Archive for July, 2021

-

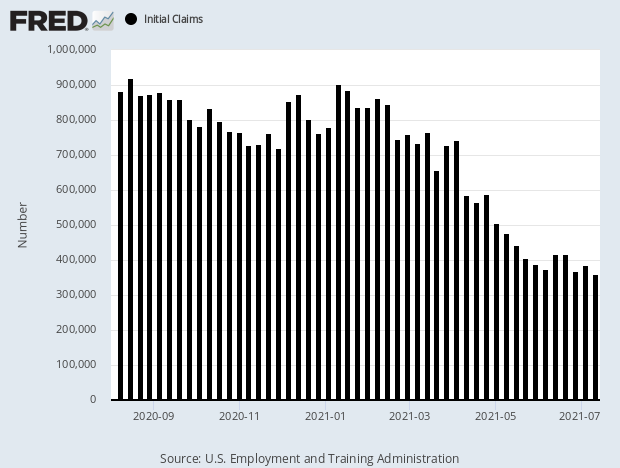

Jobless Claims Fall to 360,000

Eddy Elfenbein, July 15th, 2021 at 10:18 amThe stock market is down so far in early trading. We gapped up early yesterday and gradually drifted lower as the day wore on. By the closing bell, we had a slight gain.

This morning’s jobless claims reported came in at 360,000. That’s the lowest since March 2020.

Jay Powell is testifying again today. Yesterday was the House’s turn. Today, it’s the Senate.

A number of years ago, I trekked down to Capitol Hill to watch the semi-annual testimony. The prepared remarks are interesting. The rest of the time is grandstanding by members of Congress. I got the seat right behind Bernanke. Sorry for the blurry picture, but that’s how you know I really took it.

-

Morning News: July 15, 2021

Eddy Elfenbein, July 15th, 2021 at 7:07 amChina’s Economy Is Still Growing. But the Recovery Is Slowing Down

Inflation? Not in Japan. And That Could Hold a Warning for the U.S.

Wall Street Has Surrendered to the $500 Billion ETF Rush

The ECB Starts Work on Creating a Digital Version of the Euro

Why Wall Street Is Afraid of a Digital Dollar

Hong Kong Arrests Four in Alleged $155 Million Crypto Scheme

JPMorgan Hoards Cash as Dimon Expects Rates to Rise

How CEOs Think the Covid Crisis Will Shape Flying

Twitter’s Disappearing Snapchat Clone…Disappears

Startup Revolut Hits $33 Billion Valuation

TSMC Eyes Expansion in U.S., Japan to Meet Sustained Chip Demand

Mastercard Has Been Banned From Issuing New Cards in India

What Happens When a Private Club Goes Public?

The Unlikely Road to Riches for Russia’s Newest Billionaire

Be sure to follow me on Twitter.

-

S&P 500 Hits New High on Powell’s Remarks

Eddy Elfenbein, July 14th, 2021 at 10:42 amThe stock market has regained some ground it lost yesterday. The S&P 500 has been up to another all-time intra-day high this morning. We had some bank earnings yesterday and today.

Bank of America is down about 4% this morning. The bank reported earnings of 80 cents per share which was a three-cent beat. However, BAC missed its revenue estimate.

Wells Fargo had a very good quarter. For Q2, the bank earned $1.38 per share. That was 40 cents above estimates. The stock is about flat so far today.

Jerome Powell is testifying before Congress today and tomorrow. His full remarks are here. Here’s a sample:

Over the first half of 2021, ongoing vaccinations have led to a reopening of the economy and strong economic growth, supported by accommodative monetary and fiscal policy. Real gross domestic product this year appears to be on track to post its fastest rate of increase in decades. Household spending is rising at an especially rapid pace, boosted by strong fiscal support, accommodative financial conditions, and the reopening of the economy. Housing demand remains very strong, and overall business investment is increasing at a solid pace. As described in the Monetary Policy Report, supply constraints have been restraining activity in some industries, most notably in the motor vehicle industry, where the worldwide shortage of semiconductors has sharply curtailed production so far this year.

