CWS Market Review – September 18, 2020

The COVID-19 pandemic is causing tremendous human and economic hardship across the United States and around the world. – This week’s FOMC policy statement

Superficially, this is a quiet time for Wall Street. Daily volatility has been modest, and there’s not much big news. However, just beneath the surface, there’s a lot going on.

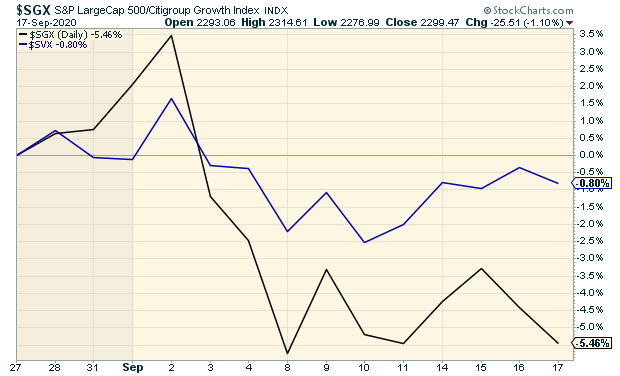

The trend that’s most prominent, in my opinion, is the shift from growth stocks to value stocks. I talked about this at length in last week’s issue. The trend continued this week after a modest pushback from growth. This could be the start of a long run for value.

We also had a Federal Reserve meeting this week. As expected, the Fed decided to forgo any change in interest rates. Additionally, it reiterated its commitment to keep interest rates low for a long time. Until now, the Fed has strongly suggested it would follow this policy. Now there’s no doubt as to the board’s intent. I’ll explain what it means for us and our portfolios.

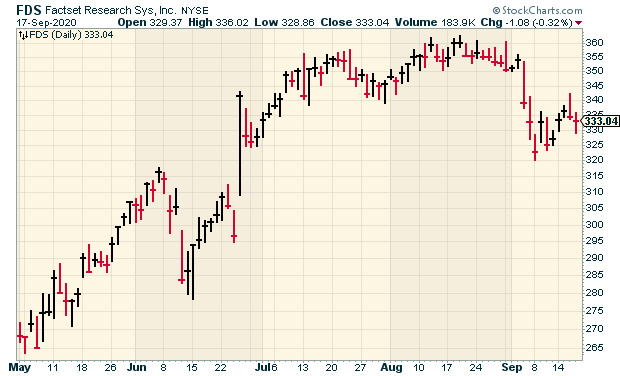

We also got a stock split this week from Trex. The deck maker has been on a tear for us this year. Through Thursday, we have a 52% profit in Trex. Now we have twice as many shares! Later on, I’ll preview next week’s earnings report from FactSet. This is another big winner for us. The financial-data stock is up 24% this year. I’m expecting more great results from FactSet. I also have some updates on our Buy List stocks. First, though, let’s look at what the Fed heads had to say this week.

The Fed Is Committed to 0%

The Federal Reserve met again this week. As expected, the central bank didn’t make any change to its target for the Fed funds rate, which is still 0% to 0.25%. Basically, rates are flat on the floor.

The Fed also mentioned its willingness to let inflation drift above 2%. This was the big policy change that it had announced at its recent Jackson Hole conference. Until then, the Fed had held a target of 2% for inflation. Of course, inflation has been running below that almost consistently.

So the Fed is now not so worried about fighting the last war—the war on inflation. To be sure, it said that it’s willing to maintain 2% as a long-run goal for inflation. This means, in theory, that the Fed is willing to allow inflation of more than 2%, which can be offset by periods of sub-2% inflation, and it will all magically add up to 2%.

Yeah, right.

Look, the Fed’s intentions are perfectly fine, but they’ve consistently misjudged the economy. In trying to fight inflation, they’re fighting an enemy that’s simply not there, and they’ve actually harmed the economy while doing so. I think it’s for the best that they leave interest rates alone for some time.

What does inflation mean for us? It’s terrible. From our perspective, high inflation is bad news for stocks. But by high inflation, I mean over 5%. We’ve haven’t seen numbers like that in years.

I should add that the recent inflation reports have run a little hot. But that’s to be expected after three months of deflation, meaning falling prices, since the lockdowns started.

The Fed isn’t adopting this policy based on the sound judgment and the wisdom of its policymakers. No, it’s because everything else they’ve tried has failed. They’re doing this because they have to.

In its policy statement, the FOMC said, “The Committee expects to maintain an accommodative stance of monetary policy until these outcomes are achieved.” In English, this means “we won’t be raising rates for a looooong time.”

I’m not exaggerating. Here’s proof. The Fed also released its latest economic projections. These projections are notoriously off the mark, but it’s interesting to see what the Fed is thinking.

The FOMC has 17 members. (It has 19 normally, but there are two vacancies.) All 17 members are against raising rates this year. All 17 members are against raising rates next year as well. Sixteen of the 17 are against raising rates the year after that, and thirteen of the 17 are against raising rates the year after that.

Add it all up, and this means that the Fed is tacitly committed to keeping rates near 0% through 2023. The Fed also projects that inflation will neatly reach 2% in 2023. Call me a doubter.

