Archive for October, 2020

-

Morning News: October 16, 2020

Eddy Elfenbein, October 16th, 2020 at 7:02 amTop World Bank Economist Says Financial Crisis Could Emerge From Pandemic

Wall Street Bank Trading Boom Does Little To Assuage Concerns About Lending

Twitter Changes Course After Republicans Claim ‘Election Interference’ & Facebook and Twitter Dodge a 2016 Repeat, and Ignite a 2020 Firestorm

A Biden Win Would Transform How the Wealthy Invest Their Money

U.S. Judge ‘Not Inclined’ To Reverse Decision On WeChat App Store Ban

Boeing Max Judged Safe to Fly by Europe’s Aviation Regulator

Antiviral Drug Remdesivir Proves Ineffective In Treating Covid-19, WHO Study Finds

Here’s Why Canned Corn Might Be Tough to Find At Supermarkets

Former Pipe Factory Worker Becomes a Budget-Store Billionaire

Shares of Gun Makers Gain as Biden’s Lead Grows

Feds Charge Tech Mogul Robert Brockman With Hiding $2 billion From IRS

Michael Batnick: This Time Was Different

Cullen Roche: Three Things I Think I Think – Cycles, Hunting Biden and Hacking Life

Ben Carlson: The Similarities Between Shane Battier and John Maynard Keynes

Joshua Brown: Here’s A Blank Slate & Countdown to the Election – Live Webcast

Be sure to follow me on Twitter.

-

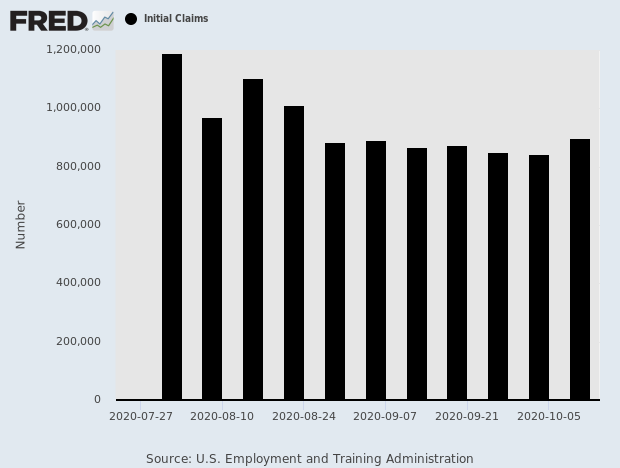

Jobless Claims Rise to 898,000

Eddy Elfenbein, October 15th, 2020 at 11:07 amThis morning’s jobless claims report rose to 898,000. That was above Wall Street’s forecast of 830,000. This was also the highest report since August 22. I’ve talked before about the increase slowing down, but now claims are now moving in the wrong direction.

The total for the week ended Oct. 10 was the highest number since Aug. 22 and another sign that the labor market continues to struggle to get back to its pre-coronavirus pandemic mark as cases rise and worries increase over a renewed wave in the fall and winter. The number represented a gain of 53,000 from the previous week’s upwardly revised total of 845,000.

The stimulus talks appear to be deadlocked but the White House has signaled its willingness to keep negotiating.

House Speaker Nancy Pelosi, the lead negotiator for Democrats, had identified testing as one of the main sticking points in talks. Mnuchin appeared to cede ground to the speaker in an interview on CNBC’s “Squawk Box.”

“That issue is getting overblown,” Mnuchin said. “We’ve agreed to $178 billion overall for health. It’s an extraordinary amount of money. We’d agreed with the Democrats with $75 billion going to testing, contact tracing.”

The big banks are usually the first to report earnings and today we got the report from Morgan Stanley. The bank had a solid Q3. Overall, the banks are doing pretty well. This week, Morgan Stanley’s market cap passed Citigroup’s.

The banks are currently not allowed to increase dividends or buy back stock. This has resulted in a growing cash hoard at the banks.

