Archive for December, 2020

-

Morning News: December 9, 2020

Eddy Elfenbein, December 9th, 2020 at 7:07 amWhere Do I Fall in the American Economic Class System?

How Oil Majors Shift Billions in Profits to Island Tax Havens

How High Can You Go? Wall Street Exuberance Makes Some Uneasy

Flood of Day Traders Strains Online Brokers and the Backlash Is Swift

How Pandemic Aid Attracted Hordes of Gleeful and Gutsy Scammers

FireEye, a Top Cybersecurity Firm, Says It Was Hacked by a Nation-State

DoorDash Set for Trading Debut After IPO Raises $3.37 Billion

Who’s Behind the Fight Between Warner Bros. and Hollywood? It’s AT&T

Tesla Equity Sale Comes at a Good Time for Index-Fund Trackers

Musk, Bezos Space Race Gets a Boost From Anti-Poverty Tax Break

Citigroup Heads to Trial Seeking to Undo Nearly $900 Million Revlon Blunder

Nick Maggiulli: My Favorite Investment Writing of 2020

Ben Carlson: Timeless Themes From the Movie Wall Street

Michael Batnick: Growth At an Unreasonable Price

Be sure to follow me on Twitter.

-

Ten Straight Up Days for the Nasdaq 100

Eddy Elfenbein, December 8th, 2020 at 2:44 pm

-

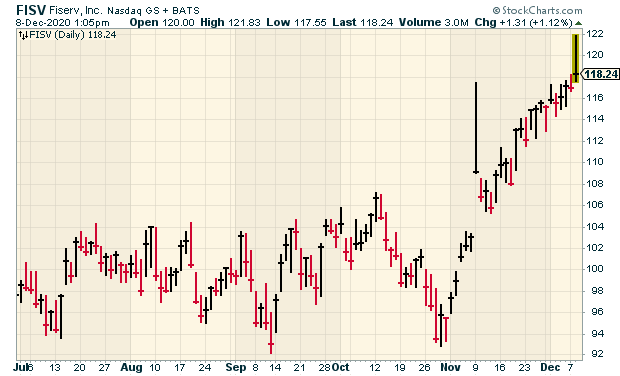

Fiserv Gives Upbeat Forecast

Eddy Elfenbein, December 8th, 2020 at 12:55 pmMany companies are holding their investor days this time of year. Or this year, they’re holding virtual investor days. Disney’s is going to be on Thursday.

Today is Fiserv’s (FISV) turn. I like Fiserv a lot, but it’s had a tough year. That’s unusual for Fiserv. The stock trailed in the bear market and trailed in the rally. Lately, the shares have started to perk up.

For 2020, Fiserv expects to see its EPS grow by 11% over last year. That would make it Fiserv’s 35th year in a row of double-digit growth.

Let’s do some math. Last year, Fiserv made $4.00 per share so 11% from there comes to $4.44 per share. The company has raked in $3.12 per over the first three quarters so that implies Q4 earnings of $1.32 per share. Sure enough, Wall Street had been expecting $1.30 per share. That’s pretty good.

For next year, Fiserv expects internal revenue growth of 7% to 12% and EPS growth of 20% to 25%.

Fiserv also expects internal revenue growth of 7% to 9% annually for 2022 and 2023, and EPS growth of 15% to 20% over this timeframe.

-

Morning News: December 8, 2020

Eddy Elfenbein, December 8th, 2020 at 7:05 amBig Push Into Helium Could Have the World on Russia’s String

Trump ‘Vaccine Summit’ Will Not Include Vaccine Manufacturers

McConnell Refuses to Endorse Bipartisan Stimulus, Risking Deal

Stimulus Compromise Is $908 Billion Better Than Nothing

Second U.S. Judge Blocks Commerce Restrictions on TikTok

Robinhood Is Losing Thousands of Traders to a China-Owned Rival

Airbnb and DoorDash IPOs Will Use a ‘Hybrid Auction.’ What That Means—and Why It Matters.

Etsy Was a Twee Culture Punchline. Now It’s a Wall Street Darling.

Uber, After Years of Trying, Is Handing Off Its Self-Driving Car Project

Calm Meditation App Hits $2 Billion Value With Goldman, TPG Backing

Trading Box Office for Streaming, but Stars Still Want Their Money

Ssslow Down! Sleeping Snakes Stall Tesla’s German Gigafactory

Ben Carlson: How to Invest When You’ve Already Won the Game

Joshua Brown: Charts of the Year 2020 – DTJB x YCharts

Be sure to follow me on Twitter.

