Archive for November, 2019

-

Fiserv Earned $1.02 per Share

Eddy Elfenbein, November 6th, 2019 at 4:39 pmFiserv (FISV) earned $1.02 per share for Q3.

“We delivered strong financial and sales results in the third quarter while focusing on providing differentiated value for clients across the new Fiserv,” said Jeffery Yabuki, Chairman and Chief Executive Officer of Fiserv. “Our primary market focus is to enhance the manner in which consumers and business engage in banking, commerce and financial services to produce meaningful value for all of our stakeholders.”

Adjusted revenue increased 5% to $3.62 billion in the third quarter and 4% to $10.73 billion in the first nine months of 2019 compared to the prior year periods.

Internal revenue growth, on a constant currency basis, was 6% in the third quarter, with 7% growth in the First Data segment, 6% growth in the Payments segment and 4% growth in the Financial segment.

Internal revenue growth, on a constant currency basis, was 6% in the first nine months of 2019, with 7% growth in the First Data segment, 5% growth in the Payments segment and 4% growth in the Financial segment.

Adjusted earnings per share increased 17% to $1.02 in the third quarter and 16% to $2.87 in the first nine months of 2019 compared to the prior year periods.

Adjusted operating margin increased 130 basis points to 29.8% in the third quarter and increased 100 basis points to 29.1% in the first nine months of 2019 compared to the prior year periods.

Free cash flow increased 13% to $2.3 billion in the first nine months of 2019 compared to $2 billion in the prior year period.

Actual sales results were up 15% in the quarter and up 8% in the first nine months of 2019 compared to the prior year periods.

The company reinstated its share repurchase program late in the third quarter and repurchased 341 thousand shares in the quarter, and 2 million shares in the first nine months of 2019, for $35 million and $156 million, respectively.

Outlook for 2019Fiserv now expects internal revenue growth of 6% for the full year and expects adjusted earnings per share in a range of $3.98 to $4.02, or growth of 16% to 17% for the period.

“We believe our financial performance along with early synergy benefits should translate to strong full year results and set a foundation for an even better 2020,” said Yabuki.

-

The Market Expects the Fed to Pause

Eddy Elfenbein, November 6th, 2019 at 2:40 pmFed Chairman Jay Powell said that these recent rate cuts are merely “mid-cycle” adjustments. It looks like the market believes him. The Fed may leave interest rates alone for a few months.

According the latest futures prices, the odds of a rate cut next month are just 8%. In fact, the futures market doesn’t see the Fed changing interest rates until July 2020. That’s at the earliest.

Also, the two-year yield has stabilized (kind of) around 1.5% to 1.7%. The two-year can sometimes be a good advanced “tell” of what the Fed will do.

The yield curve is now almost perfectly flat until three years out. After that, it slopes upward.

-

Broadridge Earns 68 Cents per Share

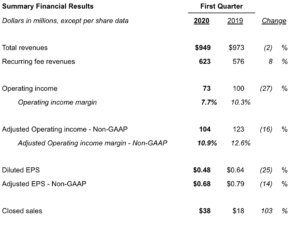

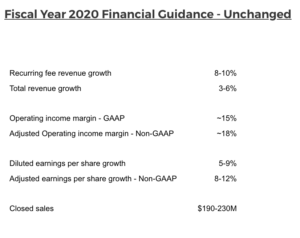

Eddy Elfenbein, November 6th, 2019 at 7:56 amBroadridge Financial Solutions (BR) today reported financial results for the first quarter ended September 30, 2019 of its fiscal year 2020. Results compared with the same period last year were as follows:

“Broadridge reported solid first quarter results and is well-positioned to deliver a strong fiscal year 2020,” said Tim Gokey, Broadridge’s Chief Executive Officer. “Recurring revenues rose 8% and we generated record first quarter Closed sales. We also continued to make targeted M&A investments in each of our core franchises, further positioning us for long-term growth. As expected, event-driven revenues returned to normalized levels from last year’s record first quarter.

“We are reaffirming our fiscal year 2020 guidance, including recurring fee revenue growth of 8-10% and Adjusted EPS growth of 8-12%,” Mr. Gokey added. “Broadridge is well on-track to achieve our three-year objectives laid out at the 2017 Investor Day, including the high end of our Adjusted EPS objectives.”

-

Morning News: November 6, 2019

Eddy Elfenbein, November 6th, 2019 at 7:06 amFrance Is Europe’s New Economic Growth Engine

Ray Dalio Says the ‘World Has Gone Mad’ With So Much Free Money

U.S. Recession Chances Inch Down to 26% Within Next 12 Months

Investors Left Exposed as Trump’s SEC Gives America Inc a Helping Hand

How California Became America’s Housing Market Nightmare

How Is a Wealth Tax Like a Cigarette Tax?

