Archive for August, 2020

-

CWS Market Review – August 21, 2020

Eddy Elfenbein, August 21st, 2020 at 7:08 am“Although it’s easy to forget sometimes, a share of stock is not a lottery ticket. It’s part ownership of a business.” – Peter Lynch

It finally happened: the stock market made a new all-time high. On Tuesday, the S&P 500 closed at 3,389.78. That eclipsed the old peak, which was reached one day shy of six months before. Take that, Covid.

This means that this year, we’ve had one of the sharpest bear markets in histor, followed by one the sharpest bull markets in history. It’s all happened this year, and we’re not even to Labor Day.

A lot of people have asked me: How can it be that the economy is so beaten up while the stock market is doing so well? More than a few have wondered if there’s some shadowy manipulation going on behind the scenes. Please. But there’s nothing unusual going on, and it’s not a secret government plot.

In this week’s issue, we’ll take a closer look at the seeming disconnect between the market and the economy. I’ll also go over Thursday’s earnings report from Ross Stores. The deep-discounter surprised us by earning a small profit. I’ll also preview next week’s earnings report from Hormel Foods. Believe it or not, Spam’s sales have benefited from the age of Covid. I’ll also look at some recent news from our Buy List stocks. But first, let’s look at the dichotomy of the economy and the stock market.

The Disconnect Between the Economy and the Stock Market

Unemployment is over 10%, yet Apple (AAPL) just crossed $2 trillion in market value. How can the stock market be rallying when the economy is flat on its back and so many people are suffering? It’s a good question, and the answer goes to the heart of investing.

I’m happy to tell you that it’s not the result of any dark conspiracy. Instead, these are two very different trends. The stock market looks forward as investors try to anticipate events that will happen a few months down the road. However, most economic data are backward looking. The most recent GDP report covered the time period of two to five months ago. In fact, we rarely have a good idea of how the economy is doing at this exact moment.

Not only that, but most economic data are subject to countless revisions. Sometimes data are updated years after the fact. We don’t even have a good idea of the workings of economic history.

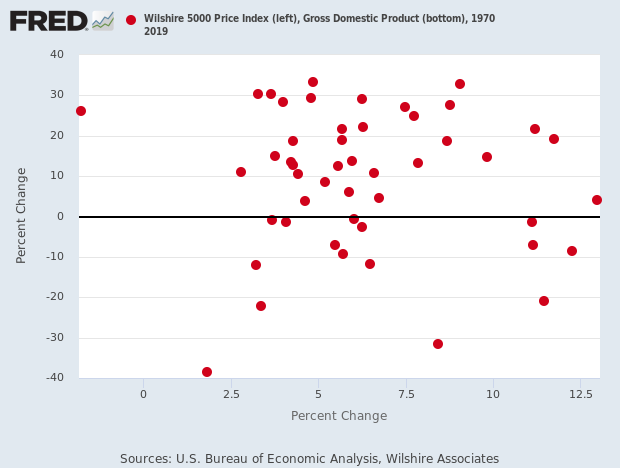

Here’s an interesting graph. I took the annual change in the economy (the horizontal axis) and compared it with changes in the stock market (the vertical axis). It looks like a totally random scatter plot. I don’t see any correlation whatsoever.

That’s not to say that there is no relationship between financial markets and the real economy. My friend Josh Brown likes to use this analogy. Imagine you see a woman walking her dog in the park. The woman generally walks in a straight line. The dog, however, darts around in every direction.

Since the woman has the dog on a leash, they eventually go in the same direction; it’s just that one does it following a more chaotic route. Here, the woman is the economy, and our frenetic canine is the stock market. Sure, it will take many more steps, but the dog will get where the woman is going.

It’s also not unreasonable to think this might be a proper valuation for the stock market. Remember, the two keys for valuation are earnings (which have dried up) and interest rates. Those have gone down significantly. The yield on the 10-year Treasury recently reached its all-time low.

Low bond yields are very good for stock valuations. This is because they make bonds tougher competition for stocks. That’s why stocks have to rally to keep up. As well as stocks have done, they’re still trailing bonds this year. Of course, it’s nice to have the Federal Reserve as your top customer.

Also, lower bond yields make it easier for companies to borrow money. Just recently we’ve seen stocks like Intercontinental Exchange and Middleby raise money from the bond market. With yields so low, why not?

