Archive for April, 2021

-

Morning News: April 14, 2021

Eddy Elfenbein, April 14th, 2021 at 7:06 am‘Make or Break’ Call on Inflation Stumps Global Investors

The Biden Administration Is Quietly Keeping Tabs on Inflation

Fed Is More Worried by Inflation Running Too Cold Than Too Hot

Coinbase Listing Marks Latest Step in Crypto’s March to the Mainstream

Dogecoin Price Surpasses 10 Cents to Reach An All-Time High

Hungry for Investors, Some Companies Woo the Little Guy

JPMorgan Posts Investment-Banking Fee Surge While Loans Decline

How the Pandemic Helped Walmart Battle Amazon Marketplace for Sellers

Inside the Secret Battery Lab With a $20 Billion Breakthrough

Broadcast News in Flux as CBS News President Prepares Exit

Controversial Toshiba CEO Steps Down, Shares Jump on Bidding War Expectations

Nick Maggiulli: When Wealth Isn’t Real

Ben Carlson: Overnight Millionaires

Michael Batnick: Animal Spirits: A Shortage of Workers

Howard Lindzon: Crypto – The Beginning of The Beginning… and the Coinbase IPO

Joshua Brown: Nothing To Do Except Gamble, Powell: We’d Rather Clean Up After A Bubble Than Try to Prevent One, You Ever Notice?

Be sure to follow me on Twitter.

-

CWS Market Review – April 13, 2021

Eddy Elfenbein, April 13th, 2021 at 3:53 pm(This is the free version of CWS Market Review. Don’t forget to sign up for the premium newsletter for $20 per month or $200 for the whole year. Wow, that a deal!)

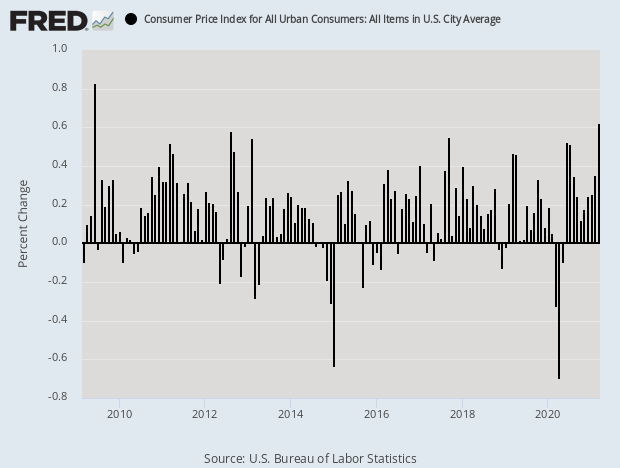

Highest Monthly Inflation in 12 Years

The big news today was this morning’s CPI report. Normally, the monthly CPI report isn’t that big of a deal, but this month, she was the belle of the ball. That’s because Wall Street expected to see a noticeable upturn in inflation.

That’s for two reasons. The first is simple comparisons. The economy went off the rails one year ago, or was pushed off, so the year-over-over number will seem elevated. The other reason is all the stimulus provided by the federal government. If people are locked up for a year, then allowed outside, plus you give them stimulus checks, well…you might see some inflation.

Wall Street was right: inflation did show up. Last month, consumer prices rose by 0.62%. That’s the highest rate since June 2009. Wall Street had been expecting an increase of 0.5%.

That’s the monthly number. Measured from one year ago, the increase was 2.64%. The year-over-year increase ending in February was just 1.68%. The largest factors for the increase were energy and food.

Gasoline prices were the biggest contributor to the monthly gain, surging 9.1% in March and responsible for about half the overall CPI increase. Gasoline is up 22.5% from a year ago, part of a 13.2% increase in energy prices.

Food nudged higher as well, up 0.1% for the month and 3.5% for the year. The food-at-home category increased 3.3%. All six of the government’s measures of grocery store indexes rose, with the biggest gain of 5.4% in the category of meats, poultry, fish and eggs.

