Archive for May, 2021

-

Morning News: May 5, 2021

Eddy Elfenbein, May 5th, 2021 at 6:58 amAs Cars Go Electric, China Builds a Big Lead in Factories

Can the Biden Agenda Fix Middle America’s Deepest Problem?

Facing Chips Shortage, Biden May Shelve Blunt Tool Used in COVID Fight

U.S. Chip Startups, Long Shunned in Favor of Internet Bets, Stir Excitement Again

Biden’s Fed Choices Add Uncertainty for Inflation-Wary Investors

U.S. Births Drop to the Lowest Level Since the 1970s

Pfizer Reaps Hundreds of Millions in Profits From Covid Vaccine

Bill and Melinda Gates’ Other Partnership Is Too Big To Fail

The Untold Story of How Jeff Bezos Beat the Tabloids

Snapchat Can Be Sued For Role In Fatal Car Crash, Court Rules

Nick Maggiulli: Two Bets for the Next Decade

Ben Carlson: When Does It Make Sense to Take Profits From Your Biggest Winners?

Howard Lindzon: The New Builders

Michael Batnick: The Biggest Threat to Tech

Be sure to follow me on Twitter.

-

CWS Market Review – May 4, 2021

Eddy Elfenbein, May 4th, 2021 at 7:52 pm(This is the free version of CWS Market Review. Don’t forget to sign up for the premium newsletter for $20 per month or $200 for the whole year. Thanks for your support.)

The Best Earnings Season Ever!

The Q1 earnings season is shaping up to be an outstanding earnings season for Corporate America.

The Wall Street Journal notes that this season’s “beat rate,” meaning how many companies are reporting results above Wall Street’s consensus, is running at 87%. That’s the highest since they started tracking these numbers in 1994. The long-term average is 65%.

Side note: That last stat says a lot about how Wall Street thinks. You’re expected to beat expectations. You’ll notice how often companies that merely meet expectations see their share prices drop. As I like to say, when they meet expectations, no one sees it coming. When in doubt, the market’s reaction is the real judge.

Once, when I was just getting started in this business, I was reading a particularly confusing earnings report. I asked one of the old-timers if the company had beaten or missed expectations. He said, “I’ll let you know at 9:31,” referring to just after trading started.

Not only are companies beating the Street, but they’re doing it by a lot. Historically, the average earnings beat has been 3.6%. This season, the average beat is 22.8%. This looks to be Wall Street’s best earnings growth in more than 10 years. Of course, that’s really due to throttling the economy a year ago and then letting go. Plus, the stimulus checks are helping out. I’ll have more on that in a bit.

I’m pleased to report that our Buy List is doing better than the rest of the market. Through Tuesday, 14 of of 15 Buy List stocks have beaten expectations. Some have beaten by a lot. Both Danaher (DHR) and Moody’s (MCO) beat expectations by 44%. Sherwin-Williams (SHW) beat by 25% and Stepan beat by 27%. Lots of our stocks are responding well. We had new highs today from AFLAC (AFL), Broadridge Financial Solutions (BR), Hershey (HSY), Sherwin-Williams (SHW) and Stepan (SCL).

There’s still an important rotation unfolding. Tuesday was the sixth day in a row that the NASDAQ trailed the S&P 500. This looks to be the continuation of a trend that started in mid-February but had stalled out somewhat by March. Now it’s moving again. The simple fact is that a lot of the tech sector is too expensive.

(Did I mention I have a premium newsletter where I go into more detail on our portfolio? OK, good.)

What to Do With All This Cash?

One of the interesting side effects of the pandemic is that companies are now flush with cash. As the economy started to lock down a year ago, many companies rushed to borrow money to ride out the storm.

So now we’re at a crossroad. With rates so low, there’s no rush to pay off that debt. That’s leading more companies to raise dividends or expand buybacks. The other choice is that more companies are willing to use that cash to make acquisitions.

Total debt loads for U.S. companies outside the financial industry rose 10% in 2020 to $11.1 trillion, according to the Federal Reserve, in part because lower interest rates have made it less burdensome for many companies to shoulder more debt. So far, corporations have largely been hoarding the money rather than spending it. Non-financial companies in the S&P 500 index that reported results before March 31 had about $2.13 trillion of cash and marketable securities on their books in the most recent quarter, up more than 25% from a year earlier, according to data compiled by Bloomberg.

