Archive for August, 2021

-

CWS Market Review – August 31, 2021

Eddy Elfenbein, August 31st, 2021 at 9:18 pm(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year.)

What Makes a Stock a Good Value?

In late 2019, I was strongly considering adding Trex (TREX) to our Buy List. I really liked the business, but I was very concerned about the price.

I hate overpaying for any stock. After running all my calculations, I determined that $45 per share was a good price for Trex. If I could add it at $43 per share, well then that was very good. But if it climbed to $47 or higher, then I was apprehensive.

I stressed about this decision a lot. Ultimately, I added it to our Buy List at $44.94 per share. Here we are 20 months later and Trex is just over $109 per share. We have a 140% gain in just 20 months!

Trex has been a home run for us. In retrospect, why was I stressing so darned much? It seems silly that I was so concerned about a few dollars on a stock that was prepared to rally. Of course, I didn’t know that at the time.

This raises a good lesson for investors and it’s something I want to share with you in this issue. The question: What is a good value?

Conventionally, it means a stock with generous valuation metrics. It may have a high dividend yield or a low price-to-earnings ratio. But shouldn’t we concern ourselves with other factors? Perhaps the company’s ability to grow may be its most undervalued asset. If so, that changes the way we value businesses, and that’s what I want to get at this week.

I’ll give you an example. In late 1998, Wall Street was taking notice of these new-fangled Internet stocks. Shares of Amazon, in particular, were soaring to the moon. On October 9, 1998, Amazon closed at $86-3/16 (remember those fractions!). By mid-December, it got to $242-3/4 per share.

Then things really got crazy! Henry Blodget, a well-known analyst, gave Amazon a $400 price target. Wall Street went bonkers and Amazon jumped $46 per share that day. It took less than a month for Amazon to reach Blodget’s price target. In fact, it smashed through it. Amazon got over $550 per share in early January (these numbers are not adjusted for splits).

Obviously, this was a massive stock bubble. Right? Once the bubble burst, shares of Amazon plunged 95%.

Hold on a second. That’s only if you sold. But what if you didn’t? In the two decades since then, Amazon has grown fantastically. Viewed that way, Blodget’s price target was a bargain—a huge bargain. (Here’s an article I wrote on the 20th anniversary of Amazon’s IPO>)

If you had paid $3,000 for Amazon and held on to it to today, then you’d have made a huge profit and also outperformed the market by a good margin.

But remember those words I just wrote, “if you held on to it.” For the long-term investor, the stock market is always cheap.

A value investor is looking to get a cheap stock based on today’s valuation. Let’s say that you buy a stock at 10 times earnings that should be going for 20 times earnings. If that eventually adjusts within a year or two, that’s a great trade. But there’s a limit an investor can make when the earnings multiple regresses to the mean. Earnings, by contrast, can keep growing and growing.

For example, shares of Colgate-Palmolive currently yield 2.3%. That’s not bad. But if you had bought it 30 years ago, then it would now be yielding you 35% based on the original purchase price. This is what I talked about in last week’s issue, the importance of spotting a stock with a competitive advantage.

The lesson is to not get bogged down with the ratios. Just about every investor can do long division. You also have consider what the company is doing.

Masimo Corporation (MASI)

Having said that, I want to talk about one of my favorite growth stocks and a stock with a definite competitive advantage, Masimo Corporation (MASI). Masimo is a medical technology company based in Irvine, CA. This is a fascinating company that’s not well-known but it’s a cool story. What I particularly like about Masimo is the role that it’s playing in combating the coronavirus.

Masimo was founded by Joe Kiani, an Iranian immigrant. Kiani came to the U.S. when he was only nine years old and he knew three words of English. Still, he graduated high school at 15 and by 22 he had a bachelor’s and master’s degree in electrical engineering. Kiani founded Masimo in 1989 when he was 25 years old.

Today, Masimo is a $15 billion enterprise. It employs 2,000 people and last year it had sales of $1.14 billion. Masimo is perhaps best known for its pulse oximetry. This is a noninvasive method for monitoring a person’s oxygen saturation. This is a great product with enormous potential.

Masimo has developed a SafetyNet device which is a disposable smart wristband with a pulse oximetry that’s taped around your finger. It monitors your vitals like your pulse and oxygen levels. If there’s a problem, an update is sent to your smart phone, and it alerts your doctor. It can also be connected to a central monitor like a hospital.

Each year, over 200 million patients are monitored with Masimo’s technology. Nine of the top ten hospitals rated by U.S. News primarily use their technology.

