CWS Market Review – June 29, 2021

This is the free version of CWS Market Review. If you have a chance, please sign up for the premium newsletter for $20 per month or $200 for the whole year.

The premium version contains more detailed analysis and I cover our Buy List stocks in greater depth.

One more thing. I’ve added a new special report that’s only for premium subscribers, “How Not to Get Screwed on Your Mortgage.” This is a great report and it has my five pointers on never getting taken advantage of. Join us today! Now, let’s look at this amazing market.

The S&P 500 closed a little bit higher today marking its 33rd new high of the year. That’s about one in every four trading days this year. Since its low 15 months ago, the stock market has nearly doubled. Charlie Bilello, one of my favorite market stats guys, notes that going back to the beginning of 2013, the index has now made 309 new all-time highs.

I used to call this the Honey Badger market for its ability not to care. Now I may call it the Rita Coolidge market. Nothing but all-time highs.

How much further can it run? Eh, that’s hard to say but there’s no obvious reason we’re due for a plunge. Tomorrow is the final trading day of Q2 and the first half of 2021. So far, it’s been a great year for stock investors. What’s interesting is that a strong first half of the year has often been a good omen for a strong second half of the year. You might think it would revert to the mean, but that’s not necessarily the case.

Ryan Detrick of LPL Financial points out that when the S&P 500 gains more than 12.5% in the first half of the year, the median gain for the second half is close to 10%. That’s nearly doubled the other years. In other words, strong gains often lead to more strong gains. Rallies build on themselves. Of course, that will eventually lead to a breaking point.

The Bull Market for Crap

While I doubt we’re at a breaking point just yet, there’s been a disturbing trend of a lot of terrible companies turning to the public market to raise tons of cash. I suppose that’s how markets are designed to work, but it’s a little unsettling that’s so many unsound companies can effortlessly rake in so much from investors.

Bloomberg notes that since March, almost 100 money-losing companies have raised money via secondary offerings. That’s twice the number of profitable companies.

According to Sundial Research, over the past 12 months, 750 unprofitable companies have turned to the secondary market. That’s the widest margin between money-making and money-losing firms in nearly 40 years.

There may be a few factors driving this phenomenon. For one, the higher-quality companies may already be flush with cash thanks to a strong market, a recovering economy and low interest rates. As the pandemic broke, many companies were quick to raise cash so they had enough protection to ride out the storm. Now that rates are still low, it’s probably not worth it to pay off those credit lines. That could be leading to a wave of buyouts.

Also, the booming market for lower-quality stocks adds extra incentive for these companies to raise money. That’s just natural supply and demand. I can’t blame low-quality companies for taking advantage of a good market for them. Several of the meme stocks already have raised money.

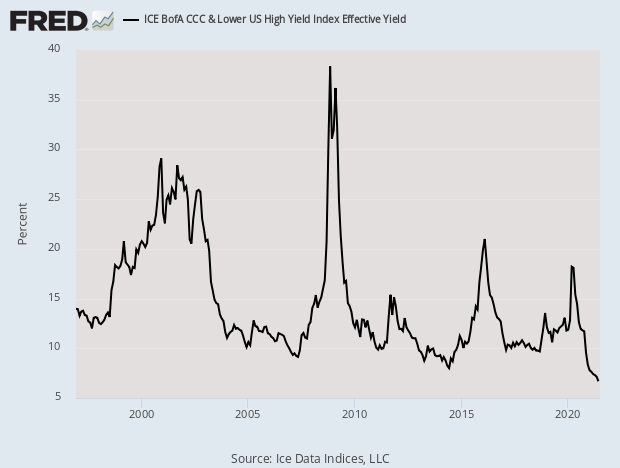

This isn’t just happening in the stock market. Junk bonds are now yielding just over 4%. That’s an all-time low. In fact, the spread between junk debt and investment-grade is the narrowest it’s been in over a decade. Crap is in, and the crappier the better.

Here’s a long term chart of junk bonds. Sorry, I mean “high yield” bonds.

