Archive for June, 2021

-

Morning News: June 17, 2021

Eddy Elfenbein, June 17th, 2021 at 7:09 amRace for a Global Tax Revolution Faces Hurdles in Final Stretch

How Will EU Ban on 10 Banks from Bond Sales Impact Markets and Banks?

Bitcoin Beach: What Happened When an El Salvador Surf Town Went Full Crypto

‘Financial Surrealism’: Lebanese Opt for Beer Over Banks

Fed Officials Rattle Rate-Hike Saber as Price Pressures Surprise

The Economic Gauges Are Going Nuts. Jerome Powell Is Taking a Longer View.

The U.S. Averted One Housing Crisis, but Another Is in the Wings

The Commodities Boom Is Luring Criminals to Make Bigger and Bolder Scores

Stung By Pandemic and JBS Cyberattack, U.S. Ranchers Build New Beef Plants

He Warned Apple About the Risks in China. Then They Became Reality.

Microsoft Names Satya Nadella as Chairman

GM Raises Electric-Car Bet, Will Add More Battery Factories

Older Americans Are on the Front Line of the Student Debt Crisis

Joshua Brown: This Is Bad News How?

Michael Batnick: Animal Spirits: Fed Apologist

Be sure to follow me on Twitter.

-

CWS Market Review – June 16, 2021

Eddy Elfenbein, June 16th, 2021 at 7:07 pm(This is the free version of CWS Market Review. Don’t forget to sign up for the premium newsletter for $20 per month or $200 for the whole year. The premium version contains more detailed analysis and I cover our Buy List stocks in greater depth. Join us today!)

I wanted to send you an update on today’s Federal Reserve meeting. This was an important meeting and the stock market dropped for the second day in a row. This was actually the largest daily drop for the S&P 500 in a month. That probably says more about the placidity of the last month than it does about today.

As I’ve discussed before, the Fed’s decisions are becoming increasingly important to us as investors. That’s because during the pandemic, the central bank took extraordinary measures to help the economy. Not only are interest rates near 0% but the Fed has been buying $120 billion in bonds every month.

Now that the economy is improving and life is returning to something resembling normal, there’s growing pressure on the Fed to pare back its enormous stimulus. Adding to this has been higher inflation which hasn’t been a major factor in the U.S. for 40 years.

I should warn you that central bankers aren’t big fans of plain English. They prefer to speak in the arcane language of Fedspeak. Fortunately for us, dear reader, your humble editor is well-versed in Fedspeak and I’ll help translate for you.

Having said that, here’s today’s statement:

The Federal Reserve is committed to using its full range of tools to support the U.S. economy in this challenging time, thereby promoting its maximum employment and price stability goals.

Progress on vaccinations has reduced the spread of COVID-19 in the United States. Amid this progress and strong policy support, indicators of economic activity and employment have strengthened. The sectors most adversely affected by the pandemic remain weak but have shown improvement. Inflation has risen, largely reflecting transitory factors. Overall financial conditions remain accommodative, in part reflecting policy measures to support the economy and the flow of credit to U.S. households and businesses.

The path of the economy will depend significantly on the course of the virus. Progress on vaccinations will likely continue to reduce the effects of the public health crisis on the economy, but risks to the economic outlook remain.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. With inflation having run persistently below this longer-run goal, the Committee will aim to achieve inflation moderately above 2 percent for some time so that inflation averages 2 percent over time and longer term inflation expectations remain well anchored at 2 percent. The Committee expects to maintain an accommodative stance of monetary policy until these outcomes are achieved. The Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee’s assessments of maximum employment and inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time. In addition, the Federal Reserve will continue to increase its holdings of Treasury securities by at least $80 billion per month and of agency mortgage backed securities by at least $40 billion per month until substantial further progress has been made toward the Committee’s maximum employment and price stability goals. These asset purchases help foster smooth market functioning and accommodative financial conditions, thereby supporting the flow of credit to households and businesses.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals. The Committee’s assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

My Take on Today’s Fed Meeting

So, what the heck does all this mean? Let’s start at the top. First, the Fed said that economic activity has strengthened. The Fed also didn’t make any changes to interest rates. The target for the Fed funds rate is still near 0%. The Fed is also going to continue to buy $80 billion a month in Treasuries and $40 billion a month in mortgage-backed securities. That’s a gigantic amount. By the way, the vote today was unanimous.