The “core rate,” which excludes food and energy prices, rose by 0.33% last month. Over the past year, core prices are up by 1.65%. What the market really hates is unexpected inflation. Traders really don’t mind Armageddon—as long as it’s on time. This time, the market has been expecting inflation numbers like this, so the effect wasn’t that much on today’s market.

My favorite newsletter used to free but …,

— Rob Masters, Rome, GA (@Chieftain82) April 13, 2021

Touché.

What’s the impact of inflation on the stock market? That’s a good question. Inflation has an unusual impact on earnings. Not all earnings are the same, and inflation exacts a heavy toll on asset-heavy businesses. Companies with high assets relative to their profits tend to report ersatz earnings.

Inflation has an impact similar to putting a magnet near a compass. Everything gets a little screwy. Historically, stocks have not performed well during periods of high inflation. Investors who lived through the 1970s will certainly recall that. It’s no accident that Walmart was such a big winner during the 70s since it was so focused on giving shoppers lower prices.

Here’s a study I did. Professor Robert Shiller, a Nobel prize winner, maintains an online database of historical market data. It goes back 150 years. I took all the monthly data and ranked it by monthly inflation, lowest to highest. I then calculated how the inflation-adjusted stock market had performed when the months were ranked by inflation.

The results were interesting. Historically, the stock market had done pretty well until the annualized inflation rate reached 7.34%. Then it’s been like a light switch. Whenever inflation has exceeded that level, stock returns have gotten markedly worse.

Earlier I mentioned that inflation in March was 0.62%. Annualized, that’s 7.70%. That’s no reason to be scared. Last month was an outlier. I wouldn’t mind seeing inflation drift above 2%, but we’re a long way from the danger zone.

Danaher Raises Revenue Guidance

We had good news today from one of our Buy List stocks. Danaher (DHR) said that its Q1 core revenue will be at the “high end” of its guidance.

For the quarter ended April 2, 2021, the Company expects revenue growth to be approximately 57.0% and non-GAAP core revenue growth including Cytiva to be approximately 29.0%. The better-than-expected performance was broad-based across the portfolio, with particular strength in Life Sciences and Diagnostics.

In its Q4 earnings report from January, Danaher said:

For the first quarter 2021 the Company anticipates that non-GAAP core revenue growth including Cytiva will be in the mid to high-teens range.

For the full year 2021, the Company anticipates non-GAAP core revenue growth including Cytiva will be in the low-double digit range.

This is very good news. The shares were up as much as 5.6% today. Danaher will release its full Q1 earnings report on April 22. I’ll have more details in the premium letter (subscribe here).

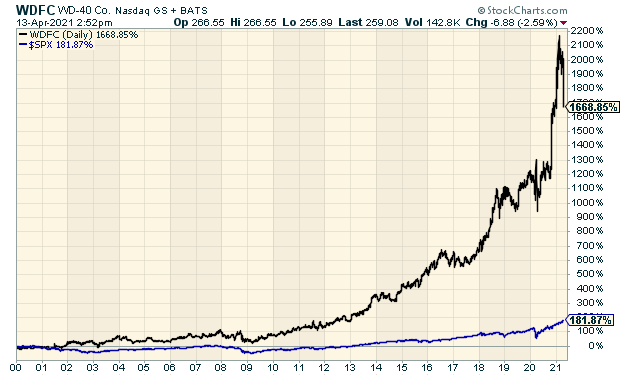

WD-40 Drops on Disappointing Earnings

Ever hear a hallway door creek in the middle the night? When your first thought is that it could be home invaders, then you realize that it’s not a job for the police. Instead, it’s a job for WD-40.

A lot of people assume WD-40 is owned by some major industrial like Dow or 3M. Nope. WD-40 is owned by WD-40 (WDFC).

Most every homeowner is familiar with WD-40. The lubricant spray is instantly recognizable by its yellow and blue label. The company dates back to 1953, and the idea of putting WD-40 in an aerosol spray for the consumer market didn’t come about until 1957. Some folks at the firm were working on a Water Displacement formula. The first 39 tries failed, but #40 worked and the name was born.

