Archive for January, 2021

-

December NFP = -140,000

Eddy Elfenbein, January 8th, 2021 at 9:41 amWe had a surprising jobs report this morning. According to the government, the US economy shed 140,000 jobs during the month of December. Prior to this report, there were several economic reports were suggesting this would be a bad job report. They were right. Wall Street had been expecting a loss of 50,000.

The unemployment rate was 6.7%, compared to the 6.8% estimate. An alternative unemployment measures that includes discouraged workers and those holding part-time jobs for economic reasons declined to 11.7% from 12%.

Markets, however, shrugged off the report, likely on the anticipation that it strengthened the case for more stimulus from Congress and reflected a likely temporary reduction in jobs that would be reversed as Covid vaccine distribution accelerated. Stocks were poised for a modest gain at the open.

“In some ways, bad news is good news, because it increases the probability for more stimulus,” said Michael Arone, chief investment strategist for US SPDR Business. “Investors have convinced themselves this week that given what’s happened in Georgia, given the weakness in the economic data, that more help is on the way. We’re going to get more fiscal help, and it’s likely to happen pretty soon.”

The stock market opened higher.

-

CWS Market Review – January 8, 2021

Eddy Elfenbein, January 8th, 2021 at 7:08 am“In a roaring bull market, knowledge is superfluous and experience is a handicap.”

– Benjamin GrahamThis week’s financial news was overshadowed by the disturbing events in Washington, D.C. It seems somewhat inappropriate to focus on financial markets at this moment, but that’s our job with this newsletter, and do it we shall.

I live in Washington, not too far from Capitol Hill. In fact, I’m writing this newsletter to you under orders of a 6 p.m. curfew. That’s a sentence I’d never thought I’d write. At this moment, I can see National Guard units from my window.

Nevertheless, the stock market has had a positive week. On Thursday, the S&P 500 broke above 3,800 to reach a new all-time high. This is another reminder of an old lesson—financial markets aren’t easily phased by scary headlines.

I’m pleased to say that our Buy List is off to a good start in 2021, and we’re already beating the overall market. Speaking of the Buy List, in this week’s issue, I want to go into more depth about the Buy List changes I made this year. But first, I want to look at a question a lot of people have been asking—are we in a bubble?

Are We In A Bubble?

Since the market low last March, the stock market has raced ahead nearly without a break. In fact, November and December were some of the best final two months for the market on record. All of this happened during a pandemic and a contentious election.

That’s led some people to claim that we’re in the midst of a gigantic bubble. Bear in mind that there are people who always claim that we’re in a bubble. Of course, bubbles do happen, but they’re rare. Bear markets also happen, but I’m distinguishing a normal market downturn from a true bubble.

First, let’s get an important fact out of the way: Just because prices go up, we don’t have proof of a bubble. This time, we’re not seeing rallies only in stocks but in other areas as well. Tesla and Bitcoin are probably the best examples. This week, Bitcoin broke above $40,000. That’s nearly a tenfold increase from its low in March. That’s an astounding rally.

In the last month, the price of Bitcoin has doubled. The total value of all cryptocurrencies is now more than $1 trillion. This week, JP Morgan said that Bitcoin could get to $146,000 in the long term.

Over the last 18 months, shares of Tesla are up close to 20-fold. Elon Musk recently passed Jeff Bezos to become the richest man in the world. During 2020, Musk saw his net worth increase by $140 billion. That works out to $265,000 every minute.

I’ve heard the claim that these aren’t separate rallies. Rather, all these rallies are connected. The world, we’re told, is drowning in fiat currency. So the argument is that this is nothing more than the inevitable outcome of unprecedented monetary stimulus all around the world.

Eh…maybe.

While it’s true that governments have printed money like never before, I tend to be a skeptic regarding all the bubble predictions. I’ve shied away from both Bitcoin and Tesla—not because I have anything against them, but rather because both appear to be difficult investments. I can’t make a reliable forecast of Musk’s future business. With Tesla, you’re paying a tremendous amount for a company that’s still quite small compared with other car companies.

With Bitcoin, you have a tremendously volatile asset. Not that long ago, it fell from $19,000 to $3,000. True, it made that money back, but this price history suggests that such plunges are part of Bitcoin’s nature. Some people might be fine with that, but others are not.