-

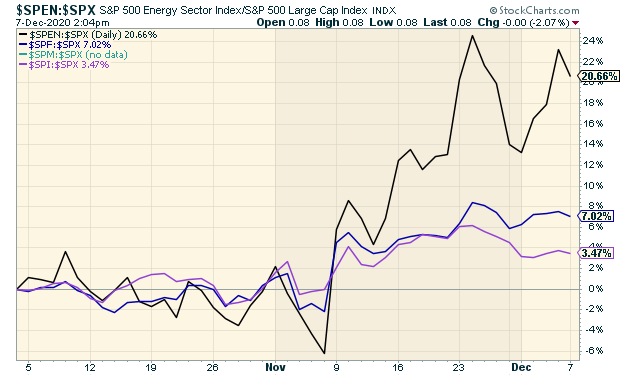

What’s Driving Value

Eddy Elfenbein, December 7th, 2020 at 2:09 pmFor the first time in two years, value has led growth for four weeks in a row.

What’s driving it? Here’s a look at the relative strength of the four major cyclical sectors. Financials, Industrials, Energy and Materials have all led the market over the past month.

The key drivers have been Energy and Financials. These are also two of the major value sectors. This shows us the strength of value stocks and how the market is shifting towards cyclicals.

-

Disney’s Investor Day Is Thursday

Eddy Elfenbein, December 7th, 2020 at 1:02 pmOn Friday, shares of Disney (DIS) got to a new all-time high. Since March, the Mouse House has gained more than 90%, but the big news comes this Thursday when Disney hosts its shareholder day.

The company will need to be transparent about the struggles ahead, and offer a clear strategy, at Disney’s investor day scheduled for Thursday, according to Gina Sanchez, CEO of Chantico Global and chief market strategist at Lido Advisors.

“Management has to address the fact that despite fantastic Disney+ subscribership – 73 million, very impressive – we still need to see a plan for how they’re going to get themselves out of this big hole that they have.

They’ve lost 62% in parks revenue, 51% in studio revenue and we need to see sort of the plan to get up and out of that,” Sanchez told CNBC’s “Trading Nation” on Friday.

Even with a vaccine, Disney could face a slow trudge to normal attendance at its parks, she said.

“Vaccine distribution isn’t expected until about midyear. Does that mean that their parks can get back up to full capacity during the summer months? Those are the questions that need to be answered,” said Sanchez.

The streaming business has done a lot for Disney but it can’t do everything.

-

The IPO Market Is Back

Eddy Elfenbein, December 7th, 2020 at 11:00 amIPOs are back. Thanks to the market’s recent rally, a spate of companies are looking to go public. Bloomberg reports that December is on pace to be the biggest month ever for new offerings.

This week, DoorDash and Airbnb will start trading. In fact, both stocks just raised their offering range which is a sign of strong demand.

Airbnb had been looking at a price range of $44 to $50 per share. Now that’s up to $56 to $60 per share. DoorDash went from a range of $75 to $85 per share up to $90 to $95 per share. Earlier this year, Airbnb had been valued at $18 billion. If this week’s offering goes off smoothly, then the company will be valued at $42 billion.

What’s the reason for the excitement? Thanks to the pandemic, a number of IPO candidates sat out the market. Now, the outlook looks much better. In fact, several more IPOs are on the way.

Airbnb and DoorDash will quickly be followed by three other mega-listings that could add billions of dollars to the IPO tally.

Also on deck to go public this month are Affirm Holdings Inc., which lets online shoppers pay for purchases such as Peloton bikes in installments, online video-game company Roblox Corp. and ContextLogic Inc., the parent of discount online retailer Wish. Each is likely to attain a valuation of tens of billions of dollars in its listing.

The New York Times quoted one investor as saying, “almost every hot company is being pursued like mad.”

-

Morning News: December 7, 2020

Eddy Elfenbein, December 7th, 2020 at 7:01 amChina Exports Generate Record Trade Surplus

Brexit Crunch Time – Stand-Off Puts EU-UK Trade Deal On A Knife Edge

A $900 Billion Plan Would Help the Economy, but Not Fix It

Santa May Have Come Early, but There’s Still Room for the Stock Market to Rally This Year

With 3 Billion Packages to Go, Online Shopping Faces Tough Holiday Test

‘This Is Insanity’: Start-Ups End Year in a Deal Frenzy

Airbnb, DoorDash Boost Price Ranges Ahead of Mega Week for IPOs

Americans Could Start Getting COVID-19 Vaccines As Early As Friday, An FDA Advisor Says

Goldman Plots Florida Base for Asset Management in a Blow to New York

IKEA Turns The Page: Drops Iconic Catalogue After 70 Years

Bob Dylan to Sell His Entire Songwriting Catalog to Universal

Howard Lindzon: Section 230…Who Do You Trust?