Conditions in the labor market have continued to improve, but there is still a long way to go. Labor demand appears to be very strong; job openings are at a record high, hiring is robust, and many workers are leaving their current jobs to search for better ones. Indeed, employers added 1.7 million workers from April through June. However, the unemployment rate remained elevated in June at 5.9 percent, and this figure understates the shortfall in employment, particularly as participation in the labor market has not moved up from the low rates that have prevailed for most of the past year. Job gains should be strong in coming months as public health conditions continue to improve and as some of the other pandemic-related factors currently weighing them down diminish.

As discussed in the Monetary Policy Report, the pandemic-induced declines in employment last year were largest for workers with lower wages and for African Americans and Hispanics. Despite substantial improvements for all racial and ethnic groups, the hardest-hit groups still have the most ground left to regain.

Inflation has increased notably and will likely remain elevated in coming months before moderating. Inflation is being temporarily boosted by base effects, as the sharp pandemic-related price declines from last spring drop out of the 12-month calculation. In addition, strong demand in sectors where production bottlenecks or other supply constraints have limited production has led to especially rapid price increases for some goods and services, which should partially reverse as the effects of the bottlenecks unwind. Prices for services that were hard hit by the pandemic have also jumped in recent months as demand for these services has surged with the reopening of the economy.

On our Buy List, shares of Middleby (MIDD) are up again. This could be our fourth up day in a row. The shares are on track to close at a two-month high.

Broadridge Financial Solutions (BR) made a new all-time high yesterday. The stock is up about 9% in the last month.

-

Morning News: July 14, 2021

Eddy Elfenbein, July 14th, 2021 at 7:04 amECB Poised to Take Next Step in Revolutionizing Euro Zone Money

China Slams ‘Sinister’ U.S. Over Hong Kong, Digital Trade Deal

China Deals Another Blow to Its Crypto Miners

China Traders to Scrutinize Maturing Mega Loan for Policy Clues

Prices Pop Again, and Fed and White House Seek to Ease Inflation Fears

U.S. Oil Consumption Surging With Industry Firing at Full Blast

There’s No Escaping Rising Prices For So Much That We Buy

After EU Tax Win, Yellen Will Try to Sell U.S. Republicans on Global Tax Deal

Seven Months and Ticking, the Case for Keeping Powell as Fed Chair Builds

The Pandemic Forged New FIRE Followers, With a Difference

Disney’s Brand Protector and Power Behind the Power Is Stepping Down

How Germany Hopes to Get the Edge in Driverless Technology

Behind the Lordstown Debacle, the Hand of a Wall Street Dealmaker

BlackRock Profit Beats Estimates As Assets Soar to Record $9.49 Trillion

NYC Restaurant Breaks World Record With Fancy $200 French Fries

Be sure to follow me on Twitter.

-

CWS Market Review – July 13, 2021

Eddy Elfenbein, July 13th, 2021 at 5:41 pmBefore I begin, permit me a brief sales pitch for the premium newsletter. I promise I won’t take long.

Do you know the difference between a limit order and a stop-market order? Or stop-limit orders and trailing stops? Lots of investors don’t know they can place things like “fill or kill” or “all or none” orders.

To be a good investor, you should really know all the tools that are available to you. Even a lot of pros get this stuff mixed up.

Don’t worry, I’m here to help. I’ve written a report, “Your Handy Guide to Market Orders.” It’s free for our premium subscribers. If you’re not a premium subscriber, well heck, then this is the perfect time to join us!

It’s just $20 per month. Or you may prefer the inflation-fighter’s option of $200 for the entire year. OK, enough of me hocking the letter. But speaking of inflation….

