Archive for October, 2022

-

Ross Stores to Open 40 More Stores

Eddy Elfenbein, October 31st, 2022 at 8:39 amMore Buy List news today. Ross Stores (ROST) said it’s opening 40 new locations. Specifically, that’s 28 Ross Dress for Less stores and 12 dd’s Discount stores. Ross now runs 2,019 stores. These new locations complete the Company’s store growth plans for fiscal 2022 with the addition of 99 new stores.

“This fall, we opened our 2,000th store and continued to expand Ross and dd’s footprints across our existing markets as well as in our newer states. In addition to openings in California, Florida, and Texas, Ross strengthened its presence in Ohio while dd’s bolstered its store base in Illinois,” said Gregg McGillis, Group Executive Vice President, Property Development. “Looking ahead, we remain confident in our expansion plans and continue to see plenty of opportunity to grow to at least 2,900 Ross Dress for Less and 700 dd’s DISCOUNTS locations over time.”

Ross should report fiscal Q3 earnings in about three weeks. Wall Street expects 80 cents per share.

-

Thermo Fisher Scientific Buys Binding Site

Eddy Elfenbein, October 31st, 2022 at 8:19 amJust after reporting a big earnings beat, Thermo Fisher Scientific (TMO) said it’s buying British specialty diagnostics firm Binding Site. The deal is worth £2.25 billion ($2.6 billion).

Thermo Fisher Scientific Inc. (TMO), the world leader in serving science, today announced that it has entered into a definitive agreement to acquire The Binding Site Group (“The Binding Site”), a global leader in specialty diagnostics, from a shareholder group led by European private equity firm Nordic Capital, in an all-cash transaction valued at £2.25 billion, or $2.6 billion at current exchange rates.

Serving clinicians and laboratory professionals worldwide, The Binding Site provides specialty diagnostic assays and instruments to improve the diagnosis and management of blood cancers and immune system disorders. The Binding Site’s Freelite® offering is widely recommended for multiple myeloma diagnosis and monitoring across all stages of the disease by major clinical guideline publications.

Headquartered in Birmingham, United Kingdom, The Binding Site has more than 1,100 employees globally and is an active and influential contributor to the broader scientific community. As an established leader in a fast-growing segment in which patient care has shifted towards early diagnosis and monitoring via regular testing, The Binding Site has an attractive financial profile. Its business has been growing approximately 10% annually and is on track to deliver more than $220 million of revenue in 2022. The strong clinical value of The Binding Site offering enables doctors across the globe to support millions of patients every year.

“This transaction perfectly aligns with our Mission and is an exciting addition to our existing specialty diagnostic offerings. With extensive expertise and a large and dedicated installed base in cancer diagnostics, The Binding Site will further enhance our specialty diagnostics portfolio,” said Marc N. Casper, chairman, president and chief executive officer of Thermo Fisher. “The Binding Site is extremely well-respected by researchers and clinicians alike for its pioneering diagnosis and monitoring solutions for multiple myeloma. We also know early diagnosis and well-informed treatment decisions for multiple myeloma can make a significant difference in patient outcomes. We are excited by the opportunity to enable further innovation in this area for the benefit of patients and look forward to welcoming The Binding Site team to Thermo Fisher.”

Stefan Wolf, chief executive officer of The Binding Site, said, “This announcement marks the beginning of a new and exciting chapter for The Binding Site and is a testament to our team’s singular commitment to improving patient lives through the development and delivery of innovative solutions. The Binding Site has long been at the forefront of medical diagnostics and by joining the world leader in serving science, we will be even better positioned to accelerate scientific discovery and expand our product offering for the benefit of our colleagues, customers and, most importantly, the patients we serve.”

The transaction, which is expected to be completed in the first half of 2023, is subject to customary closing conditions, including regulatory approvals. Upon completion, The Binding Site will become part of Thermo Fisher’s Specialty Diagnostics segment and is expected to be accretive to adjusted earnings per share by $0.07 for the first full year of ownership.

Thermo Fisher also said it plans to buy back $1 billion worth of shares in the fourth quarter of 2022. This will bring the amount of money spent on buybacks for this year to $3 billion.

