Archive for January, 2022

-

Otis Beats for Q4 and Offers 2022 Guidance

Eddy Elfenbein, January 31st, 2022 at 6:45 amThis morning, Otis Worldwide (OTIS) said it made Q4 earnings of 72 cents per share. That’s up from 66 cents per share from one year ago. The consensus on Wall Street had been for earnings of 68 cents per share.

Quarterly net sales were up 2.2% while organic sales rose by 2.8%. Adjusted operating profit margin was 14.6%, and New Equipment orders were up 7.3% in Q4.

For the year, the elevator folks made $3.01 per share. That’s an increase of 19.4% over last year. Full year net sales increased 12.1% “driven by a 8.9% increase in organic sales and a 3.0% benefit from foreign exchange.”

“Otis delivered a strong fourth quarter, capping an excellent year as we continued to execute on our long-term strategy and provide innovative solutions and services to our customers. Despite ongoing macro challenges in 2021, we achieved consistent and broad-based organic sales growth and margin expansion, grew our maintenance portfolio at the highest rate in over 10 years and gained share in New Equipment for the second consecutive year. Additionally, our continued robust cash flow generation enabled us to strategically deploy capital to create long-term value for all stakeholders,” said President and CEO Judy Marks. “We are confident this momentum will continue in 2022 and beyond, positioning us to deliver on our financial commitments and advance ESG priorities.”

Now let’s turn to guidance. For all of 2022, Otis expects earnings to range between $3.20 and $3.30 per share. That’s an increase of 6% to 10% over last year. Wall Street had been expecting $3.29 per share.

Some more details. Otis also expects free cash flow of $1.6 billion. The company sees full-year net sales of $14.4 to $14.7 billion. That’s up 1% to 3% over last year. Otis sees organic sales rising by 2.5% to 4.5%.

-

Morning News: January 31, 2022

Eddy Elfenbein, January 31st, 2022 at 6:40 amChina Is Changing Its Coal Use, and It Affects the Whole World

Europe’s Economy Shows Resilience to a Surge in Coronavirus Infections

Biden Economic Agenda on Hold as More Americans Hit Hardships

Fed Nominee Has Focused His Research on Monetary Policy and Poverty

Then and Now: How This Fed Liftoff Is Nothing Like That of 2015

Fed’s Tightening Plan Upends Outlook for Treasury’s Bond Sales

Inflation and Deficits Don’t Dim the Appeal of U.S. Bonds

Stocks Rebound But Head for Worst January Since 2016

An Army of Faceless Suits Is Taking Over the $4 Trillion Hedge Fund World

How Facebook Is Morphing Into Meta

Elliott and Vista Near Deal to Buy Citrix Systems

Streamers Struggle to Keep Users Who Joined to Watch a Hit

Global Gaming Company Entain Looks to Compete in Metaverse, Immersive Gambling

The Rising Human Cost of Sports Betting

Be sure to follow me on Twitter.

-

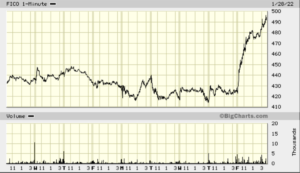

Update on FICO

Eddy Elfenbein, January 29th, 2022 at 4:31 pmI wanted to provide a brief update on FICO (FICO). In the newsletter, I mentioned that on Thursday, FICO reported fiscal Q1 earnings of $3.70 per share. That beat expectations of $3.36 per share.

FICO also said that it expects full-year earnings of $14.12 per share which was below Wall Street’s forecast of $14.81 per share.

Here comes the problem. I lowered my Buy Below price on FICO to $450 per share. On Friday, the shares opened at $426.46 and began a fantastic rally from there. I had no idea that FICO would rally like that.

This is an old lesson that in any portfolio, you never know who the big winners will be.

On Friday, FICO eventually closed at $493.12 per share. That was a gain of $70.13 per share or 16.58%. In other words, my $450 Buy Below was a wee bit off. I’ll probably adjust that upward soon.

-

Church & Dwight Earned 64 Cents per Share

Eddy Elfenbein, January 28th, 2022 at 7:18 pmOn Friday, Church & Dwight (CHD) reported Q4 earnings of 64 cents per share. That’s up 20.8% from a year ago. Wall Street had been expecting earnings of 60 cents per share.

For the year, the company made $3.02 per share. That’s up 6.7% from a year ago.

