Archive for July, 2020

-

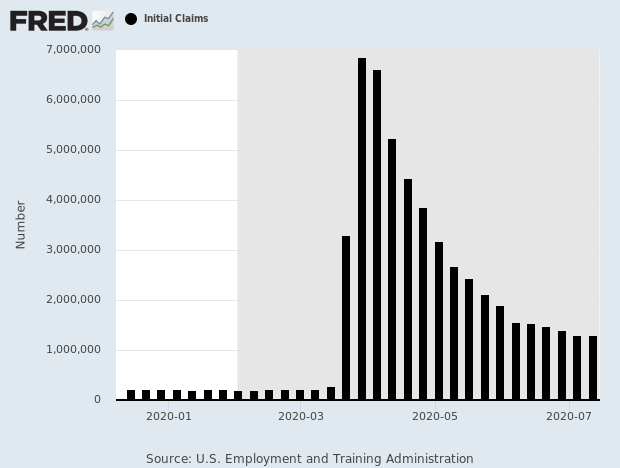

17 Weeks Straight Above 1 Million

Eddy Elfenbein, July 16th, 2020 at 10:40 am

We had two important economic reports this morning. The jobless claims report topped 1 million for the 17th week in a row. Initial weekly claims came in at 1.3 million for the week ending July 11. Economists had been expecting 1.25 million. Continuing claims came in at 17.338 million.

The retail sales report for June rose by 7.5%. That’s on top of the monster 18.2% increase for May.

Economists had been expecting an increase of 5%. Excluding autos, the increase was 7.3%.

-

Morning News: July 16, 2020

Eddy Elfenbein, July 16th, 2020 at 7:10 amEurope Beats U.S. For Private Equity Mega-Deals

India’s Reliance Seen Emerging As Bigger Threat for U.S. Firms Like Amazon, Walmart

China’s Economy Rebounds From Coronavirus, but Shares Fall

A Brazen Online Attack Targets V.I.P. Twitter Users in a Bitcoin Scam

TikTok Enlists Army of Lobbyists as Suspicions Over China Ties Grow

Communication Collapse: Inside Facebook’s Tussle With Brazil’s Central Bank

Billionaires Hunt Real Estate Bargains in Shadow of Pandemic

Bank of America Profit More Than Halves on Pandemic Woes

Carson Block Warns Tesla Short Sellers: ‘I Wouldn’t Do That’

Where to Invest $10,000 Right Now

Professor Whose Formula Predicts Bankruptcies Has a Big Warning

Joshua Brown: An Important Ratio

Michael Batnick: Animal Spirits: This is A Bubble

Ben Carlson: Investment Policy for Institutional Investors

Be sure to follow me on Twitter.

-

Five-Week High

Eddy Elfenbein, July 15th, 2020 at 11:38 am

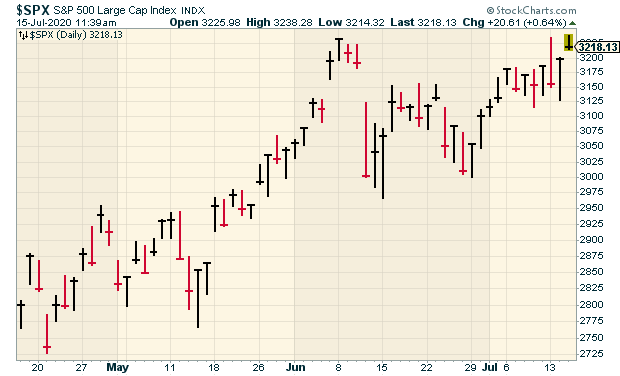

Yesterday the S&P 500 closed at a five-week high, and it’s up again today. The index is very close to the high from June 8 which is currently the highest close since the rally started on March 23.

This morning’s industrial production report showed an increase of 5.4% for June. That’s quite good although we’re still well below the high from a few months ago.

From the WSJ:

The data suggest U.S. industries have started a slow recovery from April’s record decline. Despite the recent gains, the index for the second quarter as a whole fell at an annual rate of 42.6%, the largest quarterly decrease since World War II.

We have news on Church & Dwight (CHD), Moody’s (MCO) and Danaher (DHR).