We should also consider that the economy is no longer shrinking. In fact, it’s probably rising at a rapid clip. Not enough to bring us back to status quo ante, but very fast by historical standards. This is probably what the stock market was anticipating a few months ago. According to the Atlanta Fed’s GDPNow estimate, their model sees growth of more than 25% for Q3.

The bottom line is to not worry about a rising market amid a soggy economy. It’s not an historical outlier. One of the best parts of our investing strategy is that we don’t worry if the current market “makes sense” or not. Instead, we just focus on good companies. Speaking of which, let’s look at the recent earnings report from one of our favorite retailers.

Ross Stores’s Surprise Profit

After Thursday’s close, Ross Stores (ROST) reported its fiscal Q2 results. Once again, this quarter, which was the 13 weeks ending in August 1, was heavily impacted by the economic lockdown. Ross closed all of its stores on March 20, and the company started reopening some stores on May 14. By the end of June, most of its stores were open again.

Impressively, Ross actually made a profit for its Q2. Sure, it’s a small profit, but remember, the deep discounter posted an 87-cent loss for Q1. For Q2, Ross made $22 million which works out to six cents per share. Small, but it beat Wall Street’s consensus which had been expecting a loss of 26 cents per share. For context, Ross made $1.14 per share for last year’s Q2.

Business is still tough. Total sales dropped from $4.0 million last year to $2.7 million this year. Comparable-store sales, which is a key metric for retailers, dropped by 12%.

CEO Barbara Rentler said the re-openings were helped by pent-up demand and aggressive markdowns to clear out old inventory. She noted that the average store was open for 75% of the quarter. That took a toll on ROST’s operating margin.

Looking ahead, Ms. Rentler said, “As we move into the third quarter, trends have not materially changed from the second quarter, with comparable store sales for the first two-and-a-half weeks trending down mid-teens versus last year. There remains significant uncertainty on how the pandemic will continue to evolve and affect consumer demand and the economy, and the potential exists for additional government-mandated shutdowns if COVID-19 cases remain elevated or further increase. Given these risks, we will continue to plan and manage our business very cautiously. Due to the limited visibility we have on these risks, we are not providing sales or earnings guidance at this time.”

The bottom line is that Ross is doing as well as can be expected. Shares of Ross trended lower the last two days. Perhaps some traders were anticipating bad results. Well, they didn’t get it. This report was much better than expectations, and it tells me that Ross will thrive once the economy gets back to normal. Ross Stores remains a buy up to $92 per share.

Hormel Foods Earnings Preview

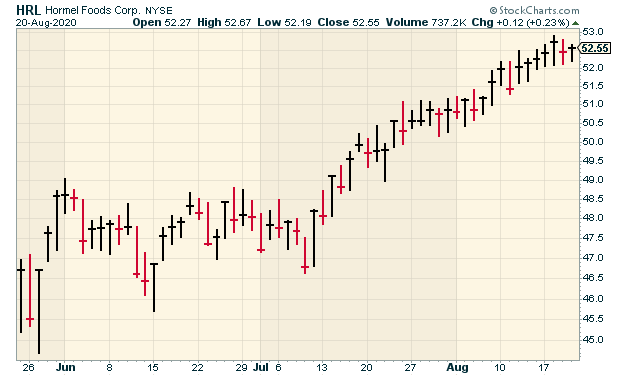

Hormel Foods (HRL) is scheduled to report its fiscal Q3 earnings on Tuesday, August 25. After that, we won’t have much in the way of earnings reports until mid-October. The only exceptions are FactSet (FDS) and RPM International (RPM), which should report sometime in September.

I often tell investors that Hormel is a lot more than Spam. At the same time, don’t overlook Spam. It’s been particularly popular this year. At Bloomberg Opinion, Alan Minter notes that in the 15 weeks ending June 13, sales of Spam jumped 70%. During Covid, Americans stocked up on Spam, and they’re still buying it. Last year was Spam’s fifth year in a row of record growth. Spam is particularly popular with Asian-American and Hispanic customers.

In May, Hormel reported a tough quarter for its fiscal Q2. That’s right as the lockdowns started. Organic sales rose 6%, but earnings fell to 42 cents per share, which matched Wall Street’s consensus.

Hormel currently has over $600 million cash on hand. The company is in a strong financial position with limited debt and consistent cash flows. Total debt is $315 million, up from $250 million at the beginning of the year.