Personally, I get a little nervous when companies have too much cash. They’re liable to do something with too little forethought. Peter Lynch referred to this as the Bladder Theory of Corporate Finance. Recently there were rumors that FactSet, one of our stocks, might be bought out. I expect to see more acquisitions.

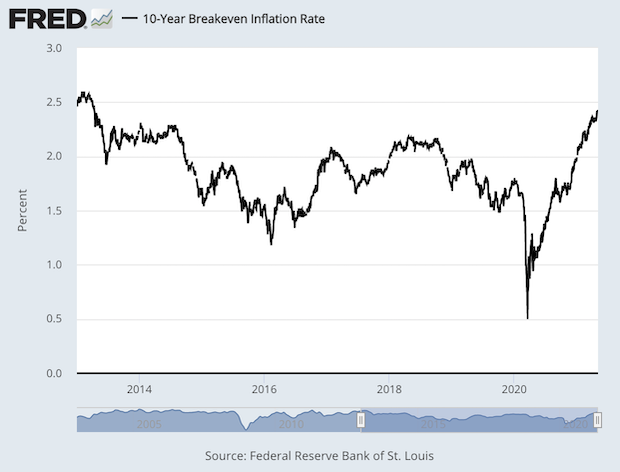

This leads us to the Federal Reserve. Chairman Jerome Powell has made it clear that the Fed has no plans to raise rates anytime soon. The Fed moved early and aggressively. Investors have gotten used to the idea that we’re going to see more inflation sometime soon. FactSet reported that inflation is being mentioned in more earnings calls than at any point in the last 10 years.

In addition to lower interest rates, the Fed has also had a massive bond-buying program. Each month, the Fed buys $80 billion in Treasuries and $40 billion in mortgage-backed securities. Now more economists on Wall Street believe that the Fed will announce a tapering of these purchases before the end of the year. This is a noticeable change compared with a few months ago. It may be related to more fiscal stimulus from Washington. One possible unveiling forum could be in late August at the Fed’s annual conference in Jackson Hole, Wyoming.

For now, I would say that I’m slightly but not strongly in the doubter camp. I’m inclined to believe that the Fed will keep buying as many bonds as it can. The key is to watch for any incipient signs of inflation.

Here’s a look at the 10-year breakevens, which is the market’s take on inflation for the next 10 years.

Household finances are also on the mend. This week we learned that household spending rose by 21.2% in March. That’s an all-time record. We have the stimulus checks to thank. Check out this stat: The stimmies made up $3.948 trillion of the total $4.213 trillion rise in personal income during March.

The most recent Case-Shiller Index showed that home prices are rising at the fastest rate in 15 years. In the 12 months ending in January, U.S. home prices increased by 11.2%. Lowe’s said it’s going to hire 50,000 workers. Trex (TREX) is up 29% for us this year. That’s after gaining 86% last year.

This boom is distorting the entire market. The number of buyers has far outpaced the number of sellers. As a result, the supply of homes is at a record low. In February, the number of homes for sale was down 30% from last February. The housing boom has actually led to a shortage of chlorine. The difference this time is that the banking system is far more resilient than it was 15 years ago.

Stock Feature: Simulations Plus (SLP)

Here’s another example of a neat company that’s not well known. Simulations Plus (SLP) is a small company that I’m a big fan of. Not many people know about this one. The market cap is just over $1 billion and only three analysts follow it. Unfortunately, the stock price is very high. Too high in fact, but it’s certainly one to keep an eye on. Simulations Plus makes software that lets drug companies simulate tests of their products in the virtual world before using any human or animal test subjects.

That’s a big cost-saver for drug companies. Simulations Plus helps streamline the R&D process by making it faster and more efficient. Not only is this cost effective, but it also helps drug companies in dealing with time-consuming regulatory hurdles.

In fact, there are times when the results from SLP’s products have allowed companies to waive clinical studies. The cost savings are substantial. This means drug companies don’t have to deal with the time and expense of recruiting test subjects and analyzing test results.

By using SLP’s software, drug companies can experiment with many variables like fine tuning dosage amounts. Companies can also see potential harmful side effects. Another important factor is that companies can identify treatments that have no benefits.

In healthcare, cost control is a major issue. That’s why SLP’s products are in such heavy demand. A great business to buy is one that helps other companies control their costs.

In many ways, I think what Simulations Plus does for pharmaceutical researchers is closely akin to what Ansys (ANSS) does for engineers. By sitting at a computer, an employee can efficiently iron out a lot of kinks before experimenting in the real world. Simulations Plus is also branching out from their core customer base of drug companies. They work with consumer products companies to see the side effect of things like pesticides.

