Archive for June, 2020

-

Making My Own Dice Baseball Game

Eddy Elfenbein, June 13th, 2020 at 4:26 pmThe idea of creating simulation baseball games based on playing dice is an old one. There are some versions that date from the 19th century. There are many different versions currently on the market. The basic idea is that the outcome of every plate appearance is determined by a roll of dice.

I wanted to try my hand and devise my own version.

My goal was two-fold. I wanted to create a dice baseball game that’s reasonably accurate to real baseball but also easy to play.

There are games on the market that are mind-numbingly complex, and in my opinion, not very fun. YouTube has some videos of people playing these games, and you’d think it’s someone doing their taxes. I didn’t want that.

My first goal was to use the “craps” version of dice. By that, I mean you simply throw two dice and add the results together. Just like craps. Other games are based on certain dice combinations. For example, a 1 and a 4 means this or a 2 and a 5 means that. That’s another thing I didn’t want.

I wanted something easy. Roll dice and boom, see the play. No charts or forms. Nothing to look up and no extra dice.

I also wanted a higher number to mean a better the result. That makes the game simple and intuitive.

With that being said, here’s my version. This is the outcome for each roll of the dice.

Dice Roll Outcome 2 Walk 3 Walk 4 GDP 5 Pop Up 6 Strikeout 7 Ground Out 8 Sac Fly 9 Single 10 Single+ 11 Double 12 Home Run Now for some explanation. The Sac Fly is only in play when there’s a runner on third with less than two outs. The other runners do not advance. If no one’s on third, then it’s a regular deep fly.

The GDP is only a double play when there’s a man on first with less than two outs. The other runners advance. If no one’s on first, then it’s a regular ground out and the other runners do not advance.

With the regular single, the runners on base advance one base. With the single-plus, runners on base advance two bases. With a double, runners on base advance two bases.

You may have noticed a few quirks in my version. For example, there are no triples. Sorry, but they’re just too rare in modern baseball.

I also didn’t have any sac bunts. Those don’t happen very often in real baseball and when they do, it’s usually the pitcher in the batter’s box. There are also no errors, and I didn’t include stolen bases. If you want to add them, knock yourself out.

Now for some basic stats. Rolling two six-sided dice gives you 36 different outcomes. Here are the probabilities for each roll:

Die Roll Odds 2 1/36 3 2/36 4 3/36 5 4/36 6 5/36 7 6/36 8 5/36 9 4/36 10 3/36 11 2/36 12 1/36 Using that, we can see that my rules produce an OBA of 0.361 (or 13/36), a batting average of 0.303 (or 10/33) and a slugging percentage of 0.455 (or 15/33). The OPS comes to 0.816. That’s higher than the average in real baseball but I wanted to make my game a little offensive heavy.

Those numbers aren’t exactly right because we still need to adjust for Sac Flies. Under baseball’s rules, a SF counts as a plate appearance but not an at bat.

How do we calculate the expected number of Sac Flies? Thankfully, my nephew knows some computer programming and we ran a simulated 1,000,000 innings. Based on that, a SF comes along once in every 113 plate appearances. That boosts our batting average to 0.306. On-base stays the same, but slugging percentage rises to 0.460. The OPS increases to 0.821.

We found that my rules produce an average of 5.07 runs per nine innings. That’s about 8% higher than the average of the last 30 years. As a general rule, my version gets more people on base but doesn’t move them across the basepaths as much.

If you’re curious, the odds of a pitcher throwing a no-hitter are one in every 17,109 while a perfect game would be one in 179,273. Since 1876, there have been about 232,000 games played.

Extra

A few years ago, “The Riddler” at FiveThirtyEight once ran a contest on devising a dice baseball game. Here’s the winning submission.

Here’s a variant I came up with that’s a little closer to actual baseball. Personally, I don’t like the erratic jumble of results.

Die Roll Outcome 2 Strikeout 3 Single+ 4 GDP 5 Sac Fly 6 Fly Out 7 Strikeout 8 Ground Out 9 Walk 10 Single 11 Double 12 Home Run You can get more accurate by getting more complicated, but I think my version is best combination of simplicity and accuracy.