As a defensive stock, Hormel didn’t fall nearly as much as the rest of the market did in February and March. It also didn’t rise as quickly as the market did since then. Still, it’s up 16% this year which is well ahead of the S&P 500. For next week’s report, Wall Street’s consensus is for sales growth of 3.3% and earnings of 34 cents per share.

Buy List Updates

In May, shares of Ansys (ANSS) slipped after their guidance fell below expectations. It’s up 25% since then, and on Thursday, the shares got to another new all-time high. This is why we focus on high-quality stocks. Ansys has been a big winner for us this year.

Deutsche Bank initiated coverage on Check Point Software (CHKP) with a Hold rating. They have a price target of $128. I usually don’t pay much attention to analyst upgrades, but I wanted to pass this news along.

Marc Rubinstein has a very good post on Intercontinental Exchange (ICE) and what makes it tick. ICE just shelled out a huge chunk of money to buy Ellie Mae, a firm in the mortgage business. ICE plans to float $6.5 billion in bonds to finance the deal. This week, I’m raising my Buy Below price on ICE to $110 per share.

This week, Middleby (MIDD) said that it’s going to float $550 million in convertible bonds. The bonds are due in five years, and the interest rate is 1%. Middleby is doing this as part of a plan to “enhance our capital structure and provide greater financial flexibility.” These moves usually rankle investors in the short term. Sure enough, shares of MIDD are off by 10% over the last three sessions. Don’t worry about Middleby. The stock remains a good buy up to $106 per share.

Trex (TREX) got to another new high for us this week. Through Thursday, Trex is up 63% for us this year.

That’s all for now. This is a slow time for Wall Street. Many of the big shots are enjoying the waning days of summer on Martha’s Vineyard or at the Hamptons. There are, however, a few key economic reports coming out next week. On Tuesday, we’ll get reports on new-home sales and consumer confidence. On Wednesday, it’s durable goods. Then on Thursday, they’ll update the Q2 GDP report. If you recall, the initial report showed a decline of 32.9%. We’ll also get another jobless-claims report. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Morning News: August 21, 2020

Eddy Elfenbein, August 21st, 2020 at 7:04 amEU’s Chief Negotiator Says Brexit Deal Looks ‘Unlikely’ at This Stage

Japan’s Consumer Prices Mired As Deflation Spectre Looms

We Just Crossed the Line Debt Hawks Warned Us About for Decades & Corporate America Is Choking on Debt and Imperiling the Recovery

Rise In U.S. Weekly Jobless Claims Clouds Labor Market Recovery & Unemployment Claims Rise as Rollout of $300 Benefit Lags

Fearing Shipping Crunch, Retailers Set Earliest-Ever Holiday Sale Plans

Poor Planning Left California Short of Electricity in a Heat Wave

Facebook Pushes for Data Portability Legislation Ahead of FTC Hearing

Goldman Sachs Has Money. It Has Power. And Now It Has a Font

TikTok Races to Calm Workers, Brands With 25 Days Until Ban

Jack Ma’s Ant Said to Target $225 Billion Valuation in IPO

Asia’s Only Sailing Cruise Line Is Fully Booked — and in Trouble

Michael Batnick: The Other 94%

Ben Carlson: Statistics Are Bloodless Things

Joshua Brown: The Worst Quarter In Modern History & How I Invest My Money

Be sure to follow me on Twitter.

-

Morning News: August 20, 2020

Eddy Elfenbein, August 20th, 2020 at 7:02 amIn U.S.-China Tech War, Investors Bet On China’s Localisation Push

Gold to Gain on Massive Currency Debasement, SkyBridge Says

Time Runs Out for Dollar Bulls That Stretched Valuations Too Far

Big Tech’s Domination of Business Reaches New Heights

Big-Box Retailers’ Profits Surge as Pandemic Marches On

Can This Relationship Be Saved? Big Tech and Big Advertisers Talk It Over.

For Firms That Got Citi’s $900 Million, It’s a Shot at Payback

Airbnb Files For IPO As Short-Term Rental Market Rebounds

Alibaba’s Sales Growth Bounces Back to Pre-Pandemic Levels

Microsoft Deepens Oil Ties, Helping Petrobras Weather Pandemic

FedEx, UPS Seek to Prove They Can Thrive in Busiest Holiday Rush

Apple’s Next Trillion Won’t Come That Easily

Ben Carlson: Animal Spirits: The Four Most Dangerous Words

Howard Lindzon: The S&P Back At All Time Highs – Definitely A Better Moment To Panic

Joshua Brown: The Real Reason for All-Time Highs

Be sure to follow me on Twitter.