Jeff Miller: Weighing the Week Ahead: What is the State of the Recovery?

Michael Batnick: This Recession is Different, This One’s a Head Scratcher & Stocks, Both Foreign and Domestic

Ben Carlson: The 20 Rules of Personal Finance, The Beauty of Outsourcing & Talk Your Book: The Structured Marketplace

Be sure to follow me on Twitter.

-

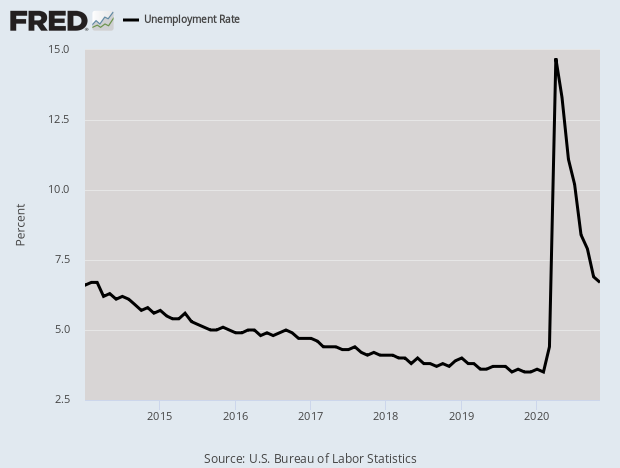

November NFP: +245K; Unemployment 6.7%

Eddy Elfenbein, December 4th, 2020 at 8:34 amThe November jobs report is out. The U.S. economy created 245,000 net new jobs last month. That compares with 610,000 for October. Wall Street expected 440,000.

The unemployment rate dropped to 6.7%.

The number of unemployed persons is 10.7 million. That’s 4.9 million higher than in February.

The numbers come amid a new wave of coronavirus cases that threatens to push the U.S. healthcare system to the brink. More than 100,000 people are hospitalized across the U.S. due to the accelerated outbreak, which saw 210,161 new cases Thursday, according to the Covid Tracking Project overseen by journalists at The Atlantic.

Though the U.S. is coming off its fastest growth quarter ever, economists worry that the next quarter or two could see flat or even negative growth before rebounding strongly in the latter part of 2021.

The November job gains would be considered strong under normal circumstances, but the pandemic has left millions of Americans out of work from jobs lost in the early stages of the crisis. The total represents the slowest job growth since the employment recovery began in May.

-

CWS Market Review – December 4, 2020

Eddy Elfenbein, December 4th, 2020 at 7:08 am“There’s no shame in losing money on a stock. Everybody does it. What is shameful is to hold on to a stock, or worse, to buy more of it when the fundamentals are deteriorating.” – Peter Lynch

Before I get to today’s newsletter, I have a quick announcement. I’ll be unveiling next year’s Buy List three weeks from today, on December 25. The market is closed that day, but I’ll send you an email with the new portfolio. As usual, five stocks go in and five stocks go out, and twenty stocks will remain the same. This will be our 16th annual Buy List.

I announce the portfolio changes a bit early so that no one can claim I’m somehow rigging the track record. The new Buy List will go into effect on the first day of trading in the new year, which will be Monday, January 4, 2021. The 25 positions will be equally weighted based on the closing price on December 31. On January 1, I’ll send you another email with all the portfolio stats and a summary of our performance in 2020.

Now, onto this week’s newsletter.

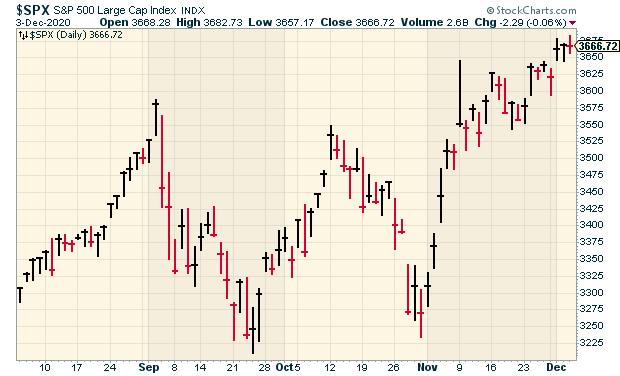

The Best November for the S&P 500 Ever

The stock market has been in the holiday spirit lately. The S&P 500 just came off its best November on record. The rally continued into December as the S&P 500 closed at an all-time high on Wednesday. Since the March 23 low, the S&P 500 has rallied more than 63%. I wonder how many people expected that eight months ago! I’m pleased to say that our 2020 Buy List has also enjoyed recent gains.

