Archive for April, 2021

-

Morning News: April 30, 2021

Eddy Elfenbein, April 30th, 2021 at 7:05 amEurope’s Green Revolution? Italy’s Spending Plans Raise Doubts

U.S. Economy’s Strong Start Signals a Stellar Year

FDA Moves to Ban Menthol Cigarettes and Flavored Cigars

What Financial Advisers Are Telling Rich Clients About Biden’s Tax Hike

In Opposing Climate and Diversity Proposals, Buffett Risks Looking Out of Step

Apple’s App Store Draws E.U. Antitrust Charge

GM to Invest $1 billion in Mexico for Electric Vehicle Production, Angering UAW Members

The Googleplex of the Future Has Privacy Robots, Meeting Tents and Your Very Own Balloon Wall

CDC Says US Cruises Can Resume in Mid-July, Sending Shares Higher

Affluent Americans Rush to Retire in New ‘Life-Is-Short’ Mindset

A Brawl Between Billionaire Founders at Apollo Sidelines One of Its Own

Ben Carlson: Stock Market Returns Are Anything But Average

Michael Batnick: A Random Walk

Joshua Brown: Days of Future Past

Be sure to follow me on Twitter.

-

Two Economic Reports This Morning

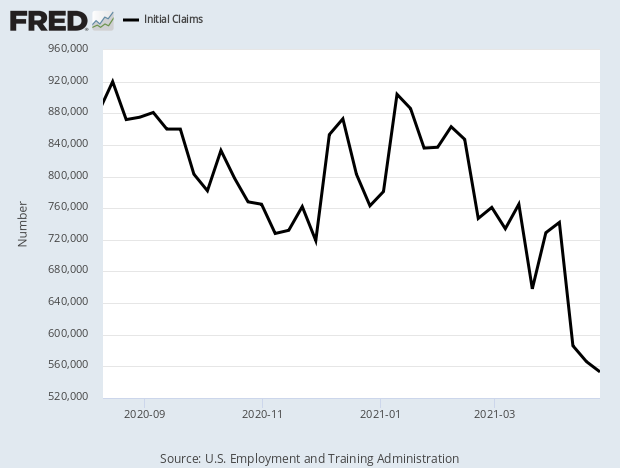

Eddy Elfenbein, April 29th, 2021 at 8:34 amToday’s Jobless Claims report was 553,000. Last week’s report was revised higher which made this week’s report another Covid low.

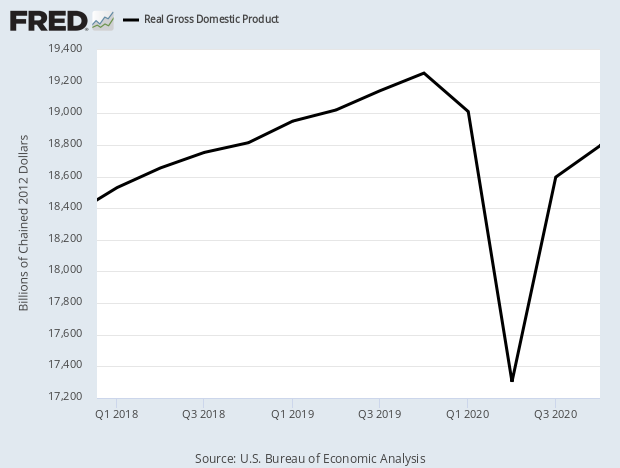

The Q1 GDP report was 6.4%. That was 0.1% below expectations. Consumer spending was up 10.7%.

Economic activity boomed to start 2021, as widespread vaccinations and more fuel from government spending helped get the U.S. closer to where it was before the Covid-19 pandemic struck.

Gross domestic product, the sum of all goods and services produced in the U.S. economy, jumped 6.4% for the first three months of the year on an annualized basis. Outside of the reopening-fueled third-quarter surge last year, it was the best period for GDP since the third quarter of 2003.

Economists surveyed by Dow Jones had been looking for a 6.5% increase. Q4 of 2020 accelerated at a 4.3% pace.

The boost in GDP came across a spectrum of areas, including increased personal consumption, fixed residential and nonresidential investment and government spending. Declines in inventories and exports as well as an increase in imports subtracted from the gain.

The latest numbers reflect an economy that has made major strides since the 2020 lockdown that sent more than 22 million American workers to the unemployment line and saw GDP plunge an unprecedented 31.4% in Q2 of 2020.

That was followed by a rebound of 33.4% in Q3. However, the Bureau of Economic Research still has not declared an end to the recession as GDP in total dollars has not passed its previous peak.

While about 14 million have returned to their jobs since then, the Federal Reserve estimates that some 8.4 million fewer hold jobs now than prior to the pandemic. The unemployment rate has tumbled from its high of 14.7% down to 6%, but that’s still well above the 3.5% in February 2020.