Did you know that unpredictable reactions to opioids kill more people than car crashes? It’s impossible to know who’s at risk. But with continuous monitoring, we can spot adverse reactions quickly.

Interestingly, the device was meant to be used for opioid addicts, but plans changed once the pandemic hit. Now it’s being used on coronavirus patients. Since the technology is wireless, it’s also safer for healthcare workers.

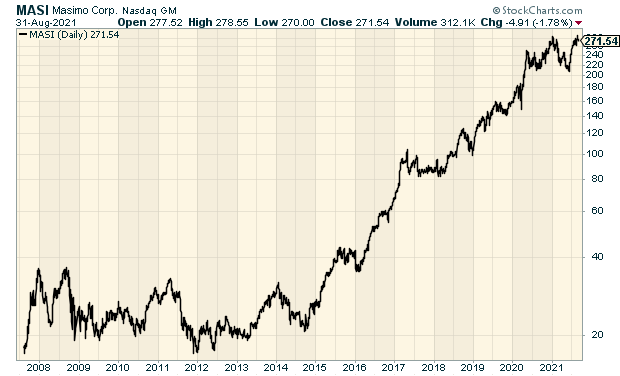

Tying back to my earlier point, Masimo has been a great growth stock. Consider these numbers. Masimo’s earnings-per-share rose from $2.28 in 2016 to $3.13 in 2017. Earnings then fell in 2018 to $3.03 per share but rebounded to $3.22 per share in 2019. Earnings then rose to $3.60 per share last year.

What about for this year? Masimo recently revised its guidance higher for 2021. Masimo now expects $3.85 per share for this year. That’s very doable. Masimo has already made $1.80 per share for the first half of the year.

I don’t think Wall Street fully understands the potential of Masimo. Only seven analysts follow it. The stock has beaten earnings for 28 consecutive quarters. The average beat has been more than 14%.

Thanks to the growing earnings, shares of Masimo have performed very well. Masimo IPO’d in 2007 at $17 and the shares are now at $271. The stock is up about 16-fold in 14 years.

There’s so much I like about this company. Here’s an interview Kiani did last year with Jim Cramer:

Interesting side note: Masimo has been in a big legal fight with Apple. Masimo claims that Apple poached their trade secrets for their Apple Watch. I should add that Kiani is no stranger to these kinds of legal battles, and he’s already won a few cases with big settlements. The odd thing with this one is Apple’s complete intransigence. Kiani said that Apple has also picked off some of Masimo’s top talent. I guess rules are a little different when you have a market cap of $2.5 trillion. Still, my money’s on Kiani in any courtroom.

One month ago, Masimo beat earnings again. For Q2, the company earned 94 cents per share. That topped the Street by four cents per share. I also like that its operating margin often runs around 22% to 24%.

Joe Kiani, Chairman and Chief Executive Officer of Masimo, said “We are happy to report strong second quarter results. While we expected the drivers and capital orders of 2021 to be lower than we achieved in 2020 due to high demand during the height of COVID-19, and expected sensor volumes to rebound as elective surgeries recover, we did not anticipate the very strong increase in single-patient-use sensors that we realized this quarter. This produced higher revenues that exceeded expectations for this period.”

I got excited earlier this year when shares of MASI tanked. The stock fell from $284 in January down to $205 by June. I love when stocks of companies I like get hammered. MASI has already made back nearly everything it lost.

Frankly, I’m not wild about MASI at $270, but if it gets back to $200 or so, then could be a very compelling buy. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

P.S. If you haven’t had a chance, you can subscribe to our premium newsletter. It’s only $20 a month or $200 a year. Please join us!

-

Morning News: August 31, 2021

Eddy Elfenbein, August 31st, 2021 at 7:06 amChina Tightens Limits for Young Online Gamers and Bans School Night Play

How Hackers Hammered Australia After China Ties Turned Sour

EU to Reimpose Travel Curbs on U.S. Amid Rise in Covid Cases

Private Equity Firms All Want the Same Thing: British Companies

The Economy Is Booming but Far From Normal, Posing a Challenge for Biden

Fed Now Risks Too-Slow Taper After Too Fast in 2013, Rajan Says

Progressives Urge Biden Not to Nominate Powell as Fed Chair

Fed Chair Race Spotlights Powell-Brainard Wall Street Rule Split

The S.E.C. Head Is Considering Banning A Key Way Robinhood Makes Money

U.S. Treasury Says China Private Equity’s Magnachip Purchase Poses Security Risks

S. Korea’s Parliament Passes Bill to Curb Google, Apple Commission Dominance

Zoom Video Earnings Beat Expectations. Why The Stock Is Falling.

