Archive for March, 2020

-

The Market Continues to Calm Down

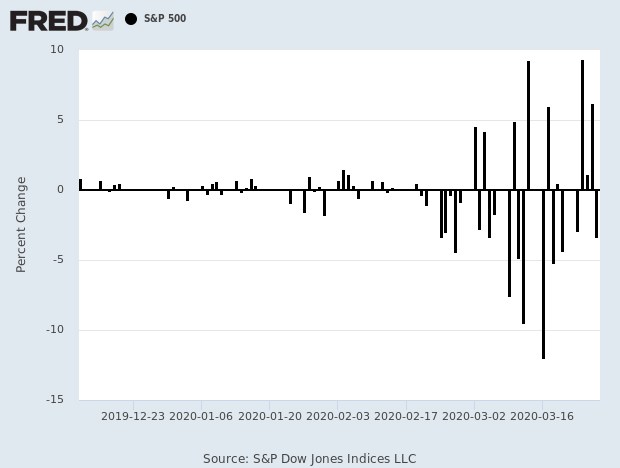

Eddy Elfenbein, March 31st, 2020 at 11:26 amI say this with some hesitation, but it looks as if the period of extreme volatility has passed. Over the last five days, the S&P 500 is up over 17%. There have been three days in the last eight where the daily change was more than 4%. In the eight days prior to that, all eight had daily changes of more than 4%.

Here are some news items impacting our stocks:

Cerner (CERN) talks about the possibility of having 27,000 employees work from home.

Stepan (SCL) said it bought Logos Technologies’s NatSurFact business.

Trex (TREX) provided an update on its business plans.

An analyst at RBC called Danaher (DHR) a “break glass in case of emergency” type of investment.

Disney’s (DIS) Chairman CEO Bob Iger said he will forgo his salary this year.

-

Morning News: March 31, 2020

Eddy Elfenbein, March 31st, 2020 at 7:08 amNightmare Haunting Euro Founders May Be a Reality With Italy

Oil Prices Are On Track for Their Worst Ever Quarter as Coronavirus Slashes Demand

Huawei Warns China Will Strike Back Against New U.S. Restrictions

Goldman Sachs Sees 34% Plunge in U.S. GDP and 15% Unemployment

Explainer: What the Federal Reserve Has Done in The Coronavirus Crisis

A Lot Is Riding on Stock Bottom Calls That Worked in a Bull Market

U.S. Retail Crisis Deepens as Hundreds of Thousands Lose Work

Strikes at Instacart and Amazon Over Coronavirus Health Concerns

Banks Stuck With $23 Billion of Loans for T-Mobile’s Sprint Deal

Ad Giant WPP Pulls Dividend, Buyback and Outlook as Clients Cut Spending

Zoom is Under Scrutiny from the New York Attorney General for Its Privacy Practices

Ben Carlson: Even Warren Buffett Can’t Nail the Bottom

Howard Lindzon: How The Pandemic Will End

Joshua Brown: What Small Businesses Need to Know About Accessing Forgivable Loans, How to Safely Take Money From Your Retirement Account Now, Three Reasons It’s Not 1929, What If GDP Falls More Than the Stock Market? & Not Depth…Duration

Be sure to follow me on Twitter.

-

Extreme Volatility May Have Peaked

Eddy Elfenbein, March 30th, 2020 at 10:57 amThe market is up modestly this morning. It’s refreshing to see more normal price action today. The big news is that President Trump said the social distancing policies will last through April.

Last week was the best week for the Dow since 1938. Healthcare stocks are particularly strong this morning. Johnson & Johnson said it’s working on a potential vaccine. Abbott Labs said it’s made a five-minute test for Covid-19. The FDA has given them emergency-use authorization.

FactSet (FDS) is up another 6% so far today. Hershey (HSY) is less than 10% from its 52-week high. Not many companies can say that.

