CWS Market Review – April 13, 2021

(This is the free version of CWS Market Review. Don’t forget to sign up for the premium newsletter for $20 per month or $200 for the whole year. Wow, that a deal!)

Highest Monthly Inflation in 12 Years

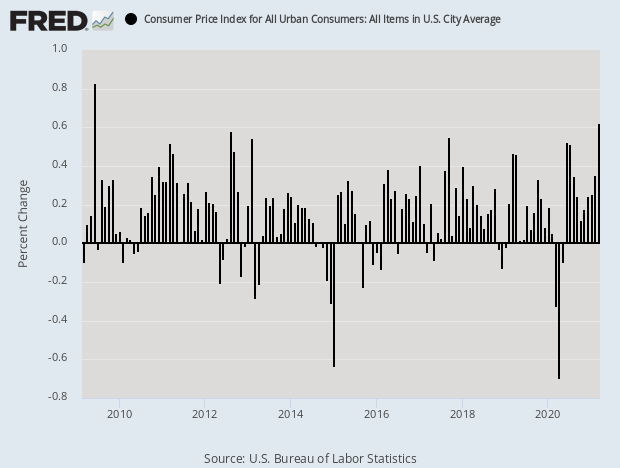

The big news today was this morning’s CPI report. Normally, the monthly CPI report isn’t that big of a deal, but this month, she was the belle of the ball. That’s because Wall Street expected to see a noticeable upturn in inflation.

That’s for two reasons. The first is simple comparisons. The economy went off the rails one year ago, or was pushed off, so the year-over-over number will seem elevated. The other reason is all the stimulus provided by the federal government. If people are locked up for a year, then allowed outside, plus you give them stimulus checks, well…you might see some inflation.

Wall Street was right: inflation did show up. Last month, consumer prices rose by 0.62%. That’s the highest rate since June 2009. Wall Street had been expecting an increase of 0.5%.

That’s the monthly number. Measured from one year ago, the increase was 2.64%. The year-over-year increase ending in February was just 1.68%. The largest factors for the increase were energy and food.

Gasoline prices were the biggest contributor to the monthly gain, surging 9.1% in March and responsible for about half the overall CPI increase. Gasoline is up 22.5% from a year ago, part of a 13.2% increase in energy prices.

Food nudged higher as well, up 0.1% for the month and 3.5% for the year. The food-at-home category increased 3.3%. All six of the government’s measures of grocery store indexes rose, with the biggest gain of 5.4% in the category of meats, poultry, fish and eggs.

The “core rate,” which excludes food and energy prices, rose by 0.33% last month. Over the past year, core prices are up by 1.65%. What the market really hates is unexpected inflation. Traders really don’t mind Armageddon—as long as it’s on time. This time, the market has been expecting inflation numbers like this, so the effect wasn’t that much on today’s market.

My favorite newsletter used to free but …,

— Rob Masters, Rome, GA (@Chieftain82) April 13, 2021

Touché.

What’s the impact of inflation on the stock market? That’s a good question. Inflation has an unusual impact on earnings. Not all earnings are the same, and inflation exacts a heavy toll on asset-heavy businesses. Companies with high assets relative to their profits tend to report ersatz earnings.

Inflation has an impact similar to putting a magnet near a compass. Everything gets a little screwy. Historically, stocks have not performed well during periods of high inflation. Investors who lived through the 1970s will certainly recall that. It’s no accident that Walmart was such a big winner during the 70s since it was so focused on giving shoppers lower prices.

Here’s a study I did. Professor Robert Shiller, a Nobel prize winner, maintains an online database of historical market data. It goes back 150 years. I took all the monthly data and ranked it by monthly inflation, lowest to highest. I then calculated how the inflation-adjusted stock market had performed when the months were ranked by inflation.

The results were interesting. Historically, the stock market had done pretty well until the annualized inflation rate reached 7.34%. Then it’s been like a light switch. Whenever inflation has exceeded that level, stock returns have gotten markedly worse.

Earlier I mentioned that inflation in March was 0.62%. Annualized, that’s 7.70%. That’s no reason to be scared. Last month was an outlier. I wouldn’t mind seeing inflation drift above 2%, but we’re a long way from the danger zone.

