Archive for April, 2021

-

Morning News: April 7, 2021

Eddy Elfenbein, April 7th, 2021 at 7:02 amHigh Stakes at Sea in Global Rush for Wind Power

A K-Shaped Recovery, This Time on a Global Scale

Millions Are Tumbling Out of the Global Middle Class in a Historic Setback

Hong Kong Courts the Rich as China Tightens Its Grip

U.S. Jobs Progress Still Far Short of Fed’s ‘Substantial’ Tripwire

Dimon Says ‘Fintech and Big Tech Are Here’ as Banks Lose Ground

Is ‘Femtech’ the Next Big Thing in Health Care?

Jeff Bezos Says Amazon Supports Biden’s Proposed Corporate Tax Hike

Intel’s Latest Hail Mary Is a $20 Billion Bet on American Manufacturing

CEO Mary Barra Bets GM Can Grow Beyond Cars and Trucks

Toshiba Gets Deal Proposal That Could Be Worth More Than $20 Billion

Joshua Brown: Buyers of the Lost ARKK & Most Definitely Not Boring

Howard Lindzon: Momentum Tuesday…Momentum Monday Was Not Enough

Michael Batnick: Animal Spirits: Housing Bubble 2.0? & The Roaring 20s

Ben Carlson: How Many Months’ Worth of Spending Do You Need in Your Emergency Fund?

Nick Maggiulli: Why You Shouldn’t Pick Individual Stocks

Be sure to follow me on Twitter.

-

CWS Market Review – April 6, 2021

Eddy Elfenbein, April 6th, 2021 at 3:40 pmI have special announcement. I’ve decided to make CWS Market Review a paid subscription service. This decision has been a long time coming, and now that day is here.

Don’t worry. It will be the same service you know and love. What’s happened is that the newsletter has grown so large and has become such a time commitment on my part, I think it’s fair to ask for some compensation. I never dreamed it would become this popular.

For my long-time readers, you can lock in our early subscription price. That will be $20 per month, or $200 for a full year.

I love doing the newsletter and bringing my thoughts to investors. I hope you join me and give me your support. You can subscribe here.

Thank you – Eddy

-

Slow Morning After Yesterday’s ATH

Eddy Elfenbein, April 6th, 2021 at 11:46 amThere’s not much going on in the market this morning. Stocks are mixed to mildly higher after yesterday’s all-time high. Most sectors are up a little but a lot of banks are in the red. The BLS said that job openings rose to 7.4 million in February. CoreLogic said that home prices rose 10.4% in the 12 months ending in February.

On our Buy List, Miller Industries (MLR), Moody’s (MCO) and Sherwin-Williams (SHW) are all at new highs. I’m impressed to see SHW rally after its recent split.

-

Morning News: April 6, 2021

Eddy Elfenbein, April 6th, 2021 at 7:02 amWhy Shortages of a $1 Chip Sparked Crisis in Global Economy

China Asks Banks to Curtail Credit for Rest of Year

Global Brands Find It Hard to Untangle Themselves From Xinjiang Cotton

As China Targets H&M and Nike, Local Brands See Their Chance

Is Big Business the Democrats’ New Best Friend?

The Fed Is Making Wall Street Forecasters Pay Attention to Black Unemployment

Credit Suisse Overhauls Management As It Takes $4.7 Billion Hit on Archegos

LG Electronics Fans Bemoan End of Era As Firm Exits Smartphone Business

DoorDash Drivers Game Algorithm to Increase Pay

Tim Cook Says He Has ‘Great Admiration And Respect’ For Tesla As He Drops Hints On Apple Car

Ben Carlson: The Growth-Value Cycle

Michael Batnick: They’re Not F*cking Leaving

Joshua Brown: Why the “Fintech Disruption” Threat to Banks Might Be Overdone & Niall Ferguson on China’s Digital Currency Ambitions

Be sure to follow me on Twitter.

-

The ISM Services Index Hits All-Time High

Eddy Elfenbein, April 5th, 2021 at 11:42 amWith Good Friday last week, the stock market wasn’t able to respond to the jobs report until this morning. Apparently, Wall Street liked what it saw. The averages are up nicely this morning. The S&P 500 has been as high as 4,074.72, which is another all-time high.