Baseball Solitaire

Eddy Elfenbein, June 13th, 2020 at 10:13 amSince it’s a weekend in June and we don’t have baseball, I thought I’d share with you a game I invented when I was a kid. It’s a simulation baseball game that uses a regular deck of playing cards.

It’s a lot of fun and the rules are easy. Each card represents a plate appearance.

Here’s the breakdown.

Cards Hearts Diam Clubs Spades Ace 1B BB GDP GDP Two 1B BB GDP GDP Three 1B BB GDP GDP Four 1B BB Out Out Five 1B Out Out Out Six 1B+ Out Out Out Seven 1B+ Out Out Out Eight 1B+ Out Out Out Nine 2B SF SF SF Ten 2B+ SF SF SF Jack 2B+ K K K Queen 3B K K K King HR K K K Some explanation. The plus on 1B+ and 2B+ means that baserunners take an extra base (ie, a seven of hearts will score a guy on second, but a five of hearts does not).

The GDP is a normal out, but a double play is there’s a guy on first with less than two outs. Same for the SF. It’s a sac fly if there’s a man on third with less than two outs.

The other baserunners don’t advance on a SF, but they do in a GDP. I don’t know why I keep the latter rule, but it seems more fun that way.

Like I said, it’s simple and a lot of fun, especially once you internalize the system. Feel free to adjust the rules as you see fit.

Some technical stuff.

The game doesn’t perfectly match a baseball, but it’s reasonably close (hey, I was a kid). BA is .271, OBA is .327, SLG is .438 and OPS is .764 That’s not bad for such a simple game. Technically, the batting average is a little higher since sac flies don’t count as much at bat do as plate appearances. My guess is with the adjustment, it’s about .273, so not much of a difference.

I estimate that runs per nine innings is about 4.1 or 4.2. That’s just a guess. That’s about 0.5 lower than the OPS would imply. I assume that no errors or SB account for the difference, but I’m not sure.

I reshuffle after every three innings. That means about half the deck is used.

When I was a kid, I played this for hours and hours. I’ve recreated dozens of World Series and all-star games. I’ve managed my own teams and conducted trades. Have I run through an entire 162-game season and kept the stats? Um…no comment.

I’ve played some truly amazing games with wild comebacks. It’s all based on playing cards and my imagination.

If you’re missing baseball this year, give my baseball solitaire a shot. Warning: You might become an addict.

CWS Market Review – June 12, 2020

Eddy Elfenbein, June 12th, 2020 at 7:08 am”We’re not even thinking about thinking about raising rates.” – Fed Chairman Jerome Powell

Last week’s issue of CWS Market Review was unusually prophetic. I said there’s a good chance that our Buy List would soon be positive for the year. Indeed, that happened two days later.

In that issue, I also said that the National Bureau for Economic Research might confirm the start of the recession before the end of the year. They did it on Monday. The expansion lasted 128 months.

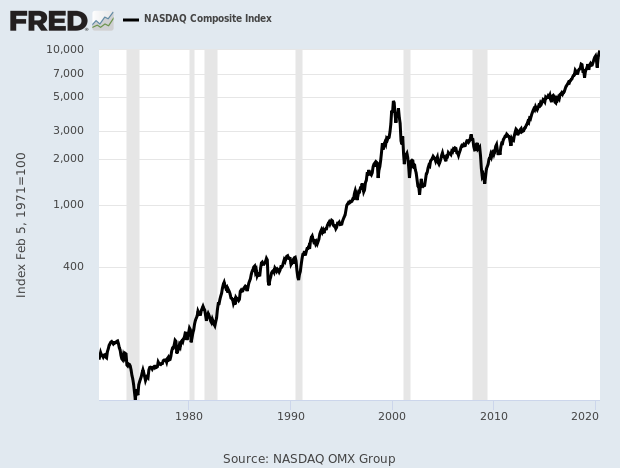

I also noted that the Nasdaq Composite had just made a new all-time high. This week, the index went on to break 10,000 for the first time ever. The index started life in 1971 at 100. It took nearly 50 years to become a 100-bagger.

