CWS Market Review – August 16, 2022

(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

The Great Summer Rally of 2022

Even if this latest bear-market rally proves to be another dud, you have to admire its resiliency. The market has rallied in the face of slowing economic growth, higher interest rates and persistent inflation. None of these seems to matter.

During the day on Tuesday, the S&P 500 poked its head above 4,325. That’s a place the index has not been since early May. The S&P 500 has now gained back more than half of what it lost during this year’s unpleasantness. There’s even a reasonable, albeit small, chance that the index will close the year in the black.

Sounds far-fetched? We’re only 11% away from a new all-time high. Bear in mind that we’ve gained more than 17% in less than two months. Check out the summer rally:

About a month ago, the S&P 500 broke above its 50-day moving average (the blue line). On Tuesday, the index came within a hair, just 0.02%, of breaking its 200-DMA (the green line).

The reason why it has a decent track record is that the moving average captures the market’s momentum, and the stock market tends to be a trend-sensitive data series. When it’s moving in one direction, the safe bet in the near-term is that it will keep moving in that direction.

Sometimes the market seems like it can do nothing right, and sometimes it can do no wrong. There’s a lot of fancy math to bear that out.

The Housing Recession Has Started

Speaking of not being able to do anything right, have you seen the housing market lately? There was an economic report that came out on Monday that didn’t, in my opinion, get the attention it deserved.

What happened is that a key index of homebuilder sentiment finally turned negative. The National Association of Home Builders/Wells Fargo Housing Market Index fell 6 points to 49. That was its eighth-straight monthly decline.

The reason why this is so important is that 50 is the tipping point. Any number above 50 is considered positive, while any number below it is considered negative. Now we’re negative. Except for a brief period around Covid, this index hasn’t been negative in eight years.

It’s hardly a secret what’s happening. Homebuilders are being squeezed by higher interest rates from the Federal Reserve and also by higher housing costs. All of this is falling on buyers. The index is composed of three parts. The most alarming is that buyer traffic dropped 5 points to hit 32.

While it’s a matter of debate as to whether or not the overall market is in a recession (I don’t think we are…yet), it’s quite clear that the housing sector is in a recession. In response, homebuilders are slashing prices.

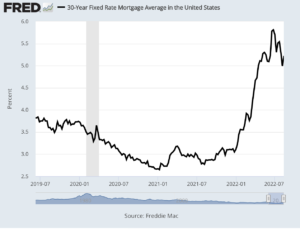

The math is simple—home prices are too darned high. Thanks to the Fed, home prices soared during the pandemic. But now, again thanks to the Fed, mortgage rates are climbing. Since early 2021, the rate on a 30-year mortgage has doubled. The combined effect is to push millions of Americans out of the housing market.

The problem is made worse by the fact that there are far too many homes on the market. Home sellers have crowded inventories and few people looking to buy. One stat I like to watch is the supply of new homes relative to the number of homes sold. That’s at its highest level since 2010. Bloomberg notes that in June, “824,000 single-family homes were under construction in the US, more than at any time since October 2006.”

The thing about housing is that it impacts so many different areas. In many regards, the U.S. economy is centered around housing. There’s even a well-regarded academic paper by Dr. Edward E. Leamer titled “Housing IS the Business Cycle.” Note the emphasis on “is.” I think he’s exactly right.

(Side note: Leamer also has a paper called “Let’s Take the Con Out of Econometrics.” How can you not like that?)

Whenever a new home is sold, that spurs the buyers, often a young couple, to head down to Lowe’s or Home Depot to buy new things to fill out the home. Of course, this usually starts with a home mortgage which gives business to the financial sector. The sale of a new home is really the core act that has several spokes that radiate outward.

We can also see the impact on our Buy List. In recent weeks, stocks like Sherwin-Williams (SHW) and Trex (TREX) have felt the impact of a slowing housing market. On Tuesday, Home Depot (HD) reported Q2 earnings of $5.05 per share which was an 11-cent beat, but the company said it expects same-store sales growth of 3% this year. That should be slowing during the second half of the year. Home Depot said that during last quarter, customer transactions fell 3%, but the average purchase rose by 9% to $90.02. In other words, people are paying more for less stuff.