There’s good news lately! The stock has been getting beaten up. (I love when companies I like but don’t own get dinged by the market.) Today was SLP’s seventh daily decline in a row. The last two earnings reports were fine, but nothing great. SLP beat by one penny per share each time. In February, SLP got above $90 per share. Lately, it’s around $57.50 per share.

The financial numbers are very impressive. Over the last ten years, Simulations Plus has maintained organic growth of 12% to 14%. Impressively, they’ve done this without carrying much debt. Sales growth is strong, 27% last quarter. Gross margins are running at 78%.

The problem is price. Ballpark guess, SLP should earn about 55 cents per share this fiscal year and 65 cents per share next year. That means the stock is going for something like 87 times next year’s earnings. That’s way too high.

Simulations Plus currently pays out a quarterly dividend of six cents per share. That’s not that much but it’s a sign of confidence from management. The company has consistently paid out a dividend for the last nine years. While SLP is too rich for me, if the stock ever drops below $40, it could be a very good buy.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

P.S. Don’t forget to sign up for our premium newsletter.

P.P.S. And support the ETF!

-

Why I Like Disney

Eddy Elfenbein, May 4th, 2021 at 8:58 amI saw this posted by Josh Brown. This is basically a three-minute clip explaining why I’m such a fan of Disney’s business.

-

Broadridge Earns $1.76 per Share

Eddy Elfenbein, May 4th, 2021 at 7:22 amThis morning, Broadridge Financial Solutions (BR) released a very good earnings report and the company increased its guidance. The company reported fiscal Q3 earnings of $1.76 per share. That beat Wall Street’s consensus by eight cents per share. Both operating income and recurring revenue grew by 8%.

“Broadridge delivered strong third quarter results, including 8% recurring revenue growth and 8% Adjusted Operating income growth,” said Tim Gokey, Broadridge’s Chief Executive Officer.

“Our results continue to be propelled by powerful long-term trends including increased digitization, mutualization, and the democratization of investing. As a result, we continue to invest in our products and technology platforms. These investments, along with the pending acquisition of Itiviti, will further strengthen our ability to drive increased value to our clients and growth to our shareholders,” Mr. Gokey continued.

The best news is that Broadridge raised its 2021 guidance. Previously the company saw recurring revenue growth coming in the top end of its 3% to 5% range. Now Broadridge sees recurring revenue growth of 8% to 10%.

For total revenue, the company had previously projected the higher end of its 1% to 4% range. Broadridge also sees total revenue growth of 8% to 10%.

On the earnings call, Broadridge said it sees earnings growth for this year of 11% to 13%. The previous guidance was 6% to 10%. Since BR made $5.03 per share last year, the old guidance implied earnings of $5.43 to $5.53 per share for this year. Going by the new range, BR expects earnings of $5.58 to $5.68 per share.

The company has already made $3.47 per share for the first three quarters of this fiscal year, so the new guidance implies fiscal Q4 (June) earnings of $2.11 to $2.21 per share. Wall Street had been expecting $2.13 per share.

-

Morning News: May 4, 2021

Eddy Elfenbein, May 4th, 2021 at 7:02 am‘We Cannot Wait Until June’: Greece’s Reopening Gamble

The Booming U.S. Recovery Is Leaving Some Communities Completely Behind

Biden Tax Rule Would Rip Billions From Biggest Fortunes at Death

Is It Over Yet? Still No Recession End Date as U.S. Economy Hums Along

Rotation Out of Megacaps Drags Nasdaq Futures Lower

Infineon Expects 2.5 Million ‘Lost Cars’ Due to Chip Shortage

Oil Giant Saudi Aramco Beats Estimates with 30% Hike in First-Quarter Profit

Buffett’s ESG Snub Risks Alienating Wall Street

The Big Stakes in the Gates Divorce

Jeweler Pandora Takes Ethical Stand Against Mined Diamonds

Eleven Madison Park, One of the World’s Best Restaurants, Is Going Vegan

Mr. Beast, YouTube Star, Wants to Take Over the Business World

Ben Carlson: The Difference Between Managing Money and Managing Investors

Joshua Brown: Disney’s Not Playing Games

Howard Lindzon: Momentum Monday: Much Ado About Inflation

Jeff Carter: Questions on Exchanges & Crying About Competition

Be sure to follow me on Twitter.

