CWS Market Review – April 24, 2020

“Praise by name, criticize by category.” – Warren Buffett

This was the week they were giving away oil. I’m not exaggerating. Thanks to the pandemic, the demand for oil has plummeted. As a result, there’s a glut of the stuff and nowhere left to store it. That became a big deal in the trading pits on Monday when no one wanted to touch the futures contract for May West Texas Intermediate.

And when I say no one, I really mean it. The price for a barrel of oil plunged into the pennies and then actually went negative. You were being paid to take it. If you hold the contract, then you take delivery and that’s that. At its high, meaning its low, folks were getting paid $37 per barrel just to take it off someone’s hands.

Of course, this was more of a technical glitch, and the storage capacity issue will be remedied soon. But it’s another example of how the coronavirus has upended the economy. On Thursday we learned that the U.S. economy has now lost all the jobs it created since the last recession. What took 11 years to make only needed five weeks to destroy.

This week’s issue is solely dedicated to earnings. We had a lot of them this time, and more are coming next week as well. So far, four of our five stocks beat the Street. Only Hershey missed expectations. Silgan Holdings not only beat the forecast, but it raised guidance and hit a new 52-week high. Not bad for a can-maker. (Sorry, a diversified consumer-goods packaging manufacturer.)

There’s a lot to get to, so let’s jump into this week’s Buy List earnings reports.

Five Buy List Earnings Reports this Week

Stepan (SCL) kicked off earnings season for us on Tuesday when it reported Q1 earnings of $1.04 per share. That includes the impact of a power outage at their Millsdale plant. Excluding that, Stepan is doing quite well. The consensus of the three analysts who follow Stepan was for earnings of 78 cents per share.

If you’re not familiar with Stepan, the company is a major manufacturer of specialty and intermediate chemicals that are used in a broad range of industries.

Although Stepan is classified with other specialty-chemical companies, it’s unique in the industry. Stepan doesn’t have a competitor or competitors to precisely match its businesses because its products have a specific focus.

Stepan makes surfactants, the key ingredients in consumer and industrial cleaning compounds. That includes things like detergents, fabric softeners, shampoos, and lotions. Surfactants make them clean and foam. In other words, Stepan makes a lot of stuff that should be flying off the shelves right now.

Stepan has three operating divisions. For Q1, Surfactants had operating income of $36.2 million. Polymers was at $7.5 million, and Specialty Products did $4.0 million. The company is also in a strong position financially. Stepan currently has over $250 million more in cash than in debt. Plus, it has access to a credit line of $350 million if it needs it.

The CEO said that excluding the Millsdale issue, Stepan had a solid start to the year. Last quarter, Stepan paid out $6.2 million in dividends and bought back 260,605 shares for $7.2 million. The company has increased its dividend every year for 52 years. This week, I’m lowering my Buy Below on Stepan to $100 per share.

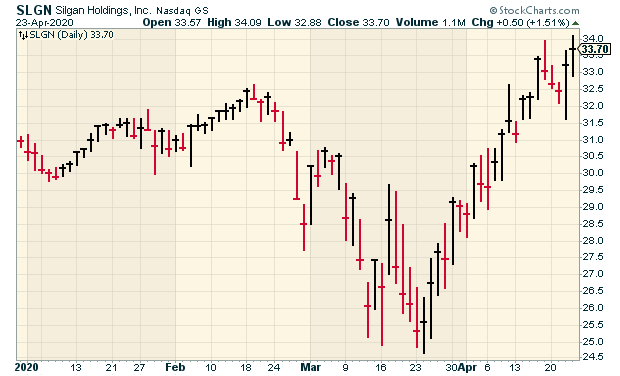

Without almost anyone noticing, Silgan Holdings (SLGN) became our top performer this year. It’s up over 8% for us in 2020. On Wednesday, the company reported Q1 earnings of 57 cents per share. That beat expectations by seven cents per share. Net sales rose 0.3% to $1.03 billion.

For Q2, Silgan sees earnings between 55 and 70 cents per share. For the whole year, Silgan estimates earnings will range between $2.30 and $2.50 per share. That’s an increase from the previous range of $2.28 to $2.38 per share. Not many companies are raising guidance in this environment.