Rivian’s Road to $80 Billion Was Paved by Tesla

Billionaire Investor John Paulson: Cryptocurrencies Will ‘Go to Zero’

Be sure to follow me on Twitter.

-

Support.com: The Latest Meme Stock

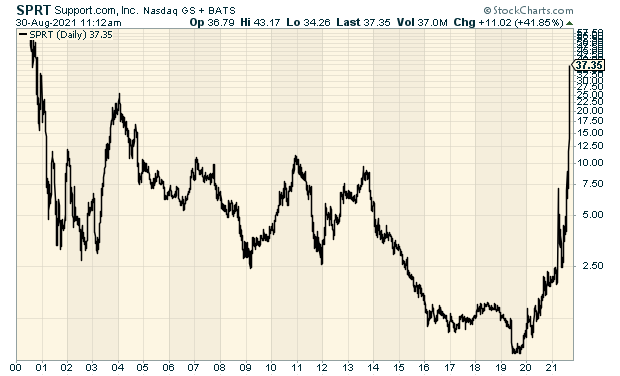

Eddy Elfenbein, August 30th, 2021 at 11:07 amThe latest meme stock is Support.com (SPRT). No, I don’t know anything about it either except it goes up a lot. SPRT is up 40% today, and that comes on top of being up 33% on Friday.

Going back to last Monday’s low, Support.com is up 315%. It’s actually down a lot from Friday’s intra-day high.

So what do they do? Beats me. This is from their recent earnings report:

Support.com, Inc. (NASDAQ:SPRT) is a leading provider of customer and technical support solutions and security software delivered by home-based employees. For more than twenty years, the company has achieved stellar results for enterprise clients, leading businesses, and consumers. Support.com efficiently meets rapidly-changing market needs with a highly-scalable homesourcing model, IoT expertise, omnichannel solutions, and proprietary software. With no bricks and mortar facilities, no commuting, and a secure cloud-based infrastructure, Support.com is a global leader in sustainability.

Hmmm. I’m still not clear on what they do. Here’s the long-term chart:

-

“Being Bullish Brings a Competitive Advantage”

Eddy Elfenbein, August 30th, 2021 at 9:53 amThe blogger at Dividend Growth Investor linked to this interview with Nick Train. In it, Train shares a lot of investing wisdom. Here’s a sample.

John Templeton once said, “History shows that time, not timing, is the key to investment success. Therefore, the best time to buy stocks is when you have money” – a philosophy you share. What would you do in a 1999 or2007- like scenario? Continue to invest? Yet another view says, “Wait till there is ‘blood in the streets’.” How do you reconcile these two?

I have never suffered from any delusion that I am an unusually smart or far-sighted investor. A keen sense of my many investing Imitations means I have had to keep my approach simple. I am mostly concerned with avoiding obviously bad or ‘losing’ investment behavior such as over-trading or backing low-quality companies and I’m willing to stick with basic investment principles that seem to me likely to work over time, even accepting there will be periods when they don’t.

Your first question is a good example. For a while, as an inexperienced investment professional, I tried to judge whether equity markets were cheap or expensive. I even allowed myself to express pessimistic views about market prospects in public and, worse, to act on them.

Now looking back over the thirty or more years of my career, it seems to me every one of those negative calls I made on markets was just plain wrong. They’ve gone up a lot over time and in hindsight there was always something to be enthused about. And likely there always will be.

Eventually I acknowledged, for me, the futility of such guesswork about market levels and concluded that it makes good commercial, investment and – perhaps most importantly – emotional sense to be permanently bullish.

This, I believe, is good, ‘winning’ investment behavior. Being bullish brings a competitive advantage over the many market participants who are either negative because that is their habitual outlook on life (an outlook that tends to overstate temporary problems and to underestimate human problem-solving ingenuity) or who back themselves to trade in and out of equity markets on the basis of their hunches about market levels; or both.

Of all the losing investment approaches out there, that of being a pessimistic trader must be the most certain to lead disappointing returns. So I practice the exact opposite – I’m an optimistic buy-and-holder. In this way I put history on my side, given the long-term propensity of stock markets to rise over time, Anglo-Saxon ones at least. In addition, I feel a lot better about myself — optimism keeps you young!

You can see the whole thing here.