Bitcoin is also highly concentrated. Very highly. According to researchers, 95% of Bitcoins are owned by 2% of accounts. That means that it can be susceptible to manipulative trading. While Bitcoin’s rally is certainly impressive, I wonder if a currency that’s so volatile will become more mainstream. There’s some comfort in knowing that your daily run to the local Starbucks won’t change that much day to day.

The other part of all this bubble talk is timing. Bubbles can go on longer than you think. John Maynard Keynes famously said, “markets can remain irrational longer than you can remain solvent.” That’s certainly true. I remember the dot-com craze of 20 years ago. Lots of people knew it was a bubble. The problem was that no one knew when it would burst. The same for the housing bubble.

I think the best strategy is to steer clear of such investments. Perhaps a modest allocation of resources, if you’re truly game. I always remember these words from Peter Lynch: “Far more money has been lost by investors preparing for corrections or trying to anticipate corrections than has been lost in corrections themselves.”

Now let’s take a closer look at this year’s Buy List changes.

This Year’s Five Buy List Sells

As happens every year, this year five stocks were added to the Buy List and five stocks were deleted. That keeps the turnover at 20%. It also means that the average holding period for each new stock is five years.

I’m often asked if that’s a handicap. I think it’s the opposite because it forces me think hard about whether I’ll be comfortable owning each new stock for five years. Doing that makes you focus on the long term.

The five sells were Becton, Dickinson (BDX), Eagle Bancorp (EGBN), Globe Life (GL), Hormel Foods (HRL) and RPM International (RPM).

The decision to sell a stock is not easy. The most common reason is that it’s no longer the company you bought. With Becton, Dickson, that’s literally true, because we originally bought CR Bard. We got shares of BDX after they bought out CR Bard.

Such situations are always a difficult call, because the nature of the investment changes. We gave BDX a good chance to prove itself, but the earnings this year weren’t as good as I expected.

With Eagle, the problem was obvious. The bank had racked up big legal bills due to possible bad deeds from its previous management. I thought I saw an opportunity for a bargain. The problems, however, were never cleared up, and I underestimated how long the cloud would hang over the bank.

The decision to sell Globe Life was about earnings. In February, the company reported a miss for its Q4. Then its Q1 earnings were down from the previous year. GL’s outlook for 2021 wasn’t terribly impressive. I thought this was a good time to let the stock go.

I love Hormel Foods, but the Spam people made my decision easy this year. Hormel simply didn’t perform well for us. The most recent earnings miss was the final nail in the coffin.

RPM International was a difficult decision. Fundamentally, it’s a solid company. However, I think the shares are rather pricey. I wouldn’t mind adding RPM back sometime. The company has a long dividend streak.

Profile of Miller Industries

The five new stocks are Abbott Laboratories (ABT), HEICO (HEI), Miller Industries (MLR), Thermo Fisher Scientific (TMO) and Zoetis (ZTS).

Over the next few issues, I want to highlight the new buys and why I like them. This week, I’ll start with Miller Industries. To refer to Peter Lynch again, in his book One Up on Wall Street, Lynch gave some advice about what kinds of companies to look for. He said investors should look for companies that do something dull. Why? Because those stories often get overlooked. He also said to look for companies that do something disagreeable. After all, someone needs to do the dirty jobs.

That reminds me of Miller Industries (MLR) of Ooltewah, Tennessee. My apologies to the good people of Ooltewah, but I don’t think it’s normally thought of as a hot spot for promising companies. Well, perhaps it should be.

Miller Industries makes and sells towing and recovery equipment. The company makes wreckers that are used to move disabled vehicles. They also make those car carriers that you often see on the road. If a car or truck needs to be hauled out of something and then hauled away somewhere, odds are, Miller’s got a vehicle that can do it.

The company was started by Bill Miller in 1990. His idea was to find well-known brand names in a highly segmented industry. Miller then planned to grow the business by buying up smaller names.

Miller standardized the business so that different parts could fit in any vehicle. Miller Industries now owns several different brands, including Century, Vulcan, Chevron and Holmes. Miller quickly grew to have 40% market share. In fact, it soon got the attention of the anti-trust folks.

