Archive for December, 2020

-

Morning News: December 21, 2020

Eddy Elfenbein, December 21st, 2020 at 7:08 amU.K. Confronts Threat of Food Crisis as Virus Blocks Trade

Stimulus Deal Provides Economic Relief, for Now

The Stimulus Deal: What’s in It for You

Big Tech’s Stealth Push to Influence the Biden Administration

Tesla’s Rise Made 2020 the Year the U.S. Auto Industry Went Electric

Agios to Sell Its Cancer Portfolio to Servier for $1.8 Billion

JPMorgan Ousted as Mideast-Africa’s Top Dealmaker by U.S. Rivals

Shell to Write Down Assets Again, Taking Cuts to More than $22 Billion

McDonald’s Sells ‘Spam Burger’ with Cookie Crumbs in China

Nick Maggiulli: 5 Lessons From the Only 2 Stocks I’ve Ever Owned

Cullen Roche: This Man Lost Everything Betting on Stocks

Jeff Miller: Weighing the Week Ahead: What Can Investors Expect before Springtime?

Ben Carlson: The Hardest Market Environment Ever

Michael Batnick: Animal Spirits: How to Start Your Financial Life & This Is Not The Way

Howard Lindzon: I Love Seeing My Friends Do Well…

Be sure to follow me on Twitter.

-

CWS Market Review – December 18, 2020

Eddy Elfenbein, December 18th, 2020 at 7:08 am“See, the stock market only deals in facts, in reality, in reason, and the stock market is never wrong. Traders are wrong.” – Jesse Livermore

Before I begin, let me remind you that I’ll be unveiling the 2021 Buy List in next week’s newsletter. On Friday, December 25, I’ll send you an email with the new Buy List. In honor of our new Buy List, the NYSE has agreed to close that day.

As in previous years, I’ll be adding five new stocks and deleting five old stocks. The Buy List will remain at 25 stocks. The new Buy List will be equally weighted based on the closing prices on December 31. The new Buy List will take effect at the start of trading on January 4, which is the first trading day of the new year. Stay tuned. Now, on to the issue.

The big news this week is that congressional leaders appear to be close to an agreement for an economic stimulus plan. Now that the election is behind us, a deal is only a matter of time. The other big news is that the vaccine for the coronavirus has finally been rolled out. While the numbers are still quite severe, if all goes well, we’ll finally turn the tide on this terrible virus.

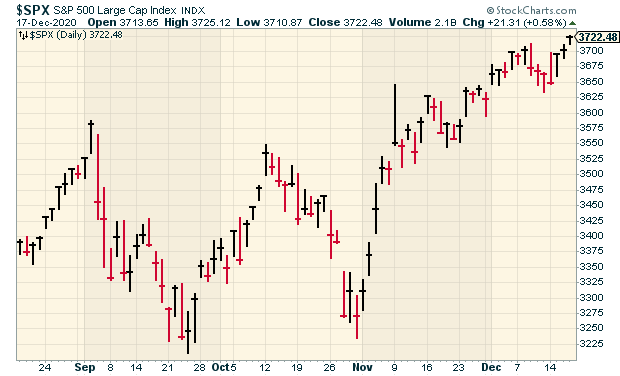

The S&P 500 closed at a new all-time high on Thursday. Since the March low, the index has rallied more than 66%. The S&P 500 has racked up 64 daily gains of more than 1%. That’s the highest number in at least 70 years. The Dow and Nasdaq are also at new highs. (Bitcoin has tripled this year!)

We also had a Federal Reserve meeting this week. As expected, the Fed didn’t offer any policy changes, but we did get a sense of how much longer the Fed plans to backstop the U.S. economy (spoiler alert: a long time!). I’ll explain what it all means. I’ll also preview next week’s earnings report from FactSet. Plus, I have some Buy List updates. (Did anyone else notice the big jump last Friday from Disney? Good. Me, too.)

The Federal Reserve Goes All In

The Federal Reserve met again this week, and as expected, the central bank didn’t make any changes to its policy. The current policy has two aspects. The first is to keep interest rates as low as possible. The target range for the Fed funds rate is 0% to 0.25%. You can’t get more accommodative than that.