-

Morning News: July 15, 2020

Eddy Elfenbein, July 15th, 2020 at 7:09 amBlow For EU As Apple Wins Fight Against $15 Billion Tax Order

U.K. Bars Huawei for 5G as Tech Battle Between China and the West Escalates

Fed’s Brainard Sees Substantial Economic Risks and Slow Recovery

Markets Walk Dangerous Tightrope Before U.S. Stimulus Expires

Banks Stockpile Billions as They Prepare for Things to Get Worse

‘Hero’ Pay Raises Disappear for Many Essential Workers

Google Buys 7.7% of Reliance’s Digital Unit For $4.5 Billion

Electric-Car Subsidies Make Renaults Free in Germany

Disney Parks Are Practically Empty and That Seems to Be the Idea

Will Tesla Be Added to the S&P 500? Here’s How It Will Be Decided

Howard Lindzon: Investing is Hard …and Tesla Topped

Michael Batnick: Brand New “What Are Your Thoughts?

Ben Carlson: It’s Easier to Start a Bull Market Than Prevent a Bear Market

Nick Maggiulli: What Risk Isn’t

Joshua Brown: CHART: The Modern History of Globalization & Musk vs Buffett, Gold vs the S&P 500

Be sure to follow me on Twitter.

-

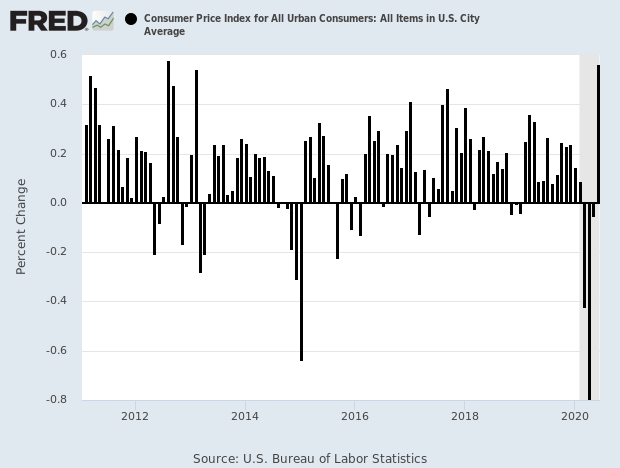

Consumer Prices Rebound in June

Eddy Elfenbein, July 14th, 2020 at 10:01 amThe stock market couldn’t hold onto its gains from yesterday morning. After 2 pm, stock prices dropped, but this morning share prices appear to have stabilized.

This morning’s CPI reported showed that after three months of deflation, consumer prices rebounded in June. The headline rate rose by 0.6%. That’s the highest in eight years. The core rate rose by 0.2%.

The Fed is pumping money into the economy through extraordinary measures, including large-scale asset purchases and funneling loans to firms. Separately, the government has provided nearly $3 trillion in fiscal stimulus, contributing to a record monthly budget deficit in June.

There have been fears that the unprecedented stimulus could stoke inflation. But with a record 33 million people on unemployment benefits, economists expect inflation is likely to remain benign.

-

Morning News: July 14, 2020

Eddy Elfenbein, July 14th, 2020 at 7:07 amAs Europe’s Economies Reopen, Consumers Go on a Spending Spree

How to Read U.S. Economic Data, Without the Spin

America’s Jobless Are About to Lose Their $600-a-Week Lifeline

Hong Kong Disneyland to Close Again, Days After Disney World Reopens

Google Is in Advanced Talks to Invest $4 Billion in Jio Platforms

TikTok’s U.S. Users Prepare for Life Without the Video App

NBC Starts Streaming With a TV-Style Platform, Peacock

SiriusXM Enters the Podcast Wars With Purchase of Stitcher for Up to $325 Million

The Bronco Is Back, Thanks to Group of Obsessed Ford Employees

Flour and Toilet Paper Are Back at N.Y. Supermarkets, but There’s a Catch

Covid Conversations With One of America’s Richest Men

Joshua Brown: Chinese Margin Madness

Ben Carlson: Wealth Inequality & Lottery Tickets

Howard Lindzon: Momemtum Monday…SPAC, SPAC, SPAC….Investing Is Soooo Easy

Michael Batnick: Was That The Top? What Should College Students Do This Fall?

Be sure to follow me on Twitter.

-

Goldman Rates Disney a Buy

Eddy Elfenbein, July 13th, 2020 at 10:48 amGoldman Sachs gave Disney (DIS) a buy rating and a price target of $137 per share.