In 1969, the company decided to rename itself after its only product and four years later, it went public and has traded on the markets ever since. Over the years, the stock has been a big winner for shareholders. Check out this chart:

Despite all its success, WD-40 is only followed by two Wall Street analysts. Why has it been so successful? Because it satisfies a basic need. It really isn’t more complicated than that. The company’s offering has grown to include many other applications for WD-40. Consumers love it.

What I like about WD-40 is that it’s a timeless product. Do-it-yourselfers will always have a need for it. No garage is complete without WD-40 and duct tape.

Did you know WD-40 can soften leather? It can also clean tile and erase crayon. It can even unstick Legos. (But do not try it on an iPhone!)

WD-40 now has more than 500 employees across 15 countries. The products are sold in 176 countries around the world. Last year, WD-40 registered sales of more than $408 million. WD-40 currently pays a quarterly dividend of 67 cents per share. That’s up from 27 cents per share 10 years ago.

The reason I bring up WD-40 is that it’s gotten clobbered recently. For its fiscal Q2, the company reported earnings of $1.24 per share. That was eight cents below estimates. Traders were not pleased. Over the past week, shares of WDFC are off about 18%.

I’ve long been a fan of WD-40 and I’ve come close to adding it to our Buy List. The problem is that it’s way too pricey. Well, in the last week, it’s gotten a lot less pricey. This is one to keep an eye on.

If you haven’t had a chance yet, please subscribe to our premium newsletter. It’s only $20 a month or $200 a year.

That’s less than $4 per week.

That’s less than 55 cents per day.

And in leap years, it’s even less!

I’ll have more for you in the next issue of CWS Market Review.

– Eddy

-

Morning News: April 13, 2021

Eddy Elfenbein, April 13th, 2021 at 7:05 amChina Huarong’s Worsening Bond Rout Stokes Market Contagion

In Battle With U.S. for Global Sway, China Showers Money on Europe’s Neglected Areas

Deliveroo IPO Flop, Jamie Dimon Threats Stoke Fears of London’s Post-Brexit Future

Bitcoin Rallies to All-Time High as Traders Eye Coinbase Listing

JPMorgan Chief Strategist Says Markets May Be at Long-Term Turning Point

Texas Oil Pipelines Face Dry Months as Production Languishes

U.S. Calls for Pause on Johnson & Johnson Vaccine After Clotting Cases

Grab Agrees World’s Biggest SPAC Merger, Valued at Nearly $40 Billion

Regulators Step Up Scrutiny of SPACs With New View on Warrants

Defying Republicans, Big Companies Keep the Focus on Voting Rights

‘Master,’ ‘Slave’ and the Fight Over Offensive Terms in Computing

Uber Reports Best Month for Bookings in Company’s History

Archegos Left a Sparse Paper Trail for a $10 Billion Firm

Ben Carlson: Who Owns Stocks in the United States?

Be sure to follow me on Twitter.

-

Powell Expects Strong Growth

Eddy Elfenbein, April 12th, 2021 at 9:53 amLots of earnings reports will be coming out this week. There was good news over the weekend. The U.S. administered 4.6 million vaccine doses on Saturday. That’s a record. Let’s hope this trend continues.

In business news, Microsoft is buying Nuance for $16 billion. The buy-out price is $56 per share which is a 23% premium to Friday’s close. I’m glad to see that despite the rally, firms are willing to open their pocketbooks.

The stock market is down a bit this morning but not too much. The S&P 500 closed at an all-time high on Friday. It’s closed higher six times in the last seven sessions. Ryan Detrick points out that over the past 22 quarters the S&P 500 has been higher in 19 of them.

Moody’s (MCO) got to a new high this morning. The company said it will report earnings on April 28.

On Sunday, Jerome Powell was interviewed on 60 Minutes. He had good things to say about the economy, but he cautioned that areas of the stock market could be over-priced. It’s in the nature of Fed chairs to warn of such things.

Scott Pelley: What are your projections for growth and employment?

Jerome Powell: If you look at what private sector forecasters are saying or what forecasters who sit around this table who are on the Federal Open Market Committee, our rate setting committee, what they’re forecasting is growth for this year in the range of 6% or 7%, which would be the highest level in, you know, 30 years. Or even maybe a little bit higher. And forecasting unemployment to move down substantially from 6%, where it is now, maybe to between 4% and 5%.