The other part is bond buying. Each month, the Fed buys up massive numbers of bonds. The Fed currently buys $80 billion worth of Treasuries every month, plus $40 billion in mortgage-backed securities. That’s why mortgage rates have plunged. In fact, they just fell to another record low. Not surprisingly, the housing market has responded. For example, Thursday’s housing-starts report was very strong.

The housing boom has filtered through much, though certainly not all, of the economy. Later on, I’ll talk about Trex, which has seen its business flourish. The stock just hit a new all-time high. I think it’s interesting that housing stocks fell sharply on November 9 after the encouraging vaccine news came out.

Where does the Fed go from here? The short answer is nowhere. The Fed members have made it clear that they don’t see the need to raise interest rates any time soon. All 17 members of the FOMC agreed that the Fed shouldn’t raise rates this year or next, and only one member of the 17 predicted the need to hike in 2022. A strong majority were still against any rate hikes in 2023. The Fed has made it clear that it intends to do whatever it can to help the economy.

I expect that at some point, the Fed will lay out guidelines for how-to plans to stop buying bonds. I imagine it will be something like, if we hit unemployment rate of X%, then we’ll reduce our bond-buying by $Y billion.

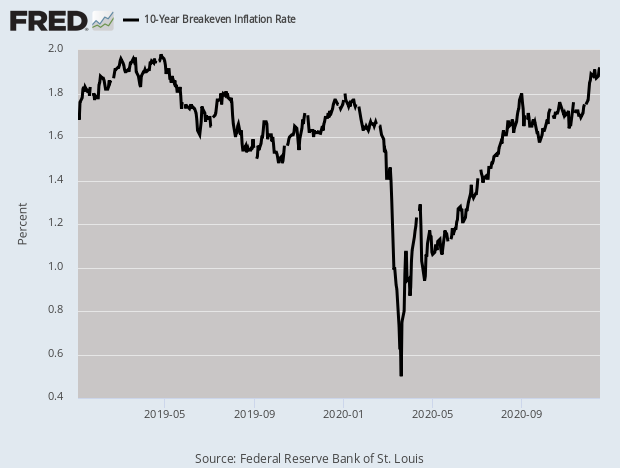

There is a concern about inflation. You can’t help but be nervous at the thought of all those new dollars being thrown around. There aren’t many examples of the economy being pinned down and then suddenly released. One example is World War II. In the immediate aftermath of the war, inflation jumped in the U.S. due to pent-up demand. Could we see that again? I doubt it. Perhaps certain sectors such as travel-related industries will see a surge in demand.

The Fed has said that it will take a more lenient attitude towards inflation. Within reason, that’s probably the right move. We can get a clue by looking at the bond market. The 10-year “breakeven” rate is the market’s guess as to what inflation will be. The 10-year breakeven has soared in recent months (see chart above), and it’s still below 2% which is the Fed’s long-run target for inflation. At some point, inflation may be a concern; but for now, it’s not something to worry about. Now let’s preview our final Buy List earnings report for 2020.

FactSet Earnings Preview

FactSet (FDS) is due to report its fiscal Q1 earnings on Monday, December 21 before the market opens. In August, the financial-data company wrapped up another very good fiscal year. For the year, FactSet earned $10.87 per share.

To give you some perspective on that result, FactSet initially told us to expect full-year earnings to range between $9.85 and $10.05 per share. The company later raised that by 55 cents per share at both ends of the range. Even with that increase, FDS still managed to blow past its own forecast. In the year before that, FDS earned $10 per share on the nose, so it was an 8.7% earnings increase.

This was FactSet’s 24th year in a row of earnings growth and its 39th year in a row of revenue growth. For Q4, client count increased to 5,875, and user count reached 133,051. The company now has 10,484 employees. That’s an increase of 8.3% in the last year.

“We executed well on our second-half pipeline to end our fiscal year in a strong position,” said Phil Snow, FactSet CEO. “I am proud of our team’s performance and remain confident in our investment plan. Our programs in content and technology are expanding the universe of knowledge our clients trust and meeting demand for the workforce of the future.”

For the quarter, FactSet’s organic revenue grew by 4.9% to $383.4 million. A key stat for the company is its Annual Subscription Value, or ASV. At the end of the quarter, the ASV stood at $1.56 billion. The organic-growth rate was 5.3%. The annual retention rate is 95%.

