CWS Market Review – February 21, 2020

“The obvious rarely happens; the unexpected constantly occurs.” – Jesse Livermore

Wall Street marched to another all-time high this week. On Wednesday, the S&P 500 got as high as 3,393.52 during the day. It seems like nothing can upend this rally.

Still, I want to urge caution. We’ve had some nice gains, but don’t get too complacent. The bear loves to knock you over the moment you get too comfortable. (Note Mr. Livermore’s quote above.)

Despite the big gains in the stock market, it’s been the bond market that’s been making news lately. The yield on the 30-year Treasury is near an all-time low. Folks are willing to lend their money to the U.S. government for 30 years for less than 2%. Still, that’s a positive yield which is something you can’t say for many other parts of the world.

In this week’s issue, I’ll discuss what’s been happening. I’ll also talk about our two Buy List earnings reports from this week. We had good news from Stepan and less good news from Hormel Foods. I’ll also preview three more Buy List earnings reports for next week. Plus, we got a nice 18% dividend hike from Sherwin-Williams. It was their 41st annual dividend hike in a row. But first, let’s look at how it’s the U.S. dollar’s world.

The Surging U.S. Dollar

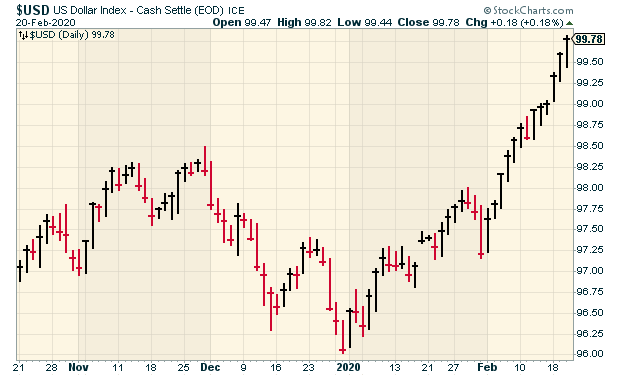

One financial side effect of the coronavirus is that investors are seeking the safety of the U.S. dollar. To put it bluntly, the greenback is smashing everything in its way. The dollar rally is acting like a magnetic force that’s disrupting nearly every other market. Even the Japanese yen, which is traditionally seen as a conservative currency, is getting pulled down. With the dollar around, no one is safe.

Bloomberg (the news service, not the candidate) quoted one strategist, “It looks like huge capitulation by almost anyone who isn’t a dollar bull.” I think that’s right. It’s especially interesting because many folks on Wall Street assumed that following a trade deal with China, the dollar would weaken. Instead, it’s rallied. In fact, the dollar index is close to breaking through 100 which could be an important psychological barrier. To give you an example, the Aussie dollar is at an 11-year low.

Meanwhile in the U.S. Treasury market, the close cousin of the currency market, bond yields are plunging. Earlier I mentioned that the yield on the 30-year Treasury is close to an all-time low: investors are now willing to lend to the U.S. government for 30 years for less than 2% per year. The yield on the 10-year TIPs (Treasury Inflation-Protected Securities) is now negative.

I think that’s partly what’s helping the U.S. stock market. The WSJ reported that 40% of the market’s gains this year have been in the four mega-cap tech stocks (the “MAGA” stocks). It’s not that growth here is particularly rosy; it’s just that these are companies that deal in dollars.

But it gets more complicated. For example, gold has been rallying as well. Why? It’s another safe haven. Gold has closed higher ten times in the last 11 sessions. Wall Street is now talking about an “everything rally,” meaning stocks, bonds and gold. A surging dollar, however, isn’t a good thing everywhere. Look at the commodity markets where oil has been falling. As a result, energy stocks have lagged.

This week, Procter & Gamble warned that the coronavirus will impact their earnings. I suspect that some companies will use the outbreak as a convenient excuse for earnings shortfalls. Of course, there are real disruptions but it’s too early to say what they impact will be.

For now, there’s nothing to fear from the dollar-induced rally. Our stocks are looking very good (here’s the updated Earnings Calendar.) Be sure you have a diversified portfolio of high-quality stocks such as you can find on our Buy List. Now let’s look at some earnings from this week.

Earnings from Stepan and Hormel Foods

We had two more Buy List earnings reports on Thursday morning. Stepan (SCL) said it made $1.10 per share for its fourth quarter. Technically, analysts had been expecting 88 cents per share but that’s a consensus of just two analysts. One expected 86 cents and the other expected 90 cents. For the year, SCL made $5.12 per share.

Stepan is one of our new stocks this year. The company is a major manufacturer of specialty and intermediate chemicals. The company has increased its dividend for 52 years in a row.

Stepan’s CEO said, “Despite significant challenges during the year, driven by the equipment failure in Ecatepec, the wet weather in the U.S. farm belt, the sulfonation exit in Germany and FX headwinds, the Company exceeded its 2018 record full year adjusted net income and grew adjusted EPS 7%.”

