Archive for January, 2020

-

Lesson in Diversification

Eddy Elfenbein, January 31st, 2020 at 4:35 pmThe final numbers are in and our Buy List lost -1.79% today, just two basis points worse than the S&P 500.

That’s pretty good considering the anchor of Broadridge (BR), which fell about 8% today.

All told, BR was a 26-basis-point weight on the Buy List today. Thanks to having many other good stocks, we absorbed the bad day from BR rather smoothly.

Mind you, I’m not happy with losing to the market today but as investors we understand that in a 25-stock portfolio, some stock is going to be the dud.

A well-diversified portfolio can be a big help when one of your stocks falls afoul of Wall Street’s judgement.

-

Earnings from Church & Dwight and Broadridge

Eddy Elfenbein, January 31st, 2020 at 2:49 pmToday is another rough day for the market. The S&P 500 is down about as much as it was on Monday.

We had two earnings reports this morning, one good and one bad. Let’s start with the good. Church & Dwight (CHD) earned 55 cents per share for Q4 which matched Wall Street’s estimate. CHD also bumped up its quarterly dividend from 22.75 cents to 24 cents per share. This is their 24th annual dividend increase in a row.

For Q1, C&D expects earnings of 73 cents per share. For all of 2020, the company is looking for earnings of $2.64 to $2.69 per share. That’s an increase of 7% to 9% over 2019. CHD is one of the few stocks in the green today. I saw it was the 7th best-performing stock in the S&P 500 today.

Now for the bad. Broadridge Financial Solutions (BR) reported earnings of 53 cents per share. That was 18 cents below estimates.

What happened? On the earnings call, the CEO said, “Event-driven activity came in significantly below our expectations, leading to a 5% decline in adjusted EPS in a seasonally small quarter. We now expect a lower level of event-driven activity to persist into the second half of fiscal 2020.”

The company stood by its forecast for this fiscal year (ending in June) for EPS growth of 8% to 12%, although now they confess it will be “at the low end.” That range had worked out to $5.03 to $5.22 per share. Now let’s say it’s $5.03 to $5.10 per share.

Shares of BR dropped as much as 11% today but they’ve made up some lost ground.

As I write this, our Buy List is trailing the S&P 500 by 0.09% today. Except for Broadridge, we’d be leading the index by about 0.20%.

-

CWS Market Review – January 31, 2020

Eddy Elfenbein, January 31st, 2020 at 7:08 am“I made my money by selling too soon.” – Bernard Baruch

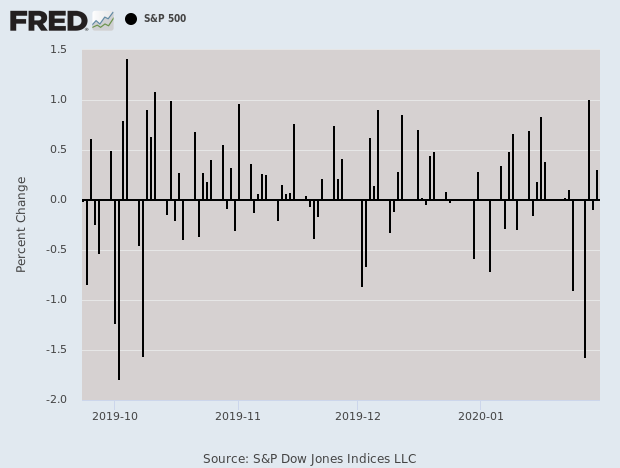

On Monday, the S&P 500 snapped its 74-day streak of not having a 1% down day. Perhaps fears of the coronavirus weighed on the market. Or maybe it was fears over earnings. In any event, the market had a very small stumble this week.

Because things had been so calm, the volatility probably seems greater than it truly is. After all, drops of 1% aren’t that uncommon. The good news for us is that our Buy List has held up much better than the overall market. Our Buy List was already leading the market this year by 1.22%. When folks get scared, they flock towards quality, and those are the kind of stocks we like.