-

Morning News: October 15, 2020

Eddy Elfenbein, October 15th, 2020 at 7:09 amIMF Sees Worldwide Debt Soaring to 100 Percent of GDP Due to COVID-19

ECB Sees Little Reason to Rush Into New Stimulus This Month

Trump Administration to Consider Adding China’s Ant Group to Trade Blacklist

Stepped Up Chinese Scrutiny Increases Investment Risk of ‘Beast’ Ant

Japanese Automakers Are Helping Fuel U.S. Recovery

Bank Earnings Show Diverging Fortunes on Wall Street and Main Street

Value Stocks Could Shine After U.S. Election, No Matter Who Wins

The End Of Oil? Battle Lines Drawn As Industry Grapples With Energy’s Future

Why These Retail Giants Are Booming Amid The Pandemic

A Small Business Argument for Joe Biden & What Small Business Owners Really Need From the Next President

DOJ Shoots Down DirecTV and Dish Merger Again

BTS Management’s Stock Soars on First Day of Trading

Ben Carlson: Animal Spirits: Bearish the Whole Way Up

Michael Batnick: Chart of the Day

Be sure to follow me on Twitter.

-

Earnings Season Begins

Eddy Elfenbein, October 14th, 2020 at 11:26 amYesterday, the market snapped its four-day winning streak, but stocks are up again today. Energy is particularly strong while the rest of the market is mixed. We got some of the first earnings reports this morning. The banks are usually first. Goldman Sachs crushed expectations ($9.68 vs $5.57) while Wells Fargo and Bank of America both missed expectations.

Richard Clarida, the vice-chair of the Fed, told the Institute of International Finance, “That said, the Covid-19 recession threw the economy into a very deep hole, and it will take some time, perhaps another year, for the level of GDP to fully recover to its previous 2019 peak…It will likely take even longer than that for the unemployment rate to return to a level consistent with our maximum-employment mandate.”

-

Morning News: October 14, 2020

Eddy Elfenbein, October 14th, 2020 at 7:02 amEurope Can Impose Tariffs on U.S. in Long-Running Aircraft Battle

After Two Lost Decades, U.S.’s Weakest Local Economies May Face Worse From Pandemic

Stocks Are Soaring — But Most Black People Are Missing Out

FDA Faults Quality Control at Lilly Plant Making Trump-Touted COVID Drug

BTS’s Loyal Army of Fans Is the Secret Weapon Behind a $4 Billion I.P.O.

Walmart’s Black Friday Plan Caps Customer Capacity at Just 20%

Amazon’s ‘Christmas Creep’ Poses Stress Test for FedEx, UPS

In China, Apple’s 5G iPhone 12 Sparks Fever-Pitch, But Divided Reaction

Three Things Apple Announced That People Actually Want, and One They Don’t

Meet The Guilt-Ridden Oil Billionaire Trying To Save The Planet

Joshua Brown: Disney Wants The Netflix Treatment, Renting A House, Breaking Up Tech Monopolies

Michael Batnick: And Now Some Bad News & New WAYT!

Ben Carlson: Why Are So Many Unprofitable Companies the Best Performing Stocks This Year?

Nick Maggiulli: The Best Investing Books for Every Kind of Investor

Be sure to follow me on Twitter.

-

The Market Is Down After Second-Highest Close

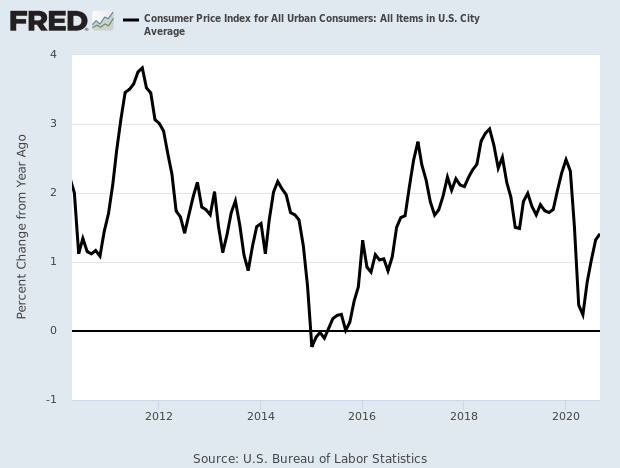

Eddy Elfenbein, October 13th, 2020 at 3:13 pmYesterday, the stock market closed at its second-highest level ever. Today, the market has pulled back some. This morning’s CPI report showed that both headline and core inflation rose by 0.2% last month.

