Archive for November, 2020

-

CWS Market Review – November 9, 2020

Eddy Elfenbein, November 9th, 2020 at 10:08 pmI wanted to send you an update due to today’s dramatic stock market action. I’ve been at this game a long time and I’ve only seen a few days like today.

This morning, Pfizer said that its Covid-19 vaccine appears to be 90% successful.

From the New York Times:

If the results hold up, that level of protection would put it on par with highly effective childhood vaccines for diseases such as measles. No serious safety concerns have been observed, the company said.

Wall Street went bonkers. Some sectors exploded higher for gains of 10%, 20% or even more. Other areas fell sharply.

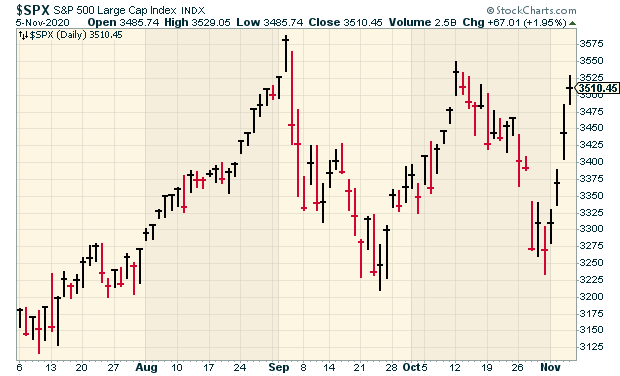

Let’s start with the indexes. The S&P 500 opened higher by 2.1%. It eventually ran up to a gain of 3.9% and touched a new all-time intra-day high. By the end of trading, the index had fallen back to close higher on the day by 1.17%.

Here’s a ten-day minute-by-minute chart of the S&P 500:

You can see how volatile today was. The gap between sectors was astounding. The Nasdaq Composite actually closed lower today by 1.53%.

At one point, the Dow was up over 1,700 points for a gain of 5.7%. It also made a new all-time intra-day high. The index closed off its high for a gain of 834 points, or 2.95%. The Dow did nearly three times better than the S&P 500. The indexes generally track each other pretty closely, but you rarely see divergences quite like this.

There was so much going on that it’s hard to summarize but I’ll give it a shot. Many of the sectors that were hit hard by the lockdowns soared. For example, Cinemark (CNK), the movie theater chain and former Buy List stock, was up over 45% today. Carnival (CCL), the cruise operator, soared 39%. Even Denny’s (DENN) gained 36%. Malls and airlines were also strong. United Airlines (UAL) was up 19%.

We saw evidence of this on our Buy List as Disney (DIS) jumped nearly 12% and Ross Stores (ROST) gained more than 15% today.

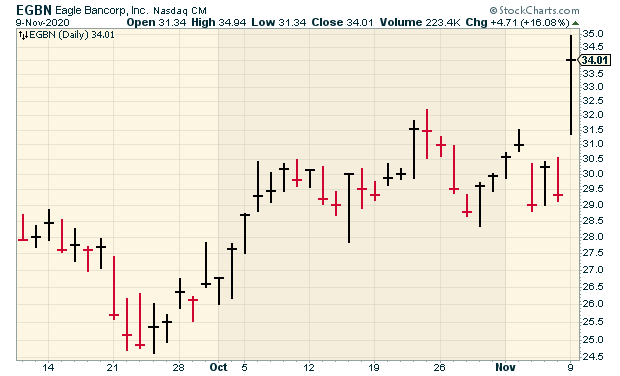

Banks and financials also had an outstanding day. AFLAC (AFL) rose 12% and Eagle Bancorp (EGBN) rallied over 16%.

The energy sector also had a strong day (we don’t have any energy stocks on our Buy List, which has largely served us well). The thinking seems to be that the world will get back to normal, and that will lead to a stronger economy. Therefore, that’s good for banks and energy stocks.

However, this also contends that interest rates may rise, and that led to a lot of weakness among housing stocks. It’s also a reminder that housing touches many different industries.

On our Buy List, Trex (TREX) fell by 14.5% and Sherwin-Williams (SHW) lost over 6%. Bear in mind, there was no news on these stocks. Traders are merely playing the assumed economic impact.

The S&P 500 High Beta Index rose 11.7% today while the S&P 500 Low Volatility was down 0.9%. I don’t even know what to say. That’s gigantic gap. The Russell 2000 Index of small-cap stocks gained 3.7% today. That index is usually skewed towards cyclicals.