-

Morning News: August 19, 2020

Eddy Elfenbein, August 19th, 2020 at 7:04 amSouth Africa Struggles to Contain Coronavirus While the Economy Crumbles

WTO Tempers Hopes for a V-Shaped Rebound, Sees L-Shape Possible

Markets Tell the Fed It’s Finally Getting an Edge on Inflation

‘This Market Is Nuts’: S&P 500 Hits Record, Defying Economic Devastation

Why Work From Home When You Can Work From Barbados, Bermuda or … Estonia?

Big Tech’s Domination of Business Reaches New Heights

World’s Largest Shipping Firm Says Demand Will ‘Significantly Decline’ This Year

GM Bets On Electric Cadillacs And Micro-Vans To Reverse China Slide

Target Sales Growth Hits Record As Faster Delivery Boosts Online Demand

Epic’s Battle With Apple and Google Actually Dates Back to Pac-Man

Nick Maggiulli: A Follower is Not a Follower

Roger Nusbaum: The S&P 500 Is At Its High And Yes That Makes No Sense

Ben Carlson: Risk Is Never as Simple as It Seems

Howard Lindzon: New York City … The Comeback

Michael Batnick: What Happens When Stocks Make New Highs? & The Real Reason for All Time Highs: What Are Your Thoughts

Be sure to follow me on Twitter.

-

Morning News: August 18, 2020

Eddy Elfenbein, August 18th, 2020 at 7:05 amGold Rebounds Above $2,000 Amid Escalating U.S.-China Tensions

Wall Street Holds The Cards As Main Street Chases Blank-Check Deal Frenzy

Tech-Fuelled ‘Everything’s Awesome’ Rally Looks Unstoppable

Currencies Break Link With Stocks to Warn of Turbulence Ahead

What Happens to the Markets If There’s a Vaccine?

Amazon Bets on Office-Based Work With Expansion in Major Cities

Uber and Lyft Consider Franchise-Like Model in California

Trump’s Attacks on TikTok and WeChat Could Further Fracture the Internet & Oracle Enters Race to Buy TikTok’s U.S. Operations

Home Depot Rises as Consumers Splurge on Do-It-Yourself Projects

America Has Two Feet. It’s About To Lose One Of Them.

Sorry, the World’s Biggest Bike Maker Can’t Help You Buy a Bike Right Now

Howard Lindzon: Momentum Monday – Enjoy The Quiet August Markets

Joshua Brown: The Most Annoying Job In The Investment Biz

Michael Batnick: They Stayed the Course

Ben Carlson: Are Emerging Markets Turning Into the S&P 500?

Be sure to follow me on Twitter.

-

Is the Traditional 60/40 Portfolio Obsolete?

Eddy Elfenbein, August 17th, 2020 at 2:08 pmIn Institutional Investor, Ron Lagnado asks if the 60/40 portfolio is obsolete.

The traditional 60/40 mix of stocks and bonds, commonly portrayed as an optimal portfolio, is supposed to mitigate the effects of this sort of extreme market volatility and deliver returns that pension fund managers can rely on. But the 60/40 mix is an artifact from another time. The optimal mix presumes it is possible to achieve a high rate of return while simultaneously constraining volatility. In practice, it limits portfolio volatility in benign market environments over the short term while making huge sacrifices in long-run performance. The so-called optimal portfolio is, in effect, the worst of all worlds. It offers scant protection against tail risk and, at the same time, achieves an under-allocation to riskier assets with higher returns in long periods of economic expansion, such as the past decade.

Lagnado thinks options-based tail-risk hedging strategies can do better than bonds.

I think the optimal portfolio is all cash all the time. In my view, the 60/40 misses something fundamental. Bonds are an asset. Stocks are equity. They’re not the same thing.

An asset is just a thing like gold or copper or even a house. But equity is a working business that takes assets to make a product. Copper is just a rock (ok, ok, an element). It just sits there. In 1,000 years, it’s still the same thing. Only when people come along can copper be employed to do something useful.

The 60/40 view assumes that bonds are like adding a calming agent to some chemical formula. Instead, equity is completely different from other classes of investments. It’s the only one that captures human ingenuity, which is the ultimate asset.