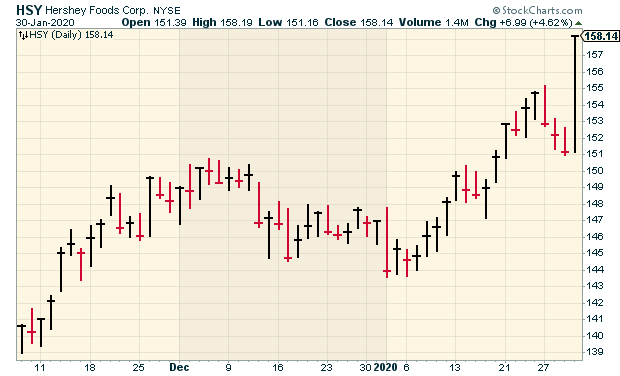

We had several Buy List earnings reports this week. Hershey led the way with a very good report. Danaher and Stryker also did well. In fact, Danaher is already our second 10% winner this year. On the downside, Sherwin-Williams came in below Wall Street’s estimate.

In this week’s issue, I’ll review all our Buy List earnings reports from this week. I’ll also preview several more that are coming next week. We’re going to have several Buy List stocks report on Tuesday, including Disney. But first, let’s run down this week’s earnings news.

Stryker Beats Earnings and Offers Good Guidance

After the closing bell on Tuesday, Stryker (SYK) reported Q4 earnings of $2.49 per share. That beat Wall Street’s estimates by three cents per share. Stryker’s own range was $2.43 to $2.48 per share.

Quarterly sales rose by 8.8% to $4.1 billion. For all of 2019, Stryker earned $8.26 per share.

From the earnings report:

“We had an excellent finish to 2019, achieving 8.1% full-year organic sales growth and 13% adjusted EPS gains. This marks our seventh consecutive year of accelerating organic sales growth and is a testament to our talent, culture and durable operating model,” said Kevin Lobo, Chairman and Chief Executive Officer. “The performance was balanced across businesses and geographies and positions us well for continued success.”

Now to guidance. For Q1, Stryker expects earnings of $2.05 to $2.10 per share. Wall Street had been expecting $2.05 per share. For all of 2020, Stryker sees earnings of $9.00 to $9.20 per share. The Street has been expecting $9.03 per share.

This is a solid report. Last month, Stryker increased its dividend by 11%. That was their 27th annual dividend hike in a row. Stryker remains a buy up to $223 per share.

Silgan Holdings Matches the Street

Also after the bell Tuesday, Silgan Holdings (SLGN) reported Q4 earnings of 38 cents per share. That pinged Wall Street’s forecast on the nose. Silgan had said they expected earnings between 34 to 39 cents per share, which seems like a wide range.

As I mentioned last week, Silgan didn’t have a great 2019, so these results are fairly mediocre. However, I see a lot of promise for Silgan going forward.

For 2020, Silgan sees earnings ranging between $2.28 and $2.38 per share. Wall Street had been expecting earnings of $2.30 per share. This was a good report, and it means Silgan is going for about 13.5 times next year’s earnings. Silgan is a buy up to $34 per share.

Thursday Earnings from Hershey, Danaher and Sherwin-Williams

We had three more Buy List earnings reports on Thursday morning. Two were good. One was not so good.

Let’s start with the good news.

Hershey (HSY) reported Q4 earnings of $1.28 per share. That was four cents better than estimates. The company had been expecting $1.18 to $1.24 per share. For the year, Hershey made $5.78 per share. This was a good year for them.

For 2020, Hershey sees earnings between $6.13 and $6.24 per share. I like that guidance. Wall Street had been expecting $6.16 per share. The shares rallied 4.6% on the news. Hershey is a buy up to $162 per share.

Also on Thursday, Danaher (DHR) reported Q4 earnings of $1.28 per share. Wall Street had been expecting $1.25 per share. This is such a good company.