Scott Pelley: It seems like you’re not expecting a recovery, you’re expecting a boom.

Jerome Powell: Well, I would say that this growth that we’re expecting in the second half of this year is going to be very strong.

-

Morning News: April 12, 2021

Eddy Elfenbein, April 12th, 2021 at 7:05 amA Tale of Two Tapers: This Time is Different for a Fed Focused on Jobs

Big U.S. Treasury Auctions Could Restart Rise in Yields

Simple Math Is About to Cause a U.S. Inflation Problem

With Quick Fixes, Biden’s Agencies Reverse Trump’s Wall Street-Friendly Rules

2 Korean Battery Makers Settle Dispute That Threatened Biden’s Green Agenda

Alibaba Will Lower Merchant Fees After Antitrust Fine

Ant to Be Financial Holding Firm in Overhaul Forced by China

Ameriprise to Buy BMO Unit, Adding $124 Billion Under Management

Microsoft Makes Big Bet on Health-Care AI Technology With Nuance

How A Winter Storm in Texas Sent a Chill through America’s RV Industry

Inside the Fight for the Future of The Wall Street Journal

Why We’re Freaking Out About Substack

Ben Carlson: What Happens After the Stock Market is Up Big? & Winnie the Pooh Translates Financial Jargon

Michael Batnick: Rise of the Machines

Jeff Carter: Still Trying To See Why You Need Crypto?

Howard Lindzon: The Fresh Tiny Bubble in Crypto

Joshua Brown: Costs, Why Direct Indexing is the New Killer App for Advisors & Getting Your Money Back from NBA TopShot with Me and Jason Concepcion

Be sure to follow me on Twitter.

-

CWS Market Review – April 9, 2021

Eddy Elfenbein, April 9th, 2021 at 7:08 am“You should definitely get a one-year subscription to Eddy’s newsletter. It’s only $200!” – Napoleon

Before I start, I want to thank everyone for your support. Earlier this week, I decided to make CWS Market Review a paid newsletter, and your response has been overwhelming.

This week’s issue is open to everyone, but going forward, you’ll need to be a paid subscriber. You can sign up here.

Don’t worry, I’m keeping the price fairly modest. It’s $20 per month, or $200 for the whole year. I’ll probably raise that soon, but I want to give my loyal readers a discount.

I’ll continue to send out periodic updates to free subscribers, but fuller analysis will only be available on the paid service. I won’t give you the hard sell. This is the newsletter. It is what it is. I give you my honest take on the markets each week. I hope you continue with us.

Now, on to business.

We’re on the doorstep of the first-quarter earnings season. Things will really get going on Monday when several of the major banks are due to report. Our first Buy List earnings report looks to be Abbott Labs on Tuesday, April 20. After that, the reports will come in a blizzard. We’re going to get 22 earnings reports in about three weeks. Buckle up.

This is a key earnings season for several reasons. The most important is that Wall Street has made a big bet that corporate America will have good news to report. That’s why the indexes have been rising, and bond yields have crept higher.

Since late October, the S&P 500 has gained more than 25%. In retrospect, the rally didn’t seem that strong, perhaps because it came in little steps. In this week’s issue, I’ll discuss some recent economic news, including last week’s jobs report, and I’ll have some Buy List updates. The S&P 500 just made a new all-time high, and so have many of our Buy List stocks.

Since the financial news has been somewhat light lately, I thought I’d dig into my views on gold. I’m often asked about the yellow metal, so this is a good opportunity to share my perspective. Before we get to that, though, let’s look at last Friday’s big jobs report.

Best ISM Services Report on Record

Last Friday, the stock market was closed for Good Friday, but the Labor Department was open. The federales said that the U.S. economy created 916,000 net new jobs in March. That’s a huge number. Wall Street had been expecting a gain of only 675,000. The unemployment rate dropped to 6.0%.