Zoom (ZM), the superstar of the lockdown, was down 17% today. Peloton (PTON) was off 20%. Clorox (CLX) lost over 10%. On our Buy List, Church & Dwight (CHD) is in the cleaning biz. CHD fell 6% today.

The bond market got hit hard today. Remember, with rates so low, even a small move in rates can be a big loss in bonds. The 30-year Treasury yield rose by 15 basis points, up to 1.75%. The main Long-Term Treasury Bond ETF (TLT) lost 2.1% today. The average duration of that ETF is 19 years.

In the last five days, the S&P 500 has gained 7.3%. The S&P 500 Equal Weight Index (meaning if every stock was 0.2% of the index) was up 4.25%. The S&P 500 High Dividend Index rose over 10% and the S&P 500 Interest-Rate Sensitive Index rallied by 7.4%. S&P 500 Value gained 3.98% today while S&P 500 Growth fell 0.58%.

These moves are just incredible.

What to do now? For one, relax. Today is very good news, but we’re a long way from beating Covid. Markets are designed to react strongly in the near-term, and that’s what’s happening. While the news is encouraging, it will take several months before any vaccine is widely available.

Stick to our investment strategy and don’t do anything rash. We have good stocks. If you have free money to invest, look at our Buy List stocks and pay attention to our Buy Below prices. They’re there for your protection.

I’ll have the next regular issue for you later this week. Until then, let’s celebrate the good news and keep wearing your mask!

-Eddy

-

Sector Breakdown

Eddy Elfenbein, November 9th, 2020 at 11:28 amHere’s the performance of each sector in the S&P 500. I’ve never seen a spread quite like this:

Energy 12.17%

Financial 7.09%

The Real Estate 4.60%

Utilities 3.74%

Industrial 3.71%

Materials 2.41%

Technology 2.38%

Health Care 1.72%

Consumer Discretionary 1.41%

Consumer Staples 1.38%

Communication Services 1.31%The areas that had been suffering are up the most.

-

Stocks Soar on Vaccine News

Eddy Elfenbein, November 9th, 2020 at 10:51 amIs there a vaccine miracle? Could be! Pfizer says its vaccine is proving to be 90% effective.

Dr. Anthony Fauci, the government’s top-infectious disease expert, said the results suggesting 90% effectiveness are “just extraordinary,” adding: “Not very many people expected it would be as high as that.”

The market is celebrating. The Dow is up over 1,200 points, or more than 4.3%. The Russell 2000 is up more than 5%. The laggard is the Nasdaq which is up “only” 1.6%.

The Dow hit an intra-day high:

Disney, Ross Stores and Eagle Bank are all up more than 10%. Disney is up 9%.

I’ve never seen a market this divided. All the sectors that had suffered are soaring. Banks and Energy stocks are up 10%, 12%, or even more. Biogen, on the other hand, is down 30%. So are some other “pandemic stocks.” For example, the housing sector isn’t doing so well today.

The cruise stocks are very happy. Carnival is up 36% while Royal Caribbean is up 29%.

-

Morning News: November 9, 2020

Eddy Elfenbein, November 9th, 2020 at 7:03 amChina Has a Clever Plan to Keep Its Citizens Spending at Home

Turkish Finance Minister Resigns In Second Surprise Departure After Lira Slide

Germany Considers Delaying a $4 Billion Tariff Strike on the U.S.

Why the Biden Economy Could Be the Same Long Slog as the Obama Economy

In a Divided Washington, Biden Could Still Exert Economic Power

A Low Fed Funds Rate Is A Sign That Credit Is Very Tight

Wall Street Set to Jump as Pfizer Says Vaccine Effective & Pfizer’s Covid Vaccine Prevents 90% of Infections in Study

McDonald’s Beats Profit Estimates on U.S. Drive-Thru Demand

SoftBank’s Vision Fund Back To Black Even As Some of Son’s Tech Bets Sting

Jeff Miller: Weighing the Week Ahead: The Elusive Logic of Mr. Market

Michael Batnick: Don’t Sell America Short

Cullen Roche: The Markets and the Economy Don’t Care About Your Politics & The Other Side of the Trade

Joshua Brown: Invest In You: How I Invest My Money, The Most Powerful Man in Washington Stays Put, How to Buy a Correction (with Tony Dwyer) & Normal

Ben Carlson: My Biggest Post-Election Market Questions & What Happens When Investors See People Dumber Than They Are Getting Rich

Be sure to follow me on Twitter.

