Archive for September, 2020

-

FactSet Beats Earnings

Eddy Elfenbein, September 24th, 2020 at 9:50 amThe stock market is down again this morning. If this holds up, it will be our sixth losing session in the last seven days. The S&P 500 is now down for the year.

This morning’s jobless claims report came in at 870,000. That was worse than expectations of 840,000.

Also this morning, FactSet (FDS) reported very good fiscal Q4 earnings this morning. Adjusted EPS rose 10.3% to $2.88. Wall Street had been expecting $2.54 per share.

“We executed well on our second-half pipeline to end our fiscal year in a strong position,” said Phil Snow, FactSet CEO. “I am proud of our team’s performance and remain confident in our investment plan. Our programs in content and technology are expanding the universe of knowledge our clients trust and meeting demand for the workforce of the future.”

For the year, adjusted diluted EPS increased 8.7% to $10.87. FactSet has increased its earnings for the last 24 years in a row.

For the coming year, FactSet expects earnings to range between $10.75 and $11.15 per share. The stock has been up as much as 6% this morning.

-

Morning News: September 24, 2020

Eddy Elfenbein, September 24th, 2020 at 7:05 amA Roller Coaster Six Months Leaves U.S. Recovery Still Uncertain

Harvard’s Chetty Finds Economic Carnage in Wealthiest ZIP Codes

NYC Commercial Property Crisis Signals Hazards for Local Banks

Covid Risk, Online Classes Spur Drop in U.S. College Enrollments

Tesla’s Nevada Lithium Plan Faces Stark Obstacles On Path To Production

Beyond TikTok, Walmart Looks to Transform

McDonald’s Is Quietly Working On Its First-Ever Food Loyalty Program

Why Disney’s Delay Of ‘Black Widow’ Means Doomsday For Hollywood

Whole Foods Founder: ‘The Whole World Is Getting Fat’

Scorpio Falling: How Harley-Davidson Went From Trump’s Favorite Motorcycle To An American Pariah

Ben Carlson: Animal Spirits: It’s Hard Being Rich

Michael Batnick: Know Your Competition

Joshua Brown: SPACs are still bulls***

Howard Lindzon: Subscriptions and Bundles Are The New Bonds In A Zero Interest Rate World.

Be sure to follow me on Twitter.

-

Lowest Close in Eight Weeks

Eddy Elfenbein, September 23rd, 2020 at 6:38 pmToday was a rough day for the market. The S&P 500 fell over 2.3% to reach its lowest close in eight weeks.

Measuring from the closing high of three weeks ago, the S&P 500 is now down 9.6%. In other words, we’re not far from 10% which is considered to be an official market correction.

Once again, growth was down more than value. The tech sector was a big loser. For the day, the S&P 500 Tech Index was down 3.2%. Apple, Amazon and Netflix were all down more than 4%.

Our Buy List held up relatively well against the market. While the S&P 500 lost 2.37%, our Buy List lost 1.81%. FactSet is due to release its fiscal Q4 earnings tomorrow morning.

-

Why the Return from Dividends Matters

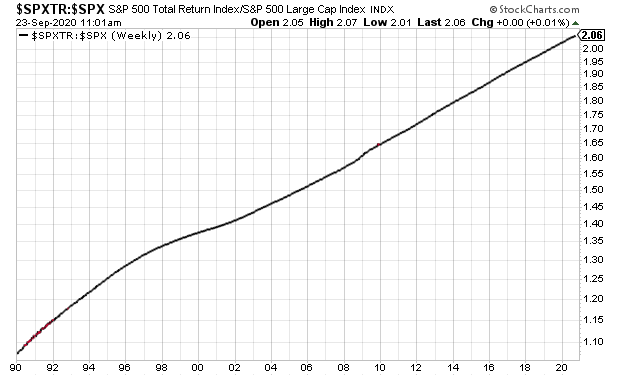

Eddy Elfenbein, September 23rd, 2020 at 11:01 amYesterday, I posted what I called a very “underrated chart” to Twitter. This is the S&P 500 Total Return Index divided by the S&P 500.

Some of the responders on Twitter weren’t terribly impressed. To generalize, they said, “so what, it’s just a 2% dividend yield. Big deal.”

But in my view, it’s a very impressive chart and it shows us the importance of dividends.