This gets to the key dilemma of the current economy. The broader economy is probably not in a recession at the moment, but its most important sector likely is.

If there is a silver lining to the recent economic news, it’s that earlier today, Walmart (WMT) released a decent earnings report. This is a relief since the company has been struggling lately. After the last earnings report three months ago, traders gave the shares a super-atomic wedgie. I often say that the Walmart earnings report is, in effect, a report on American consumer behavior.

For Q2, Walmart earned $1.77 per share which was a 14-cent beat, but the most important news is that Walmart reiterated its forecast for the second half of this year. The company expects same-store sales to rise by 3% for the back half of 2022. For earnings, that’s still ugly. Walmart said it expects EPS to decline by 9% to 11% for this year.

For Q2, same-store sales rose by 6.5%. That’s not bad. Digging into the numbers, Walmart is being helped by rising food sales, which has been aided by inflation. Here’s an interesting stat via CNBC: About three quarters of Walmart’s market share gains in food came from customers with annual household incomes of $100,000 or more. Rich folks like a good bargain.

Quarterly revenue was $152.86 billion. That works out to more than $1.1 million every minute. It also beat estimates by $2 billion. This report is good news for Walmart and should help to alleviate some concerns about the health of the American consumer. Still, the problem of inflation needs to addressed without delay.

Stock Focus: Polaris

Polaris (PII) is one of those oddball stocks that deserves more respect than it gets. It’s especially intriguing right now because the valuation appears to be quite favorable.

If you’re not familiar with Polaris, the company started off making snowmobiles. They still do today, but they also make all sorts of off-road vehicles, those crazy “slingshot” cars, plus snowmobiles, power boats, pontoon boats and lots of other stuff. They also do a nice business in selling apparel. (Off the record, it’s basically a toy store for adult men. That’s a very good business to be in.) If you want to see an example of wares Polaris has to offer, here’s Chad “Ochocinco” Johnson going off-roading in a Polaris RZR Pro R.

Polaris is based in Medina, MN and they’ve been in business since 1954. Polaris currently has more than 35 brands and it does business in more than 120 countries. Last year, the company did $8.1 billion in sales. Wall Street expects that to rise to $8.5 billion this year and to $8.73 billion in 2023. Global employee count is over 16,000.

Polaris is a good example of a company with a wide “moat.” Not many firms can do what they do. In fact, Polaris is one of the largest holdings in the VanEck Morningstar Wide Moat ETF (MOAT).

These days, Polaris is a complete company that makes parts and accessories. The company IPO’d in August 1987, right near the market top.

The stock has been a massive home run. Since the IPO, PII is up nearly 100-fold. Including dividends, it’s up more than 160-fold. Despite this massive return, the share price today is lower than where it was eight years ago.

Even though the share price has lagged, business continues to go well for Polaris. In 2019, the company made $6.32 per share. In 2020, that increased to $7.74 per share, and last year it rose to $9.13 per share.

In April, Polaris bombed its Q1 report. The company earned $1.29 per share which was 49 cents below expectations. Sales were flat. Three weeks ago, Polaris rebounded with a solid Q2 report. Polaris earned $2.42 per share for Q2 which beat the Street by 33 cents. Sales were up 8% to $2.063 billion.

For guidance, Polaris now expects sales for this year to rise by 13% to 16%. That’s up from the prior guidance of 12% to 15%. Polaris also sees full-year earnings ranging between $10.10 and $10.30 per share. That’s up 11% to 14% over last year. If those forecasts are accurate, that means Polaris is going for just 12 times earnings. Not that long ago, Polaris used to go for twice that valuation. One more thing: Polaris has increased its dividend every year for the last 27 years.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

Posted by Eddy Elfenbein on August 16th, 2022 at 7:22 pm

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

- Tweets by @EddyElfenbein

-

-

Archives

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His