Tech stocks are leading the way and the Nasdaq is doing much better than the S&P 500. On our Buy List, Moody’s (MCO) and Miller Industries (MLR) are both at new highs. There’s not much economic news out this week, but the Fed will release the minutes from its last meeting. The Dow is also at a new all-time high. It wasn’t on Friday.

One report that came out this morning was the ISM Services index. That hit an all-time high of 63.7 in March.

-

Morning News: April 5, 2021

Eddy Elfenbein, April 5th, 2021 at 7:01 amNations Begin to Shape Post-Covid-19 Economy Amid Diverging Fortunes

If China Is As Bad As Its Critics Say, Then We Have Nothing To Fear

How Brexit Ruined Easter for Britain’s Chocolate Makers

A 33-Year-Old Fueling Crypto Boom Is Worrying Thai Regulators

Joe Biden Picked a Good Time to Become President

Inside Corporate America’s Frantic Response to the Georgia Voting Law

Goldman Axes Short Dollar Call as Higher U.S. Yields Spoil Bet

South Korea’s LG Becomes First Major Smartphone Brand to Withdraw From Market

Amazon’s Clashes With Labor: Days of Conflict and Control

Amazon Illegally Fired Activist Workers, Labor Board Finds

GameStop to Offer Up to $1 Billion in Shares; Stock Declines

Tesla China Demand Fuels ‘Home Run’ Quarter for Deliveries

Carl Icahn Taps Former GE Executive to Be CEO of His Firm

Howard Lindzon: Spotify On The Attack

Ben Carlson: The 4 Types of Robinhood Traders & How Much Money Do You Need to Make to Buy a New Car?

Michael Batnick: How Retail Traders Impacted the Stock Market, I’m Ready to Go Back & Animal Spirits: The Psychology of Investing in Bitcoin

Be sure to follow me on Twitter.

-

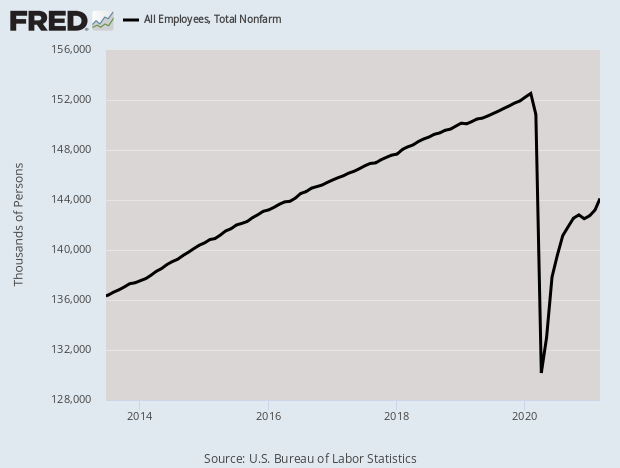

March Jobs Report

Eddy Elfenbein, April 2nd, 2021 at 8:32 amFor March, the U.S. economy created 916,000 net new jobs. Wall Street had been expecting a gain of 675,000.

The private sector added 780,000 while the government added 136,000. The unemployment rate fell to 6.0%.

A more encompassing measure of unemployment that includes discouraged workers and those holding part-time jobs for economic reasons dropped to 10.7% from 11.1% in February.

The labor force continued to grow after losing more than 6 million Americans at one point last year. Another 347,000 workers came back, bringing the labor force participation rate to 61.5%, compared to 63.3% in February 2020.

There are still nearly 5 million fewer Americans employed than a year ago while the labor force is down 2.2 million.

Leisure and hospitality, a sector critical to restoring the jobs market to its former strength, showed the strongest gains for the month with 280,000 new jobs. Bars and restaurants added 176,000 while arts, entertainment and recreation contributed 64,000 to the total.

-

CWS Market Review – April 2, 2021

Eddy Elfenbein, April 2nd, 2021 at 7:08 am”I’m always fully invested. It’s a great feeling to be caught with your pants up.”

– Peter Lynch4,000! It finally happened. On Thursday, the S&P 500 broke the 4,000 barrier for the first time in history. The index finished the day at 4,019.87.