SoftBank Takes a $4.6 Billion Hit From WeWork. Its C.E.O. Remains Defiant.

‘Game-Changer’ Warrant Let Detective Search Genetic Database

Tesla Plans After-Sales Network Expansion in China as Shanghai Factory Spins Up

What A Potentially Private Walgreens Would Mean for Markets

Nick Maggiulli: Realistic Investment Results

Ben Carlson: The Hierarchy of Stock Market Losses

Michael Batnick: “Should We Be Selling Short?”

Roger Nusbaum: Gen-X Has Less Than 10% Of What It Needs For Retirement

Be sure to follow me on Twitter.

-

Becton, Dickinson Beats by a Penny per Share

Eddy Elfenbein, November 5th, 2019 at 11:50 amThis morning, Becton, Dickinson (BDX) reported earnings of $3.31 per share for its fiscal Q4. That beat by a penny per share. Becton now sees revenue growth for next year of 4% to 4.5%, which is 5% to 5.5% on a currency neutral basis. Becton sees 2020 EPS ranging between $12.50 and $12.65. That’s below Wall Street’s forecast of $12.94.

“We are very proud of our accomplishments in fiscal year 2019. Our performance this year demonstrates our ability to overcome multiple headwinds and deliver on our financial and operational goals,” said Vincent A. Forlenza, chairman and CEO. “We enter fiscal 2020 with continued optimism. There are significant opportunities ahead to leverage the capabilities we’ve built to better serve our customers and their patients around the world. It has been a privilege to lead BD and our global team of talented associates. I’m confident that under Tom Polen’s leadership the company will further accelerate its impact as BD enters its next phase of value creation.”

For the year, Becton made $11.68 per share. The shares are down about 3% in today’s trading.

-

Morning News: November 5, 2019

Eddy Elfenbein, November 5th, 2019 at 7:18 amXi Zeroes In on Trump Trade Deal as China Acts to Steady Markets

Companies Cut Back, but Consumers Party On, Driving the Economy

Goldman CEO Sees Small Chance of U.S. Recession

Microsoft Tried a 4-day Workweek in Japan. Productivity Jumped 40%

China’s TikTok Blazes New Ground. That Could Doom It.

How Will Apple, Disney, AT&T and Netflix Retain Streaming Subscribers?

SoftBank Says WeWork Japan Can Become Profitable ‘In Near Future’

Shell to Buy French Offshore Wind-Power Developer

Uber Posts $1.2 Billion Loss as Growth Improves

It’s Back: 8chan Returns Online

Facebook Wants You To Know It Owns Instagram and WhatsApp So It’s Changing Its Logo

Mystery Swiss Trader May Link Insider Groups on Two Continents

Cullen Roche: The Permaeverything Approach

Joshua Brown: Manager of Managers

Jeff Carter: The Health of A Startup Community

Be sure to follow me on Twitter.

-

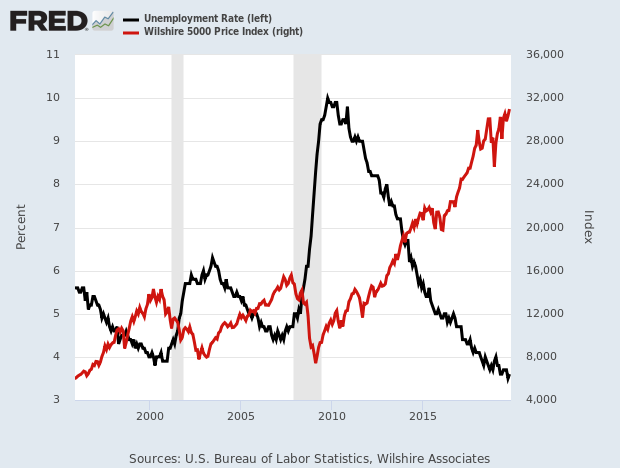

The Stock Market and Unemployment

Eddy Elfenbein, November 4th, 2019 at 9:21 amI thought this was an interesting chart. This is a 24-year look at the stock market (red) and the unemployment rate (black):

-

Stryker to Buy Wright Medical Group

Eddy Elfenbein, November 4th, 2019 at 9:16 amBig news this morning. Stryker (SYK) has agreed to buy Wright Medical Group (WMGI) for $4 billion. Stryker is offering $30.75 for each share of WMGI. That’s nearly a 50% premium to Friday’s closing price.

The deal is expected to close in the second half of next year. Stryker expects the deal to have no impact on its earnings. Stryker looks to open a little lower this morning while Wright looks to open much, much higher.