-

Morning News: August 30, 2021

Eddy Elfenbein, August 30th, 2021 at 7:08 amOil and Gas Futures Gyrate After Ida Disrupts Production

Mississippi River is Flowing in Reverse as Ida Pushes Inland

China Sees Skilled Labor Shortages Worsening Amid Tech Push

China Slashes Kids’ Gaming Time to Just Three Hours a Week

Billionaire Paulson Who Shorted Subprime Calls Crypto ‘Worthless’ Bubble

Biden’s Alliance with Big Tech Shows a Power Shift

The Social-Media Stars Who Move Markets

The World Is Still Short of Everything. Get Used to It.

Housing Affordability to Worsen Near-Term, Even as Prices Cool Off

Singapore’s Shopee Changes the Game in Brazil’s e-Commerce Sector

McDonald’s, Others Consider Closing Indoor Seating Amid Delta Surge in U.S.

Demand Surges for Deworming Drug for Covid, Despite No Evidence It Works

Australia’s Fortescue Sets Sights on Becoming World’s First Supplier of Green Iron Ore

The ‘Best Places to Live’ May Not Be the Best Places to Live

How the Left Wrist Became the Right Wrist for Watches

FTC Interviewed Zuckerberg in 2012 Making Facebook Suit Hard

Schemer or Naïf? The Trial of Elizabeth Holmes

Be sure to follow me on Twitter.

-

The S&P 500 Breaks 4,500

Eddy Elfenbein, August 27th, 2021 at 3:20 pmThis morning, the government released the personal income and spending numbers for July. This report always comes out the day after the GDP report. Personal income gained 1.1% while spending rose 0.3%. The slowdown in spending is probably due to the delta variant.

Over the last year, the core personal consumption price index is up by 3.6%. That’s the fastest growth rate in 30 years. This is the Fed’s preferred measure of inflation.

Atlanta Fed President Raphael Bostic told CNBC on Friday that business contacts in his region have told him they see inflation persisting beyond the near-term time frame.

“We don’t want and we really can’t afford to have inflation that is too high, because people at the lower end of the spectrum are going to be hurt pretty significantly,” he told CNBC’s Steve Liesman during a “Squawk Box” interview.

Much of the current inflation pressure is coming from energy and food, which rose 23.6% and 2.4%, respectively, from a year ago.

The stock market doesn’t seem too bothered. The S&P 500 is up to another new high. The S&P 500 broke 4,500 today. It first topped 45 on September 16, 1955. It then broke 450 on March 8, 1993. Going way back, the index last broke 4.5 on July 11, 1932.

-

Morning News: August 27, 2021

Eddy Elfenbein, August 27th, 2021 at 7:02 amPushing the Limits Paid Off for Didi, Until China Cracked Down

China Blasts ‘996’ Excessive Work Culture

Bitcoin Helped Tank El Salvador Bonds. Now They’re Rising Back.

Exit Game: Central Banks’ Shift From Crisis Policies Gathers Momentum

Gold Is Out, Bonds Are In for Investors’ Jackson Hole Playbook

Fed’s Bostic Says ‘Reasonable’ to Begin Bond-Buying Taper in October

Billionaire-Backed Stock Picker Says Bubble Talk Is for Boomers

Supreme Court Scraps Biden’s Eviction Protection for Tenants

Apple Settlement Gives App Developers a Way to Avoid Its Commission

Tim Cook Receives Over 5 Million Shares of Apple Stock Worth $750 Million

Barclays Buys $3.8 Billion Gap Credit Card Portfolio in the U.S.

Peloton Stock Is Falling Because the Stay-at-Home Trade Is Definitely Over

German Publisher Axel Springer to Acquire U.S. News Website Politico for Over $1 Billion

FedEx Ground Delivery Becomes a Road to Riches for Contractors

Why Kanye West’s Name Change Could Make Him Richer

Be sure to follow me on Twitter.

-

51 Record Closes This Year

Eddy Elfenbein, August 26th, 2021 at 10:38 amThe stock market closed at another all-time high yesterday. It’s the 51st new high of this year. The market is down a little this morning. Once again, the high beta stocks are beating up on the low vol stocks. This has been the trend lately.

The August jobs report will come out next Friday. This morning, we got another jobless-claims report and for the first time in five weeks, jobless claims increased but only slightly. Jobless claims were 353,000 which is very close to another pandemic low.