Stepan remains a buy up to $110 per share.

The other report came from Hormel Foods (HRL). This is for Hormel’s fiscal Q1 which ended at the end of January. The Spam people report early so their earnings report tends to blend in with the other stocks whose Q4 ended in December.

For Q1, Hormel made 45 cents per share which matched Wall Street’s expectations. For the quarter, organic sales were up 4%. The company reiterated its full-year 2020 forecast for sales ranging between $9.5 billion and $10 billion and EPS between $1.69 and $1.83.

Hormel also said it reached an agreement to buy Sadler’s Smokehouse which is a pit-smoked meats company based in Henderson, Texas. Sandler has been a long-time supplier. Hormel paid $270 million for Sadler’s.

The CEO said, “We have started to see a negative impact on our business in China from the coronavirus outbreak, but we are not yet able to forecast the impact for the remainder of the year.”

These numbers were basically what I had been expecting, but I think traders are unnerved about any coronavirus news. Shares of HRL pulled back 6% after the report. I’m keeping my Buy Below for Hormel at $48 per share.

Sherwin-Williams Raises Dividend

We got good news on Wednesday when Sherwin-Williams (SHW) announced an 18.6% increase to its dividend. The quarterly payout will rise from $1.13 to $1.34 per share. The dividend is payable on March 13 to shareholders of record on March 2. This is Sherwin’s 41st consecutive annual dividend hike.

Sherwin had a weak Q4 and guidance was below expectations. The CEO noted “softness in certain industrial end markets and choppiness in our international businesses.” For 2020, Sherwin-Williams expects earnings to range between $22.70 and $23.50 per share. Sherwin-Williams is a buy up to $590 per share.

Earnings Preview for Trex, Ansys and Middleby

We have three more Buy List reports coming next week and they’re all for new additions to this year’s Buy List.

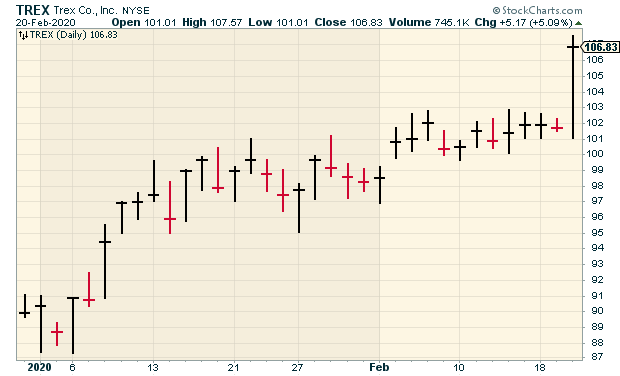

Let’s start with Trex (TREX) which is scheduled to report on Monday, February 24. Trex is turning into a major winner for us. Through Thursday, the stock is up more than 18% for us. That’s in less than two months.

Three months ago, Trex report Q3 earnings of 72 cents per share. That topped estimates by four cents per share. It was an increase of 44% over Q3 from 2018. Trex didn’t provide an EPS forecast for Q4 but the company said it expects net sales of $160 million. That’s an increase of 14% over last year. That should translate into earnings of about 50 cents per share.

Ansys (ANSS) has also been a strong performer for us. It’s our #3 best-performer this year with a YTD gain of 14.2%. Ansys is due to report on Wednesday, February 26.

Three months ago, the simulation-software company said it made a profit of $1.42 per share for Q3. That easily beat Wall Street’s estimate of $1.26 per share. Quarterly revenue grew by 18%.

The CEO said, “Once again we delivered an outstanding quarter, with double-digit ACV and revenue growth and strong operating income.” Wall Street liked what it saw. At one point, shares of ANSS closed higher 12 times in 14 trading days. The stock was also recently added to the Nasdaq 100 Index. That means a lot of funds have to buy it. For Q4, Ansys expects earnings to range between $1.87 and $2.05 per share.

Also on Wednesday, Middleby (MIDD) is due to report. The company makes industrial cooking equipment for restaurants and hotels. This is one of those businesses that most people never even think about but can be very profitable. In November, MIDD said it made $1.72 per share for its Q3. That beat the Street by nine cents per share. For Q4, Wall Street expects $1.71 per share.

Both Trex and Ansys have outrun their Buy Below prices. I’ll probably raise both next week but I want to see their earnings results first.

Looking ahead, Ross Stores (ROST) will report on March 3. Then FactSet (FDS) will report sometime in later March, and RPM International (RPM) will probably report in early April. After that, the Q1 earnings season will start in mid-April.

That’s all for now. There’s not much scheduled for next week but there are a few things I want to highlight. On Wednesday, the new-homes sales report is due out. On Thursday, the government will update its estimate for Q1 GDP growth. The initial estimate was for 2.1%. That’s also how fast the economy grew in the third quarter. We’ll also get the durable goods report for January. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Posted by Eddy Elfenbein on February 21st, 2020 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His