-

Hershey Earns $1.86 per Share

Eddy Elfenbein, November 6th, 2020 at 10:16 amGood news this morning for Hershey (HSY). The chocolate company earned $1.86 per share for the third quarter. Wall Street had been expecting $1.72 per share.

Quarterly revenues were up 4.2% to $2.22 billion. That beat by $60 million. Organic sales grew by 3.8%. Consensus was for 2.5%.

“We had a strong third quarter, with accelerated reported net sales growth of 4%, adjusted diluted EPS growth of more than 15% and confectionery share gains across markets, including an almost 190 basis point gain in the U.S. Our core U.S. business remains healthy as consumers reach for small treats during the pandemic, and our decision to lean into Halloween ahead of the season supported consumers’ desire to find new and creative ways to celebrate safely. We also saw sequential improvement in the areas of our business hit hardest by COVID-19, including our international markets, owned retail locations and food service business,” said Michele Buck, The Hershey Company President and Chief Executive Officer. “We are continuing to focus on executing with excellence, investing in the business, and advancing our strategic priorities to deliver a strong fourth quarter and position us well for 2021.”

Hershey expects full-year earnings of $6.18 to $6.24 per share. That’s up 7% to 8% over last year. For the first three quarters of this year, Hershey has made $4.80 per share. That implies Q4 earnings of $1.38 to $1.44 per share. Wall Street had been expecting $1.38 per share. The stock is up about 2% in today’s trading.

-

U.S. Economy Added 638,000 Jobs Last Month

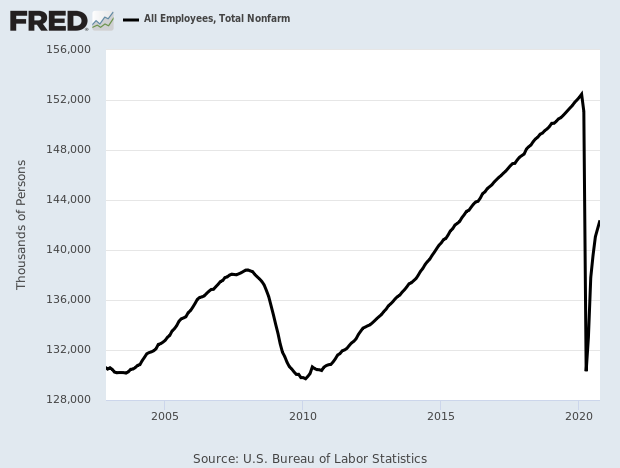

Eddy Elfenbein, November 6th, 2020 at 8:35 amThe economy created 638,000 net new jobs last month. The estimate was for a gain of 530,000.

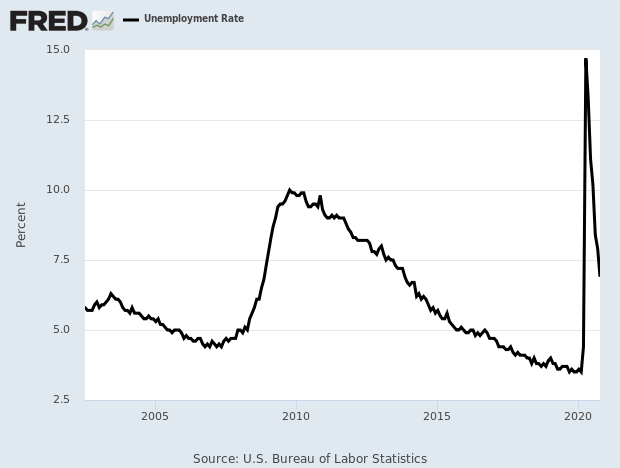

The unemployment rate fell to 6.9%. The estimate was for 7.7%. The U-6 number fell to 12.1%.

The jobless rate decline was positive as it came with a labor force participation rate that rose 0.3 percentage points to 61.7%. An alternative measure that includes discouraged workers and those holding part-time jobs for economic reasons also declined, to 12.1% from 12.8% a month ago.

The survey of households showed an even stronger level of job growth, with the total employment level rising by 2.24 million and the employment to population ratio increasing by 0.8 percentage points to 57.4%. The household survey also showed a decline of 1.52 million in the total unemployed level and a drop of 541,000 in those considered not in the labor force.

The bottom line. The jobs numbers were decent but there’s a long way to go. We’re probably about 10 million jobs away from full employment.