-

Four Earnings Reports Today

Eddy Elfenbein, April 29th, 2021 at 7:10 amThis morning, Thermo Fisher Scientific (TMO) reported Q1 earnings of $7.21 per share. Wall Street had been expecting $6.65 per share. The company said it will provide guidance on its earnings call.

Hershey (HSY) beat and raised guidance. The chocolatier said it made $1.92 per share for Q1. Wall Street had been expecting $1.80 per share. For 2021, Hershey expects earnings of $6.79 to $6.86 per share. That’s an increase of 8% to 10%. The previous range was 6% to 8%.

Church & Dwight (CHD) earned 83 cents per share. That was a two-cent beat. CHD sees earnings this year ranging between $3.00 and $3.06 per share. That’s a reiteration of its prior forecast. CEO Matthew Farrell said, “We now expect full year 2021 reported sales growth to be 5-6% (initial outlook of approximately 4.5%) and organic sales growth to be 4-5% (initial outlook of approximately 3%).”

Intercontinental Exchange (ICE) said it made $1.34 per share for Q1. That was four cents higher than Wall Street’s consensus. ICE didn’t provide earnings guidance but the company expects Q2 recurring revenues between $844 million and $859 million.

-

Morning News: April 29, 2021

Eddy Elfenbein, April 29th, 2021 at 7:06 amEurope’s Oil Majors Leave Pandemic Blues Behind

Class of COVID-19: Next Generation of Bankers Fear For Future

‘Dog Biting Dog’: China’s Online Fight Could Further Empower Beijing

Biden Offers a Can-Do Unity Vision With Rich Paying ‘Fair Share’

Why Wall Street’s Favorite Tax Break Is Biden Target

Fed Chair Powell In Response To GameStop, Dogecoin Mania Says He Sees ‘Froth In Equity Markets’

Global Chip Drought Hits Apple, BMW, Ford as Crisis Worsens

Facebook Earnings Just Obliterated Expectations

Apple Sales Crush Estimates on Surging Device Demand

The Exxon of Green Power: A Spanish Company and Its Boss Set Sky-High Goals

Tesla’s Latest Solar Stumble: Big Price Increases

Diapers, Cereal and, Yes, Toilet Paper Are Going to Get More Expensive

The Declaration of Independence is the Next Hot IPO

Ben Carlson: Animal Spirits: The YOLO Economy

Michael Batnick: Apple Is On Fire

Be sure to follow me on Twitter.

-

AFLAC Earned $1.53 per Share for Q1

Eddy Elfenbein, April 28th, 2021 at 4:09 pmAflac (AFL) today reported its first quarter results:

Total revenues were $5.9 billion in the first quarter of 2021 compared with $5.2 billion in the first quarter of 2020. Net earnings were $1.3 billion, or $1.87 per diluted share, compared with $566 million, or $0.78 per diluted share a year ago, driven by higher net investment gains.

Net earnings in the first quarter of 2021 included pretax adjusted net investment gains* of $304 million, or $0.44 per diluted share, compared with pretax adjusted net investment losses of $448 million, or $0.62 per diluted share a year ago, which are excluded from adjusted earnings. The adjusted net investment gains were driven by net gains from certain derivatives and foreign currency activities of $361 million and a decrease in the allowances associated with the company’s estimate of current expected credit gains (CECL) of $22 million, offset by a decrease in the fair value of equity securities of $68 million and net losses of $11 million from sales and redemptions.

The average yen/dollar exchange rate* in the first quarter of 2021 was 105.88, or 2.8% stronger than the average rate of 108.84 in the first quarter of 2020.

Total investments and cash at the end of March 2021 were $143.3 billion, compared with $137.0 billion at March 31, 2020. In the first quarter, Aflac Incorporated repurchased $650 million, or 13.4 million of its common shares. At the end of March 2021, the company had 85.7 million remaining shares authorized for repurchase.

Shareholders’ equity was $32.1 billion, or $47.16 per share, at March 31, 2021, compared with $26.4 billion, or $36.75 per share, at March 31, 2020. Shareholders’ equity at the end of the first quarter included a net unrealized gain on investment securities and derivatives of $8.8 billion, compared with a net unrealized gain of $6.0 billion at March 31, 2020. Shareholders’ equity at the end of the first quarter also included an unrealized foreign currency translation loss of $1.7 billion, compared with an unrealized foreign currency translation loss of $1.5 billion at March 31, 2020. The annualized return on average shareholders’ equity in the first quarter was 15.8%.

Adjusted earnings* in the first quarter were $1.1 billion, compared with $882 million in the first quarter of 2020, reflecting an increase of 20.0% driven by lower-than-expected benefit ratios in the United States and favorable effective tax rates. Adjusted earnings included pretax variable investment income of $34 million on alternative investments, which was $25 million above long-term return expectations. Adjusted earnings per diluted share* increased 26.4% to $1.53 in the quarter. The stronger yen/dollar exchange rate impacted adjusted earnings per diluted share by $0.02.

