CWS Market Review – May 25, 2021

“I can calculate the motion of heavenly bodies, but not the madness of people.”

– Isaac Newton

(This is the free version of CWS Market Review. Don’t forget to sign up for the premium newsletter for $20 per month or $200 for the whole year. Thank you for your support.)

Finance and Physics Envy

In this week’s issue, I’ll let you in on a little secret about finance. Finance suffers from a bad case of physics envy. The greats of physics have come up with all these cool equations that help explain the world. Finance wants in on the action.

As a result, Finance has come with its equations as well. The problem is that the equations are good but they’re not perfect, and that matters a lot in finance.

Finance would have you believe its practitioners are calm and rational. They simply follow the math. But sometimes numbers only tell you so much. I’ll give you an example. During the 1960s and early 1970s, there was a tremendous bull market in a select group of stocks that the press named the Nifty Fifty. Some classic Nifty 50 names were Coke, McDonalds, Disney, Polaroid, Eastman Kodak and IBM.

There was an odd connection to many of these stocks. They were seen as companies that promoted social harmony. It may seem somewhat naïve today but that was an important concern during the tumultuous 1960s. Think of the famous Coke ad of young people from different areas of the world singing the praises of Coca-Cola.

The Nifty 50 were considered “one decision” stocks. You just had to buy and hold on. The idea of social harmony gripped Wall Street. The valuations of the Nifty 50 soon left orbit. At one point, their collective P/E ratio was twice that of the rest of the stock market. The 1973-74 bear market was particularly hard on the Nifty 50. Bear in mind that the crash was the worst since 1929.

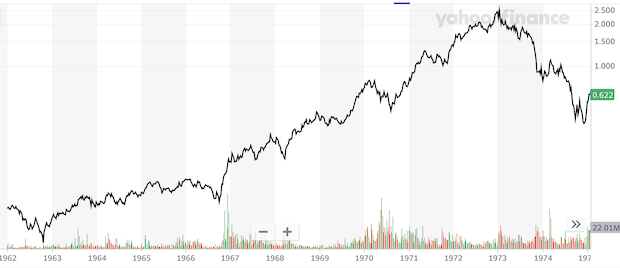

Here’s a look at Disney. Adjusted for splits, the stock went from 10 cents at its 1966 low to $2.50 by its 1973 high.

Interestingly, several of the Nifty 50 names have outperformed the market since 1972. So even paying a premium worked out after a long period. My point is that a non-numerical theme can take hold and override any concern about valuations.

This happened during the dot-com bubble when the concern was the first-mover advantage. Everyone, I recall being told, had to be aware of this. For example, the only reason Microsoft became the big winner wasn’t because they were good. No, it was that they were first and they made the industry standard.

This idea also goes by the name Winner-Take-All. (That was the name of a book in the 1990s, and the phrase turned up in Bill Clinton’s campaign speeches.)

The idea is that an early entrant could establish an industry standard which remains in place simply because it’s already there. It’s not better—it’s just there. I can’t tell you how many times I was told that some Internet stock was just like the QWERTY keyboard. There was even a magazine called The Industry Standard. In 2000, it sold more ad pages than any magazine in America. Unfortunately, the magazine folded in August 2001.

Here’s a good exercise. Imagine a roomful of people. I tell every person to choose a number between zero and 100. I say that I’ll give a cash prize to the person whose number is closest to two-thirds of the average of all the guesses.

Well, a smart person would assume the average of everyone’s guess is around 50. Therefore, two-third of that is around 33.

Easy? Not exactly. Everyone else is aware of the rules so they’ll say 33 as well. Now we’re caught up in a cycle of smaller guesses and still smaller two-thirds. Eventually, it will hit zero. (I believe studies of this game show the winning bid is around 15.)

This exercise highlights an important part of finance. Market participants know they’re part of the game. Their feelings play an important role in determining the price. In physics, gravity doesn’t know it’s being watched.

Again, numbers only tell you so much. You’ve probably heard stories like this. An art dealer has a painting she can’t move. It hangs on the wall day after day. She then triples the price, and it sells the next day. Even if it’s not literally true, it’s certainly believable.