CEO Tony Allott noted that Silgan has been declared “essential” by many government agencies. In February, the company raised its dividend by 9%. Silgan has raised its dividend every year for the last 16 years in a row. The shares just touched a new 52-week high. I’m lifting my Buy Below on Silgan to $36 per share.

After the close on Wednesday, Globe Life (GL) reported net operating income for the quarter of $1.73 per share. That was two cents above expectations.

For the quarter, GL’s return on equity was 14.1%. Globe Life sees full-year EPS ranging between $6.65 and $7.15. The earlier estimate was for $7.03 to $7.23 per share. Considering what’s happened to the economy, that downward adjustment isn’t that bad.

I’m lowering GL’s Buy Below to $80 per share.

Also on Wednesday, Eagle Bancorp (EGBN) reported Q1 earnings of $23.1 million. That works out to 70 cents per share. That’s below the estimate of 92 cents per share. However, the bank had legal fees of $4.6 million last quarter. That comes to about 14 cents per share. Eagle now has total assets of $10.01 billion. (Note: This paragraph has been updated to correct for an error in the emailed version of the newsletter.)

For the quarter, Eagle had a net interest margin of 3.49%, and the efficiency ratio was 43.83%. Both are pretty good. I think our thesis holds that this is a good bank that’s been held back by legal fees and old issues involving people no longer with the bank. Once that matter clears up, EGBN should get a much better valuation. I’m lowering my Buy Below on Eagle to $34 per share.

Here’s a major footnote to those results. The compensation to the former CEO was $6.2 million, or 13 cents per share. So excluding that, Eagle made a nice $1.11 per share last quarter. That’s a pretty bit of change the former CEO got.

Our winning streak ended with Hershey (HSY). On Thursday, the candy company reported Q1 earnings of $1.63 per share. That was eight cents below estimates. Sales rose 1% to $2.04 billion. Constant-currency sales were up 0.5%.

CEO Michele Buck said, “We had a solid start to the year with our business performing as expected prior to the impact of COVID-19.” Then came the coronavirus, and business started to suffer.

In January, the chocolatier said it expected full-year earnings between $6.13 and $6.24 per share. On Thursday, Hershey withdrew that guidance, although the company said it stands by its long-run goal of growing EPS by 6% to 8%. The shares fell about 4% in Thursday’s trading.

I’m lowering my Buy Below on HSY to $150 per share.

Eight More Buy List Reports Next Week

Here’s the updated Earnings Calendar.

| Company | Ticker | Date | Estimate | Result |

| Stepan | SCL | 21-Apr | $0.78 | $1.04 |

| Eagle Bancorp | EGBN | 22-Apr | $0.92 | $0.70 |

| Globe Life | GL | 22-Apr | $1.71 | $1.73 |

| Silgan Holdings | SLGN | 22-Apr | $0.50 | $0.57 |

| Hershey | HSY | 23-Apr | $1.71 | $1.63 |

| Check Point Software | CHKP | 27-Apr | $1.38 | |

| Cerner | CERN | 28-Apr | $0.70 | |

| AFLAC | AFL | 29-Apr | $1.10 | |

| Sherwin-Williams | SHW | 29-Apr | $3.94 | |

| Church & Dwight | CHD | 30-Apr | $0.77 | |

| Intercontinental Exchange | ICE | 30-Apr | $1.24 | |

| Moody’s | MCO | 30-Apr | $2.19 | |

| Stryker | SYK | 30-Apr | $1.83 | |

| Trex | TREX | 4-May | $0.61 | |

| Disney | DIS | 5-May | $0.88 | |

| ANSYS | ANSS | 6-May | $0.80 | |

| Becton Dickinson | BDX | 7-May | $2.37 | |

| Danaher | DHR | 7-May | $1.01 | |

| Fiserv | FISV | 7-May | $1.01 | |

| Broadridge Financial Solutions | BR | 8-May | $1.72 | |

| Middleby | MIDD | TBA | $1.36 |

Next week will be another busy one for us. We have eight Buy List stocks scheduled to report.