Shareholders’ equity excluding AOCI* was $25.3 billion, or $37.16 per share at March 31, 2021, compared with $22.2 billion, or $30.92 per share, at March 31, 2020. The annualized adjusted return on equity excluding foreign currency impact* in the first quarter was 16.7%.

OUTLOOK

Commenting on the company’s results, Chairman and Chief Executive Officer Daniel P. Amos stated: “While earnings are off to a strong start for the year, they are largely supported by low benefit ratios associated with pandemic conditions. In addition, pandemic conditions in the first quarter continued to impact our sales results both in the United States and Japan, as well as earned premium and revenues. We continue to expect these pandemic conditions to remain with us through the first half of 2021, but look for improvement in the second half of the year as communities and businesses open up, allowing more face-to-face interactions. We are encouraged by the production and distribution of COVID-19 vaccines, but we also recognize that vaccination efforts are still in the early stages around the world. In the interim, we are cautiously optimistic and remain vigilant, and our thoughts and prayers are with everyone affected.

“Looking at our operations in Japan, sales were essentially flat for the first quarter with the launch of our new medical product, offset by continued pandemic conditions. While we continue to navigate evolving pandemic conditions in Japan, we expect continued strength in medical sales. In addition, Japan Post Group’s announcement to resume proactive sales in April paves the way for gradual improvement in Aflac cancer insurance sales in the second half of the year. In the U.S., small businesses are still in recovery mode, and we expect that they will be for most of 2021. At the same time, larger businesses remain focused on returning employees to the worksite, rather than modifying the benefits for their employees. As a result, we continue to work toward reinforcing our position and a recovery in U.S. sales in the second half of 2021.”

-

Today’s Fed Statement

Eddy Elfenbein, April 28th, 2021 at 3:09 pmHere’s the statement:

The Federal Reserve is committed to using its full range of tools to support the U.S. economy in this challenging time, thereby promoting its maximum employment and price stability goals.

The COVID-19 pandemic is causing tremendous human and economic hardship across the United States and around the world. Amid progress on vaccinations and strong policy support, indicators of economic activity and employment have strengthened. The sectors most adversely affected by the pandemic remain weak but have shown improvement. Inflation has risen, largely reflecting transitory factors. Overall financial conditions remain accommodative, in part reflecting policy measures to support the economy and the flow of credit to U.S. households and businesses.

The path of the economy will depend significantly on the course of the virus, including progress on vaccinations. The ongoing public health crisis continues to weigh on the economy, and risks to the economic outlook remain.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. With inflation running persistently below this longer-run goal, the Committee will aim to achieve inflation moderately above 2 percent for some time so that inflation averages 2 percent over time and longer‑term inflation expectations remain well anchored at 2 percent. The Committee expects to maintain an accommodative stance of monetary policy until these outcomes are achieved. The Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee’s assessments of maximum employment and inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time. In addition, the Federal Reserve will continue to increase its holdings of Treasury securities by at least $80 billion per month and of agency mortgage‑backed securities by at least $40 billion per month until substantial further progress has been made toward the Committee’s maximum employment and price stability goals. These asset purchases help foster smooth market functioning and accommodative financial conditions, thereby supporting the flow of credit to households and businesses.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals. The Committee’s assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Thomas I. Barkin; Raphael W. Bostic; Michelle W. Bowman; Lael Brainard; Richard H. Clarida; Mary C. Daly; Charles L. Evans; Randal K. Quarles; and Christopher J. Waller.

-

Earnings from Moody’s and Silgan

Eddy Elfenbein, April 28th, 2021 at 9:10 amWe had two earnings reports this morning. First up, Moody’s (MCO) said it made $4.06 per share. That’s up 49% over last year’s Q1. Wall Street had been expecting $2.82 per share.

Sales were up 24% to $1.6 billion. Breaking that down, Moody’s Investors Service was up 30% to $1 billion while Moody’s Analytics was up 14% to $564 million.

Moody’s also raised its full-year earnings range to $11.00 to $11.30 per share. The previous range was $10.30 to $10.70 per share.

“Moody’s performance this quarter demonstrates the increased demand for our integrated risk assessment solutions and insights,” said Rob Fauber, President and Chief Executive Officer of Moody’s. “Strong execution and robust activity, particularly in the leveraged loan and speculative grade bond markets, drove Moody’s Investors Service’s top-line growth. Moody’s Analytics’ performance reflects its strong position in high-growth risk markets, further supported by elevated retention rates, renewable products and an expanding solutions suite. Following our strong results in the first quarter, we are increasing our revenue outlook to high-single-digit percent growth, and raising and narrowing our full year 2021 adjusted diluted EPS guidance range to $11.00 to $11.30.”