Here’s a chart of the S&P 500’s daily volatility. It’s early to say this but the extreme volatility may have peaked.

-

Morning News: March 30, 2020

Eddy Elfenbein, March 30th, 2020 at 7:06 amOil Hits New Lows and Stock Markets Signal Lingering Unease

‘We Will Starve Here’: India’s Poor Flee Cities in Mass Exodus

China Rejoins Monetary Easing Wave as World Shuts Down

European Stocks Edge Lower After ECB Calls for Banks to Halt Dividends Through October

After Fed Unleashes Firepower, Washington Rearms Central Bank

U.S. Stimulus Package is Biggest Ever, But May Not Be Big Enough

Coronavirus Worries and Strife: Investors Fear Markets Not Out of Woods Despite Big Rally

Mortgage Bankers Ask SEC to Save Them From Wave of Margin Calls

The U.S. Tried to Build a New Fleet of Ventilators. The Mission Failed.

Inside G.M.’s Race to Build Ventilators, Before Trump’s Attack

Scary Times for U.S. Companies Spell Boom for Restructuring Advisers

Michael Batnick: When Should I Rebalance?

Roger Nusbaum: The Importance Of Perspective & Priorities & Did The Tide Just Go Out On 60/40?

Jeff Carter: Some Things We Might Be Learning & We Can’t Go On Forever Like This

Ben Carlson: The Hardest Part of a Buy & Hold Strategy & Some Questions I’m Pondering During the Crisis & A Short History of Dead Cat Bounces

Be sure to follow me on Twitter.

-

Today’s Webinar

Eddy Elfenbein, March 27th, 2020 at 12:13 pmPlease join me today at 4 pm ET.

You can register here.

-

CWS Market Review – March 27, 2020

Eddy Elfenbein, March 27th, 2020 at 7:08 am”We’re not going to run out of ammunition.” – Fed Chairman Jerome Powell

This week, the stock market staged a quick and massive rebound. We still have one day to go, but the Dow Jones Industrial Average is on pace for its best week since 1932. On Tuesday, Wednesday and Thursday, the Dow had its biggest three-day gain since 1931.

On Tuesday, the Dow surged more than 11% for its single-best day in 87 years. (Notice how many of these records are since the 1930s. The Great Depression was really bad.)

This quick rally is welcome relief from the nasty bear market that’s run roughshod over Wall Street for the previous five weeks. But does this mean that the downdraft is over? Not at all.

We have to face certain facts. The coronavirus is still uncontained, although we are making concrete gains. The S&P 500 is still well below its 50- and 200-day moving averages. That’s often a warning sign. Also, the Volatility Index is very elevated.

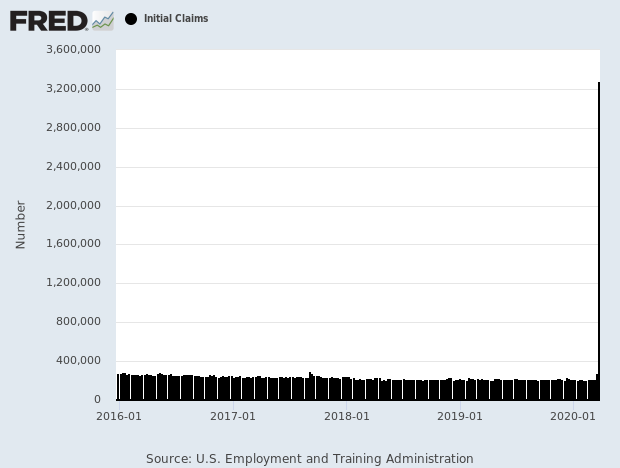

Worst of all, the economy is a mess. On Thursday, the initial-jobless-claims report came in at 3.28 million. That’s off-the-charts bad. It’s literally more than four times the worst week in history. In this week’s issue, we’ll talk about where we are and some possible scenarios for what we’ll face in the coming weeks.