Analyst Brett Feldman wrote in a note that he believes the market is underestimating the potential of Disney+, Disney’s recently-launched direct to consumer (DTC) streaming service.

“We believe Disney’s best-in-class brand, global distribution (breadth), production assets (build), sizable content library (backlist) and strong financial profile (balance sheet) position the company to build scaled DTC video platforms in the highly competitive streaming environment,” Feldman said.

Disney is up to $119 per share. Disney World reopened this weekend.

-

S&P 500 Crosses 3,200

Eddy Elfenbein, July 13th, 2020 at 10:01 am

The stock market is having a nice morning. The S&P 500 is back over 3,200. We haven’t closed above that level in over a month. In fact, we’re getting close to a new all-time high.

The weak spot is that the overall rally continues to be very narrow. Tech stocks are surging while the rest of the market is rather flat. Speaking of tech, Analog Devices said it would buy Maxim Integrated for $21 billion in an all-stock deal.

This quote from a recent Reuters article summed it up:

“COVID-19 is now inversely related to the markets. The worse that COVID-19 gets, the better the markets do because the Fed will bring in stimulus. That is what has been driving markets,” said Andrew Brenner, head of international fixed income at NatAlliance.

The Q2 earnings season is about to begin. Wall Street expects corporate profits to fall by 44%. If that’s right, it would be the worst quarter in over a decade.

We have new highs this morning from FactSet (FDS), Check Point Software (CHKP) and Church & Dwight (CHD). Moody’s (MCO) is very close to a new high.

-

Morning News: July 13, 2020

Eddy Elfenbein, July 13th, 2020 at 7:05 amGoogle Will Invest $10 Billion in India Over the Next Few Years

Federal Reserve’s $3 Trillion Virus Rescue Inflates Market Bubbles

Wealthy Investors Worry About Lack of Cash If Pandemic Returns

Did Uncle Sam’s Virus Aid Help Your Credit Score? Don’t Count on a Loan

Analog Devices in Talks to Buy Maxim Integrated for About $20 Billion

Google Search Upgrades Make It Harder for Websites to Win Traffic

How May Google Fight an Antitrust Case? Look at This Little-Noticed Paper

Tesla Lowers the Starting Price of Its Model Y Electric SUV

Inside the White House, a Gun Industry Lobbyist Delivers for His Former Patrons

Diageo to Launch Johnnie Walker in Paper Bottles in 2021

Lawrence Hamtil: The COVID Crisis Provides Further Validation for Barbell Strategies

Michael Batnick: How to Protect Your Portfolio

Roger Nusbaum: Knowing When You’ve Won

Ben Carlson: What Should College Students Do This Fall? & If We Can Print Our Own Money Why Do We Have to Pay Taxes?

Jeff Carter: Scarcity & So You Want To Be A Trader

Cullen Roche: The 2020 Podcast World Tour Continues

Jeff Miller: Time for Some Hedging?

Howard Lindzon: Halt And Catch Tech Stocks

Be sure to follow me on Twitter.

-

CWS Market Review – July 10, 2020

Eddy Elfenbein, July 10th, 2020 at 7:08 am“The key to making money in stocks is not to get scared out of them.” – Peter Lynch

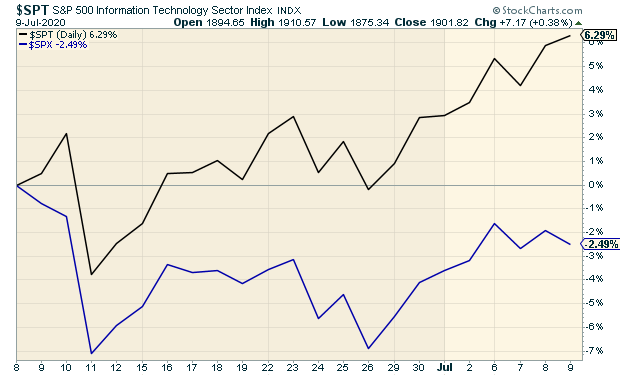

Apparently, technology stocks didn’t get the memo that this is supposed to be a “dangerous” and “pricey” market. Since the S&P 500 reached its near-term peak on June 8, the S&P 500 has pulled back about 2.5%, but the S&P 500 tech sector has marched ahead another 6.3%.