During Q4, FactSet bought back 81,948 shares, for $28.6 million. That’s an average price of $349.25 per share. In March, the company approved an increase to its share-repurchase program of $220 million. There’s now $259 million available to buy more shares.

Now let’s look at guidance. For the current fiscal year, FactSet expects earnings between $10.75 and $11.15 per share. Wall Street had been expecting $10.84 per share. The company sees operating margin ranging between 32% and 33%. That’s very good.

For Q1, Wall Street expects earnings of $2.75 per share. FDS is a 28.7% winner for us this year.

Buy List Updates

In October, Cerner (CERN) reported another strong quarter. The company made 72 cents per share, which was inside its guidance. For Q4, Cerner expects revenue between $1.365 billion and $1.415 billion and earnings between 76 and 80 cents per share.

On Friday, Cerner announced that it’s hiking its dividend. The quarterly payout will rise from 18 cents to 22 cents per share. That’s a 22% increase. The new dividend will be payable on January 12 to shareholders of record as of the close of business on December 28.

Last year, Cerner reached a deal with Starboard Value, an activist investor. In exchange for some seats on the board, Cerner agreed to start paying a dividend and to buy back some shares. The initial quarterly dividend was for 18 cents per share, so this is Cerner’s first dividend increase.

This week, I’m lifting our Buy Below for Cerner from $75 to $82 per share.

On November 9, shares of Trex (TREX) got pounded for a 14% loss. This was the reaction to Pfizer saying its vaccine was 90% successful. That’s a bizarre reaction, but traders were probably guessing that it would spark higher mortgage rates and that would choke off Trex’s business.

Not even close. Trex has now made back everything it lost, and shares broke out to a new high this week. From the November low to the December high, Trex rallied back over 30%. We have an 84% gain this year in Trex. I’m raising our Buy Below to $88 per share.

In last week’s issue, I mentioned Disney’s (DIS) positive Investor Day and how it impressed shareholders. I said that Disney had been trading up over 3% in Thursday’s after-hours market. As it turns out, Friday’s reaction was much more positive than expected. At one point on Friday, Disney was up 16% on the day.

Check out this list of upcoming Disney movies. No one has content quite like the Mouse. I’m raising our Buy Below to $182 per share.

That’s all for now. With the holidays approaching, the economic calendar will get shifted around a little bit. On Tuesday, December 22, we’ll get the second update on Q3 GDP growth. The initial report showed that the U.S. economy grew (or rather, rebounded) at a 33.1% rate for Q3. The first revision was unchanged. On Wednesday, we’ll get reports on consumer income and spending. On Thursday, December 24, the stock market will close at 1 p.m. ET, and trading will be closed all day on Christmas Day. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Morning News: December 18, 2020

Eddy Elfenbein, December 18th, 2020 at 7:02 amGhana’s Central Bank Shuts Door on Lending Government More Money

How to Reset the Relationship Between the U.S. and China

Reopening Rally? Speculative Bubble? These Days, It’s Hard to Tell

Hijacking the Fed to Bail Out States

U.S. FDA Advisory Panel Sets Stage for Moderna Vaccine Authorization

U.S. Retailers Want Shoppers to Help Santa With Curbside Pickup

Russia-Linked SolarWinds Hack Ensnares Widening List of Victims

Google’s Legal Peril Grows in Face of Third Antitrust Suit

Robinhood Pays $65 Million Fine to Settle Charges of Misleading Customers

The Quest to Replicate Tesla’s Success Keeps EV Mania Alive

Howard Lindzon: Individualism and The Unbundling of The Stock Market Indexes

Cullen Roche: The 2020 Podcast World Tour Continues!

Ben Carlson: Penis Thieves & Asset Bubbles

Be sure to follow me on Twitter.

-

Eagle Bancorp Announces Big Share Buyback

Eddy Elfenbein, December 17th, 2020 at 10:24 pmAfter the closing bell, Eagle Bancorp (EGBN) issued a press release which touched on two items. The first is that the bank is paying out a quarterly dividend of 22 cents per share. That’s not really news because Eagle has paid a 22-cent dividend for several quarters. The cash dividend will be payable on February 1 to shareholders of record on January 8.

The other item is that the Board of Directors adopted a new share repurchase program. The new program will start on January 1. The board authorized Eagle to buy back 15.89 million shares of stock. That’s about 5% of the outstanding shares. Eagle currently has 31.78 million shares outstanding as of December 16.