In simple terms, the jobs situation has gone from a disaster to merely poor. So it’s an improvement, but we have to keep it in context. The details of the report were quite good. The private sector added 780,000 jobs, while the government added 136,000. The labor-force participation rate rose to 61.5%. That’s below the 63.3% we had in February 2020, but it’s a lot better than where it was a few months ago. Very roughly speaking, I’d say the U.S. economy is about eight or nine million jobs from full employment.

The jobs news suggest that the upcoming corporate-earnings news will be good. Again, in a relative sense. We hit a rough patch in February due to the weather, but it looks like Q1 was solid. It’s not just me saying the jobs outlook has improved; Federal Reserve Chairman Jay Powell also said as much this week. He said he wants to see a string of months of one million new jobs.

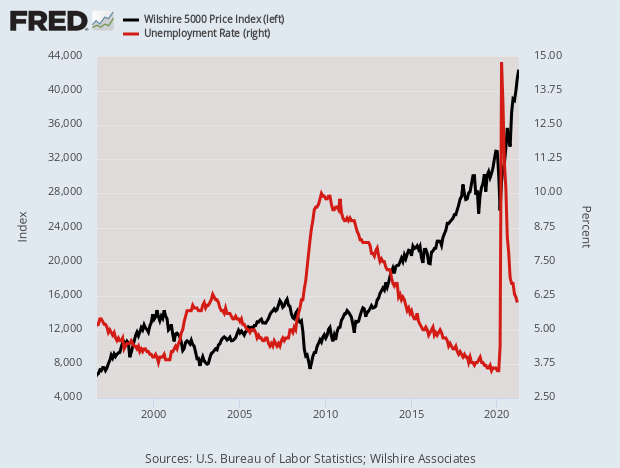

The IMF said it expects to see the U.S. economy grow by 6.4% this year. It also said that it expects to see world economic growth of 6%. That would be the strongest pace in four decades. Here’s a metaphor for the economy: we’re driving around in a broken truck, but it used to be stuck in the ditch. Check out this interesting 25-year chart of the stock market in black and the unemployment rate in red. The message is to buy when things are bad.

On Wednesday, the Fed released the minutes from its last meeting. As expected, the Fed didn’t make any changes to interest rates or its bond-buying policy. The minutes indicated that the Fed is willing to go all out to help the U.S. economy recover.

Specifically, the minutes said, “Participants noted that it would likely be some time until substantial further progress toward the Committee’s maximum-employment and price-stability goals would be realized and that, consistent with the Committee’s outcome-based guidance, asset purchases would continue at least at the current pace until then.” That’s Fedspeak for “dude, we’re not even close to done.”

Wall Street liked what it heard. On Thursday, the S&P 500 closed at 4,097.17, which is yet another all-time high.

Last week I told you how we had the best ISM Manufacturing Index report in 37 years. On Monday, we got even better news. The ISM Services Index report was the strongest one in its history. I believe that series goes back to 1997. For March, the ISM Manufacturing Index was 63.7.

The economy’s improvements have led to concerns about inflation. That’s sparked a debate about gold. Let me share my thoughts on the issue.

What to Make of Gold’s Slide?

With the Federal Reserve committed so strongly to helping the U.S. economy get back on its feet, some investors are concerned that we’ll see a resurgence of inflation. The recent movement in the gold market, however, has baffled some people. That’s because gold has dropped sharply over the last eight months.

If inflation is such a threat, shouldn’t gold be moving higher? This is a big topic on the minds of many investors in the gold corner of the market. I have to confess that I have slightly heterodox views on gold. (Prepare for a long-winded essay.)

There’s an old joke that there are exactly two people in the world who understand the price of gold. They both work for the Bank of England and they disagree.

Gold is an interesting but complex topic, so I’ll need some space to address it fully. For one, I don’t believe that gold responds to inflation. Rather, gold responds to real short-term interest rates. By this I mean interest rates adjusted for inflation. Inflation is part of the equation, but it’s not the only thing.

Basically, as long as real short-term rates are low, then you can expect gold to do well, but there’s a small caveat to this statement. Real short-term rates need to be low relative to the “natural interest rate.”