For Q1, Danaher said they expect earnings of $1.06 to $1.09 per share. That’s pretty good. Wall Street was expecting $1.04 per share. For all of 2020, Danaher expects earnings of $4.80 to $4.90 per share (note that that doesn’t include the impact from the GE Biopharma acquisition). Remember, the company also recently IPO’d its dental business.

The stock rallied 2.3% on the earnings news. DHR is already a 10% winner for us this year. I’m lifting my Buy Below on Danaher by $25 to $180 per share.

Now for the bad one. (Okay, it wasn’t that bad.) Sherwin-Williams (SHW) reported Q4 earnings of $4.27 per share. That was 12 cents below estimates. Sherwin’s earnings report is a bit complicated because there are a few charges and adjustments. The CEO noted “softness in certain industrial end markets and choppiness in our international businesses.”

For 2020, Sherwin-Williams expects earnings to range between $22.70 and $23.50 per share. Wall Street had been expecting $24.26 per share. I want to see better numbers here. The stock lost 3.6% on Thursday, although it had been down close to 6% earlier in the day. I’m keeping my Buy Below price for SHW at $590 per share.

Several More Buy List Earnings Next Week

Here’s the updated Earnings Calendar:

Company Symbol Date Estimate Result Eagle Bancorp EGBN 15-Jan $1.07 $1.06 Silgan Holdings SLGN 28-Jan $0.38 $0.38 Stryker SYK 28-Jan $2.46 $2.49 Danaher DHR 30-Jan $1.25 $1.28 Hershey HSY 30-Jan $1.24 $1.28 Sherwin-Williams SHW 30-Jan $4.39 $4.27 Broadridge Financial Solutions BR 31-Jan $0.71 $0.53 Church & Dwight CHD 31-Jan $0.55 $0.55 Check Point Software CHKP 3-Feb $1.99 AFLAC AFL 4-Feb $1.02 Cerner CERN 4-Feb $0.74 Disney DIS 4-Feb $1.48 Fiserv FISV 4-Feb $1.14 Globe Life GL 4-Feb $1.72 Becton, Dickinson BDX 6-Feb $2.64 Intercontinental Exchange ICE 6-Feb $0.95 Moody’s MCO 12-Feb $1.94 Stepan SCL 20-Feb $0.88 Trex TREX 24-Feb $0.51 ANSYS ANSS 26-Feb $1.98 Middleby MIDD TBA $1.72 Next week will be another busy one for us.

On Monday, Check Point Software (CHKP) is due to report. The Israeli cybersecurity firm is wrapping up another good year.

For Q4, Check Point sees earnings ranging between $1.93 and $2.04 and revenue between $527 million and $557 million. The company reiterated its 2019 full-year guidance of earnings between $5.85 per share and $6.25 per share and revenue between $1.94 million and $2.04 billion.

I hope Check Point offers some guidance on 2020. I think CHKP can hit $6.20 to $6.40 per share. The shares have struggled over the past year.

Get ready for a very busy day on Tuesday when we’ll have five Buy List earnings reports.

Let’s start with AFLAC (AFL). In October, the duck stock raised its full-year guidance to a range of $4.35 to $4.45 per share. That was a big increase over the old guidance of $4.10 to $4.30 per share. The range is based on the 2018 exchange rate of 110.39 yen to the dollar. The guidance implies a Q4 range of 94 cents to $1.04 per share. AFLAC is going for less than 13 times earnings. Expect conservative 2020 guidance.

For Q4, Cerner (CERN) expects earnings between 73 and 75 cents per share on revenue of $1.41 billion to $1.46 billion. The healthcare-IT firm sees new-business bookings ranging between $1.45 and $1.65 billion.

The Q4 earnings guidance is effectively a narrowing of their previous full-year guidance. Previously, Cerner had expected 2019 earnings of $2.64 to $2.72 per share. With new Q4 guidance, that works out to $2.66 to $2.68 per share.