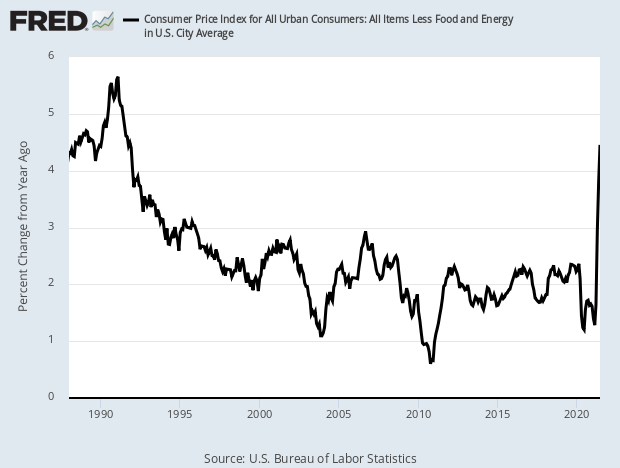

Highest Core Inflation in 30 Years

Remember how the Federal Reserve said that inflation will be “transitory”?

Yeah…about that.

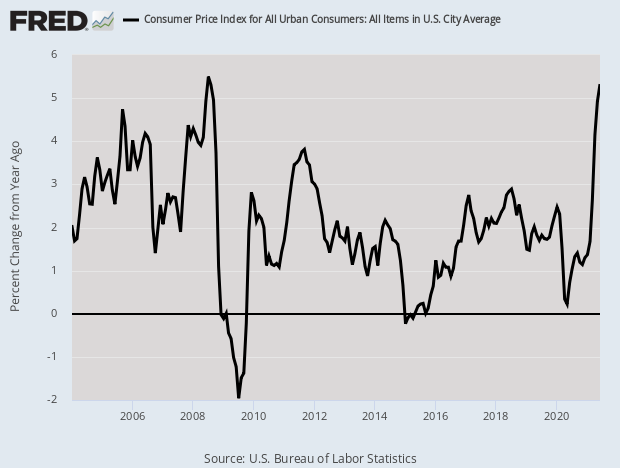

This morning’s CPI report shows that inflation is still with us, and it’s running as hot as it’s been in years. Apparently, this transitory person may hang around for a while longer.

Let’s look at the details. The government said that consumer prices rose by 0.90% in June. That’s the largest monthly increase in 13 years. Over the last year, consumer prices are up 5.32%. That’s also the fastest pace in 13 years.

As a quick side note: Sometimes the “rate over the last 12 months” can be misleading. For example, when you hit a pothole one month, the rate of increase over the coming 12 months will look unusually high. That’s why we often see “highest in 13 years” because it brings us back to the drama of 2008 when prices plunged.

The inflation story isn’t about food and energy. About one-third of the total increase in the CPI was due to used cars and trucks. (Have you tried to rent a car lately? Or even tried to find a car that’s available to rent? It’s not so easy these days.)

The core rate of inflation, which excludes food and energy, rose by 0.88% in June. That’s also the highest rate in 13 years. The core rate is, by its nature, more stable than the headline rate. Still, core inflation is on the rise. Over the last year, core inflation is up by 4.53%. That’s the fastest rate in 30 years.

Here’s a chart that gets your attention:

Has this changed the outlook for inflation? The answer is…not really. Don’t listen to me, listen to the bond market. The yield on the 10-year bond is below 1.4%. That’s a few points below the rate of inflation. In fact, the yield is down from where it was three and four months ago. If anything, the outlook for inflation is fading.

The 10-year TIPs rate, meaning the inflation-adjusted rate, is at -0.9%. In effect, investors are paying other people, in real terms, to borrow their money. “Here. Take my money. I’ll pay you.”

There’s simply no rush to raise interest rates. Fed Chairman Jerome Powell has clearly indicated his willingness to keep on waiting. The futures market doesn’t see the Fed raising interest rates until September 2022. Even by February 2023, the futures market is betting that the Fed will have only hiked rates once. That a 25 basis-point increase over the next 19 months.

What does this mean for stocks? A few months ago I touched on this subject, and it’s a complicated dynamic. Inflation has an unusual impact on earnings. Not all earnings are the same, and inflation exacts a heavy toll on asset-heavy businesses. Companies with high assets relative to their profits tend to report ersatz earnings.