For some context, the S&P 500 first closed above 400 on December 26, 1991. That’s a 10-fold gain in nearly 30 years.

Going back further, the index first closed above 40 on June 17, 1955 (technically, that was the old S&P 90). What about before that? Well, the S&P 500 never got down to 4. But if we go way, way back to the mega-low from July 8, 1932, it was 4.41. That means we still need a nice rally to make it a 1,000-fold gain in about 90 years.

The S&P 500 is now up more than 80% from its low of just over a year ago. At the time when the world was locking itself down due to the coronavirus, who would have predicted such a robust recovery? I know I didn’t. (Take note of this week’s epigraph.)

Once again, a strategy of buying and holding high-quality stocks has been a big winner. I’m glad to see that many of our Buy List stocks are also doing well. In fact, little Miller Industries just touched a new 52-week high. We already have a 23% gain in Miller.

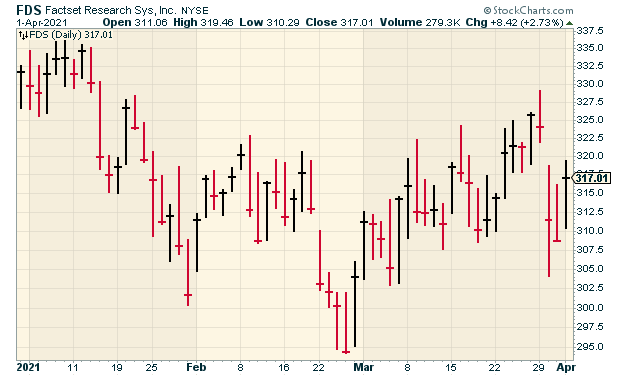

In this week’s issue, I want to discuss the recent earnings report from FactSet. Honestly, it was OK but not great. The stock took a hit after the earnings report, but it has since made back most of what it lost. As we know well, the market prefers to act first and think second. I’ll have all the details in a bit.

Since it was a slow news week, I wanted to take a step back and discuss the oft-overlooked consumer-staples sector. I’ll also have some updates on our Buy List stocks. Before we get to that, let’s look at some recent news on the economy.

Best ISM Manufacturing Report in 37 Years

The stock market is closed today for Good Friday. This is one of the rare days when the stock market is closed while much of the world is still open. The government will release the March jobs report later this morning. Wall Street is expecting more job gains.

Earlier this week, the ADP payroll report showed that private-sector jobs increased by 517,000 last month. That’s the best month for jobs growth since September. On Thursday, the weekly jobless-claims report increased to 719,000. Last week’s report was 658,000, which is the post-pandemic low.

The other news was that the ISM Manufacturing Index jumped to 64.7. That’s a huge number. It’s the highest level since December 1983. Any number above 50 means that the factory sector of the economy is improving. This is very good news.

Bond yields continued to climb higher. I think this is a response to news of an improving economy. On Tuesday the yield on the 10-year Treasury bond got up to 1.765%. That’s the highest yield in 14 months. It also might be a guess that the Federal Reserve will cut off its massive bond buying sooner rather than later. I doubt that will happen soon, but some folks are clearly getting ready.

The Case for Consumer Staples

Earlier this week I hosted a webinar with Lawrence Hamtil, and one of the things we both agree on is that we’re big fans of consumer-staples stocks. Many new investors don’t realize what a profitable sector of the market this has been, and I believe it will continue to be so.

Unfortunately, these tend to be fairly dull stocks, but don’t let that fool you. There are many excellent stocks among the consumer staples.

First off, what do we mean by consumer staples? These are regular day-to-day items that you use like food, soft drinks and household items. Two such stocks on our Buy List are Hershey (HSY) and Church & Dwight (CHD). Yet folks new to investing get mesmerized by high-profile tech stocks and often pass over humdrum consumer staples.

There are several reasons why I’m a fan of consumer staples. Their businesses tend to be fairly simple. Not only can tech stocks be hard to follow, but many banks and insurance companies can be very opaque. The earnings reports of consumer staples can be quite easy to follow.