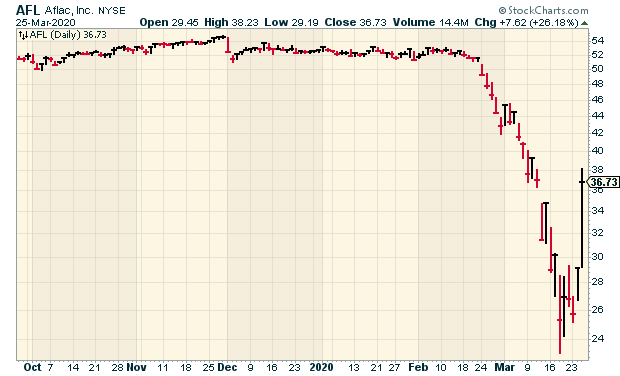

I’ll also cover the strong earnings report from FactSet. The stock gapped up more than 10% on the news. In fact, several of our stocks have been up strongly since Tuesday. On Wednesday, shares of AFLAC gained more than 26%. Is this rally for real, or just a head fake? Let’s take a look.

The Bulls Strike Back

What prompted the market’s reversal of fortune was this week’s news of the government’s stimulus package. The details have yet to be worked out, but it appears to be in the neighborhood of $2 trillion. That’s huge. It’s interesting that the market finally responded to news of a fiscal stimulus after failing to rally a few times after the Fed announced monetary stimulus.

The problem with this economic halt is that it punishes many of the most vulnerable. I think of folks in the service sector who live paycheck to paycheck. Many large businesses will pull through, but many small businesses will not. Many workers aren’t being merely laid off; their employers are being forced out of business.

The key for any stimulus is to get money in the hands of the folks who need it. Earlier this week, Goldman Sachs upgraded shares of Ross Stores. The people at Goldman ran the numbers at Ross and found out what we knew along: the company has a strong enough balance to ride out the storm.

The Federal Reserve has not only lowered interest rates to 0% but has also promised to buy an unlimited number of bonds. While the Fed’s actions won’t help the economy directly, they will help prevent the banking system from becoming so injured that it would be harmful to the broader economy.

So how bad is the economy right now? That’s hard to say. A lot of folks are tossing around numbers of Q2 GDP crashing by 15% or 20%. Some say even more. I won’t make any predictions except to say that whatever happens, it will be historic.

We got a taste of that on Thursday when the jobless-claims report came out. Lately, the weekly jobless-claims reports have been around 200,000 to 230,000, give or take. A few times recently we hit 50-year lows for jobless claims. But Thursday’s report was an earthquake. For the week, 3.28 million Americans filed first-time jobless claims. That’s more than 11 times the previous week, which was already showing some of the impact of the economy’s shutting down.

This isn’t a recession, or even a depression. It’s an ice age. The U.S. economy has come to a standstill. I was near the White House earlier this week, and I can’t recall seeing the streets of Washington so deserted.

It’s still unclear how much longer the economy will remain shuttered. President Trump said he hopes we’ll be in the clear by Easter. I’m afraid that may be overly optimistic. The key, of course, depends on the coronavirus itself. We’ve all heard the phrase “bend the curve.” Things will change once the number of new cases increases by a decreasing rate. It will happen.

In the meantime, this strategy is designed to buy us more time. More time to get more tests. Lots more tests. Also, more hospital beds and more ventilators. We saw what happened in Italy when the healthcare system was simply overrun. We may be seeing a repeat of that in New York state right now.

I don’t want to sound overly pessimistic. I’m happy to say that one of our stocks may play an important role. In 2016, Danaher (DHR) bought Cepheid. The FDA just approved a quick-acting COVID-19 test. Instead of waiting a few days to get the result, patients only need to wait 45 minutes. Let’s hope this gets to doctors as soon as possible.

As good as the last three days have been for the market, there’s a strong possibility that the bears will attack again and take back most of the gains. That’s simply how bear markets work. Bear market rallies are always frustrating because they lull you into believing the coast is clear.