What do we mean by the natural interest rate? Now things get a little interesting. That’s the idea that there’s one magic interest rate that hangs over the entire world. The natural rate is sometimes called the Wicksellian rate in honor of the Swedish economist Knut Wicksell (1851-1926). You can’t see it, touch it or feel it. Nor does any media outlet report on what it closed at, but the natural rate covers the world, and everyone is impacted by it.

If the Fed brings rates below the natural rate, it’s helping the economy. If the Fed brings rates above the natural rate, it’s putting on the brakes. The problem is, no one knows exactly what the natural rate is.

Wherever the natural rate is, there seems to be widespread belief that in recent years the natural rate has declined. I’m in that camp as well. As a result, lower real rates haven’t had the impact on gold that they used to. Last summer, an ounce of gold cracked $2,000. Recently, it dipped below $1,700 per ounce.

I’m generally not much of a fan of investing in gold. That’s not an economic take or even a political view. Rather, it’s based on the view that gold is simply a rock. It doesn’t do anything. It just sits there. Gold has some industrial uses, but not many. In the long run, equity is a better and safer bet than assets.

For some reason, gold has bewitched man for millennia. There are some people, not all, who are quite simply unreasonably attracted to gold. They make Goldfinger look like an amateur. Maybe one day some cognitive scientist will find a connection between our brains and gold.

For example, gold never rusts. You can take the gold out of an Egyptian pyramid and stick it in a cavity in a tooth (though you might want to clean it first). It’s also non-toxic. And it’s also incredibly soft. One ounce can be stretched for 50 miles. It can be pounded down to a few millionths of an inch thickness. And gold is very heavy. Despite what you see in The Treasure of the Sierra Madre, gold dust can’t be blown away.

Gold has been found on every continent on earth. Gold has also had strong religious connections. It’s mentioned in the Bible more than 400 times. Marx writes of commodity fetishism, a term that’s meant to have a religious connotation.

A large part of the goldbug community is wedded to the idea of the gold standard and that civilization has been imperiled ever since the gold standard was left behind. Eh…maybe, but I’m more interested in finding things that make money. Some of the fervor may have migrated to the crypto world.

Also, gold tends to move in big price spikes. It’s either all or nothing. I understand why people might be attracted to gold, and I’m not unsympathetic. For me, however, I think the best way to build long-term wealth is to buy superior stocks and then do as little as possible. Now let’s look at news from our Buy List stocks.

Buy List Updates

Ansys (ANSS) is one of my favorite tech stocks. The company helps engineers see how their ideas look on a computer simulation. The stock got hit hard during the tech crunch in February, even though Ansys reported outstanding earnings for Q4. The stock has since reversed course and is up 23% in the last month. This week, I’m lifting my Buy Below price on Ansys to $375 per share. Look for another solid earnings report soon.

Several of our Buy List stocks have hit new highs lately or come very close. Middleby (MIDD) has gained 280% on a little over a year. On Thursday, shares of Ross Stores (ROST) rallied to a new 52-week high. I’m a big fan of Ross, but even I’ve been impressed with this stock’s resiliance lately. Along with Disney, this has become a favorite of the “reopening trade.” Ross Stores is a buy up to $130 per share.

Stryker (SYK) also hit a new high on Thursday. The company is due to report on April 27. Wall Street is looking for $1.99 per share. Stryker is a buy up to $260 per share.

That’s all for now. Looking at next week, we’ll get an update on the Federal budget on Monday. Then on Tuesday, the government releases its inflation stats for March. We still aren’t seeing much in the way of broad-based inflation, but that may soon change. Thursday will be crowded. We’ll get reports on retail sales and industrial production, plus the regular jobless-claims report. Then on Friday, we’ll get reports on housing starts and building permits. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

P.S. Don’t forget to sign up for a premium subscription: $20 per month or $200 for the whole year!

-

Morning News: April 9, 2021

Eddy Elfenbein, April 9th, 2021 at 7:03 amBiden Faces Key Test on EV Battery Trade Dispute

Beyond Pandemic’s Upheaval, a Racial Wealth Gap Endures

Are NFT Purchases Real? The Dollars Are.