Of course, it’s important that low-quality sectors have their day in the sun. That’s how marginal areas can thrive. However, our concern is when it overshoots any reasonable expectations. Some low-quality companies will improve even though the odds are against them.

This raises some interesting questions about investment analysis. So much of valuation analysis works on a disconnect between price and value. But what’s interesting is how price can impact value.

Let me explain what I mean. Is AMC a good company? Not at all. But that didn’t stop them from raising a ton of cash thanks to an inflated stock price. Heck, if folks are going to throw money your way, why not take it? All that new cash is a big help to AMC’s business. As a result, the business is truly more valuable. AMC’s finances are better. A change in price caused a real increase in value. In fact, thanks to the new cash, AMC got a credit-rating upgrade.

Investor George Soros wrote about this process in his book, The Alchemy of Finance. Soros calls the interplay between price and value the General Theory of Reflexivity. (I tried to read the book a few times and didn’t get far.)

I suspect that the run for low-quality may be nearing an end. At the Financial Times, Michael Mackenzie writes:

Other strategists are looking at the merits of shifting towards “quality” companies that are well managed with strong balance sheets and steadily increasing dividends. After the stirring rebound of lower quality companies that populate the value stock universe, these are looking more attractive on a relative basis.

BlackRock’s benchmark of high-quality companies is currently trading at its largest discount to the Russell 1000 index in more than two decades. That reflects how investors have sought recovery stories in companies that were hit hard by lockdowns in the leisure, travel and retail industries.

“We are still very value tilted, but we are starting to dial that back and look at the quality trade,” says Tony DeSpirito, chief investment officer of US fundamental active equity at BlackRock. While he expects that value and cyclical shares have not fully exhausted their run, the clock is ticking.

Once the economy shifts into a mid-cycle phase, history shows that quality shares start outperforming.

I wouldn’t be surprise to see a turn to quality sometime soon.

Facebook Becomes a Trillionaire

Yesterday, shares of Facebook (FB) rallied after a judge dismissed two anti-trust complaints. The stock gained more than 4% and FB’s market cap broke the $1 trillion barrier.

Facebook becomes the fifth member of the “four comma” club. The others are Apple, Amazon, Google and Microsoft. What’s most interesting about Facebook is that it made the journey in the fastest time. The company was founded, famously, in Mark Zuckerberg’s dorm room 17 years ago.

I’m reminded of the scene in The Social Network when Sean Parker says, “one million dollars isn’t cool. You know what’s cool? A billion dollars.” Now Facebook is at one thousand times that.

I found an interesting tidbit at Bloomberg. There are currently 58 Wall Street analysts who follow Facebook. Among those, 49 have it rated as a buy. I can’t imagine what the 49th buy opinion has to say that hasn’t been covered by any of the other 48. What’s the point of analysis if everyone agrees with each other? Just three analysts rate Facebook a sell.

Speaking of the ultra-wealth, Morgan Housel tweets that Steve Ballmer’s net wealth is about $100 billion. That’s especially impressive because he wasn’t a founder of Microsoft. He was employee #30. Also, Ballmer hasn’t sold as much stock as Bill Gates has. I’m pretty sure that Gates would be the richest person in the world if he had held onto all his shares.

But I find Ballmer’s enormous wealth fascinating because so much of it came after he left Microsoft. Here’s a chart of MSFT since Ballmer left:

Wow! Shares of MSFT didn’t perform terribly well when Ballmer was CEO. He came in for a lot of criticism and some prominent folks on Wall Street urged him to step down. It’s a tough job, so I’m not going to pile on.

Since Satya Nadella took over as CEO seven years ago, the stock has been a big winner. No one has benefitted as much as Steve Ballmer. That’s an impressive achievement to profit off of getting replaced. He’s now one of the wealthiest people who has ever lived. In any event, Ballmer’s Clippers are trailing the Suns 3-2.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

Posted by Eddy Elfenbein on June 29th, 2021 at 8:04 pm

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His