Last year, Cerner reached an agreement with Starboard Value to start paying a dividend and increase its buyback authorization by $1.5 billion. That’s been exhausted, and Cerner raised the authorization by another $1.5 billion. If they offer 2020 guidance, I’m expecting a range near $3 per share.

Disney (DIS) makes a lot of money. On Tuesday, we’ll hear how much. The stock has been somewhat weak lately. This is probably due to travel fears from the coronavirus. If you don’t own Disney, this is a good window. The share price is actually lower than where it was nine months ago. Wall Street expects earnings of $1.46 per share.

In November, Fiserv (FISV) raised its guidance. The company now sees 2019 earnings of $3.98 to $4.02 per share which implies Q4 earnings of $1.11 to $1.15 per share. The previous 2019 guidance was $3.39 to $3.52 per share. That was a big increase. Business is going well for them. I’ll also be curious to hear guidance for 2020. Fiserv will probably be conservative.

Globe Life (GL) had been quiet for some time until this week when it was one of our best-performing stocks. Globe Life is a classic defensive stock. When people get nervous, they seek out GL.

By the way, the Texas Rangers baseball team will open its new ballpark, Globe Life Field, in March. For Q4, Wall Street expects $1.72 per share.

On Thursday, Becton, Dickinson (BDX) will be ready to report. This will actually be for its fiscal Q1. The medical-instruments firm already offered EPS guidance this year of $12.50 to $12.65. Wall Street wasn’t exactly thrilled with those numbers. Analysts had been expecting more.

I suspect BDX is trying to lower expectations. Last month, Becton bumped up its dividend for the 48th year in a row. The quarterly payout increased from 77 cents to 79 cents per share. For fiscal Q1, Wall Street expects $1.64 per share.

Intercontinental Exchange (ICE) is one of six Buy List stocks that’s up more than 8% this year. ICE has a great business, but one troubling spot is that the government isn’t pleased with the pricing power that exchanges have for their data services. That’s a big money maker for them. I don’t think this issue can be solved easily or quickly, and it will probably get settled by the courts.

ICE provides guidance for several metrics except EPS. But if we use a little math, the numbers they gave for Q4 should work out to earnings of about 95 cents per share, give or take. For Q4, ICE expects data revenue to be between $555 million and $560 million.

That’s all for now. Broadridge and Church & Dwight will report later today. On Monday, we’ll get the ISM Manufacturing report. The recent numbers here have been sluggish. On Wednesday, we’ll get the ADP payroll report, plus the ISM Non-Manufacturing report. Friday will be the big December jobs report. I’ll be particularly interested to see if there’s an increase in wages. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

P.S. I’m going to be at the Money Show next week in Orlando. I’ll be speaking on Friday at 5:30 p.m. ET and again on Saturday at 2 p.m. ET. If you’re around, come on by and say hi.

Morning News: January 31, 2020

Eddy Elfenbein, January 31st, 2020 at 7:05 amShares Struggle for Footing After Virus-Battered Week

Pilots, Flight Attendants Demand Flights to China Stop As Virus Fear Mounts Worldwide

German Banks Are Hoarding So Many Euros They Need More Vaults

Trump Called Powell an ‘Enemy.’ ‘Ugh’ Was a Response Inside the Fed.

The Fed’s Dilemma: Fighting A Battle They Cannot Win

Swiping Their Way Higher: Visa, Mastercard Could Be the Next $1 Trillion Companies

Amazon Holiday Sales Jump as One-Day Shipping Pays Dividends, Stock Up 13%

Ginni Rometty to Step Down as C.E.O. of IBM

How Private Equity Buried Payless

Caterpillar’s 2020 Outlook Adds More Gloom to Virus-Shaken Markets

Zuckerberg Says He Doesn’t Need Facebook to Be Liked. That’s New

Ben Carlson: Putting the Next Market Downturn into Perspective

Michael Batnick: Untouchable Amounts of Wealth

Cullen Roche: Sorry, but Your ESG Funds Probably Suck

Joshua Brown: They’re Going to Invert the Yield Curve Again

Be sure to follow me on Twitter.