That’s quite a large gap for such a short amount of time, especially since tech is by far the largest sector in the index. It looks like the tech sector is leaving everyone else behind, and that’s a gain on top of a very nice run since late March. Since the market bottomed out four months ago, the tech sector has gained 53%.

If you feel like you’ve seen this movie before, you’re not alone. This is somewhat similar to what happened 20 years ago when the Dot-Com Bubble and Bust turned Wall Street upside-down. The difference was that that case was, to use a technical term, totally bananas. This time, it’s merely worthy of attention.

In this week’s issue, I want to discuss the dangers of a divided market, because that’s exactly what we’re seeing. On Wall Street, a rising tide does not lift all boats. I’ll break down what it means for us.

I also have some Buy List updates for you. Several of our stocks have been hitting new highs like Ansys (ANSS), Church & Dwight (CHD), Danaher (DHR), Moody’s (MCO) and Trex (TREX). We’ve also had hot stocks like FactSet (FDS), which is up more than 20% in the last month, and Check Point Software (CHKP), which has closed higher for the last eight days in a row. But first, let’s dig deeper into this growing divide on Wall Street.

The Divided Market

When someone asks how the market is doing, it’s actually a more difficult question than it appears. The reason is that the market is the average of hundreds or even thousands of stocks, depending on the index.

My preferred index, the S&P 500, is the combined market value of 500 different companies. Due to different class shares, the index is technically composed of 505 different stocks. Lots of stocks can be doing lousy while the overall market is just fine. Or some stocks can rally while the overall market is in the dumps.

Lately, we’ve seen another phenomenon. The technology sector is rallying strongly while the rest of the market is puttering along. This isn’t noteworthy except in its degree. Even within technology stocks, the gains have been heavily skewed toward the big five tech giants.

Just this year, Apple is up 30%. Microsoft is up 35%. Google is up just 13%. Facebook is up 19%, and Amazon is the winner with a YTD gain of 72%. Bear in mind that we’re talking about big moves in companies already worth more than $1 trillion. Combined, these five companies are worth nearly $6.5 trillion. In other words, 1% of the stocks in the index comprise close to one-quarter of its entire value.

While these stocks had certainly done well before the coronavirus, they’ve become even more dominant since the economy closed up. The difference this time is that these tech giants are seen as safe assets. In normal markets, when investors flee to safety, that means stocks like utilities or blue chips. Now, many of the old safe sectors are doing the worst.

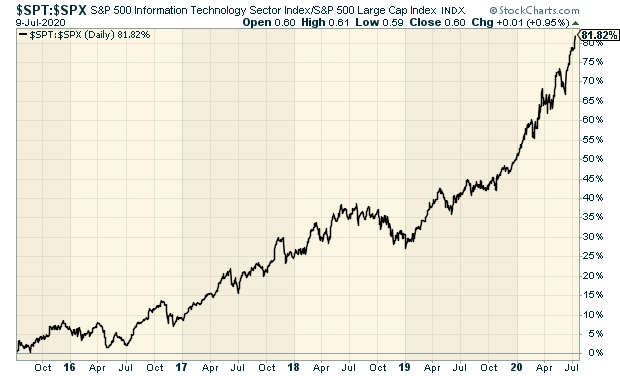

Here’s another example. The Nasdaq Composite is heavily skewed towards tech stocks. The index recently completed a 30-day run where it closed higher 25 times. On Thursday, the Nasdaq notched its 26th record close of the year. Here’s a remarkable chart. This is the S&P 500 technology sector divided by the S&P 500.

As a result, the entire S&P 500 is being impacted by only a few stocks. If you don’t own any of them, it’s like you’re playing a different game. On Wednesday, the S&P 500 was up over 0.75%. That’s a good day, but less than 300 members in the index closed higher.

More and more of the heavy lifting is falling on the shoulders of fewer stocks. Apple, Amazon and Microsoft accounted for half of Wednesday’s move.