-

Getting Close to a New High

Eddy Elfenbein, August 17th, 2020 at 11:54 amThe S&P 500 is in record territory again. The index has been as high as 3,387.59 this morning. That’s higher than the all-time high close. This is the third day we’ve been in record territory but the other two times, we failed to close at a new high.

On our Buy List Ansys (ANSS), ICE (ICE), Trex (TREX) and Stepan (SCL) are all at new 52-week highs today. Ross Stores (ROST) is also strong this morning. The deep-discounter is due to report later this week.

This morning, Goldman Sachs raised its target for the S&P 500 from 3,000 to 3,600. That’s a big increase and Goldman isn’t alone. A few other Wall Street strategists have also bumped up their forecasts.

Goldman’s David Kostin wrote, “Looking forward, a falling equity risk premium will outweigh a rise in bond yields, and combined with our above-consensus EPS forecast, will lift the S&P 500 Index to 3,600 by year-end.” That’s a fancy way of saying that investors are no longer afraid of the market.

-

Morning News: August 17, 2020

Eddy Elfenbein, August 17th, 2020 at 7:02 amJapan’s Economy Contracts 7.8%, the Worst Decline on Record

Europe’s Big Oil Companies Are Turning Electric

Rolling Blackouts in California Have Power Experts Stumped

Goldman Boosts S&P 500 Target by 20%

Hedge Funds Are Short on Dollar for First Time in Two Years

Sanofi to Buy Biotech Company Principia for $3.4 Billion

Netflix Tools Up In South East Asia As Disney+ Indonesia Launch Sets Scene For Streaming Battle

Chinese Dronemaker DJI Makes Sweeping Cuts In ‘Long March’ Reforms

How Apple’s 30% App Store Cut Became a Boon and a Headache

California Ruling Against Uber, Lyft Threatens to Upend Gig Economy

Chicago’s 1855 ‘Beer Riot’ Is a Bridge to the Unrest of 2020

Jeff Miller: Weighing the Week Ahead: Do Housing Market Changes Present an Investment Opportunity?

Howard Lindzon: Much Ado About Bonds

Joshua Brown: The Roaring 2020s

Michael Batnick: We’re Not So Different, You And I

Ben Carlson: Talk Your Book: Understanding Opportunity Zones, The 3 Es of Personal Finance & The “Smart” Money & The Flying V-Shaped Recoveries

Be sure to follow me on Twitter.

-

CWS Market Review – August 14, 2020

Eddy Elfenbein, August 14th, 2020 at 7:08 am“Big Stock Market Numbers!” – President Donald Trump

So tweeted the president, and he’s right. The stock market has been bigly strong recently. On Wednesday, the S&P 500 closed at its second-highest level ever. The index came close to marking a new all-time high on Wednesday and again on Thursday, but finished just shy of that record at the time the closing bell rang.

I’m pleased to report that our Buy List is doing well. In fact, we’re doing even better than the rest of the market. Through Thursday, our Buy List is up 6.63% on the year (not including dividends). That’s ahead of the S&P 500, which is up 4.42% on the year. It’s still close, so I’m not ready to declare victory just yet. But it does show you how much you can do by not doing anything except buy and hold good stocks.

We just wrapped up a very good earnings season. All of our stocks but one beat expectations, and the lone exception merely met expectations. In this week’s CWS Market Review, I’ll cover our final earnings report, which was from Broadridge Financial Solutions. The company beat earnings and raised its dividend, and the shares rallied to a new all-time high. Big numbers indeed. I’ll have all the details in a bit.

While the president might be pleased with the market, the overall U.S. economy is still in a difficult spot. In this issue, I’ll discuss the recent jobs report. This week, we saw the highest report for core consumer inflation in nearly 30 years. We also saw jobless claims finally fall below one million. That had not happened for 20 consecutive weeks. I’ll also preview next week’s earnings report from Ross Stores. But first, let’s take a closer look at the jobs report.