Here’s the chart of nonfarm payrolls:

Here’s the unemployment rate:

-

CWS Market Review – November 6, 2020

Eddy Elfenbein, November 6th, 2020 at 7:08 am“Successful investing is anticipating the anticipations of others.” – J.M. Keynes

What a news-filled week this has been! We had a presidential election, and they’re still counting the ballots. We may not know the winner for a few days. Wall Street doesn’t seem to mind. Over the last four days, the S&P 500 has gained more than 7.3%.

We also had a Federal Reserve meeting. As expected, the Fed didn’t alter interest rates. The October jobs report is due out later today, and, of course, there have been lots more Q3 earnings reports.

So far, none of our Buy List earnings reports has missed expectations. In fact, many of them have beaten by a lot. This week, Middleby trounced Wall Street’s consensus, and the shares jumped more than 17% in one day!

Broadridge Financial Solutions creamed estimates, and the stock rallied to a new 52-week high. Ansys gained more than 4% after its earnings report, and Trex also reported nice numbers.

In this week’s issue, I’ll go over all of our recent reports. I’ll also preview next week’s report from Disney. I should also mention that CWS Market Review turns 10 years old! We sent out our premiere issue on November 5, 2010. I can’t believe it’s been one full decade! Thanks to everyone for your support. Now, let’s jump right in.

More Buy List Earnings Reports

Here’s an updated look at our Earnings Calendar:

Stock Ticker Date Estimate Result Eagle Bancorp EGBN 21-Oct $0.81 $1.28 Globe Life GL 21-Oct $1.75 $1.75 Silgan SLGN 21-Oct $0.95 $1.04 Stepan SCL 21-Oct $1.40 $1.56 Check Point Software CHKP 22-Oct $1.53 $1.64 Danaher DHR 22-Oct $1.36 $1.72 AFLAC AFL 27-Oct $1.13 $1.39 Fiserv FISV 27-Oct $1.16 $1.20 Sherwin-Williams SHW 27-Oct $7.75 $8.29 Cerner CERN 28-Oct $0.71 $0.72 Church & Dwight CHD 29-Oct $0.67 $0.70 Intercontinental Exchange ICE 29-Oct $0.99 $1.03 Moody’s MCO 29-Oct $2.10 $2.69 Stryker SYK 29-Oct $1.40 $2.14 Broadridge Financial Sol BR 30-Oct $0.63 $0.98 Trex TREX 2-Nov $0.38 $0.41 Ansys ANSS 4-Nov $1.26 $1.36 Becton, Dickinson BDX 5-Nov $2.52 $2.79 Middleby MIDD 5-Nov $1.04 $1.34 Hershey HSY 6-Nov $1.72 Disney DIS 12-Nov -$0.71 There’s a lot of earnings to get to. Let’s start with Broadridge Financial Solutions (BR). Last Friday, the company reported fiscal Q1 earnings of 98 cents per share. That’s a huge beat. Wall Street had been expecting 63 cents per share.

The best news is that Broadridge increased its earnings guidance for this fiscal year. The company now expects earnings growth of 6% to 10%. The previous range was 4% to 10%. Last year, BR made $5.03 per share, so the new guidance works out to a full-year range of $5.33 to $5.53 per share.

“Broadridge reported strong first-quarter results, including 8% Recurring revenue growth and record first quarter earnings,” said Tim Gokey, Broadridge’s Chief Executive Officer. “Our continued growth highlights the long-term trends driving our business and the strength of our recurring-revenue business model. In addition, our strong cost actions helped drive significant margin expansion. This positive start to the fiscal year gives us additional confidence in our full-year guidance and enables us to increase our level of investment in our people, platforms and technology.

“We have updated our outlook to reflect our increased confidence in our full-year results. Our updated guidance now calls for recurring-revenue growth of 3-6% and Adjusted EPS growth of 6-10%,” Mr. Gokey added. “By investing now, we will be even better positioned to address our clients’ accelerating need for next-generation mutualization, resiliency and digital transformation.”

This is a quiet company that gets the job done. The stock rallied to a new 52-week high. We now have a 17% gain this year. Broadridge remains a buy up to $150 per share.

On Monday, Trex (TREX) said it made 41 cents per share for its fiscal Q3. That was three cents better than estimates. This stock has had a charmed year in 2020. For Q3, sales rose nearly 20% to $232 million.