Academics who have studied horse-racing bets have found that the absolute worst pony to bet on is the longshot. It’s obvious to me why. Because people want to bet on the longshot. (Duh!) It’s the same as the painting. Price becomes the issue. As a result, people over-bet on the longshot which unnaturally lowers its odds.

Does it make sense? Of course not. This isn’t rocket science. It’s much harder than that.

Stock Focus: Veeva Systems

I like to say that the only thing better than owning a monopoly is owning a near-monopoly. After all, the real thing tends to draw too much attention.

That leads to me to Veeva Systems (VEEV) of Pleasanton, CA. While Veeva isn’t technically a monopoly, it enjoys many of the advantages that a monopoly has. Veeva is a cloud-computing company that’s focused on pharmaceutical and life sciences industry applications. The company was founded in 2007 by Peter Gassner and Matt Wallach. Gassner has become a billionaire along the way and he currently serves as CEO.

What Veeva does is it helps drug companies capture clinal trial data and follow regulations while allowing their sales force to be more effective. The company has been very successful. In 2019, Veeva became the fifth software-as-a-services company to join the billion-dollar revenue club. The key is that Veeva brings the benefits of cloud computing to a single industry.

The age of Covid has been critical for Veeva. In order to run all those clinical trials, it normally involves visiting doctors and researchers. Veeva allows that to happen virtually. That places Veeva’s services in great demand. A particular strength is that Veeva helps its clients comply with government regulations.

I have to confess that watching Veeva has become somewhat entertaining because Wall Street consistently predicts that Veeva’s remarkable run is about to come to an end. Yet each quarterly earnings report easily dispels that notion.

Veeva has now beaten Wall Street’s consensus for at least the last 16 quarters in a row. (It could be even longer, but that’s as far back as my data goes.)

The next earnings report (their fiscal Q1) is due out this Thursday, May 27. For Q1, Veeva expects total revenues between $408 and $410 million and earnings between 77 and 78 cents per share. That’s unusually narrow guidance. For the entire year, Veeva sees revenues between $1.755 and $1.765 billion and earnings of $3.20 per share.

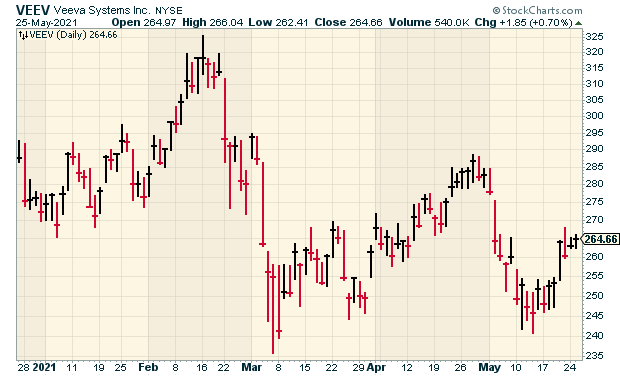

Veeva’s stock has not done particularly well compared with the overall market. The stock has lagged since October. Veeva has been ganged up on more than once by a nest of short-sellers. Their mantra has been, “Sure, Veeva’s had some impressive growth until now but the total addressable market isn’t that large.” I think that’s way off base.

Now let’s get to some truly remarkable stats. Veeva maintains gross margin in excess of 70%. That’s very impressive. Their operating margins are consistently over 25% and the company doesn’t carry any long-term debt. That’s a testament to how strong a position Veeva has in its market. Peter Gassner has referred to Veeva as having delivered what he calls “30/30” quarters, meaning 30% growth and 30% operating margins.

While I like Veeva a lot, I’m not a fan of the share price. Even if we assume the company’s optimistic forecast is correct (and it probably is), that means Veeva is currently trading around 80 times this year’s earnings estimate. That’s about five times what many other stocks go for.

I understand the need to pay for growth, but investors must keep things in perspective. Even if Veeva continues to cream estimates, the stock is still very, very pricey.

That’s why this earnings report is so important. If traders react badly, and they often do, it could knock the shares down. Personally, I’d love to see Veeva with a lot lower share price.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

P.S. Don’t forget to sign up for our premium newsletter.

Posted by Eddy Elfenbein on May 25th, 2021 at 6:29 pm

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His