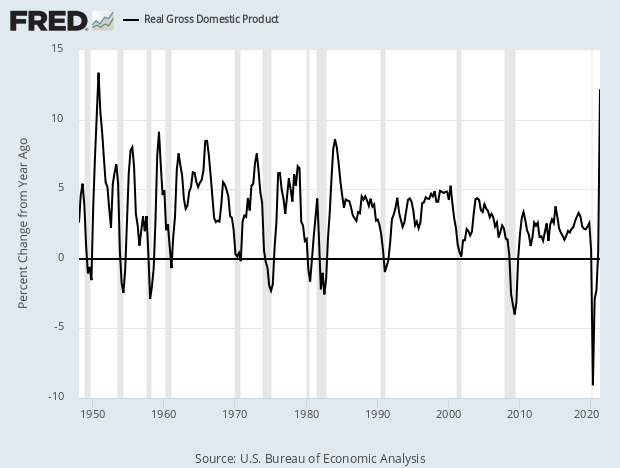

We also got our first revision to the Q2 GDP report. The initial report said the economy grew by 6.5% in Q2. Today that was revised up to 6.6%. Wall Street had been expecting an increase to 6.7%. We may see the fastest full-year GDP growth since the 1980s.

The economy has grown by over 12% in real terms over the last four quarters. That’s the fastest rate in 70 years. Of course, that’s largely due to last year’s plunge.

-

Morning News: August 26, 2021

Eddy Elfenbein, August 26th, 2021 at 7:09 amSouth Korea’s Rate Hike Suggests It’s Not Too Worried About Delta

Spies for Hire: China’s New Breed of Hackers Blends Espionage and Entrepreneurship

Google and Microsoft Promise Billions to Help Bolster US Cybersecurity

India Urges Its Automakers to Cut Reliance on Imports From China

The World Economy’s Supply Chain Problem Keeps Getting Worse

Maersk’s Green Ships Have First-Mover Disadvantage

Vaccinated Democratic Counties Are Leading the Economic Recovery

Virtual Jackson Hole Underscores Uncertainty in Fed’s Next Steps

Inflation Could Stay High Next Year, and That’s OK

How Should the Fed Deal With Climate Change?

The Hybrid Work Revolution Is Already Transforming Economies

Delta’s Extra $200 Insurance Fee Shows Vaccine Dilemma for Employers

Rent-a-Robot: Silicon Valley’s New Answer to the Labor Shortage in Smaller U.S. Factories

Dollar General Forecasts Bleak Profit View As Transport, Raw Material Costs Bite

Dollar Tree Cuts Full-Year Earnings Forecast

Why the Baby on Nirvana’s ‘Nevermind’ Album Is Suing Now

Be sure to follow me on Twitter.

-

Broadridge: “A True Monopoly”

Eddy Elfenbein, August 25th, 2021 at 12:15 pmThe Financial Times profiles Broadridge Financial Solutions (BR). The FT calls them “an obscure but lucrative Wall Street utility.” That sounds about right. They note that Broadridge holds a market share of 80%, and that’s not sitting well with some mutual funds.

The New York Stock Exchange regulates fees for investor communications, setting a cap of 25 cents a report. Broadridge charges the full 25 cents for an email, according to analysts. It costs more than for paper mailings because of a 10 cent fee that Broadridge charges to review whether shareholders prefer email over paper, according to the company.

The fees vastly exceed the cost, according to the Investment Company Institute, a trade group for the fund industry in Washington. For investor accounts not held through a broker, a typical fund paid 5 cents to send a shareholder report by either email or paper mail exclusive of postage, ICI said.

(…)

The payrolls company Automated Data Processing spun off Broadridge in 2007. In the fiscal year ended June 30, Broadridge reported a record $5bn in revenue and $902m in adjusted operating income, equal to an operating profit margin of 18 per cent.

Most of the company’s revenues and profits derive from the Broadridge “investor communication solutions” business, which includes organising virtual shareholder meetings and votes, an area that was increasing in popularity even before the pandemic and has since boomed.

In 2019 it handled more than 90 per cent of proxy voting services for public companies and mutual funds in the US, according to the company, whose annual report states, “We operate in a highly competitive industry.”

Broadridge recently said it made $2.19 for its fiscal Q4. That matched Wall Street’s consensus. That was a 13% increase over the same quarter last year. Full-year EPS was $5.66. That’s up nicely from $5.03 per share last year.

The company increased its quarterly dividend from 57.5 cents per share to 64 cents per share. That’s an increase of 11.3%. This is Broadridge’s 15th annual dividend increase in a row. In eight of the last nine years, the dividend has increased by double digits.

For the coming year, Broadridge expects earnings growth of 11% to 15%, recurring-revenue growth of 12% to 15% and operating margins around 19%. That translates to earnings for this year of $6.28 to $6.51 per share.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His