In addition to the news, we also want to see the internals of any upward move. If it’s a big spike of just a few stocks, then it’s unlikely to hold. Bear-market bottoms are usually quiet, and it takes some time before you realize what happened.

For now, I urge investors to remain calm. This is a good opportunity to put free money to work. Some Buy List stocks that look particularly good right now would be Hershey (HSY), Church & Dwight (CHD) and Ansys (ANSS).

FactSet Beats the Street

On Thursday morning, FactSet (FDS) reported fiscal Q2 earnings of $2.55 per share. That beat Wall Street’s consensus of $2.49 per share, and it’s an increase from $2.42 per share one year ago.

Quarterly revenue rose 4.2% to $369.8 million. I should add that this was for the quarter that ended on February 29, so coronavirus didn’t have a noticeable impact on their operations.

For FactSet, the key stat to watch is Annual Subscription Value, or ASV. For Q2, that stood at $1.44 billion. ASV is growing at more than 4%.

“We performed well in our second quarter and continued to execute successfully against our three-year investment plan,” said Phil Snow, FactSet’s CEO. “I am most proud, however, of the way the FactSet community has united to support its members and our clients during this challenging period. While we proceed with caution for the remainder of the year due to the heightened impact and uncertainty surrounding the coronavirus pandemic, our commitment to our team and our clients remains absolute.”

At the end of the quarter, FactSet’s client count reached 5,699, and the user count is up to 128,896. Annual ASV retention is over 95%.

During the quarter, FactSet bought back 267,500 shares for $74.2 million. That works out to an average price of $277.28 per share. The company just increased the current buyback authorization by $220 million. There’s now $300 million available to buy back shares.

Now for guidance. FactSet prefaced its guidance by noting that their “actual future results may differ materially from these expectations.” That’s an understatement. Still, with that major caveat, FactSet stood by its previous guidance. The company still sees full-year earnings between $9.85 per share and $10.15 per share.

FactSet had been one of our better-performing stocks. Still, the shares crashed from over $300 in mid-February to less than $200 during the day on Monday. FDS jumped more than 13% on Tuesday and another 10.7% after the earnings on Thursday. If the company’s guidance is accurate, then this is a good time to add shares of FactSet.

This week, I’m lowering my Buy Below price on FactSet to $275 per share.

Buy List Updates

RPM International (RPM) is our only stock to report between now and the beginning of Q1 earnings season in mid-April. RPM is due to report on April 8. Last Friday, RPM said it expects to report earnings at the high end of its guidance.

Thanks to the lousy market, many of our Buy Below prices are out of whack. There are a few I want to adjust this week.

Shares of Middleby (MIDD) got clobbered, but the stock had three straight impressive days on Tuesday, Wednesday and Thursday. In those three days, MIDD gained 40%. I’m moving our Buy Below to $72 per share.

Ross Stores (ROST) was upgraded this week by Goldman Sachs. They noted that Ross has a strong balance sheet that can tide it over in tough times. Over the last three days, Ross gained 36%. I’m dropping our Buy Below down to $100 per share.

On Monday, shares of Danaher (DHR) got a boost after the FDA approved a quick-acting COVID-19 test. The current tests take several hours and have to be shipped off to a hospital, but Danaher’s takes 45 minutes and can be done right there. I’m moving Danaher’s Buy Below to $150 per share.