The Labor Department said on Tuesday its consumer price index increased 0.2% last month after gaining 0.4% in August. The CPI advanced 0.6% in both June and July after falling in the prior three months as business closures to slow the spread of the coronavirus weighed on demand.

In the 12 months through September, the CPI increased 1.4% after rising 1.3% in August. Economists polled by Reuters had forecast the CPI climbing 0.2% in September and rising 1.4% year-on-year.

That’s not bad and it indicates that inflation isn’t heating up despite the Fed’s new permissive attitude. As I write this, the S&P 500 is off by about 0.60%.

Disney got a nice boost today thanks to its reorg announcement. At one point, shares of the Mouse House were up over 5%.

Here’s a chart of headline inflation:

-

Morning News: October 13, 2020

Eddy Elfenbein, October 13th, 2020 at 7:06 amDalio Says ‘Time Is on China’s Side’ in Power Struggle With U.S.

July Is the New January: More Companies Delay Return to the Office

Walt Disney Restructures Entertainment Businesses to Boost Streaming

Covid-19 Vaccines Are Chance at Salvation, Financial and Beyond, for Drug Makers

First, A Vaccine Approval. Then ‘Chaos and Confusion.’

J&J Halts Covid-19 Vaccine Trial Due to Unexplained Illness

Apple Event Expected to Bring 5G Speed, Smaller iPhone 12

Amazon Pandemic Prime Day Steals Rivals’ Black Friday Spotlight

Amazon Bets on Prime Day in Latin America to Battle Local Rivals

Audi to Build Electric Cars Geared to Chinese Buyers From 2024

Retail Investors Embrace Risk and the ‘Hive Mind’ in Stock Boom

Goldman Sachs Struggling to Reach Financial Targets

Economists Tell Stories, Just Like Novelists — Don’t Let the Nobel for ‘Economic Sciences’ Fool You

Three Rockefellers Say Banks Must Stop Financing Fossil Fuels

Ben Carlson: Don’t Mix Your Politics With Your Portfolio

Howard Lindzon: Momentum Monday – Blue Wave?

Be sure to follow me on Twitter.

-

Disney’s Reorg Announcement

Eddy Elfenbein, October 12th, 2020 at 4:39 pmAfter the bell, Disney released a statement.

In light of the tremendous success achieved to date in the Company’s direct-to-consumer business and to further accelerate its DTC strategy, The Walt Disney Company (NYSE: DIS) today announced a strategic reorganization of its media and entertainment businesses. Under the new structure, Disney’s world-class creative engines will focus on developing and producing original content for the Company’s streaming services, as well as for legacy platforms, while distribution and commercialization activities will be centralized into a single, global Media and Entertainment Distribution organization. The new Media and Entertainment Distribution group will be responsible for all monetization of content—both distribution and ad sales—and will oversee operations of the Company’s streaming services. It will also have sole P&L accountability for Disney’s media and entertainment businesses.

The creation of content will be managed in three distinct groups—Studios, General Entertainment, and Sports—headed by current leaders Alan F. Horn and Alan Bergman, Peter Rice, and James Pitaro. The Media and Entertainment Distribution group will be headed by Kareem Daniel, formerly President, Consumer Products, Games and Publishing. All five leaders will report directly to Bob Chapek, Chief Executive Officer, The Walt Disney Company. Disney Parks, Experiences and Products will continue to operate under its existing structure, led by Josh D’Amaro, Chairman, Disney Parks, Experiences and Products, who continues to report to Mr. Chapek. Rebecca Campbell will serve as Chairman, International Operations and Direct-to-Consumer. Bob Iger, in his role as Executive Chairman, will continue to direct the Company’s creative endeavors.

“Given the incredible success of Disney+ and our plans to accelerate our direct-to-consumer business, we are strategically positioning our Company to more effectively support our growth strategy and increase shareholder value,” Mr. Chapek said. “Managing content creation distinct from distribution will allow us to be more effective and nimble in making the content consumers want most, delivered in the way they prefer to consume it. Our creative teams will concentrate on what they do best—making world-class, franchise-based content—while our newly centralized global distribution team will focus on delivering and monetizing that content in the most optimal way across all platforms, including Disney+, Hulu, ESPN+ and the coming Star international streaming service.”