What’s the reason for the rally? That’s hard to say precisely, but my guess is that it’s two things. First, the positive news about a Covid vaccine. The FDA is currently reviewing two vaccine candidates for approval. If everything goes well, the next step will be rolling them out as quickly as possible. This is a difficult time as new coronavirus cases have soared across the U.S. Many states seem to be moving back to lockdown procedures.

The other reason for the market’s optimism is that Congress seems to be coming together to support a stimulus deal. Before the election, no one was interested in striking a deal. Now that the election has passed, the mood is quite different.

This week, a group of bipartisan legislators came together to support a $908 billion stimulus package. That probably won’t become law, but it may serve as a starting point for future negotiations. It seems very likely that some sort of deal will ultimately be reached before the end of the year. The details still haven’t been worked out, but the important point is that everybody wants a deal to be done before the end of the year. It’s in no one’s interest to let this drag on.

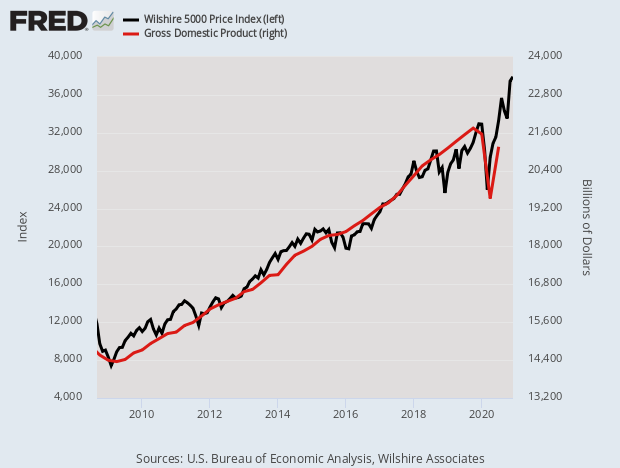

It’s true, the stock market isn’t the economy. But they are related. Here’s a long-term look at share prices and GDP:

The November jobs report is due out later this morning. The consensus on Wall Street is for a net gain of 500,000 jobs and for the jobless rate to fall to 6.7%. I haven’t seen the results yet, but there’s been some sogginess in the recent economic data. One exception was this week’s initial jobless claims report, which showed another pandemic low.

Most economists expect GDP growth for Q4 of around 4%. However, one outlier is the Atlanta Fed’s GDPNow, which sees Q4 GDP growth of 11.1%. That’s very good, and it’s well above expectations. What helped increase their forecast was this week’s ISM Manufacturing report, which came in at 57.5.

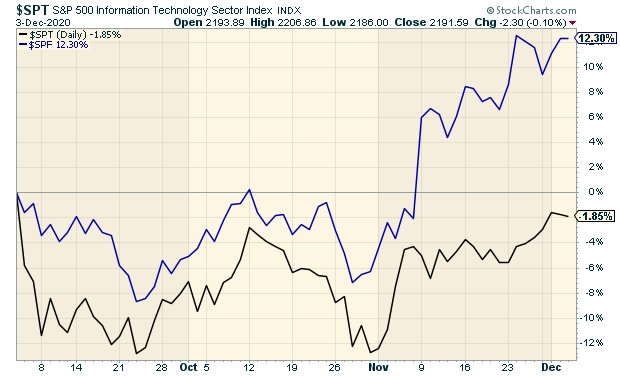

We’re continuing to see the trend I’ve talked about in recent issues. Value stocks are outpacing growth stocks. That’s not always the case in a rising market. The big drivers of value’s lead in recent weeks has been the performance of financial stocks and energy stocks. Of course, it’s not so much that these stocks are doing well. Rather, they’re bouncing back after terrible performances. Still, that counts.

Here’s a look at the performance of finance stocks (in blue) and tech stocks (in black):

This trend is still going strong. It also suggests that the Atlanta Fed may be right and that the outlook for the economy is improving. This has caused a seeming contradiction. At one end, coronavirus cases and hospitalizations are rising. Some healthcare systems may even be overwhelmed. At the same time, some vaccines may soon be ready, and that could mean life may get back to something like normal in 2021.

Hormel Misses by a Penny per Share

On November 24, Hormel Foods (HRL) reported earnings for its fiscal Q4, and the results were on the weak side. Hormel made 43 cents per share for the quarter, which was one penny per share below the Street’s forecast. This was for the three months ending October 25.