I also discussed the recent surge in cyclical stocks and wondered if the cycle had finally turned. On Thursday, however, cyclical stocks were severely punished as the market suffered its worst day in nearly three months. The S&P 500 plunged by 5.89% to close just above 3,000.

What caused the selling? We can point our fingers at the Federal Reserve, which met this week. Chairman Jerome Powell’s pessimistic outlook threw cold water on the market’s recent rally. There are also concerns that the long-feared “second wave” is starting to form.

On Thursday, the S&P 500 fell for the third day in a row. A three-day losing streak isn’t that big a deal, but we haven’t had one in 94 calendar days. That’s an usually long stretch. I guess we were due for one, and it came hard. In this week’s issue, I want to take a closer look at what’s been happening to the market and what we can expect going forward.

Cyclicals Get Crushed

One of the keys to understanding the stock market and investing is that the market tends to move in broad cycles. This happens as the market gets attached to a thesis. Let’s say the market convinces itself that the economy is gradually improving.

With that, we’ll see a fairly standard playbook. A rising market. Leadership from industrials and cyclicals. Lower bond prices. Higher yields and higher commodity prices. Greater pressure on the Fed to raise rates.

That’s the standard. Of course, each cycle will have its own peculiarities. Since March 23, the strong rally has been based on the idea of a diminishing threat from the coronavirus. Of course, that thesis isn’t completely unexpected since the rally is largely reversing the bear market which the coronavirus first caused. X is followed by negative X.

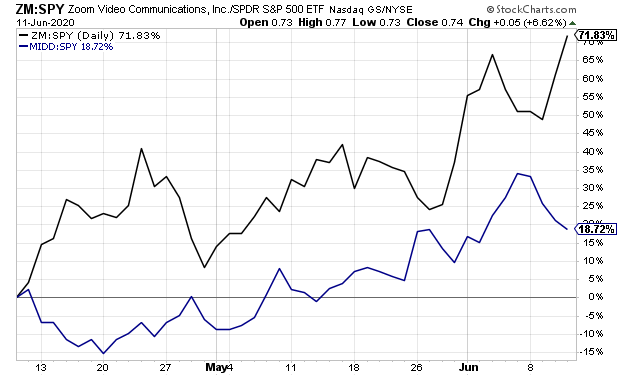

Here’s a good example of what I mean. This is a chart of the Zoom Video Communications (ZM) divided by the S&P 500 ETF, along with Middleby (MIDD) divided by the S&P 500 ETF.

When the lines are rising that means those stocks are beating the market. Conversely, when they’re falling, they’re lagging the market. If you examine the charts, you’ll notice that they tend to move in opposite directions. That’s the key point I want to get across.

In the age of the coronavirus, these two stocks are nearly polar opposites. I chose Zoom because it’s profited greatly from the lockdown, whereas Middleby has suffered. What’s been good news for one has been bad news for the other. (Zoom, truthfully, probably isn’t the best example for this exercise because the bullish trend has been so powerful, but even so, the cycle is still visible.)

Once these cycles get established, there will be strong contra-trend days. That’s a fancy word to say that everything that had been doing well gets crushed one day. At the same time, all the laggards suddenly find themselves in the spotlight. Or to quote more authoritatively, “So the last shall be first, and the first last.” As the thesis of the rally is debated on Wall Street, we’ll constantly see a tug-of-war between trend and contra-trend.

That’s exactly what we got on Thursday. It was a classic contra-trend rally. I’ll give you an example. If we look at High Beta stocks, these are stocks that tend to move around the most, and they got crushed. The S&P 500 High Beta Index lost more than 10% on Thursday. The High Beta sector is close to being an all-purpose anti-Covid sector. Whenever news breaks that the virus is fading, you can be sure High Beta will shine.

