quarter and 2.88 Percent for the 2018 Third Quarter. Core Net Interest Margin on a Tax-Equivalent Basis Excluding Loan Prepayment Penalty Income Decreased Five Basis Points to 2.66 Percent, Compared with 2.71 Percent for the 2019 Second Quarter. Excess Cash Balances From Significant Deposit Flows Lead to Four Basis Points of the Core Net Interest Margin Decline.

Tier 1 Leverage, Common Equity Tier 1 Risk-Based, Tier 1 Risk-Based, and Total Risk-Based Capital Ratios were 9.66 Percent, 11.91 Percent, 11.91 Percent, and 13.16 Percent, Respectively, at September 30, 2019. Signature Bank Remains Significantly Above FDIC “Well Capitalized” Standards. Tangible Common Equity Ratio was 9.51 Percent.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His