By 1994, Miller had its initial public offering. The company sold 10.7 million shares to the public, which brought in $30 million. The stock took off and vaulted eight-fold in less than three years. As you can see in the chart below, the stock price got a reckoning about 20 years ago. After that, it’s been much more of a steady grower. The current market cap is $450 million.

The company currently has three manufacturing facilities in the United States, plus one in England and another in France. I like how they keep innovating. A few years ago, Miller introduced the world’s first rolling rotator with a 100-ton recovery capacity.

This is an interesting time to look at MLR because the stock got slammed during the initial lockdowns. From top to bottom, the shares lost one-third of their value. However, the stock hasn’t bounced that much off its low. It’s up, but not nearly as much as the rest of the market. That got my attention.

Like many other businesses, Miller was impacted by the lockdowns. In May, Miller said that sales for Q1 fell by 10.7% to $176.1 million and net income fell from 76 cents per share down to 48 cents per share.

Jeffrey I. Badgley, the co-CEO, said they had to shut down some of their manufacturing facilities. However, Miller has adjusted operations, and the company has been classified as an essential business. Miller should be able to weather the storm.

For Q3, Miller saw its sales drop by 13.9%. EPS was 57 cents. That was down 19% versus the same quarter the year before. Miller also paid off all its long-term debt. The next earnings report should be out in early February.

Miller Industries is a good example of a company with a strong “moat.” There are competitors, but it’s the dominant name in the business. It would be very difficult for a competitor to come in and knock Miller off its perch.

I like that no Wall Street analysts follow Miller. That’s pretty remarkable considering the company’s long-term success. The company currently pays out a quarterly dividend of 18 cents per share. That works out to a dividend yield of 1.8%. Miller Industries is a buy up to $42 per share.

That’s all for now. The December jobs report is due out later today. There are a few key economic reports scheduled for next week. The CPI report comes out on Wednesday. We get another jobless-claims report on Thursday. The retail-sales and industrial-production numbers come out on Friday. Soon after that, the Q4 earnings seasons starts up. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

P.S. Josh Brown recently hosted me on his podcast. I had a great time. Check it out.

-

Morning News: January 8, 2021

Eddy Elfenbein, January 8th, 2021 at 7:04 amThe Pandemic Helped Reverse Italy’s Brain Drain. But Can It Last?

Europe’s Contested Deal With China Sends Warning to Joe Biden

In Trump Era’s End, an Uneasy Reckoning for Corporate America

Democrats Get Clout Needed for Risky Bid to End Trump’s SALT Cap

Trump Moves to Loosen Mining Regulations, Approve Projects As He Exits

The President Is Losing His Platforms

UK’s Competition Watchdog to Probe Google’s Browser Changes

Hyundai Motor Says It’s In Early Talks With Apple to Develop A Car, Sends Shares Soaring 19%

Boeing Reaches $2.5 Billion Settlement With U.S. Over 737 Max

Tesla Founder Elon Musk Surpasses Jeff Bezos As World’s Richest Human

The Sperm Kings Have a Problem: Too Much Demand

Cullen Roche: Is All of Finance Just a Big Network Effect?

Ben Carlson: Deep Risk in the United States of America

Joshua Brown: Commodities Are Breaking Out in 2021 & This Will Probably Go On Forever

Michael Batnick: Animal Spirits: 2021 Outlook, The Flows & 10 Things I’ll be Watching Closely in 2021

Be sure to follow me on Twitter.

-

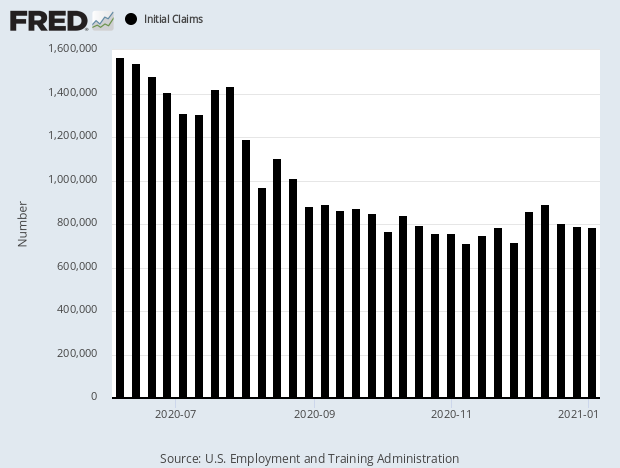

Initial Claims Beat Expectations

Eddy Elfenbein, January 7th, 2021 at 12:04 pmThis morning’s initial claims report came in at 787,000. That was better than expectations. To me, the only noticeable feature in the report is that the claims have been very stable for the last few weeks.