Inflation has an impact similar to putting a magnet near a compass. Everything gets a little screwy. Historically, stocks have not performed well during periods of high inflation. Investors who lived through the 1970s will certainly recall that.

Here’s a study I did a few years ago. I found that stocks perform well until inflation reaches 5.72%. . The two things stocks don’t like are inflation and deflation. The sweet spot is when inflation is boring and between 0% and 3%. That’s when stocks perform the best.

The other part of the equation is jobs. We’re currently at a very unusual crossroads. There are a lot of jobs and a lot of people out of work. The U.S. has 6.8 million fewer jobs than it had 18 months ago. Still, there are 9.3 million job openings. That’s an all-time record. Near me, it seems that every business is understaffed. I’m sure you’re seeing the same.

The fancy-pants term for this is “match.” What folks are looking for and what folks have to offer ain’t the same. The solution is simple: time. It will take some time for all this to work itself out.

What’s the cause for the mismatch? As I see it, there are a few issues happening at once. Some observers are blaming overly generous unemployment benefits. That’s probably playing a role. I would also add the high cost of childcare. The school lockdowns drove this issue. Also, more workers want to work from home. Of course, there are still many Americans who are simply reluctant to return to the office. The WSJ cited a poll that said that 70% of workers in leisure and hospitality say they want to work in a different industry.

We’ve also seen many Americans decide to accelerate their retirement plans. It’s not so easy to replace long-standing employees.

That’s the key reason why I think inflation will likely fade over the next few months. There’s a lot of matching to be done. Despite the strong inflation report this morning, I still side with the bond market and the Federal Reserve though I differ from the Fed in that it may take closer to six months.

Now let’s look at one of my favorite subjects: great stocks that no one knows about.

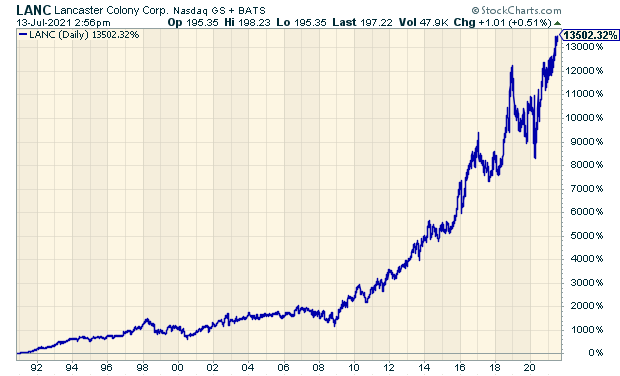

Stock Focus: Lancaster Colony

In the movie The Graduate, Dustin Hoffman is given the famous advice, “Plastics.”

I wonder how the scene would have played if the advice had been “croutons.” As odd as it may seem, the company Lancaster Colony (LANC) has been an outstanding market performer thanks to its business in salad dressings, croutons, and, to be fair, other food products.

Last November, Lancaster raised its dividend from 70 cents to 75 cents per share. That marked its 58th consecutive annual dividend increase. That’s an outstanding record. There are only 13 companies with streaks that long.

Still, Lancaster is barely known. Since October 1990, Lancaster’s stock and dividends have returned more than 135-fold. That’s a lot of croutons. Check out this chart:

You’d think Lancaster would be widely followed. I see that there are only three analysts on Wall Street who currently follow the stock. It’s not some micro-cap, either. The current market cap is well over $5 billon.

Lancaster’s last two earnings reports easily beat consensus. That is, if you can call a handful of analysts a consensus. In February, Lancaster reported fiscal Q2 earnings of $1.85 per share. That was 41 cents more than consensus. In May, Lancaster said it made $1.35 per share for fiscal Q3. That beat by 11 cents per share. The Q4 report should be out sometime towards the end of August.

Update on Simulations Plus

Good news! Simulations Plus (SLP) got crushed today. I mean that’s good news because I like the stock and I don’t own it.