I think it’s likely that at some point soon, the Fed will start tapering its bond buying. Meaning, they’ll still be raking in bonds but at gradually smaller amounts.

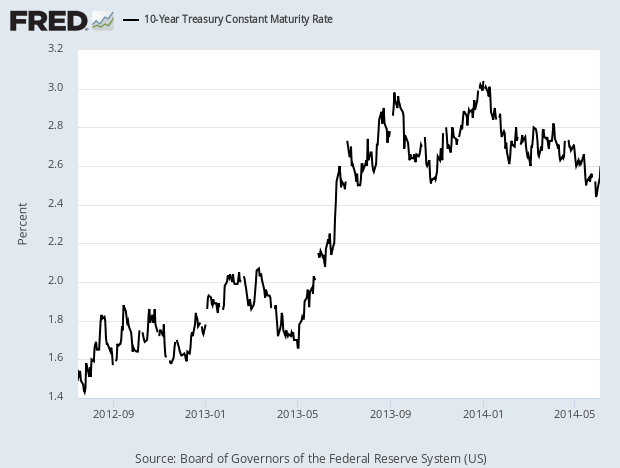

Here’s the problem: this is what the Fed did eight years ago. The Fed Chief at the time was Ben Bernanke and he mentioned tapering en passant at a Congressional hearing. The bond market totally freaked out. Bonds dropped and yields soared. This become known as the infamous “Taper Tantum.” The Powell Fed wants to avoid that.

That’s why the Fed said it won’t make any changes to its bond buying until “substantial further progress has been made.” The Fed is trying to send a message that they’re not about to cut and run. Of course, this starts another debate of what exactly “substantial” means. Still, I think there’s a good chance that the Fed will announce its tapering plans in late summer. At the end of August, the Fed will host its annual shindig at Jackson Hole, WY. That might be the best opportunity.

About inflation, the Fed noted that inflation is rising but reiterated that it thinks it is “transitory.” That’s basically what it said last time. I hope the Fed is right about that. We’ve seen prices for some commodities start to fall. Lumber, in particular, has been dropping hard.

It looks like a meme stock!

Now let’s turn to the Fed’s economic projections. The Fed increased its forecast for inflation for this year from 2.4% to 3.4%. That’s a big increase considering the year is nearly half over. By 2022, the Fed sees inflation falling back to 2%.

The Fed raised its GDP outlook for this year from 6.5 to 7%. The forecast for unemployment at the end of this year is unchanged at 4.5%. Frankly, I think that’s way too optimistic, but I hope it’s correct. The Fed even sees unemployment dropping to 3.5% by 2023. In other words, we’ll have steady inflation and low unemployment. So the Fed think its policies will be a roaring success!

Now here’s the big change. Seven of 18 Fed officials see a rate hike coming sometime next year. That’s up from four at the last meeting. Specifically, five voters see one hike this year and two see two hikes. Previously, three saw one hike and one saw two.

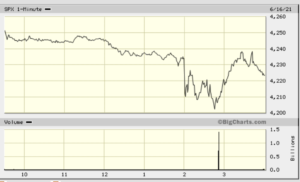

The market took this as a hawkish statement. Almost immediately, the Dow fell 200 points. At its low, the S&P 500 was down more than 1% and the yield on the 10-year Treasury rose seven basis points.

Here’s a minute-by-minute chart of the S&P 500 today. You can tell the Fed released its statement at 2 p.m.

I should explain that there are currently 18 members on the Federal Open Market Committee. However, not all of them are currently voting members. The regional bank presidents rotate as voting members. As a result, those seven votes probably overstate the desire of the Fed to hike rates. Bear in mind, we’re debating a 0.25% rate increase coming 18 months from now. I just don’t think that’s something to worry about.

Jerome Powell even said in his press conference to not read too much into the economic projections. I would go even further. I question the usefulness of the Fed releasing its economic projections. If you release them, then the market will take it seriously. That’s how markets act. But don’t release the projections and then say “well, it’s no big deal.”

The bottom line is that the Fed is still on the side of investors. Rates will stay low and the bond buying will continue. This has been good for stock investors and I expect it will continue to be. At some point, the Fed will “take away the punchbowl from the party,” but we’re not there yet.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

P.S. Don’t forget to sign up for our premium newsletter.