Excluding some charges, Trex’s gross margins are running close to 40%. That’s very good. For Q4, the company didn’t provide any EPS guidance, but they see sales ranging between $210 million and $220 million. At the midpoint, that’s a 30% increase. For 2021, Trex expects double-digit sales growth (btw, they’re low-balling).

This earnings report is more good news. Trex also reinstated its share-buyback program. Through Thursday, we have a 77% gain this year in Trex. I’m lifting our Buy Below on Trex to $84 per share.

After the market closed on Wednesday, Ansys (ANSS) reported Q3 earnings of $1.36 per share. That beat the Street by 10 cents per share. The company said that growth in the Asia-Pacific region was particularly strong. Growth exceeded 10% in South Korea and Japan.

CFO Maria Shields said, “We reported a record third-quarter balance of deferred revenue and backlog of $880 million, an increase of 35% over the third quarter of 2019. Additional financial highlights reflecting the resiliency of our business model included ACV growth, which continues to be comprised of a high level of recurring sources at 78% for the quarter and 81% for the first nine months of the year.”

Now let’s look at guidance. For Q3, Ansys expects revenues between $542.3 million and $582.3 million and earnings between $2.36 and $2.67 per share. That’s a pretty wide range. For all of 2020, Ansys sees revenues between $1,610.0 million and $1,650.0 million, and earnings between $6.09 and $6.40 per share.

The stock gained 4.2% on Wednesday. Ansys remains a buy up to $340 per share.

We had two more earnings reports on Thursday morning. Middleby (MIDD) had an outstanding quarter. The company reported earnings of $1.34 per share. Wall Street had been expecting $1.04 per share. If you’re not familiar with Middleby, the company makes kitchen equipment for hotels and restaurants. Think big ovens and grills, and stuff with conveyer belts.

The stock got demolished during the market wipeout in February and March. Gradually, Middleby has worked its way back. This last quarter was a solid one for Middleby. Tim FitzGerald, CEO of Middleby said, “We delivered record cash flows, improved profitability, and enhanced our capital structure for the long-term.”

On Thursday, the stock jumped 17.1%. Middleby is a good example of how our buy-and-hold philosophy bails us out. I’m sure many nervous investors sold out near the low. We held on, and the shares have nearly tripled from their March low. This week, I’m lifting my Buy Below price to $133 per share.

Also on Thursday, Becton, Dickinson (BDX) said it made $2.79 per share for its fiscal Q4. Revenues increased 4.4% to $4.784 billion. Revenues inside the U.S. increased by 7.4%, while revenues from outside the country rose by just 0.5%. For the year, Becton made $10.20 per share.

I have to confess that I haven’t been pleased with Becton’s performance this year. One silver lining has been Becton’s work on the coronavirus. Recently, Becton’s rapid Covid-19 test was approved for Europe. That’s very good news, because the region has had trouble keeping up with the need for tests.

For next year, Becton expects sales growth in the high-single to low-double digits. The company sees earnings coming in between $12.40 and $12.60 per share. That’s growth of 21.5% to 23.5%. Becton remains a buy up to $250 per share.

Earnings Preview for Hershey and Disney

We have two reports remaining. Hershey (HSY) is due to report later today. Three months ago, the chocolate folks said they wouldn’t be providing financial guidance for Q3. I certainly understand.

For Q2, sales fell 3.4%, but Hershey earned $1.31, which beat the Street by 18 cents per share. The company said it expects accelerated sales growth during the back half of this year. Hershey also expects pricing and cost management to drive margin expansion.

For Q3, Wall Street expects Hershey to earn $1.72 per share. Look for an earnings beat.

I’ve said that if I were to custom-design a company to be harshly impacted by the coronavirus, it would be hard to top Disney (DIS). The company makes films. It’s deep into sports and travel. As if that weren’t not enough, they have a cruise line.

Three months ago, Disney stunned the world by reporting a profit for its Q2. Not a big one, but it was a profit nonetheless. For Q2, the Mouse House earned eight cents per share. Wall Street had been expecting a loss of 64 cents per share.

The weak spot was revenue. For the quarter, Disney had $11.78 billion in revenue. That was below estimates for $12.37 billion. The only parts of Disney’s business that saw an increase in revenue were the direct-to-consumer and international-businesses sectors.

The big success story is Disney’s streaming service. I guess it helps that everyone is stuck at home! If you add up all the subscription services, Disney now has over 100 million paid subscribers. Disney+ is up to 57.4 million.