Under the new structure, the Company’s three content groups will be responsible and accountable for producing and delivering content for theatrical, linear and streaming, with the primary focus being the Company’s streaming services:

STUDIOS: Messrs. Horn and Bergman will serve as Chairmen, Studios Content, which will focus on creating branded theatrical and episodic content based on the Company’s powerhouse franchises for theatrical exhibition, Disney+ and the Company’s other streaming services. The group will include the content engines of The Walt Disney Studios, including Disney live action and Walt Disney Animation Studios, Pixar Animation Studios, Marvel Studios, Lucasfilm, 20th Century Studios and Searchlight Pictures.

GENERAL ENTERTAINMENT: Mr. Rice will serve as Chairman, General Entertainment Content, which will focus on creating general entertainment episodic and original long-form content for the Company’s streaming platforms and its cable and broadcast networks. The group will include the content engines of 20th Television, ABC Signature and Touchstone Television; ABC News; Disney Channels; Freeform; FX; and National Geographic.

SPORTS: Mr. Pitaro will serve as Chairman, ESPN and Sports Content, which will focus on ESPN’s live sports programming, as well as sports news and original and non-scripted sports-related content, for the cable channels, ESPN+, and ABC.

The Media and Entertainment Distribution group, led by Mr. Daniel, will be responsible for the P&L management and all distribution, operations, sales, advertising, data and technology functions worldwide for all of the Company’s content engines, and it will also manage operations of the Company’s streaming services and domestic television networks. The group will work in close collaboration with the content creation teams on programming and marketing.

-

Should Disney Cut Its Dividend?

Eddy Elfenbein, October 12th, 2020 at 12:16 pmLast week, Dan Loeb called on Disney (DIS) to suspend its dividend. Loeb is a well-known activist investor. Currently, Disney pays a semi-annual dividend of 88 cents per share, each July and December. The company skipped its dividend this summer.

An annual dividend of $1.76 per share works out to over $3 billion per year. Loeb wants Disney to put that cash into its streaming service.

But through it all, Disney’s streaming business has been a notable success story. After making its debut last November, Disney+ had 60.5 million subscribers worldwide by August—well ahead of analysts’ and Disney’s own forecasts. Its other offerings are Hulu, with 36 million, and ESPN+, with 9 million. Next year, Disney is also planning to add an international streaming service similar to Hulu, to be called Star.

Barron’s points out that this is the opposite of what activist investors usually do. They’re known for pursuing short-term profits at the expense of long-term financial health. This time, Loeb is looking at the long term.

I understand Loeb’s thinking, but I think he’s premature. In my view, it all comes down to Covid-19. If a vaccine comes out tomorrow, then Disney’s troubles go away. Disney is a company almost perfectly made to be impacted by the coronavirus.

Relatedly, I floated the idea on Twitter recently of Disneyland leaving California. Most Twitterers responded by saying this was a very farfetched idea. Probably so. Still, the mess of Covid has allowed people to rethink what their business is about, and unthinkable options are now thinkable.

(Note on the chart above. The black line is dividends. Disney switched from an annual to a semi-annual dividend.)

-

The Racial Investing Gap

Eddy Elfenbein, October 12th, 2020 at 10:31 amAt the Washington Post, Michelle Singletary has an important column on the racial investing gap. For obvious historical reasons, many people of color have little trust in financial institutions. She describes how her own grandmother was unwilling to invest her savings.

Big Mama eventually put aside about $20,000 for her retirement. But she kept it all in a simple savings account. The bank teller couldn’t even persuade her to put the money in a short-term certificate of deposit.

“No, ma’am,” Big Mama told her. “Leave my money right in the savings account.”

Federal Reserve data from the 2019 Survey of Consumer Finances found that Black families are far less likely than White families to have retirement investment accounts.

“Among middle-aged families — who have the highest rates of account ownership — 65 percent of White families have at least one retirement account, compared to 44 percent of Black families,” the Fed said.

Those who like to pigeonhole Blacks as financial illiterates argue that the disparity results from the failure of Blacks to comprehend the importance of investing. This viewpoint ignores the history of slavery and its enduring impact on the descendants of enslaved people.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His