-

The Federal Reserve’s Policy Statement

Eddy Elfenbein, June 16th, 2021 at 2:00 pmHere’s the Fed’s statement:

The Federal Reserve is committed to using its full range of tools to support the U.S. economy in this challenging time, thereby promoting its maximum employment and price stability goals.

Progress on vaccinations has reduced the spread of COVID-19 in the United States. Amid this progress and strong policy support, indicators of economic activity and employment have strengthened. The sectors most adversely affected by the pandemic remain weak but have shown improvement. Inflation has risen, largely reflecting transitory factors. Overall financial conditions remain accommodative, in part reflecting policy measures to support the economy and the flow of credit to U.S. households and businesses.

The path of the economy will depend significantly on the course of the virus. Progress on vaccinations will likely continue to reduce the effects of the public health crisis on the economy, but risks to the economic outlook remain.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. With inflation having run persistently below this longer-run goal, the Committee will aim to achieve inflation moderately above 2 percent for some time so that inflation averages 2 percent over time and longer‑term inflation expectations remain well anchored at 2 percent. The Committee expects to maintain an accommodative stance of monetary policy until these outcomes are achieved. The Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee’s assessments of maximum employment and inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time. In addition, the Federal Reserve will continue to increase its holdings of Treasury securities by at least $80 billion per month and of agency mortgage‑backed securities by at least $40 billion per month until substantial further progress has been made toward the Committee’s maximum employment and price stability goals. These asset purchases help foster smooth market functioning and accommodative financial conditions, thereby supporting the flow of credit to households and businesses.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals. The Committee’s assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Thomas I. Barkin; Raphael W. Bostic; Michelle W. Bowman; Lael Brainard; Richard H. Clarida; Mary C. Daly; Charles L. Evans; Randal K. Quarles; and Christopher J. Waller.

Here are the economic projections.

My Comments

Bottom line. The Fed didn’t make any changes to interest rates. The Fed will continue to buy $120 billion in bonds each month. The Fed didn’t make any changes regarding the language of its bond buying.

The central bank noted that inflation is rising but reiterated that it thinks it is transitory. That’s basically what it said last time. The Fed also said that economic activity has strengthened. The vote today was unanimous.

Now let’s turn to the Fed’s economic projections. The Fed increased its forecast for inflation for this year from 2.4% to 3.4%. That’s a big increase considering the year is nearly half over.

The Fed raised its GDP outlook for this year from 6.5 to 7%. The forecast for unemployment is unchanged at 4.5%. I think that’s too optimistic, though I hope it’s correct.

Now here’s the big change. Seven Fed officials see a rate hike coming sometime next year. That’s up from four at the last meeting. (Specifically, five see one hike and two see two hikes. Previously, three saw one hike and one saw two.)

The market is taking this as a hawkish statement. Almost immediately, the Dow fell 200 points. At its low, the S&P 500 was down more than 1%. The yield on the 10-year Treasury rose about four basis points.

-

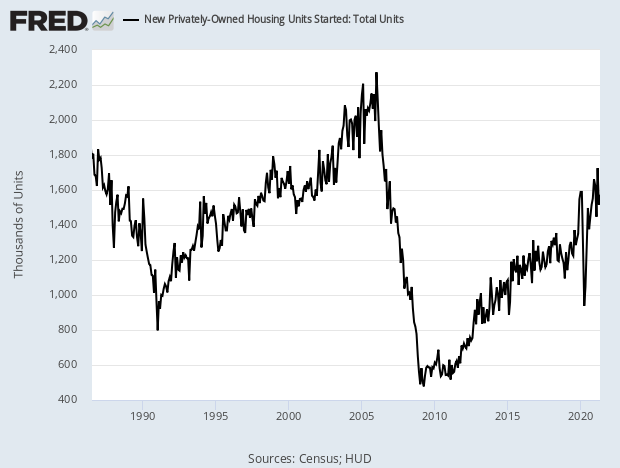

Home Construction Rose 3.6% in May

Eddy Elfenbein, June 16th, 2021 at 10:48 amFed Day is here. The Federal Reserve’s policy statement is due out at 2 pm ET. The statement will include updated economic projections. Jerome Powell will also hold a press conference.

This morning’s housing report showed that home construction rose by 3.6% last month. That was below expectations.

It appears that the soaring cost of lumber is having an impact. Interestingly, lumber has been falling sharply for the last few days.