Wall Street wasn’t pleased, and frankly, neither was I. The shares dropped over 5% that day, and they had been falling going into the report.

Let’s look at some details:

• Volume of 1.2 billion lbs., down 2%; organic volume down 3%

• Net sales of $2.4 billion, down 3%; organic net sales down 4%

• Operating margin of 11.4%, compared to 12.8% last year

• Effective tax rate of 15.9%, compared to 21.0% last year

• Diluted earnings per share of $0.43, down 9% from $0.47Those are some soggy numbers across the board. Here’s how the quarter broke down by Hormel’s different business units:

Refrigerated Foods

Volume down 4%; organic volume down 5%

Net sales down 5%; organic net sales down 7%

Segment profit down 17%Grocery Products

Volume up 1%

Net sales down 1%

Segment profit up 1%Jennie-O Turkey Store

Volume down 2%

Net sales down 6%

Segment profit down 21%International & Other

Volume down 1%

Net sales up 8%

Segment profit up 55%Not that great. Obviously, doing business in the world of the coronavirus is difficult. One silver lining is that business in China picked up a bit.

The balance sheet is still pretty clean, and Hormel has $1.7 billion in cash. For the year, Hormel made $1.66 per share. That’s down from $1.74 per share last year. I’ve not been pleased with Hormel’s performance this year.

Here’s an interesting chart. This is shares of Hormel divided by the S&P 500 ETF (SPY). You can see that HRL crushed the market during the panic in February and March. That’s exactly what defensive stocks are supposed to do. Since then, HRL has lagged, and the gap has only grown wider recently. This is the other side of the coin of cyclical stocks leading. Defensive stocks are lagging.

Buy List Updates

There’s been a lot of news impacting our stocks recently.

First, I have to comment on shares of Disney (DIS) making a new 52-week high. That’s astounding. The company has really suffered under the pandemic. The parks business has been squeezed. No one’s going to the movies. The cruise industry is in the docks, and pro sports is having a rough time.

Despite it all, the Mouse House continues to rally. Every day the company becomes more of a streaming business with a side business of amusement parks. I would guess that the pandemic caused Disney to do five years of evolution in less than one. I’m lifting our Buy Below on Disney to $160 per share.

I saw that Hershey (HSY) recently altered its famous Jingle Bells ad with Hershey Kisses. Apparently, this has outraged Hershey fans! As you might guess, they took to the Internet to express their displeasure. Some practically blamed the chocolatier for ruining Christmas. Mind you, Hershey merely altered the ad. Fortunately, Hershey finally caved and said it will run the classic version of the ad.

A lot of this is harmless fun, but there is a serious business point underneath it. It’s that we see a company that has very strong brand loyalty. The customers know and love the product, and they feel a sense of ownership. That’s very important. These facts don’t show up on a balance sheet, but they’re real.

We also had three of our Buy List stocks recently raise their dividends. They all extended long streaks of continuous dividend hikes.

Let’s start with Stryker (SYK). The company just bumped up its quarterly dividend from 57.5 cents to 63 cents per share. That’s an increase of 9.6%. This is Stryker’s 28th annual dividend increase.

Stryker’s last earnings report blew the doors off. For Q3, the orthopedics company earned $2.14 per share. That was up 12% over last year. Wall Street had been expecting earnings of $1.41 per share. I’m raising our Buy Below on Stryker to $240 per share.

Becton, Dickinson (BDX) raised its quarterly dividend from 79 to 83 cents per share. That’s an increase of 5.1%. This is their 49th annual dividend increase in a row.

The new dividend will be payable on December 31 to holders of record on December 10. The indicated annual dividend rate for next year is $3.32 per share.

Earlier I mentioned the earnings report from Hormel Foods (HRL). The company also raised its quarterly dividend from 23.25 cents to 24.5 cents per share. This is the 55th annual dividend increase in a row. Not bad for Spam!

The dividend will be paid on February 16 to stockholders of record at the close of business on January 11. Since becoming a public company in 1928, Hormel has paid a regular quarterly dividend without interruption.

Lastly, FactSet (FDS) said it will release its fiscal Q1 results on Monday, December 21. Wall Street expects earnings of $2.75 per share.

That’s all for now. The November jobs report is due out later today. For October, the jobless rate fell to 6.9%. There’s not much in the way of economic reports next week. On Tuesday, productivity growth for Q3 will be updated. The job-openings report comes out on Wednesday. On Thursday, the CPI report is due out along with the initial-jobless-claims report. So far, inflation has been relatively tame. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His