-

Morning News: October 31, 2022

Eddy Elfenbein, October 31st, 2022 at 7:05 amChina’s Factory Slowdown Worse Than Expected Under Weight of Covid Policies

Three Top Bankers Pull Out of Hong Kong’s Global Finance Summit

U.N., Turkey Race to Save Ukraine Grain Deal

Eurozone Inflation Reaches 10.7 Percent as Economies Slow Down

Frackers Jockey With Potash Miners for Space to Grow in Top U.S. Oil Field

Jerome Powell Is Popular. His War on Inflation Could Change That

The Fed’s Problem With the Job Market

The Fed May Have to Blow Up the Economy to Get Inflation Under Control

Bitcoin’s Proponents Promise a Future That It Cannot Provide

Affirmative Action’s End Will Crush the Diversity Talent Pipeline

Using Superheroes to Sell, This Time to Adults

Credit Suisse Hires 20 Banks for $4 Billion Capital Increase

China’s IPhone Sales Drop May Mean Bigger Problems for Apple

Twitter Is Drafting Broad Job Cuts in Whirlwind First Weekend Under Elon Musk

Can Elon Musk Make the Math Work on Owning Twitter? It’s Dicey.

Wilderness Trail Bourbon to Be Sold to Italy’s Campari at $600 Million Valuation

Taylor Swift’s ‘Midnights’ Breaks Album Sales Records in First Week

TuSimple Probed by FBI, SEC Over Its Ties to a Chinese Startup

Be sure to follow me on Twitter.

-

Morning News: October 28, 2022

Eddy Elfenbein, October 28th, 2022 at 7:03 amWith Recession Looming, Big European Economies Still Show Some Growth

Norway’s Wealth Fund Sees High Volatility in UK Bonds

Xi’s $6 Trillion Rout Shows China Markets Serve the Party First

As Inflation Bites, Japan Says It Will Help With Electricity Bills

Coal Baron or Climate Warrior? The Dizzying Rise of Asia’s Richest Man.

EU Strikes Deal to Ban the Sale of New Diesel and Gasoline Cars from 2035

Exxon and Chevron Rack Up Giant Profits

‘No Jobs Available’: The Feast or Famine Careers of America’s Port Drivers.

This Is The Legal Mess Now Facing the Trucking Industry

Fed Seen Aggressively Hiking to 5%, Triggering Global Recession

Elon Musk Takes Twitter, and Tech Deals, to Another Level

Tech Boom Ends as Companies From Amazon to Meta Adjust to Turbulent Times

Amazon, Intel Pressed to Slash Costs After Years of Bulking Up

How Brands Split With Celebrity Partners

Yeezy Sneakers Flood Resale market After Adidas Drops Kanye West Over Anti-Semitic Outburst

Be sure to follow me on Twitter.

-

WSJ Profiles Hershey

Eddy Elfenbein, October 27th, 2022 at 2:44 pmToday’s Wall Street Journal profiled Hershey (HSY). This company has been a big winner and the article helps explain why.

Here’s a sample:

There are many companies that will find themselves dealing with crises during this market downturn. Some will double down on existing strategies. Some will diversify. Hershey did both and discovered an unlikely new identity.

“They’re not just a confectionery company anymore,” said Morningstar analyst Erin Lash.

That sounds a bit like Willy Wonka going keto. But this is a company based in a town built on chocolate and controlled by a powerful trust designed by founder Milton Hershey in 1905 to support his school for underprivileged children. Hershey has always been different from most corporations. Otherwise it might not be around.

Almost every one of its rivals has salivated at the idea of buying Hershey. The company’s last battle for independence took place in 2016, when its stock was trading below $100, and Mondelez offered to pay $107 and then $115 a share in a deal that would have created the world’s largest candy maker. Hershey’s board rebuffed the approach from Mondelez, the parent company of Oreo, Cadbury and Sour Patch Kids, but the takeover bid lasted for months.

Today its stock price is above $230 because of what happened next. A management shake-up weeks later elevated Michele Buck to CEO, and she laid out her vision for a long-term strategy on her first day on the job. She told investors to expect changes. “We’ll have less growth in the international markets than perhaps we’ve seen in the past,” Ms. Buck said in March 2017. “We’re clearly seeing that North America is going to be the biggest driver.”

It was counterintuitive, but she was right: North American sales went from 88% of Hershey’s total sales in 2017 to 92% in 2021. Instead of competing against varied tastes and established brands, Hershey pulled back internationally and shifted the playing field to where it already had the advantage.

We added Hershey to our Buy List in 2019. It’s been a nice winner since then.