I also like that consumer staples tend to have strong brand names. In business, this means a lot because it signifies reliability to consumers. In the S&P 500, there are 32 stocks that are classified as consumer staples. Nearly half of them date back to the 19th century.

Consumer staples tend not to be capital-intensive businesses. This is a key point that investors overlook. In plain English, some businesses demand huge investments to keep the profits flowing. Semiconductors are a good example. Maintaining operating facilities or big R&D investments can suck up a lot of the cash flow. Toothpaste? Not so much.

Since these consumer staples are well established, they can afford to pay out generous dividends to shareholders. I also like that consumer staples tend to have fairly stable sales and earnings growth. That means they aren’t hurt so much during a recession. I believe sales of soup actually improve. Contrast that with industries like housing or energy which can see wild boom-and-bust cycles. Probably the best industry over the past several decades has been tobacco stocks. That’s about as stable as you can get.

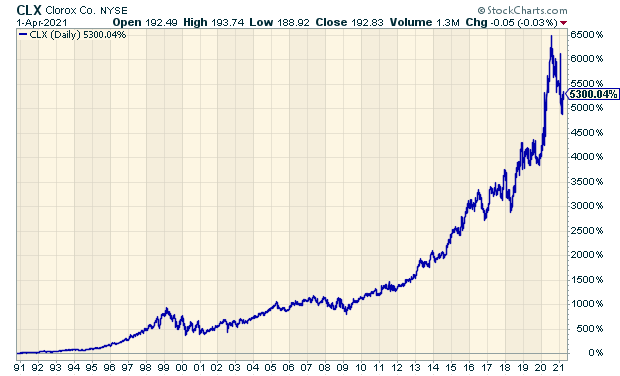

Not only are the business staples solid, but the stocks are also stable. This is why consumer staples are classic defensive stocks. They tend to lead the market during rough times. Here’s a great example. Check out this long-term chart of Clorox (CLX):

Would you have guessed that something so boring and everyday would have been such a big winner? The stock is up 54-fold in 30 years, and it’s just…Clorox! There are a lot of hedge funds that don’t come close to Clorox.

Outside of the ones I’ve mentioned, some high-quality consumer stables include Procter & Gamble (PG), Colgate-Palmolive (CL), Kellogg (K), General Mills (GIS), Coke (KO), Kimberly-Clark (KMB), McCormick (MKC), Pepsi (PEP), Hormel (HRL), Smucker (SJM) and Sysco (SYY). Or you can grab the whole bunch with the Consumer Staples ETF (XLP). Don’t overlook this valuable sector.

Now let’s look at the earnings report from FactSet.

Fact Set Earned $2.72 per Share

On Tuesday morning, FactSet (FDS) reported fiscal-Q2 earnings. This is for the quarter that ended on February 28. If you’re not familiar with FactSet, it’s a financial-data and -software company. It provides Wall Street with all the numbers we love to crunch.

For Q2, FactSet earned $2.72 per share. That’s a 6.7% increase over last year’s Q2. That’s pretty good, but it was two cents below Wall Street’s consensus. I’m hardly worried by a two-cent miss, but the stock took a hit after the report. At one point on Monday, FactSet was down more than 6%.

Let’s dig into some details. Quarterly revenue increased by 6% to $391.8 million. The key stat for FactSet is Annual Subscription Value (or ASV) plus professional services. For the quarter, that came in at $1.598 billion. I was pleased to see FactSet’s adjusted operating margin increase from 31.8% to 32.6%. That’s a good sign. The company also added $206 million to its share-buyback program, which brings the total to $350 million.

The most important news is that FactSet didn’t change its full-year earnings outlook. One positive change is that the company raised the low end of its ASV professional-services forecast.

“I am proud of how we executed this quarter, resulting in a solid first half of our fiscal 2021,” said Phil Snow, CEO, FactSet. “In our second quarter we saw a number of key wins validating our strategy for long-term growth. Our focus on digital transformation, content expansion and being an open platform continues to resonate with our clients as they navigate a rapidly evolving landscape.”

At the end of the quarter, client count stood at 6,103. User count increased by 6,659 to 153,355. Annual ASV retention was greater than 95%. When expressed as a percentage of clients, annual retention improved to 90%, year over year. Employee count reached 10,660. That’s an increase of 7.8% over the last 12 months. That’s a clear message of strength in a tough labor market.