More importantly, what does this mean for us? It’s good for stocks. Low rates are usually a strong catalyst for higher equity valuations. In particular, it’s good for high-yielding stocks. AFLAC (AFL), for example, currently yields 3%. You can’t get that at the bank. Also, AFLAC has increased its dividend for 37 consecutive years. On our Buy List, Hershey (HSY) and Hormel Foods (HRL) are also good dividend stocks.

Low rates for longer will also be good news for the housing sector. Mortgage rates are very low. This week, we learned that homebuilder confidence just touched an all-time high. This is good news for a company like Trex (which I’ll be discussing next).

I also want to mention that I’m seeing some signs of weakness in this market. No reason to panic, but the market likes to give us a nice shake every so often. For example, the S&P 500 has run above its 50-day moving average every day for nearly five months. This is a quick measure of the stock market’s momentum. Twice in the last five days, the S&P 500 has dipped below its 50-DMA during the trading day, but it hasn’t closed the day below it.

The economy may also be weaker than a lot of folks realize. This week’s industrial-production report was below expectations. So was the housing-starts report. Core retail sales fell slightly last month.

While the economy has certainly improved, the recovery has been choppy and uneven. There are lots of sectors of the economy that are still in rough shape. Furthermore, there’s the uncertainty of the U.S. election which is only a few weeks away. Now let’s look at our #1 stock this year.

Trex Splits 2-for-1

On Tuesday, shares of Trex (TREX) split 2-for-1. This means shareholders got twice as many shares while the share price fell in half.

A stock split doesn’t add any value in and of itself. Shareholders seem to prefer a stock with a lower nominal price, and boards of directors are willing to comply. Stock splits were much more popular in the 1990s.

I remember when the airline JetBlue split 3-for-2 three times in three years, even though the stock didn’t do much of anything. These splits don’t happen nearly as much as they used to.

Trex’s Buy Below price splits along with the stock. The Buy Below is now $75 per share.

For track-record purposes, I assume the Buy List is a $1 million portfolio that’s equally weighted at the beginning of each year. For this year, that meant we ”bought” 445.03783 shares of Trex with a starting value of $89.98 per share. That now becomes 890.07566 shares at $44.94 per share.

Trex has had an outstanding year for us. Last month, Trex reported Q2 earnings of 81 cents per share. That beat the Street by 16 cents per share. Quarterly sales rose 7% to $221 million. Not bad, considering we’re in an economic lockdown. The company also had nice increases to its gross and EBITDA margins. For Q3, Trex expects a 13% sales increase over last year’s Q3.

FactSet’s Earnings Preview

FactSet (FDS) is scheduled to report its fiscal Q4 earnings on Thursday, September 24. The financial-data company has been a very good stock for us this year, and the report for fiscal Q3 was quite good.

Let’s look at some details from Q3, which ended on May 31. Adjusted diluted earnings rose by 9.2% to $2.86 per share. That beat estimates by 43 cents per share. Quarterly revenues rose 2.6% to $374.1 million, while organic revenues climbed 2.6% to $375.3 million. I was particularly impressed to see FactSet’s operating margin rise by 1.5% to 35.5%.

For guidance, FactSet said it expects full-year revenues to range between $1.485 billion and $1.49 billion. FactSet also expects full-year earnings to range between $10.40 and $10.60 per share. That implies fiscal Q4 earnings of $2.41 to $2.61 per share. The consensus on Wall Street is for $2.54 per share.

The Q3 earnings were so strong that FactSet raised both ends of its full-year guidance by 55 cents per share. FactSet is our fourth-best stock this year. Through Thursday, FactSet is up over 24% for us. The company has raised its dividend every year since 1999.

Buy List Updates

Shares of Stryker (SYK) have been trending higher recently. The stock just hit a post-lockdown high, and it’s not far from its pre-lockdown high. This week, I’m lifting our Buy Below on Stryker to $220 per share. The next earnings report should be out in late October.

Becton, Dickinson (BDX) has been going through a rough patch. The stock is down close to 20% since the beginning of August. This week, the Wall Street Journal said that Becton’s coronavirus test is giving false-positive results. So far, the number of bad results is small, but it’s not good news. Becton is planning to ramp up its production of these tests to two million per week. I’m lowering our Buy Below on BDX to $250 per share.

Shares of Eagle Bancorp (EGBN) are sliding yet again. On Thursday, EGBN closed at $27.79 per share. That’s a six-month low. The stock is selling for roughly three-fourths of its book value. The dividend now yields 3.17%. I’m lowering our Buy Below price on Eagle to $31 per share.

Sherwin-Williams (SHW) has also been hot lately. This week, I’m bumping up its Buy Below to $720 per share.

That’s all for now. Next week will be pretty light as far as economic reports go. On Tuesday, we’ll get the report on existing-home sales. Thursday will be another report on initial jobless claims. Also on Thursday, the report on new-home sales comes out. On Friday, the report for durable goods is due out. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Posted by Eddy Elfenbein on September 18th, 2020 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His