-

Morning News: October 27, 2022

Eddy Elfenbein, October 27th, 2022 at 7:11 amCurrency Craters in Arab World’s Most-Populous Nation

Italy Looks to Unlock Financing for Lukoil-Owned Refinery

Peak Fossil-Fuel Demand Is Possible in a Few Years, IEA Says

With Inflation at 9.9 Percent, the European Central Bank Is Set to Raise Rates Again

A Rising Dollar Is Hurting Other Currencies. Central Banks Are Stepping In.

Wall Street Says It’s Too Early to Bet on King Dollar’s Demise

U.S. GDP to Detail State of Economy Amid High Inflation

What’s the Inflation Rate? It’s a Surprisingly Hard Question to Answer

Once-in-a-Generation Wealth Boom Ends for America’s Middle Class

A New Survey Reveals Americans’ Magic Number for Retirement

Airlines Need New Planes, but the Supply Chain Has Other Ideas

Shell Reports Its Second-Highest Profit, at $9.5 Billion, and Raises Dividend

There’s an American Icon That Beat the Market Meltdown

Credit Suisse Sinks on Plan to Raise $4 Billion and Slash Headcount by 9,000

Facebook Parent Meta’s Earnings Fall Short as Revenue Decline Accelerates

McDonald’s Earnings Beat As Customers Return Despite Higher Prices

Altria to Take on Juul, Philip Morris in Smoke-Free Tobacco

New SEC Rule Requires Executives to Give Back Bonuses When Accountants Screw Up

Be sure to follow me on Twitter.

-

Morning News: October 26, 2022

Eddy Elfenbein, October 26th, 2022 at 7:06 amXi’s Vow of World Dominance by 2049 Sends Chill Through Markets

Sunak Delays UK Economic Plan to Set Strategy

IMF Chief Wants Central Banks To Keep Raising Rates To Hit ‘Neutral’ Level

U.S. Officials Had a Secret Oil Deal With the Saudis. Or So They Thought.

Another Closely Watched Recession Alarm Is Ringing

Mnuchin Warns Market Watchers Who Misread Fed May Be Wrong Again

Companies Seek Guidance on New U.S. Minimum Tax as Launch Date Nears

Stock Picking Isn’t Dead. But for Most Investors It Might As Well Be

U.S. Mortgage Interest Rates Jump to 7.16%, Highest Since 2001

Bad News, Deal-Seekers. Even Cheap Flights Are Expensive Now.

Musk Tells Bankers He Plans to Close Twitter Deal on Friday

How Elon Musk Became a Geopolitical Chaos Agent

Google Shares Fall as YouTube and Search Ads Take Hit

Spotify Wants to Get Into Audiobooks but Says Apple Is in the Way

Deutsche Bank Logs Ninth Straight Quarter Of Profit With Big Earnings Beat

Bed Bath & Beyond, Trying to Turn Things Around, Names New C.E.O.

Coca-Cola Keeps Raising Prices, Driving Profits Higher

Russian Oligarchs Obscure Their Wealth Through Secretive Isle of Man Network

Be sure to follow me on Twitter.

-

CWS Market Review – October 25, 2022

Eddy Elfenbein, October 25th, 2022 at 6:21 pm(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

The Important Nugget Buried in the Fed Minutes

The stock market is finally showing some backbone. On Tuesday, the S&P 500 rallied 1.63% to close at its highest level in five weeks. The index finished the day less than 0.25% away from its 50-day moving average (the blue line in the chart below).

For traders, the 50-day moving average is an important psychological barrier. If we move above it, that could give more confidence to the bulls. The S&P 500 has traded below its 50-DMA nonstop for nearly six weeks.

I say this cautiously because we know how these bear market rallies like to fool us, but I have to confess that I’m more optimistic for the market’s latest move. Let me explain why.

For one, it’s been a far more measured climb. The S&P 500 hasn’t jerked forward by huge advances in a few days like we’ve seen in previous false starts. But more importantly, there may be concrete reasons why the Federal Reserve may alter its rate-hiking policy soon.

I’m referring to a small two-sentence blip buried in the minutes of the Fed’s last meeting. In fact, I overlooked it in my first reading.

First, some background. The stock market’s most recent closing low came on October 12. That’s when the S&P 500 finished the day at 3,577.03. The next day was a raucous one. The S&P 500 plunged as low as 3,491.58 which brought the stock market all the way back to its pre-Covid high from more than 30 months ago.