Allow me to explain. First, note how stable the line is and how it rises consistently. As an investor, that’s nice to see.

Technically, the chart shows us the return from dividends for investing in the S&P 500 since the beginning of 1990. It’s not just the dividend yield. It’s the return from dividends. That means it’s the dividend yield plus it accounts for the growth of dividends. That’s a key factor.

Think of it this way. Imagine a stock with a 1% dividend yield. For the next several years, the stock and the dividend both grow by 15%. What’s the result? The dividend yield will stay at 1% but you actually make a ton of money from those dividends.

There’s also the multiplier effect. Over the last 30 years, the return from dividends has been 91.58%. Getting dividends from the S&P 500 hasn’t added 91% to your total return.

Not even close.

Instead, it turns an 835% gain into a 1,693% gain. It adds hundreds of percentage points to your totals — and that extra amount balloons higher each year. Dividends are small and easy to overlook, but they make a big difference.

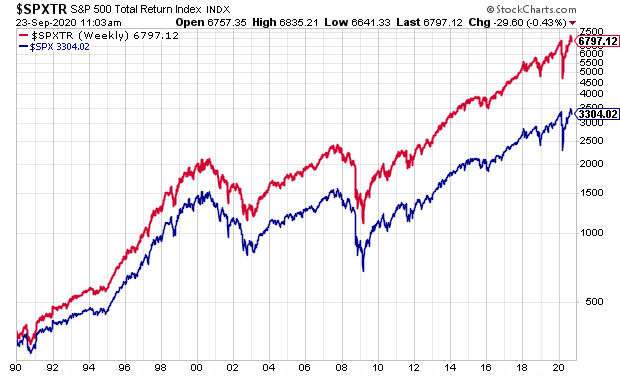

For another picture, here’s a look of the S&P 500 (blue) along with the S&P 500 Total Return Index (red). So the first chart is the red line divided by the blue line.

-

Morning News: September 23, 2020

Eddy Elfenbein, September 23rd, 2020 at 7:07 amChina Threatens to Kill TikTok Deal Over ‘Dirty’ Trump Tactics

Embattled Fed Nominee Celebrates Free Markets, but Not in Her Backyard

Justice Dept. Case Against Google Is Said to Focus on Search Dominance

Amazon Restricts How Rival Device Makers Buy Ads on Its Site

Tesla’s Value Drops $50 Billion As Musk’s Promised Cheaper Battery Three Years Away

Jack Ma’s Ant Plans $17.5 Billion Hong Kong IPO, No Cornerstone Investors

Nike Profit, Revenue Boosted By China Demand And Online Sales

KKR to Buy Online Contact Lens Retailer 1-800 Contacts

Store Operators Outraged At Subway’s COVID-19 Demands

Can Luxury Fashion Ever Regain Its Luster? & Is the New Guards Group the New Guard of Fashion?

Halloween Costume Masks Don’t Replace Face Masks, CDC Warns

Nick Maggiulli: How Much Lifestyle Creep is Okay?

Ben Carlson: Is the Ford F-150 Partially Responsible For the Retirement Crisis?

Michael Batnick: The Stock Market Makes No Sense. And it Makes Perfect Sense.

Joshua Brown: Household Net Worth Explodes: What Are Your Thoughts?

Be sure to follow me on Twitter.

-

Q3 Earnings Preview

Eddy Elfenbein, September 22nd, 2020 at 3:31 pmSeptember comes to a close next week and with it, the third quarter of 2020. By the middle of October, firms will start releasing their Q3 earnings reports.

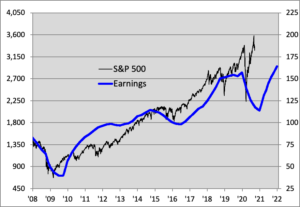

Here’s the S&P 500 in black with trailing operating earnings in blue. Trailing earnings are expected to trough in Q4. The two lines are scaled at a ratio of 18 to 1.

This will be another tough earnings season due to the widespread dislocations caused by Covid-19. The good news is that we’ve gradually improved from the dire numbers we saw earlier this year. For Q1, operating earnings plunged 49% from Q1 of 2019. For Q2, earnings were down 33%.

Now analysts are “only” expecting a decline of 19%. That estimate has actually increased somewhat in recent weeks. At the middle of the year, Wall Street had been expecting Q3 earnings of $30.89 per share for the S&P 500 (that’s the index-adjusted number). Now the estimate is up to $32.05 per share. (Every point in the S&P 500 is worth around $8.27 billion.)