Applications for building permits dropped by 3% in May. That’s often an indicator of future construction.

Here’s an interesting fact: the IPO market for this year is already on pace to break last year’s record, even though this year isn’t quite half over.

The IPO gold rush is set to reach new heights in the second half of 2021, as a number of high-profile startups such as China’s largest ride-sharing company Didi Chuxing Technology Co Ltd, online brokerage Robinhood Markets Inc and electric-vehicle maker Rivian Automative LLC prepare to launch multi-billion dollar share sales.

“If the markets hang in anywhere near where they are right now, we are going to be incredibly busy this summer, and into the fall with IPOs,” said Eddie Molloy, co-head of equity capital markets for the Americas at Morgan Stanley.

-

Morning News: June 16, 2021

Eddy Elfenbein, June 16th, 2021 at 7:00 amCheer Over Boeing, Airbus Deal Belies Cracks in EU, U.S. Trade Relationship

Crypto Lode of $100 Billion Stirs U.S. Worry Over Hidden Danger

Record Run in Emerging-Market Currencies Is Now Stirring Worry

Is the Fed Planning an Escape Route?

How to Have a Roaring 2020s (Without Wild Inflation)

Biden Names Lina Khan, a Big-Tech Critic, as F.T.C. Chair

Retail Sales Fell in May, in Latest Sign of a Bumpy Recovery

Amazon Will Open the Doors to a Grab-and-Go, Checkout-Less Grocery Store on Thursday

Can A $110 Million Helmet Unlock the Secrets of the Mind?

Girl Scouts Stuck With Over 15 Million Boxes of Unsold Cookies

Ben Carlson: Predicting Inflation is Hard

Nick Maggiulli: Don’t Win the Game Too Early

Michael Batnick: The Sleeping Giants & Animal Spirits: Fed Apologist

Joshua Brown: IT LITERALLY GROWS ON TREES & Why JPMorgan’s Stockpiling Half a Trillion in Cash

Be sure to follow me on Twitter.

-

CWS Market Review – June 15, 2021

Eddy Elfenbein, June 15th, 2021 at 5:32 pm(This is the free version of CWS Market Review. Don’t forget to sign up for the premium newsletter for $20 per month or $200 for the whole year. The premium version contains more detailed analysis and I cover our Buy List stocks in greater depth. Join us today!)

The stock market closed at another all-time high yesterday. That was its third record close in a row, although the S&P 500 closed a bit lower today. The stock market has now gone 17 days in a row trading in less than a 1% daily range.

For now, Wall Street is focused on this week’s Fed meeting. The policy statement will come out tomorrow afternoon. The central bank is nearing an important juncture. The Fed went to extraordinary lengths during the pandemic to help the U.S. economy.

Now that the economy is getting better, the Fed needs to unwind these efforts. We know that’s coming, but we don’t know when and how just yet. The Fed already said it’s going to pare back its holding of corporate bonds.

To be fair, that’s a minor item for the Fed. The big issue is the Fed’s massive buying of Treasury and mortgage bonds. Sometime soon, in all likelihood, the Fed will announce that it will gradually taper its bond purchases. However, the Fed doesn’t want a repeat of the infamous Taper Tantrum of 2013. That’s when the bond market went into a hissy fit at the mere mention of less support from the Fed.

In a Congressional hearing in May 2013, Ben Bernanke said that if the economy continued to improve, then Fed would gradually pull back on its quantitative easing. The bond market freaked out and yields soared. Bernanke quickly walked back his comments. (The bond market isn’t happy unless it’s upset.)

In late August, the Kansas City Fed will host its annual shindig in Jackson Hole, WY. My guess is that that’s when the Fed will address the issue of any sort of tapering. The Fed has been buying $120 billion in bonds every month, so I expect that any tapering will leave a big footprint.

Fortunately, I don’t expect any tapering to have a big impact on our Buy List stocks. For one, the tapering is widely expected. Also, our stocks are in much better shape than other companies so they did not need the support like others did.