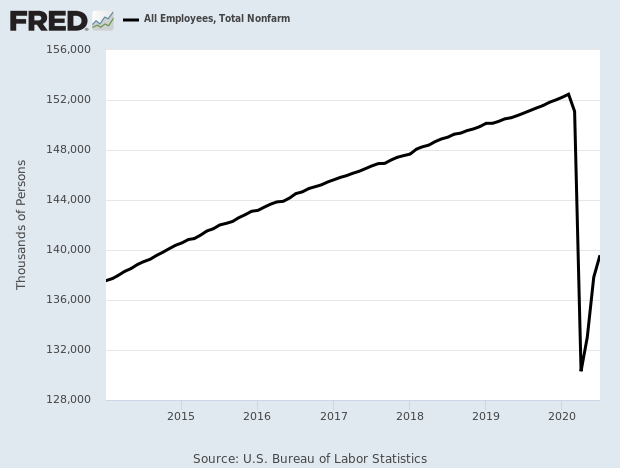

The Economy Created 1.8 Million New Jobs — and We Need More

Shortly after I sent you last week’s issue, the government reported that the U.S. economy created 1.763 million new jobs last month. The expectations had been for 1.48 million. More accurately, many folks were returning to their own jobs that got axed during the lockdown. Still, it’s good to see the numbers going in the right direction.

These are huge gains in employment, but it comes after even larger losses. To be sure, the economy is a long way from where it was just six months ago. The unemployment rate is down to 10.2%. We’ve had recessions that peaked with lower unemployment rates. The number of unemployed people dropped by 1.4 million to 16.3 million.

The labor-force participation rate is 61.4%, which isn’t as bad as I had expected. Average hourly earnings rose by 0.2%. Here’s a look at nonfarm payrolls:

I’ll be frank: these numbers really aren’t about economics. They’re about the coronavirus. Where the economy is allowed to work, it can. In areas that are still locked down, it can’t.

I’m far from an immunologist, but the trends appear to be favorable. In Florida, for example, which saw a big run-up of new cases in June and July, the numbers are clearly trending downward.

For example, let’s look at leisure and hospitality, which is a crucial sector for the economy. Leisure and hospitality added 592,000 jobs in July. In May and June, the sector added 3.4 million jobs. That sounds impressive, but leisure and hospitality lost over 8.3 million jobs in March and April.

We had more good news for the jobs market on Thursday when the jobless-claims report finally fell below one million. The number of folks filing for jobless benefits fell to 963,000. That’s the first time in 20 weeks it came in under one million. Economists had been expecting 1.1 million.

While the jobs market is better, there’s still a long, long way to go.

I was most surprised this week by the strong CPI report. On Wednesday, the government reported that consumer prices rose by 0.59% in July. That was the largest monthly increase in 11 years. Wall Street had been expecting an increase of 0.3%.

This comes after a 0.57% increase in June. Before that, we had three straight months of lower prices, better known as deflation.

Wednesday’s report also showed that “core” consumer prices, which exclude volatile food and energy prices, rose by 0.62%. That’s the largest increase since January 1991. The core rate had also dropped in March, April and May, so this could be simple mean reversion.

There appears to be some nascent optimism for the U.S. economy. The housing market, for example, appears to be doing well. Also, bond yields are creeping higher. On August 4, the 10-year Treasury yield got down to 0.52%. Deutsche Bank said that Treasury yields were at a 234-year low. On Thursday, the 10-year yield got to 0.71%.

We’re also seeing another move towards cyclical stocks. By this, I mean stocks whose fortunes are closely tied to the broader economy. When cyclicals do well, that’s often—though not always—a harbinger of an improving economy.

A few weeks ago, there was a similar turn to cyclicals, but it didn’t last (see our June 5 issue). Alas, head fakes are common on Wall Street. We’re seeing another one. In fact, Industrials have actually outperformed Tech over the last three months. I would not have guessed that. Perhaps Wall Street is sensing that the economy will reopen sooner than expected.

Earlier I mentioned that the S&P 500 is up 4.42% this year. As it turns out, that’s nearly the exact long-term average for this point in the year. We’ve seen typical returns for this most atypical year.

Now let’s look at our last earnings report for the Q2 earning season.

Broadridge Beats Earnings, Raises Dividend and Hits New High

On Tuesday morning, Broadridge Financial Solutions (BR) became our final stock to report this earnings season. I had been a little nervous because Broadridge’s last earnings report was somewhat mediocre, and the one prior to that was a dud. The company missed earnings three times in a row.

I was relieved to see that this report was a good one. For its fiscal Q4, BR’s earnings rose 25% to $2.15 per share, which beat estimates by six cents per share. Recurring revenue, which is a key stat for them, rose 14% to $930 million.