Let’s start with Check Point Software (CHKP). The company will report Q1 earnings on Monday, April 27. Three months ago, the cyber-security outfit reported Q4 earnings of $2.02 per share. That beat the Street by three cents per share.

In the last earnings report, the company announced a big $2 billion extension to its share-buyback program. Check Point hasn’t provided any guidance for 2020. For Q1, Wall Street expects $1.38 per share.

On Tuesday, it’s Cerner’s (CERN) turn. In February, Cerner said it sees Q1 earnings of 69 to 71 cents per share. For all of 2020, they forecast $3.09 to $3.19 per share. I haven’t seen any updates since then.

The healthcare-IT company recently talked about the possibility of having 27,000 employees work from home. Wall Street expects Q1 earnings of 70 cents per share. The stock has gained 34% from its low one month ago.

Two companies are due to report next Wednesday: AFLAC and Sherwin-Williams.

Shares of AFLAC (AFL) got hit hard during the scary bear market. The stock lost half its value in 18 trading days. The good news is that it’s come back a lot. AFL is now up more than 50% from its low.

I like the duck stock a lot, and I admire the firm’s management. For 2020, AFLAC said it’s looking for earnings of $4.32 to $4.52 per share. That assumes an exchange rate of 109.07 yen to the dollar (which was the average for 2019).

Earlier this year, AFLAC raised its quarterly dividend from 27 cents to 28 cents per share. This was their 37th annual dividend increase in a row. For Q1, Wall Street expects $1.10 per share.

Sherwin-Williams (SHW) had a weak Q4, so I’ll be curious to see how well the paint folks rebounded in Q1. The CEO noted “softness in certain industrial-end markets and choppiness in our international businesses.”

Sherwin is another stock that recently gave us a nice dividend boost. Last month, Sherwin hiked its dividend by 19%. That was its 41st dividend increase in a row. For 2020, Sherwin-Williams expects earnings to range between $22.70 and $23.50 per share. For Q1, Wall Street expects earnings of $3.94 per share.

Next Thursday, April 30 will be a busy day for us. We have four more Buy List earnings reports.

Let’s start with Church & Dwight (CHD), which has been one of our better-performing stocks this year, meaning it’s actually up for the year. For Q4, they hit expectations on the nose.

For Q1, C&D expects earnings of 73 cents per share. For all of 2020, the company is looking for earnings of $2.64 to $2.69 per share. That’s an increase of 7% to 9% over 2019. CHD hasn’t withdrawn that forecast, but it has taken out $825 million from a credit facility, so it has some short-term cash on hand.

Earlier this year, before the news was taken over by the virus, Intercontinental Exchange (ICE) was reported to have made an offer to buy eBay. ICE later denied it had made an offer.

I like to keep an eye on ICE’s data revenue. For Q4, that came in at $559 million which is about what I expected. After two people tested positive for COVID-19, the company closed the trading floor of the NYSE and only had electronic trading. For Q1, Wall Street expects $1.24 per share.

Moody’s (MCO) got off to a great start for us this year before the shares got wrecked in March. Like many others, Moody’s has rallied back. Their Q4 earnings report was particularly good.

The ratings agency initially came out with 2020 guidance of $9.10 to $9.30 per share. In March, they reiterated that range, although they said results would be at the lower end. For Q1, the consensus on Wall Street is for earnings of $2.19 per share.

Last is Stryker (SYK). For Q1, Stryker expects earnings of $2.05 to $2.10 per share, and $9.00 to $9.20 per share for the whole year. Wall Street has pared its consensus for Q1 down to $1.83 per share.

That’s all for now. The Federal Reserve meets again next week on Tuesday and Wednesday. I’ll be curious to hear what the central bank has to say. Also on Wednesday, we’ll get our first look at the Q1 GDP report which will only be partially affected by COVID-19. Weekly jobless claims will come out on Thursday, and the ISM Manufacturing Index is due out on Friday. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Posted by Eddy Elfenbein on April 24th, 2020 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His