Over the last three months, shares of Eagle have gained more than 63%.

-

Housing Starts and Initial Claims

Eddy Elfenbein, December 17th, 2020 at 8:48 amWe got two important economic reports this morning, and we got good news and bad news.

Let’s start with the bad. The initial claims report came in at 885,000. That’s not so good. That’s an increase of 23,000. We’re moving in the wrong direction. On top of that, the number for last week was revised higher by 9,000. A silver lining is that continuing claims came in at 5.508 million. That’s a pandemic low.

The good news is that the housing starts number was very strong. Housing starts were up 1.7% last month compared with expectations for a decline of 0.7%. That works out to 1.547 million (that’s an annualized and seasonally adjusted number). Permits were up 6% to 1.639 million.

The futures indicate that the S&P 500 will open at an intra-day high.

-

Morning News: December 17, 2020

Eddy Elfenbein, December 17th, 2020 at 7:05 amBOE Maintains QE Plan, Extends Company Aid on Prolonged Crisis

Bitcoin Soars Above $23,000 as More Wall Street Firms Pile In

Why the US Government Hack Is Literally Keeping Security Experts Awake At Night

Fed Leaves Rates Unchanged and Commits to Ongoing Bond Purchases

What’s New With the Fed’s 2020 Bank Stress Tests?

$900 Billion Covid-Relief Plan Inches Forward With Talks Down to Final Details

Workers Tap Retirement Savings as a Last Resort

10 States Accuse Google of Abusing Monopoly in Online Ads

Samsung Works Its Way Into European 5G Race to Fill Huawei Gap

A 1958 ’Vette Translated Into Modern Chinese

Amazon Has Turned a Middle-Class Warehouse Career Into a McJob

Mackenzie Scott’s Gifts Cast Unflattering Light on Bezos’ COVID Capitalism

Joshua Brown: “take all your common stocks and sell them”

Howard Lindzon: The Killer B’s … Biotech and Bitcoin

Michael Batnick: Animal Spirits: IPO Mania

Be sure to follow me on Twitter.

-

The Fed Policy Statement

Eddy Elfenbein, December 16th, 2020 at 2:02 pmHere’s the latest policy statement from the Federal Reserve:

The Federal Reserve is committed to using its full range of tools to support the U.S. economy in this challenging time, thereby promoting its maximum employment and price stability goals.

The COVID-19 pandemic is causing tremendous human and economic hardship across the United States and around the world. Economic activity and employment have continued to recover but remain well below their levels at the beginning of the year. Weaker demand and earlier declines in oil prices have been holding down consumer price inflation. Overall financial conditions remain accommodative, in part reflecting policy measures to support the economy and the flow of credit to U.S. households and businesses.

The path of the economy will depend significantly on the course of the virus. The ongoing public health crisis will continue to weigh on economic activity, employment, and inflation in the near term, and poses considerable risks to the economic outlook over the medium term.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. With inflation running persistently below this longer-run goal, the Committee will aim to achieve inflation moderately above 2 percent for some time so that inflation averages 2 percent over time and longer-term inflation expectations remain well anchored at 2 percent. The Committee expects to maintain an accommodative stance of monetary policy until these outcomes are achieved. The Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee’s assessments of maximum employment and inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time. In addition, the Federal Reserve will continue to increase its holdings of Treasury securities by at least $80 billion per month and of agency mortgage-backed securities by at least $40 billion per month until substantial further progress has been made toward the Committee’s maximum employment and price stability goals. These asset purchases help foster smooth market functioning and accommodative financial conditions, thereby supporting the flow of credit to households and businesses.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals. The Committee’s assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michelle W. Bowman; Lael Brainard; Richard H. Clarida; Patrick Harker; Robert S. Kaplan; Neel Kashkari; Loretta J. Mester; and Randal K. Quarles.

To summarize, there’s no change in policy. The Fed is going to keep rates on the floor and it will continue to buy bonds.

Here are the updated economic projections. The Fed’s projections are notoriously poor, but they’re interesting to see. For example, the Fed now sees the economy growing by 4.2% next year. That’s quite good. The Fed sees the jobless rate getting down to 5% next year.