Silgan Holdings (SLGN) earned 75 cents per share which was five cents more than estimates. Q1 net sales rose 20.2% to $1.24 billion.

“We are very pleased to report continued record financial performance in the first quarter of 2021, with a 20% increase in sales and a 32% increase in adjusted earnings per diluted share over the previous record first quarter of 2020,” said Tony Allott, Chairman and CEO. “Our businesses exceeded a very strong prior year quarter that had been positively impacted by the initial pantry stocking in response to the global Covid-19 outbreak, and earnings grew solidly despite power and supply chain disruptions associated with winter storms across the southern U.S. and unparalleled increases in resin costs,” continued Mr. Allott.

For Q2, Silgan sees earnings of 75 to 85 cents per share. Wall Street had been expecting 87 cents per share. For all of 2021, the company reiterated its earlier guidance of $3.30 to $3.45 per share. The midpoint is a 10.3% increase over 2020.

-

Morning News: April 28, 2021

Eddy Elfenbein, April 28th, 2021 at 7:06 amJust Don’t Mention the ‘T’ Word

Fed Poised to Maintain Aggressive U.S. Economic Support

Biden Unveils Massive Family Aid Plan Funded by Taxing Rich

California’s ‘White Gold’ Rush: Lithium In Demand Amid Surge In Electric Vehicles

California Is Awash in Cash, Thanks to a Booming Market

Consumer Brands Eye Public Markets

QuantumScape Defends Its Battery Breakthrough Against the Short Sellers

Most Americans Would Take a Pay Cut to Keep Working From Home

Huawei Reports 16.5% Drop in Revenues in First Quarter, Warns of ‘Another Challenging Year’ Ahead

Samsung’s Lee Family to Pay More Than $10.8 Billion Inheritance Tax

Joshua Brown: “Stock Market Bubble” Searches Explode

Cullen Roche: The Scarcity of Money Myth

Jeff Carter: Changing Midstream, and Going Against The Current

Michael Batnick: Big Money Poll

Ben Carlson: The Golden Age of Fraud is Upon Us

Nick Maggiulli: Whose Decline is it Anyway?

Be sure to follow me on Twitter.

-

Morning News: April 27, 2021

Eddy Elfenbein, April 27th, 2021 at 7:09 amA Graying China May Have to Put Off Retirement. Workers Aren’t Happy.

Soaring Oxygen Demand Makes Indian Tycoon Cut Steel Output

Still Getting Your Head Around Digital Currency? So Are Central Bankers.

Nomura, UBS Take Global Banks’ Archegos Hit to Over $10 Billion

U.S. Companies Bump Up Prices on Supply Squeeze and Demand Boom

Biden Raises Minimum Wage for Federal Contractors to $15/hr

Biden Forms Task Force to Explore Ways to Help Labor

Biden Seeks $80 Billion to Beef Up I.R.S. Audits of High-Earners

General Electric Reports Smaller Cash Outflow, Reaffirms 2021 Outlook

3M Beats Profit Estimates as Pandemic Fuels Demand for Personal Safety Products

Tesla Posts Record Net Income of $438 Million, Revenue Surges by 74%

Toyota Truck Subsidiary and EV Start-Up Ink Deal for Electric Trucks

Why the Meaning of ‘Infrastructure’ Matters So Much

Howard Lindzon: Momentum Monday – Dips Are Still Being Bought

Ben Carlson: The Psychology of Fighting the Last Crash

Be sure to follow me on Twitter.

-

WR Grace Is Being Bought Out

Eddy Elfenbein, April 26th, 2021 at 11:20 amThis morning, WR Grace (GRA) said that it’s going to be bought out by Standard Industries for $70 per share.

Standard Industries had previously offered $65 per share which Grace turned down.

The name WR Grace is an important one in the history of American business. Truthfully, the WR Grace of today doesn’t have much in common with the WR Grace of history. The old firm used to be a vast empire, and I use the term empire in its literal sense. Grace’s recent history has been less than kind. The company spent 12 years in bankruptcy before emerging in 2014.

The company was started in Peru in 1854 by William Russell Grace, an Irish immigrant who left during the Great Famine. What brought him to Peru was guano, which is bird and bat droppings. Guano has a high level of nutrients like nitrate and ammonium. This is very good for fertilizer and Grace made a fortune. He was later elected the first Catholic mayor of New York City.

Grace’s grandson, J. Peter Grace, ran the company for 48 years. He led the Grace Commission which was authorized by Ronald Reagan to look at government waste. WR Grace owned countless holdings including, at various times, Miller Brewing, FAO Schwarz and Roto-Rooter. In 1974, the government of Peru nationalized WR Grace. The same year, the WR Grace building was completed in Manhattan overlooking Bryant Park and the New York Public Library.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His