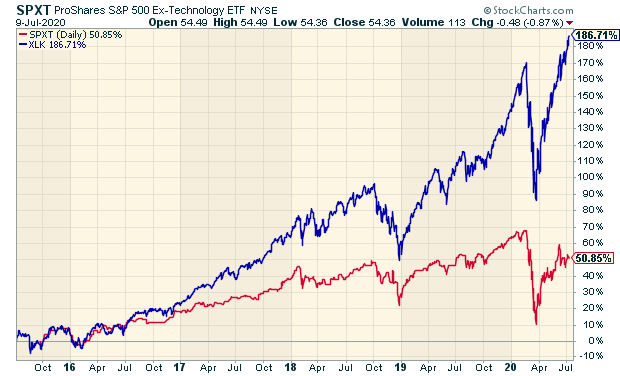

Here’s another chart. This is of two ETFs. The blue line is the tech sector, and the red line is everything in the S&P 500 except the tech sector.

There are some similarities between today and the tech bubble of 20 years ago. Of course, that bubble was driven by the emergence of the Internet, which was a new and exciting technology. (Remember Pets-Dot-Com?) The difference this time is that it’s almost entirely being driven by a small group of companies. There are no crazy IPOs with explosive one-day gains. Also, there’s no great new technology this time. Most of the buying seems to be FOMO, fear of missing out.

The Big Five have become the mask and social distancing of investing. Everyone’s focusing on them for safety. But there’s an important question: how much will consumer behavior change in a post-Covid world? I’m inclined to think it won’t be much.

Sure, Amazon has done well since the economy has been in lockdown, but many other companies are also doing well. I expect to see many high-quality companies get back on track as the economy reopens. Disney certainly hasn’t gone away. The coronavirus has temporarily altered consumer behavior, but it hasn’t permanently changed it.

I won’t predict the bursting of a bubble, but I am leery of those stocks. While our Buy List doesn’t hold any of the Big Five, we’re not being completely shut out of the tech stocks. Ansys, Fiserv and Broadridge are all in the S&P 500 tech sector.

Our Buy List has done much better than the S&P 500 Equal Weighted Index. That includes the same stocks as the S&P 500, but with all the companies weighted equally. What this means is that we’re doing better than most stocks, even though we’re running very close to the market-cap weighted index.

I’m not trying to make excuses. We’re doing fine, but it’s important to understand the context of the current market. This trend of the Big Five can easily unwind at any moment.

The important lesson here is to not be scared by a divided market. Our stocks are still very good businesses. We’ll soon get more proof of that when earnings season starts. You should also be wary of chasing after big gains. Good investing is disciplined investing. Now let’s look at some recent news impacting our stocks.

Buy List Updates

Here are some updates on our Buy List stocks.

Shares of AFLAC (AFL) have been sluggish lately. Don’t worry. The duck stock is due to report earnings on July 28. This week, I’m dropping my Buy Below on AFLAC to $37 per share. I’m expecting good news.

Danaher (DHR) has been looking very good lately. On Thursday, DHR touched a new all-time high of $187.19 per share. Earnings will probably come out in early August. Don’t chase this one. Danaher is like the Harris Tweed jacket of investments. It belongs in every gentleman’s portfolio.

FactSet (FDS) continues to behave well for us over the last month. The stock reacted much better to its recent earnings report than I expected. For its fiscal Q3, FDS earned $2.86 per share. That beat the Street by 43 cents per share. The shares have rallied more than 20% in the last month.

Disney (DIS)’s streaming service, Disney+, got a big boost this weekend thanks to Hamilton. From Friday through Sunday, the mobile app was downloaded 513,323 times globally and 266,084 times in the United States. “Raise a glass to freedom!”

Becton, Dickinson (BDX) had some good news. The FDA gave emergency approval for its rapid antigen test for COVID-19. The shares recently broke above $258. Earnings are due out on August 6.

Check Point Software (CHKP) has been on a very nice run. The shares have closed higher for eight straight days. In its last earnings report, Check Point said it’s seen a “dramatic rise” in the number of cyber-attacks related to the coronavirus. The company will report earnings on July 22. Wall Street expects $1.43 per share. The stock has floated above our Buy Below recently, but I want to hold off on raising the latter until I can see the earnings report. If you don’t own it, hold off for now.

That’s all for now. We’ll get some key economic reports next week. On Monday, the report on the federal budget is due out. Then on Tuesday, the CPI report comes out. Consumer prices have fallen for the last three months. Wednesday is industrial production. The last three reports have been terrible. Then on Thursday, we’ll get another jobless-claims report and another report on retail sales. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His