During the trading day, the Federal Reserve released the minutes from its September meeting. The overall tone of the minutes was quite hawkish. The Fed members clearly believe that the Fed needs to keep raising rates.

That’s what dominated the headlines. However, the minutes also contained this brief section:

Several participants noted that, particularly in the current highly uncertain global economic and financial environment, it would be important to calibrate the pace of further policy tightening with the aim of mitigating the risk of significant adverse effects on the economic outlook. Participants observed that, as the stance of monetary policy tightened further, it would become appropriate at some point to slow the pace of policy rate increases while assessing the effects of cumulative policy adjustments on economic activity and inflation.

I added the boldface. Why is this important? It means that some members inside the Fed recognize that there’s a limit to the Fed’s current policy. The yield curve is already inverted. Interest rates can only go so high. Perhaps we don’t know exactly what that level is, but the negative effects will soon become clear. To use the buzzword of this year, the Fed needs an offramp and some FOMC members are already discussing it.

I don’t think the Fed will alter course immediately, but it’s a real possibility within the next few months. We now have solid evidence that the Fed’s higher interest rates are causing harm to the economy.

I could be premature, but the stock market appears to have picked up the signal. After the minutes came out on October 13, the stock market staged a dramatic U-turn and closed higher by 2.6%. From low to close, the S&P 500 gained more than 5% that day.

The following day, October 14, was the day of the CPI report. Once again, the numbers were higher than expected, and the stock market dropped, but here’s what’s important: the low from the 12th held. The market didn’t make a new low. This tells me that the minutes were a turning point. Since then, the S&P 500 has rallied five times in seven days.

Let’s be clear that the Fed isn’t about to stop. The central bank will almost certainly raise short-term rates by 0.75% at its meeting next week. After that, the Fed meets again in mid-December. The futures market is evenly split on the odds of a 0.5% increase or another 0.75% increase.

After that, things may start to change. Except for one or two smaller rate increases, the Fed will probably hold tight for much of 2023. If the economic news is dire, then we may even see rate cuts before this time next year.

Let’s remember that the stock market peaked in January. The first Fed rate hike wasn’t until March. It’s natural for stocks to move before the news, even if the full details aren’t completely known. The initial move we’ve had over the last two weeks could be an omen for a friendlier Fed in 2023. This bear-market rally could finally be real.

Thursday’s Q3 GDP Report

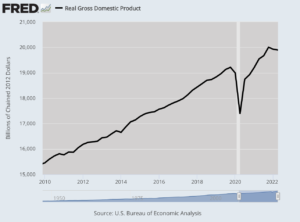

While this week will be dominated by earnings news, on Thursday, the government will release its first estimate for Q3 GDP. This will be a noteworthy report because the first two quarters showed negative growth.

Two or more consecutive quarters of negative growth is often used as a shorthand for a recession. That’s not the technical definition used by most economists. Still, it’s an alarming thing to see two quarters in a row of falling real GDP. To be fair, the consumer side of the economy has seen some slow growth.

The consensus on Wall Street is that the U.S. economy will post growth of 2.3% for Q3 (that’s the annualized after-inflation number). I think there’s a good chance we’ll exceed that number, but that doesn’t mean the economy is in full health.

The weak spot is the housing market. Unfortunately, the housing market become the chief mechanism for Fed policy. I wish there were a better way to curb inflation without flattening the housing market. Mortgage demand is now at a 25-year low. Applications to refinance a home are down 86% from one year ago.

Update on Polaris

Before I get to this week’s stock, I wanted to pass along an update on Polaris (PII). I featured the stock for you in August.

Polaris is a cool company. They make snowmobiles and all sorts of off-road vehicles. I like Polaris because it’s a good example of a company with a wide “moat.” Not many firms can do what they do.

In April, Polaris bombed its Q1 report. The company earned $1.29 per share which was 49 cents below expectations. Sales were flat. This summer, Polaris rebounded with a good Q2 report. The company made $2.42 per share which beat the Street by 33 cents. Sales were up 8% to $2.063 billion.

This morning, Polaris reported another solid quarter. For Q3, the company made $3.25 per share. That’s up 65% over last year. Wall Street had been expecting $2.82 per share.