Simulations Plus makes software that lets drug companies simulate tests of their products in the virtual world before using any human or animal test subjects.

That’s a big cost-saver for drug companies. Simulations Plus helps streamline the R&D process by making it faster and more efficient. Not only is this cost effective, but it also helps drug companies in dealing with time-consuming regulatory hurdles.

I highlighted the stock a few weeks ago. I said that while I like the company, the stock price is way too high. Well, I guess I was right. SLP dropped 18% today.

In May, I wrote that if the stock ever drops below $40, it could be a very good buy. SLP closed today at $44.03 per share. I’m not fully onboard just yet. Simulations Plus still has some serious issues to address. But I have taken notice. I always like when a promising stock goes on sale. I hope to highlight SLP in a future issue.

Don’t forget to join our premium service so you get can get “Your Handy Guide to Market Orders.” There’s lots of good info in it.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

-

Strongest Inflation in 13 Years

Eddy Elfenbein, July 13th, 2021 at 11:04 amThe consumer inflation report came out this morning, and “transitory” may still be with us a little while longer.

Here are the details. Seasonally-adjusted inflation rose by 0.90% last month. That’s the fastest pace in 13 years. The seasonally-adjusted core rate rose by 0.88%.

“What this really shows is inflation pressures remain more acute than appreciated and are going to be with us for a longer period,” said Sarah House, senior economist for Wells Fargo’s corporate and investment bank. “We are seeing areas where there’s going to be ongoing inflation pressure even after we get past some of those acute price hikes in a handful of sectors.”

A separate report from the Labor Department’s Bureau of Labor Statistics noted that the big monthly hike in consumer prices translated into negative real wages for workers. Real average hourly earnings fell 0.5% for the month, as a 0.3% increase in average hourly earnings was more than negated by the CPI increase.

Inflation has been escalating due to several factors including supply-chain bottlenecks, extraordinarily high demand as the Covid-19 pandemic eases and year-over-year comparisons to a time when the economy was struggling to reopen in the early months of the crisis.

Policymakers at the Federal Reserve and the White House expect the current pressures to begin to ease, though central bank officials have acknowledged that inflation is stronger and perhaps more durable than they had anticipated.

Fed Chairman Jerome Powell likely will be asked for his views on inflation when he speaks Wednesday and Thursday to separate House and Senate panels. Powell has been steadfast that inflationary pressures are primarily transitory, though a Fed report Friday indicated that upside risks are increasing.

Over the last 12 months, headline inflation is up by 5.32%. That’s also the fastest pace in 13 years. Used car and truck prices comprised about one-third of the total CPI increase.

Over the last 12 months, core inflation has increased by 4.53%. That’s the fastest pace in 30 years.

-

Middleby Throws in the Towel

Eddy Elfenbein, July 13th, 2021 at 10:30 amGood news today. Middleby (MIDD) said it will not increase its bid to buy Welbilt (WBT).

Here’s the press release:

The Middleby Corporation today announced that, under the terms of its previously announced Merger Agreement with Welbilt, Inc., it will not exercise its right to propose any modifications to the terms of the Merger Agreement and will allow the five-day match period to expire. Middleby expects that the Merger Agreement will terminate at the end of the match period today.

“We believe that the previously agreed terms of the Merger Agreement between Middleby and Welbilt offered significant long-term strategic value to the Welbilt shareholders through the ability to participate in substantial upside opportunity from Middleby’s continued growth, while remaining attractive to our existing Middleby shareholders,” said Timothy FitzGerald, CEO of Middleby. “As we considered our options over the course of the match period, we concluded to deploy our substantial financial resources wisely. We are excited about the momentum of our business and future prospects of our three industry leading foodservice platforms. As a seasoned acquirer, we remain disciplined and committed to ensuring the best outcome for our Middleby shareholders.”