Earnings from Hershey, Danaher and Sherwin-Williams

Eddy Elfenbein, January 30th, 2020 at 1:16 pmWe had three more Buy List earnings reports this morning. Two were good. One was not so good.

Let’s start with the good news.

Hershey (HSY) reported Q4 earnings of $1.28 per share. That was four cents better than estimates. The company had been expecting $1.18 to $1.24 per share. For the year, Hershey made $5.78 per share. This was a good year for them.

For 2020, Hershey sees earnings between $6.13 and $6.24 per share. I like that guidance. Wall Street had been expecting $6.16 per share. The stock is up nicely today on a down day for the market.

Also this morning, Danaher (DHR) reported Q4 earnings of $1.28 per share. Wall Street had been expecting $1.25 per share.

For Q1, Danaher said they expect earnings of $1.06 to $1.09 per share. That’s pretty good. Wall Street was expecting $1.04 per share. For all of 2020, Danaher expects earnings of $4.80 to $4.90 per share (note that that doesn’t include the impact from the GE Biopharma acquisition). The shares are up a bit so far.

Now for the bad one. Sherwin-Williams (SHW) reported Q4 earnings of $4.27 per share. That was 12 cents below estimates. Sherwin’s earnings report is a bit complicated because there are a few charges and adjustments.

Commenting on the financial results, John G. Morikis, Chairman and Chief Executive Officer, said “Sherwin-Williams delivered record results in 2019, driven by above-market growth in our North American paint stores and margin improvement in all of our segments. Sales grew to $17.90 billion as the strength of our stores platform and growth with our largest North American retail partners more than offset softness in certain industrial end markets and choppiness in our international businesses. Gross margin expanded to 44.9% as our pricing initiatives enabled us to gain ground on the raw material inflation we have experienced since 2017. Adjusted EBITDA grew 8.3% to more than $3.0 billion, and adjusted earnings per share increased 14% to $21.12, both of which are full year records. Net cash from operations was more than $2.32 billion, which enabled us to invest in organic growth initiatives, repurchase over 1.6 million shares of our common stock, reduce debt, increase our dividend 31% from the prior year and execute on selected acquisition targets.

For 2020, Sherwin-Williams expects earnings to range between $22.70 and $23.50 per share. Wall Street had been expecting $24.26 per share.

Morning News: January 30, 2020

Eddy Elfenbein, January 30th, 2020 at 7:05 amFear in the Age of Coronavirus: Chinese No Longer Welcome

Brexit Is Finally Happening, but the Complicated Part Is Just Beginning

Trump’s First Presidential Portfolio Lags Job, Stock Market Growth

Powell Paves Way for Possible Dovish Shift in Inflation Strategy

What Will Today’s G.D.P. Reading Show? Here’s a Preview.

Global Agriculture Has a Planting Problem

Germany Is Planning to Make Jet Fuel From Water

Deutsche Bank Reports Huge Loss for 2019

Facebook to Pay $550 Million to Settle Facial Recognition Suit

Boeing Expects 737 Max Costs Will Surpass $18 Billion

Cullen Roche: Do Recessions Need to Happen?

Jeff Carter: Common Law and Privacy

Be sure to follow me on Twitter.

The Fed Leaves Rates Unchanged

Eddy Elfenbein, January 29th, 2020 at 2:04 pmAs expected, the Federal Reserve decided to keep interest rates the same. The target for the Fed funds rate is still 1.50% to 1.75%. The vote was unanimous.