The report also showed a drop of 126,000 in continuing claims, taking the total down to 5.07 million. Those receiving benefits from all programs also fell, declining by 420,000 to 19.2 million.

Claims remain well above pre-pandemic levels as a continued surge in Covid-19 cases has caused economic restrictions in states and municipalities across the country.

The stock market continues to climb higher. The S&P 500 has been up as much as 1.5% today. This time, it’s Tech that’s doing the heavy lifting. In yesterday’s market, Tech was the laggard.

On our Buy List, there are new highs today from Broadridge Financial Solutions (BR), HEICO (HEI) and Trex (TREX). A few others are very close.

The internals today are a bit odd. For example, the Dow is trailing the S&P 500 was 60 basis points today. That kind of gap is not unheard of, but it’s pretty wide. The Nasdaq is leading the S&P 500 by about 90 basis points.

-

Morning News: January 7, 2021

Eddy Elfenbein, January 7th, 2021 at 7:08 amIndia Sees 7.7% Contraction in Fiscal Year 2021 on Virus Woes

Will the Sudden E.U.-China Deal Damage Relations With Biden?

Corporate Group Urges Officials Consider Trump’s Removal ‘To Preserve Democracy’

Twitter and Facebook Lock Trump’s Accounts After Violence on Capitol Hill

Stocks Hold Gains Amid Violence at the Capitol

How Covid Laid Bare America’s Economic and Political Divides

Crypto Market Value Tops $1 Trillion as Bitcoin Hits $38,000

2 U-turns in 2 days: Why the NYSE Finally Decided to Delist 3 Chinese Companies

U.S. Considering Adding Alibaba, Tencent to China Investment Ban

Brevan Howard’s Main Hedge Fund Has Best Year on Record

Ben Carlson: Animal Spirits: Inflation Truthers

Cullen Roche: Is Inflation Really 10%?

Howard Lindzon: The Unbundling Of Indexes and Markets – Further Explained

Joshua Brown: Old School Karate

Michael Batnick: Am I Being Duped?

Be sure to follow me on Twitter.

-

Nice Gain for our Buy List

Eddy Elfenbein, January 6th, 2021 at 11:32 pmI live in Washington, DC, not far from today’s news. I’m in no danger but we have a 6 pm curfew.

I wanted to mention briefly that today was a very good day for our Buy List. It’s odd to focus on financial markets on a day like this, but that’s our job around here. The S&P 500 gained 0.57% while our Buy List gained 1.78%. Of course, that’s just one day so we don’t want to get carried away.

Stepan (SCL) was up over 6% and Miller Industries (MLR) rose by more than 5%. The Tech sector performed unusually poorly today. We’ll see how well that holds up this week.

The futures market suggests another up day tomorrow.

-

ADP Drops by 123,000

Eddy Elfenbein, January 6th, 2021 at 12:27 pmWe’re in Jobs Week and it has a traditional timeline. On Wednesday, the ADP report comes out. On Thursday, the jobless claims report is due out. Then on Friday, the official jobs report is released.

I suspect that Friday’s report will not be good. In fact, today’s ADP was pretty bad. According to the payroll firm, private payrolls dropped by 123,000 last month.

December’s decline countered seven straight months of job growth coming out of the massive furloughs instituted in March and April as large swaths of the U.S. economy shut down to combat the Covid-19 spread.

Companies laid off a net 19.4 million workers in April and have recovered 9.9 million since, according to ADP estimates that sometimes have differed widely from the official Labor Department nonfarm monthly payrolls tally. The decline in December followed an increase of 304,000 in November, a number revised lower by 3,000 from the initial estimate.

I should caution that the ADP figure isn’t always a good predictor of the official report. Also, both reports are subject to lots of revisions.

Today’s market reaction is unusual. First is that stocks are up. Second is that they’re up by a lot. Third, it’s a strongly divided market. Cyclical stocks are doing very well while the rest of the market is somewhat flat.

By cyclical stocks, I mean industries that are heavily tied to the economic cycle. Things like cars and homebuilders.