Within the stock sectors, the biggest loser was energy stocks. The S&P 500 energy sector lost over 9% on Thursday. In fact, the four worst-performing sectors on Thursday were (in order) Energy, Financials, Materials and Industrials. If you recall, these are the exact four that I told you last week comprise the cyclicals universe.

It’s these cyclical stocks that had performed so well that got their heads chopped off on Thursday. The price action on Thursday wasn’t a minor pushback, either. The bears gave these stocks a super-atomic wedgie. Callie Cox noted that on the NYSE, decliners led advancers by 1,800. That’s the most in nearly five years. In other words, the bears were going after everyone.

Last week, I asked if the cycle has finally turned. This week told us, “maybe not.” I wish I could be more emphatic in my predictions, but the facts won’t allow for it. Until we know more, we should maintain a conservative approach to our investments. Three of our stocks that look particularly good right now are Stepan (SCL), Middleby (MIDD) and Stryker (SYK).

Mr. Powell Spooks the Market

As I mentioned earlier, the Federal Reserve got together this week. On Wednesday, the Fed released its policy statement. As expected, there wasn’t any change to its policy. Rates are already rock bottom, and I doubt they’ll soon go negative.

What caught Wall Street’s attention were comments made by the Fed Chairman in his post-meeting press conference. Jerome Powell was unusually blunt. He said the Fed isn’t “even thinking about raising interest rates.” The Fed probably sees rates staying near 0% through this year, next year and the year after that. On top of that, the Fed will most likely continue to buy up bonds at a frenetic pace. Central bankers rarely speak so forthrightly.

This is somewhat ironic in that Mr. Powell was often harshly criticized by President Trump (who appointed him) for not lowering rates. There’s another story going on. A lot of the Fed’s job involves signaling. Right now, the Fed wants to make it clear to Wall Street that it will not stand in the way of any nascent recovery. Wall Street took the message to mean that the economy is more precarious than the bulls believe. Then on Thursday, it was as if three months of frustration from the bears came out all at once.

One big change between now and the market in March is that daily volatility has dropped significantly. The Fed also released its economic projections for the next few years. The central bank forecasts a very robust recovery. Of course, that’s coming off a very steep low.

The economic news is still quite scary. The latest jobless-claims report came in at 1.542 million. That’s the tenth weekly decline in a row. There was good news in last Friday’s jobs report. It showed an increase of 2.5 million jobs, although the Bureau of Labor Statistics conceded there were some errors in this report. We’ll have more details next month. (It’s not some conspiracy. It’s just hard to get the right data during extreme events.)

On Wednesday, we learned that consumer prices fell again last month. That’s the third monthly decline in a row. The good news is that we’re not too far from the normal range. My fear was that we could be near a deflation spiral where lower prices begat even lower prices. Things are getting back to normal, but it will take time.

That’s all for now. On Tuesday, we’ll get the retail-sales report for May. The previous report was terrible. Hopefully, that was the nadir. We’ll also get the latest report on industrial production. Then on Wednesday, we’ll have the latest report on new-home sales. Thursday, of course, will be another report on jobless claims. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Morning News: June 12, 2020

Eddy Elfenbein, June 12th, 2020 at 6:46 amU.K. Economy Plunges by Record 20%

Lebanon’s Currency Plunges, and Protesters Surge Into Streets

Investors, No Longer in Denial About Grim Outlook, Drive Market Down

U.S. Manufacturers Struggle To Keep Workers In Face Of Weak Demand

What Rebound? North Dakota In Economic Crunch As Virus Batters Oil, Agriculture

‘Corona Cycleways’ Become the New Post-Confinement Commute

Hertz Proposes $1 Billion Stock Sale to Capitalize on Odd Rally

Amazon to Face Antitrust Charges From EU Over Treatment of Third-Party Sellers

Walmart, CVS, Walgreens to Stop Locking Up Black Beauty Products

Hello Kitty Gets a 31-Year-Old CEO

Ben Carlson: Some Things About the Markets That Will Never Change

Michael Batnick: How Often Do Stocks Fall?

