CWS Market Review – January 22, 2021

“Never buy at the bottom, and always sell too soon.” – Jesse Livermore

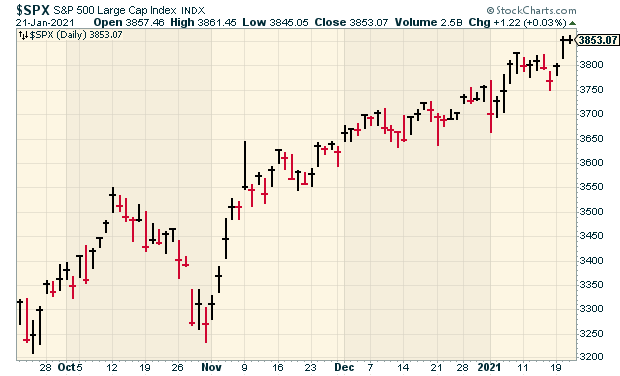

This week, we got a new president. Also, the stock market rallied to another new all-time high. Although I strongly doubt the former caused the latter. Instead, we’re in the midst of Q4 earnings season, and so far, the results have been pretty good.

All told, corporate earnings are expected to fall by 15% for 2020. But for this year, Wall Street expects earnings to rebound by 24%. As the Q4 reports come out, we’ll learn more about Corporate America’s outlook for this year.

None of our Buy List stocks has reported yet, but that will soon change. In this week’s issue, I’ll preview six Buy List stocks that are due to report earnings next week. I’m expecting good results. Later on, I’ll highlight HEICO, one of this year’s new additions. But first, let’s look at this season’s Earnings Calendar.

Six Buy List Earnings Reports Next Week

Here’s the Earnings Calendar for this season. Twenty-two of our 25 stocks will report earnings over the next few weeks. I’ve listed each stock’s earnings date and Wall Street’s earnings consensus.

| Stock | Ticker | Date | Estimate | Result |

| Silgan | SLGN | 26-Jan | $0.53 | |

| Abbott Labs | ABT | 27-Jan | $1.35 | |

| Stryker | SYK | 27-Jan | $2.55 | |

| Danaher | DHR | 28-Jan | $1.87 | |

| Sherwin-Williams | SHW | 28-Jan | $4.85 | |

| Church & Dwight | CHD | 29-Jan | $0.52 | |

| Thermo Fisher | TMO | 1-Feb | $6.50 | |

| Broadridge Financial Sol | BR | 2-Feb | $0.70 | |

| AFLAC | AFL | 3-Feb | $1.05 | |

| Check Point Software | CHKP | 3-Feb | $2.11 | |

| Hershey | HSY | 4-Feb | $1.43 | |

| Intercontinental Exchange | ICE | 4-Feb | $1.09 | |

| Fiserv | FISV | 9-Feb | $1.29 | |

| Cerner | CERN | 10-Feb | $0.78 | |

| Disney | DIS | 11-Feb | -$0.44 | |

| Moody’s | MCO | 12-Feb | $1.94 | |

| Zoetis | ZTS | 16-Feb | $0.86 | |

| Trex | TREX | 22-Feb | $0.36 | |

| Ansys | ANSS | TBA | $2.54 | Middleby | MIDD | TBA | $1.40 |

| Miller Industries | MLR | TBA | n/a | |

| Stepan | SCL | TBA | $1.08 |

Silgan Holdings (SLGN) kicks off the show after the close on Tuesday when it reports its Q4 earnings. The container company had a solid Q3. Silgan made $1.04 per share. That was up 37% over last year’s Q3. Wall Street had been expecting 95 cents per share.

The metal-containers business saw volume growth of 17% thanks to more folks eating at home. The closures business was helped by increased demand for household-cleaning products. Their plastic-containers business had volume growth of 14%.

Best of all, Silgan raised its full-year guidance range to $2.92 to $2.97 per share. The previous range was $2.70 to $2.85 per share. Last year, Silgan made $2.16 per share.

For Q4, Silgan now expects earnings of 47 to 52 cents per share. They made 38 cents per share for last year’s Q4.

CEO Tony Allott said, “While we are still completing our annual budget process for 2021, at this time we anticipate overall operating earnings for the Company remaining at these strong levels.”

We have two more reports on Wednesday. Stryker (SYK) can’t offer guidance for Q4, but I’m optimistic. Three months ago, the orthopedics company reported solid numbers for Q3. Stryker earned $2.14 per share. That was up 12% over last year. Wall Street had been expecting earnings of $1.41 per share. That was a huge beat.