Danaher Raises Revenue Guidance

We had good news today from one of our Buy List stocks. Danaher (DHR) said that its Q1 core revenue will be at the “high end” of its guidance.

For the quarter ended April 2, 2021, the Company expects revenue growth to be approximately 57.0% and non-GAAP core revenue growth including Cytiva to be approximately 29.0%. The better-than-expected performance was broad-based across the portfolio, with particular strength in Life Sciences and Diagnostics.

In its Q4 earnings report from January, Danaher said:

For the first quarter 2021 the Company anticipates that non-GAAP core revenue growth including Cytiva will be in the mid to high-teens range.

For the full year 2021, the Company anticipates non-GAAP core revenue growth including Cytiva will be in the low-double digit range.

This is very good news. The shares were up as much as 5.6% today. Danaher will release its full Q1 earnings report on April 22. I’ll have more details in the premium letter (subscribe here).

WD-40 Drops on Disappointing Earnings

Ever hear a hallway door creek in the middle the night? When your first thought is that it could be home invaders, then you realize that it’s not a job for the police. Instead, it’s a job for WD-40.

A lot of people assume WD-40 is owned by some major industrial like Dow or 3M. Nope. WD-40 is owned by WD-40 (WDFC).

Most every homeowner is familiar with WD-40. The lubricant spray is instantly recognizable by its yellow and blue label. The company dates back to 1953, and the idea of putting WD-40 in an aerosol spray for the consumer market didn’t come about until 1957. Some folks at the firm were working on a Water Displacement formula. The first 39 tries failed, but #40 worked and the name was born.

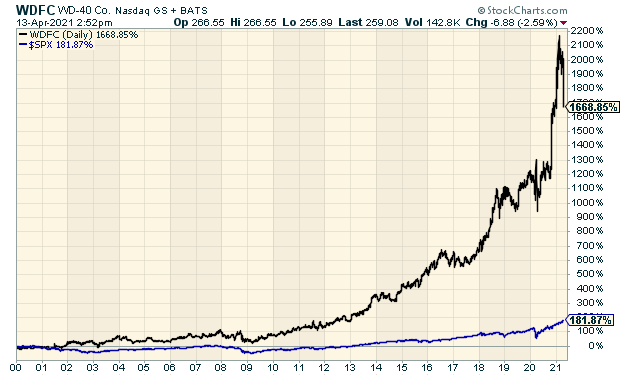

In 1969, the company decided to rename itself after its only product and four years later, it went public and has traded on the markets ever since. Over the years, the stock has been a big winner for shareholders. Check out this chart:

Despite all its success, WD-40 is only followed by two Wall Street analysts. Why has it been so successful? Because it satisfies a basic need. It really isn’t more complicated than that. The company’s offering has grown to include many other applications for WD-40. Consumers love it.

What I like about WD-40 is that it’s a timeless product. Do-it-yourselfers will always have a need for it. No garage is complete without WD-40 and duct tape.

Did you know WD-40 can soften leather? It can also clean tile and erase crayon. It can even unstick Legos. (But do not try it on an iPhone!)

WD-40 now has more than 500 employees across 15 countries. The products are sold in 176 countries around the world. Last year, WD-40 registered sales of more than $408 million. WD-40 currently pays a quarterly dividend of 67 cents per share. That’s up from 27 cents per share 10 years ago.

The reason I bring up WD-40 is that it’s gotten clobbered recently. For its fiscal Q2, the company reported earnings of $1.24 per share. That was eight cents below estimates. Traders were not pleased. Over the past week, shares of WDFC are off about 18%.

I’ve long been a fan of WD-40 and I’ve come close to adding it to our Buy List. The problem is that it’s way too pricey. Well, in the last week, it’s gotten a lot less pricey. This is one to keep an eye on.

If you haven’t had a chance yet, please subscribe to our premium newsletter. It’s only $20 a month or $200 a year.

That’s less than $4 per week.

That’s less than 55 cents per day.

And in leap years, it’s even less!

I’ll have more for you in the next issue of CWS Market Review.

– Eddy

Posted by Eddy Elfenbein on April 13th, 2021 at 3:53 pm

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His