The four major cyclical sectors are Energy (XLE), Materials (XLB), Industrials (XLI) and Finance (XLF). Sure enough, these are the top four sectors today.

-

Morning News: January 6, 2021

Eddy Elfenbein, January 6th, 2021 at 7:04 amU.S. 10-Year Treasury Yield Hits 1% for First Time Since March

Saudi Arabia Will Cut Its Oil Production, Allowing Russia’s to Grow

NYSE May Make Second U-turn on China Telecom Delistings Amid Confusion Over Policy

Trump Bars U.S. Transactions with Eight Chinese Apps Including Alipay

UnitedHealth to Buy Change Healthcare for $7.84 Billion to Build Up Technology Services

AmerisourceBergen to Buy Walgreens’ Distribution Business in $6.5 Billion Deal

Environmental Debt Risk Is Bigger Than Japan’s GDP

The 10 Ways Renewable Energy’s Boom Year Will Shape 2021

Henry Paulson Returns to Finance, to Run Climate-Focused Fund

Starburst Data Hits $1.2 Billion Valuation as Andreessen Invests

Amazon Buys Planes From Airlines Struggling With Pandemic Slowdown

Buffett Loses Spot on Wealthy List to China’s Bottled Water King

Ben Carlson: Updating My Favorite Performance Chart For 2020

Michael Batnick: One of The Great Bubbles of Financial History

Joshua Brown: There’s No Such Thing As A Local Advisor Anymore, It’s Worth What the Buyers and Sellers Believe It’s Worth & Bubbles Always Burst in January?

Be sure to follow me on Twitter.

-

Strongest ISM in Two Years

Eddy Elfenbein, January 5th, 2021 at 1:17 pmMost of Wall Street seems to be focused on the state of Georgia today and its two Senate races. These may decide who controls power on Capitol Hill.

After a rough trading day yesterday, the stock market is making back some of those losses today. So far, cyclical stocks and small-caps look strong. Value is outpacing growth. Energy stocks are exceptionally strong today.

This morning’s ISM Manufacturing report looked pretty good. It came in at 60.7 which is the best number since August 2018.

The ISM’s index of national factory activity rebounded to a reading of 60.7 last month. That was the highest level since August 2018 and followed a reading of 57.5 in November. A reading above 50 indicates expansion in manufacturing, which accounts for 11.9% of the U.S. economy. Economists polled by Reuters had forecast the index would slip to 56.6 in December.

But some of the surprise rebound in the ISM index was due to an increase in the survey’s measure of supplier deliveries to a reading of 67.6 last month from 61.7 in November.

A lengthening in suppliers’ delivery times is normally associated with a strong economy and increased customer demand, which would be a positive contribution. But in this case slower supplier deliveries also indicate supply shortages related to the pandemic.

This is jobs week. Tomorrow, we’ll get the ADP private payroll report. Then on Thursday, another jobless claims report. On Friday, the big December jobs report comes out. I suspect that this may be a weak report.

-

Morning News: January 5, 2021

Eddy Elfenbein, January 5th, 2021 at 7:02 amUltra-Low Interest Rates Are Here to Stay: 2021 Central Bank Guide

Hedge Funds Raise Mining Shorts As COVID Vaccines Seen Tamping Gold Gains

In a Topsy-Turvy Pandemic World, China Offers Its Version of Freedom

NYSE Scraps Plan to Delist China Telcos in ‘Bizarre’ U-Turn

$900 Billion Won’t Carry Biden Very Far

Drugmakers Kick Off 2021 with 500 U.S. Price Hikes

Lineage Logistics Makes $500 Million Bet on Refrigerated Rail

A Simple Way to End Questionable Stock Trading by Lawmakers

Auto Sales in 2020 Expected to Hit Lowest Point in Nearly a Decade

Why Solar Energy Stocks Can Beat the Market Again in 2021

Haven, the Amazon-Berkshire-JPMorgan Venture to Disrupt Health Care, is Disbanding After 3 Years

Nick Maggiulli: Why I’ve Changed My Mind on Bitcoin

Howard Lindzon: Momentum Monday….Let’s Travel?

Cullen Roche: Three Things I Think I Think – Happy New Year!

Ben Carlson: Inflation Truthers

Be sure to follow me on Twitter.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His