CWS Market Review – November 15, 2019

“The best stock to buy may be the one you already own.” – Peter Lynch

On Tuesday, I sent you a special update telling you about the deal to buy out Continental Building Products for $37 per share. This is great news for us, and it’s another nice winner for the Crossing Wall Street Buy List.

In this week’s issue of CWS Market Review, I’ll fill you in on the details. Or at least, the details that we have. The deal will probably take some time to commence. Alas, lawyers and regulators need to get involved.

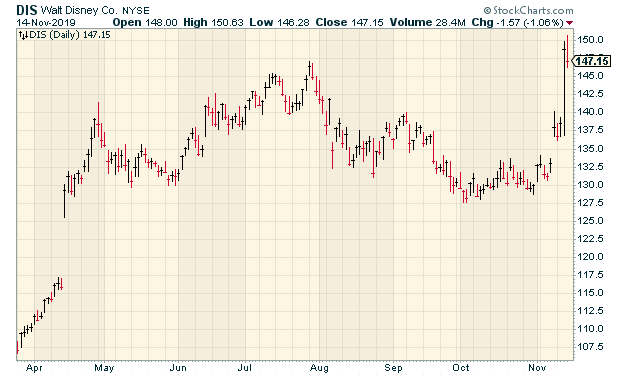

That wasn’t the only good news for us. Disney said that its Disney+ service is off to a big start. They’ve already signed up 10 million subscribers. Shares of Disney popped 7.3% on Wednesday to reach a new 52-week high. I’ll have more on the Mouse in a bit.

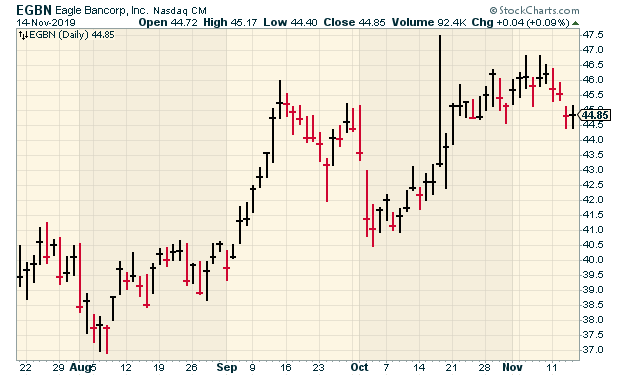

The overall market continues to push through to new highs. The S&P 500 has now rallied 13 times in a seventeen-day stretch. Our Buy List is now up more than 26% on the year. We have three +50% winners, plus two more up over 40%. I’ll also have an update on Eagle Bancorp. But first, let’s look at our big win this week with Continental Building Products.

Continental Building Gets Bought Out for $37 per Share

After the closing bell on Tuesday, Continental Building Products (CBPX) said it’s going to be bought out for $37 per share.

The acquirer is Compagnie de Saint-Gobain S.A., a French multinational. The deal values Continental at $1.4 billion. I’m curious if someone released the news too early, because the shares shot up moments before the closing bell. The final trade was $35.75. That’s a gain of 11.65% for the day. Since early August, CBPX is up 62%.

Don’t expect CBPX to trade at $37 just yet. The companies need to jump over some regulatory hurdles before the deal is complete. Also, shareholders need to sign off on the deal. That shouldn’t be a problem. It’s already been unanimously approved by the company’s Board of Directors.

Unfortunately, the companies haven’t provided much in the way of details. This is from the press release:

Edward Bosowski, Chairman of Continental Building Products and Mr. Bachmann, stated, “Building on our successful accomplishments since 2013, we are pleased to reach this agreement with Saint-Gobain and to provide liquidity, certainty and compelling value to our stockholders. We believe our combined business will be better positioned to enhance our product offerings, customer relationships and operating platform. With our mutual focus on dedicated service to customers and operational excellence, we believe this transaction provides an opportunity to benefit all of our stakeholders.”

Under the terms of the agreement, the Company will be merged with and into a newly-formed subsidiary of Saint-Gobain and each issued and outstanding share of the Company’s common stock will be converted into the right to receive $37.00 per share in cash.

Here’s a cool factoid: Saint-Gobain was founded in 1665. Almost as an afterthought, Continental released its Q3 earnings. Sales fell 2.9% to $127.4 million. Wallboard volume rose by 4.6%, but lower prices caused the revenue decline. For Q3, CBPX earned 39 cents per share. That was two cents below estimates.

What to do now? Just sit tight with this stock. There’s no reason to sell. I’m raising our Buy Below to $37 per share. I want to hear more about a timetable for this transaction. I’m assuming it will be completed sometime in 2020.

Disney Gets 10 Million Subscribers for Disney+

Disney (DIS) did not start out well for us this year. In the March 22 issue of CWS Market Review, I even had a subheading titled “What’s Wrong with Disney?” My conclusion: nothing.