In accordance with the terms of the Merger Agreement, Middleby will be entitled to a termination fee of $110 million to be paid by Welbilt simultaneously with the termination of the Merger Agreement. “The additional cash infusion Middleby stands to receive upon termination will put us in an even better position to execute on our existing M&A growth strategy, as we continue to build upon our long-standing track record of value-creating deals,” added Mr. FitzGerald. Middleby has completed over 20 acquisitions since 2018 alone, with a history of successfully integrating businesses and realizing significant synergies at the acquired companies.

“Looking ahead, we remain highly confident in our ability to drive continued growth and profitability and believe we are uniquely positioned to deliver superior value creation for our shareholders,” said Mr. FitzGerald.

As I see it, Middleby is being paid $110 million to avoid a mistake. The shares have been up as much as 5% today.

-

Morning News: July 13, 2021

Eddy Elfenbein, July 13th, 2021 at 7:07 amBitcoin Miners Navigate Extreme World of Crypto Power-Hunting

E.U. Delays Digital Levy as Tax Talks Proceed

Janet Yellen Makes a Case for Ireland to Join the Global Tax Deal

Biden Team Mulls Digital Trade Deal to Counter China in Asia

Consumer Price Index in U.S. Forecast to Climb at a Solid Pace

Fed Chair Powell Charged with Convincing Congress this Week that Easy Policy is Still Needed

U.S. SEC Focuses On Bank Fee Conflicts As It Steps-Up SPAC Inquiry

Wall Street Charges Ahead But Some Option Traders Hedge Against Sharp Pullback

Inflation Is Still High. Used Car Prices Could Help Explain What Happens Next

Customers Are Back at Restaurants and Bars, but Workers Have Moved On

Northern U.S. Plains Drought Shrivels Spring Wheat Crop to Smallest in 33 Years, USDA Says

Boeing Will Slow Work on Its 787 Dreamliner to Fix a New Problem

Popeyes Stockpiles Chicken Ahead of Nationwide Nugget Debut

Broadcom in Talks to Buy SAS Institute for as Much as $20 Billion

Google Fined $593 Million by French Antitrust Agency

Only the Rich Could Love This Economic Recovery

Be sure to follow me on Twitter.

-

Lancaster Colony: 58 Consecutive Dividend Hikes

Eddy Elfenbein, July 12th, 2021 at 11:38 amLawrence Hamtil points out that Lancaster Colony (LANC) is “one of 13 companies to raise its cash dividend every year for 58 straight years.”

Only three analysts follow them. They don’t even have a Wikipedia page. What does Lancaster Colony do?

From Lawrence: “They sell salad dressing and croutons to households and restaurants.”

-

Damn It Feels Good to Be a Banker

Eddy Elfenbein, July 12th, 2021 at 9:58 amBank profits are soaring. So says The New York Times. What’s causing the good news? Well, there are a few reasons. For one, as the pandemic recedes, consumers are spending again. Also a lot of big Wall Street deals are coming back.

The banks were prepared for a wave of defaults. There were certainly defaults, but the massive wave never came. Of course, there was a lot of support from the government to keep things afloat.

This week, we’ll learn a lot more as Wall Street banks report their Q2 earnings. Tomorrow, Goldman Sachs and JP Morgan are due to report. Then on Wednesday, it’s Citigroup’s and Wells Fargo’s turn.

To give you an idea of how the outlook for banking has changed, three months ago, Wall Street was expecting Goldman Sachs to report Q2 earnings of $8.11 per share. Today that forecast is up to $9.95 per share. Still, many of these large banks are trading at less than 10 times this year’s expected earnings.

The uncertainty that’s depressing bank stocks will probably dissipate, said Susan Roth Katzke, an analyst at Credit Suisse. She forecast a rally of about 20 percent in some of their shares in the next six to 12 months. They will be fueled by an accelerating recovery, prospects for rising interest rates and increasing loans, Ms. Katzke wrote in a note to investors.

The big banks are in much better health. Last month, Morgan Stanley and Wells Fargo said they would increase their dividends. The NYT notes that four banks–JPM, BofA, Wells Fargo and Morgan Stanley–have said they’ll buy back $85 billion in shares.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His