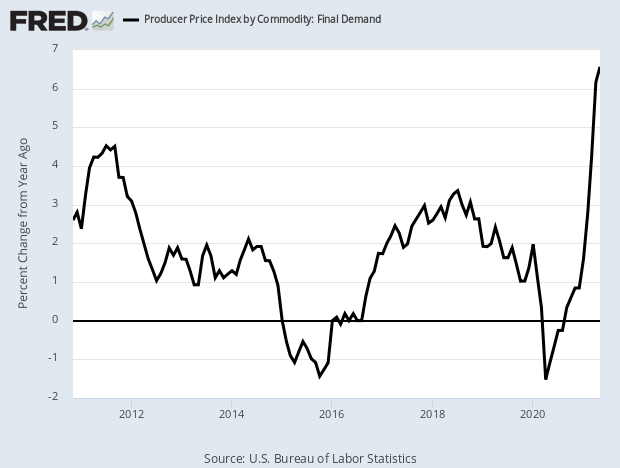

Highest Producer Inflation on Record

The market and inflation news appear to be moving in opposite directions. The news, which is lagging, continues to show evidence of higher inflation. The bond market, which looks ahead, appears to be chilling out in its view of inflation.

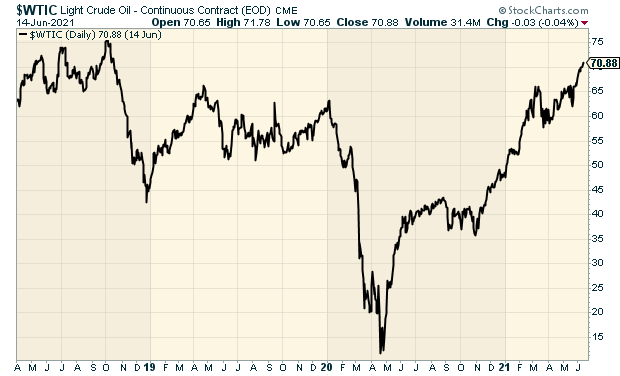

Remember all those stories about the soaring price of lumber. Well, lumber is down 40% since May. Corn is also down as is copper. We’ll also seeing a break in home prices.

But it’s a mixed market. Today, for example, oil prices got to their highest level since 2018. This story ain’t so complicated. That’s the natural outcome of greater demand and lower supplies. But that’s not the only inflation warning we got today.

This morning, the Labor Department said that producer prices (PPI) rose 0.8% in May. That’s a big increase and it easily beat Wall Street’s forecast of 0.5%. Typically, inflation shows up at the producer level first before it works its way down to consumers.

Over the last year, producer prices are up by 6.6%. That’s the largest year-over-year increase since they started collecting the data in 2010. It’s not just food and energy. The “core” PPI is up by 5.3% over the past year. That’s the highest since they started tracking that data in 2014. Still, the bond market has been pretty chill. The 10-year yield is currently around 1.5%. Just a few weeks ago, it was close to 1.7%.

We also had the retail sales report come out this morning. For May, retail sales fell by 1.3%, but the details are more complicated. What’s really happened is that consumers have been shifting their spending to services which aren’t included in retail sales.

This made for an unusual retail sales report. For example, online sales fell as more folks wanted to go shopping in person. That’s certainly understandable. Spending at restaurants and bars rose 1.8% last month. Spending at casinos rose nearly 17% and theme parks were up 9%. Gyms saw an increase of 4%. These numbers compare May to April, but if we compare last month’s numbers with May 2020, then retail sales were up 28%. Clearly, people want to go out after being cooped up for so long. That ties into the demand for more labor.