Revenue for their Parks, Experiences and Products business was down a staggering 85%. Disney’s Media Networks was only down 2%. As a result of the lockdown, Disney took a $3.5 billion hit to its operating income.

The success of Disney+ lies in the company’s recent reorg. I’m sure Disney looks at Netflix and wonders why they can’t have an earnings multiple like them. Solution: organize yourself to be more like them. We’ll see. In any event, Wall Street expects Disney to report a Q3 loss of 71 cents per share.

That’s all for now. I expect that the election will be resolved by next week. Fortunately, the stock market doesn’t appear nervous. Next Wednesday is Veteran’s Day. Wall Street is open, although many government offices will be closed. On Thursday, we’ll get another jobless-claims report. Also on Thursday, the CPI report is due out, and we’ll get an update on the federal budget. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Morning News: November 6, 2020

Eddy Elfenbein, November 6th, 2020 at 7:00 amChina’s Central Bank Says Ant’s IPO Suspension Is To Safeguard Consumer, Investor Interests

With Ant’s IPO On Hold, China Emphasizes Need For Fintech Regulation

Smallest Job Gains In Five Months Expected As U.S. Labor Market Momentum Wanes

Gold Set for Biggest Weekly Gain Since July as Biden Closes In

Stock Market’s Post–Election Day Rally Shows That Gridlock In Washington Is Good for Wall Street

Facebook, Alarmed by Discord Over Vote Count, Is Said to Be Taking Action

On Election Day, Facebook and Twitter Did Better by Making Their Products Worse

Bitcoin Hits $15,500 as Post-Election Rally Loses Some Steam

Marijuana Stocks Surge As Investors Bet on a More Weed-Friendly U.S.

Berkshire Hathaway to Show Investors If Adventurous Moves Lifted Profit

The Faces of Americans Living in Big Debt

Ben Carlson: Everybody Lies: Pollster Edition

Michael Batnick: I Don’t B*llshit Myself & Animal Spirits: Farmland for the Modern Investor

Jeff Carter: Blockchain Voting

Cullen Roche: What the Heck Just Happened?

Joshua Brown: “There’s far too much variance during actual events because humans are often unpredictable.” & Cracking the YouTube Code

Be sure to follow me on Twitter.

Today’s Fed Statement

Eddy Elfenbein, November 5th, 2020 at 2:02 pmHere’s today’s Fed policy statement:

The Federal Reserve is committed to using its full range of tools to support the U.S. economy in this challenging time, thereby promoting its maximum employment and price stability goals.

The COVID-19 pandemic is causing tremendous human and economic hardship across the United States and around the world. Economic activity and employment have continued to recover but remain well below their levels at the beginning of the year. Weaker demand and earlier declines in oil prices have been holding down consumer price inflation. Overall financial conditions remain accommodative, in part reflecting policy measures to support the economy and the flow of credit to U.S. households and businesses.

The path of the economy will depend significantly on the course of the virus. The ongoing public health crisis will continue to weigh on economic activity, employment, and inflation in the near term, and poses considerable risks to the economic outlook over the medium term.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. With inflation running persistently below this longer-run goal, the Committee will aim to achieve inflation moderately above 2 percent for some time so that inflation averages 2 percent over time and longer-term inflation expectations remain well anchored at 2 percent. The Committee expects to maintain an accommodative stance of monetary policy until these outcomes are achieved. The Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee’s assessments of maximum employment and inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time. In addition, over coming months the Federal Reserve will increase its holdings of Treasury securities and agency mortgage-backed securities at least at the current pace to sustain smooth market functioning and help foster accommodative financial conditions, thereby supporting the flow of credit to households and businesses.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals. The Committee’s assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michelle W. Bowman; Lael Brainard; Richard H. Clarida; Mary C. Daly; Patrick Harker; Robert S. Kaplan; Loretta J. Mester; and Randal K. Quarles. Ms. Daly voted as an alternate member at this meeting.

Initial Claims = 751,000

Eddy Elfenbein, November 5th, 2020 at 11:48 amThis going to be another busy day for us. We already had two Buy List earnings reports this morning. Later today, we’ll get the Fed announcement. Don’t expect any change on rates.

This morning’s jobless claims report was 751,000. That’s down from 758,000 last week. Not bad, but still way above normal.

Meanwhile, new cases of the coronavirus topped 100,000. On the election front, they’re still counting the ballots. I have no idea what to expect, but this may take several days.

-

-

Archives

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His