CEO Matthew Farrell said:

Our brands once again experienced strong consumption in Q4 2021. In the U.S. we grew consumption in 11 of the 16 categories in which we compete. Five of our brands experienced double digit consumption growth including ARM & HAMMER® Scent Boosters, ARM & HAMMER® Clumping Litter, OXICLEAN® stain fighters, BATISTE® dry shampoo and ZICAM® zinc supplements. Consumption continues to outpace shipments as supply chain disruptions continue. This strong consumption would likely have been higher if not for the ongoing supply chain challenges. This demonstrates the strength of our brands as we gained share on 6 of the 13 power brands in a difficult supply environment. Global online sales grew 12.7% in 2021, and as a percentage of total sales has expanded to 15% for the full year.

The market liked the report as shares of CHD rallied 4.40% to close at $103.

-

Morning News: January 28, 2022

Eddy Elfenbein, January 28th, 2022 at 7:02 amIMF Says China’s Economic Imbalances Have Worsened

This Chinese Miner Could Kill the Battery Metals Boom

Wall Street’s Big Bet on Chinese Markets Is Going All Wrong

For Olympic Sponsors, ‘China Is an Exception’

Crypto Secrecy Makes DeFi a Financial Felon’s Wonderland

How Crypto Became the New Subprime

U.S. Economy Grew 1.7% in 4th Quarter, Capping a Strong Year

U.S. Employers Confront Highest Labor Costs in 20 Years, Fueling Inflation

Meme Stock Hangover: A Year After GameStop, Traders Face Gloomier Markets

Goldman, Google and Just About Every NYC Employer Will Soon Have to Disclose Pay Secrets

Macy’s Is Betting on Online Shopping and Smaller Neighborhood Stores

Apple’s Profit Jumps to $34.6 Billion in Holiday Quarter Despite Supply Issues

Chevron Kicks Off Oil Industry’s Fourth Quarter Results With a Miss

Marcelo Claure Leaves Masa Son’s Orbit

Mike Lynch Loses $5 Billion Court Fight With HP Over Autonomy

Be sure to follow me on Twitter.

-

Morning News: January 27, 2022

Eddy Elfenbein, January 27th, 2022 at 7:04 amU.S. and China Rush in Opposite Directions to Save the Global Economy

Fed Signals Rate Increase in March, Citing Inflation and Strong Job Market

A Big Change Is Afoot. It’s Not Just a Rate Hike

Jeremy Grantham Has an Even Scarier Prediction Than His Crash Call

Bridgewater Sees ‘Much Bigger’ Drop in Stocks Before Fed Blinks

Robust U.S. Growth Is Expected for Late 2021, but Omicron Looms Now

It’s Hard to Tell When the Crypto Bubble Will Burst, or If There Is One

Robinhood Shares Stumble as Trading Frenzy Wanes, Regulators Circle

UBS Steps Into ‘Gen Z’ Push With $1.4 Billion Wealthfront Buy

Deutsche Bank Beats Profit Expectations, Restores Dividend

Apple to Rival Square by Turning iPhones Into Payment Terminals

Rising Costs, Pandemic Curbs Take a Bite Out of McDonald’s Profit

Tesla Puts Off New Models To Focus on Boosting Output

GM Rolls Out $7 Billion Investment Plan to Build Electric Trucks and Batteries

Americans’ Gas Stoves Are as Bad for Climate as 500,000 Cars

Be sure to follow me on Twitter.

-

Principles for Reducing the Balance Sheet

Eddy Elfenbein, January 26th, 2022 at 2:19 pmThe Fed also released a statement of principles for reducing its balance sheet:

The Federal Open Market Committee agreed that it is appropriate at this time to provide information regarding its planned approach for significantly reducing the size of the Federal Reserve’s balance sheet. All participants agreed on the following elements:

The Committee views changes in the target range for the federal funds rate as its primary means of adjusting the stance of monetary policy.

The Committee will determine the timing and pace of reducing the size of the Federal Reserve’s balance sheet so as to promote its maximum employment and price stability goals. The Committee expects that reducing the size of the Federal Reserve’s balance sheet will commence after the process of increasing the target range for the federal funds rate has begun.

The Committee intends to reduce the Federal Reserve’s securities holdings over time in a predictable manner primarily by adjusting the amounts reinvested of principal payments received from securities held in the System Open Market Account (SOMA).