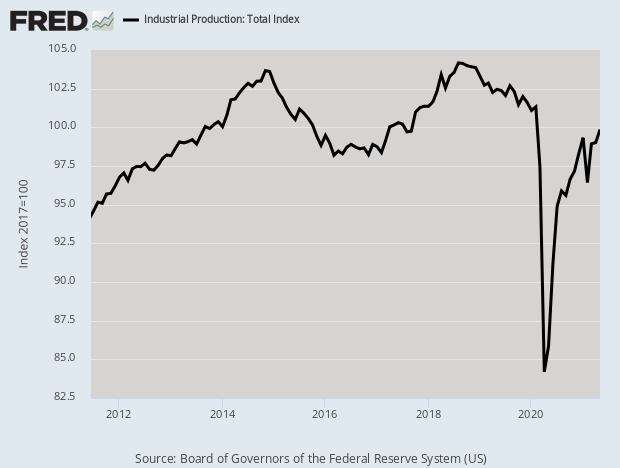

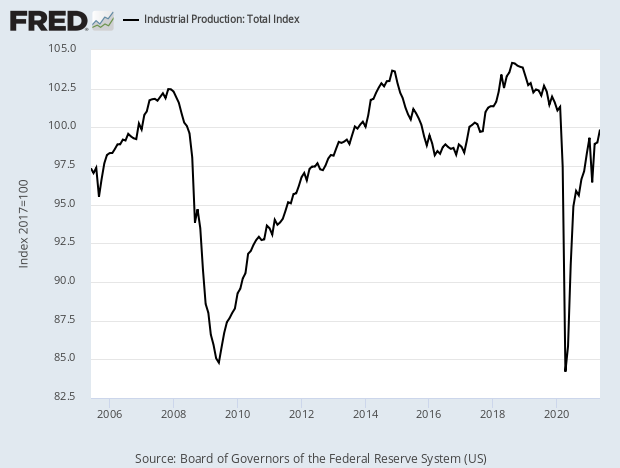

Also this morning, the Federal Reserve said that industrial production rose by 0.8% in May. That’s a good number. Production of autos rose by 6.7%. I often hear people say that America “doesn’t make anything anymore.” That’s not true. America is a manufacturing superpower. The difference is that a lot fewer people do it.

The plunge and recovery in industrial production is something to behold:

List of Meme Stocks

A number of readers have asked about “meme” stocks. Obviously, I’m not a big fan of that type of investing, which is really gambling. I’ll give you a good example. Shares of Koss are up roughly 20 times their 52-week low. The shares are also off about 80% from their 52-week high.

There isn’t a precise definition of what makes up a meme stock, but here’s a list of 12 names that are often included in the meme universe.

AMC Entertainment (AMC)

Bed Bath & Beyond (BBBY)

BlackBerry (BB)

Clean Energy Fuels (CLNE)

Express (EXPR)

GameStop (GME)

Koss (KOSS)

Rocket Companies (RKT)

Sundial Growers (SNDL)

Tilray (TLRY)

Wendy’s (WEN)

Workhorse Group (WKHS)Stock Focus: Waters Corporation

Now, for a much better stock. A company that’s been a finalist for our Buy List a few times but never a member is Waters Corporation (WAT). I like this company a lot. Even though it’s not well-known to investors, Waters is one of the world’s leading specialty measurement companies. Waters is focused on improving human health and well-being through the application of high-value analytical technologies.

The company was founded in 1958 by James Waters. He passed away a few weeks ago at the age of 95. Waters got his big break in 1972 when he solved a complicated problem for Robert Woodward, a Nobel Prize-winning chemist at Harvard. Waters went to Woodward’s lab with a liquid chromatograph and helped solve the problem within a few weeks.

Waters is headquartered in Milford, Massachusetts. After 73 years, it’s become a pretty big outfit. The company currently has over 40,000 customers and a workforce of 7,400 employees. Waters went public in 1995 and the shares are up 90-fold since then. This year, Waters is on track to register $2.7 billion in revenue. The current market cap is $21 billion. Waters is also a member of the S&P 500.

So what do they do? The company makes, sells and services high-performance liquid chromatographs, ultra-performance liquid chromatographs and mass spectrometers. Waters operates through two segments, Waters and TA (for thermal analyzers).

If you’re like me, then you probably rarely find yourself in the market for a spectrometer. Or maybe never. But there are lots of businesses who love them and buy them. But what do these things do? Spectrometers help identify chemical compounds. This is important for drug development, food testing, and air and water quality testing. Waters also designs and sells thermal analysis, rheometry and calorimetry instruments through its TA product line.

This is normally a very good business to be in. Waters has a high “moat” which means it’s well-protected from competitors. That’s the kind of company I like to buy. Waters often delivers operating profit margins near 30%. That’s quite good.

Unfortunately, Waters had a difficult year last year and also in 2019. I’ll give you an example. For Q1 2020, Waters reported earnings of $1.15. That was 32 cents below estimates. Wall Street was not pleased. During the pandemic bear market, the stock lost nearly 40% in a few weeks. Lately, however, business has greatly improved. Last month, Waters reported Q2 earnings of $2.29 per share. That beat estimates by 72 cents per share. Earlier today, the shares hit a new all-time high. From its 2020 low, Waters has gained more than 135%.

Check out its long-term performance:

Focusing in on the Q1 earnings report, I was glad to see that recurring revenue increased by 20%. Instrument systems sales were up by 49% and the pharmaceuticals market was up 32%. The sales results from Asia were also very good.