Polaris also increased its full-year guidance (of course, that’s only for one more quarter). The company now expects 2022 sales to rise by 15% to 16%. The previous guidance was 13% to 16%, and before that it was 12% to 15%.

Polaris also reiterated its full-year guidance of $10.10 to $10.30 per share. In the first three quarters of this year, Polaris made $6.98 per share so the guidance implies Q4 earnings of $3.12 to $3.32 per share.

That’s up 11% to 14% over last year. If those forecasts are accurate, that means Polaris is going for less than 10 times this year’s earnings. Not that long ago, Polaris would have gone for twice that valuation. One more thing: Polaris has increased its dividend every year for the last 27 years. The stock rallied 3.7% today, but it’s down significantly in the last few months.

Another stock I want to highlight is Middleby (MIDD). You may remember that we had Middleby on our Buy List in 2020 and 2021. It was our second-best performer last year with a gain of 52%. I decided against including it on this year’s Buy List, and I had pretty good timing. The shares are down more than 30% this year.

But Middleby is worth a look, especially at a discounted price. If you’re not familiar with Middleby, the company makes kitchen equipment for hotels and restaurants. Think big ovens and grills, and stuff with conveyer belts. The stock got demolished during the Covid panic in early 2020. Then it roared back and we did very well with Middleby.

So far this year, Middleby beat earnings for Q1 and Q2. For Q3, Wall Street expects $2.36 per share. For next year, Wall Street expects earnings of $10.29 per share. That means the stock is going for just over 13 times earnings. That’s not bad. The Q3 report will probably be out in early November.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

P.S. If you want to learn more about the stocks on our Buy List, please sign up for our premium service. It’s $20 per month, or $200 per an entire year.

-

Morning News: October 25, 2022

Eddy Elfenbein, October 25th, 2022 at 7:05 amGlobal Economic Growth Is Weighed Down by Inflation, Rising Interest Rates

‘Frustrated and Angry,’ Global Funds Worry About Xi’s New China

Why Natural Gas Prices in Europe Are Suddenly Plunging

Why the Price of Gas Has Such Power Over Us

Hedge Funds Get Their First Prime Minister in UK’s Rishi Sunak

Fed Is Losing Billions, Wiping Out Profits That Funded Spending

The Only Crypto Story You Need

Morgan Stanley’s Wilson Ranked No. 1 Strategist in Institutional Investor Survey

Health-Insurance Inflation Is Poised to Drop Sharply

Mortgages Sold to Fannie, Freddie Should Use More Than FICO Scores, Regulator Says

Wall Street Bonuses Expected to Slide 22% This Year – NY State Comptroller

Big Tech Earnings Are Here. A Fed Slowdown Can’t Come Soon Enough

G.M. Reports Jump in Profit on Strong Sales

Swiss Bank UBS Posts 24% Profit Slide But Beats Analyst Expectations

UPS Reaffirms Its Outlook for 2022 As It Posts Mixed Quarterly Results

With Promise of Legalization, Psychedelic Companies Joust Over Future Profits

Adidas Ends Ye Partnership After String of Controversies

Be sure to follow me on Twitter.

-

Chinese Stocks Drop on Xi’s Power Grab

Eddy Elfenbein, October 24th, 2022 at 11:19 amThe stock market is up again today but given the level of recent volatility, who knows how long that will last? At one point today, the S&P 500 was up more than 1.17%. We’ve already given most of that back.

We’ve been in an unusual stretch where all the up days have been up by a lot. In the last 24 trading sessions, the S&P 500 has been up just seven times, but all of those times have been by more than 1%. Five of the seven were up by more than 2.3%.

Many Chinese stocks are getting walloped today. This comes on the news that Xi Jinping will be heading to a third term as president of China. The precedent has always been two terms. The Hang Seng index is having its worst day since 2008.

Shares of Tesla dipped below $200 earlier today. That’s the lowest they’ve been since June 2021. At its peak, Tesla was at $414.

The market is leaning strongly to the conservative stocks today. The S&P 500 Low Volatility Index is up 0.84% while the High beta Index is -0.40%.

Daniel Pinto, the president of JPMorgan Chase, said that a recession may be the price we have to pay in order to defeat inflation. He grew up in Argentina and remembers the severe inflation they had.

In Britain, Rishi Sunak will become the new prime minister. The pound rallied against the dollar. Last month, the pound got down to $1.07.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His