That’s all for now. The first quarter comes to an end next Tuesday. On Wednesday, ADP will release its payroll report for March. I expect it to be dismal. We’ll also get the ISM Manufacturing Index, which should be little better. Then on Thursday, the jobless-claims report comes out. That leads up to the big jobs report on Friday. I can’t sugarcoat it. I expect the numbers to be terrible. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Morning News: March 27, 2020

Eddy Elfenbein, March 27th, 2020 at 7:02 amMigrant Farmworkers Whose Harvests Feed Europe Are Blocked at Borders

Argentina Sacrifices Economy to Ward Off Virus, Winning Praise

Russia Calls for New Enlarged OPEC Deal to Tackle Oil Demand Collapse

Trump Didn’t Calm the Oil Markets. Now It May Be Too Late

The Second Virus Shockwave Is Hitting China’s Factories Already

U.S. Stock Futures Dip After Three-Day Rally as Virus Cases Grow

The Coronavirus Economy: When Washington Takes Over Business

Massive Unemployment Claims During Coronavirus Crisis Have California Officials Scrambling

How Multi-Strategy Funds Are Faring as Coronavirus Slashes Returns

I Became a Disciplined Investor Over 40 Years. The Virus Broke Me In 40 Days.

Nick Maggiulli: The Greatest Investment Quotes of All Time

Ben Carlson: Surviving Your Very First Market Crash

Michael Batnick: The Best Books about Financial Panics & Why The Stock Market Rallies on Bad News

Joshua Brown: It Doesn’t Always Have to Make Sense & The Bravery of Jon Boorman

Be sure to follow me on Twitter.

-

The Dow Is on Pace for Its Best Week Since 1932

Eddy Elfenbein, March 26th, 2020 at 11:30 amThe market’s rebound is continuing into today. This is the first rebound of note since the market started to break over a month ago. In fact, the Dow is on pace for its best week since 1932.

This morning, FactSet (FDS) reported fiscal Q2 earnings of $2.55 per share. That beat Wall Street’s forecast of $2.49 per share. The stock is up about 5% in today’s trading. FDS also reiterated its full-year guidance range of $9.85 to $10.15 per share but also said that its results may differ significantly.

This is good news but don’t think the coast is clear. The major averages are still well below their 50- and 200-DMAs. Expect to see a lot more volatility ahead.

-

Morning News: March 26, 2020

Eddy Elfenbein, March 26th, 2020 at 7:09 amEurope’s Leaders Ditch Austerity and Fight Pandemic With Cash

The Gold Market Is Being Tested Like Never Before

Unemployment Claims Expected To Shatter Records

Senate Passes $2 Trillion Virus Rescue Plan; Sends Bill to House

A $2 Trillion Lifeline Will Help, But More May Be Needed

U.S. Corporate Crisis Bailouts May Prove Bonanza for Insider Trading, New Study Warns

U.S. Senate Offers $58 Billion Aid to Airlines As They Struggle to Stay Airborne

Coronavirus Shock Is Destroying Americans’ Retirement Dreams

JPMorgan’s Equity Derivatives Haul Soars to $1.5 Billion

Essential? Retailers Like Guitar Center and Michaels Think They Are

Don’t Dash For Cash: Authorities Say There’s No Need To Empty The ATM

Michael Batnick: What is Happening in the Stock Market? & What Do You Do Now?

Ben Carlson: How Did We Ever Get to The Roaring Twenties? & Animal Spirits: The First Thing to Go in a Crisis

Jeff Carter: Sledgehammers or Scalpels

Joshua Brown: The Economic Stimulus Bill Explained & No Bottom Until the Virus Tops

Be sure to follow me on Twitter.

-

AFLAC Jumps 26% in One Day

Eddy Elfenbein, March 25th, 2020 at 7:58 pmThis was another remarkable day for the stock market. The S&P 500 gained 1.15% which means the market did something it had not done in over a month: it registered back to back gains. It’s refreshing that after Tuesday’s big gain, the market didn’t immediately give back all of its gains.

Our Buy List gained 2.55%. It was led by AFLAC (AFL) which gained 26.2%. That’s astounding. Both Middleby (MIDD) and Ross Stores (ROST) gained over 13%. Ross had been upgraded by Goldman Sachs. They said that Ross has enough cash on hand to keep operations going.

Tomorrow we’ll get the jobless claims report and it will be historically bad.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His