In March, I wrote, “I added Disney to the Buy List at the start of this year, and I’m not sorry I did. The stock, however, is down 1% for us. In fact, the stock is exactly where it was four years ago. I’m not concerned one bit.” The stock is up 36% since then.

Last Thursday, Disney reported very good results for Q3. The company made $1.07 per share, which was 12 cents better than expectations. Revenue also beat expectations.

Then on Tuesday of this week, Disney+ went live. On Wednesday, we learned that Disney has already added 10 million subscribers. As impressive as that is, remember that Disney+ only went live in the U.S., Canada and the Netherlands. The global rollout will last until 2021.

On Wednesday, shares of Disney jumped higher by 7.3% to reach a new 52-week high. That day, Disney accounted for 75% of the Dow’s gain. The company said its goal is to have 60 million to 90 million subscribers by 2024. I’m lifting our Buy Below on Disney to $152 per share.

Some Details on Eagle Bancorp’s Legal Issues

Shares of Eagle Bancorp (EGBN) plunged in July when the bank revealed its large legal bills surrounding unspecified actions. We assumed it had to do with local D.C. city council member, Jack Evans. Eagle couldn’t talk about it since it was an ongoing investigation.

This week, we finally got more details. The Washington Post got a confidential report on the matter. It seems that Evans was involved in a lot of shady dealing, and some of that involved Eagle. However, there don’t appear to be any accusations against the bank. Ron Paul, Eagle’s former CEO, is mentioned in the report, but Paul declined to comment due to health issues.

The allegations appear to be pretty shady stuff, but nothing that should impact the performance of the bank, outside of legal fees. Paul is no longer with Eagle, and the bank has moved on.

Susan Riel is the new CEO, and this is all she had to say about the mess:

“What we are told is that it may never get resolved. It may just go away and we might not get closure to it. We’ve talked to many people. We are working with a number of attorneys on it, and they have all the experience in the world — and that’s where we are,” Riel said. “We don’t know the answer to that question. I don’t think the government agencies know the answer to that question.”

Eagle is a buy up to $47 per share.

Three More Buy List Earnings Reports This Month

The earnings report from Continental Building was our final Buy List earnings report of this earnings season. Now we’re ready for the earnings reports from our stocks that have quarters ending in October. There are three such stocks on our Buy List.

Ross Stores (ROST) is due to report on Thursday, November 21. Traditionally, Ross likes to give very conservative guidance, which they almost always beat. Sometimes, by a lot.

The October quarter is ROST’s fiscal Q3, and the biggie is Q4 (meaning, November, December and January). For Q3, Ross said it expects comparable-store sales growth of 1% to 2% for Q3 and Q4.

Because of the trade war with China, Ross now sees Q3 earnings of 92 to 96 cents per share. That’s lower than what the Street had been expecting. For Q4, the biggie, Ross sees earnings of $1.20 to $1.25 per share. That adds up to full-year guidance of $4.41 to $4.50 per share. Last year, Ross made $4.26 per share.

Here’s a fact that would surprise a lot of investors. Since the beginning of 2008, Ross has narrowly outperformed Amazon (AMZN), which is some sort of Internet bookseller.

The last earnings report from JM Smucker (SJM) was a dud. The company is due to report on November 22. For the August quarter, comparable net sales fell 4%, and earnings fell 11% to $1.58 per share. That was 16 cents below expectations. Ouch.

What went wrong? The company was hurt by poor sales of its pet-foods business. Smucker owns Milk Bone and Meow Mix. In recent years, the company has been working to build up this business. That’s why they bought Ainsworth, but the competition has been stronger than they thought. Management has conceded the difficulties in this sector. Smucker’s coffee business was weak last quarter as well.

Previously, the company was expecting sales to rise by 1% to 2%. Now they expect sales to be flat to -1%. Smucker had been expecting full-year earnings of $8.45 to $8.65 per share. Now they see earnings of $8.35 to $8.55 per share. Wall Street expects earnings next week of $2.14 per share.

Hormel Foods (HRL) is due to report on November 26. This will be for their fiscal Q4. Like Smucker, this has been a tough year for Hormel. In May, the Spam people lowered their full-year guidance due to African swine fever and other issues. I think that rattled investors.

The August earnings report was a relief, and Hormel stood by its full-year forecast for earnings of $1.71 to $1.85 per share. Since Hormel has already earned $1.33 through the first three quarters, the guidance implies a range for fiscal Q4 of 38 to 52 cents per share. Hormel also sees full-year sales of $9.5 billion to $10 billion.

That’s all for now. There are a few key economic reports coming next week. On Tuesday, the housing-starts report is due out. On Wednesday, the Fed will release the minutes of its October meeting. The minutes could provide clues as to what the central bank currently thinks about the economy and interest rates. On Thursday, the existing-home sales report is due out. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Posted by Eddy Elfenbein on November 15th, 2019 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

- Tweets by @EddyElfenbein

-

-

Archives

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His