China’s Forced-Labor Backlash Threatens to Put N.B.A. in Unwanted Spotlight

China Set to Clear Tencent’s $3.5 Billion Sogou Deal Subject to Data Security Conditions

Amazon Takes 2-1 Lead in Union Election; Count Continues Friday

McDonald’s Is Closing Hundreds of Its Walmart Restaurants

‘Satan Shoes’ to Be Recalled as Nike Agrees to Settle Lawsuit

The Forgotten Shipping Pallet Is Staging a Pandemic-Era Rally

Ben Carlson: Why This is Not Another Housing Bubble

Michael Batnick: Animal Spirits: Listener Mailbag

Joshua Brown: Why Copper Is Crushing Gold

Be sure to follow me on Twitter.

-

Stocks Rally Despite Higher Jobless Claims

Eddy Elfenbein, April 8th, 2021 at 11:18 amApril 15 is traditionally Tax Day, although not this year. In my opinion, April 8 is a better representation of the power of government versus the people. There were three key events that defined government power that happened on April 8.

On April 8, 1895, the Supreme Court ruled Congress’s income tax unconstitutional. This decision was later overruled by the 16th Amendment.

On April 8, 1952, President Truman nationalized the steel industry. Most Americans don’t realize this happened. Once again, the Supreme Court overruled the decision.

Perhaps the biggest one came in 1943. That’s when FDR froze wages and prices, prohibited workers from changing jobs unless the war effort would be aided thereby, and barred rate increases by common carriers and public utilities.

Now, onto the stock market. The S&P 500 got as high as 4,093.87. This morning’s jobless claims came in at 744,000 which was 50,000 higher than expected. The post-pandemic low was two weeks ago at 658,000.

Earnings season is almost here. On Monday, a few of the big banks – JPMorgan, Wells Fargo, and Goldman Sachs – are set to report earnings. The other big banks will follow later in the week. Right now, it looks like Stepan will be our first Buy List stock to report this season, on Tuesday, April 20. We don’t have all the earnings dates just yet.

-

Morning News: April 8, 2021

Eddy Elfenbein, April 8th, 2021 at 7:08 amEurope Should Invest in Chip Design, Not A Mega-Fab

Drought in Taiwan Pits Chip Makers Against Farmers

Inflation Has Gone K-Shaped in the Pandemic Like Everything Else

As Investors Switch to ETFs, So Do Managers

As Talk Turns to Inflation, Some Investors Look to Gold

Biden Tax Plan Targets Fossil Fuel Subsidies Worth $35 Billion

Fixing the Credit Catch-22: How Biden Wants to Make Credit Scores Fairer

Silicon Valley Is Flooding Into A Reluctant Austin

Best Buy Launches A New $200 Membership Program to Fight Amazon

Hours After CEO Decried Inequality, JPMorgan Seeks to Quash Call for Racial-Equity Audit

Bill Hwang Had $20 Billion, Then Lost It All in Two Days

Online Scammers Have a New Offer For You: Vaccine Cards

How Trader Jeff Yass Parlayed Poker And Horse Race Handicapping Into A $12 Billion Fortune

Joshua Brown: Jamie Dimon: Dear Shareholder

Ben Carlson: Animal Spirits: Housing Bubble 2.0?

Michael Batnick: The Bubble Burst

Be sure to follow me on Twitter.

-

Fed Minutes Boost the Market

Eddy Elfenbein, April 7th, 2021 at 2:32 pmThe Fed released the minutes from its last meeting. The Fed has been pretty clear that it intends to hold down interest rates for as long as it can.

At the meeting, the Federal Reserve’s monetary policymaking arm voted to keep short-term borrowing rates anchored near zero and to continue buying at least $120 billion in bonds each months.

In addition, the committee raised its outlook for economic growth and inflation ahead. The median outlook for GDP tin 2021 went to 6.5%, a big upgrade from the 4.2% expectation in the December projections.

Officials also indicated that the unemployment rate could fall to 4.5% by the end of the year and inflation could run to 2.2%, slightly above the Fed’s traditional 2% target.

The market is holding up well and we’re looking at a new all-time high close.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His