CFO Helen Shan said, “We enter our fiscal second half with good momentum and remain focused on delivering significant value to our clients and shareholders.” During the quarter, FactSet bought back 221,959 shares for $71.5 million. That’s an average price of $322.11.

Let’s look at their guidance. The company expects earnings to range between $10.75 and $11.15 per share. (Their fiscal year ends on August 31.) I suspect that’s probably too low. For the first half of this year, FactSet has already made $5.12 per share. The company also sees revenue coming in between $1.57 billion and $1.585 billion. FactSet expects operating margins between 32% and 33%. These are good numbers.

Fortunately, the shares firmed up some on Thursday. I’m keeping our Buy Below on FactSet at $340 per share.

Buy List Updates

I mentioned earlier that little Miller Industries (MLR) is already racking up some big gains for us. Miller is up 23% so far this year. Stepan (SCL) is our second-smallest stock, and it’s more than five times the size of Miller. If you want to learn more about the company, here’s an old profile of Bill Miller. This week, I’m raising our Buy Below on Miller to $50 per share.

We finally had our 3-for-1 stock split for Sherwin-Williams (SHW). This means stockholders now have three times as many shares while the share price falls by two-thirds. SHW hit a new 52-week high earlier this week. With the stock split, our Buy Below falls to $250 per share.

Shares of Broadridge Financial Solutions (BR) have improved in recent weeks. This is one of our quieter companies, and I should write about it more. They really don’t make a lot of news, which is fine by me. Broadridge beat its last earnings report by three cents per share. The CEO said he expects sales and earnings growth to be at the “higher end” of guidance. I’m raising our Buy Below price on Broadridge to $165 per share.

Abbott Laboratories (ABT) said this week that the government gave the greenlight for BinaxNOW, which is Abbott’s at-home COVID-19 test. The company hopes to start shipping it to retailers soon. The test takes about 15 minutes. People will be able to buy it at stores or online without a prescription. Abbott said it doesn’t know the price point yet, but it will probably be under $10. The company currently sells about 50 million units a month. In August it was approved for use by medical professionals.

That’s all for now. The stock market is closed today for Good Friday. The March jobs report will be out later this morning. There’s not much in the way of economic news next week. One item that I’ll be looking out for is the minutes from the Federal Reserve’s last meeting. That will be due out on Wednesday afternoon. On Thursday, we will get another initial jobless-claims report. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Morning News: April 2, 2021

Eddy Elfenbein, April 2nd, 2021 at 7:04 amChina Puts Limits on Foreign Banks, Worrying Businesses

Why the Markets Need a Strong Government Hand

The Bull Market Roulette Wheel Just Keeps Landing on Winners

Mortgage Firms Warned to Prepare for a ‘Tidal Wave’ of Distress

God and Man Collide in Bill Hwang’s Dueling Lives on Wall Street

That Spotty Wi-Fi? There’s $100 Billion to Fix It.

TSMC to Invest $100 Billion to Increase Semiconductor Output

An Accidental Disclosure Exposes a $1 Billion Tax Fight With Bristol Myers

BTS’s K-Pop Agency Buys Bieber Manager’s Firm for $1 Billion

Robocalls May Get Worse Soon, and You Can Blame Facebook

Brooklyn Man Accused of Using Information from Bloomberg Reporter for Insider Trading

Nike Scores Victory in Legal Battle Against Lil Nas X’s ‘Satan Shoes’

Michael Batnick: The Generational Wealth Gap

Ben Carlson: The Problem With Timing The Housing Market

Be sure to follow me on Twitter.

-

The S&P 500 Breaks 4,000

Eddy Elfenbein, April 1st, 2021 at 1:50 pmThe S&P 500 finally broke 4,000 today. The index has been as high as 4,012.75 today.

We had mixed economic news this morning. The weekly jobless claims report increased to 719,000. Last week’s report was 658,000 which is the post-pandemic low. The big jobs report comes out tomorrow,

The other news was that the ISM Manufacturing Index jumped to 64.7. That’s a huge number. It’s the highest level since December 1983.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His