For Q3, reported net sales rose by 4.2% to $3.7 billion. Orthopaedics sales rose 4.4% to $1.3 billion. MedSurg sales were up 3.2% to $1.6 billion. Neurotechnology and Spine sales increased 6% to $0.8 billion.

Stryker is currently above our $240 per share Buy Below price. I may raise it next week, but I want to see the earnings results first. Stryker is an excellent company.

The big change to Danaher (DHR) this year was the addition of Cytiva. That’s the new name for GE’s biopharma business, which Danaher bought last year. For Q4, Danaher expects revenue growth, excluding Cytiva, in the low-single digits.

Three months ago, Danaher’s CEO said, “We delivered outstanding third-quarter results, achieving double-digit revenue growth, over 60% adjusted EPS growth, and we more than doubled our free cash flow year-over-year.”

For Q3, Danaher earned $1.72 per share. That beat the Street by 36 cents per share. For Q4, Wall Street expects $1.87 per share. I’m expecting another earnings beat.

Abbott Labs (ABT) is one of our new stocks this year, and it’s due to report earnings on Thursday. In October, Abbott reported 98 cents per share for Q3, which topped the Street by seven cents per share.

I was also impressed to see ABT raise its quarterly dividend by 25%. This marked the company’s 49th annual dividend increase. Many times, stocks with long dividend streaks raise their payouts by a tiny amount just to keep the streak alive. That’s not the case with Abbott.

In fact, Q3 was so good for Abbott that it raised its full-year 2020 guidance to $3.55 per share. Since the company has already made $2.20 per share for the first three quarters, that implies Q4 earnings of $1.35 per share.

There was also more good COVID news.

Abbott Laboratories’ rapid COVID-19 antigen test is highly likely to correctly detect if people have ever contracted the virus and could help with earlier isolation, according to the U.S. Centers for Disease Control and Prevention.

Sherwin-Williams (SHW) is also scheduled for Thursday. Three months ago, Sherwin reported third-quarter earnings of $8.29 per share. That easily beat Wall Street’s forecast of $7.75 per share. Sales rose 5.2% to $5.12 billion.

CEO John G. Morikis said, “Continued and unprecedented strength in our DIY business, solid demand across our residential repaint and new residential segments and improving demand in our industrial coatings businesses and regions drove our strong third-quarter results.”

Let’s look at the breakdown by each business segment. Net sales in The Americas Group increased by 2.8% to $2.98 billion. Consumer Brands Group increased its sales by 23.5% to $838.1 million, and Performance Coatings Group’s net sales increased 1.2% to $1.31 billion. All in all, this was a solid quarter. Sherwin generated $2.56 billion so far this year. That’s up 54% over last year.

For Q4, Wall Street expects earnings of $4.85 per share.

Last is Church & Dwight (CHD). The household-products company reported Q3 earnings of 70 cents per share. That beat estimates by three cents per share. You really can’t go wrong with condoms and baking soda.

C&D’s results were pretty good considering the environment. Q3 net sales grew 13.9% to $1,241.0 million. COVID has actually helped some of C&D’s business.

The company was able to increase its full-year guidance. Before, they saw reported sales rising by 9% to 10%; now they see them up 11%. Not a big increase, but it’s good to see. Most importantly, C&D sees full-year earnings of $2.79 to $2.81 per share. That’s a slight increase over the previous guidance.

So far this year, Church & Dwight has earned $2.30 per share, so that implies Q4 earnings of 49 to 51 cents per share. C&D should easily beat that.

Profile of HEICO (HEI)

At the start of the year, I added five new stocks to our Buy List. Each week, I’ve taken some time to highlight one of our new stocks. I’ve already profiled Miller Industries and Thermo Fisher Scientific. This week, it’s time for HEICO (HEI) of Hollywood, FL.

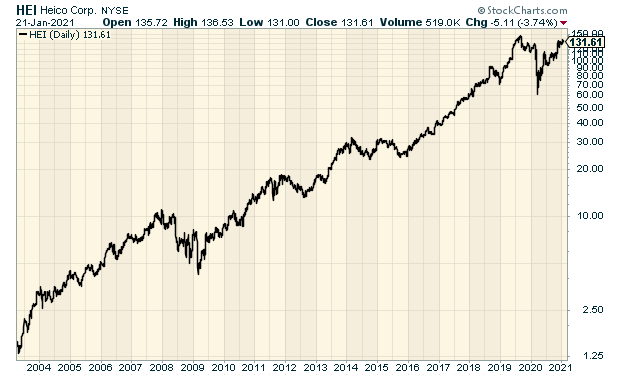

If you’ve been with us for a while, you may recall that HEICO was on our Buy List in 2016 and 2017, before I unwisely decided to sell the stock. (Ugh, what was I thinking?) The stock promptly doubled over the next three years. Once again, I relearned the valuable lesson about buying good stocks and then doing nothing. Yes, even your humble editor is prone to such mistakes.