Jeff Carter: The Corporate Route

Howard Lindzon: The Worst Risk/Reward In History?…and Why I Still Love Venture Capital

Joshua Brown: Ten Reasons The “Second Wave” Hasn’t Spooked The Markets (Yet) & Two Big L’s In A Row

Be sure to follow me on Twitter.

Dow -1,300

Eddy Elfenbein, June 11th, 2020 at 1:03 pmThe stock market is taking a hit today. Actually, it’s been a while since the bears had a good day so perhaps this was due. The Dow is currently down over 1,300 points. Of course, that’s a smaller percentage than it used to be. This may be the worst day since March.

This morning’s initial jobless claims report came in at 1.542 million. That’s the tenth weekly decline in a row. (By that, I mean decline in the increase.)

Many of the stocks that had been doing well, meaning stocks tied to an economic recovery, are down the most today. The “recovery thesis” is getting its first push-back in a few weeks.

This could be the market’s first three-day losing streak since March. That’s the longest run without one since 2017.

Morning News: June 11, 2020

Eddy Elfenbein, June 11th, 2020 at 7:03 amU.S. Weekly Jobless Claims Seen Declining Further, But Millions Still Unemployed

U.S. Futures Slump on Fed Caution and Virus Fears

Pessimistic Pros Missed the Big Rally, and So Did Many Americans

Economics, Dominated by White Men, Is Roiled by Black Lives Matter

Amazon Pauses Police Use of Its Facial Recognition Software

Tesla Approaches Milestone of World’s Most Valuable Carmaker

China’s Street Vendor Push Ignites a Debate: How Rich is It?

Despite Pandemic, New U.S. Solar Capacity Will Grow 33% In 2020

How Uber Hailed A Deal With Grubhub Only To Let It Slip

Tyson Foods Cooperating in U.S. Probe of Chicken Price-Fixing

Ben Carlson: Backtests vs. Real Life in the Markets

Howard Lindzon: Nasdaq 10,000 – Here We Are …And The Uniquely Risky Future

Michael Batnick: Animal Spirits: Stock Market Euphoria & There Are Always Reasons to Sell

Be sure to follow me on Twitter.

Today’s Federal Reserve Policy Statement

Eddy Elfenbein, June 10th, 2020 at 2:50 pmHere’s today’s Fed policy statement:

The Federal Reserve is committed to using its full range of tools to support the U.S. economy in this challenging time, thereby promoting its maximum employment and price stability goals.

The coronavirus outbreak is causing tremendous human and economic hardship across the United States and around the world. The virus and the measures taken to protect public health have induced sharp declines in economic activity and a surge in job losses. Weaker demand and significantly lower oil prices are holding down consumer price inflation. Financial conditions have improved, in part reflecting policy measures to support the economy and the flow of credit to U.S. households and businesses.

The ongoing public health crisis will weigh heavily on economic activity, employment, and inflation in the near term, and poses considerable risks to the economic outlook over the medium term. In light of these developments, the Committee decided to maintain the target range for the federal funds rate at 0 to 1/4 percent. The Committee expects to maintain this target range until it is confident that the economy has weathered recent events and is on track to achieve its maximum employment and price stability goals.

The Committee will continue to monitor the implications of incoming information for the economic outlook, including information related to public health, as well as global developments and muted inflation pressures, and will use its tools and act as appropriate to support the economy. In determining the timing and size of future adjustments to the stance of monetary policy, the Committee will assess realized and expected economic conditions relative to its maximum employment objective and its symmetric 2 percent inflation objective. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments.

To support the flow of credit to households and businesses, over coming months the Federal Reserve will increase its holdings of Treasury securities and agency residential and commercial mortgage-backed securities at least at the current pace to sustain smooth market functioning, thereby fostering effective transmission of monetary policy to broader financial conditions. In addition, the Open Market Desk will continue to offer large-scale overnight and term repurchase agreement operations. The Committee will closely monitor developments and is prepared to adjust its plans as appropriate.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michelle W. Bowman; Lael Brainard; Richard H. Clarida; Patrick Harker; Robert S. Kaplan; Neel Kashkari; Loretta J. Mester; and Randal K. Quarles.