Broadridge also offered guidance. For the new fiscal year, which ends on June 30, Broadridge expects earnings growth of 4% to 10%. Since the company made $5.03 per share last year, breaking out the math, that implies earnings this year between $5.23 and $5.53 per share. Wall Street had been expecting $5.44 per share.

The company also increased its quarterly dividend from 54 cents to 57.5 cents per share. That’s a 6.5% increase. This is BR’s 14th consecutive annual dividend increase. It’s not a big dividend. Based on Thursday’s close, the dividend yields 1.66%. Still, it’s better than most anything you can find in fixed income.

The shares jumped nearly 6% during the day on Tuesday and got to a new 52-week high. This week, I’m raising my Buy Below on Broadridge to $150 per share.

Earnings Preview for Ross Stores

That’s it for Q2 earnings, but we’ll soon get the earnings reports for companies with reporting quarters ending in July. We only have two such stocks on our Buy List. Hormel Foods (HRL) will report on August 25. The other, Ross Stores, will report next Thursday, August 20.

Ross Stores (ROST) is in a difficult situation. Fundamentally, it’s a sound company. However, the economic lockdown has been hard on them. Some of our Buy List stocks have been able to muddle through, but Ross has had many of its stores shut down. In fact, one of Ross’s competitors, Stein Mart, just went bankrupt.

At one point, Ross had shut all of its stores. For fiscal Q1, which ended on May 2, Ross reported a loss of 87 cents per share. Sales fell by half. The deep-discounter halted its dividend and share buybacks. None of this, however, is a reflection on the business.

The same factors hold sway over the upcoming earnings report. For its part, Wall Street expects a loss of 30 cents per share. The good news is that Ross has the money to ride this out. The company drew on its $800 million revolving-credit facility. Ross also completed a $2 billion bond offering. I’m confident Ross Stores will make a nice profit once it’s allowed to make one.

Buy List Updates

Good news from AFLAC (AFL). The duck stock said it’s going to increase its buyback authorization by 100 million shares. The current authorization is down to 21.9 million shares.

AFLAC is one of the few companies that actually reduces its share count. Many other companies buy back stock but then give executive stock options at the same time, so the funds bypass the shareholders. I’m lifting our Buy Below on AFLAC to $40 per share.

Last week, Intercontinental Exchange (ICE) said that it will buy Ellie Mae, a mortgage-services provider, for $11 billion.

ICE is buying Ellie Mae from Thoma Bravo, a private company. This is a nice pay day for them since they bought Ellie Mae last year for $3.7 billion. The deal will mostly be in cash and some will be in ICE stock.

Bloomberg had an interesting article on Bob Chapek, Disney’s (DIS) new CEO. Bloomberg describes Chapek as “using the Covid-19 crisis to transform Disney much faster than expected, all with an eye toward making the company an online juggernaut that reaches far more people worldwide.” Check it out.

That’s all for now. There’s not much in the way of economic news next week. On Tuesday, the report on housing starts is released. This is usually a good indicator of the housing market. On Wednesday, the Fed will release the minutes of its last meeting. The Fed members appear to be united in their current approach. On Thursday, we’ll get another jobless-claims report. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Morning News: August 14, 2020

Eddy Elfenbein, August 14th, 2020 at 7:02 amGold Fever Spurs Dollar Oddity Not Seen Since Erdogan Took Power

A Faltering U.S.-China Trade Deal Is Now The Nations’ Strongest Link

China’s Economic Recovery Underwhelms As Consumer Comeback Stays Elusive

Stimulus Talks Are Stuck in $1 Trillion Ditch Over Aid to States

America’s Retirement Race Gap, and Ideas for Closing It

Goldman Sees Room for S&P to Surpass 3,600

Trump Administration Criticizes New Fannie Mae, Freddie Mac Mortgage Fee

U.S. Faces Bumpy Antitrust Road Despite Big Tech’s Emails, Memos

Fortnite Creator Sues Apple and Google After Ban From App Stores

TikTok Looks Like a Dangerous Dance Move for Nadella’s Microsoft

A Century-Old Moving Company Says the Summer of Covid Is ‘Insane’

Trump’s Labor Chief Accused of Intervening in Oracle Pay Bias Case

Ben Carlson: The Hardest Investing Questions to Answer

Michael Batnick: Bye Bye, New York

Joshua Brown: 10 Years Ago & Dollar Plays

Be sure to follow me on Twitter.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His