-

April ISM Disappoints

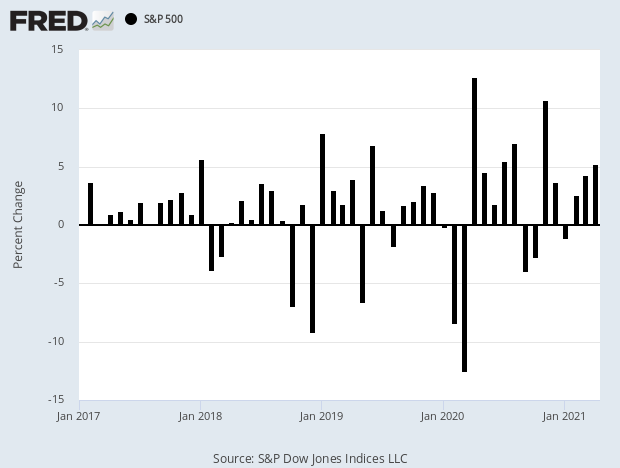

Eddy Elfenbein, May 3rd, 2021 at 10:23 amApril is on the books and the S&P 500 gained 5.24% last month. With dividends, the index was up 5.34%. That’s the third monthly gain in a row, and 10th of the last 13.

This is the first week of the month and that means we get several important economic reports, concluding on Friday with the jobs report. This morning, the ISM Manufacturing came in at 60.7. That’s a good number but it was below expectations of 65.

Construction spending rose by 0.2%. Wall Street had been expecting 1.8%. The stock market is up so far this morning and it’s not far from a fresh all-time high.

This is an outstanding earnings season. Right now, 87% of companies are beating expectations. That’s the highest ever recorded since they started keeping track in 1994. The historical average is 65%. (That’s right, you’re expected to beat expectations.)

Going back to 1994, companies have beat earnings estimates by an average of 3.6%, according to Refinitiv. But this earnings season, companies have posted profits that have been 22.8% above expectations.

-

Morning News: May 3, 2021

Eddy Elfenbein, May 3rd, 2021 at 7:09 amEthereum Breaks Past $3,000 to Quadruple in Value in 2021

U.S. Household Income Surged by Record 21.1% in March

Biden’s Proposals Aim to Give Sturdier Support to the Middle Class

Biden’s Tax-and-Spend Plans Are Big, But Wealth Gaps Are Bigger

Fourth Stimulus Check? Billionaires’ Pandemic Profits Could Easily Fund Two More Payments

Albuquerque Is Winning the Streaming Wars

Verizon Near Deal to Sell Yahoo and AOL

Dell Reaches Deal to Sell Boomi to TPG, Francisco Partners

Tesla, Under Scrutiny in China, Steps Up Engagement With Regulators

Berkshire Hathaway Faces Headwinds As Shareholders Look To Its Future

Warren Buffett Says Greg Abel Is Likely Successor at Berkshire

Has Online Retail’s Biggest Bully Returned?

LSD, Cargo Shorts and the Fall of a High-Flying Tech CEO

Ben Carlson: Owning a Car vs. Leasing a Car & The U.S. Stock Market SHOULD Be In a Bubble

Michael Batnick: Animal Spirits: The Sports Memorabilia Boom & They Said What?

Howard Lindzon: Smart People With Bad Takes…Bitcoin, Robinhood and Price Pays

Be sure to follow me on Twitter.

-

Sherwin-Williams as Inflation Hedge

Eddy Elfenbein, May 1st, 2021 at 5:05 pmFrom Barron’s:

Either way, prices are going higher—and Sherwin-Williams (SHW) should benefit. The paint manufacturer’s stock was little changed this past week after reporting a profit of $2.06 a share, well above forecasts for $1.64, on sales of $4.66 billion, topping expectations for $4.51 billion. But it was its comments on pricing that really caught investors’ attention.

“Our previously announced 3% to 4% price increase to U.S. and Canadian customers became effective Feb. 1, before the supply-chain disruption the industry began experiencing later in the quarter,” Sherwin-Williams CEO John George Morikis said on the company’s conference call this past Tuesday. “We likely will need to take further pricing actions if raw material costs remain at these elevated levels.”

Baird analyst Ghansham Panjabi, who rates Sherwin-Williams a Buy, notes that it is likely waiting to see just how much its costs rise so it doesn’t have to raise prices more than once more this year. If the company can raise prices without hurting sales, it can keep growing its profit margin even as input prices rise. Panjabi raised his price target on the stock to $300, up about 10% from Friday’s close of $273.87, calling it “the ultimate hedge toward inflation.”

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His