Now for interest rates. The Fed unanimously sees no rate hikes next year and the year after that, except for one member who sees one hike in 2022.

Five members sees hikes in 2023, but the other 12 members continue to see no need for rate increases.

-

Retail Sales Fall Again

Eddy Elfenbein, December 16th, 2020 at 12:30 pmThe stock market is up again today. The S&P 500 briefly broke above 3,700. The market is not far from a new all-time high. The Dow came very close to a new high this morning. Yesterday, in fact, the Russell 2000 got to a new high.

This morning’s retail sales report showed a decline of 1.1% in November. This is probably due to the impact of new lockdown measures. Over the last year, retail sales are up 4.1%.

The second straight monthly decline in retail sales reported by the Commerce Department on Wednesday could nudge Congress to agree on another fiscal stimulus package. News of the weak start to the holiday shopping season came as Federal Reserve officials were wrapping up a two-day policy meeting.

The U.S. central bank is expected to keep interest rates near zero and deliver a playbook for what might prompt the Fed to pump more money into the economy.

Retail sales dropped 1.1% last month, with receipts declining almost across the board. Data for October was revised down to show sales slipping 0.1% instead of rising 0.3% as previously reported, adding a sting to the report.

October’s dip was the first since April, when stringent measures to control the first wave of coronavirus cases crippled the economy.

We’ll learn more this afternoon when the Fed releases its new policy statement. Don’t expect much in the way of action, but the Fed may lay out its plans regarding its bond-buying program.

-

Morning News: December 16, 2020

Eddy Elfenbein, December 16th, 2020 at 7:04 amLook at the Big Picture in Money Market Reform, Says Regulator

Big Fines and Strict Rules Unveiled Against ‘Big Tech’ in Europe

Tech Companies Shift Their Posture on a Legal Shield, Wary of Being Left Behind

After COVID Shock, U.S. Treasury Market Set for New Scrutiny

How to Revive the Economy, and When to Worry About All That Debt

Fed Closes Out Wild Year as All Eyes Focus on Bond-Buying Program

Federal Reserve ‘Boneheads’ Emerge From Trump Era Unscathed

Fifty Years of Tax Cuts for Rich Didn’t Trickle Down, Study Says

Aphria, Tilray Combining to Create Biggest Cannabis Company

Satellite-to-Smartphone Broadband Company AST & Science to Go Public Through A SPAC

MacKenzie Scott Donates $4.2 Billion to 384 Organizations

Joshua Brown: Vaccine Week, the Trillion Dollar Fund, Moving to Austin, ‘Your Honor’

Nick Maggiulli: The Best Way to Organize Your Assets

Ben Carlson: The 2020s Will be the Decade of Customization For Financial Advisors

Be sure to follow me on Twitter.

-

Industrial Production Rises 0.4% in November

Eddy Elfenbein, December 15th, 2020 at 10:51 amThe stock market is up today after four days in a row of losses. The declines, however, have been quite modest. We’re still within earshot of a new all-time high.

The Federal Reserve begins its meeting today. We’ll get the policy statement tomorrow afternoon followed by Chairman Powell’s press conference. I doubt the Fed will actually do anything, but it may update its guidance on buying bonds.

The Fed is currently gobbling up $80 billion in Treasuries each month, plus another $40 billion in mortgage-back securities. The amounts will probably stay the same, but the Fed may discuss the timetable at which they’ll pare back their purchases.

At the Fed’s last meeting, they made it clear that they’re going to keep interest rates low through 2023.

This morning’s report on industrial production showed an increase of 0.4% for November. We’re now 5% from the pre-pandemic peak.

Manufacturing was up 0.8% in November, its seventh consecutive monthly gain, with last month’s increase boosted by a rebound in auto production. Production of motor vehicles and parts rose 5.3%, the biggest monthly increase since a 31% surge in July. However, after that jump following spring lockdowns, auto production fell in August, September and October.

Output in the mining sector, which includes oil and gas production, rose 2.3% while utility output fell 4.3%, a decline that reflected unseasonably warm weather in November.

U.S. industry operated at 73.3% of capacity in November, still below the pre-pandemic rate of 76.9% in February.

On our Buy List, Trex (TREX) finally took out its high from October. The shares are at a new 52-week high this morning. We have a gain of more than 82% in Trex this year.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His