Over time, the Committee intends to maintain securities holdings in amounts needed to implement monetary policy efficiently and effectively in its ample reserves regime.

In the longer run, the Committee intends to hold primarily Treasury securities in the SOMA, thereby minimizing the effect of Federal Reserve holdings on the allocation of credit across sectors of the economy.

The Committee is prepared to adjust any of the details of its approach to reducing the size of the balance sheet in light of economic and financial developments.

-

Today’s Fed Policy Statement

Eddy Elfenbein, January 26th, 2022 at 2:02 pmHere’s today’s statement:

Indicators of economic activity and employment have continued to strengthen. The sectors most adversely affected by the pandemic have improved in recent months but are being affected by the recent sharp rise in COVID-19 cases. Job gains have been solid in recent months, and the unemployment rate has declined substantially. Supply and demand imbalances related to the pandemic and the reopening of the economy have continued to contribute to elevated levels of inflation. Overall financial conditions remain accommodative, in part reflecting policy measures to support the economy and the flow of credit to U.S. households and businesses.

The path of the economy continues to depend on the course of the virus. Progress on vaccinations and an easing of supply constraints are expected to support continued gains in economic activity and employment as well as a reduction in inflation. Risks to the economic outlook remain, including from new variants of the virus.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent. With inflation well above 2 percent and a strong labor market, the Committee expects it will soon be appropriate to raise the target range for the federal funds rate. The Committee decided to continue to reduce the monthly pace of its net asset purchases, bringing them to an end in early March. Beginning in February, the Committee will increase its holdings of Treasury securities by at least $20 billion per month and of agency mortgage‑backed securities by at least $10 billion per month. The Federal Reserve’s ongoing purchases and holdings of securities will continue to foster smooth market functioning and accommodative financial conditions, thereby supporting the flow of credit to households and businesses.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals. The Committee’s assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michelle W. Bowman; Lael Brainard; James Bullard; Esther L. George; Patrick Harker; Loretta J. Mester; and Christopher J. Waller. Patrick Harker voted as an alternate member at this meeting.

-

Abbott Earned $1.32 Per Share for Q4

Eddy Elfenbein, January 26th, 2022 at 9:09 amThis morning, Abbott Laboratories (ABT) reported Q4 earnings of $1.32 per share. That beat expectations of $1.21. Sales rose 7.2% to $11.5 billion. Of that, Covid testing made up $2.3 billion.

For the year, Abbott earned $5.21 per share. Abbott has distributed more than 1.4 billion Covid tests since the start of the pandemic.

“2021 was an outstanding year for Abbott,” said Robert B. Ford, chairman and chief executive officer, Abbott. “We achieved more than 40 percent EPS growth, exceeding the baseline EPS guidance we set at the beginning of last year and, importantly, continued to advance our new product pipeline across the portfolio.”

For this year, Abbott expects earnings of at least $4.70 per share. That’s based on test sales of $2.5 billion. Wall Street had been expecting $4.78 per share.

-

Morning News: January 26, 2022

Eddy Elfenbein, January 26th, 2022 at 7:00 amRussia’s Attempts to Sanction-Proof Its Economy Have Exposed a Weak Spot

What Happens if Russia Cuts Off Europe’s Natural Gas?

U.S. to Bolster Europe’s Fuel Supply to Blunt Threat of Russian Cutoff

Top U.S. Oil States Vie for Carbon Capture Oversight to Speed Up Permits

I.M.F. Forecasts U.S. & China Slowdowns Will Hold Back Growth

Market Selloff Is Ultimate Test of What’s Real and What’s Not

How to Survive When Stocks Behave Badly

Why the Fed Is Unlikely to Start Raising Rates With a Half-Point Increase

Goldman, Citi Strategists Say It’s Now Time to Buy Stocks Rout

EV Battery Maker’s Sales Pitch to the West: We’re Not Chinese

Commerce Dept. Survey Uncovers ‘Alarming’ Chip Shortages

Intel Scores Major Win as Court Scraps $1.2 Billion EU Antitrust Fine

GE’s ‘Simplification’ Is a Work in Progress

Mark Zuckerberg’s Stablecoin Ambitions Unravel With Diem Sale Talks

Picasso Heirs Launch NFTs of Unseen Work to Ride Crypto Wave

McDonald’s Says Will Accept Dogecoin Only If Tesla Takes `Grimacecoin’

Can Hugo Boss Actually Be Cool?

Be sure to follow me on Twitter.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His