Earnings are expected to fall another 9% for Q4. After that, earnings are expecting to snap back briskly in 2021. That’s why price/earnings ratios, based on trailing earnings, are to be so stretched. Earnings are looking backward but prices are looking forward.

For all of this year, earnings are expected to be $113.84 per share. By today’s price, that gives the S&P 500 a lofty p/e ratio of 29. However, Wall Street expects full-year 2021 earnings of $164.04 per share. That assumes earnings growth of 45% for next year. Going by that figure, that gives the S&P 500 a forward p/e ratio of 20.

Here’s the expected earnings growth for Q3:

Health Care 23.81%

Technology 9.77%

Utilities -1.19%

Consumer Staples -1.68%

Communication -9.95%

Materials -12.56%

Financials -34.55%

Consumer Discretionary -37.20%

Real Estate -50.29%

Industrials -60.10%

Energy -108.27% -

Existing-Home Sales Hit 14-Year High

Eddy Elfenbein, September 22nd, 2020 at 11:06 amThe stock market is up modestly this morning. Fed Chairman Jerome Powell is testifying this morning about the economic relief package.

This morning, we learned that existing-home sales rose for August rose to an annualized rate of six million. That’s the highest in 14 years. In the last year, sales are up 14.5% and housing inventory is down 18.6%.

This comes after July when existing-home sales were up 24.7%. In August, the median sales price rose to $310,600. That’s up 11.4% in the last year. In the last year, sales of homes worth over $1 million are up 44%.

From the WSJ: “’The luxury housing sector is just simply taking off,’ said Lawrence Yun, chief economist of NAR.” The average mortgage rate is now down to 2.87%.

-

The Bank of Jamaica

Eddy Elfenbein, September 22nd, 2020 at 9:36 amThe Bank of Jamaica wins the award for best communication with the public:

-

Morning News: September 22, 2020

Eddy Elfenbein, September 22nd, 2020 at 7:04 amEU Top Court Backs Crackdown On Short-Term Home Rentals In Setback To Airbnb

Justice Dept. to Brief States on Google Antitrust Inquiry

Stakeholder Capitalism Gets a Report Card. It’s Not Good. & Capitalism Isn’t Working Anymore. Here’s How The Pandemic Could Change It Forever

Ruth Bader Ginsburg’s Indelible Mark On American Business

The Magic Number That Unlocks The Electric-Car Revolution

TikTok’s Zero Hour: Haggling With Trump, Doubts in China and a Deal in Limbo

The Math Doesn’t Add Up on TikTok’s Deal With Oracle and Walmart

The Disappointing Ban Of WeChat Calls For American Conservatives To Look Inward

Houston-to-Dallas Bullet Train Given Green Light From Feds, Company Says

Hedge Fund Bridgewater Set Up Tent Offices In The Woods To Beat COVID-19

Judge Fast-Tracks Tiffany Suit Against LVMH Over Abandoned $16B Deal

Ben Carlson: How Benchmarking Impacts Your Decisions

Michael Batnick: The Easiest Thing In Investing

Joshua Brown: How Big A Drawdown Can You Survive? & “more than half the racial gap in individual stock ownership has disappeared essentially overnight.”

Be sure to follow me on Twitter.

-

Fourth Down Day in a Row

Eddy Elfenbein, September 21st, 2020 at 4:19 pmA rough day for the markets is on the books. The S&P 500 lost ground for the fourth day in a row. At its low, the index was off by 2.72%. Fortunately, we made a good deal of that back by the close. For the day, the S&P 500 lost “just” 1.16%.

The S&P 500 isn’t far from being down 10% from its high from earlier this month. That’s the official definition of a correction.

Even though the market was down, value stocks were down more than growth. Generally, value stocks don’t fall as much as growth, nor do they rally as strongly. Today was an exception. For the day, the S&P 500 Growth lost -0.73% while Value lost -2.43%. Bank stocks were the culprit. The entire financial sector got hit hard.

The big divide today was between cyclical and defensive stocks. Cyclical stocks were down the most. By this, I mean sectors like industrials, energy, financials and materials. From today’s action, I assume the market has raised its outlook for longer lockdowns.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His