Waters’s President and CEO Dr. Udit Batra said, “There is much to be pleased about with our first quarter results, driven by strong growth across each of our major end markets, with pharma leading the way. Thanks to solid execution and instrument sales growing in double-digits, we saw revenue increases across every region, with China’s sales more than doubling. Our transformation plan is well underway, with commercial momentum and a strong leadership team in place, we now turn towards developing a new strategy as we work to more closely align our portfolio with higher growth areas of the market.”

What to expect for the rest of this year? Waters expects to see full-year sales growth of 8% to 11%. For earnings, Waters sees earnings ranging between $9.85 and $10.05 per share. That’s optimistic, but certainly doable.

For Q3, Waters expects sales growth of 14% to 16%. For earnings, Waters forecasts a range of $2.15 to $2.25 per share. Wall Street had been expecting $2.11 per share.

As much as I like this company, the stock is way too high. The shares are going for roughly 34 times this year’s earnings. However, if we were to see a 20% or so pullback, then I’d be very interested in Waters Corporation.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

P.S. Don’t forget to sign up for our premium newsletter.

-

Retail Sales and Producer Prices

Eddy Elfenbein, June 15th, 2021 at 10:56 amThe stock market closed at yet another all-time high yesterday. It’s mostly flat so far today. There hasn’t been much volatility of late.

This morning’s retail sales report said that retail sales dropped 1.3% last month. What’s happening is that as areas of the economy are reopening, consumers are shifting their buying to services. That’s not included in the retail sales report.

This was an unusual retail sales report. For example, online sales actually fell as more folks want to go shopping in person. That’s certainly understandable. Spending at restaurants and bars rose 1.8% last month.

If we compared last month’s numbers with May 2020, then retail sales are up 28%. From the Wall Street Journal:

In the four weeks ending June 2, spending at casinos rose nearly 17% from the four weeks prior, while consumers spent 9% more at theme parks and indoor-entertainment centers including bowling alleys, according to Earnest Research. Spending at gyms was up almost 4% over the same period.

This morning, the Labor Department said that producer prices rose by 0.8% in May. That’s a very big increase. Typically, inflation will show up at the producer level first before it works its way down to consumers. Over the last year, producer prices are up by 6.6%. That’s the largest year-over-year increase since they started collecting the data in 2010.

Even if you exclude food and energy, then the PPI was up 5.3% over the last year. That’s the highest increase in seven years.

The Federal Reserve said that industrial production rose by 0.8% in May.

-

Morning News: June 15, 2021

Eddy Elfenbein, June 15th, 2021 at 7:04 amBritain and Australia Announce Free Trade Deal, Johnson Hails ‘New Dawn’

World’s Bubbliest Housing Markets Flash 2008 Style Warnings

Billionaire’s Hedge Fund Offers Hefty Pay to Combat Talent Squeeze

Deutsche Bank Set to Reap $1 Billion on Trader’s Freight Bet

Facebook, Big Tech Face EU Blow in National Data Watchdogs Ruling

EU Says It Has Resolved 17-Year Aircraft Battle with U.S.

Two Republican U.S. Senators Introduce Antitrust Bill

Get Ready for a Flood of Sugar as Brazilians Buy Electric Cars

A Major Revamp at PwC Is All About Trust

Lordstown, Truck Maker That Can’t Afford to Make Trucks, Is on the Brink

The Amazon That Customers Don’t See

Michael Batnick: Did Barron’s Top Tick Teen Traders?

Joshua Brown: The Wage Inflation Is Going to Stick

Be sure to follow me on Twitter.

-

This Week’s Fed Meeting

Eddy Elfenbein, June 14th, 2021 at 2:28 pmThe Federal Reserve meets again this week, and cutting back its massive bond buying will probably be on the table.

The Fed wants to avoid a replay of 2013’s taper tantrum when bond yields started to rise on news that the Fed was paring back its bond purchases.

I doubt we’ll get any news this week. We’ll probably hear more on this topic at the Fed’s Jackson Hole meeting in late August.

As far as interest rate hikes go, that may not happen in all of 2021 and 2022.

-

Meme Stocks

Eddy Elfenbein, June 14th, 2021 at 2:22 pmThere’s no official definition of what makes a meme stock, but here’s a list of some of the well-known ones:

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His