This is from the Fed’s policy statement:

Information received since the Federal Open Market Committee met in December indicates that the labor market remains strong and that economic activity has been rising at a moderate rate. Job gains have been solid, on average, in recent months, and the unemployment rate has remained low. Although household spending has been rising at a moderate pace, business fixed investment and exports remain weak. On a 12 month basis, overall inflation and inflation for items other than food and energy are running below 2 percent. Market-based measures of inflation compensation remain low; survey-based measures of longer-term inflation expectations are little changed.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee decided to maintain the target range for the federal funds rate at 1 1/2 to 1-3/4 percent. The Committee judges that the current stance of monetary policy is appropriate to support sustained expansion of economic activity, strong labor market conditions, and inflation returning to the Committee’s symmetric 2 percent objective.

Morning News: January 29, 2020

Eddy Elfenbein, January 29th, 2020 at 7:09 amChina Death Toll Climbs to 132 as Cases Soar

Coronavirus Crisis Exposes Cracks in China’s Facade of Unity

Buoyed by Company Earnings, World Markets Look Past Virus Death Toll

Trump to Sign North American Trade Pact at White House; Key Democrats Not Invited

Ordinary or ‘Enemy’? How Jay Powell Is Positioning the Fed in a Fraught Era

Fed to Keep Rates Steady and Mull Tapering: Decision-Day Guide

New iPhones Fuel Strong Profit for Apple

Focus at Goldman’s First Investor Day Will Be On Its Consumer Bank Marcus

Bitcoin Has Lost Steam. But Criminals Still Love It.

Goldman Sachs Is Remaking Itself (Again)

Investors Find Some Unilever Foods Hard to Swallow

Nick Maggiulli: Why Market Timing Can Be So Appealing

Ben Carlson: What the 2020s Will Look Like For the Markets

Michael Batnick: Aaand It’s Gone & Animal Spirits: Apocalyptic Thinking

Joshua Brown: Incumbency & What Long Term Investors Can Learn From Traders

Be sure to follow me on Twitter.

Silgan Earns 38 Cents per Share

Eddy Elfenbein, January 28th, 2020 at 10:52 pmAlso after the bell Tuesday, Silgan Holdings (SLGN) reported Q4 earnings of 38 cents per share. That exactly matched Wall Street’s forecast. The company had expected earnings between 34 to 39 cents per share.

“We had another record year in 2019 with adjusted net income per diluted share of $2.16, an increase of 3.8 percent over the prior year record performance in spite of pension headwinds and tariff related cost volatility,” said Tony Allott, Chairman and CEO. “These record results were largely driven by improvements in our metal and plastic container businesses. Our closures business performed well, but faced headwinds due to weaker volumes in food markets as a result of lower fruit and vegetable pack yields and the unfavorable impact of the customer pre-buy of products in 2018 in advance of significant metal price increases in 2019,” continued Mr. Allott.

For 2020, Silgan sees earnings ranging between $2.28 and $2.38 per share. Wall Street had been expecting earnings of $2.30 per share. This was a good report.

Stryker Beats Earnings and Offers Good Guidance

Eddy Elfenbein, January 28th, 2020 at 4:22 pmAfter the closing bell, Stryker (SYK) reported Q4 earnings of $2.49 per share. That beat Wall Street’s estimates by three cents per share. Stryker’s own range was $2.43 to $2.48 per share

Quarterly sales rose by 8.8% to $4.1 billion. For the year, Stryker earned $8.26 per share.

“We had an excellent finish to 2019, achieving 8.1% full-year organic sales growth and 13% adjusted EPS gains. This marks our seventh consecutive year of accelerating organic sales growth and is a testament to our talent, culture and durable operating model,” said Kevin Lobo, Chairman and Chief Executive Officer. “The performance was balanced across businesses and geographies and positions us well for continued success.”

For Q1, Stryker expects earnings of $2.05 to $2.10 per share. Wall Street had been expecting $2.05 per share. For all of 2020, Stryker is looking for earnings of $9.00 to $9.20 per share. The Street was expecting $9.03 per share.

This is a solid report. Last month, Stryker increased its dividend by 11%. This was their 27th annual dividend increase in a row.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His