Here are the economic projections.

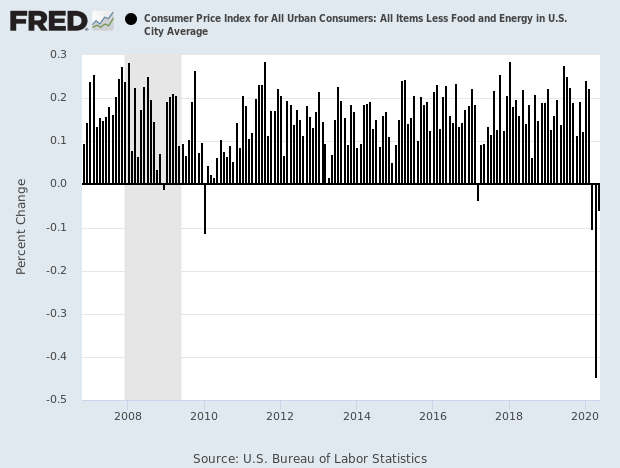

Still More Deflation

Eddy Elfenbein, June 10th, 2020 at 12:00 pmThis morning’s CPI showed that inflation fell by 0.1% last month. This was the third monthly drop in a row. This comes after the CPI fell by 0.8% in April.

In the 12 months through May, the CPI gained 0.1%. That was the smallest year-on-year rise since September 2015 and followed a 0.3% increase in April. Economists polled by Reuters had forecast the CPI would be unchanged in May and gain 0.2% year-on-year.

The National Bureau of Economic Research, the arbiter of U.S. recessions, declared on Monday that the economy slipped into recession in February. Nonessential businesses were shuttered in much of the country in mid-March to slow the spread of COVID-19, the respiratory illness caused by the novel coronavirus, almost bringing the economy to a halt.

Excluding the volatile food and energy components, the CPI slipped 0.1% in May after decreasing 0.4% in April, the largest drop since the series started in 1957. The so-called core CPI fell in March for the first time since January 2010.

The stock market is down a bit today. The Federal Reserve’s policy statement will come out this afternoon. Also, Chairman Powell will hold a press conference.

Here’s a look at the monthly change in the core rate. It appears to be getting back to normal. We’ll see.

Morning News: June 10, 2020

Eddy Elfenbein, June 10th, 2020 at 7:02 amEconomic Impact Of The Coronavirus Crisis Is ‘Dire Everywhere,’ OECD Says

China Factory Gate Deflation Deepens On Global Demand Slump

Expats Fleeing Dubai Is Bad News for the Economy

ECB Prepares ‘Bad Bank’ Plan For Wave Of Coronavirus Toxic Debt

With Crisis Response In Place, Fed Looks To Long Term

A $22 Trillion Stock Rally Now Hinges on Rapid Economic Recovery

Virus Splinters Global Economy, Exposing Inequality Fault Lines

What Are Fintechs and How Can They Help Small Business?

‘Morally Impossible’: Some Advertisers Take a Timeout From Facebook

Jack Dorsey’s Stand Against Trump Marks a Long-Debated Red Line

CrossFit C.E.O. Greg Glassman Steps Down in Chaos

AMC Says ‘Almost All’ U.S. Theaters Will Reopen in July

Tesla Model Y: The Legacy Car Killer

Nick Maggiulli: The Depth of Privilege

Ben Carlson: 5 Signs This Might Be a New Bull Market

Be sure to follow me on Twitter.

Nasdaq 10,000

Eddy Elfenbein, June 9th, 2020 at 2:58 pmAt 1:43 pm ET, the Nasdaq Composite broke 10,000 for the first time ever.

The index has nearly doubled its famous peak from 20 years ago.

The index was started in 1971 at 100. It’s now up 100-fold in just under 50 years. The Nasdaq Composite first got to 1,000 in 1995.

There are about 2,500 in the index, but the Nasdaq 100 contains about 90% of the full Nasdaq’s weighting.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His