Here’s the press release:

Stryker (SYK) announced today a definitive agreement to acquire all of the issued and outstanding ordinary shares of Wright Medical Group N.V. (WMGI) for $30.75 per share, or a total equity value of approximately $4.0 billion and a total enterprise value of approximately $5.4 billion (including convertible notes). Wright Medical, which was founded in 1950, is a global medical device company focused on extremities and biologics.

Wright Medical brings a highly complementary product portfolio and customer base to Stryker’s trauma and extremities business. With global sales approaching $1 billion, Wright Medical is a recognized leader in the upper extremities (shoulder, elbow, wrist and hand), lower extremities (foot and ankle) and biologics markets, which are among the fastest growing segments in orthopaedics.

Wright Medical’s leading upper extremity portfolio and advanced preoperative planning technology will significantly add to Stryker’s offering. Additionally, Wright Medical’s lower extremity and biologics will complement Stryker’s portfolio and strengthen the company’s position in this high-growth segment.

“This acquisition enhances our global market position in trauma & extremities, providing significant opportunities to advance innovation, improve outcomes and reach more patients,” said Kevin Lobo, Chairman and Chief Executive Officer, Stryker. “Wright Medical has built a successful business, and we look forward to welcoming their team to Stryker.”

“We believe this transaction will provide truly unique opportunities and will create significant value for our shareholders, customers and employees,” said Robert Palmisano, Executive Director, Chief Executive Officer and President of Wright Medical. “By merging our complementary strengths and collective resources, we will be able to advance our broad platform of extremities and biologics technologies with one of the world’s leading medical technology companies that shares our vision of delivering breakthrough and innovative solutions to improve patient outcomes.”

Under the terms of the agreement, Stryker will commence a tender offer for all outstanding ordinary shares of Wright Medical for $30.75 per share, in cash. The boards of directors of both Stryker and Wright Medical have approved the transaction. The closing of the transaction is subject to receipt of applicable regulatory approvals, the adoption of certain resolutions relating to the transaction at an extraordinary general meeting of Wright Medical shareholders, completion of the tender offer and other customary closing conditions.

The acquisition of Wright Medical is expected to close in the second half of 2020 and is expected to have no impact to Stryker’s net earnings per diluted share and adjusted net earnings per diluted share in 2019. There is no change to Stryker’s previously announced expected adjusted net earnings per diluted share for the full year, which is a range of $8.20 – $8.25. Assuming a September 30, 2020 closing, the transaction is expected to have no impact to Stryker’s adjusted net earnings per share in 2020, $(0.10) dilution in 2021 and will be accretive thereafter.

-

Morning News: November 4, 2019

Eddy Elfenbein, November 4th, 2019 at 6:42 amFlood of Oil Is Coming, Complicating Efforts to Fight Global Warming

Asia-Wide Trade Pact on Course Despite India, Thailand Says

Equity Trading to Only Get Bloodier in Europe After Macquarie Exit

We Just Wanted to Talk E.U. Farm Policy. Why Was Someone Always Looking Over Our Shoulders?

Aramco Starts IPO With Prince’s Economic Vision at Stake

An Energy Breakthrough Could Store Solar Power for Decades

Morgan Stanley Sees Market Returns Tumbling Over Next 10 Years

Teens Love TikTok. Silicon Valley Is Trying to Stage an Intervention.

Apple Pledges $2.5 Billion to Fight California Housing Crisis

McDonald’s Fires CEO Steve Easterbrook Over Relationship With Employee

Under Armour Plunges After Disclosing U.S. Accounting Probe

Jeff Miller: Weighing the Week Ahead: A Time for Investors to Act

Roger Nusbaum: Confronting Unexpected Circumstances

Ben Carlson: Will We Ever See Another Great Depression? & Refinancing Gains in Real Estate

Be sure to follow me on Twitter.

-

October NFP = +128,000

Eddy Elfenbein, November 1st, 2019 at 8:42 amThe October jobs report is out.

The U.S. economy created 128,000 jobs last month. This is despite the GM strike.

There was also 95,000 in upward revisions (51,000 in August and 44,000 in September).

Drilling down some, the private sector added 131,000 jobs in October.

Average hourly earnings rose six cents in October to $28.18. That’s a 0.2% increase for the month and a 3% increase for the year.

The unemployment rate ticked up to 3.6%. The U-6 rate rose to 7.0%.

The labor force participation rate is 63.3%. That’s the highest since August 2013. It’s also higher than every month from 1948 until 1978.

The jobs-to-population ratio is up to 61.00%. That’s the highest since November 2008.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His