HEICO is the kind of niche business I love. With investing, the only thing better than a monopoly is a near-monopoly. (The full-on monopolies tend to get too much government attention.)

HEICO makes replacement parts for the airline industry. Sexy, right? Well, not exactly, but let’s consider a few things. If a commercial aircraft needs some obscure new part, the airline can’t run down to the local hardware store. Instead, it needs to special-order it. Moreover, there’s a great deal of cost pressure on the airlines to keep the older planes serviceable.

Also, the aircraft parts often need to meet strict regulatory guidelines. The part maker really has to know what it’s doing. That’s where HEICO comes in. The business is lean and well run.

HEICO is one of our three “off-cycle” stocks. The company’s fiscal year ended in October, so it reported its Q4 earnings last month. (That’s why it’s not listed in the earnings calendar.)

Last year, HEICO did $1.78 billion in business. The company would have probably cracked $2 billion this year if not for the economic lockdowns. HEICO’s long-term track record is very impressive—and the stock is still below its high from mid-2019:

I can’t tell the HEICO story without mentioning the Mendelson family. Larry Mendelson is the current chairman and CEO. In the 1950s, he took a finance class taught by David Dodd. Fans of value investing will recognize Dodd’s name. He was the co-author of Security Analysis with Ben Graham. Security Analysis is probably the foundational text of value investing.

Mendelson took those lessons to heart. He made a good deal of money in real estate and wanted to diversify his holdings. That led him to invest in an under-performing industrial company. He really didn’t care what he bought, as long as it was cheap and had potential to be retooled for future growth. He chose well.

HEICO was originally founded in 1957 by Dr. William Heinicke as Heinicke Electronics. By the 1980s, Mendelson controlled a sizeable share in the company and was able to make himself CEO. The still family owns a large chuck of the voting shares, and several family members hold key positions within the company.

(Important side note: HEICO trades with regular shares and with “A” shares. The A shares afford fewer voting rights for stockholders, which is why they have a lower price. That’s common with business that are controlled by a family. For our purposes, I’m discussing the regular shares.)

When airplane owners need a new part and go back to the original equipment manufacturer (OEM) to get replacements, they’re often charged a steep price. The profit margins can exceed 30%. That provides enormous opportunity for HEICO. Consider that many aircraft are over 20 years old.

The aviation industry is broadly diversified, and HEICO is also able to get sales from commercial and military customers. That means that if there’s a drop-off on one end of the business, the other side can pick up the slack. Wherever there’s a demand to cut costs, HEICO has the potential to do well.

In some respects, I see HEICO’s role as similar to that of a generic drugmaker. HEICO provides a low-cost copy of the original product, which is regulated by the Federal Aviation Administration. By the way, HEICO does more than aircraft parts. They also supply parts for satellites, rockets, missiles and even medical instruments.

HEICO is in an enviable position and nearly dominates its market. The company sells to 19 of the top 20 airlines in the world, and their customers love them. Like nearly everyone else, though, HEICO has felt the squeeze of the economy, and COVID was especially rough on the airline industry.

Still, Larry Mendelson managed HEICO well during a rough patch. For last year, HEICO’s operating margin was 21%, which is quite good, and the company’s cash flow exceeded $409 million. Historically, HEICO has used its cash flow to buy out smaller operators. HEICO currently pays a very small semi-annual dividend of eight cents per share.

Last year’s bear market was brutal on HEICO. In two weeks, the stock plunged 48%. The shares have come back a long way, but I still have some concerns about how quickly the airline industry will rebound. With so few planes flying, not as many will need repairs. I currently rate HEICO a buy up to $140 per share. The company’s fiscal Q1 earnings report will be out sometime in late February.

That’s all for now. The Federal Reserve gets together again next week, on Tuesday and Wednesday. I don’t expect any policy change, but it will be interesting to hear what the central bank has to say in its policy statement. On Thursday, the government will report its first estimate for Q4 GDP growth. I suspect that it will be worse than what Wall Street is expecting. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Posted by Eddy Elfenbein on January 22nd, 2021 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His